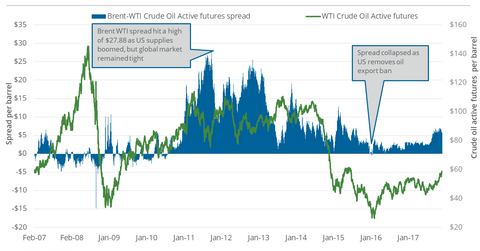

WTI Crude Oil Is Rising Faster than Brent

On November 28, 2017, Brent crude oil (BNO) active futures closed at $5.62 higher than US WTI crude oil (USO) (UCO) active futures.

Nov. 20 2020, Updated 1:27 p.m. ET

The spread

On November 28, 2017, Brent crude oil (BNO) active futures closed $5.62 higher than US WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures. The difference or the “Brent-WTI spread” was $5.74 on November 21, 2017.

On November 16, 2017, the Keystone pipeline’s operations were suspended because of a spill in South Dakota. The pipeline resumed operation on November 28, 2017, but at a reduced rate. On November 16–28, 2017, US crude oil active futures rose 4.8% compared to a 3.7% gain in Brent crude oil active futures. The same trend has been observed in the seven calendar days to November 28, 2017. During this period, US crude oil active futures rose 2% and Brent crude oil active futures rose 1.7%. It caused the Brent-WTI spread to compress. On November 21, 2017, the spread fell below the $6 level for the first time in almost a month.

US share in the global oil trade

US crude oil exports were ~1.6 MMbpd (million barrels per day) for the week ending November 17. A relatively higher Brent-WTI spread can benefit US crude oil exporters. On a year-over-year basis, US crude oil exports have risen by more than 1 MMbpd.

If US crude oil production grows as we discussed in Part 2, we would see more upside in the US share in the global oil trade. Over a long-term period, it might be an important catalyst for oil prices.

A higher spread would mean that US oil producers (XOP) (DRIP) selling in the domestic market benchmarked at lower WTI crude oil prices aren’t able to earn the higher revenues that their international peers can earn by selling at higher Brent prices. At the same time, it could boost US refineries’ (CRAK) profit margins with cheaper US crude oil being their input and higher priced refined items they produce tracking stronger Brent oil prices.

Visit Market Realist’s Energy and Power page for more on oil prices.