An Introduction to Brazil’s Largest Banks, Latin America’s Biggest

Since the ’80s and ’90s, Latin American banks have stabilized. Today, the largest banks in Latin America are concentrated in two countries: Brazil and Mexico.

Nov. 20 2020, Updated 10:40 a.m. ET

After prolonged periods of turbulence in the ’80s and ’90s, Latin American banks have stabilized. Today, the largest banks in Latin America are concentrated in two countries: Brazil and Mexico.

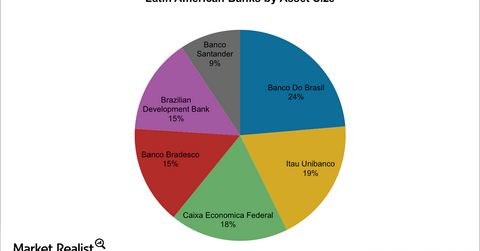

Brazil has the five largest institutions by asset size while Mexico claims the remainder.

Let’s take a further look at the top three publicly traded banks by assets size in Latin America.

Banco do Brasil

Baco do Brasil is the largest Latin American bank by assets and the third-largest in terms of market value. As of 2014, it has total assets of $534.7 billion. The bank is controlled by the government but trades on the São Paulo Stock Exchange.

On top of lending to individuals and businesses, the bank also offers asset management services and foreign exchange capabilities. Based in Brasília, the bank operates in North America, South America, Europe, Asia, and Africa.

Year-to-date, this bank’s shares have lost 11.61%.

Itaú Unibanco Holding

Itaú Unibanco (ITUB) is the second-largest bank in Latin America by assets and the tenth-largest bank in the world by market value. It’s is a Brazilian publicly traded bank listed on the São Paulo Exchange as well as the New York Stock Exchange. The bank is the result of the merger of Banco Itaú and Unibanco, which occurred on November 4, 2008. Year-to-date, the stock has plunged ~33%.

Banco Bradesco

Banco Bradesco (BBD) is the third-largest bank in Latin America (ILF) by assets. It was the largest private bank before the merger of Itaú and Unibanco in 2008. Bradesco’s stock trades on BM&F Bovespa, where it’s part of the Índice Bovespa. It’s also listed on the New York Stock Exchange and Madrid Stock Exchange. Shares of Banco Bradesco have collapsed in 2015 by 6.02%.

Other large banks in Latin America are Caixa Economica Federal, a government-controlled bank, BancoSantandar (SAN), with an asset base of $194 billion, and BBVA Bancomer, the largest bank in Mexico.

Banco Santander, Banco Bradesco, and Itaú Unibanco constitute ~30% of the Global X Brazil Financials ETF (BRAF). These banks also form a large part of the iShares MSCI Brazil Capped ETF (EWZ), which tracks the broad markets in Brazil.