Rabindra Samanta

I have been working at Market Realist since August 2015. My primary area of expertise includes qualitative and quantitative analysis of crude oil and the natural gas market. This focus also includes tracking macroeconomic indicators. But, later into my career, I also started covering global markets, hedge fund manager commentary, and other macro developments.

I completed the PGDBM degree in 2014. Prior to Market Realist, I worked with one of India's largest brokerage house, Kotak Securities. My primary responsibilities include market analysis, portfolio advisory, and investor presentations.

After my graduate degree, I worked as an Associate at Vedanta Resources CPP (captive power plant) and IPP (Independent Power plant) project at Jharsuguda Odisha.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Rabindra Samanta

Why Oil Rigs Could Overshadow Natural Gas’s Gains

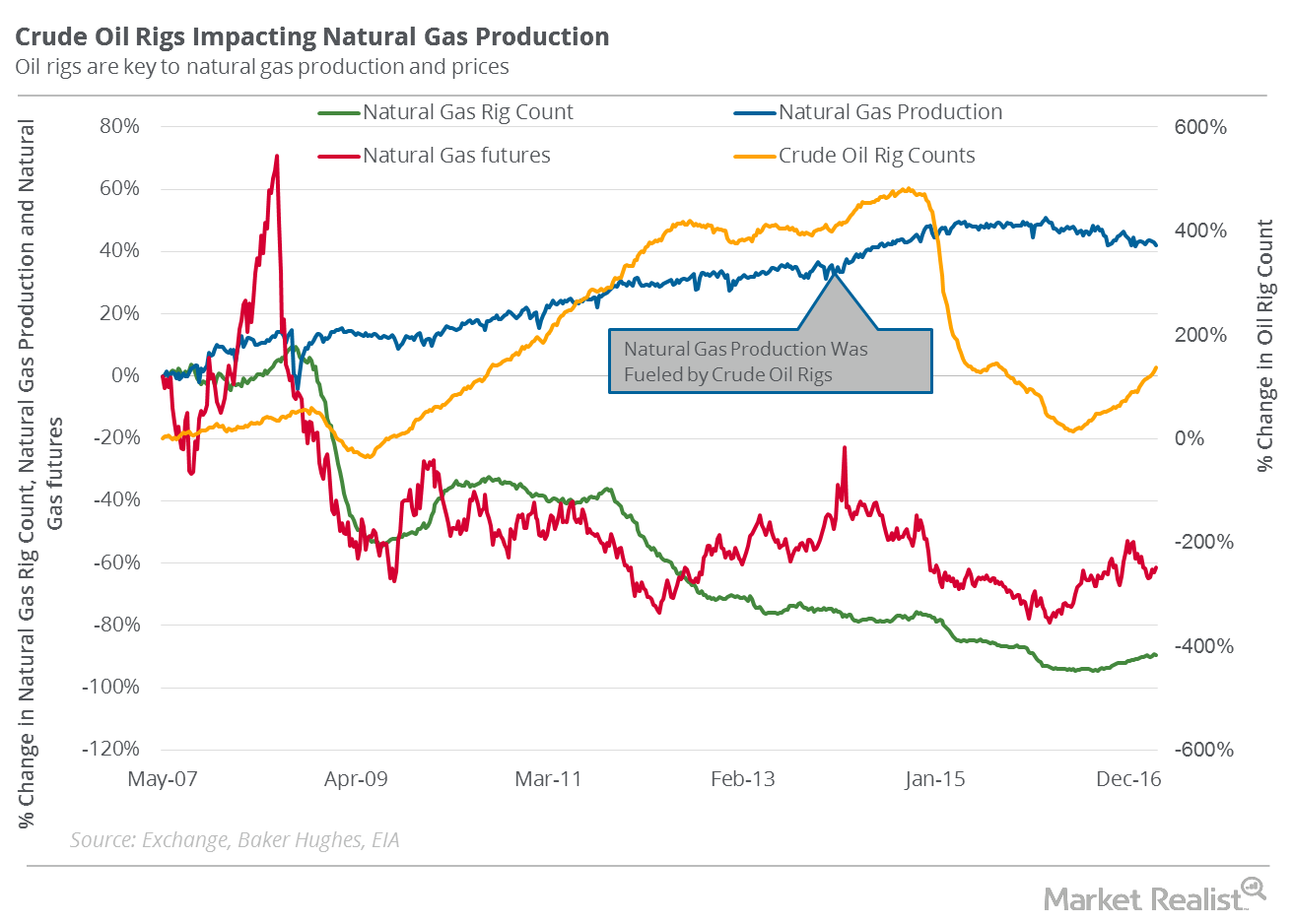

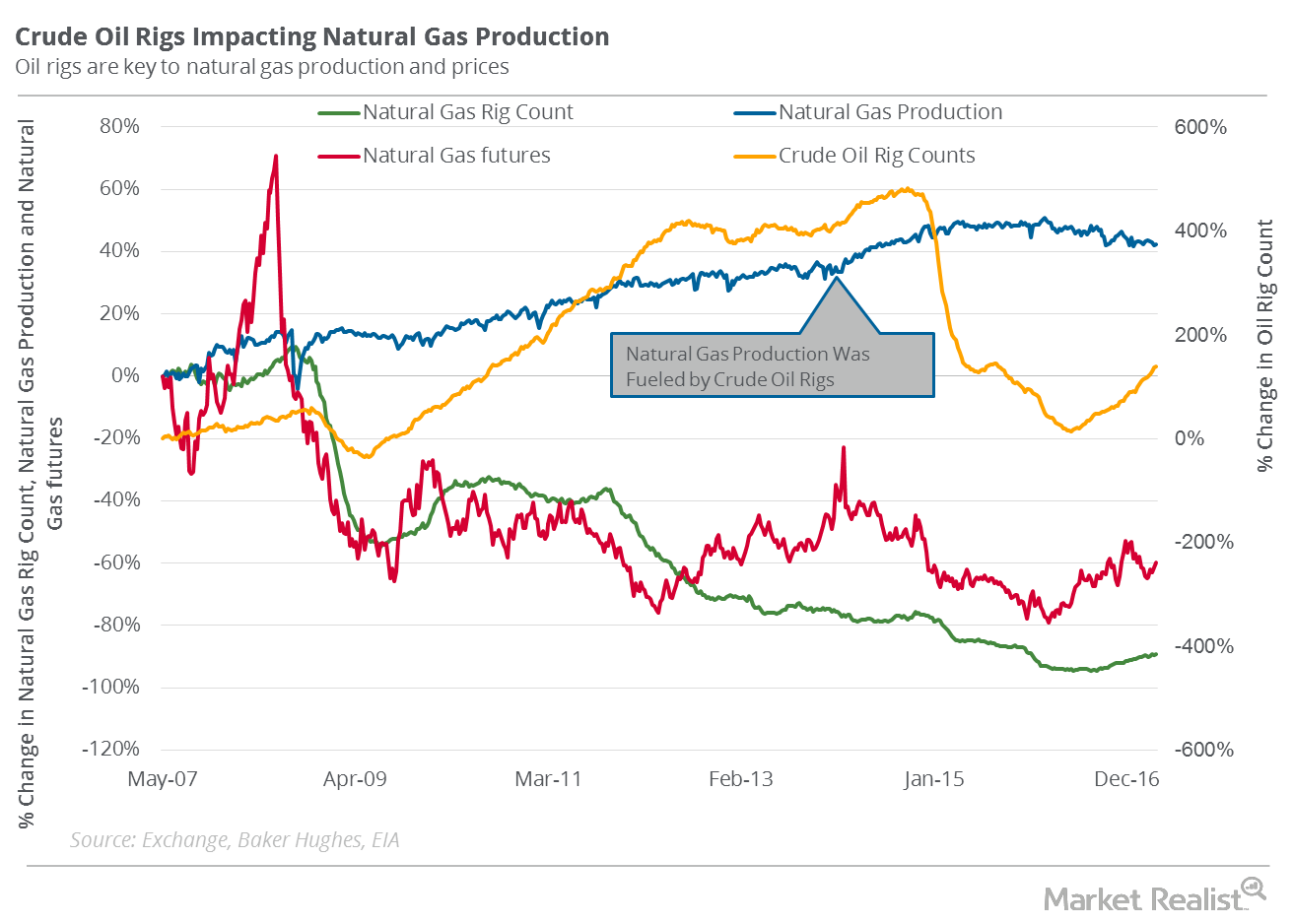

On March 31, 2017, the natural gas (BOIL) (GASX) (FCG) (GASL) rig count was 160, a rise of five rigs over the previous week.

Could Natural Gas Hit a New 2017 Low Next Week?

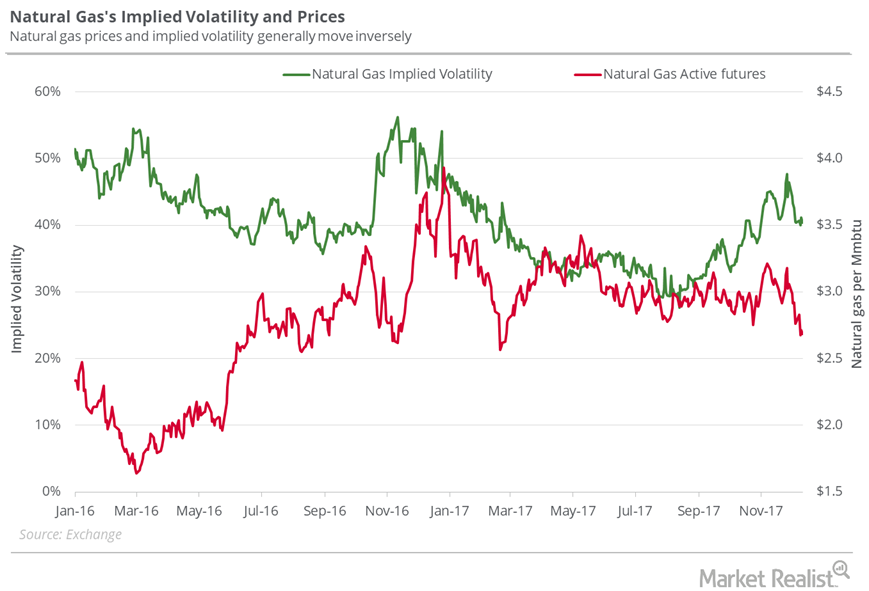

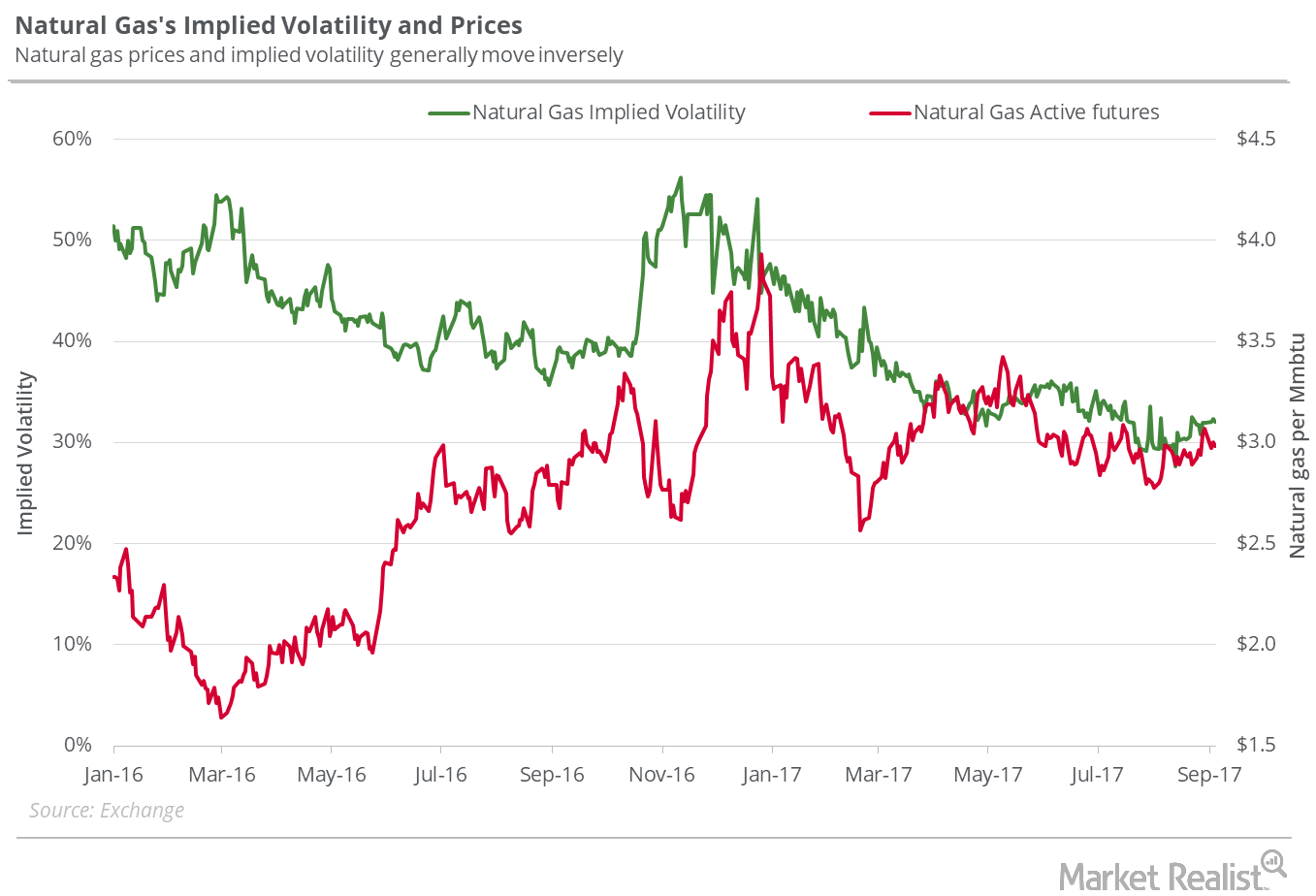

On December 14, 2017, the implied volatility of natural gas futures was 40.4%. It was ~5.9% below its 15-day average.

How Oil Rigs Could Make Natural Gas Traders Bearish

On April 7, 2017, the natural gas (BOIL) (GASX) (FCG) (GASL) rig count was 165, a rise of five rigs over the previous week.

Is Oil Set to Make Record Highs in 2018?

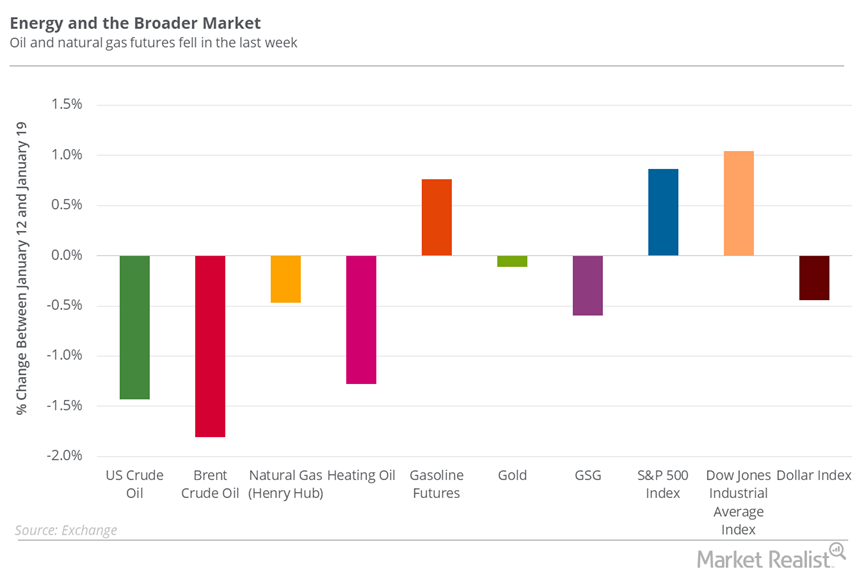

Between January 12 and January 19, 2018, US crude oil (USO) (USL) March futures fell 1.4%.

Will Natural Gas Reclaim $3 Next Week?

On October 12, 2017, natural gas implied volatility was 35.9%, 1.7% above its 15-day average.

JPMorgan Chase’s 2020 Market Outlook

On Wednesday, JPMorgan Chase’s strategists discussed the market’s 2020 outlook. These strategists expect stocks to rise next year, while gold could decline.

US Crude Oil at New 2017 High: Is Risk Rising?

Between November 17 and November 24, 2017, US crude oil (USO) (USL) January futures rose 3.9%.

Recent Fall in the US Dollar: Crucial for Natural Gas?

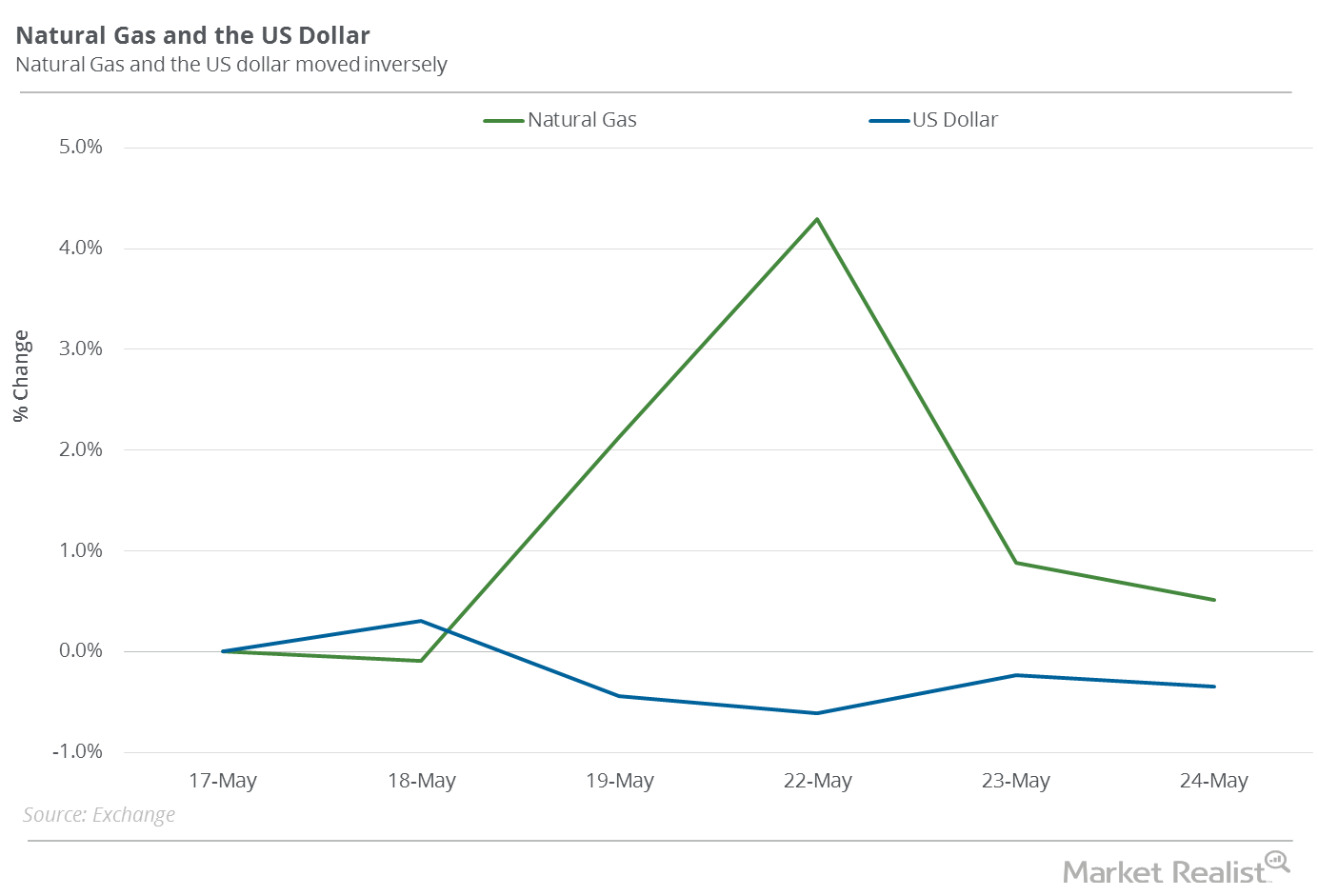

Natural gas (GASX) (FCG) (GASL) July futures rose 0.5% on May 17–May 24, 2017. During this period, the US dollar (UUP) (UDN) (USDU) fell 0.3%.

Crude Oil: A Bear Trap for Traders?

On March 4, US crude oil prices rose 1.4% and settled at $56.59 per barrel. The rise in oil prices was likely due to the falling global oil supply.

Should Energy Investors Be Cautious with Oil-Weighted Stocks?

On March 7, US crude oil April futures fell 2.3% and closed at $61.15 per barrel. Here’s what you need to know.

US Crude Oil Exports: Will They Affect OPEC’s Production Cut Deal?

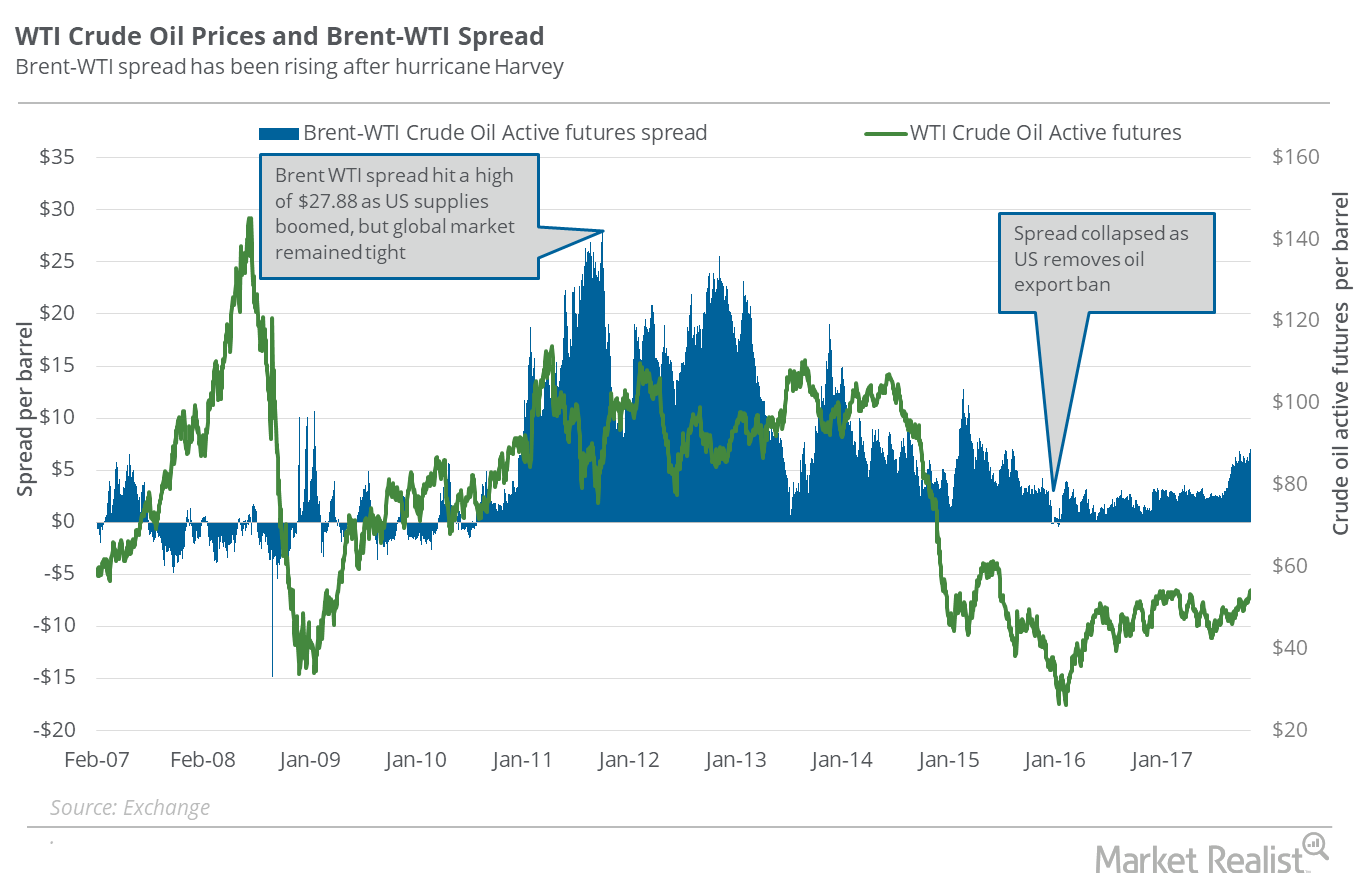

On November 7, 2017, the difference between Brent crude oil (BNO) active futures and US crude oil (USO) active futures, or the Brent-WTI (West Texas Intermediate) spread, was $6.50.

What Could Impact Oil Prices in 2018?

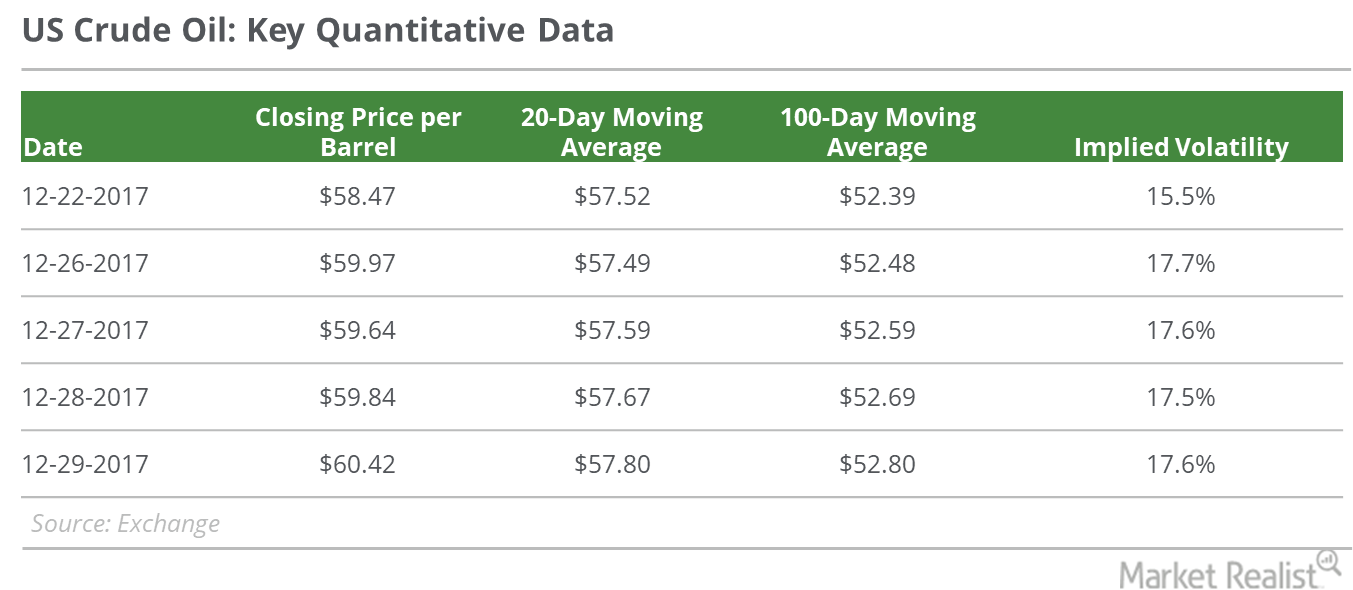

On December 29, 2017, US crude oil’s (USO) (USL) February 2018 futures rose 1% and closed at the 2017 highest closing price of $60.42 per barrel.

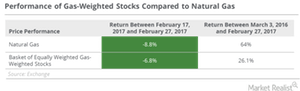

Analyzing Gas-Heavy Stocks amid Falling Natural Gas Prices

From February 17–27, 2017, natural gas futures contracts for April 2017 delivery fell 8.8%. On March 3, 2016, natural gas futures touched a 17-year low.

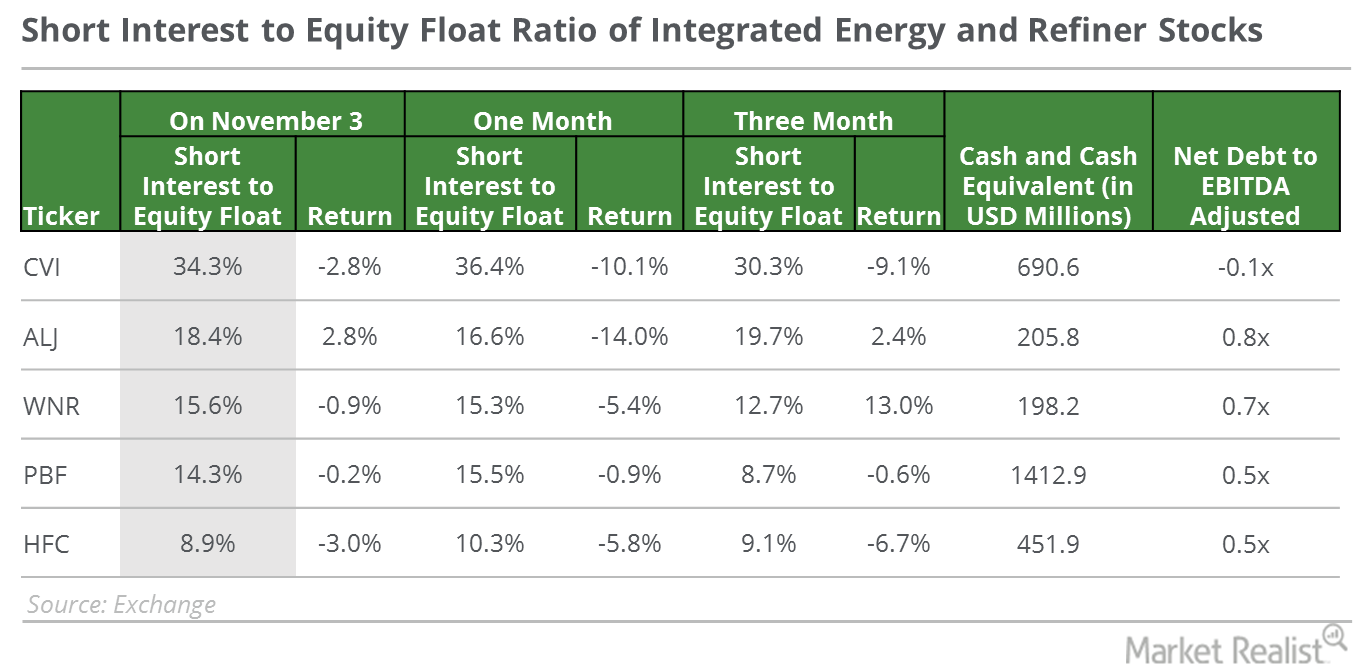

Integrated Energy and Refiner Stocks That Lead in Short Interest

As of November 3, 2016, CVR Energy (CVI) had the highest short interest-to-equity float ratio among our list of integrated energy and refiner stocks.

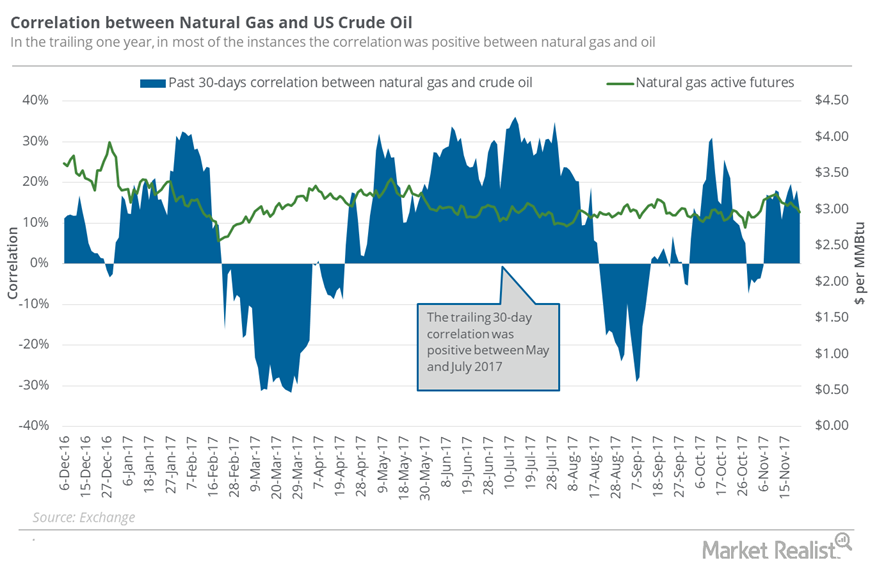

How Closely Is Natural Gas Tracking Oil?

Between November 15 and 22, natural gas (UNG)(FCG) January futures had a correlation of 52.5% with US crude oil January futures.

Noble Energy: Analysts’ Recommendations

Among the 23 analysts tracking Noble Energy (NBL), 29% recommended a “hold,” 68% recommended a “buy,” and 3% recommended a “sell.”

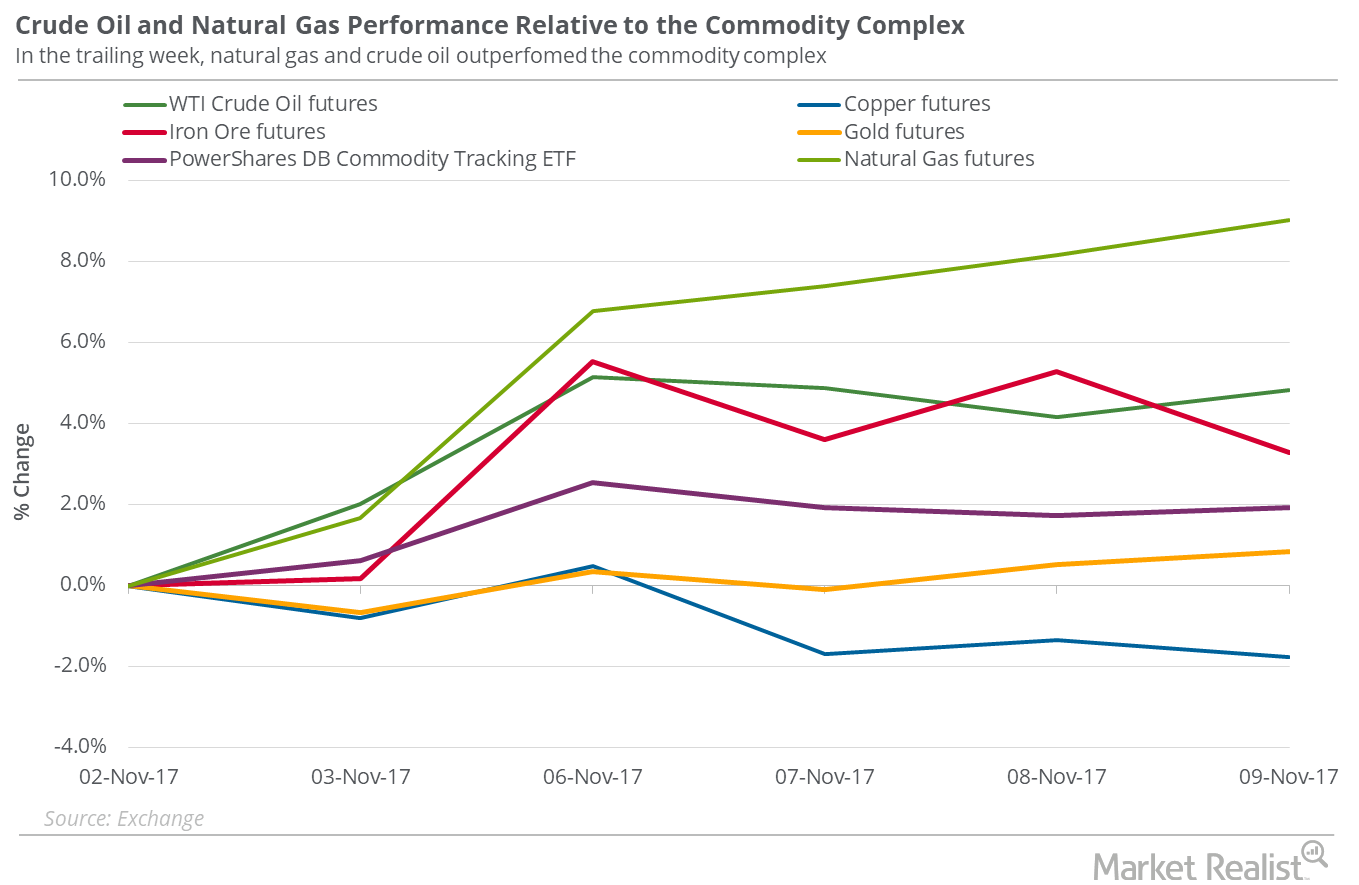

What to Expect from Crude Oil Prices

On November 9, US crude oil active futures rose 0.6% and closed at $57.17 per barrel. Geopolitical concerns in the Middle East could have helped crude oil.

Natural Gas: Analyzing the Inventory Levels

In the week ending May 24, the inventories spread was -12.1%. The spread contracted by ~1.4 percentage points compared to the previous week.

Natural Gas Could Reach the $3.4 Mark Next Week

On November 9, 2017, natural gas had an implied volatility of 43.5%—9.4% more than its 15-day average. Natural gas active futures settled at $3.2 per MMBtu.

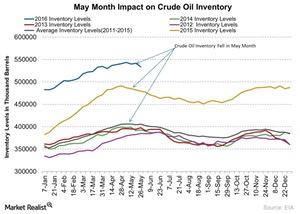

How Does Seasonality Impact Crude Oil Inventories?

US commercial crude oil inventories fell by around 4.2 MMbbls for the week ending on May 20, 2016—compared to the previous week.

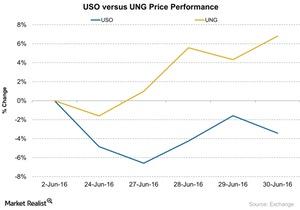

Why Did UNG Outperform USO?

From June 23—30, the United States Natural Gas ETF (UNG) outperformed the United States Oil ETF (USO). UNG rose ~6.8%, while USO fell ~3.4%.

Dow Jones Hits Record High after Jobs Growth Report

This morning, after the release of the jobs growth report, the Dow Jones Industrial Average surpassed the 29,000 level, a record for the index.

Why George Soros Sold Most of His Financial Stocks

George Soros’s firm sold out all of its positions in JPMorgan Chase, Citigroup, Bank of America, Wells Fargo, and Ally Financials in the first quarter.

BlackRock Is Neutral on US Equities: More Risk Ahead!

BlackRock, the leading investment institute, shared its latest view on the equity market across the globe in its second-half outlook.

Ray Dalio Invested in These Stocks in Q1: Should You?

The top five buys of Ray Dalio’s Bridgewater Associates in the first quarter were INDA, Home Depot, Sherwin-Williams, United Health Group, and McDonald’s.

Paul Singer and Elliott Management’s Top Holdings

Elliott Management filed its 13F, disclosing its latest holdings, and its billionaire hedge fund manager, Paul Singer, has made some headlines.

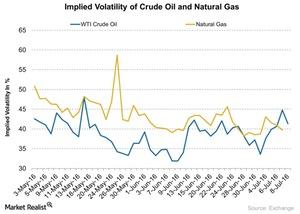

What Are the Implied Volatilities of Crude Oil and Natural Gas?

Crude oil’s (USO) (OIIL) implied volatility was 41.3% on July 8, 2016.

JPMorgan Chase Predicts Crude Oil Will Reach $190 in 2025

JPMorgan Chase predicts that oil will reach $190 per barrel in 2025. Just a few months ago, Brent crude touched a multiyear low.

Stanley Druckenmiller Is Bearish on Growth Stocks: What’s He Buying?

Amazon (NASDAQ:AMZN), Facebook (NASDAQ:FB), and Microsoft (NASDAQ:MSFT) remained in Stanley Druckenmiller’s top five holdings in the first quarter.

Natural Gas: What Can Investors Expect?

The EIA reported a rise of 120 Bcf in natural gas inventories for the last week. However, analysts expected a rise of 106 Bcf in the inventories level.

Are Bill Ackman’s Investment Strategies Successful?

In the first quarter of 2020, activist hedge fund manager Bill Ackman made a windfall profit of $2 billion. He was short on the market in March 2020.

Jim Simons’ Renaissance Technologies Is Bearish on TSLA

On May 14, Jim Simons’ Renaissance Technologies filed its 13F for the first quarter of 2020. The hedge fund reduced its holdings in Tesla.

Why Elliott Management Might Be in Trouble

Last week, Elliott Management filed its 13F for the first quarter of 2020. In the last quarter, the hedge fund’s AUM was worth around $73.15 billion.

Gold or Crude Oil: Where to Hide amid US-Iran Tensions?

Active gold futures have risen to their highest level since 2013 after the renewal of US-Iran tensions. Last week, active gold futures rose by 1.1%.

Bill Gross: Top Stock Picks with High Dividend Yields

On October 18, CNBC reported Bill Gross top picks. His top stock picks were Annaly Capital (NLY), Invesco (IVZ) and Allergan (AGN).

Key Oil Price Indicators at the End of 2019

Last week, WTI crude oil prices gained 0.6%—the third consecutive weekly gain. The rally in oil prices started towards the end of 2019.

Goldman Sachs’ Best Stock Picks for 2020

Strategists at Goldman Sachs (GS) project Netflix (NFLX), T-Mobile (TMUS), and Coca-Cola (KO) to be among the best stock picks for 2020.

Oil Price Outlook: Goldman Sachs Sees a New High

Last week, Goldman Sachs increased its target on oil prices, but only for the short term. Its long-term target on oil prices is almost unchanged.

2020’s Natural Gas Outlook: Winter Is Coming

Natural gas’s outlook might turn bearish. Last week, natural gas prices rose by 2.3%. The higher prices were due to the bullish weather forecast.

Oil Prices This Week: Key Fundamentals and Outlook

Last week, WTI crude oil prices rose just 0.1%, while the United States Oil Fund LP (USO) rose 0.2%. Crude oil rose for the third consecutive week.

Occidental Petroleum Earnings and Icahn versus Buffett

On November 4, Occidental Petroleum (OXY) released its Q3 earnings after markets closed. The battle between Carl Icahn and Warren Buffett is heating up.

How Are Citadel Advisors Hedging their Portfolio?

Kenneth Cordele Griffin is the CEO of investment management firm Citadel Advisors LLC. He is the hedge fund manager and he founded Citadel in 1990.

Ron Baron Sees the Dow at 650,000 in the Next 50 Years

Ron Baron, the CEO of Baron Funds, expects to see the Dow Jones at 650,000 in the next 50 years. He predicted a similar Dow level of 500,000 last November.

Why Natural Gas Prices Could Take a Hit Next Week

On October 24, natural gas prices rose 1.5% and settled at $2.32 per MMBtu. On the same day, the United States Natural Gas Fund LP rose 1.4%.

Mike Wilson: Growth Stocks Could Decline 20-30%

On October 10, in an interview with CNBC, Mike Wilson said investors should focus on the fundamental story. He’s worried about expensive growth stocks.

Amazon: Is Mark Cuban Influenced by Berkshire?

On September 30, Mark Cuban said to Fox Business that he had a stake worth around $1 billion in Amazon. He added, “It’s my biggest holding.”

Walmart’s All-Time High—Should You Listen to Buffett?

On September 25, Walmart stock closed at $118.47, just 1.4% below the all-time high it made in the previous trading session.

Chesapeake Energy: Recommendations, Moving Averages

Of the 25 analysts tracking Chesapeake Energy (CHK), only three recommended a “buy” on the stock and 40% have a “sell” recommendation.

Netflix: Soros Exited Even before Barclays’ Warning

According to Barclays, Netflix’s current business model and expected total addressable market until 2026 don’t justify its current valuation.

Weekly Update: Trade Talk Uncertainty and Gold Prices

Last week (ended September 20), gold rose 1.1% and settled at $1,507.30 per ounce. Meanwhile, the SPDR Gold Shares ETF (GLD) rose 2%.