Investing in Latin America Can Bear Fruit, but Should We?

With commodity prices recovering and major developed markets (EFA) (VEA) caught in the lull, Latin America should see sunnier days ahead.

Nov. 20 2020, Updated 3:42 p.m. ET

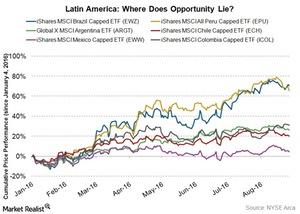

Latin America is outperforming

Earlier in this series, we saw how Latin American equity is outperforming other markets to deliver a whopping 24.4% return for the year up to July 2016. This comes at a time when investors have begun to believe that money doesn’t yield anything.

Where does opportunity lie?

With commodity prices recovering and major developed markets (EFA) (VEA) caught in the lull, Latin America should see sunnier days ahead. However, when looking at Latin American equities, you also need to consider the opportunities as well as what you should avoid. Broadly, Latin America consists of Brazil, Argentina, Mexico, Chile, Peru, Columbia, Venezuela, Bolivia, Uruguay, and Paraguay.

Brazil at 70% return, while Mexico at a mere 5%

The Brazilian-equity-tracking iShares MSCI Brazil Capped ETF (EWZ) has yielded a 70.7% return. The Peru-equity-tracking iShares MSCI All Peru Capped ETF (EPU) has risen 65.4%. The Mexican-equity-tracking iShares MSCI Mexico Capped ETF (EWW) has barely managed a 4.6% return year-to-date as of August 30, 2016.

In the next part of this series, we’ll take a look at investor sentiment, valuations, and macro economic variables that support or distort growth prospects in some of these countries. We’ll try to get a fair view of what’s actually driving return performance in Latin America and what’s anchoring its rise.