iShares MSCI South Korea ETF

Latest iShares MSCI South Korea ETF News and Updates

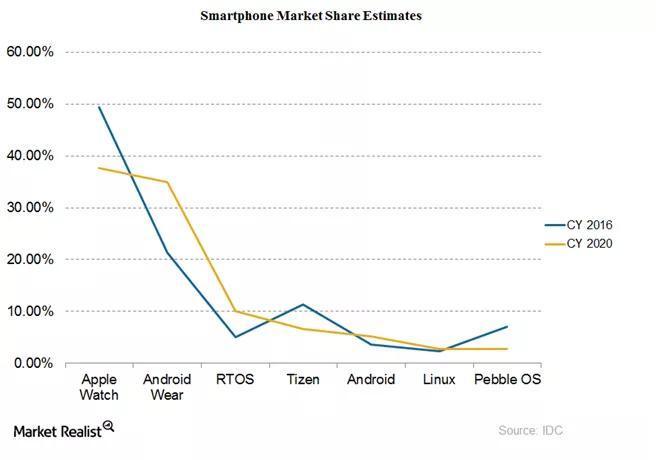

Apple Watch Sales May Fall: Can It Remain a Dominant Player?

According to KGI, Apple Watch (AAPL) sales will fall more than 25% in 2016. KGI forecasts sales of 7.5 million units in 2016 compared to estimated sales of 10.6 million units in 2015.

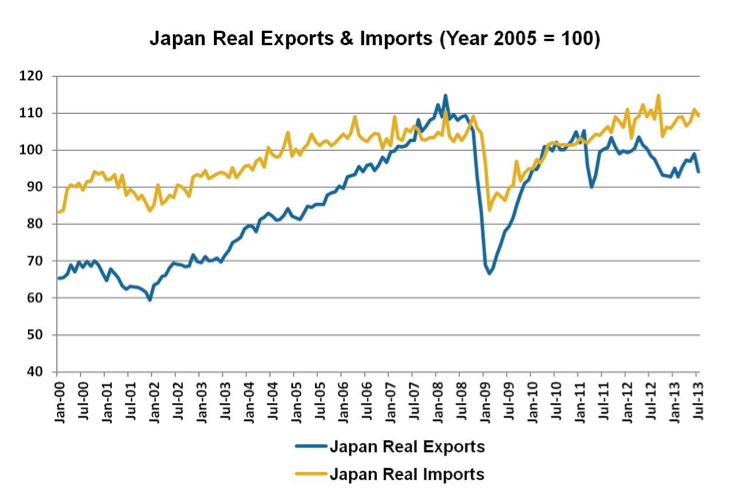

Why we could see a new trend in Japan’s exports and imports

Japan’s import and export dynamics The below graph provides a clearer picture of the import and export dynamics of the Japanese economy. By using 2005 as a base year and adjusting for inflation or deflation, the graph shows how exports and imports have changed on a “real” basis, as opposed to a “nominal” basis. Viewing […]

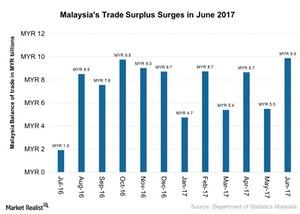

What’s behind Malaysia’s Large Trade Surplus in June 2017?

Malaysia’s trade surplus jumped to 9.9 billion Malaysian ringgit (MYR) (about $2.3 billion as of August 11, 2017) in June 2017—an 80% rise YoY.

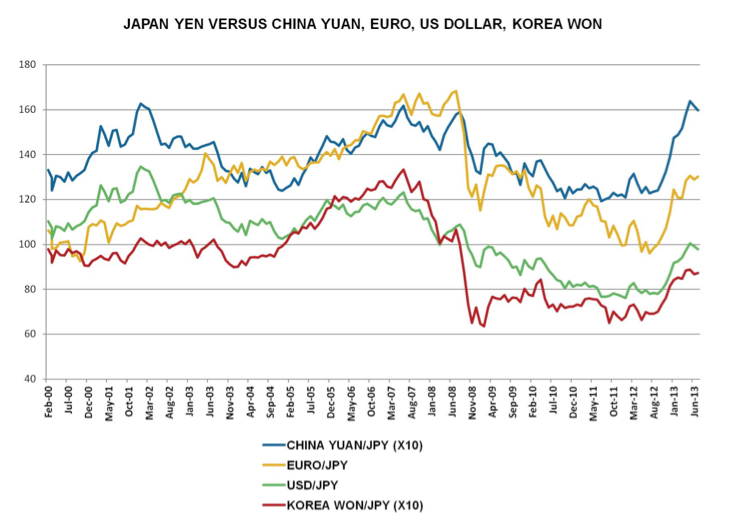

Does “Abenomics” mean a new era of yen depreciation?

A change in yen appreciation? The below graph reflects a potential big change in Japan post-2012—has yen appreciation turned the corner as a result of post-2012 “Abenomics“? In the mid 1970’s, the U.S. dollar bought 300 yen, and by the mid-1980’s, the U.S. dollar bought 250 yen. By the end of the 1980s, the dollar […]

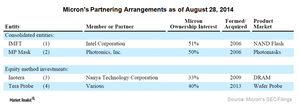

An Instructive Rundown of Micron’s Business Strategies

Two business strategies that Micron can use to beat competition include innovating processes that reduce costs and developing next-generation products.

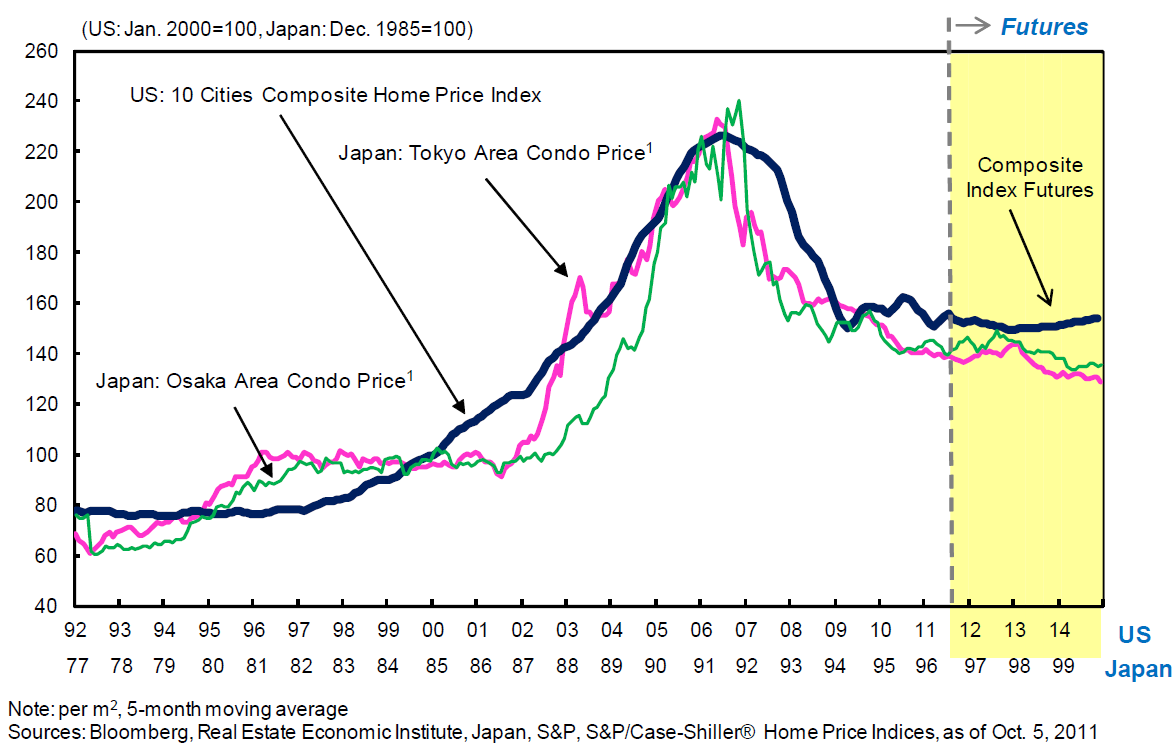

Why we’re seeing a brand new housing bubble—Japan style

Residential investments in Japan The below graph reflects the ongoing decline in the rate at which residential investments are being made in Japan. As with other forms of fixed investment noted earlier in this series, Japan has seen a long-term decline in the housing market since the peak of the economic bubble, which was accompanied […]

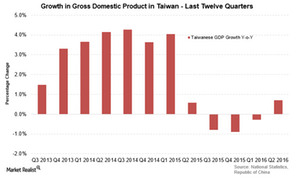

Taiwan’s Economy Expands, Bank Indonesia Keeps Rates Unchanged

Taiwan’s economy rose by 0.7% on an annual basis in 2Q16—compared to a contraction of 0.29% in the previous quarter and slightly above estimated forecasts.

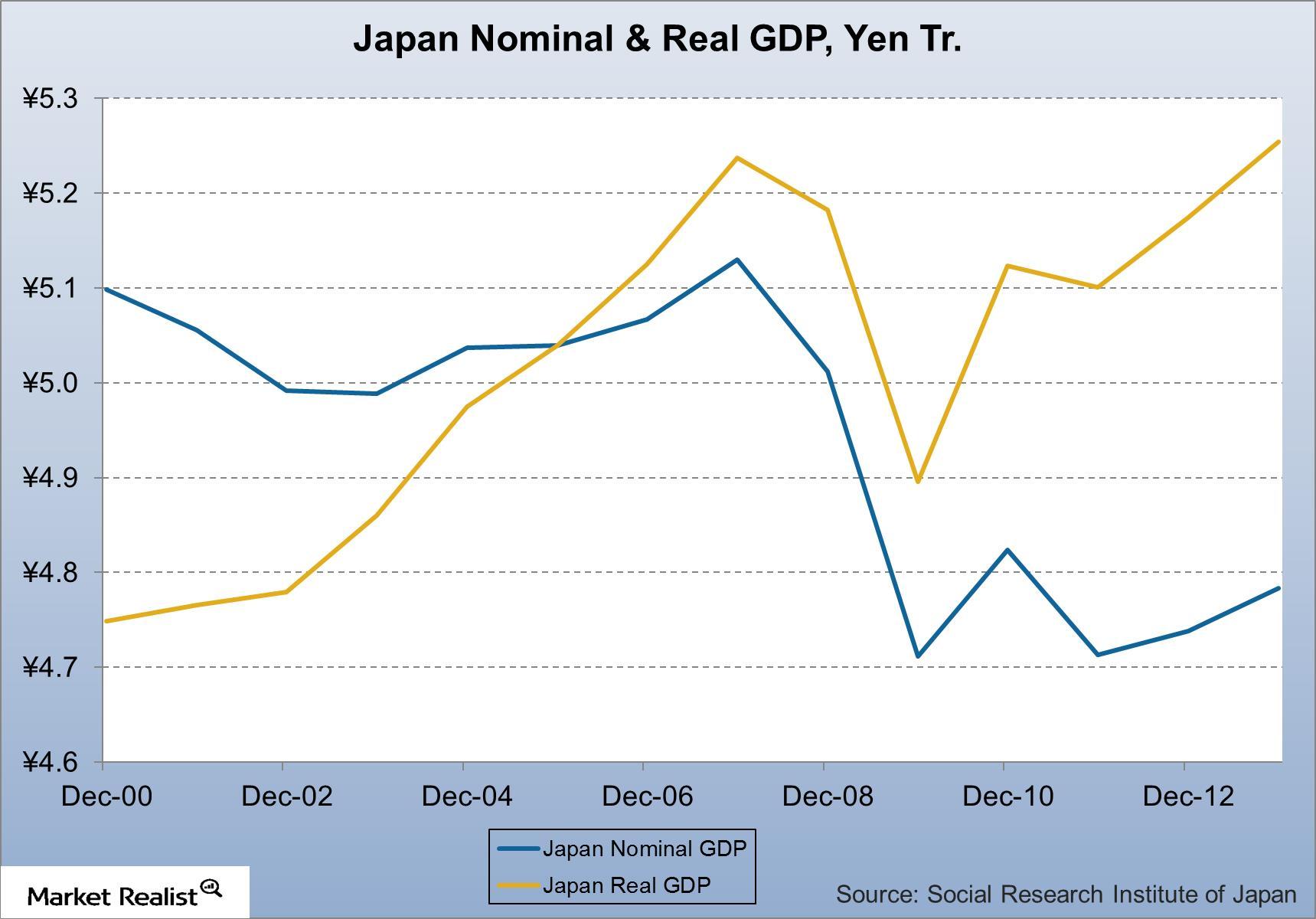

Japan’s GDP back to peak levels: Auto sales and Toyota benefit

This article considers the prospects for further real GDP growth acceleration and the implications for Japanese exporters like Toyota.

How NZ50, ASX, Singapore, KOSPI Indexes Fared Today

Australia’s ASX200 lost marginally today. Although the index was trading higher until noon, it erased those gains afterward. 70 stocks gained, while 118 fell. BHP Group (BHP) outperformed the index with marginal gains, while Rio Tinto (RIO) gained 0.64%.

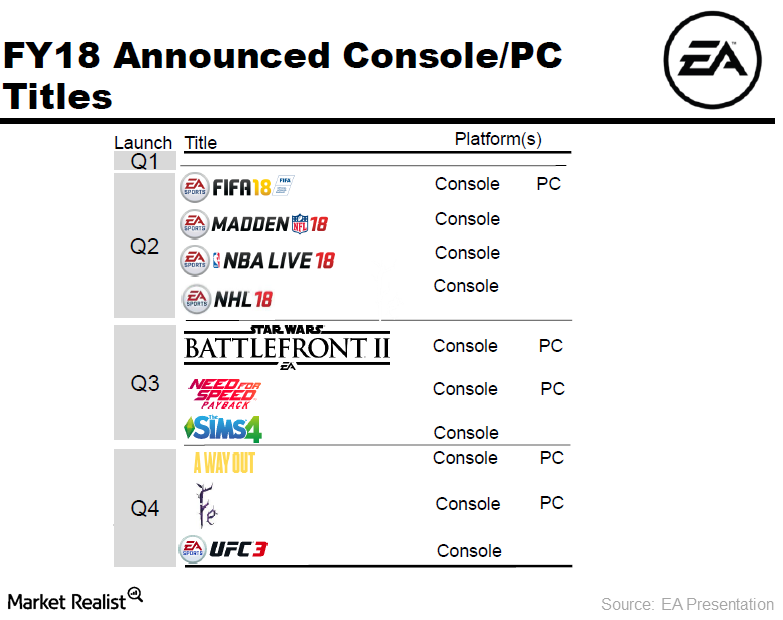

A Look at Electronic Arts’ Huge Player Base across Verticals

EA’s FIFA franchise remains one of the leading games worldwide. It has approximately 42 million players on console platforms PlayStation (SNE) and Xbox (MSFT).

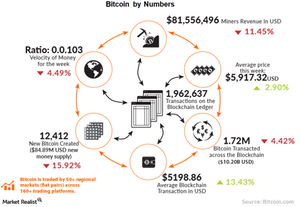

Things to Know Before You Buy Bitcoin

The sharp rise and fall in the price of bitcoin are mainly because ownership of the currency is heavily concentrated in just a few hands.

Why Asian Markets Grabbed Investors’ Attention in 2017

Stock markets around the world rallied in 2017. Asian equities, in particular, grabbed investors’ attention in 2017, as they have been outperforming other markets.

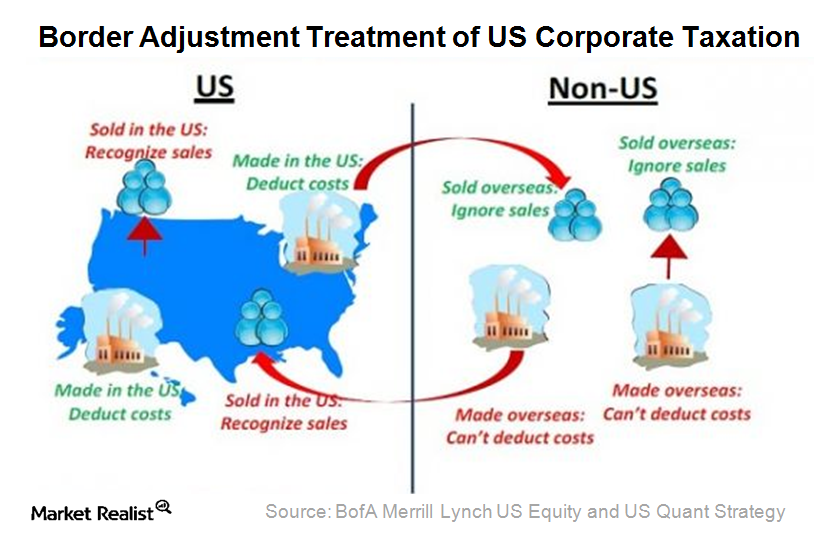

Why US Companies Have Concerns about the Corporate Tax Structure

Among the 35 OECD countries, the US has the highest corporate tax rate of 35%. This tax rate puts US companies at a disadvantage compared to their foreign rivals.

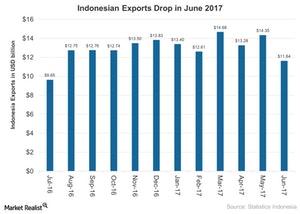

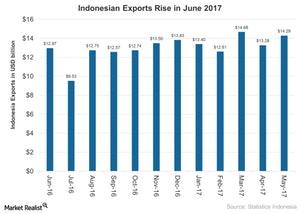

Indonesia’s Exports Fell in June 2017

Exports from Indonesia (EIDO) in June 2017 stood at $11.6 billion, a fall of 11.8% on a year-over-year basis and 19% on a month-over-month basis.

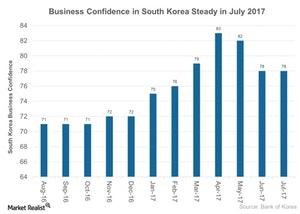

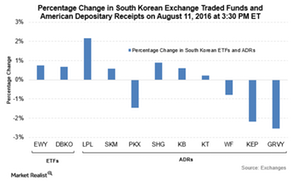

South Korea’s Business Confidence Remains Steady in July 2017

Business confidence in the manufacturing sector in South Korea (EWY) has remained stable at 78 in July 2017.

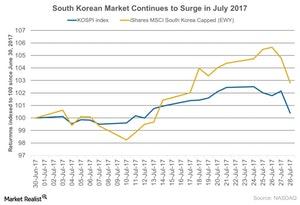

Equities in South Korea Rise with Tech Rally in July 2017

South Korean equities are soaring in 2017, with the Korea Composite Stock Price Index (or KOSPI), its benchmark index, reaching an all-time high of 2,451.5 in July 2017.

Will North Korea Undermine Broader Asian Markets?

Under Kim Jong-Un, North Korea has adopted a more aggressive stance toward its regional adversaries, fueling unprecedented tension in the region.

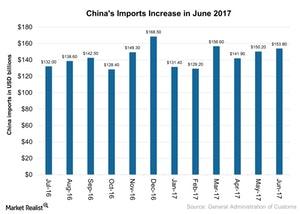

Did China’s Imports Rise on Its Structural Shift in June 2017?

China’s (FXI) imports rose to $153.8 billion in June 2017, a 17.2% rise year-over-year (or YoY) and a 2% rise month-over-month.

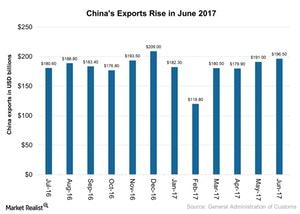

Chinese Exports Rose in June 2017 on Improving Global Demand

Chinese (FXI) exports stood at $196.6 billion in June 2017, a rise of 11.3% year-over-year basis and a rise of 8.7% month-over-month.

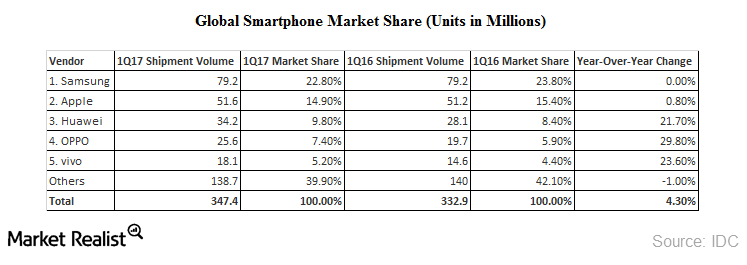

Where Does Apple Stand in the Global Smartphone Market?

Apple (AAPL) had a market share of 14.9% in the global Smartphone market at the end of 1Q17. Apple’s market share in 1Q16 was 15.4%.

Improved Global Trade Supports Indonesia’s Economy

Several external factors are expected to impact Indonesia’s economy in 2017. The US government’s protectionist stance is expected to influence global trade.

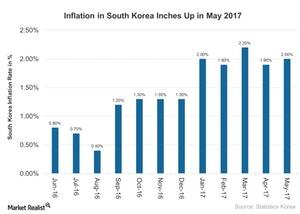

South Korea Reaches Target Inflation Rate in May 2017

South Korea’s (EWY) inflation rate rose to 2% in May 2017 as compared 1.9% in the previous month.

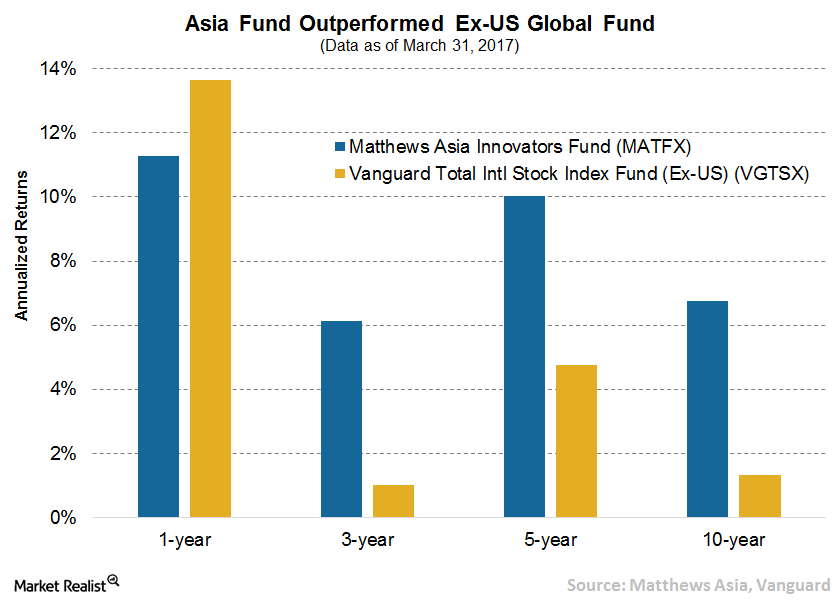

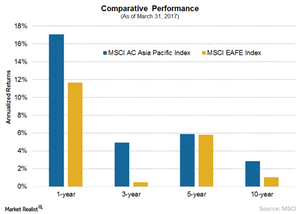

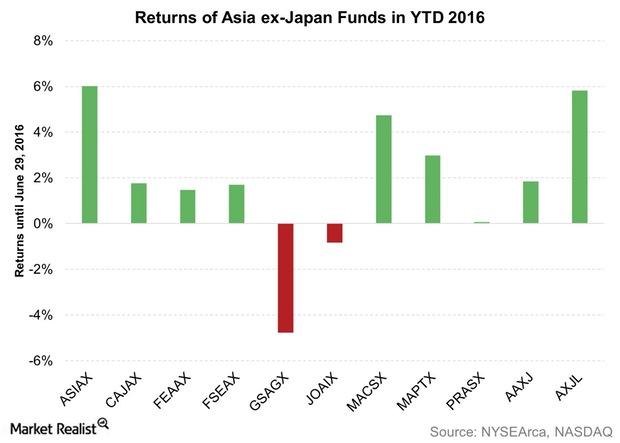

Substantial Asia Exposure Could Improve Risk-Adjusted Returns

A higher allocation to Asia could certainly provide diversification benefits to investors while enhancing their risk-adjusted returns.

Why Investors Should Consider Core Asian Funds

The EAFE Index provides exposure to slow-growing developed markets while disregarding Asia’s fast-growing markets (FXI) (INDA).

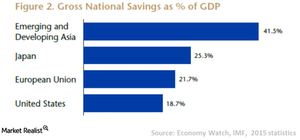

What’s Driving Asia’s Growth?

For the last three decades, Asia has posted higher economic growth than any other region of the world.

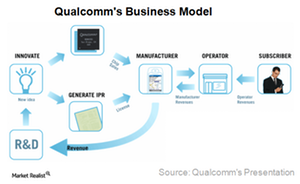

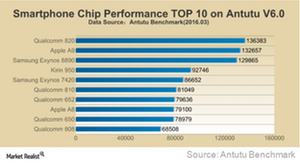

Legal and Regulatory Issues Challenge Qualcomm’s Business Model

Qualcomm (QCOM) has been and continues to be the preferred choice of dividend-seeking investors because of its strong balance sheet and rich cash flows.

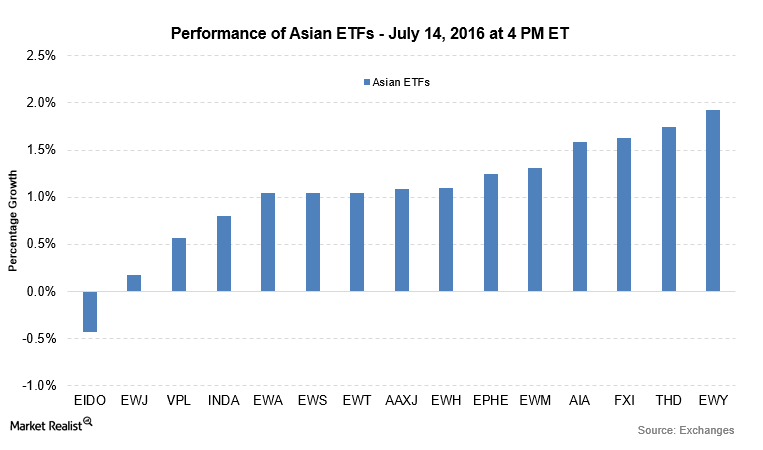

Bank of Korea Keeps Rates Unchanged, Asian ETFs Trade Positive

South Korea’s monetary policy committee kept the benchmark interest rate unchanged at a record low of 1.3%—in line with expectations.

Manufacturing PMI Releases across Asian Economies, China Struggles

The official manufacturing PMI for China, published by the National Bureau of Statistics of China, came in at 49.9 for July—slightly below June’s reading of 50.

Asian Markets Rise as Investors Focus on Chinese GDP Release

On a quarterly basis, the advance GDP for Singapore rose by 0.8%, marginally below estimated forecasts of 0.9%.

Is Asia a Compelling Investment Proposition?

Given the diversity it can provide due to its composition, Asia makes a compelling investment destination for investors who are looking for growth.

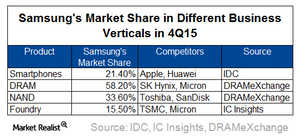

Samsung: A Semiconductor Foundry, Competitor, and Customer

Through its foundry business, Samsung provides chip manufacturing services to companies such as Qualcomm (QCOM), NVIDIA (NVDA), and Apple (AAPL).

What Is Samsung’s Growth Strategy in the Smartphone Market?

South Korea–based (EWY) Samsung (SSNLF) is making efforts to boost revenue and maintain a double-digit margin amid slowing smartphone sales.

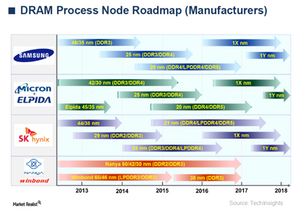

Micron’s Strategy for Coping with Declining DRAM Prices

Micron’s strategy for coping with competition is to reduce its manufacturing costs. It currently has higher manufacturing costs than Samsung and SK Hynix.

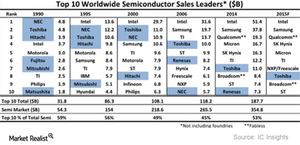

Why Did Japan’s Semiconductor Industry Fall?

In 1990, Japan led the semiconductor industry, with six companies named in the top ten semiconductor sales leaders. In 2014, only two companies made the list.

South Korea: Second Largest Global Semiconductor Manufacturer

After memory chips, LEDs comprise the second most produced semiconductor products in South Korea. The country accounts for ~13% of the global LED market.

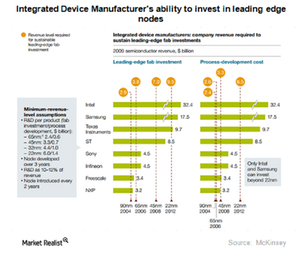

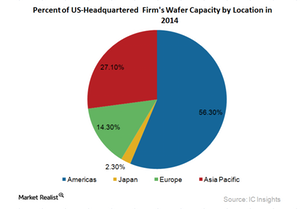

What Led to the Emergence of the Fabless-Foundry Model?

A fabless company only focuses on chip designing and a foundry focuses on manufacturing the chips designed by fabless firms.

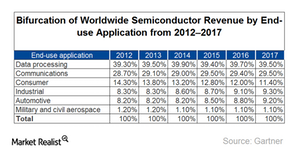

An Overview of the Semiconductor Industry

According to IDC, YoY growth in worldwide semiconductor revenues should slow from 7.1% in 2014 to 3.6% in 2015. Semiconductor revenues are estimated to reach $389.4 billion in 2019.