What Led to the Emergence of the Fabless-Foundry Model?

A fabless company only focuses on chip designing and a foundry focuses on manufacturing the chips designed by fabless firms.

Sept. 10 2015, Published 4:09 p.m. ET

Fabless foundry model

In the first part of this series, we saw that the global semiconductor industry is slowing down after enjoying 40 years of rapid growth. The rising pressure of innovating more advanced technology has kept the industry on its toes and led to the creation of the fabless-foundry model.

In this model, a fabless company only focuses on chip designing and a foundry focuses on manufacturing the chips designed by fabless firms. Companies that are involved in both designing and manufacturing are termed as IDMs, or integrated device manufacturers.

The R&D (research and development) cost is rising with every new technological development, pushing down the price of the old technology. Moreover, the high cost of owning and maintaining a fabrication facility, or fab, is a taxing issue in the volatile semiconductor industry. A fab is profitable only when used at full capacity. A wave of industry downturns can lead to excess capacity, forcing firms to stop production.

Concerns of the ever-increasing costs of R&D and the high cost of owning a fab resulted in the emergence of the fabless-foundry model. While fabless companies direct all their funding in designing leading-edge technologies, foundries run fabs at full capacity by partnering with a pool of fabless companies.

Fabless foundry model in global scenario

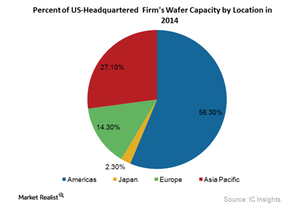

Global adoption of this model is redrawing the map of semiconductor manufacturing. The US and Europe are specializing in chip designing and outsourcing manufacturing to Asian countries. Generous government incentives are making some Asian countries attractive locations for building fabs. As seen from the above chart, some US-headquartered firms shifted 27.1% of their manufacturing capacity to the Asia–Pacific region, mainly Taiwan (EWT) and South Korea (EWY).

The model is encouraging specialization and enabling companies to grow rapidly. In 2007, US-based fabless firm Qualcomm (QCOM) entered the IC Insights’ ranking of the top ten semiconductor leaders worldwide by revenue for the first time. The company now ranks fourth. On the other hand, Taiwan Semiconductor Manufacturing Company (TSM) began as a pure-play foundry and is now the third largest semiconductor company by revenue. However, IDMs like Intel (INTC) continue to dominate the semiconductor space.

However, the fabless-foundry model brings its own set of challenges. In the next part of this series, we will study these challenges and various measures adopted by industry players to overcome them.