Imperial Oil Ltd

Latest Imperial Oil Ltd News and Updates

More about KBR’s Major Clients

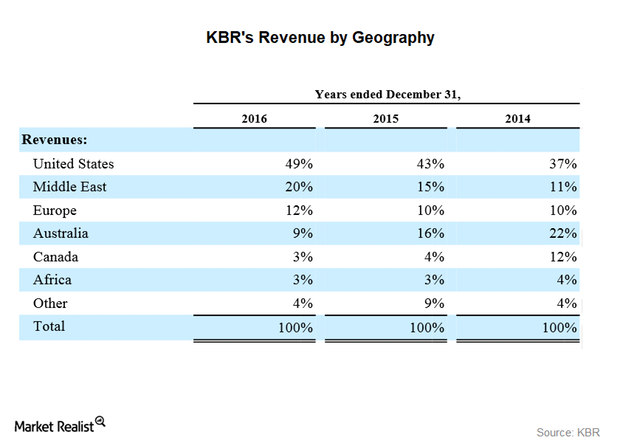

Clients and their sectors KBR (KBR) has a diverse customer base. According to KBR, its customers are “domestic and foreign governments, international and national oil and gas companies, independent refiners, petrochemical producers, fertilizer producers and manufacturers.” Revenue from overseas operations represented 63%, 57%, and 51% of KBR’s total revenue in 2014, 2015, and 2016, respectively. In this part, we’ll look at […]

A Look at KBR’s Subsidiaries

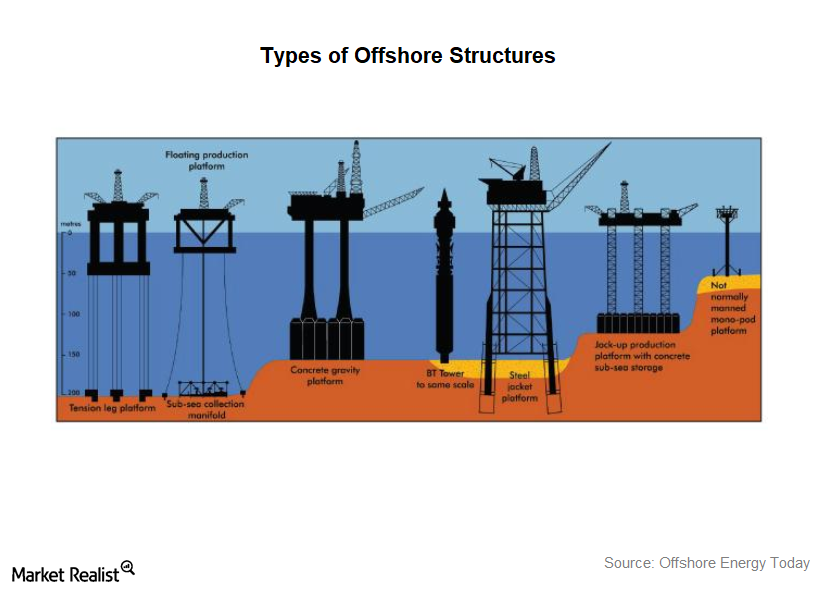

Primary subsidiaries Previously, we discussed various acquisitions completed by KBR (KBR). Let’s now take a look at some of KBR’s subsidiaries and how they fit into the big picture for the company. Energy and construction Granherne, a KBR technology and engineering subsidiary, operates in the oil and gas industry. Granherne provides front-end engineering and design services […]Company & Industry Overviews How Has 2016 Treated HLMNX So Far?

The HLMNX’s standard deviation, or the volatility of returns, in the one-year period until February 29 was 15.2%.

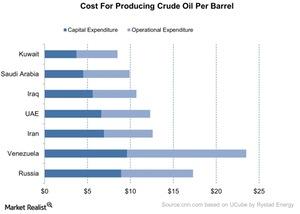

What’s the Break-Even Cost for the Top Oil Exporters?

Venezuela accounted for 17.5% of the world’s total proved crude oil reserves in 2014. BP (BP) conducted a study. It’s break-even cost is ~$23.50.

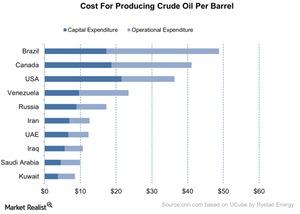

The Break-Even Costs of the World’s Top Oil Producers

Venezuela accounted for 17.5% of the world’s total proven crude oil reserve in 2014. According to a study by BP, Venezuela’s break-even cost is ~$23.5.

How Long Can the Price War Continue in Crude Oil?

According to data compiled by Rystad Energy, the cost of production per barrel of crude oil is $17.20 in Russia—compared to $9.90 in Saudi Arabia.