BTC iShares MSCI Emerging Markets ETF

Latest BTC iShares MSCI Emerging Markets ETF News and Updates

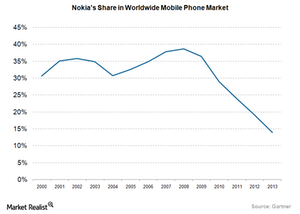

How Nokia Lost Its Mobile Brand Value so Quickly

Nokia clearly ruled the mobile phone market from the late 1990s until 2011. Then Nokia began to decline, and Samsung emerged as the leader in mobile phones.

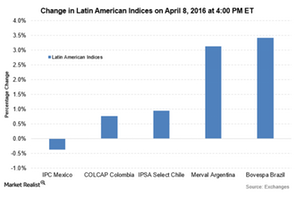

Why Did Inflation Rates Ease for Brazil and Chile?

Brazil’s inflation rate slowed for the second straight month in March. The annual inflation rose by 9.4%—compared to 10.4% in the previous month.

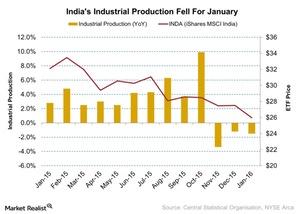

Why Did India’s Industrial Production Fall?

India’s industrial production fell by 1.5% in January, according to the Central Statistical Organization. In January 2015, the industrial production index rose to 2.8%.

Why Apple Is Optimistic about Its Future Growth Prospects

Although Apple does not provide guidance beyond the next quarter, the management is optimistic about the company’s growth prospects in the long term.

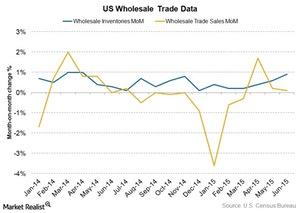

Indicators Suggest US Inventory Build-Up, SPY Falls 0.94%

August 11 saw the release of a number of key indicator around the world. Wholesale inventory data was the most eagerly awaited in the United States.

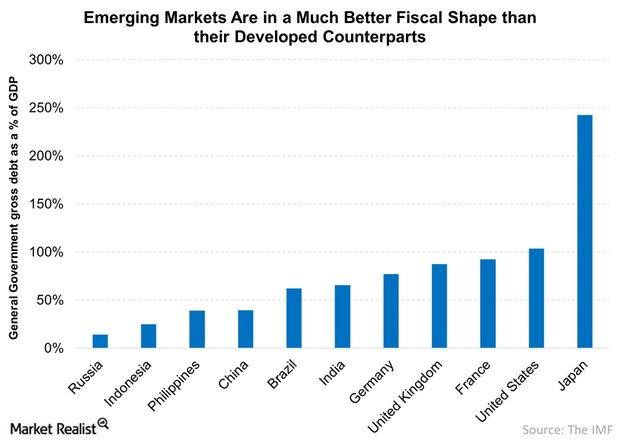

Emerging Markets Are in Good Fiscal Shape

Many of the emerging markets that were viewed as risky or even dangerous a mere 15 years ago now appear to be more attractive than many developed countries.

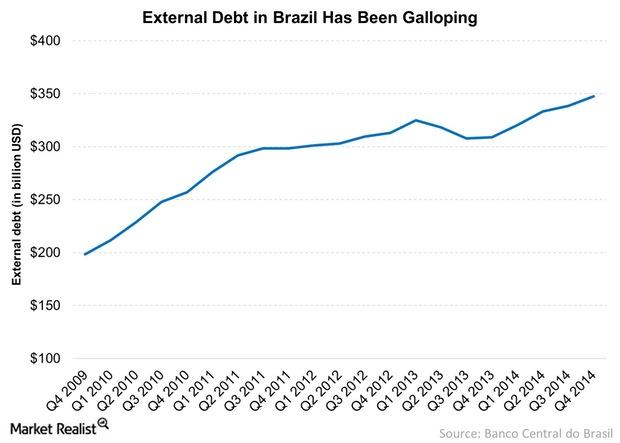

Why the Brazilian Government’s Debt Has Surged over the Years

The Brazilian government’s debt has surged over the last five years. The country’s internal debt has also increased.

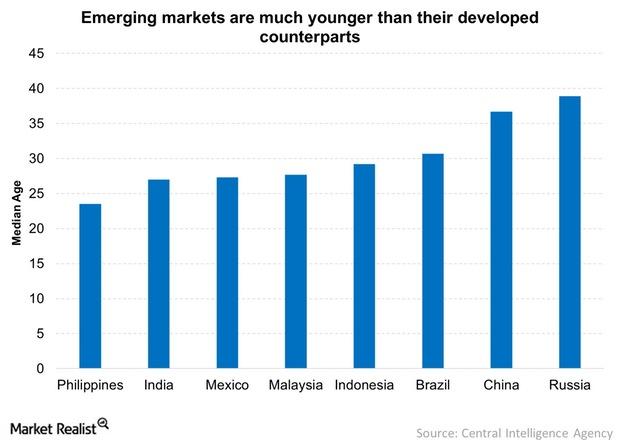

A Young Population Makes Emerging Markets Attractive

A young population in emerging markets makes them attractive, but beware! Some of the emerging economies are facing a lot of headwinds.

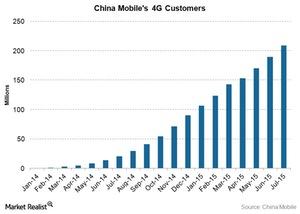

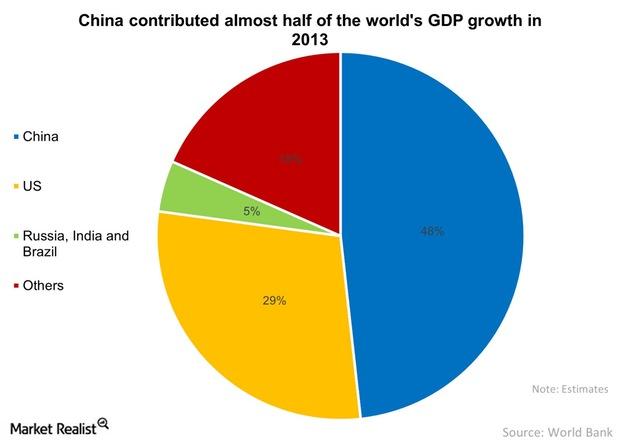

Why China Is Important To The Global Economy

As the second-biggest economy in the world, China is important. It’s also growing at a much faster rate than the biggest economy, the US.

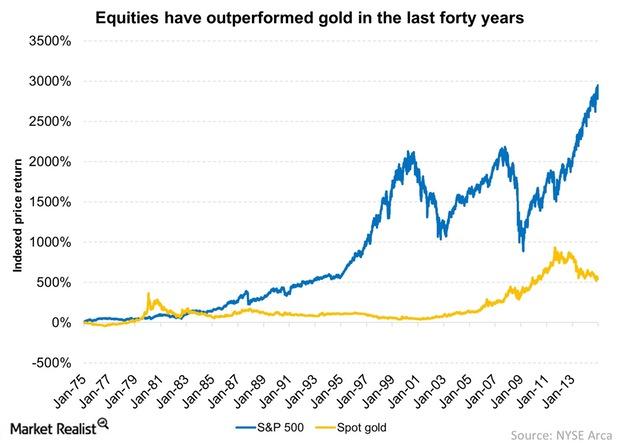

Equities are the best performing asset class in the long term

The CAGR for equity for the last 20 years is 7.8%. Equities outperformed investment-grade corporate bonds. Equities are the best performing asset class.

Where Are High Yield Bonds On The Risk Continuum?

High yield bonds (HYG), which are usually issued by mid- and small-cap companies, are considered riskier than investment grade corporate bonds.

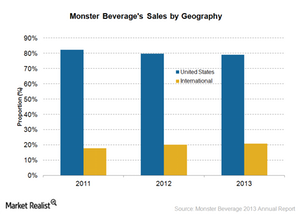

Why Monster Beverage’s international business is growing

Monster Beverage’s revenues from international regions increased over the years. Its international operations accounted for 21% of its 2013 revenues—up from 18% in 2011.

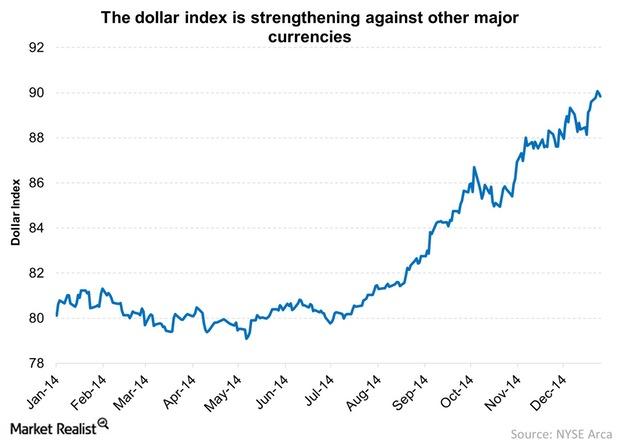

Key Catalysts Behind The US Dollar Rally In 2014

Can the US dollar rally continue? What does this mean for commodities? Russ answers these queries in his latest Ask Russ installment.

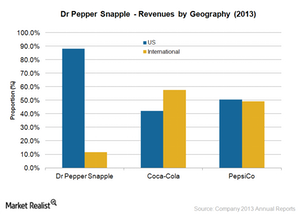

Why international expansion is vital for Dr Pepper Snapple

The carbonated soft drink volumes in North America have been continually declining. This makes it important for Dr Pepper Snapple to grow beyond its US operations.Macroeconomic Analysis Why emerging market bonds are not as risky as they seem

Most emerging markets have less debt compared to their developed market counterparts. This means emerging market bonds aren’t as risky as you may think!