Russ Koesterich, CFA

Russ is Head of Asset Allocation for BlackRock’s Global Allocation Fund. He works with portfolio managers to establish the fund’s macro-level views and also develops systematic strategies to augment the team’s security-selection process and risk management. He is the author of two books, including “The Ten Trillion Dollar Gamble,” on positioning portfolios for the growing U.S. deficit.

Disclosure: The content Market Realist publishes should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of BlackRock.

More From Russ Koesterich, CFA

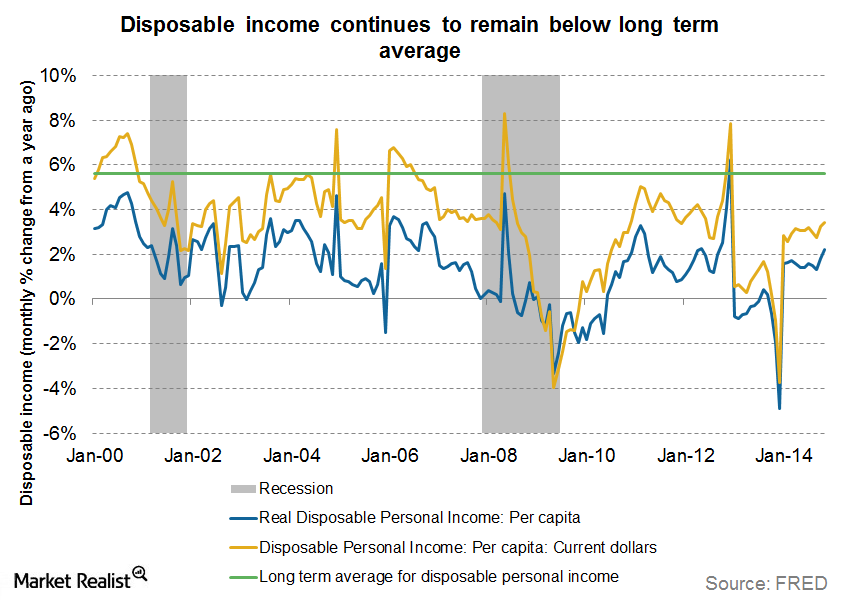

Disposable Income Is Still Below Historical Averages

Disposable income refers to the income available to a household or individual after paying off personal current taxes. Disposable income is still below historical averages.

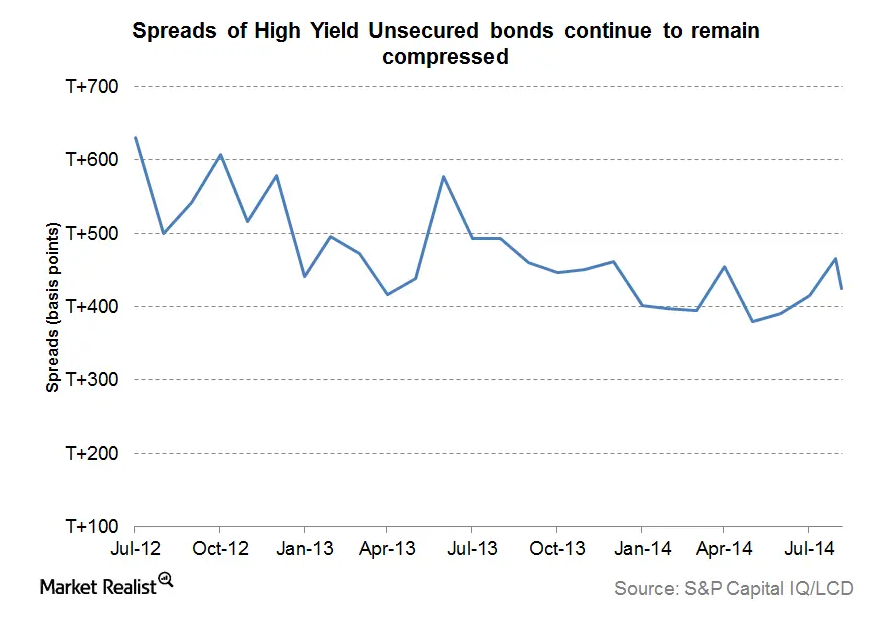

Why tight credit spreads usually mean a period of global expansion

Today, most measures of credit conditions are positive, with tight spreads across all of fixed income. Even high yield spreads have come in after a short scare last month.

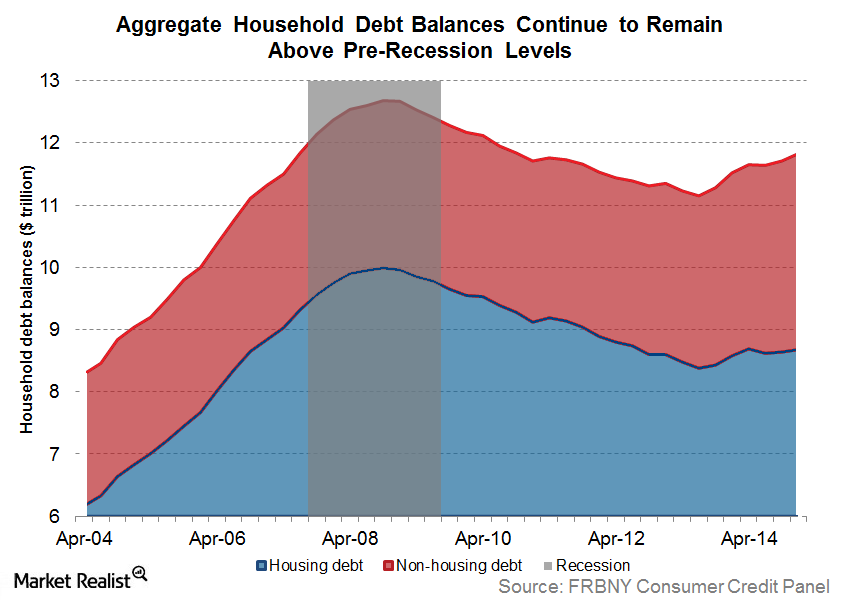

The Great American Deleveraging: Fact or Myth?

The great American deleveraging has largely been limited to the financial sector (XLF) (IYF). Non-financial debt is still much higher than historical averages.

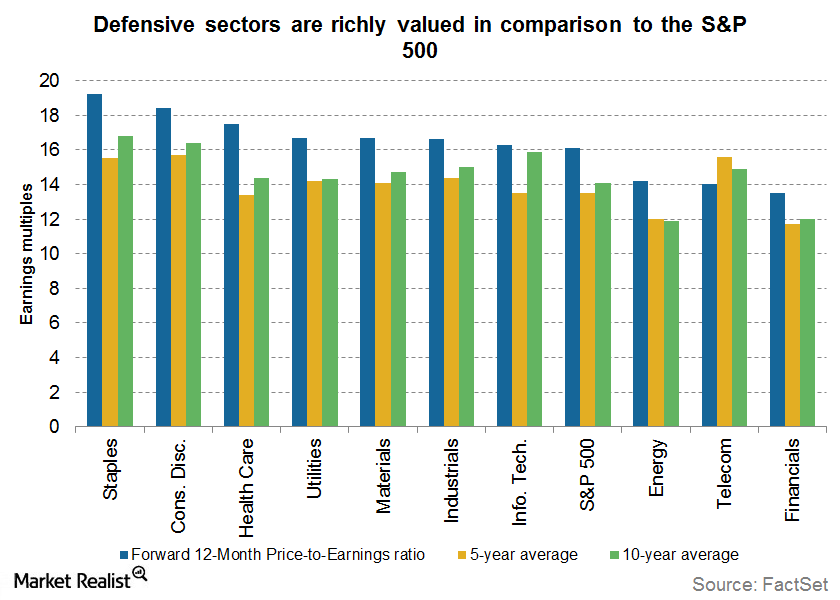

Investors Should Avoid Defensive Sectors If Rates Rise

Valuations are at the higher end of their historical range. Investors should avoid defensive sectors, which are highly sensitive to interest rate changes.

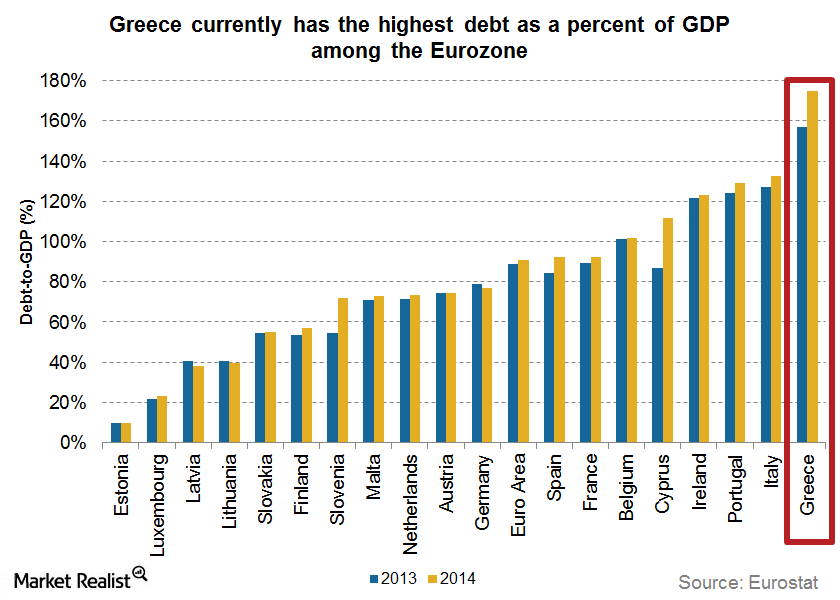

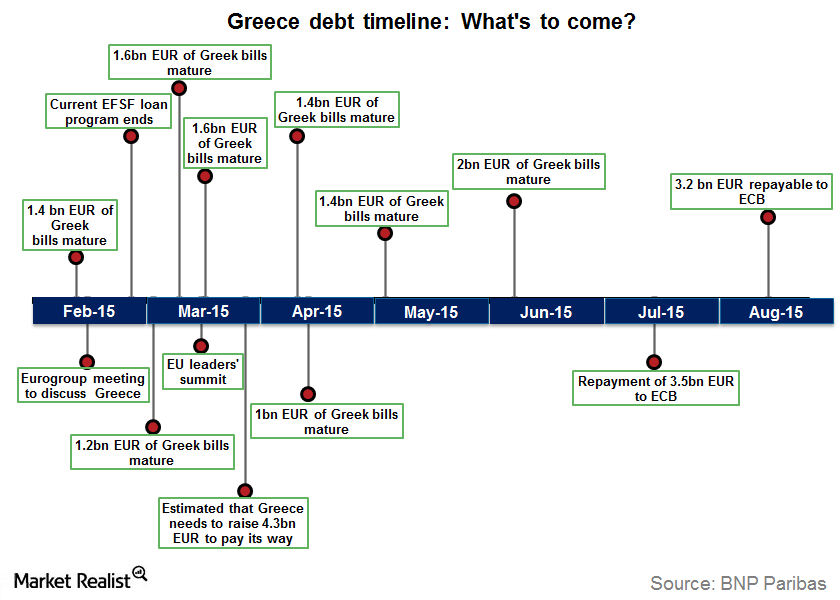

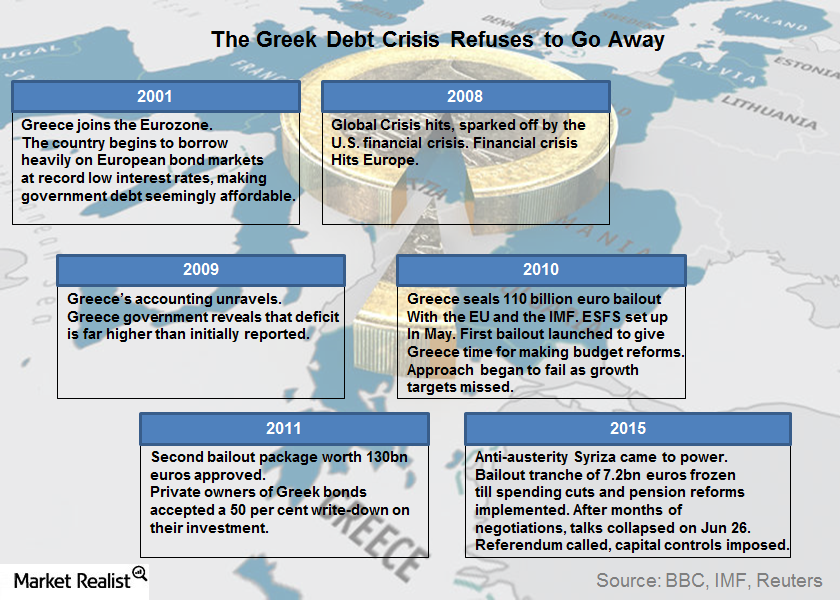

Greek Debt Crisis 101: Getting To The Crux Of The Matter

According to estimates by EuroStat, Greek debt stood at more than 315 billion euros at the end of September 2014.

Market Paradox: Stocks Reach Record Highs Despite Headwinds

We’ll explore whether record highs signal a top for equity markets or whether there’s still some room for growth in the current bull market.

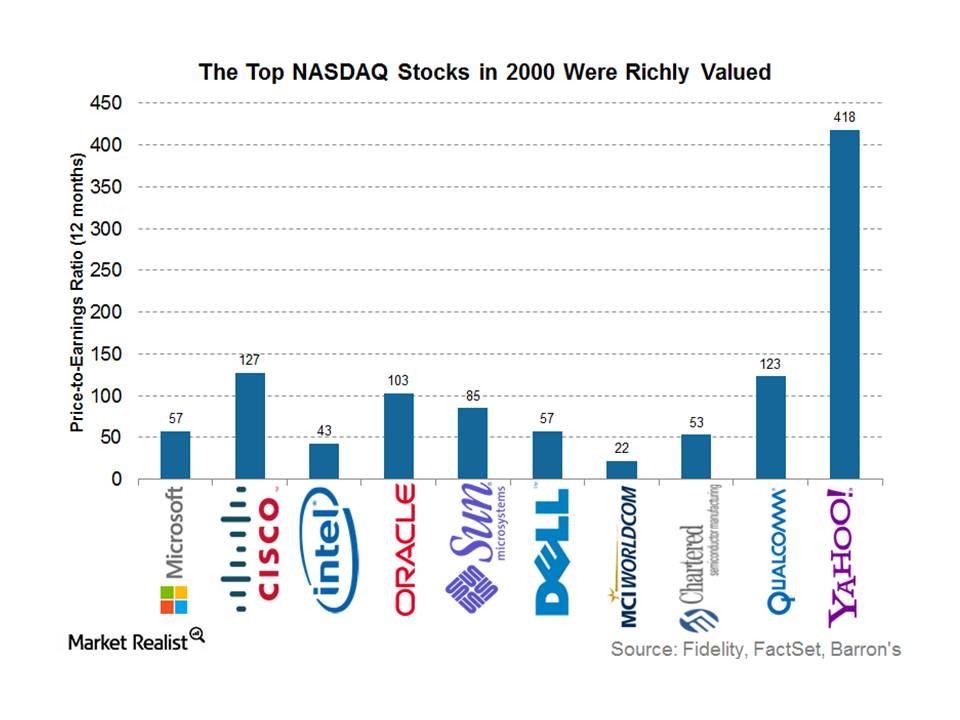

Dotcom Bubble 2.0? We Don’t Think So!

Although tech stocks have been buoyant in 2015, we don’t think that this means the advent of dotcom bubble 2.0. There are some key differences.

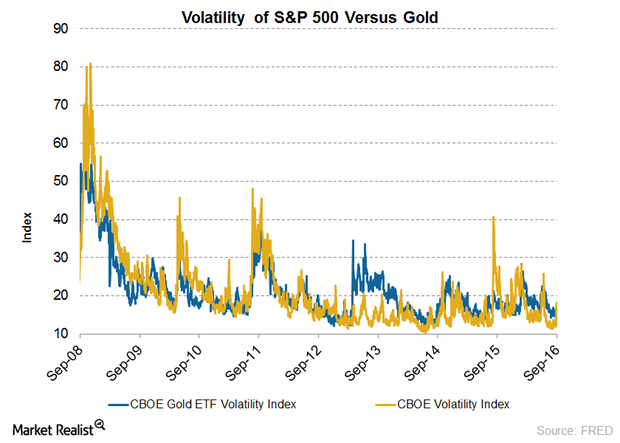

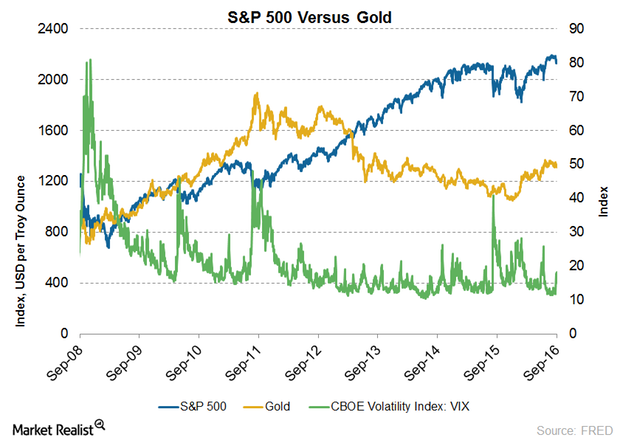

How Has the Volatility of Gold Changed over the Years?

The performance of gold as a contrast to the S&P 500 is reflected during periods of high and low volatility. The S&P 500 has always outperformed gold since April 10, 2013, during periods of both high and low volatility.

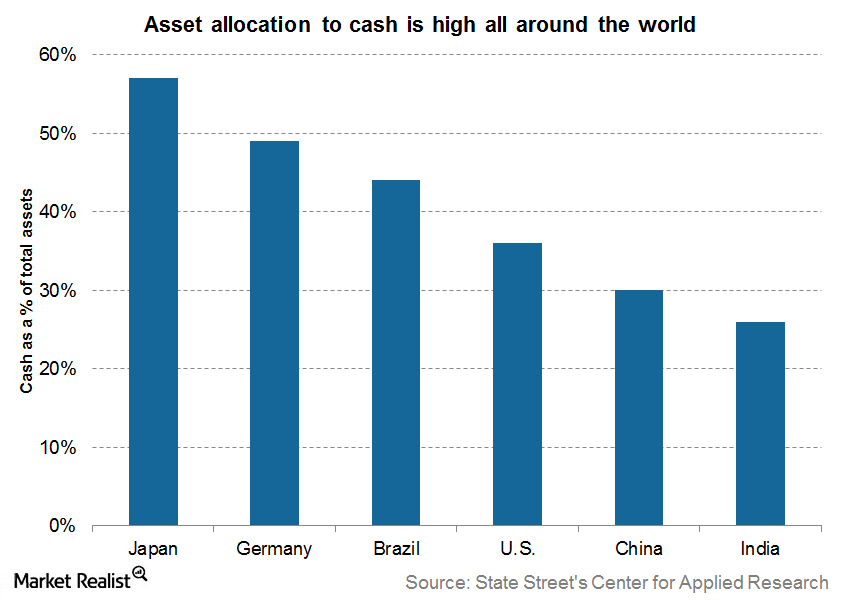

What Should Be The “Right Amount” of Cash Allocation?

If you’re preparing your portfolio for the short term, the allocation to cash should be high. As the horizon increases, allocation to cash should go down.

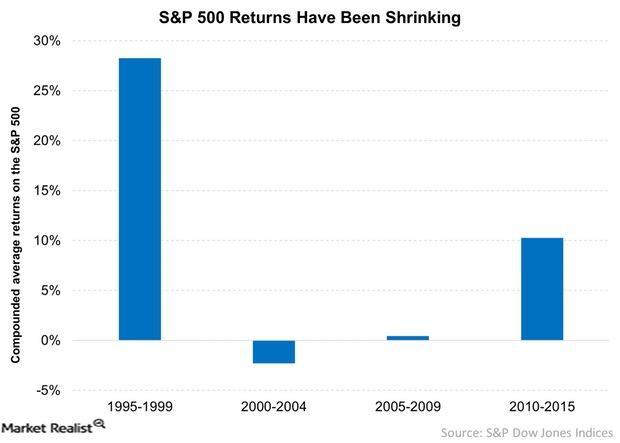

Why To Expect Muted Returns from US Equities

We can expect muted returns from US equities going forward. US stocks face the prospect of higher interest rates, albeit gradual and from unusually low levels.

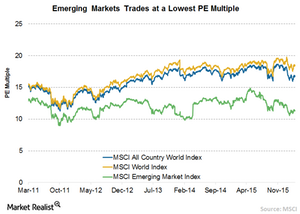

Why Emerging Markets Are Trading at a Discount to Developed Markets

With the recent fall, some of these emerging markets have certainly become very cheap compared to most of the developed markets.

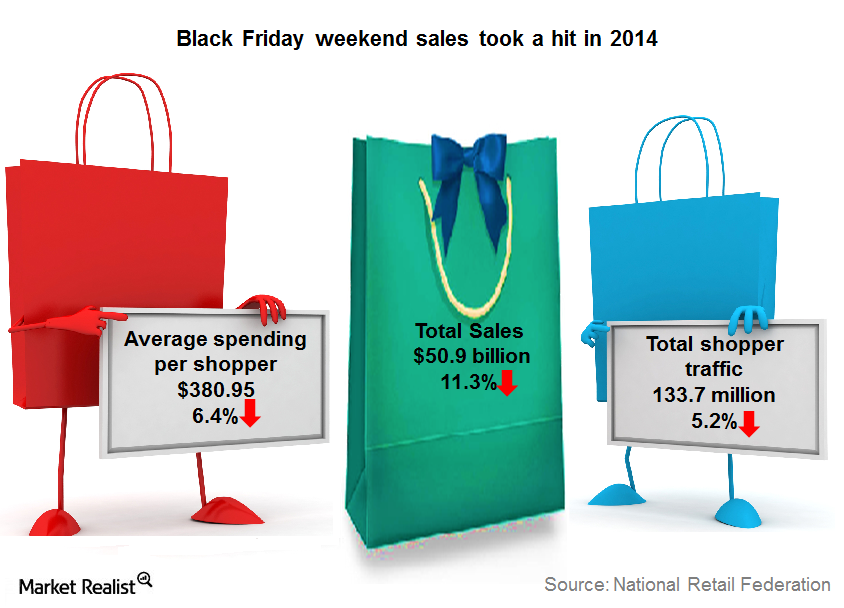

Santa Could Yet Bring Cheer To Holiday Retail Sales

We think the final tally for holiday retail sales could differ from the gloomy picture some of the initial estimates had painted.Energy & Utilities Must-know: Is the utilities sector a bond market proxy?

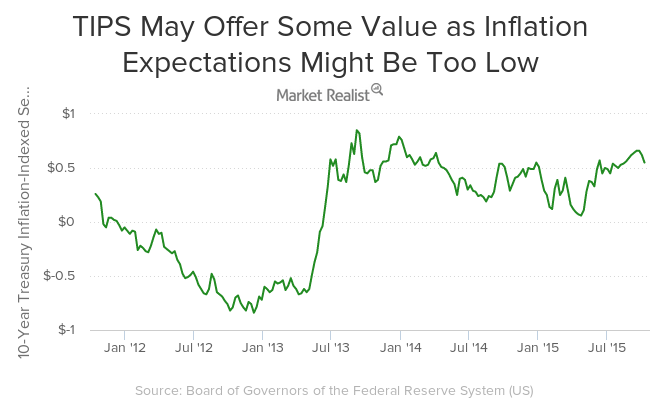

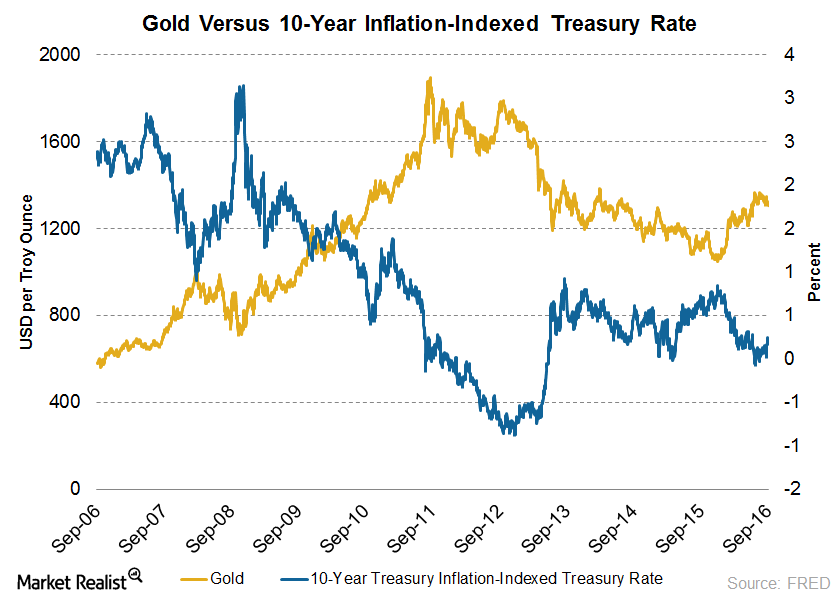

It’s important to note that higher real yields, not rising inflation, are driving today’s higher nominal yields as investors are demanding more compensation for holding bonds

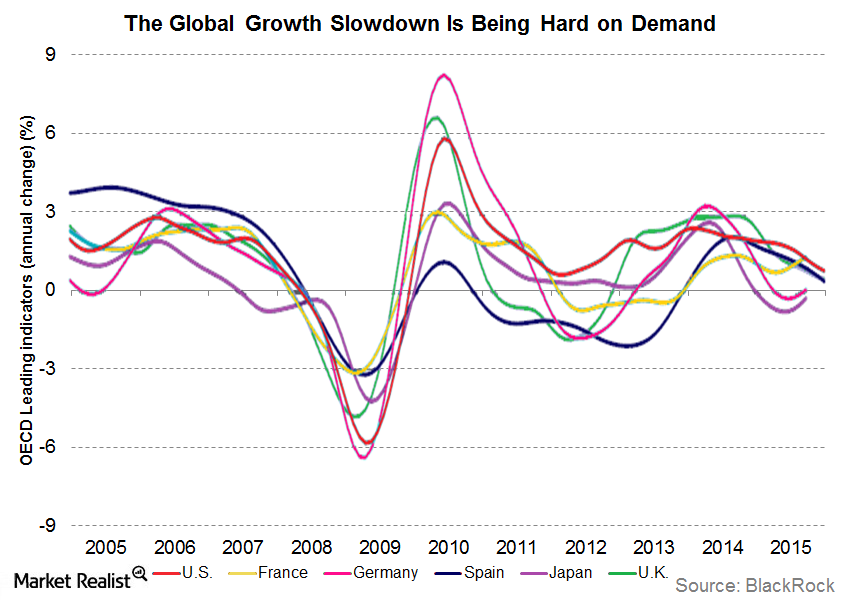

What Has Muted the Demand for Commodities?

The demand for commodities has been dampened by a variety of factors, particularly in the last two years.

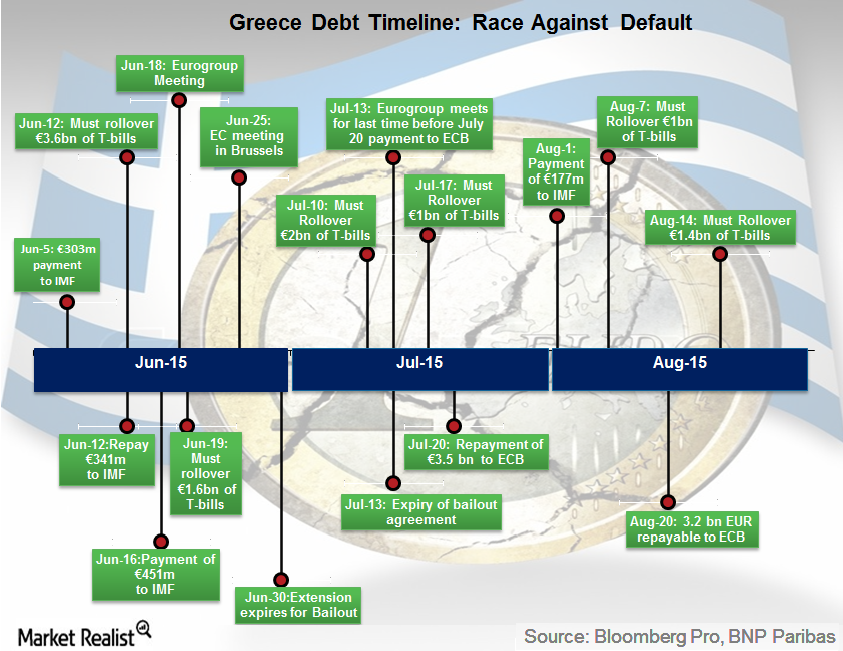

Greece Debt Drama: What’s Next?

Keep a close eye on further developments in the unfolding Greek debt drama and hope that it does not turn into a tragedy.

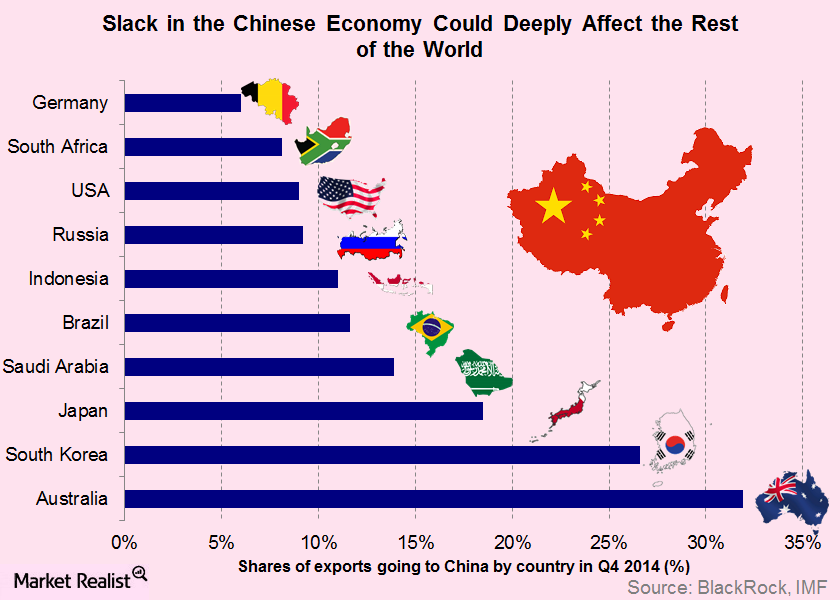

Chinese Sell-Off Hasn’t Affected the Global Economy

The Chinese sell-off sparked concerns about how the crash will affect economies all over the world. China makes up 11.3% of the global economy and is a huge consumer of resources.

Why Treasury Inflation-Protected Securities May Offer Some Value

TIPS may offer some value as inflation breakeven seems modest. TIPS provide investors a hedge against inflation just like gold (GLD) and other commodities (DBC).

Will Gold Rally if Volatility Picks Up?

It’s true that market volatility has been unusually low lately, but it’s expected to rise. There are several ways to mitigate the impact of rising volatility and historically, gold has been one of the more effective tools.

Gold versus 10-Year Treasury Bonds

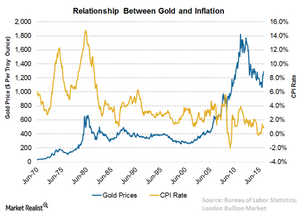

The negative interest policy of the central banks is casting government bonds as a futile choice for investors compared to stocks and gold. As a result, bond prices dipped and yields started rising.Materials Is gold no longer an inflation hedge?

Gold certainly can be an inflation hedge, and it has worked in the past. Obviously, one of the reasons gold has been weak of late is that people are becoming less concerned about inflation.Financials Why you should pay attention to Scottish referendum opinion polls

As I write in my new weekly commentary, over the past two weeks, several polls have suggested a realistic chance that the people of Scotland will vote for independence in this week’s referendum.Financials Why the banking sector is better, but with room for improvement

Russ explains the good news behind his upgrade of the global financial sector as well as the bad news keeping his sector outlook somewhat subdued.Financials Overview: What stretched valuations mean for investors

As I’ve been noting for some time, emerging markets (EEM) can offer compelling long-term value.

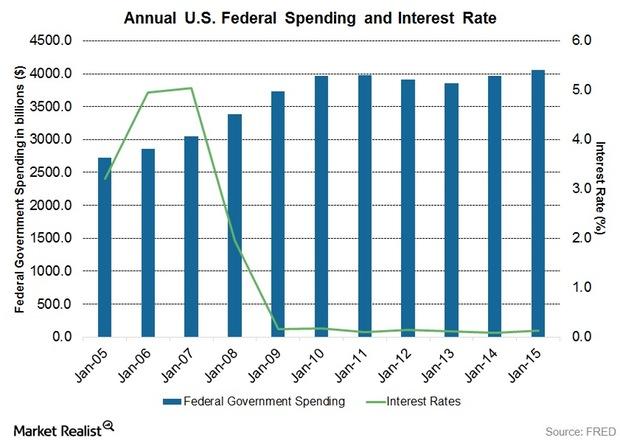

Federal Spending and Interest Rates: Analyzing the Connection

What about the impact on interest rates? Here again, there is no consistent relationship between spending and interest rates.

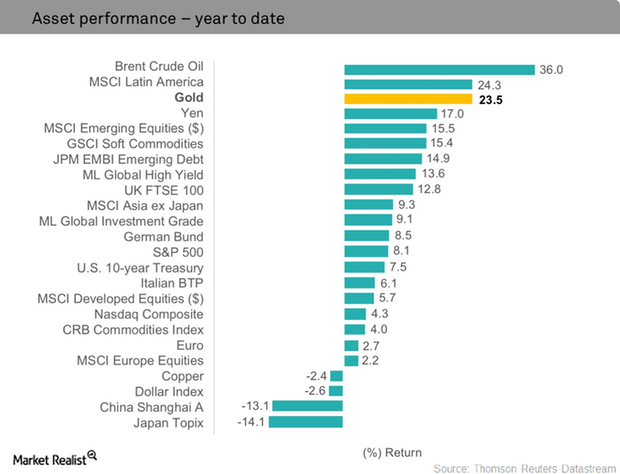

How Has Gold Performed So Far in 2016?

Gold prices have gained 21% YTD in 2016 and closed at $1,308.40 on September 16, 2016.

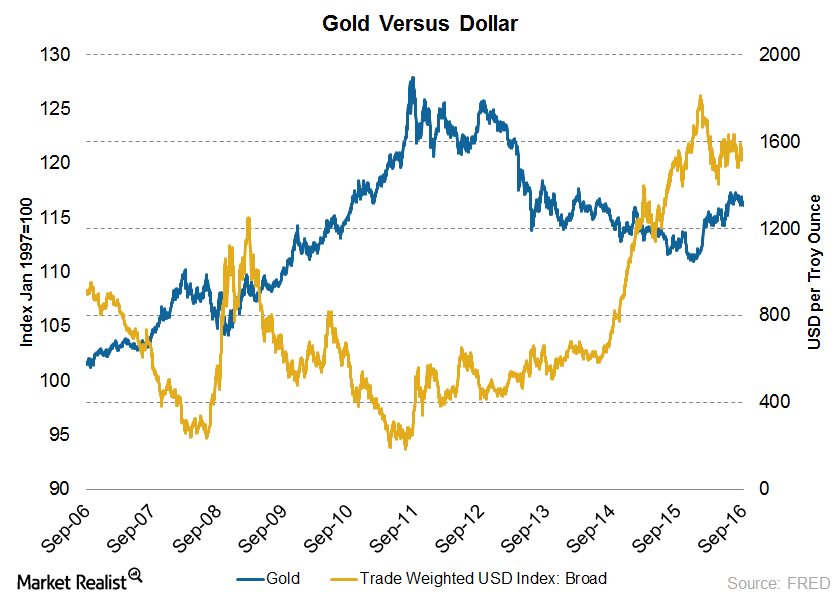

How Did the Dollar’s Move Affect the Price of Gold?

Gold is valued in dollars. As a result, the stronger dollar, driven by the recovery of the US economy, is pushing the gold prices further down.

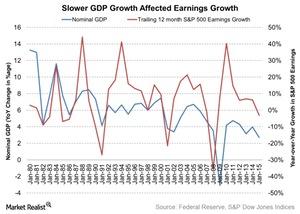

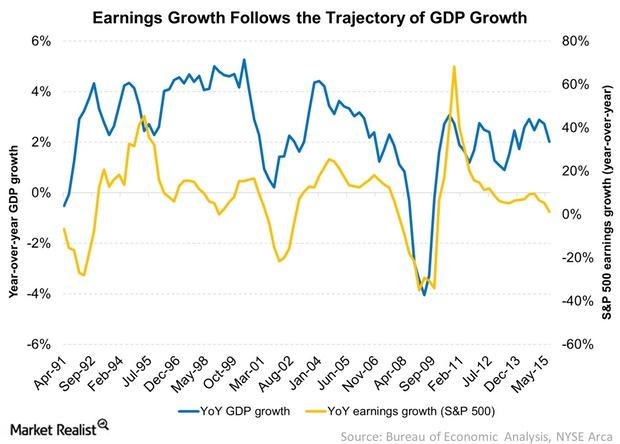

What’s the Primary Driver of Corporate Earnings?

Nominal gross domestic product in the United States is strongly correlated with the trailing-12-month earnings growth of the S&P 500.

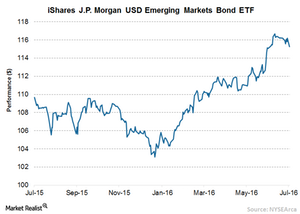

Intense Search for Yield Leads to Emerging Market Debt

Under the current uncertain economic circumstances, investors flocked to emerging market debts in search of higher yields.

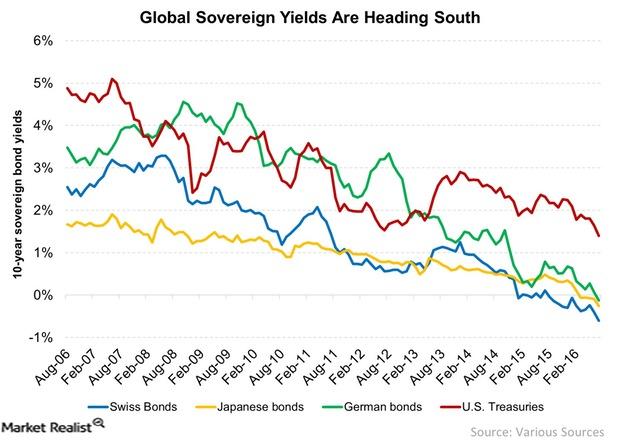

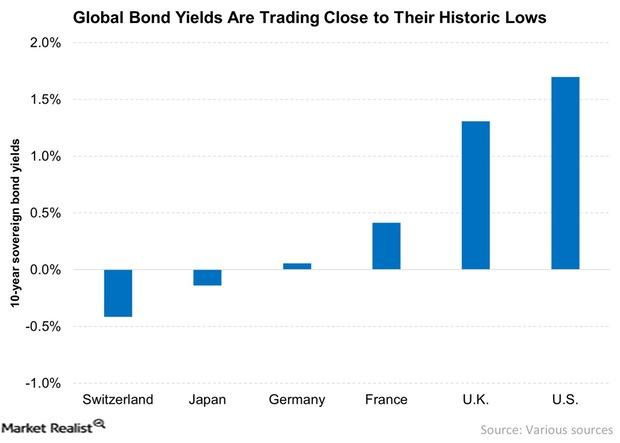

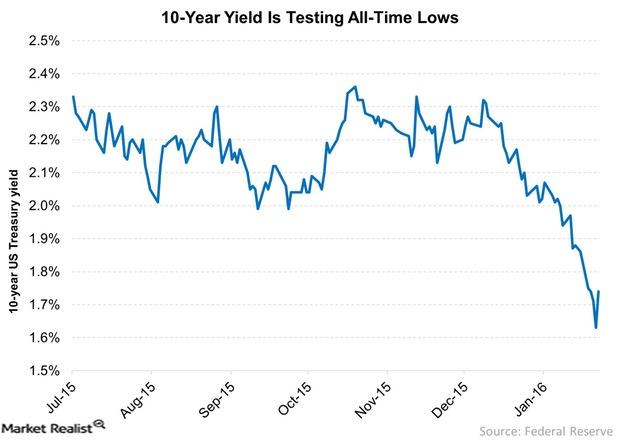

Low Yields: The Reason Lies outside the United States

The reason for low yields lies outside the United States. Global yields have been heading south over the last ten years.

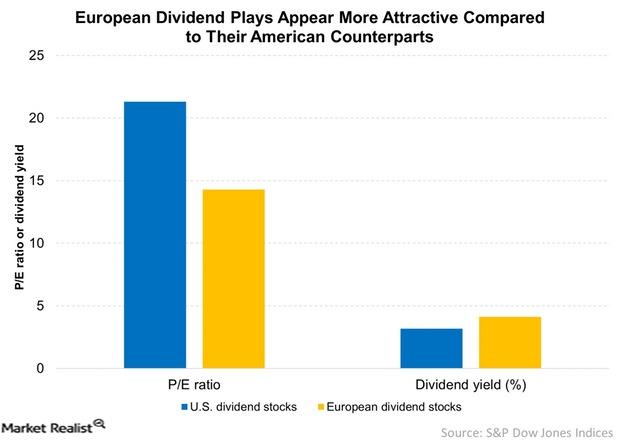

Yield-O-Philes Face a Difficult Challenge

Yields remain at unattractive levels. This has caused yield-thirsty investors to flock to high-dividend-yielding stocks, driving their valuations higher.

Yield for Yields! Where Can You Find Yields Today?

Not only are European stocks cheaper than American ones, they also offer more attractive dividend yields.

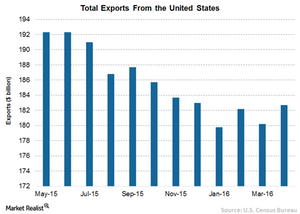

How to Navigate Uneven Economic Growth

A number of factors have contributed to the slowdown, including soft overseas growth and a sharp drop in capital spending by energy and mining companies.

How Inflation Expectations Affect Gold Prices

In the 1990s and 2000s, when gold prices tracked inflation, although the correlation seems to be a bit weak compared to the 1970s and 1980s.

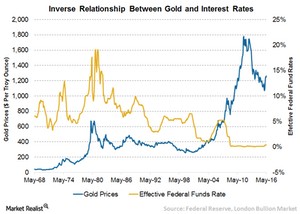

Why Gold Has Performed Better When Interest Rates Are Lower

J.P. Morgan’s analysis states that gold has outperformed equities, bonds, and a broad commodities index in a low interest rate environment.

Why Predicting Gold Returns Is a Dubious Exercise

Generally, gold is viewed as a hedge against rapid inflation and lower interest rates. That makes it hard to value gold as there are no cash flows or earnings associated with it.

Why Your Portfolio Needs More Carry

Since 2009, equities have staged a comeback. Between 2010 and 2015, the S&P 500 index has risen 10.3% on a CAGR basis. Most of the comeback is due to multiple expansion.

Treasury Yields Could Stay Low: Here’s Why

The ten-year Treasury (IEF) yield has plunged in recent weeks. It dipped from 2.3% at the start of this year to ~1.6% currently, in a risk-off trade.

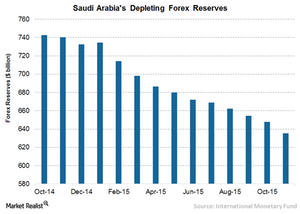

Saudi Arabia Is Depleting Its Foreign Exchange Reserves

It’s been more than a year since Saudi Arabia has had a new king, and what an eventful year for the country under his leadership!

What’s the Biggest Driver of Earnings Growth?

Economic growth is the biggest driver of earnings growth. Earnings growth seems to follow the same trajectory of GDP growth.

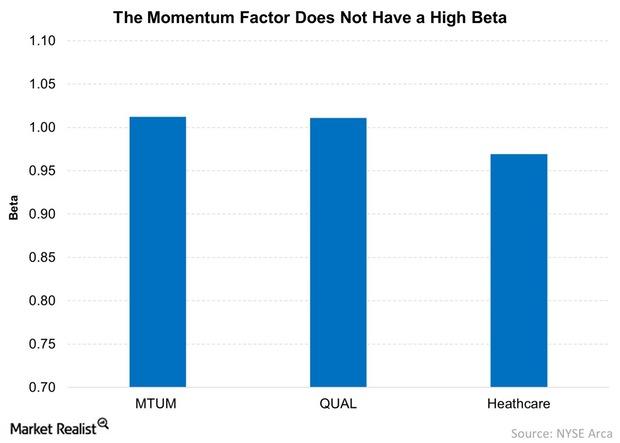

Momentum Stocks Don’t Have a High Beta

The healthcare sector, especially the biotech stocks, have garnered momentum over the last few years, as strong earnings growth has excited investors.

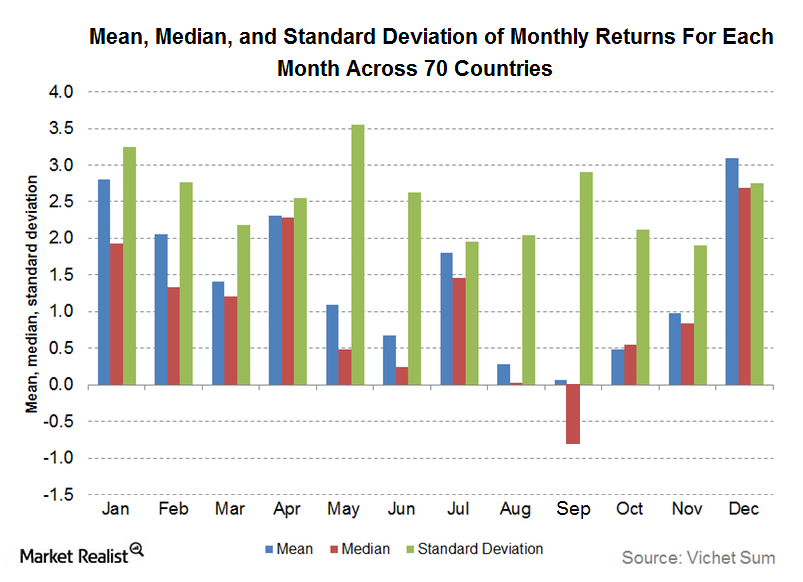

Making Sense of the ‘September Effect’ on Equities

The dreaded September effect is not limited to US stocks (SPY). It’s relevant to markets around the globe (ACWI).

The Greek Debt Crisis Refuses to Go Away

Greek Prime Minister Alexis Tsipras walked away from negotiations this weekend and called for a referendum from his people on July 5. This surprising turn of events has sharply raised the probability of a Grexit.

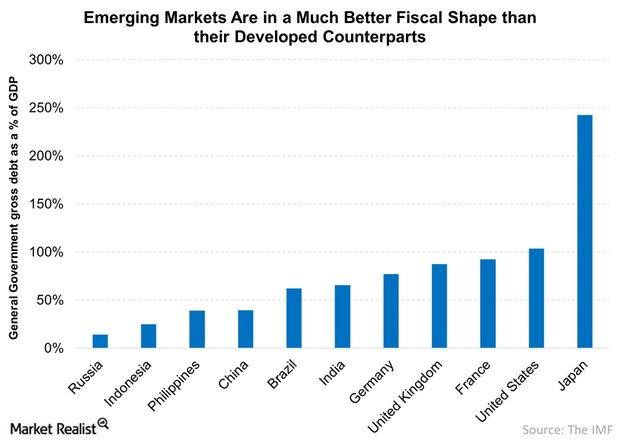

Emerging Markets Are in Good Fiscal Shape

Many of the emerging markets that were viewed as risky or even dangerous a mere 15 years ago now appear to be more attractive than many developed countries.

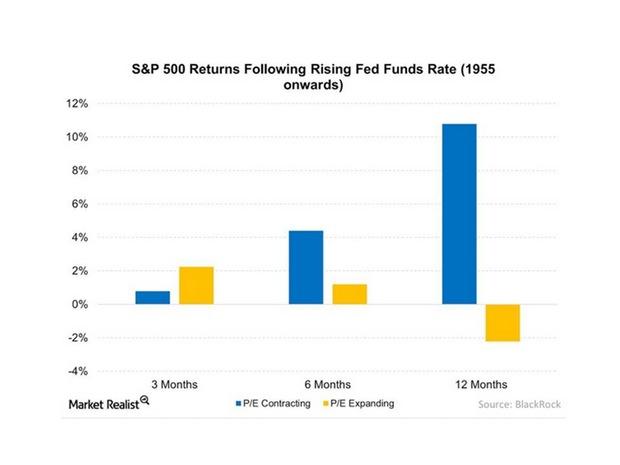

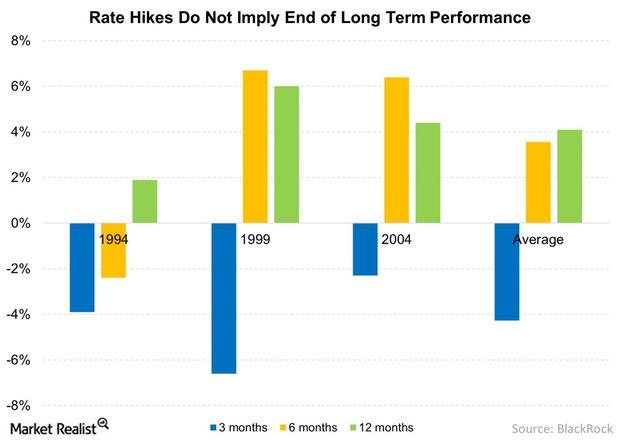

Rate Hikes Historically Lead to Muted Stock Returns

The last three rate hikes have seen negative three-month returns following the initial tightening period. Yet in the subsequent months, the S&P 500 Index rebounded.

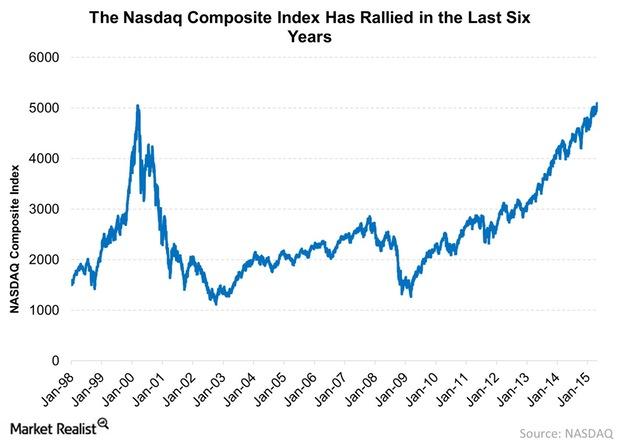

Why the NASDAQ’s 5000 Level Is Not Like the Tech Bubble

The NASDAQ’s 5000 level is not like the tech bubble. Earnings have grown multifold, making current valuations sane.

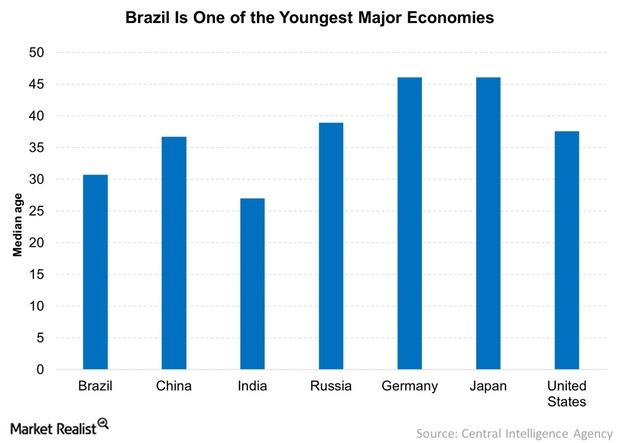

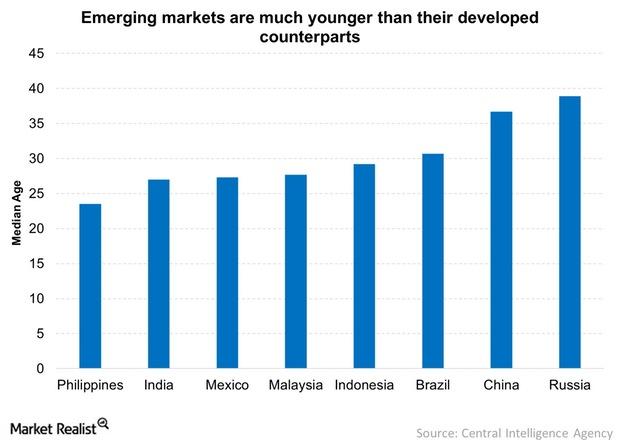

Why the Young Brazilian Population is Key to Brazil’s Success

The young Brazilian population could revive the economy. A younger population is a key demographic indicator to watch out for.

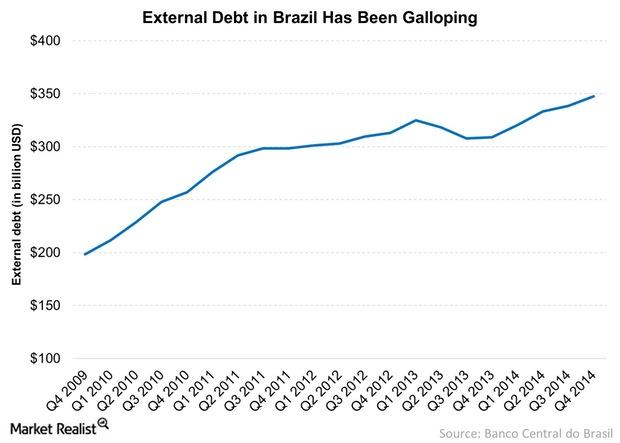

Why the Brazilian Government’s Debt Has Surged over the Years

The Brazilian government’s debt has surged over the last five years. The country’s internal debt has also increased.

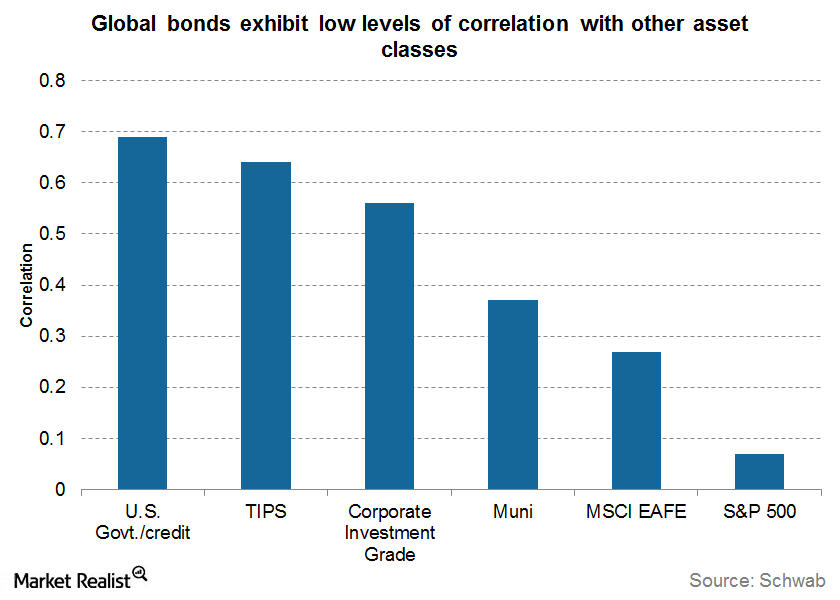

Cushion Volatility With Bonds

High yield bonds are becoming increasingly correlated with the S&P 500 and might increase your risk exposure instead of giving diversification benefits.

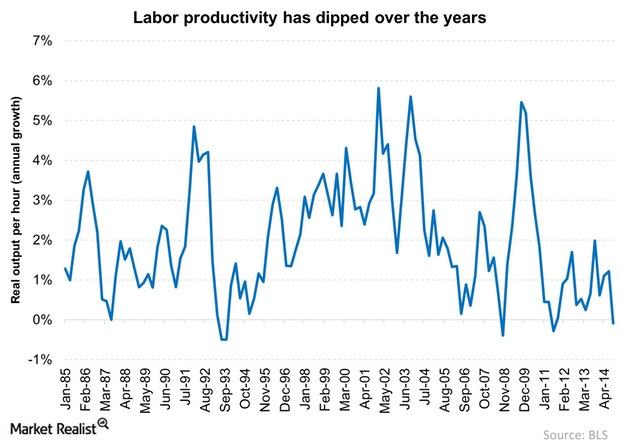

Why Low Labor Productivity Could Affect GDP Growth

Labor productivity growth has slumped to a negative. The 30-year average is 2%. However, this average has been quite volatile.

A Young Population Makes Emerging Markets Attractive

A young population in emerging markets makes them attractive, but beware! Some of the emerging economies are facing a lot of headwinds.