Vanguard FTSE Developed Markets ETF

Latest Vanguard FTSE Developed Markets ETF News and Updates

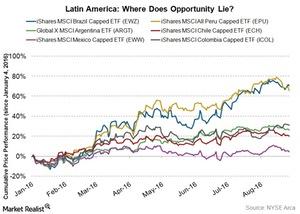

Investing in Latin America Can Bear Fruit, but Should We?

With commodity prices recovering and major developed markets (EFA) (VEA) caught in the lull, Latin America should see sunnier days ahead.

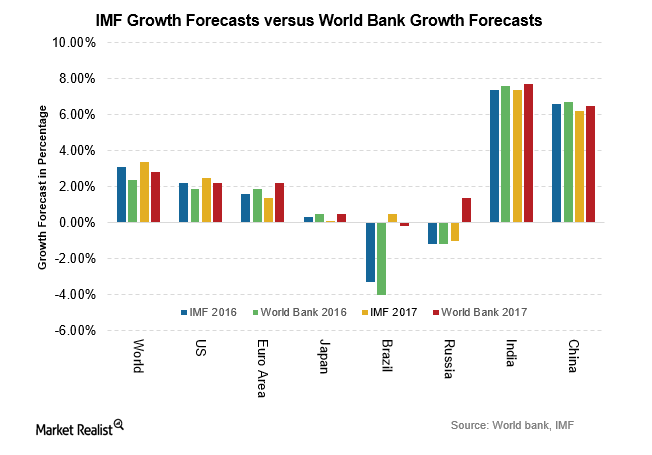

Outlook Projections: IMF Cuts Global Growth Forecasts

The IMF cut its global economic growth forecasts, according to the latest IMF World Economic Output Update dated July 19. The cut in forecasts was expected.

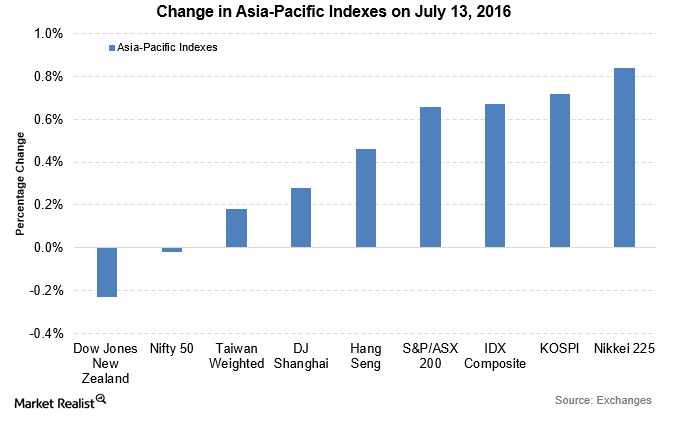

Why Are Global Markets Range Bound?

The contrasting movement among the global markets was primarily due to caution ahead of the Bank of England’s monetary policy release on July 14.

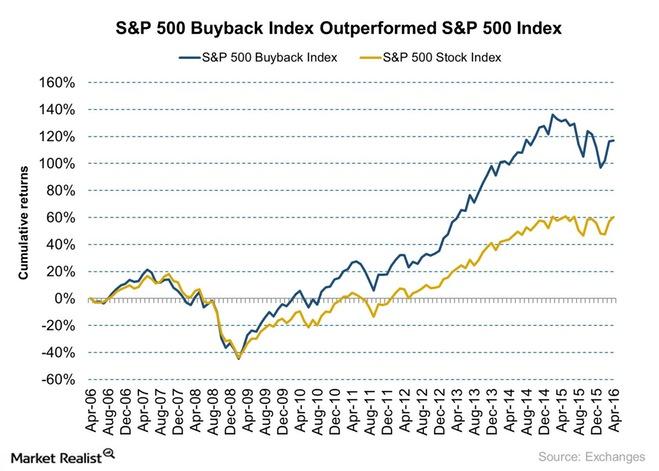

Icahn Identifies a Key Motivation behind the Buyback Spree in the US

Carl Icahn is one of the first activist investors to voice his opinion against share buybacks. He believes that companies are increasingly putting money into buybacks instead of using them for much-needed capital improvements.

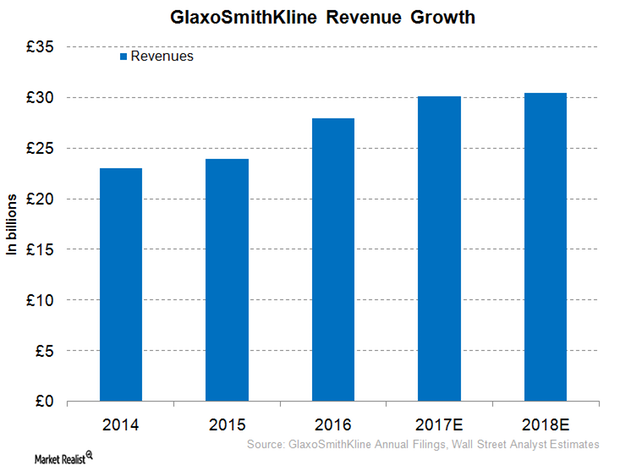

GlaxoSmithKline Could Witness Modest Rise in Revenues in 2017

GlaxoSmithKline (GSK) is a leading player in the global respiratory market with a major focus on the asthma and chronic obstructive pulmonary disease (or COPD) segments.

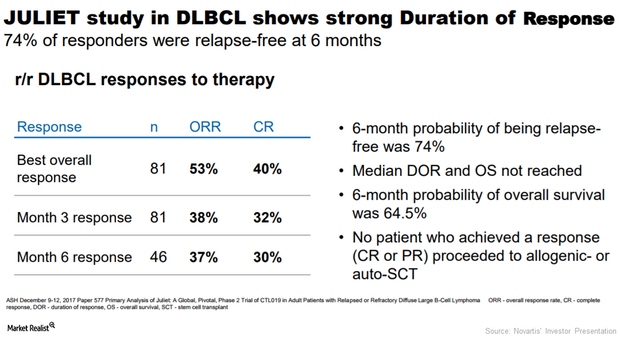

Key Updates on Novartis’s Kymriah

In December 2017, Novartis (NVS) presented updated results from the Juliet clinical trial, which demonstrated sustained responses of Kymriah (tisagenlecleucel) for the treatment of adults with relapsed or refractory diffuse large B-cell lymphoma (or DLBCL).

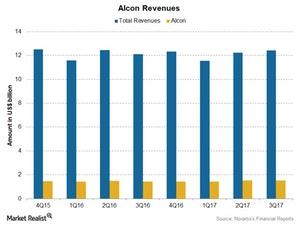

Reading the Estimates for Novartis’s Alcon in 4Q17

For 4Q17, Alcon is expected to report growth in revenues, driven by the increased demand for contact lenses and surgical products.

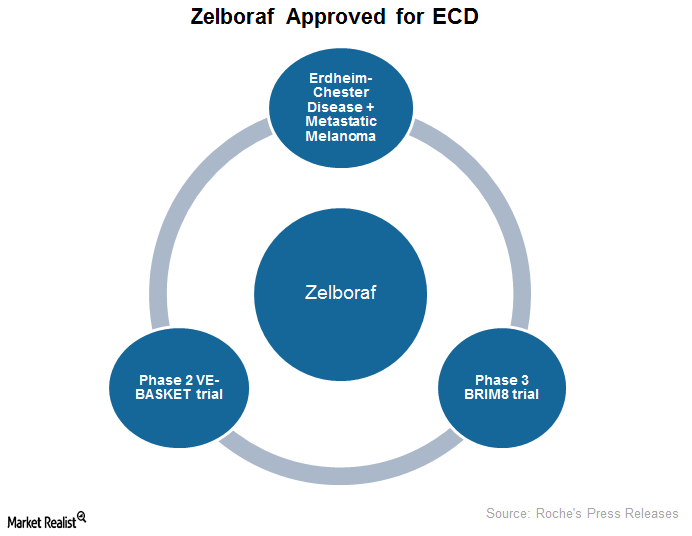

Zelboraf Could Boost Roche’s Sales Growth in 2018

Roche’s (RHHBY) Zelboraf (vemurafenib) is indicated for the treatment of individuals with unresectable or metastatic melanoma with the BRAF V600 mutation.

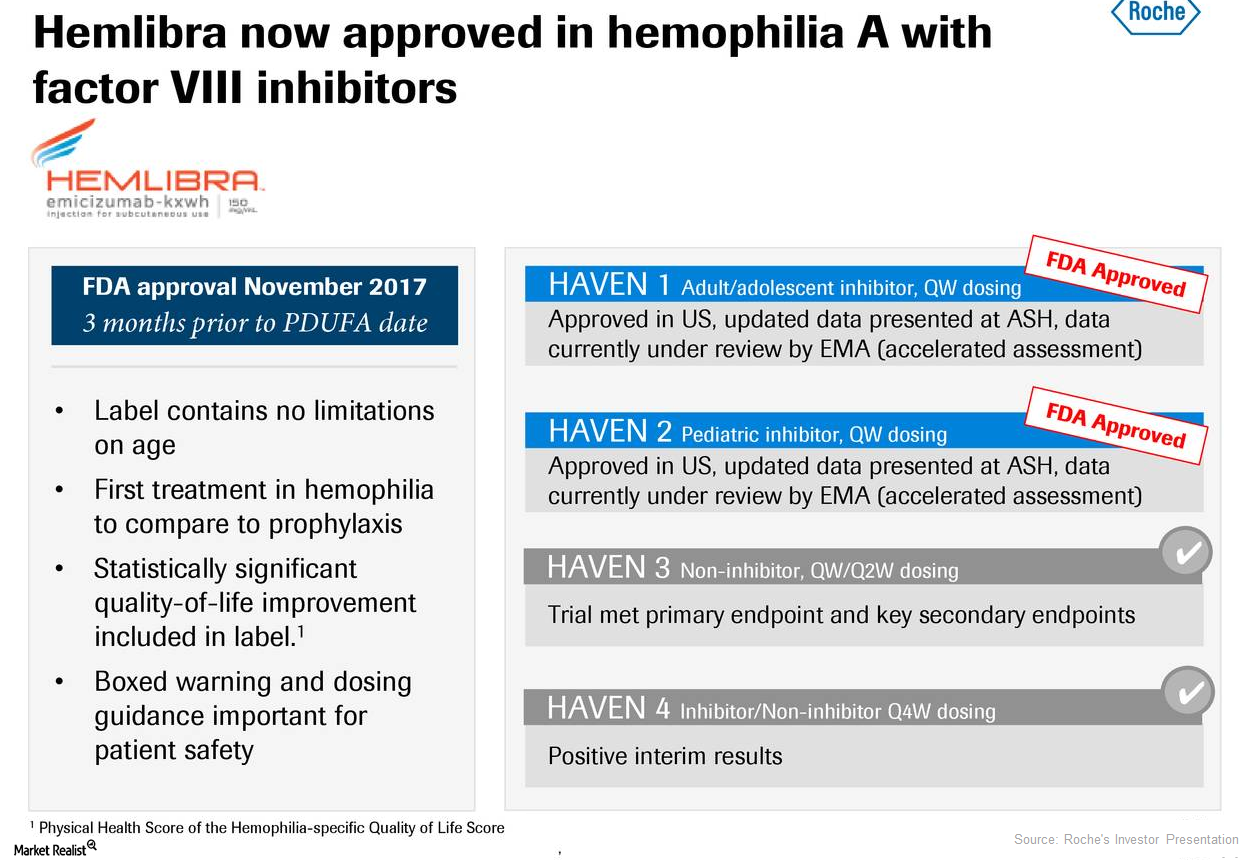

How Is Roche’s Hemlibra Positioned for 2018?

Roche’s (RHHBY) Hemlibra is used for the prevention and reduction of the frequency of bleeding episodes in individuals with hemophilia A with factor VIII inhibitors.

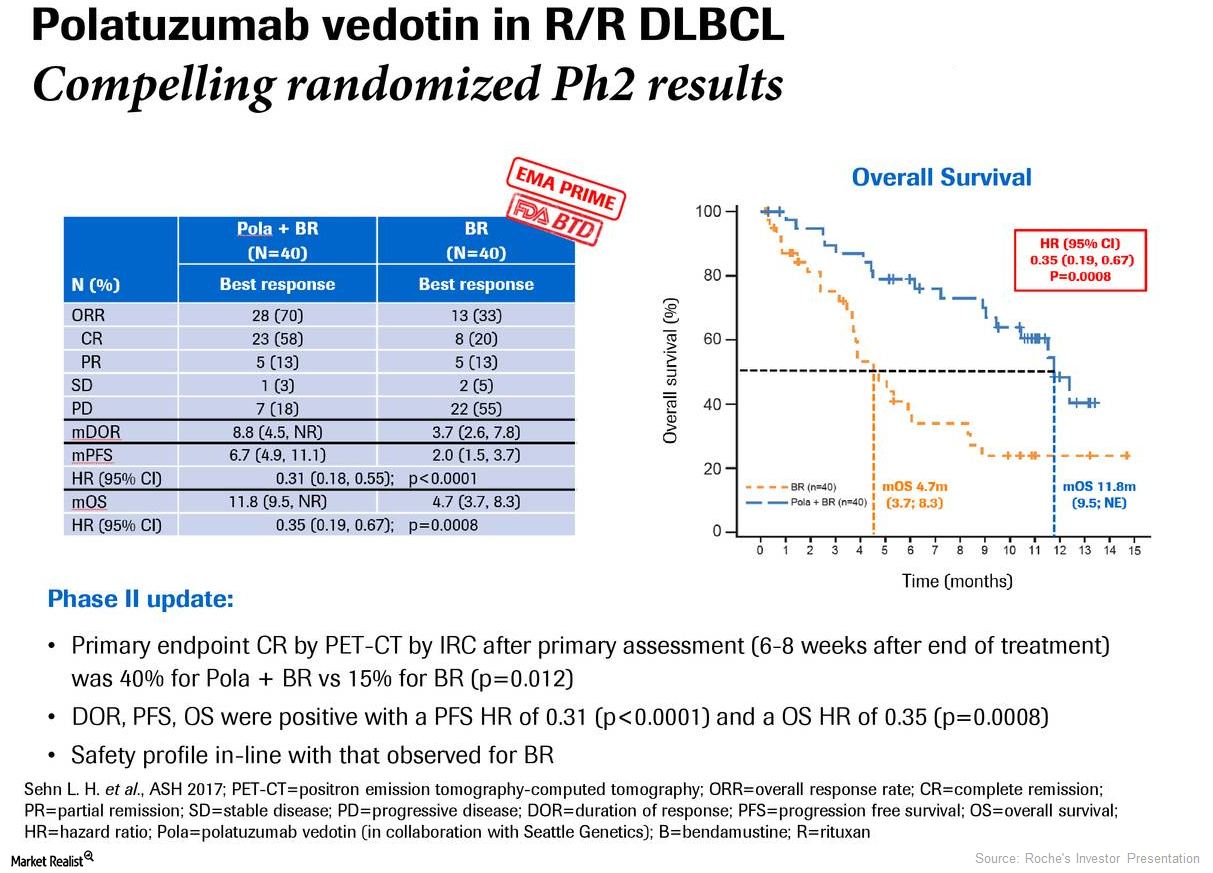

What to Expect from Roche’s Investigational Drug Polatuzumab Vedotin

In December 2017, Roche (RHHBY) presented the results of its randomized phase two GO29365 trial.

Novo Nordisk’s Xultophy, Ryzodeg, and Fiasp Could Boost Revenue Growth in 2018

Novo Nordisk’s (NVO) Xultophy (insulin degludec and liraglutide combination) is used as an addition to diet and exercise for improvement of blood sugar levels in adults with type-2 diabetes mellitus whose blood sugar level could not be controlled adequately with basal insulin.

Analysts’ Recommendations for GlaxoSmithKline in November 2017

Wall Street analysts estimate that GlaxoSmithKline’s (GSK) top line could fall 0.8% to ~7.5 billion pounds in 4Q17.

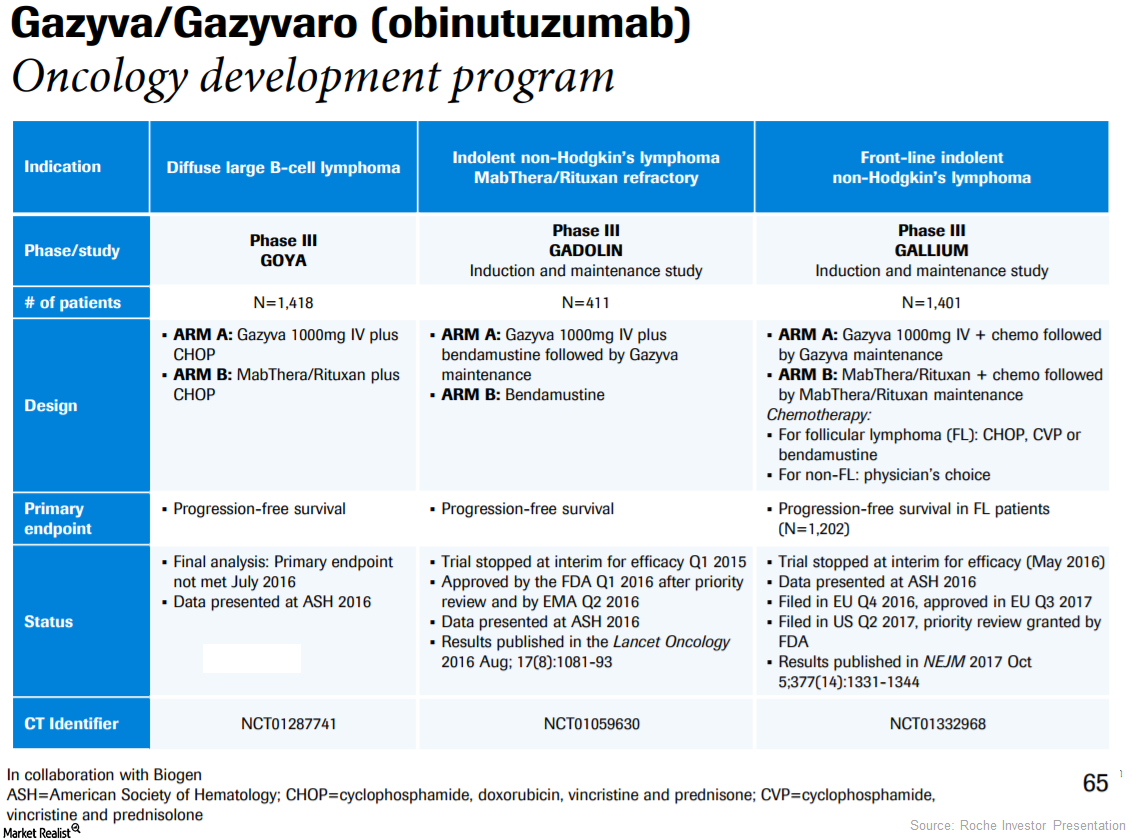

How Roche’s Oncology Drug Gazyva Is Positioned after 3Q17

In 3Q17, Roche’s (RHHBY) Gazyva generated revenues of 69 million Swiss francs, which reflected ~34% growth on a year-over-year (or YoY) basis.

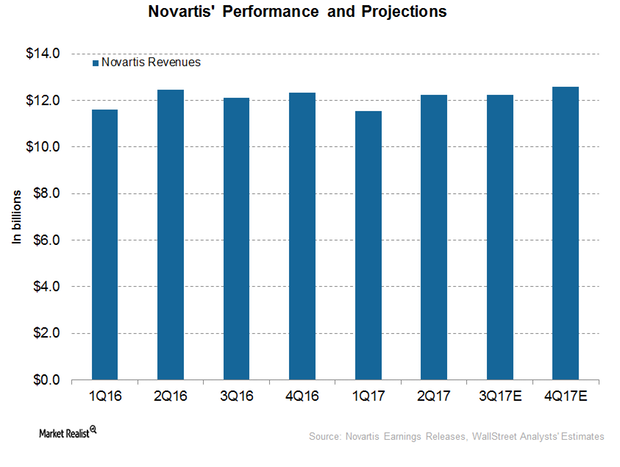

How Did Novartis Perform in 1H17?

In 1H17, Novartis (NVS) reported revenues of around $23.8 billion, a ~1% decline on a year-over-year (or YoY) basis.

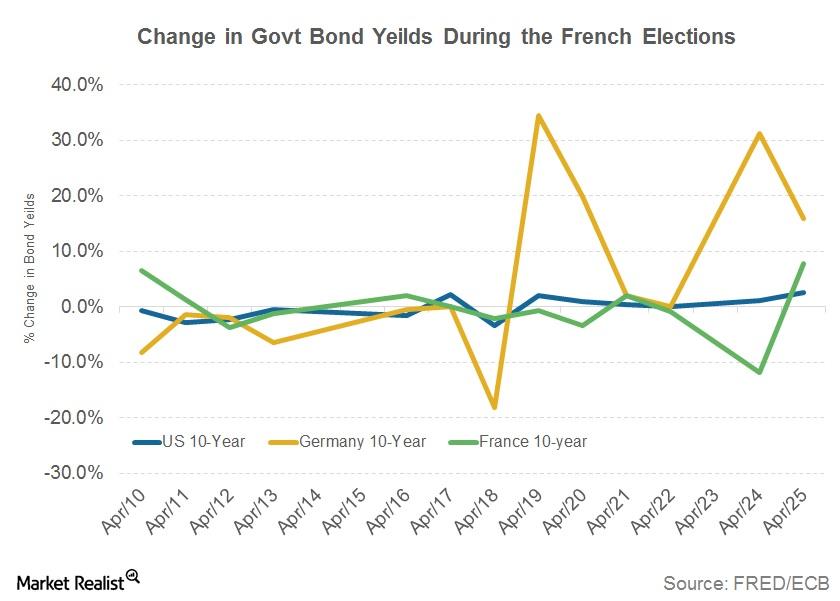

How Did Fixed Income Markets React to the First Round?

Demand for fixed income securities will likely be subdued because of excess supply this week, which would mean additional support for bond yields.

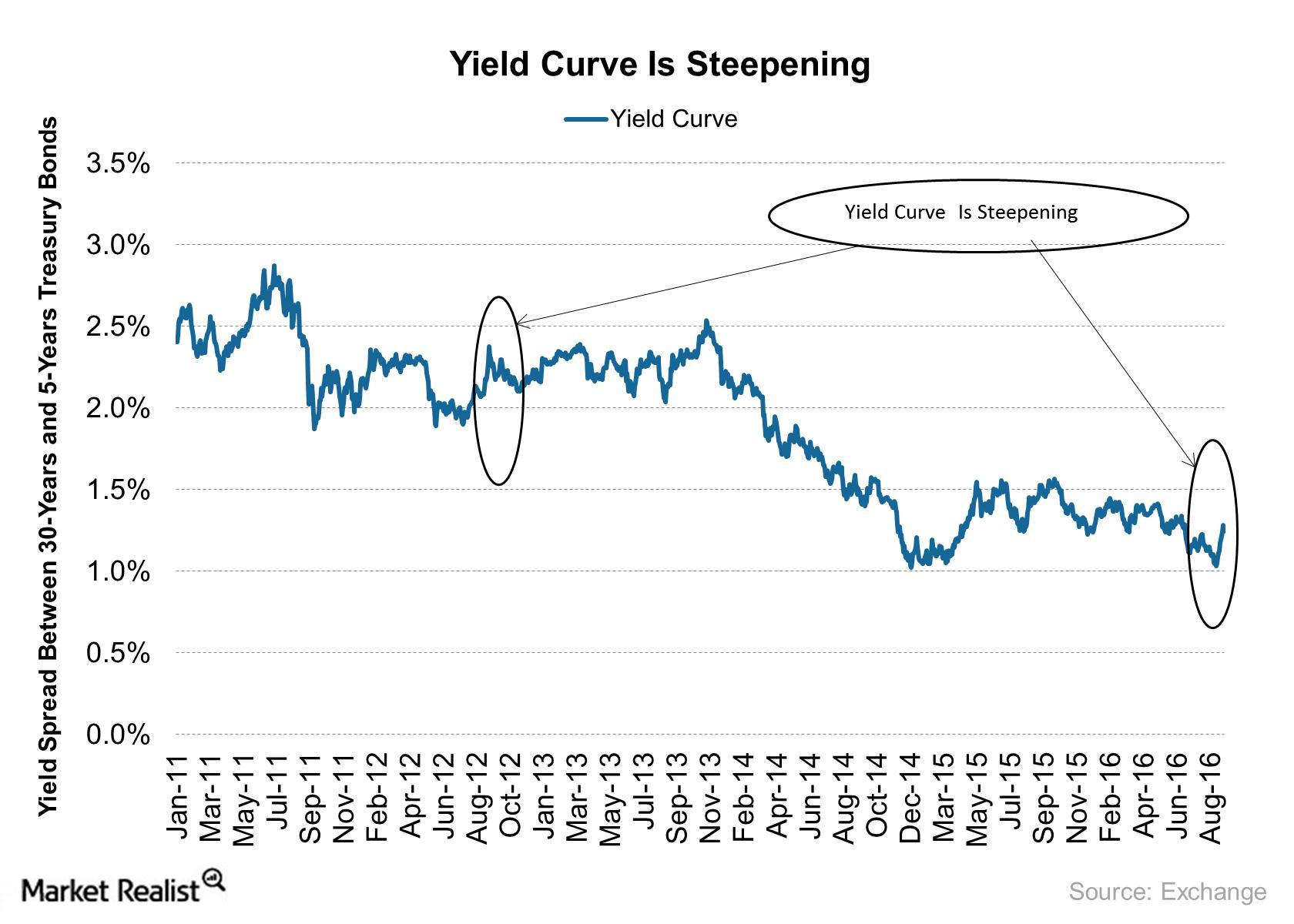

Yield Curve Is Steepening: What Does It Indicate for the Market?

In this series, we’ll compare yields across various developed markets (EFA) (VEA). We’ll also look at how a steepening yield curve affects the financial sector (XLF).

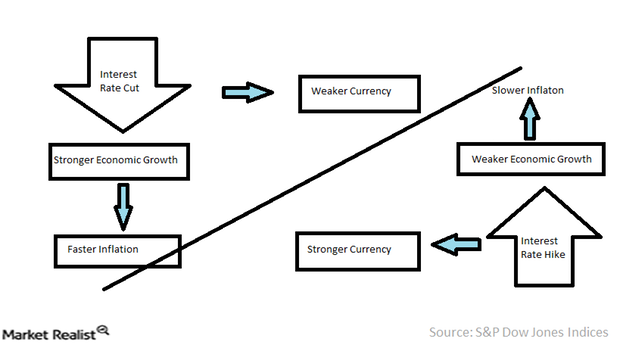

How Are Inflation, Interest Rates, and Foreign Exchange Related?

A low rate of inflation doesn’t guarantee a favorable exchange rate. But a high inflation rate is likely to have a negative effect on a currency’s value.

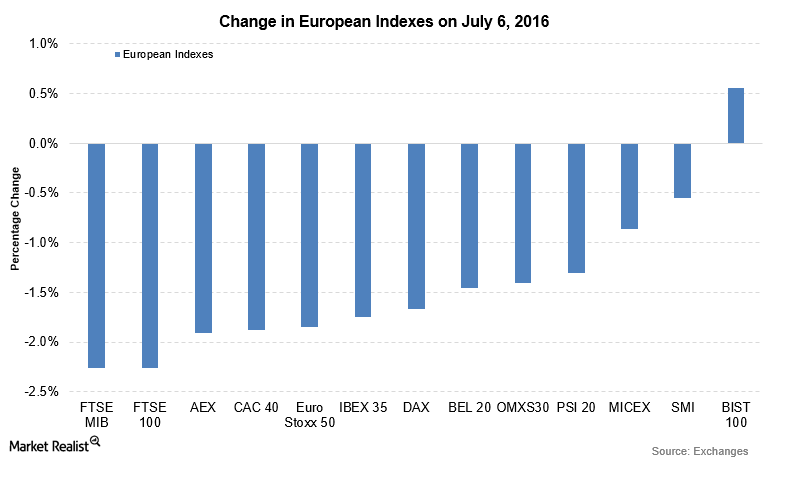

Weak Data Puts Downward Pressure on European Indexes

On July 6, major European indexes were trading lower for the second day. The fall in the indexes was led by the Italian FTSE MIB and the UK-based FTSE 100.

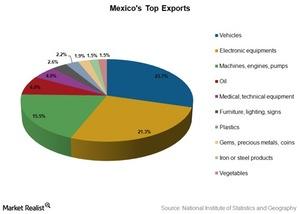

Consumerism Abroad to Drive Growth in Mexico

Mexico is known for its industrial base. In 2015, vehicles constituted about 23.7% of Mexican exports, followed by electronic equipment at 21.3% of exports.

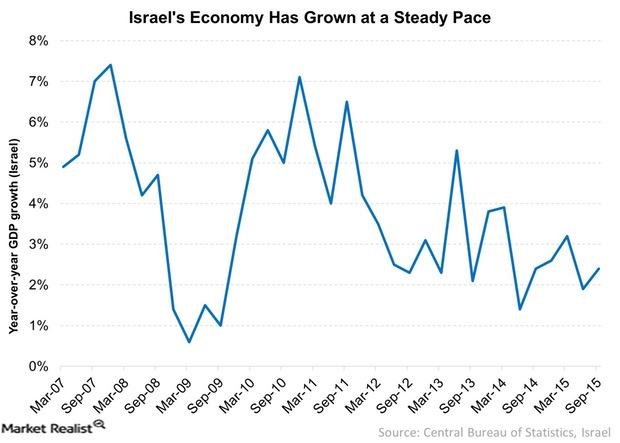

Why Israel’s Economy Is Still Resilient

Israel’s government debt as a proportion of gross national product has declined steadily this century.

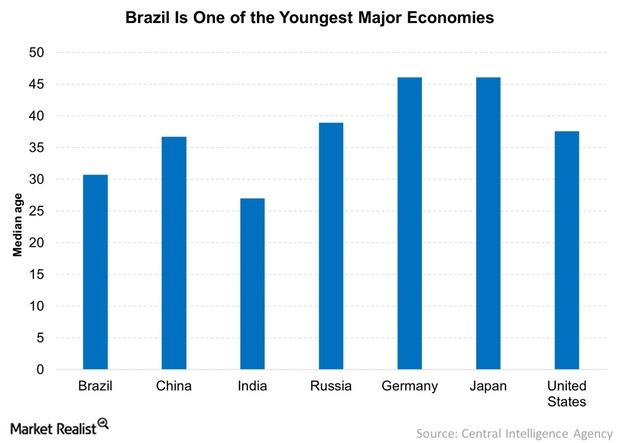

Why the Young Brazilian Population is Key to Brazil’s Success

The young Brazilian population could revive the economy. A younger population is a key demographic indicator to watch out for.

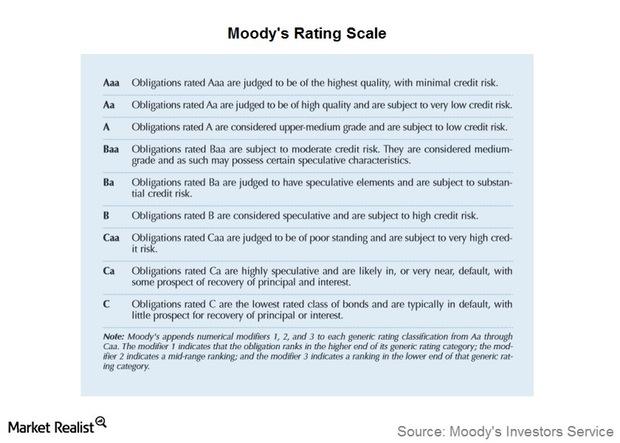

What rating action did Moody’s announce for Japan?

On December 1, 2014, Moody’s Investors Service, a business unit of Moody’s Corporation (MCO), downgraded Japan’s debt rating by one notch, from Aa3 to A1, with a stable outlook.