BTC iShares MSCI Emerging Markets ETF

Latest BTC iShares MSCI Emerging Markets ETF News and Updates

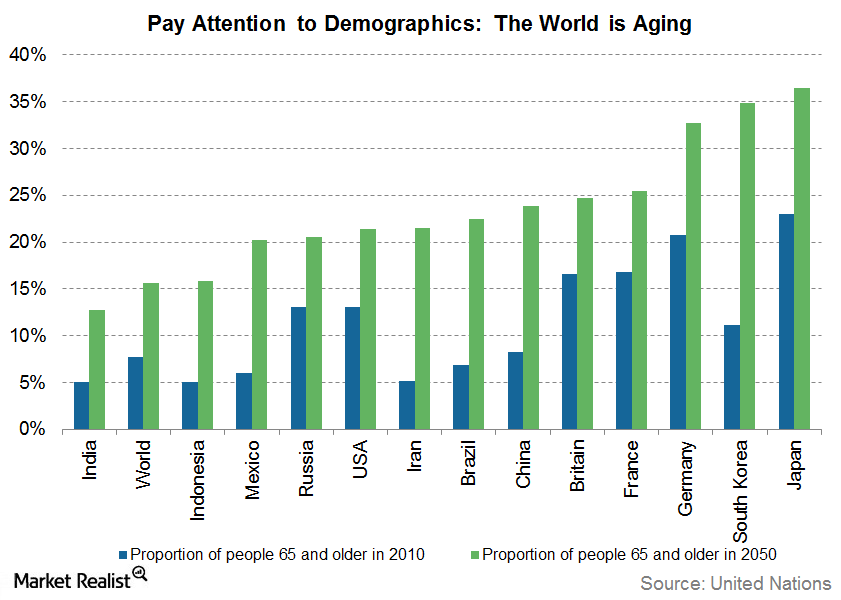

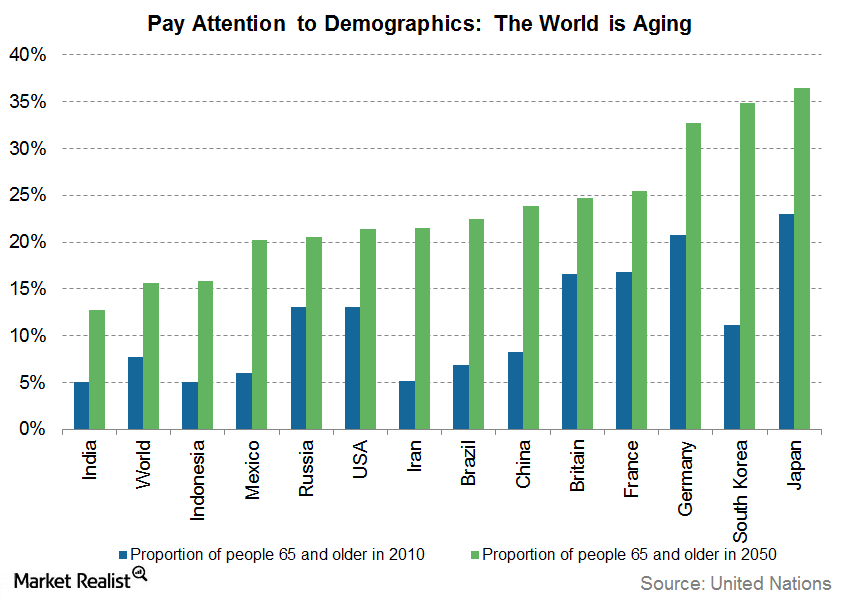

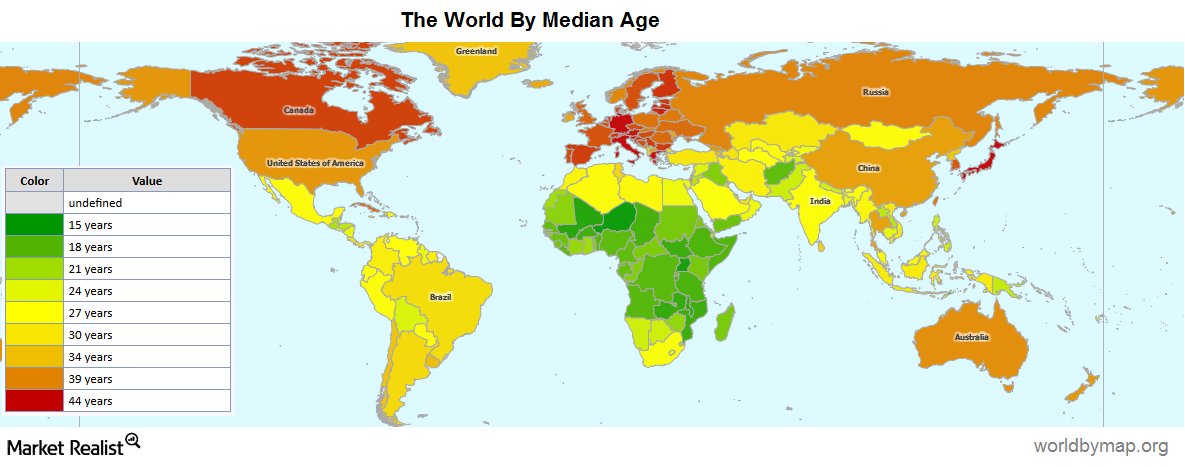

The Longevity Phenomenon: Impact on the World

The longevity phenomenon has given rise to a unique problem. The world’s population is aging rapidly, which could have a negative impact on productivity and growth rates.

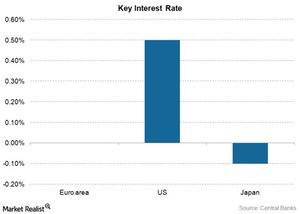

Why Do Central Bankers Continue to Surprise Bill Gross?

In his recent webcast by Janus Capital, Bill Gross expressed his surprise at the extent to which central bankers of the developed world (EFA) (VEA) have distorted the financial system.

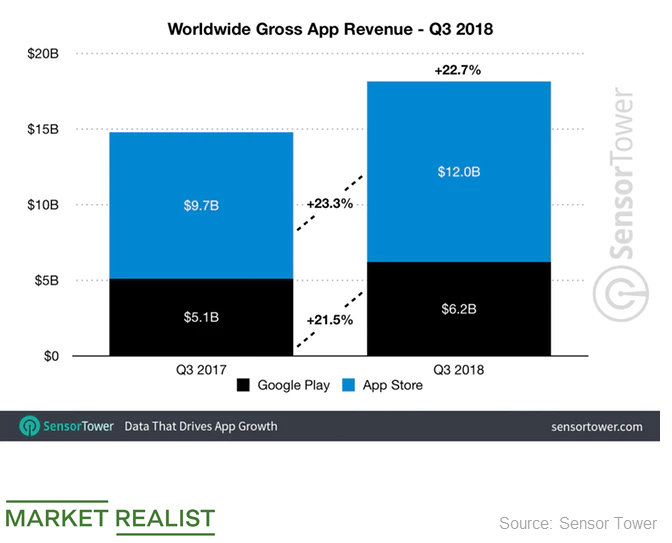

What Will Drive Services Revenue for Apple?

Emerging markets such as China and international markets such as Japan have contributed significantly to Apple’s Services segment over the years.Must-know: Why the Fed drove up emerging market asset prices

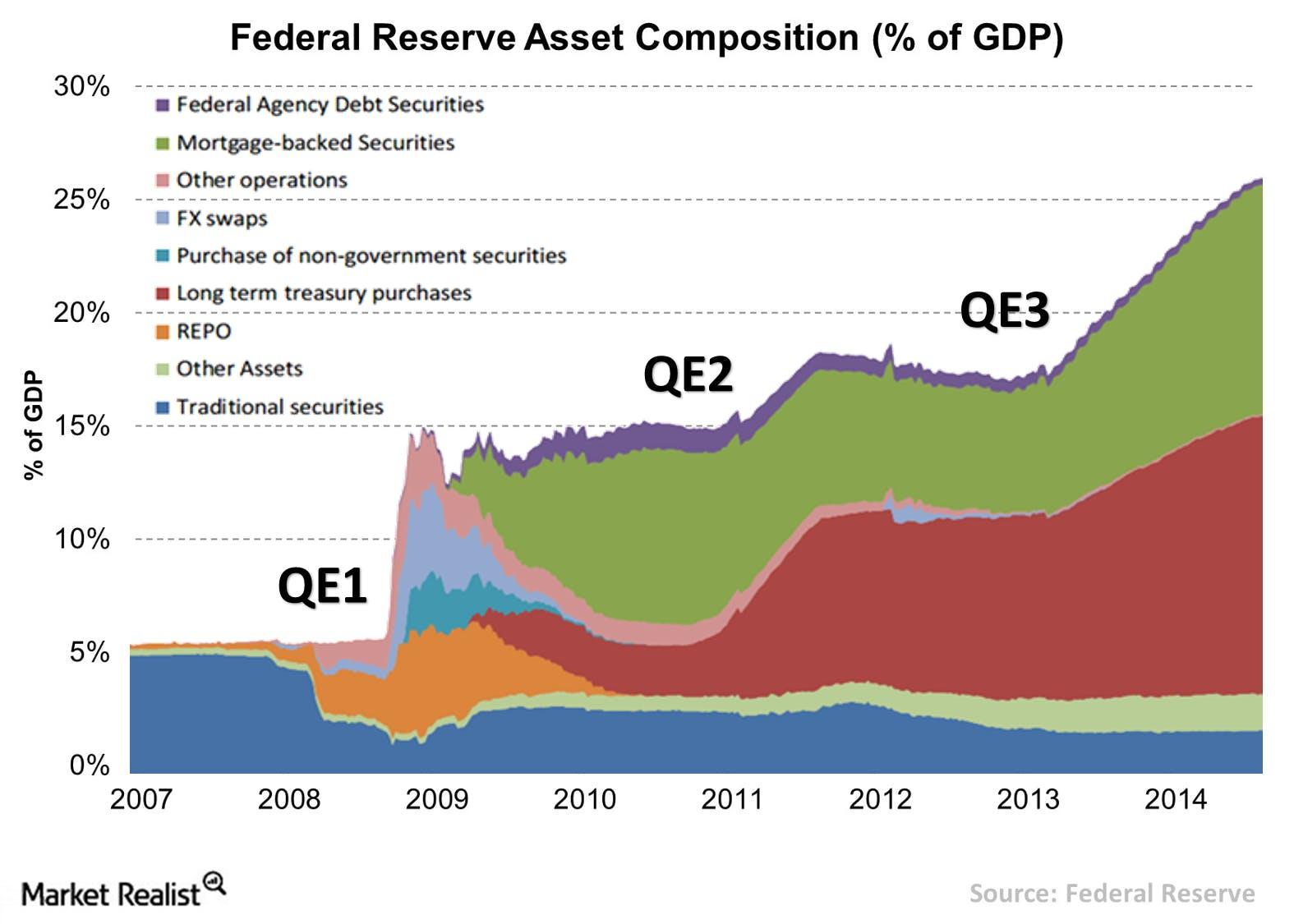

Many economists, like the Nobel Prize–winning Paul Krugman, believe that the Fed acted as a “white knight” in 2008, saving the global economy in the dire aftermath of the financial crisis.

Investment Opportunities in This Environment

VanEck CEO, Jan Van Eck, joins me today to discuss his macroeconomic outlook and also to talk about investment opportunities that he finds most interesting in the current environment.

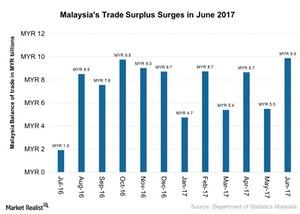

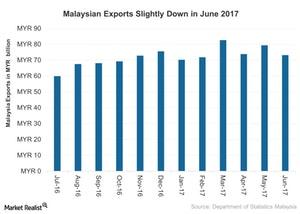

What’s behind Malaysia’s Large Trade Surplus in June 2017?

Malaysia’s trade surplus jumped to 9.9 billion Malaysian ringgit (MYR) (about $2.3 billion as of August 11, 2017) in June 2017—an 80% rise YoY.

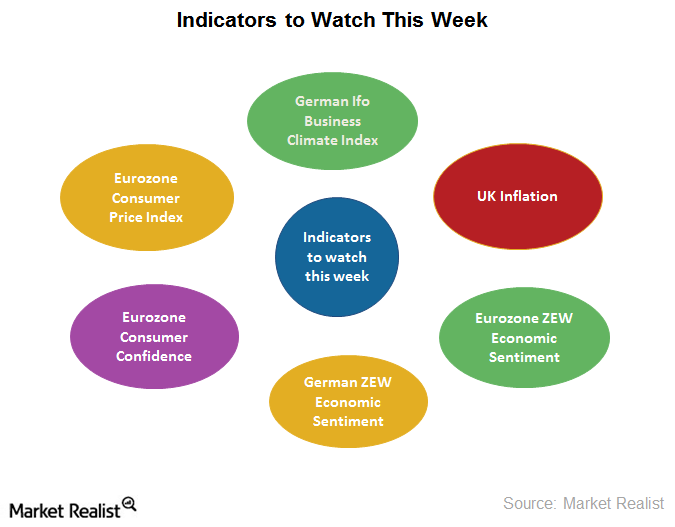

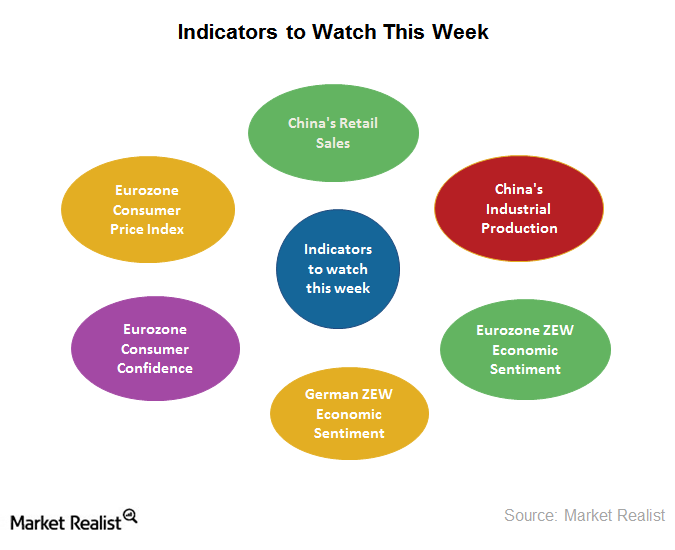

Economic Indicators Investors Should Watch This Week

If major Eurozone economic indicators improve in the coming months, we could expect those economies to regain some strength.

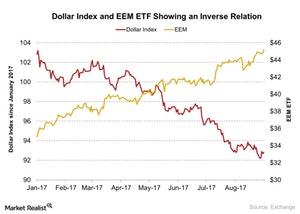

Stanley Druckenmiller Exited Position in EEM

Stanley Druckenmiller also sold his position in the iShares MSCI Emerging Markets ETF (EEM).

Beyond the Ephemeral: Pay Attention to Demographics

Lost in all the chatter about interest rates is a structural phenomenon that may be of far greater significance: demographics.

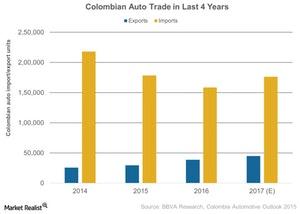

Will Trade Deal with Mercosur Bloc Boost Colombia’s Auto Sector?

Colombia (GXG) signed a deal with the Mercosur trade bloc on July 21, 2017, to allow the import of limited quantities of certain products without a tariff in the Colombian market.

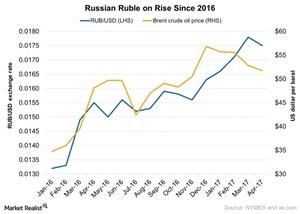

Why the Ruble Is on the Rise

The recovery of oil prices in the latter half of 2016 has helped the Russian ruble to appreciate along with improved exports.

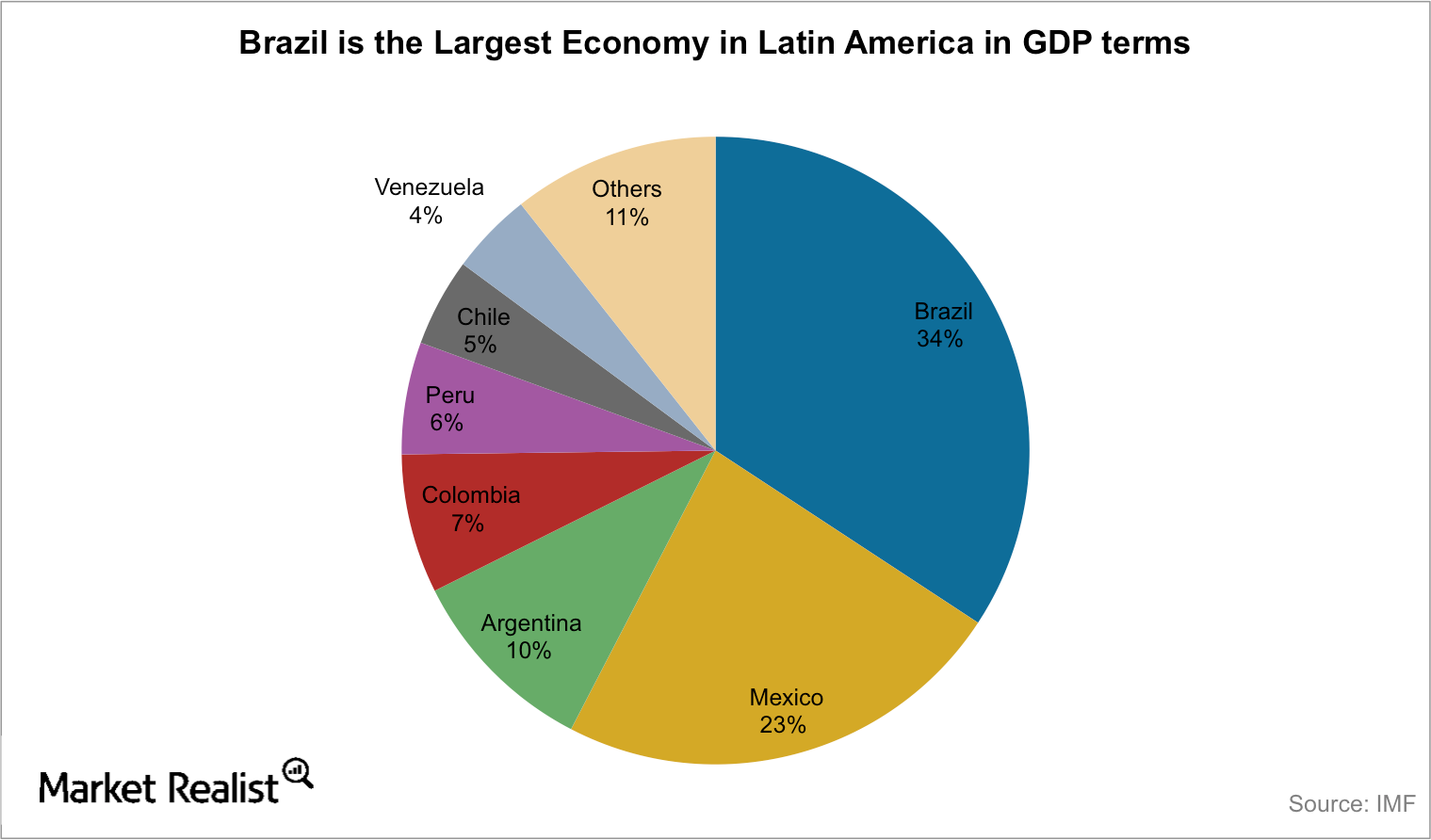

Why Latin American Economies May Be in Trouble

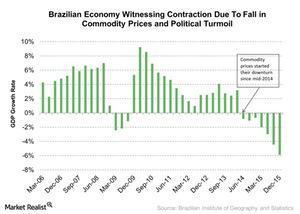

Worsening economic conditions in Brazil and Venezuela hit economic growth in Latin America in the first quarter of 2015.

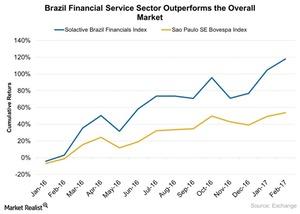

Why the Service Sector’s Contribution to Brazil Is Important

The service sector is the main contributor to Brazil’s GDP and job creation, but it’s currently suffering from structural weakness and poor international performance.

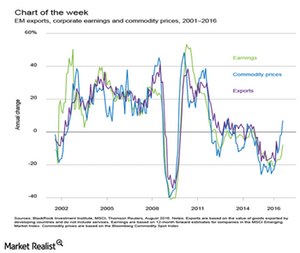

Why Emerging Markets Are Rebounding

Emerging markets (IEMG) (AAXJ) are expected to grow at a healthy pace of 4% in 2016 and see even higher growth in 2017.

Can Malaysia’s Improved Retail Sales Support Economic Growth in 2017?

Retail sales in Malaysia rose 13.9% YoY (year-over-year) in June 2017, compared with its 13.6% gain in May 2017.

Why Is David Rubenstein Optimistic about Brazil?

The Brazilian economy is experiencing contraction due to a fall in commodity prices and the political turmoil. The commodities market is one of Brazil’s most important growth drivers.

Understanding the Marginal Decline in Malaysian Exports in June

Exports from Malaysia in June 2017 stood at 73.1 billion Malaysian ringgit (MYR) (about $17 billion as of August 11, 2017), or 10% higher YoY.

What Indicators Should Investors Watch This Week?

As China is one of the important emerging economies, investors should keep an eye on its important indicators.

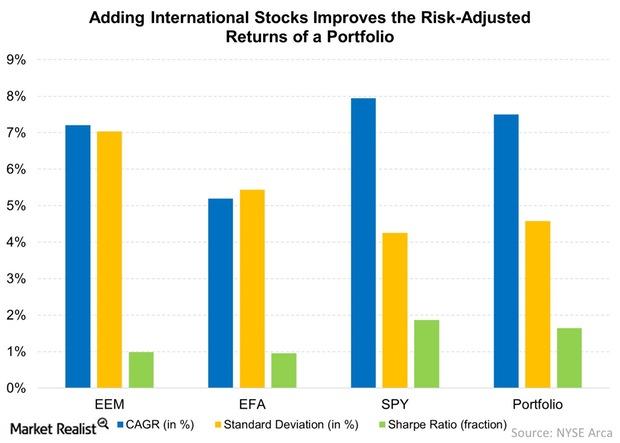

Why Diversification Is More than Just a Buzzword

Diversification is important because a diversified portfolio has higher risk-adjusted returns than a portfolio exposed to only one security.

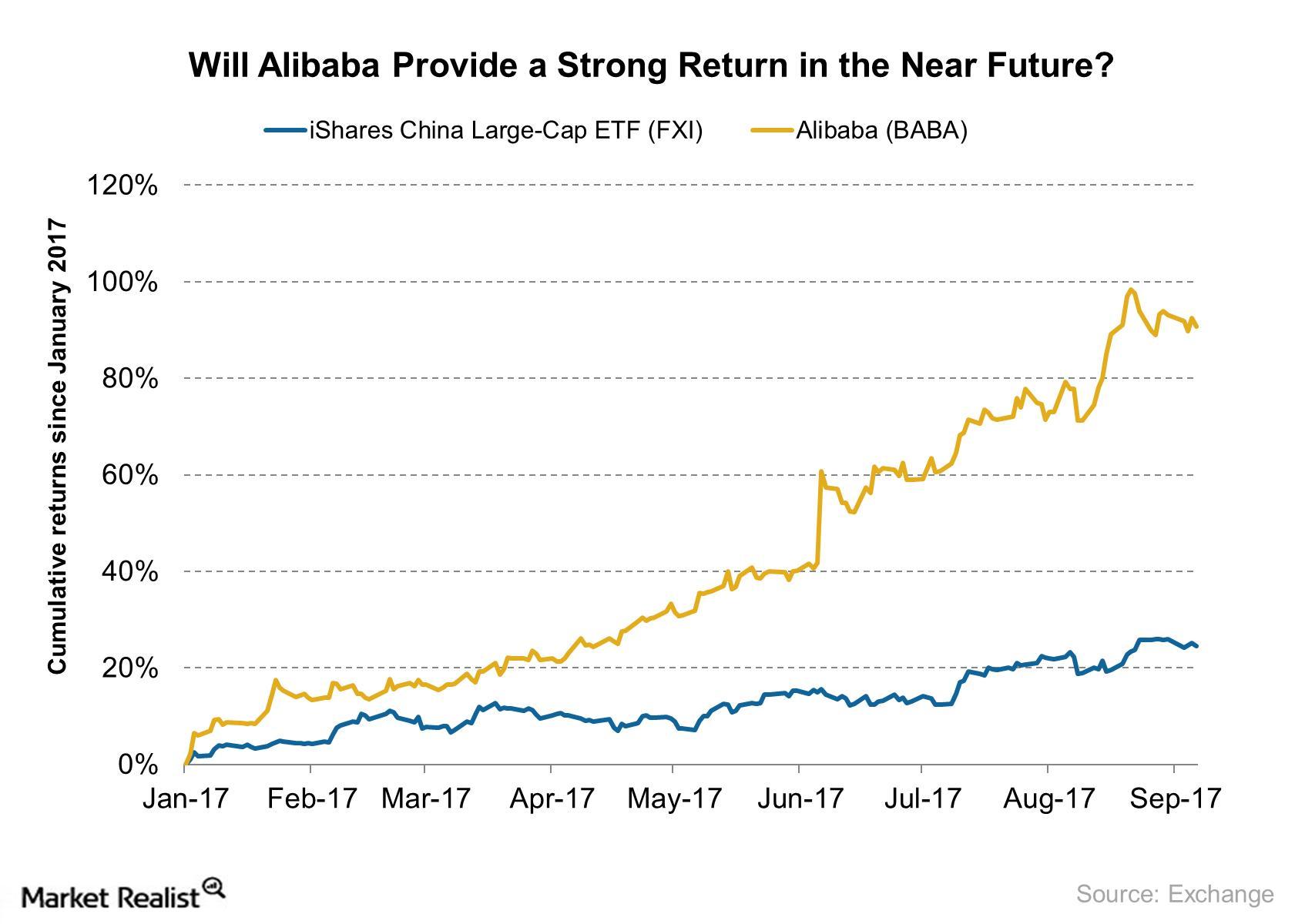

Why Goldman Sachs Is Optimistic about Alibaba

Alibaba was trading at $169 on September 8, 2017. Its 52-week high is $177 and its 52-week low is $86.01.

Labeled Green Bonds’ Significance to Investors

Global climate leaders have set a $1 trillion target for green finance by 2020, which would require a tenfold increase in global green bonds issuance.

How Has the Russian Stock Market Changed?

The Russian stock market is upbeat, which adds to the ruble’s strength.

A Look at Emerging Markets PMI Reports in December 2017

In this series, we’ll analyze the manufacturing and services activity of China, India, and Brazil (EEM) in December 2017.

How Demographics Are the Key to India’s Growth

Demographics are the key to India’s growth story. India’s strength in numbers is one of its biggest advantages over the rest of the world.

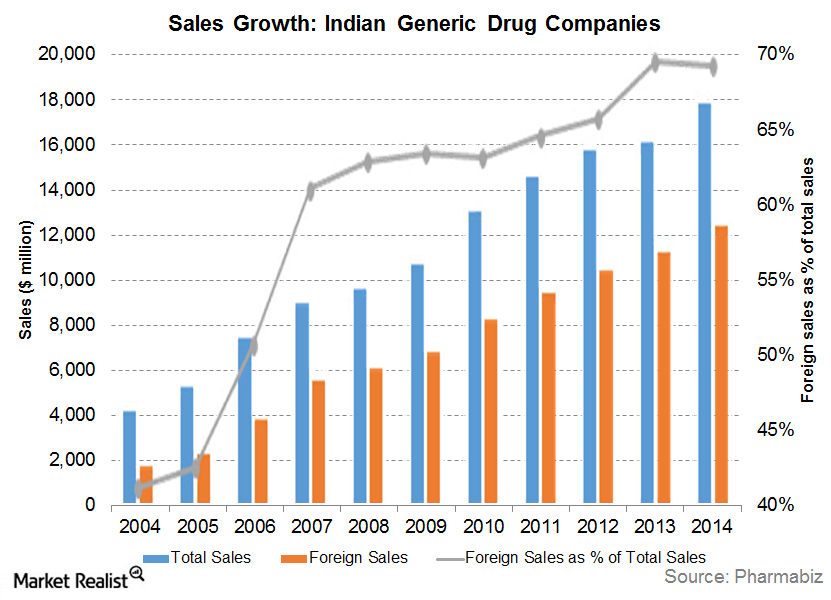

Why India Is So Important for Global Pharma

There are several compelling reasons for India’s rising pharma stature, including inexpensive labor, strong government support, and lower production costs.Financials Overview: The must-know characteristics of frontier markets

Looking for the next frontier in emerging market investing? Del Stafford dives into these underdeveloped countries to assess the investment case.Financials Overview: What stretched valuations mean for investors

As I’ve been noting for some time, emerging markets (EEM) can offer compelling long-term value.

Emerging Markets Have Been Leading Stock Returns in 2016

While developed markets have been caught in a lull, we’ve seen emerging markets grab the spotlight. Emerging markets have been leading stock market returns so far in 2016.

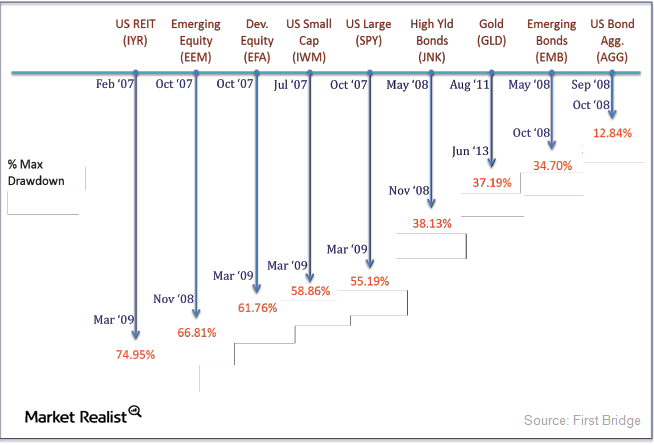

Must-know: Minimizing ETF losses by observing max drawdowns

In practice, asset owners (both retail and institutional) want to avoid significant portfolio drawdowns even if the benchmark index declines.

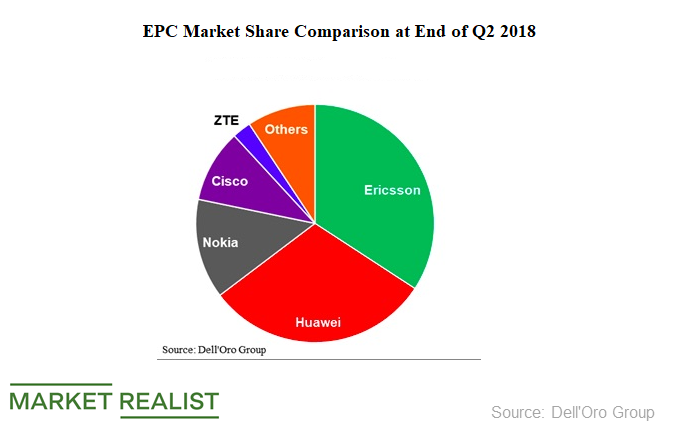

Ericsson and Huawei Still Lead Evolved Packet Core Market

According to research firm Dell’Oro Group, Ericsson (ERIC) is the leader in the global evolved packet core (or EPC) market.

The Dollar Is Strengthening: How Will It Affect Markets?

The US Dollar Index, which measures the strength of the dollar against a basket of other currencies, has risen 2.2% in the past month.

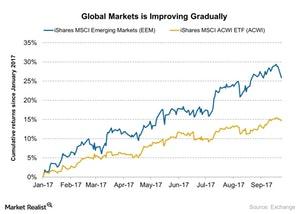

A Look at Emerging Market December PMI Reports

The iShares MSCI Emerging Markets ETF (EEM), which tracks the performance of emerging markets, rose 37.3% in 2017.

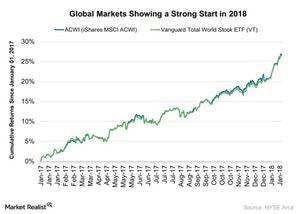

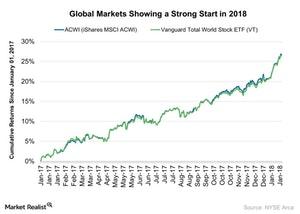

Will 2018 Be a Smooth Road for Investors?

2018 also brings with it many geopolitical events that could bring uncertainty and turn the market around.

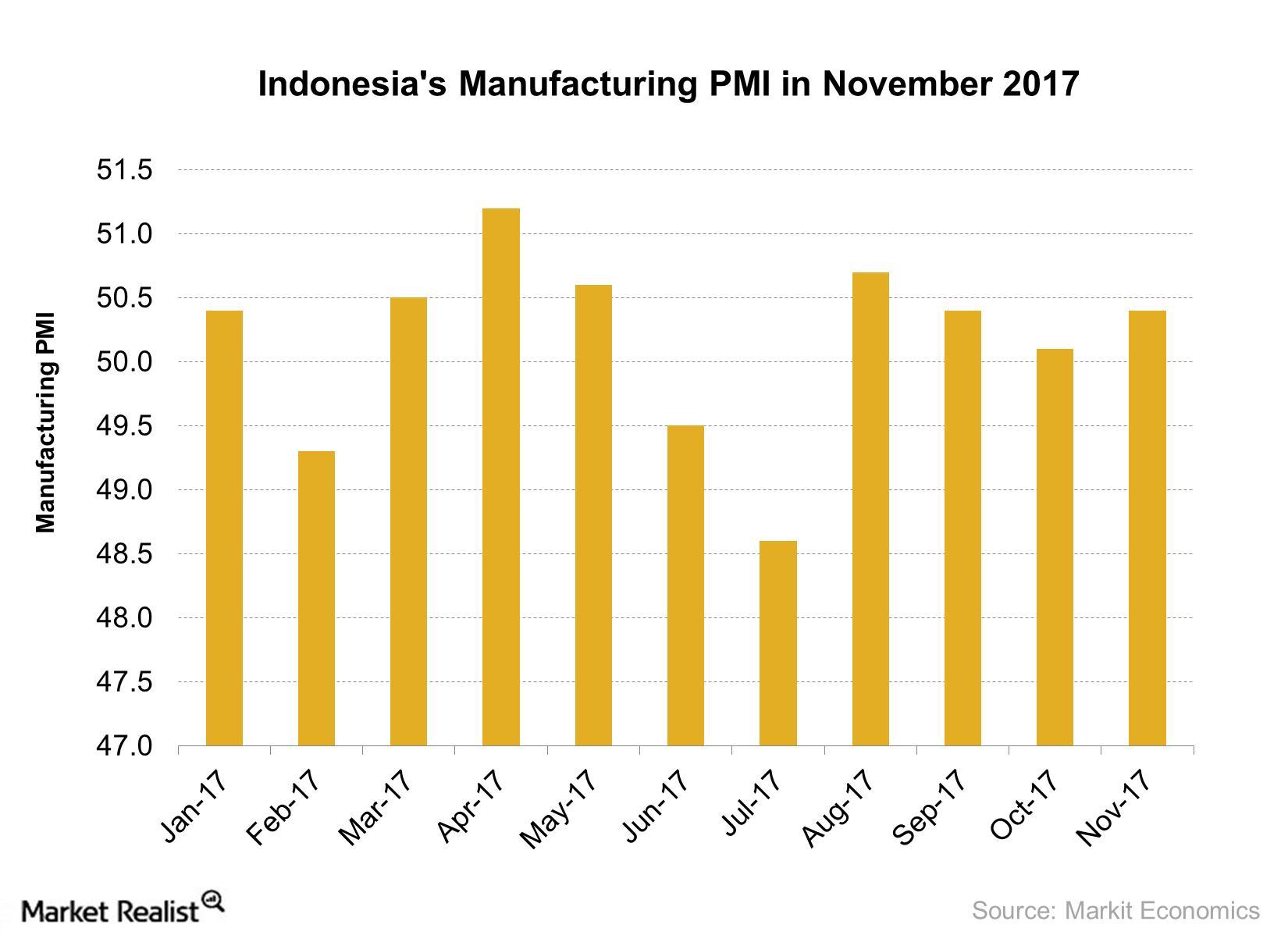

Analyzing Indonesia’s Manufacturing Activity in November 2017

Indonesia’s manufacturing activity in November According to a report by Markit Economics, Indonesia’s (IDX) (ASEA) manufacturing PMI (purchasing managers’ index) rose to 50.4 in November from 50.1 in October 2017, marking the fourth consecutive month of expansion. In November, Indonesia’s manufacturing PMI was driven by the following: production output and volume rose, marking a second consecutive month of expansion in […]

Why Emerging Markets Are Rallying

There are a lot of reasons behind the sharp rally in EMs (SCHE). The prominent reason is that the GDP growth in many of these nations has improved in the last few quarters partially on the back of the rise in commodity prices like copper and oil.

A Look at Indonesia’s Manufacturing PMI in September 2017

Indonesia’s (IDX) (ASEA) manufacturing activity stood at 50.4 in September 2017 compared to 50.7 in August 2017.

What’s the IMF’s View on Tax Reform?

According to the IMF (International Monetary Fund), a moderate progressive tax system may not negatively impact economic growth in developed economies (SPY) (EZU).

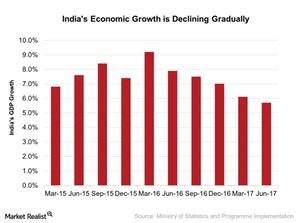

Could Indian Economy Grow Faster after GST Implementation?

On a yearly basis, economic growth in India (INDA) showed a strong improvement of 9.2% in the first quarter of 2016.

How Emerging Economies Are Supporting Global Growth

According to the report provided by the World Bank in June 2017, global (ACWI) growth is expected to strengthen to 2.7% in 2017.

How Emerging Market Manufacturing Activity Is Trending

In this series, we’ll take a look at the manufacturing activity and service activity of major emerging economies (EEM) (VWO) in August 2017.

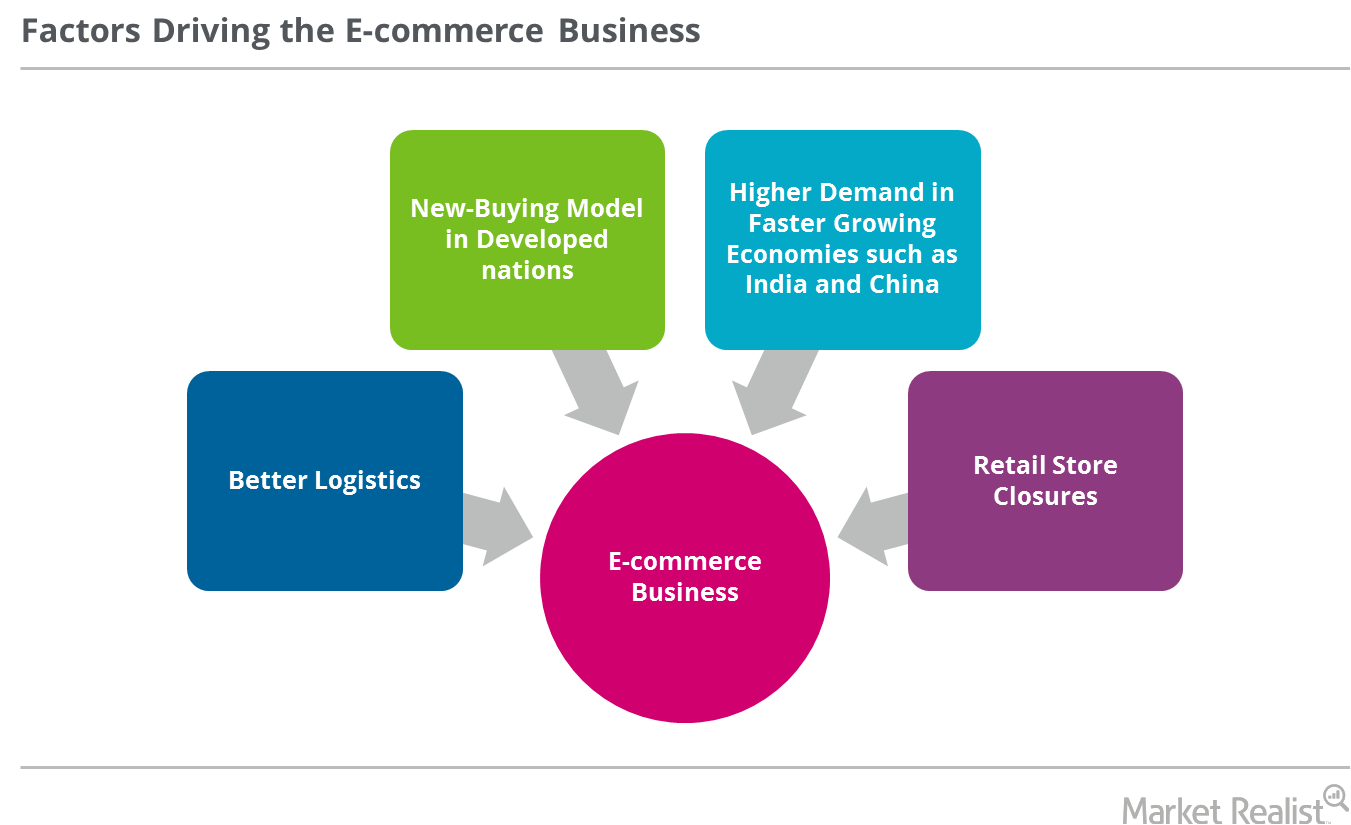

Why Goldman Sachs Is Optimistic about e-Commerce

The iShares MSCI Emerging Markets ETF (EEM), which tracks the performance of emerging markets, rose nearly 27.3% on a year-to-date basis as of September 7, 2017.

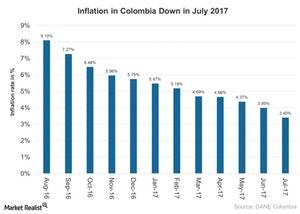

Inflation in Colombia Continues to Fall in July 2017

Consumer prices in Colombia (GXG) rose 3.4% on a year-over-year basis in July 2017, lower than the 4.0% rise in June 2017.

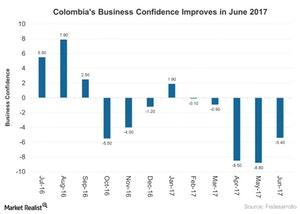

Marginal Rise in Industrial Confidence in Colombia in 2017

Industrial confidence in Colombia (GXG) improved in June 2017 to -5.4% as compared to -8.8% in May 2017.

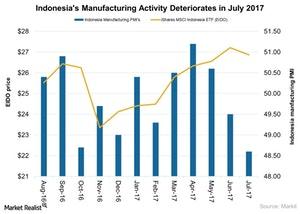

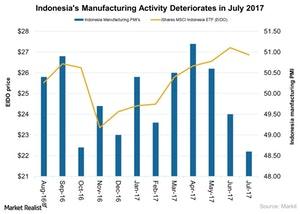

Why Indonesia’s Manufacturing Activity Fell

Manufacturing activity in Indonesia In July 2017, manufacturing activity in Indonesia (EIDO) fell at the fastest pace in 19 months, mainly due to sharp decline in its output. Indonesia’S (EEM) manufacturing PMI (purchasing managers’ index) fell to 48.6, compared with 49.5 in June 2017, according to an IHS Markit report. New orders also fell in July […]

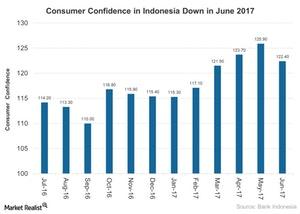

Why Indonesia’s Consumer Confidence Was Down in June 2017

Consumer confidence in Indonesia (EIDO) fell to 122.4 in June 2017 from an all-time high of 125.9 in May 2017.

Manufacturing Activity in Indonesia Contracted in July 2017

Manufacturing activity in Indonesia (EEM) in July 2017 fell at its fastest pace in the last 19 months mainly due to the sharp decline in its output.

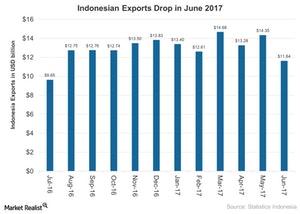

Indonesia’s Exports Fell in June 2017

Exports from Indonesia (EIDO) in June 2017 stood at $11.6 billion, a fall of 11.8% on a year-over-year basis and 19% on a month-over-month basis.

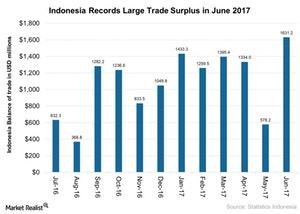

Here’s Why Indonesia’s Trade Surplus Rose in June 2017

Indonesia’s (EIDO) trade surplus in June 2017 stood at $1.6 billion as compared to $1.1 billion in the corresponding period last year and $0.57 billion in the previous month.

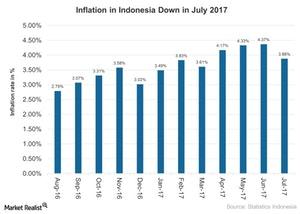

Inflation in Indonesia Fell in July: Is It a Correction or Trend?

Inflation in Indonesia (EEM) in July 2017 stayed in line with the market expectation of 3.9%.

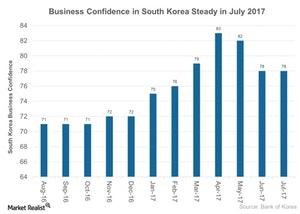

South Korea’s Business Confidence Remains Steady in July 2017

Business confidence in the manufacturing sector in South Korea (EWY) has remained stable at 78 in July 2017.