iShares MSCI Brazil ETF

Latest iShares MSCI Brazil ETF News and Updates

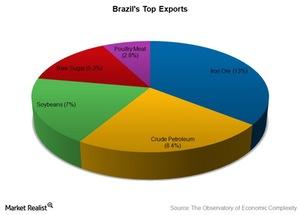

Are Commodities a Boon or a Bane for Brazil?

Brazil (EWZ) is rich in commodities. It’s among the top producers and exporters of iron ore, crude petroleum, soybeans, sugar, and meat.

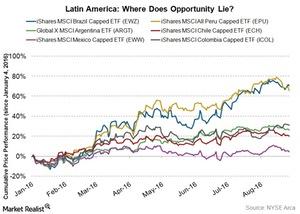

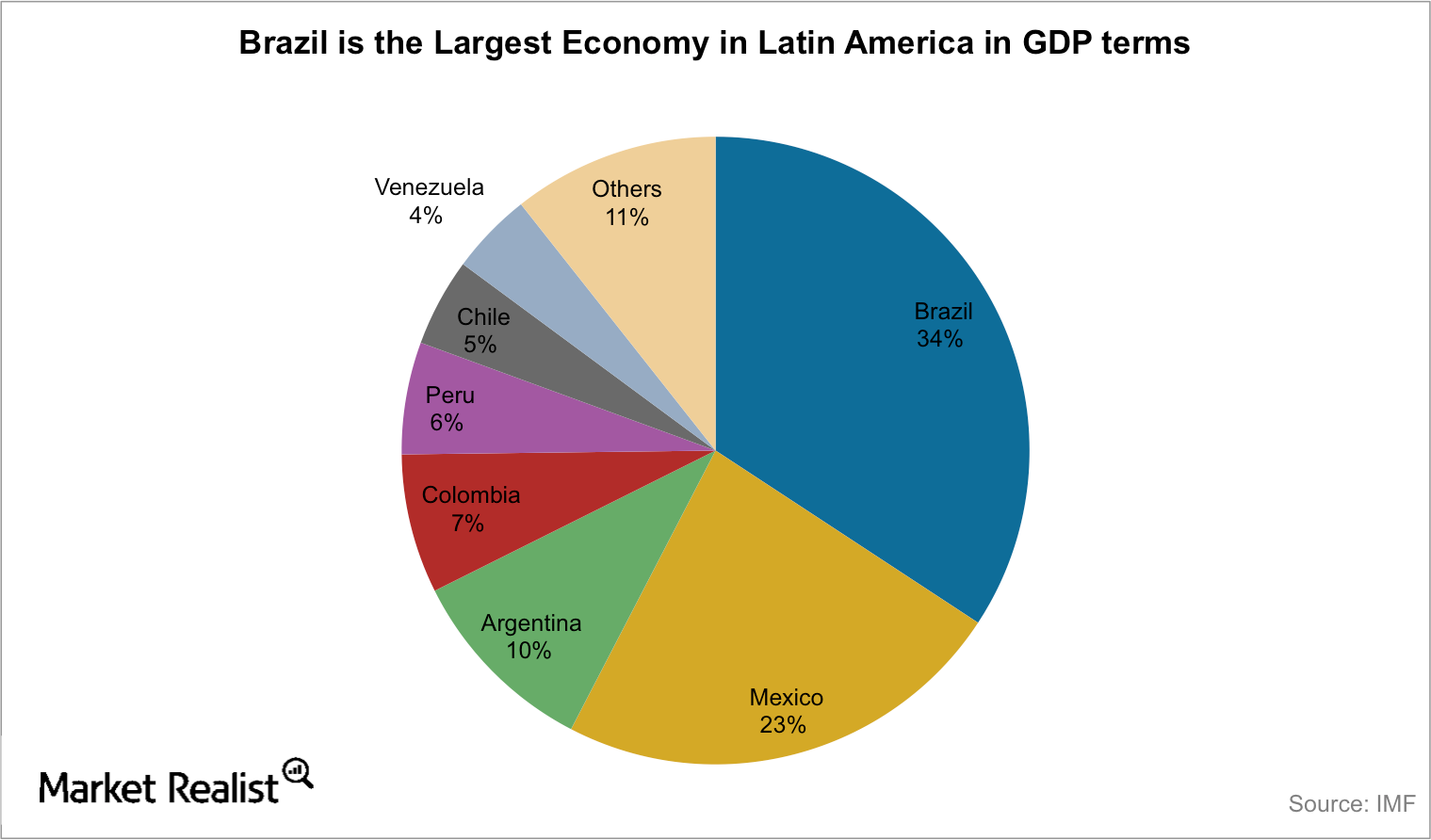

Investing in Latin America Can Bear Fruit, but Should We?

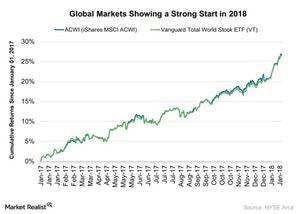

With commodity prices recovering and major developed markets (EFA) (VEA) caught in the lull, Latin America should see sunnier days ahead.

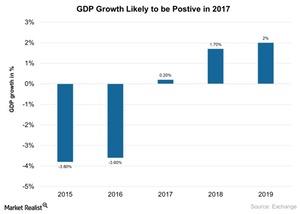

Why IMF Slashed Brazil’s Economic Growth Outlook in 2017

Economic activity in Brazil (EWZ) has been slow as it tries to emerge from its deep recession in 2016. But consumer and business confidence is improving.

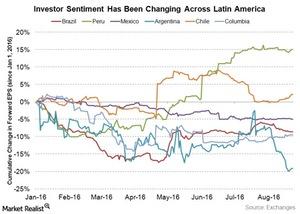

Investor Sentiment Favors Peru, Chile, and Brazil

Investor sentiment with respect to Latin American economies has definitely been changing since the beginning of the year.

Why Latin American Economies May Be in Trouble

Worsening economic conditions in Brazil and Venezuela hit economic growth in Latin America in the first quarter of 2015.

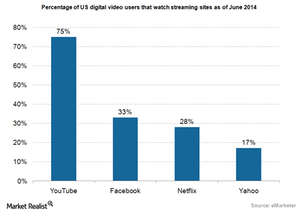

Spotify Plans to Enter Video Streaming Market

Spotify now plans to enter the video streaming market, according to a May 7 Wall Street Journal report.

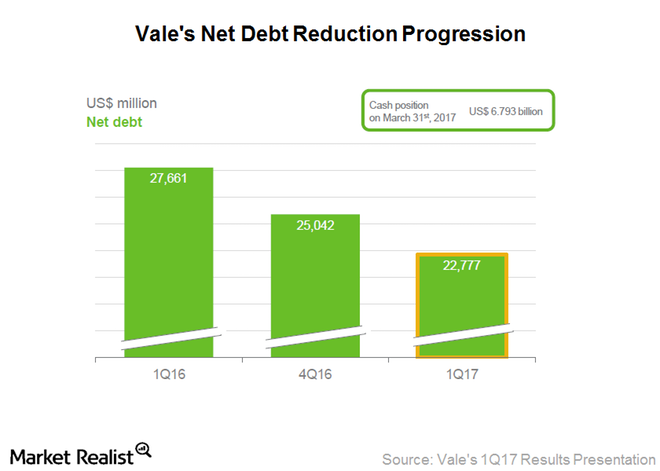

Can Vale SA Reverse Its 2Q17 Performance in 2017?

While Vale SA outperformed peers including Rio Tinto (RIO) and BHP Billiton by rising 24.7% in 1Q17, its performance deteriorated significantly in 2Q17.

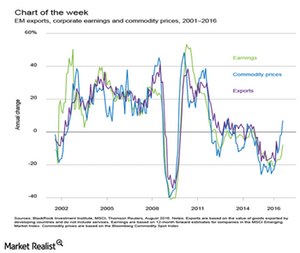

Why Emerging Markets Are Rebounding

Emerging markets (IEMG) (AAXJ) are expected to grow at a healthy pace of 4% in 2016 and see even higher growth in 2017.

Why Is David Rubenstein Optimistic about Brazil?

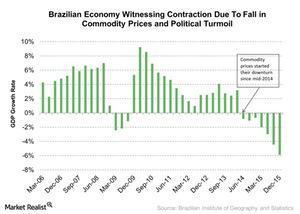

The Brazilian economy is experiencing contraction due to a fall in commodity prices and the political turmoil. The commodities market is one of Brazil’s most important growth drivers.

Why Colombian Stocks Are Surging in 2017

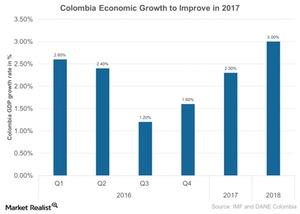

As the third-largest economy in Latin America, Colombia is expected to recover from its subdued growth of ~2% in 2016—its lowest figure since 2009.

An Introduction to Brazil’s Largest Banks, Latin America’s Biggest

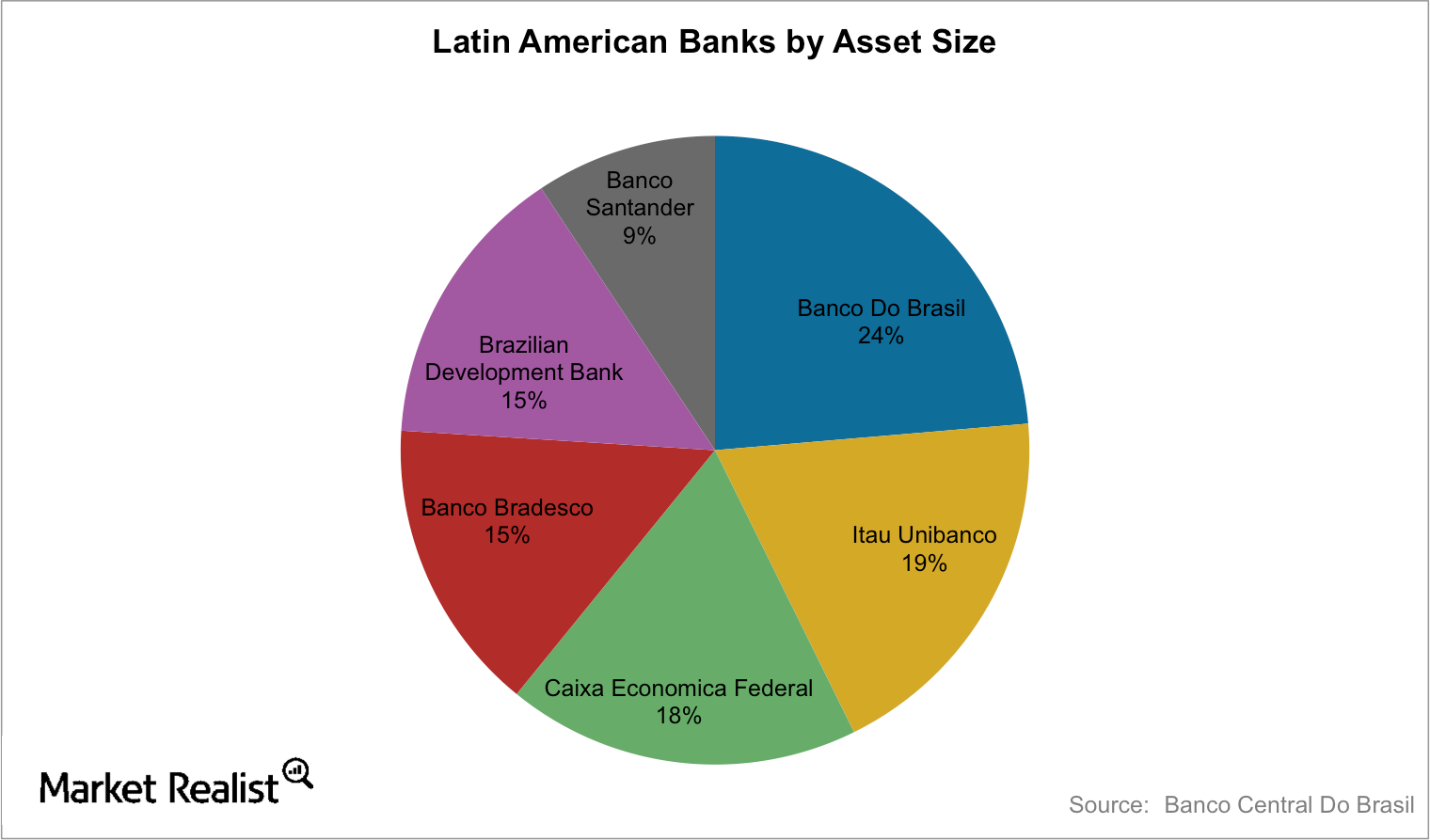

Since the ’80s and ’90s, Latin American banks have stabilized. Today, the largest banks in Latin America are concentrated in two countries: Brazil and Mexico.

A Look at Emerging Markets PMI Reports in December 2017

In this series, we’ll analyze the manufacturing and services activity of China, India, and Brazil (EEM) in December 2017.

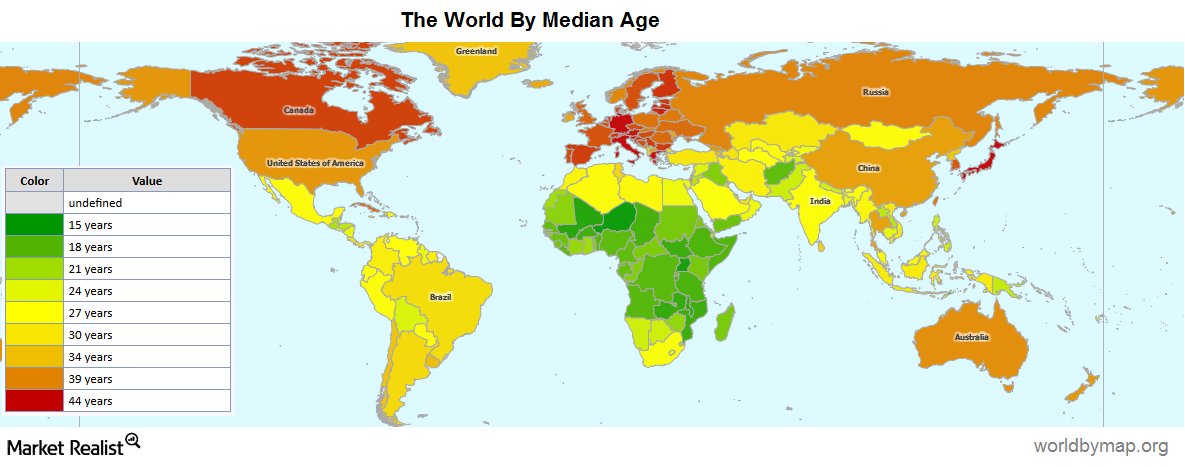

How Demographics Are the Key to India’s Growth

Demographics are the key to India’s growth story. India’s strength in numbers is one of its biggest advantages over the rest of the world.Financials Why Brazil seeks diversification

Given the declining competitiveness of its commodity exports, Brazil’s economy is attempting to diversify away from its economic model.Financials Overview: The must-know characteristics of frontier markets

Looking for the next frontier in emerging market investing? Del Stafford dives into these underdeveloped countries to assess the investment case.

Emerging Markets Have Been Leading Stock Returns in 2016

While developed markets have been caught in a lull, we’ve seen emerging markets grab the spotlight. Emerging markets have been leading stock market returns so far in 2016.

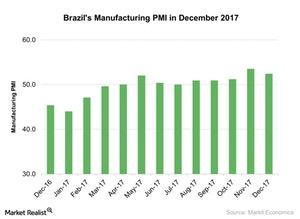

Analyzing Brazil’s Manufacturing PMI in December 2017

The final Markit Brazil manufacturing PMI stood at 52.4 in December compared to 53.5 in November 2017. The December PMI didn’t beat the initial estimate of 52.8.

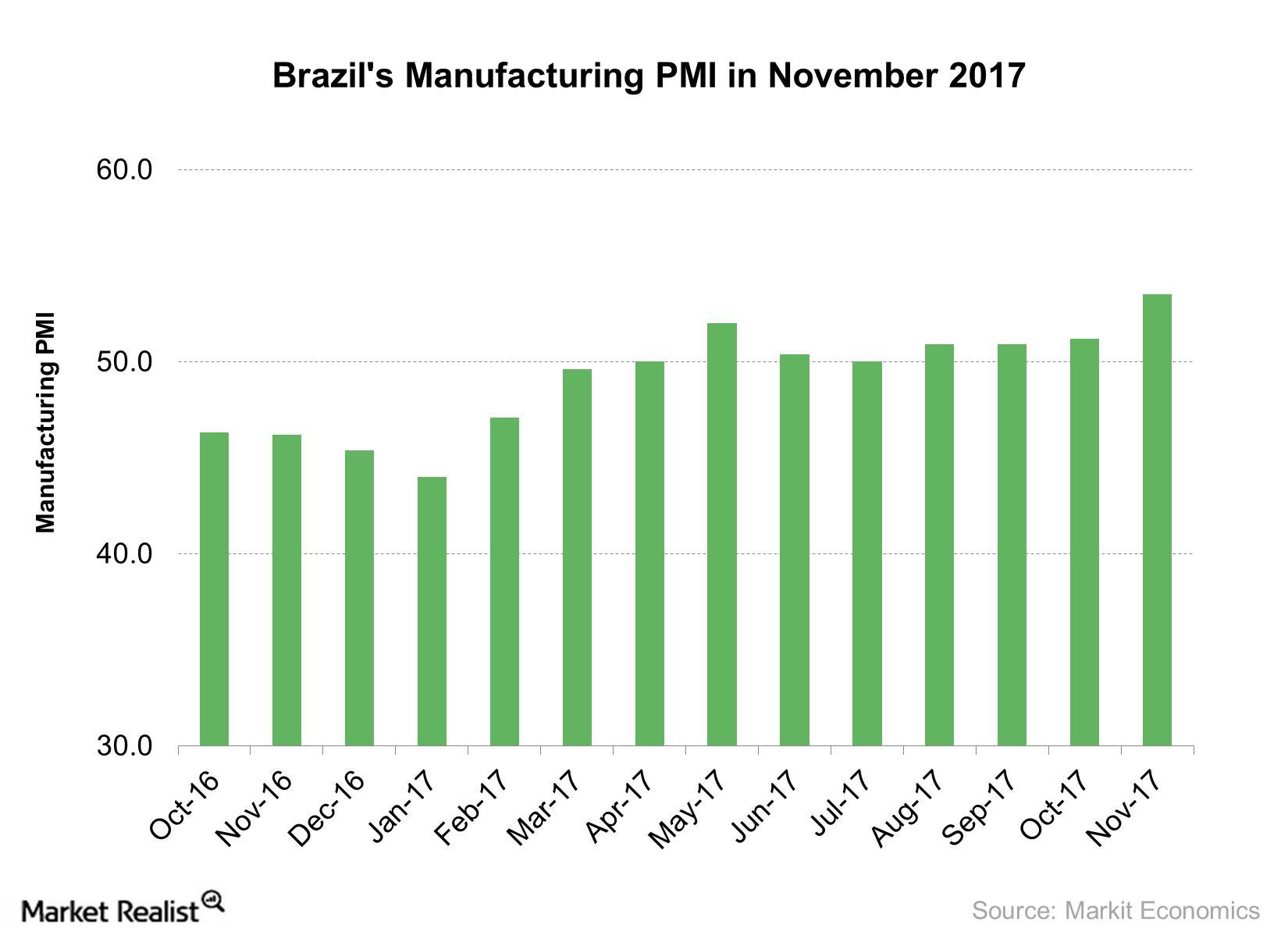

Brazil’s Manufacturing Activity Improves in November 2017

Brazil’s manufacturing activity in November According to data provided by Markit Economics, Brazil’s manufacturing PMI (purchasing managers’ index) rose to 53.5 in November from 51.2 in October, beating the estimate of 52.5 and marking the strongest rise in five years. November’s improvement in manufacturing activity was mainly due to the following factors: production output and volume […]

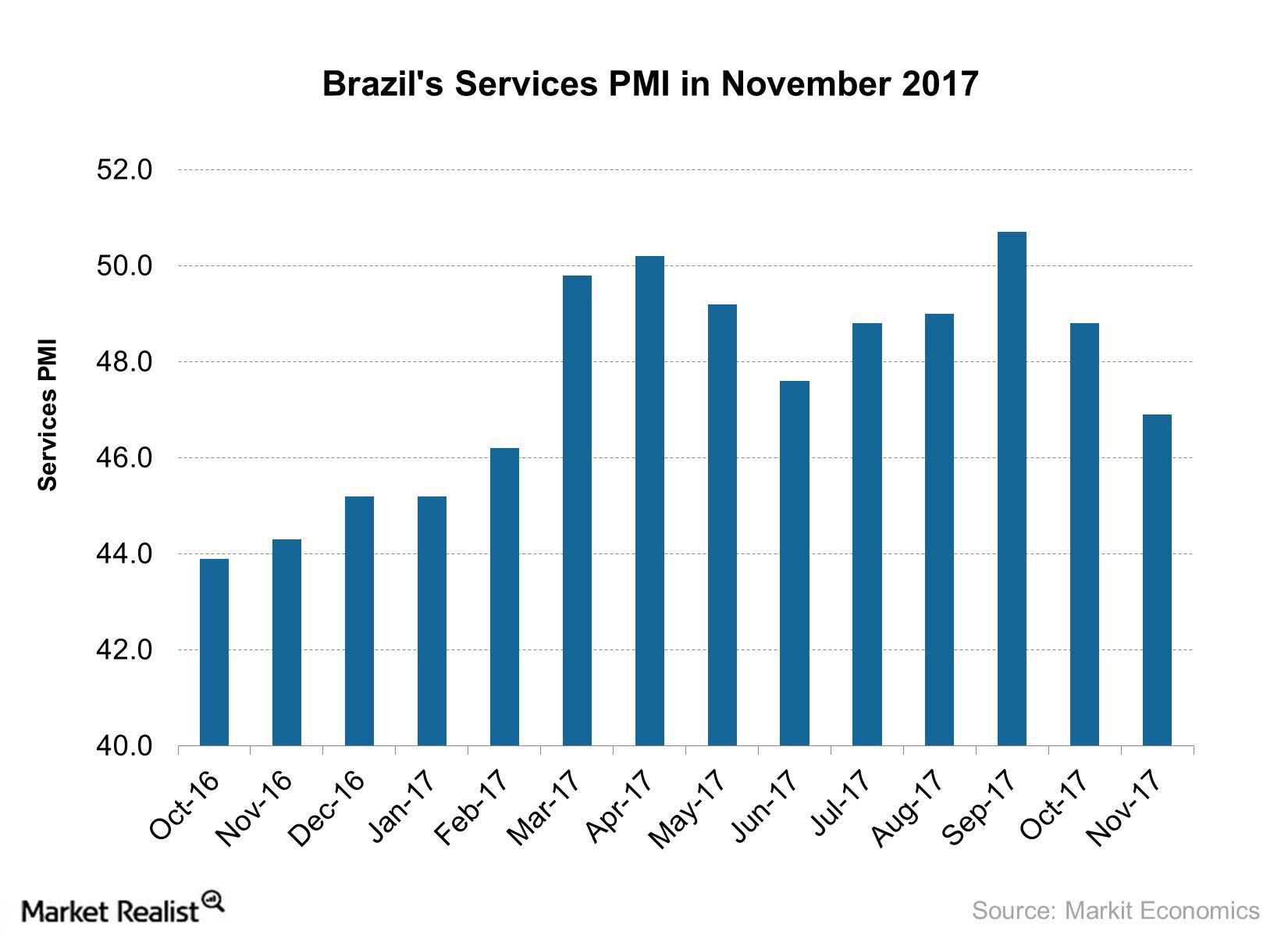

A Look at Brazil’s Service Sector in November 2017

Brazil’s service sector in November According to a report by Markit Economics, Brazil’s service PMI (purchasing managers’ index) continued to fall in November. A level below 50 indicates contraction in economic activity, and a level above 50 indicates expansion in economic activity. Brazil’s service PMI fell to 46.9 in November from 48.8 in October. The contraction […]

Key Economic Indicator Data Released Last Week

In this series, we’ll analyze major emerging nations’ manufacturing and service PMIs (purchasing managers’ indexes).

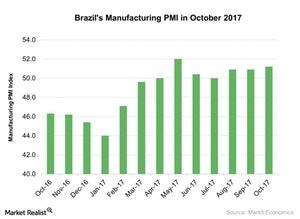

Brazil’s Manufacturing PMI Improved: What’s Driving the Growth?

According to data provided by Markit Economics, the final Markit Brazil Manufacturing PMI (purchasing managers’ index) stood at 51.2 in October 2017 as compared to 50.9 in September 2017.

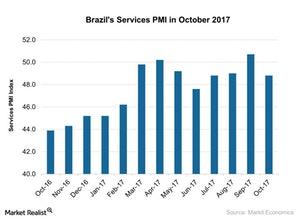

How Brazil’s Services PMI Looked in October 2017

Brazil’s service PMI stood at 48.8 in October as compared to 50.7 in September 2017 and was below the preliminary market expectation of 50.5.

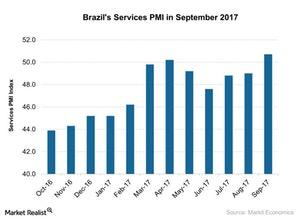

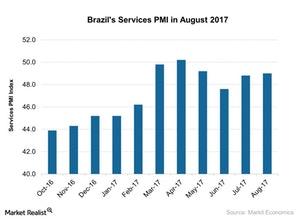

What Helped Brazil’s Services PMI Rise So Much in September?

The final Brazil Services PMI (Purchasing Managers’ Index) stood at 50.7 in September 2017 compared to 49.0 in August.

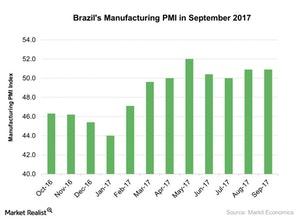

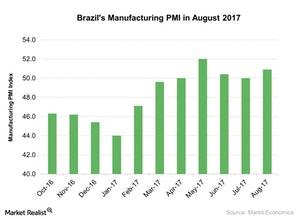

Insights into Brazil’s Manufacturing PMI in September 2017

The final Markit Brazil Manufacturing PMI (Purchasing Managers’ Index) stood at 50.9 in September 2017. It remained unchanged compared to August 2017.

Why Brazil’s Services Activity Was in the Contraction Zone in August

Brazil’s (EWZ) services PMI was in the contraction zone in August 2017.

Did Brazil’s Manufacturing Activity Improve in August?

According to a report by Markit Economics, the final Brazil manufacturing PMI (purchasing managers’ index) rose to 50.9 in August 2017 as compared to 50 in July.

How Emerging Market Manufacturing Activity Is Trending

In this series, we’ll take a look at the manufacturing activity and service activity of major emerging economies (EEM) (VWO) in August 2017.

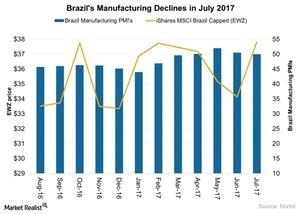

Why Manufacturing Activity in Brazil Is on a Decline

Manufacturing activity in Brazil In July 2017, the manufacturing PMI (purchasing managers’ index) in Brazil (BRZU) continued to decline, falling to 50 from 50.5 in June 2017. July 2017 brought a slowdown in both output and new business. US companies doing business in Brazil include Walmart (WMT), ExxonMobil (XOM), Chevron (CVX), and Apple (AAPL). Brazil (EWZ) […]

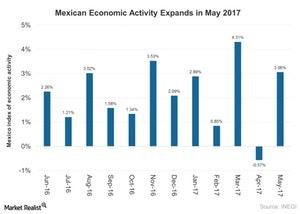

Mexico’s Economic Activity Rebounded in May 2017

Economic activity in Mexico rose 3.1% year-over-year (or YoY) in May 2017, a rebound from its YoY fall of 0.57% in April 2017.

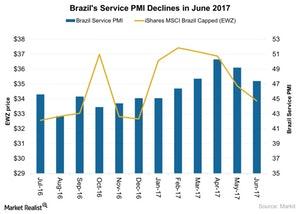

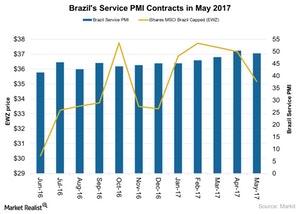

Understanding Brazil’s Service PMI in June

The services sector is one of the most important sectors contributing to Brazil’s GDP and job creation, but its been facing structural issues and poor performance.

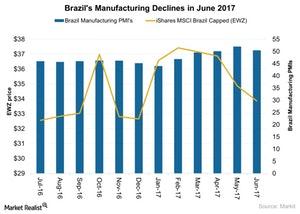

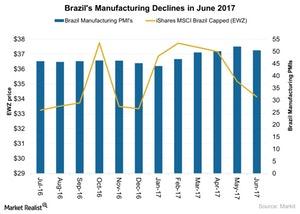

Inside Brazil’s June Manufacturing Activity

The Brazil Manufacturing PMI (purchasing managers’ index) fell slightly in June 2017 due to political turmoil in the country’s government.

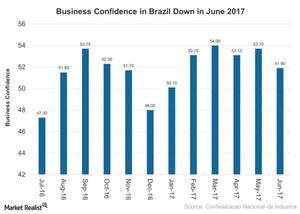

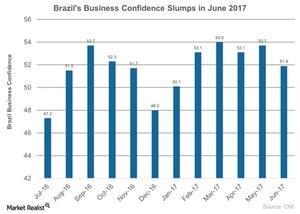

Is Brazil’s Business Confidence on a Declining Trend in 2017?

Political chaos has affected confidence levels in Brazil, which saw its business confidence reach its lowest level in 2017 in June.

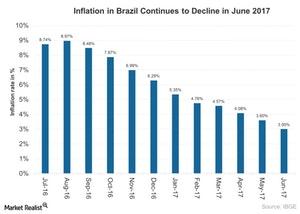

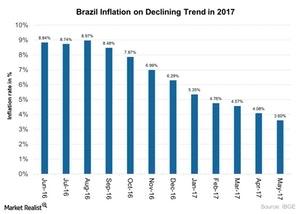

Brazil’s Inflation in June: A Story of Decline

Consumer prices in Brazil (BRZU) grew by 3% YoY in June 2017, compared with 3.6% in May 2017.

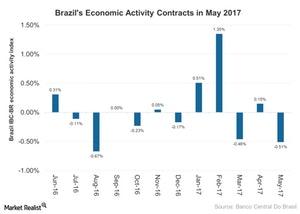

Will Brazil’s Economic Activity Keep Contracting amid Political Chaos?

Brazil seems to be giving mixed signals, with its index of economic activity (BRZU) dropping by 0.51% month-over-month in May 2017.

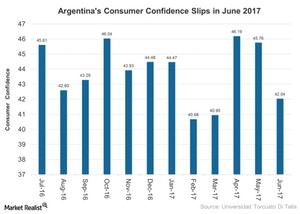

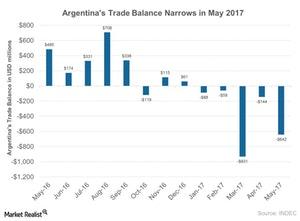

Why Argentina’s Consumer Confidence Fell in June 2017

President Mauricio Macri’s austerity measures seem to be impacting Argentina’s consumer confidence, as it saw another fall in June 2017.

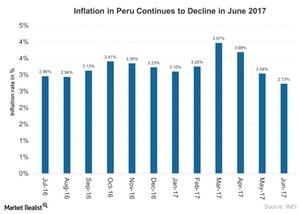

Peru’s Inflation in 2017 and Slower Economic Activity

Peru’s economy continues to suffer in 2017 from the damage caused by floods in March 2017 due to the ENSO (El Niño Southern Oscillation).

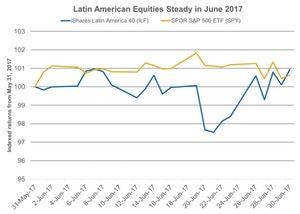

Performance of Latin American Equities Steady in June 2017

Latin American (ILF) equities in June 2017 remained steady amid the political turmoil among its member nations.

Political Tensions in Brazil: Former President Lula’s Conviction

On July 13, 2017, Brazil’s former President Luiz Inácio Lula da Silva was sentenced to ten years in prison for graft.

Why Brazil’s Manufacturing Activity Lost Momentum in June 2017

Brazilian (ILF) manufacturers remain firmly optimistic about the country’s output growth in the next 12 months.

Why Brazil’s Service Sector Activity Contracted in May 2017

The Markit Brazil Services PMI dropped to 49.2 in May 2017 compared a two-year high of 50.3 in April 2017.

Political Unrest Impacts Brazil’s Business Confidence in June 2017

The Industrial Entrepreneur Confidence Index in Brazil (FBZ) dropped to 51.9 in June 2017 compared to 53.7 in May 2017, reaching its lowest level since January 2017.

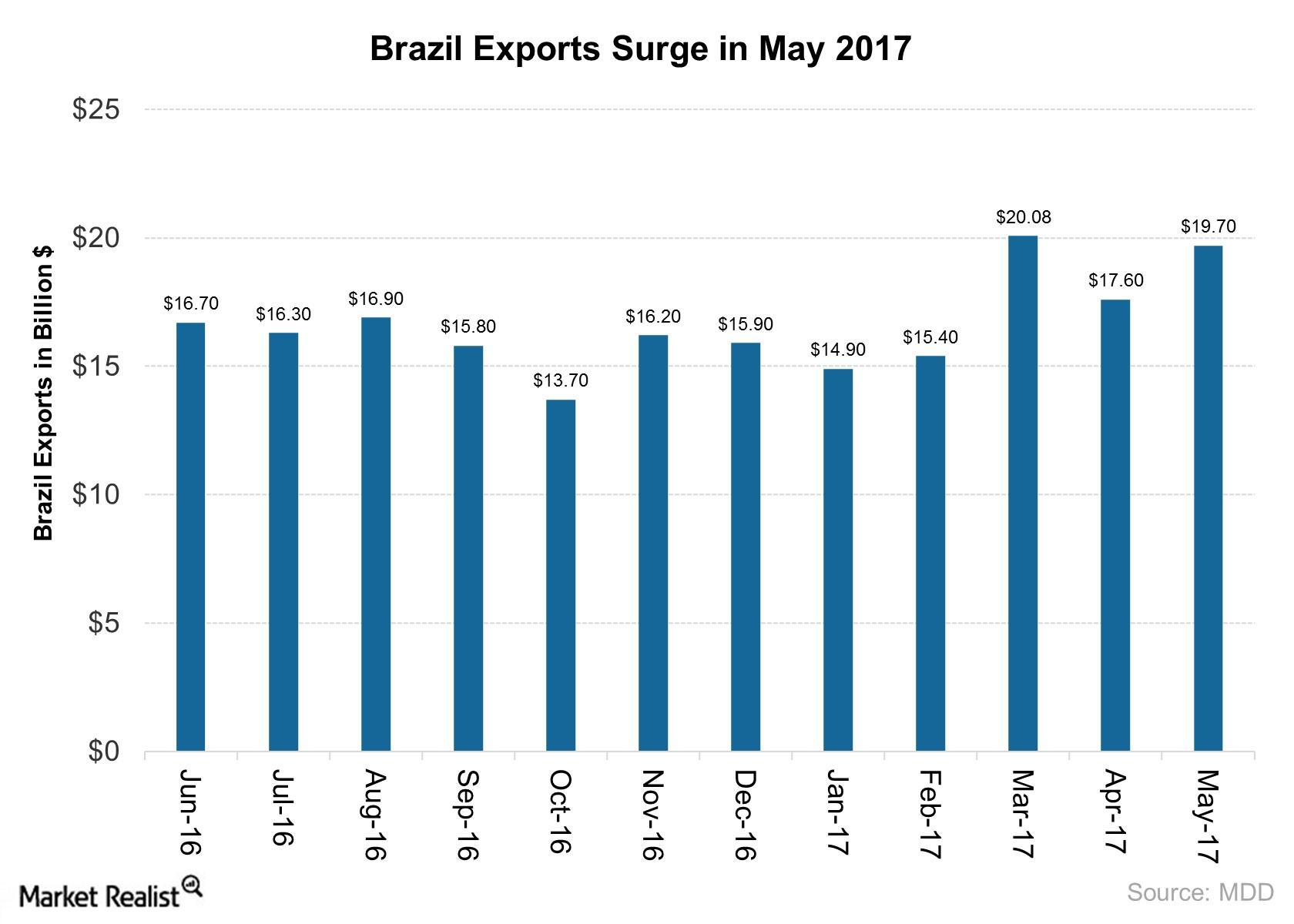

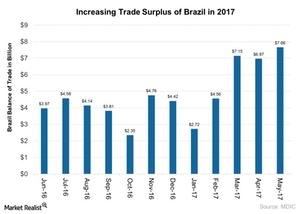

Did Brazil’s Exports Surge in May 2017 Due to Improved Global Demand?

In the first five months in 2017, the Brazil’s exports rose 18.5% to $87.9 billion compared to the same period in 2016.

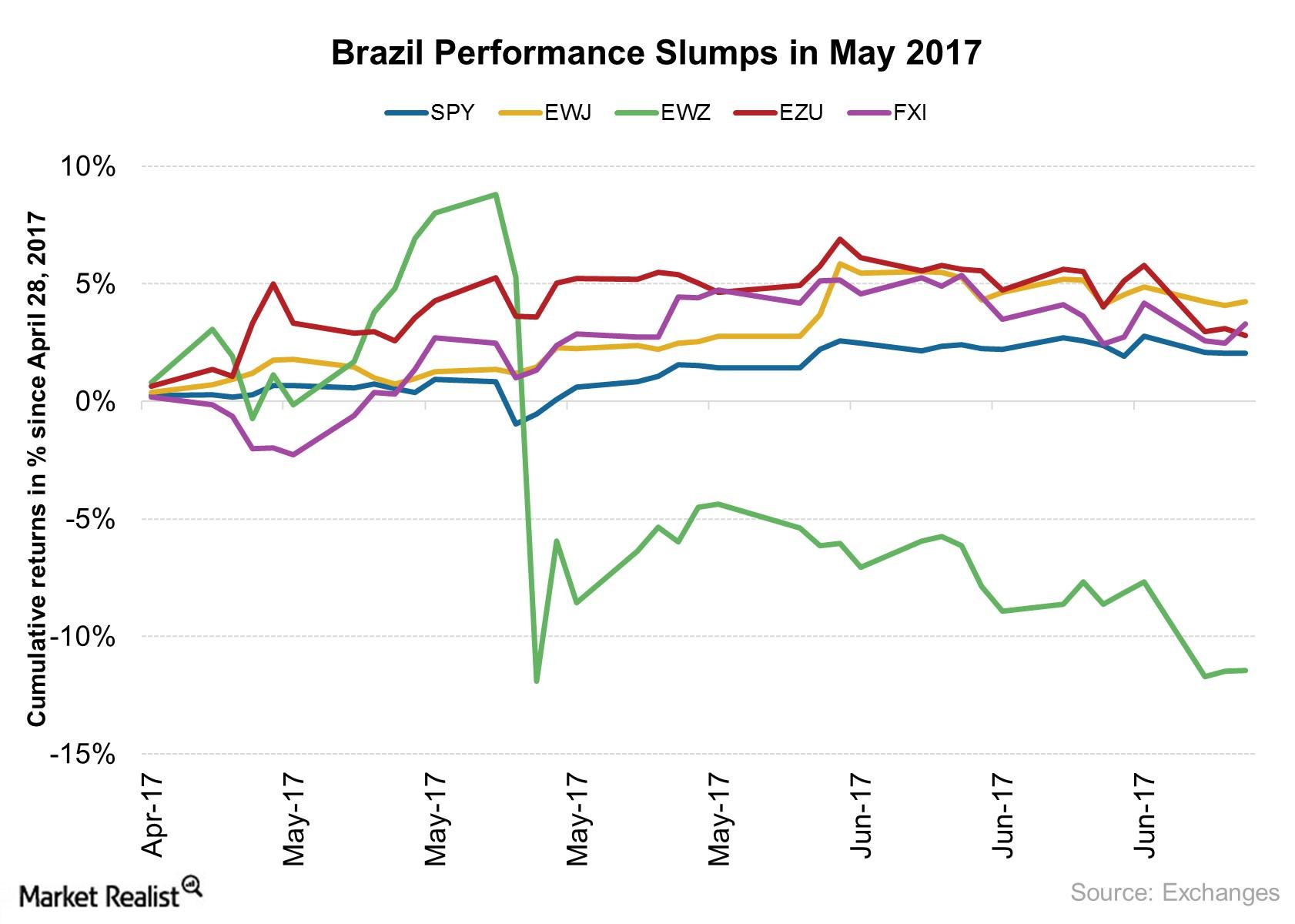

How Political Instability Affected Brazil’s Stock Performance in May 2017

The International Monetary Fund is projecting 0.5% growth in Brazil’s GDP output in 2017, according to its April 2017 outlook report.

Improved Global Demand Boosted Brazil’s Trade Surplus in May 2017

Brazil’s exports stood at $19.7 billion in May 2017, a 12.6% increase year-over-year, boosted by sales of semi-manufactured products and basic products.

Why Consumer Confidence in Argentina Is Falling in 2017

Argentina’s (FM) consumer confidence saw a huge drop in June 2017, as Argentinians are highly unsatisfied with the austerity measures President Macri’s government has adopted.

Inflation in Brazil Declined in May 2017

Inflation in Brazil (BRZU) continued its decline in May 2017, standing 1% below the central bank’s target of 4.5%.

Is Argentina Outperforming Emerging Markets in June 2017?

The Merval Index, Argentina’s benchmark index, has risen about 10.5% so far in 2017 as of June 23.

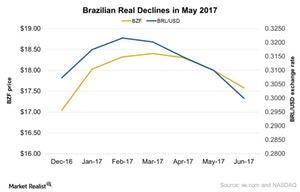

Slumping Commodity Prices Pressure the Brazilian Real in 2Q17

The Brazilian real dropped ~2% in May 2017 amid the country’s ongoing political instability.

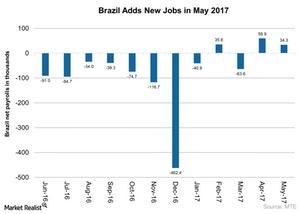

What Brazil’s Job Growth in May 2017 Could Indicate for the Year

The Brazilian (BRZU) economy added ~34,250 jobs in May 2017, making it the second consecutive month of job creation in 2017.

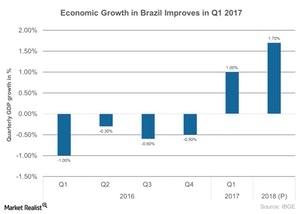

Factors Impacting Brazil’s Economic Growth in 1Q17

Brazil’s (EWZ) economy improved in 1Q17, mostly due to the manufacturing sector, exports, and business confidence. However, recent political scandals have undermined its growth and credit rating.