Banco Santander SA

Latest Banco Santander SA News and Updates

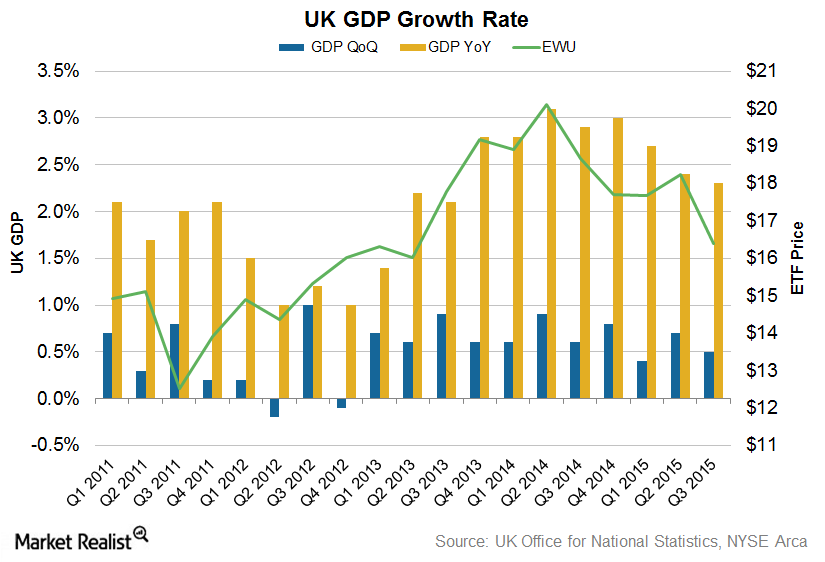

Rise in Household Spending Provided Respite for UK Economic Growth

With household spending gathering pace, it could be an important growth driver for the United Kingdom’s economic growth.

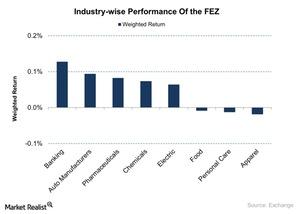

Positive Manufacturing Reports Drive the FEZ Up

The SPDR Euro Stoxx 50 ETF (FEZ) is a US exchange-traded ETF that tracks the performance of the 50 largest companies across the Eurozone.

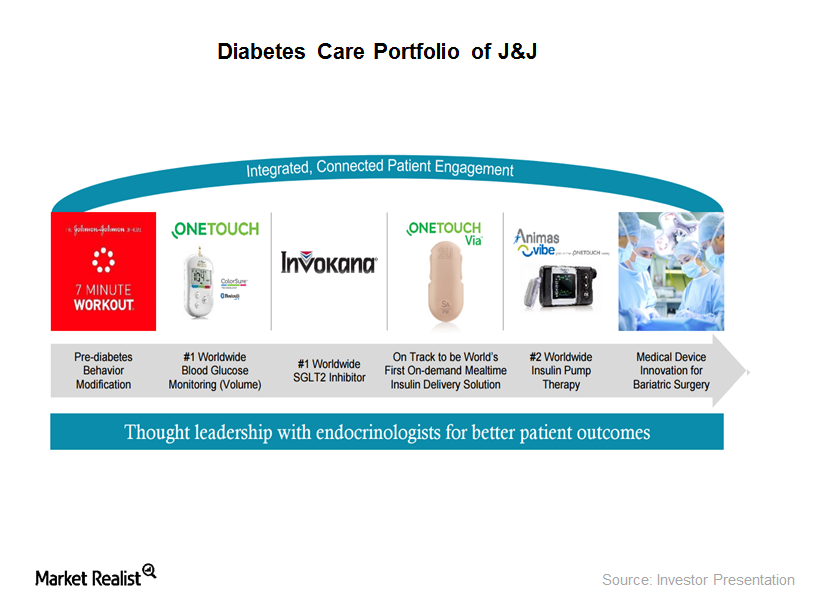

Johnson & Johnson Gets FDA Approval for Type 2 Diabetes Drug

On September 21, 2016, the FDA approved Jannsen Pharmaceuticals’ Invokamet XR for the treatment of adults suffering from Type 2 diabetes.

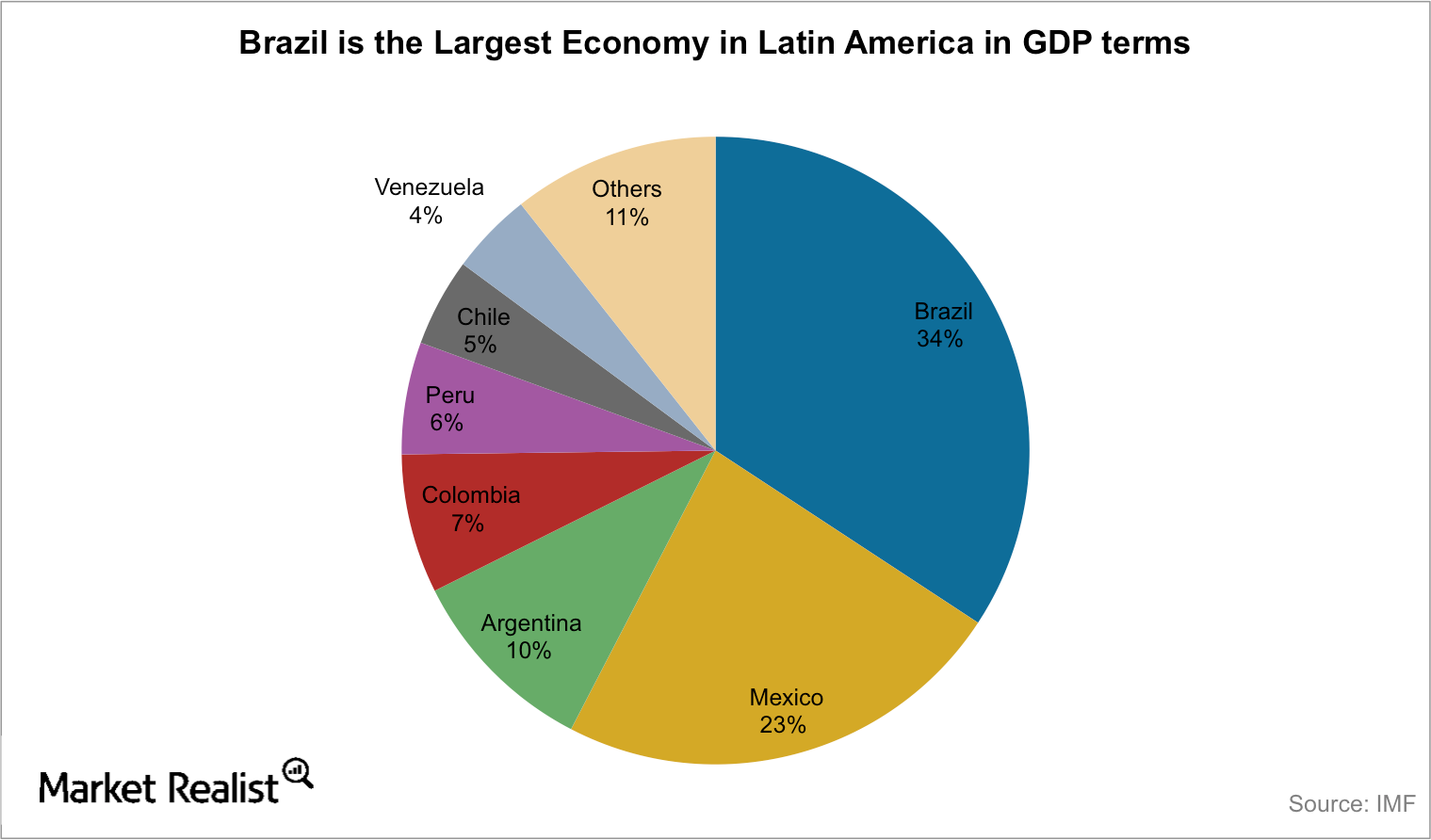

Why Latin American Economies May Be in Trouble

Worsening economic conditions in Brazil and Venezuela hit economic growth in Latin America in the first quarter of 2015.

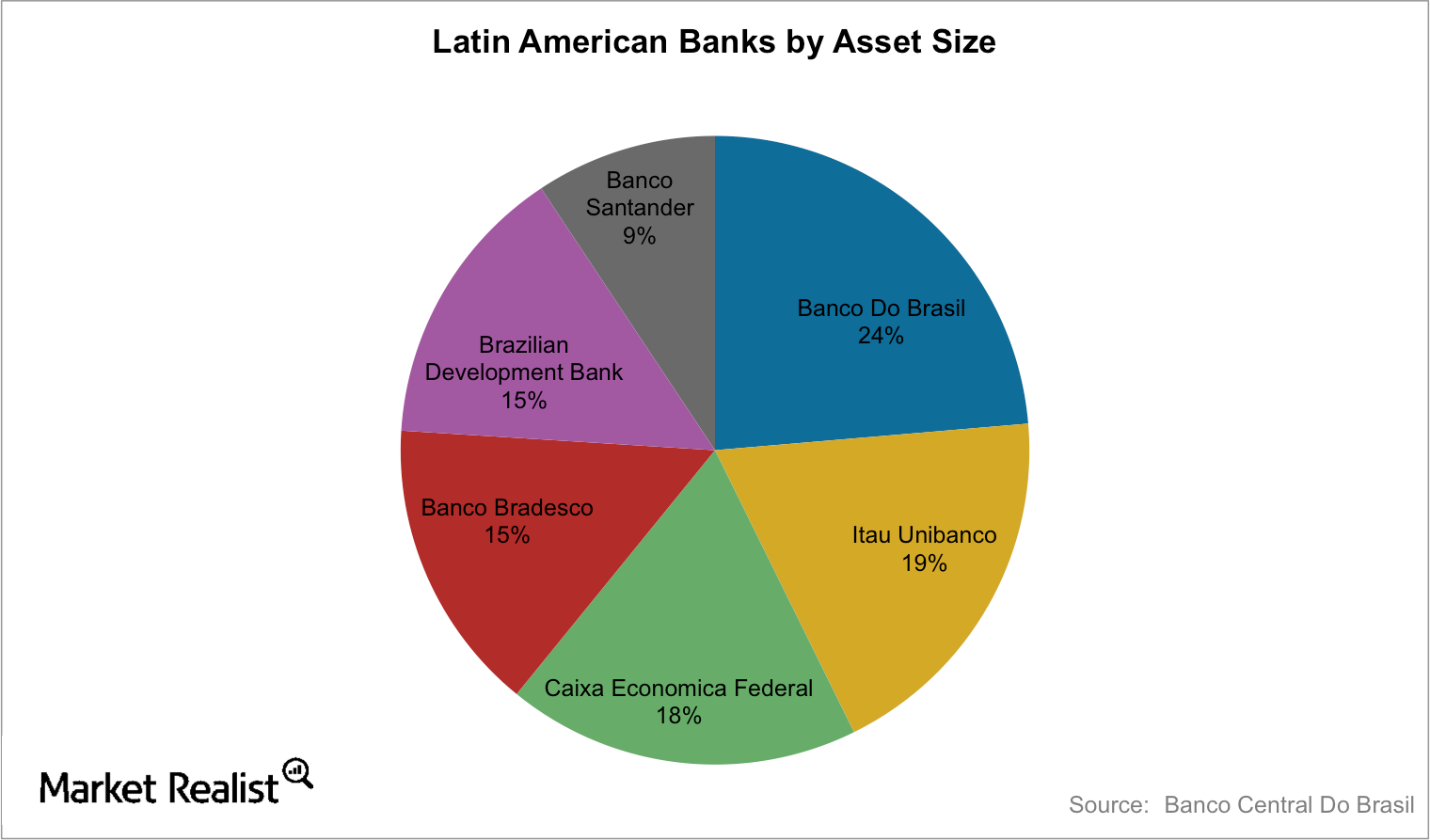

An Introduction to Brazil’s Largest Banks, Latin America’s Biggest

Since the ’80s and ’90s, Latin American banks have stabilized. Today, the largest banks in Latin America are concentrated in two countries: Brazil and Mexico.

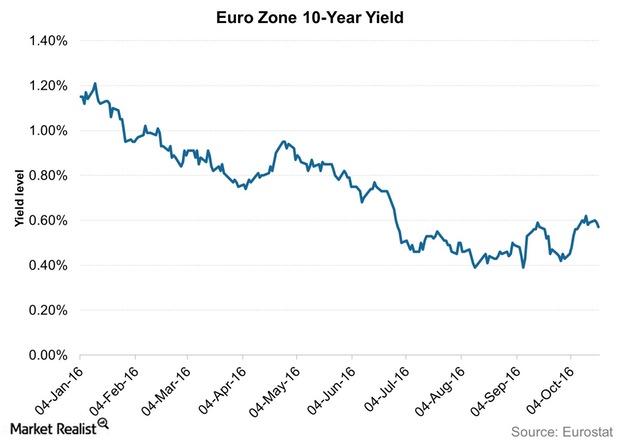

No Tapering, No Extension: ECB Avoids Future Talk on QE

ECB chief Mario Draghi had nothing to say about either tapering or extension of the bond buying program.

Should You Look to European Stocks for Growth?

European stocks began the year with a lot of hope pinned on them for providing capital appreciation in the year.

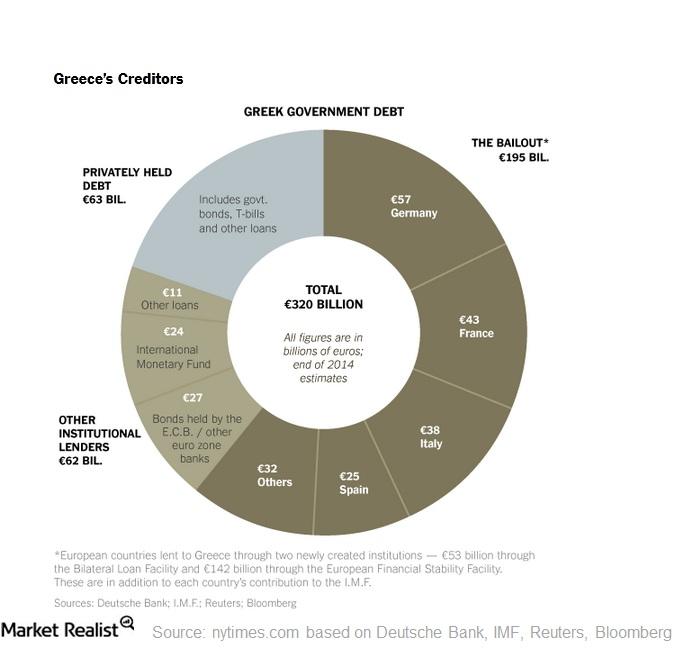

How Does the Greek Debt Crisis Impact the Eurozone?

Greece’s debt was around 250 billion euros. It’s nearly 175% of its 2013 GDP figures. The GDP could fall more in 2016. The debt crisis started in 2010.