BTC iShares MSCI EAFE ETF

Latest BTC iShares MSCI EAFE ETF News and Updates

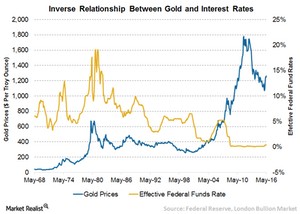

Why Gold Has Performed Better When Interest Rates Are Lower

J.P. Morgan’s analysis states that gold has outperformed equities, bonds, and a broad commodities index in a low interest rate environment.

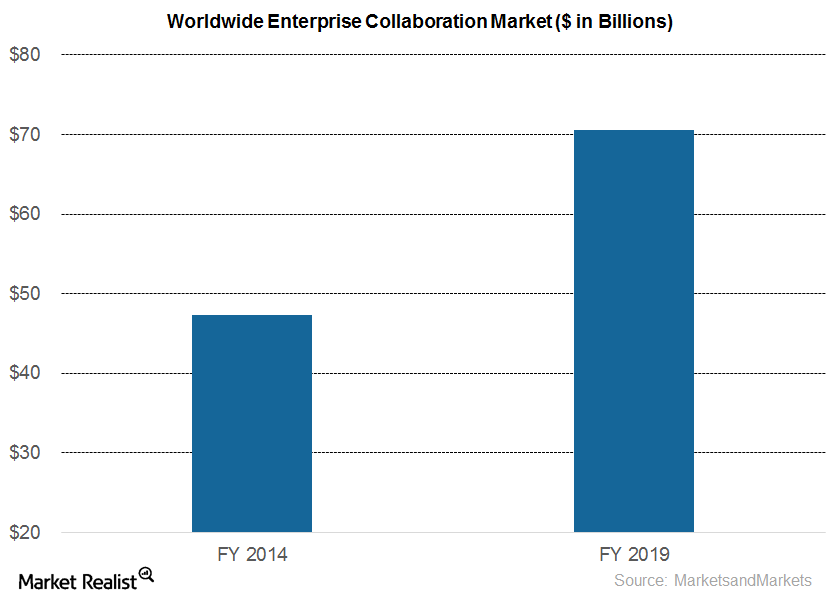

Understanding the Key Growth Drivers in the Collaboration Business

With businesses growing at a rapid pace, companies have begun to adopt new and innovative collaboration solutions to keep up in the competitive environment.

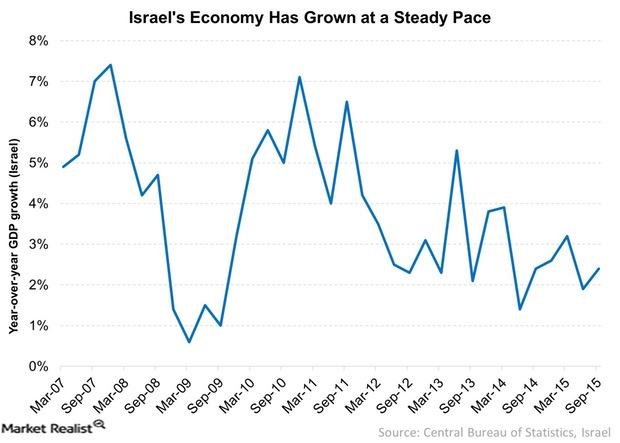

Why Israel’s Economy Is Still Resilient

Israel’s government debt as a proportion of gross national product has declined steadily this century.

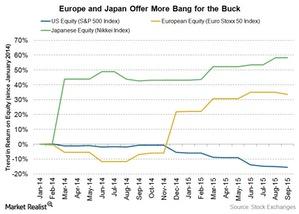

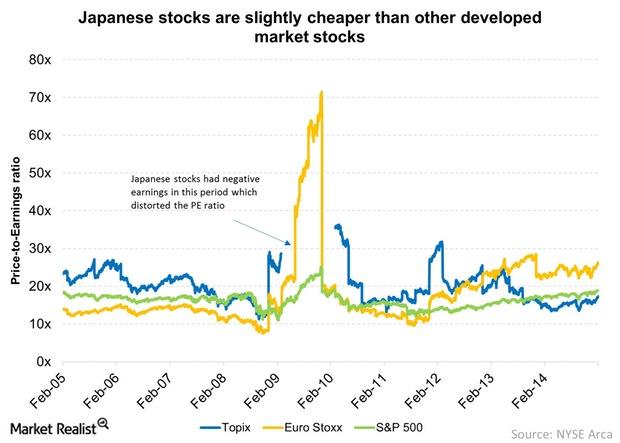

Japanese and European Equities Offer Relative Value

A Janus Capital (JNS) report for 2015 outlook by Bill Gross stated, “We like Japanese and European equities due to cheap valuations and monetary boosters.”

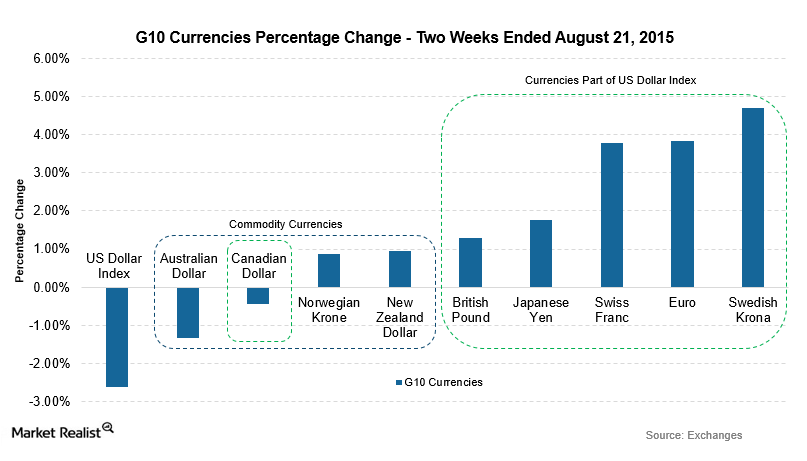

G10 Currencies Gain as US Dollar Index Sinks

The G10 currencies were impacted positively as the US dollar index dropped in value in the two weeks ending August 21, 2015.

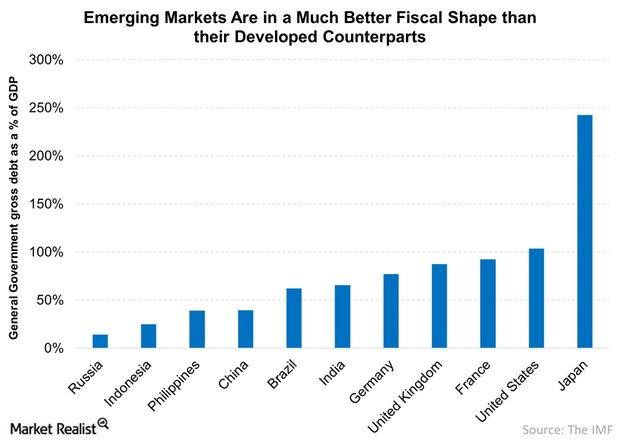

Emerging Markets Are in Good Fiscal Shape

Many of the emerging markets that were viewed as risky or even dangerous a mere 15 years ago now appear to be more attractive than many developed countries.

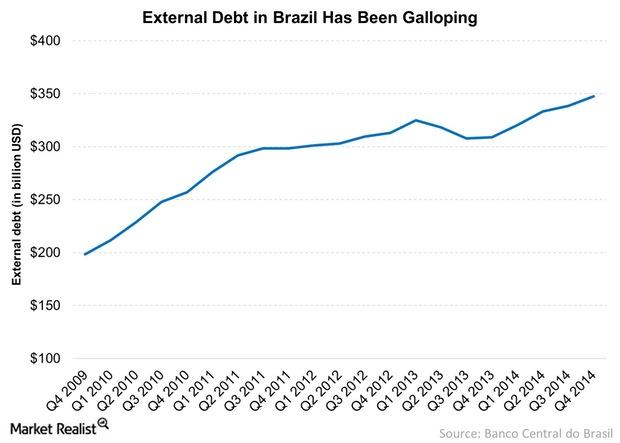

Why the Brazilian Government’s Debt Has Surged over the Years

The Brazilian government’s debt has surged over the last five years. The country’s internal debt has also increased.

Why Japanese Stock Valuations Could Be Justified

Japan looks cheap compared to other developed markets. Japanese stock valuations can be justified if the “three arrows” are used prudently.

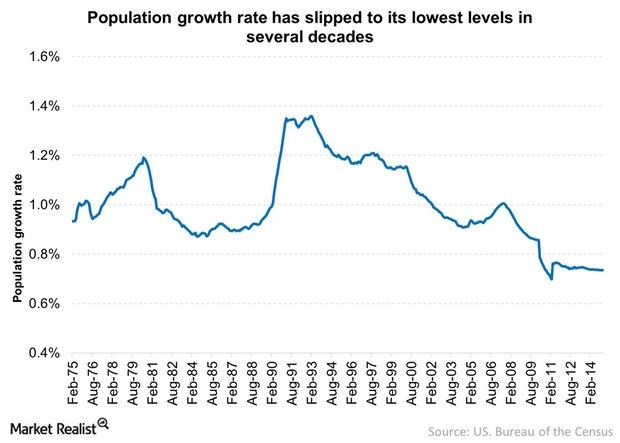

Job Creation Isn’t Matching Population Growth

Job creation isn’t matching population growth. The population growth has been dipping over the last two decades. Currently, it’s 0.7% per year.

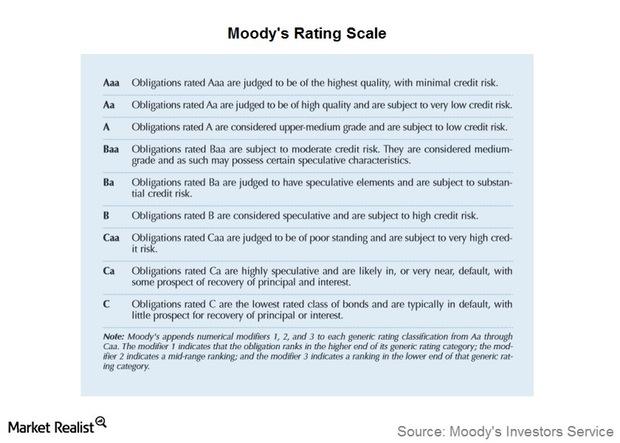

What rating action did Moody’s announce for Japan?

On December 1, 2014, Moody’s Investors Service, a business unit of Moody’s Corporation (MCO), downgraded Japan’s debt rating by one notch, from Aa3 to A1, with a stable outlook.Macroeconomic Analysis Why emerging market bonds are not as risky as they seem

Most emerging markets have less debt compared to their developed market counterparts. This means emerging market bonds aren’t as risky as you may think!