VanEck Vectors Oil Refiners ETF

Latest VanEck Vectors Oil Refiners ETF News and Updates

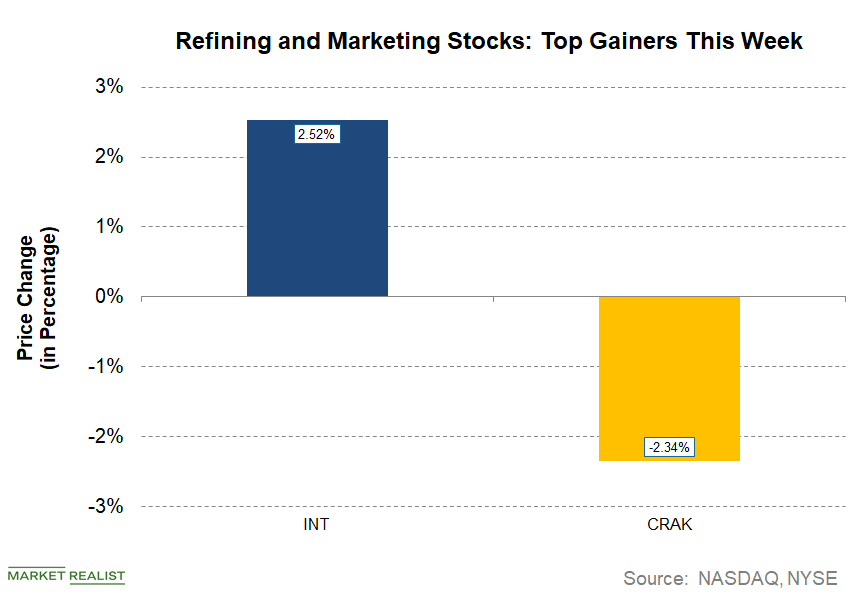

Which Refining and Marketing Energy Stocks Are Rising This Week?

World Fuel Services (INT) increased from last week’s close of $21.80 to $22.35 on June 14—an increase of more than 2.5%.

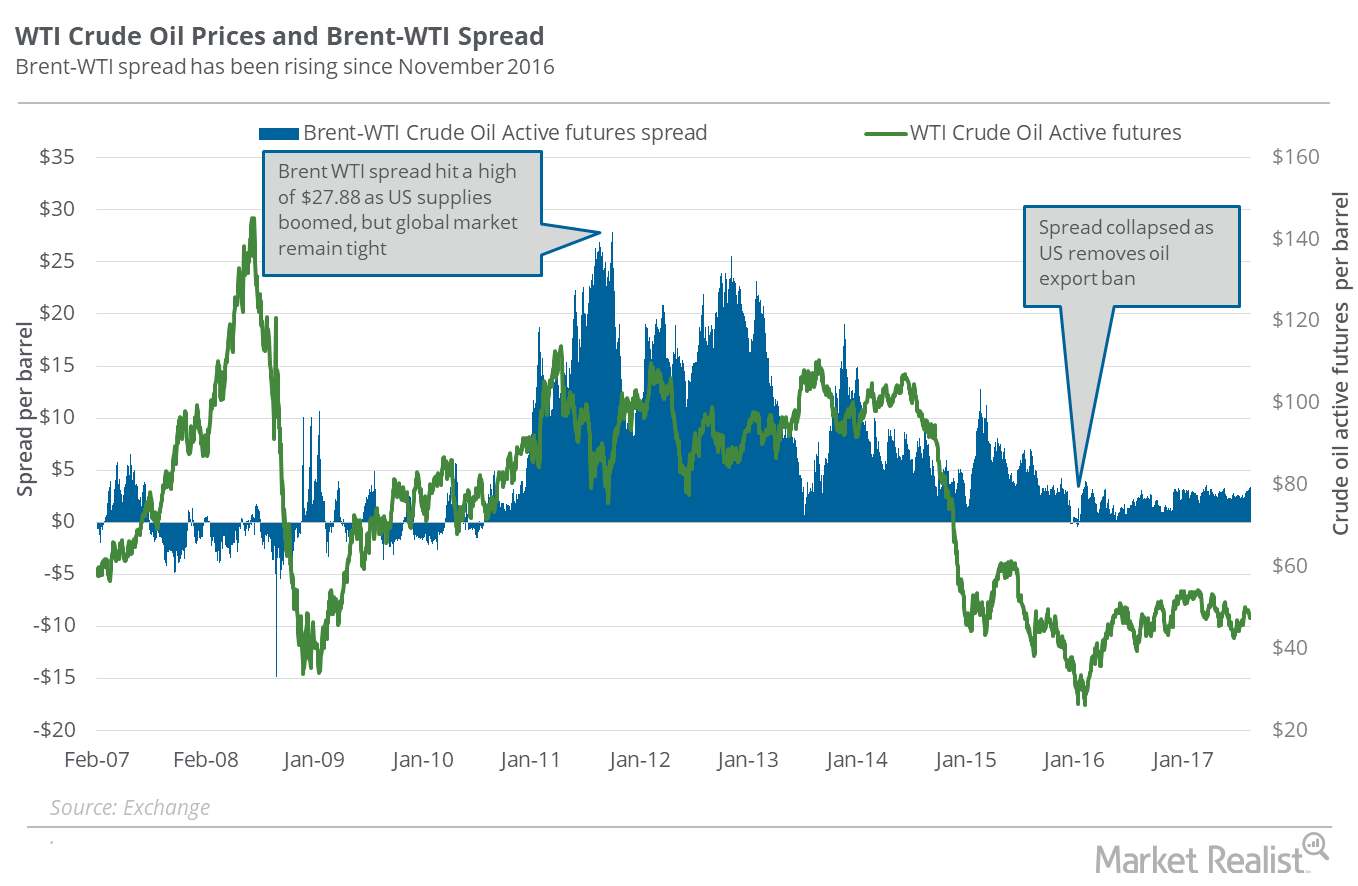

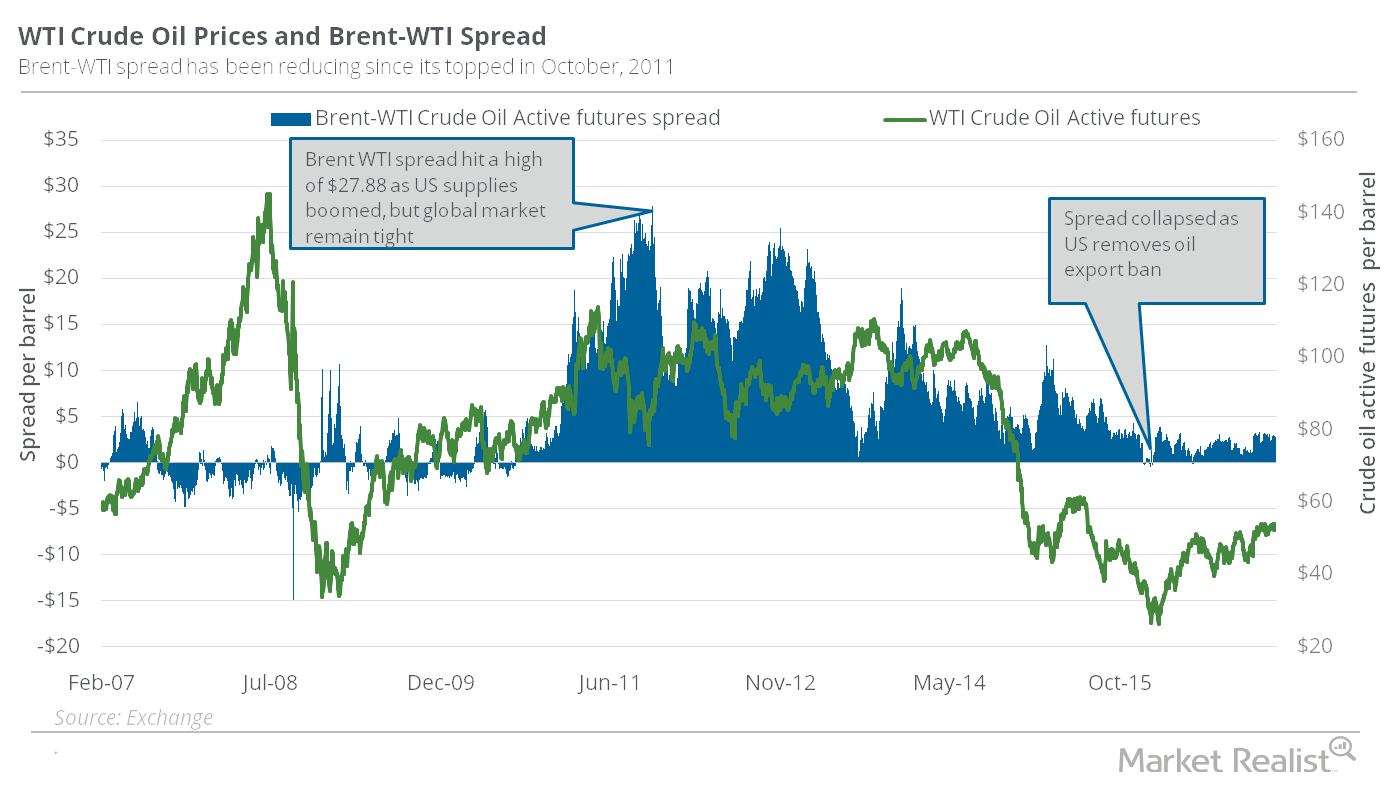

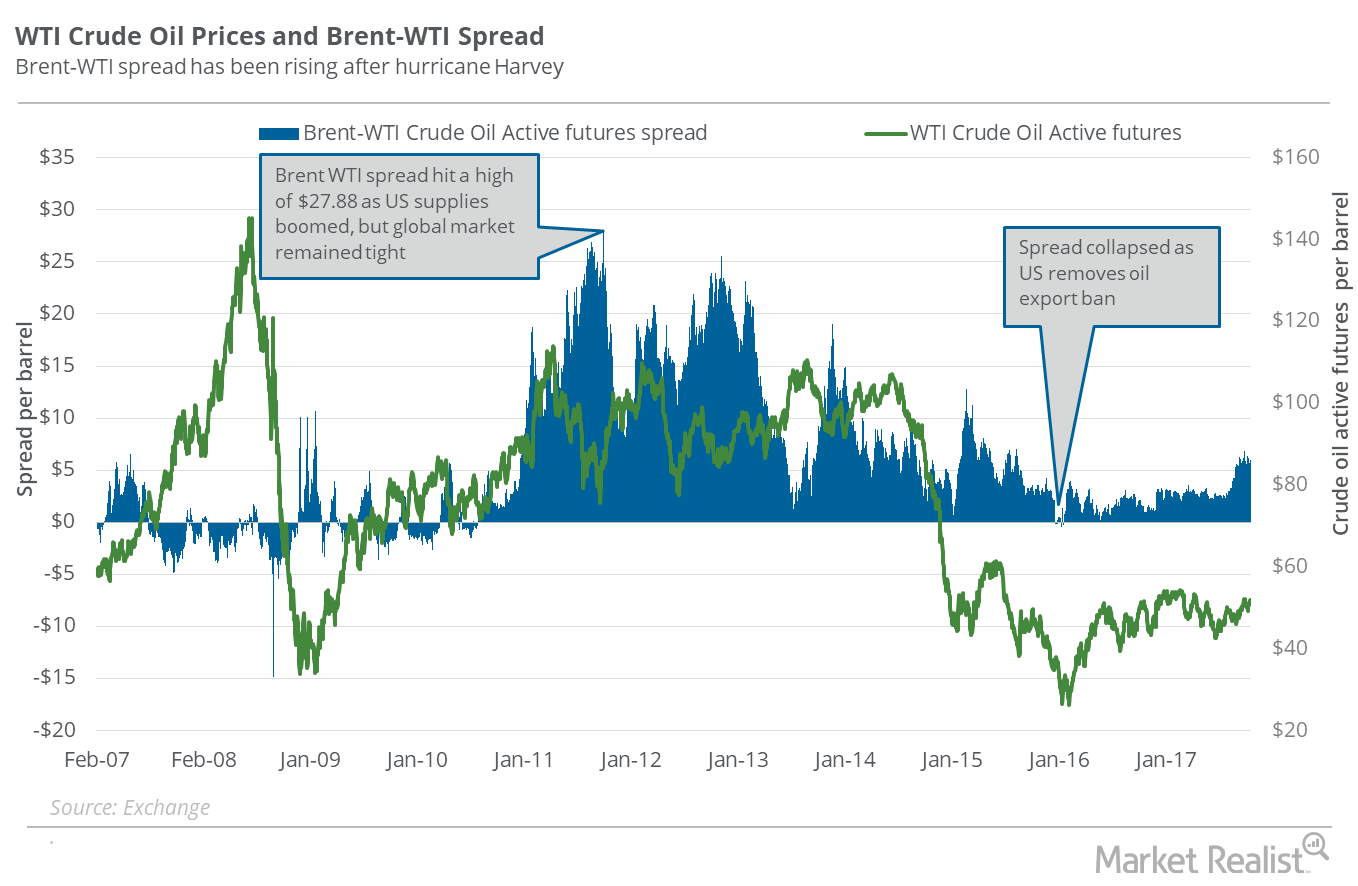

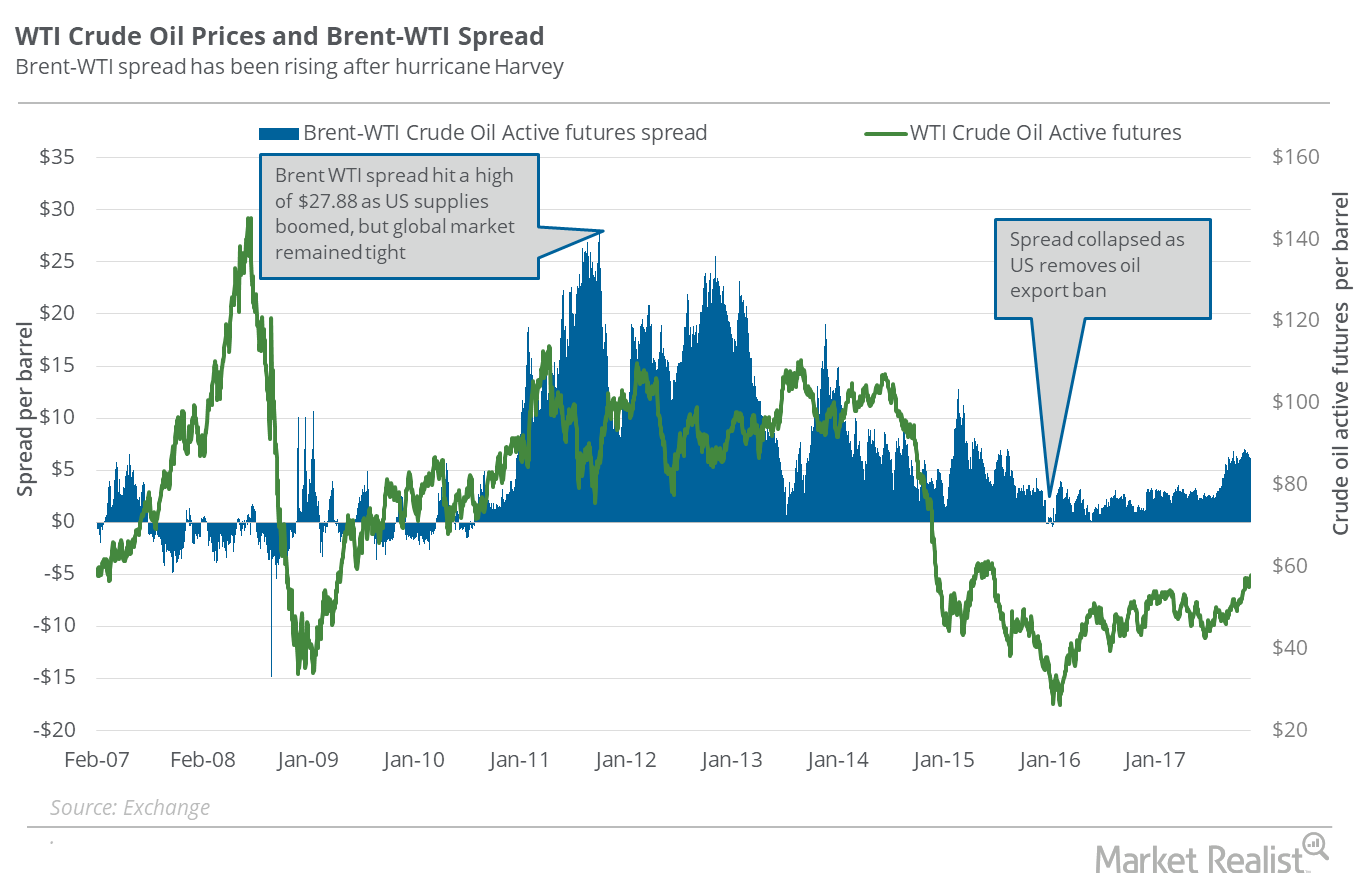

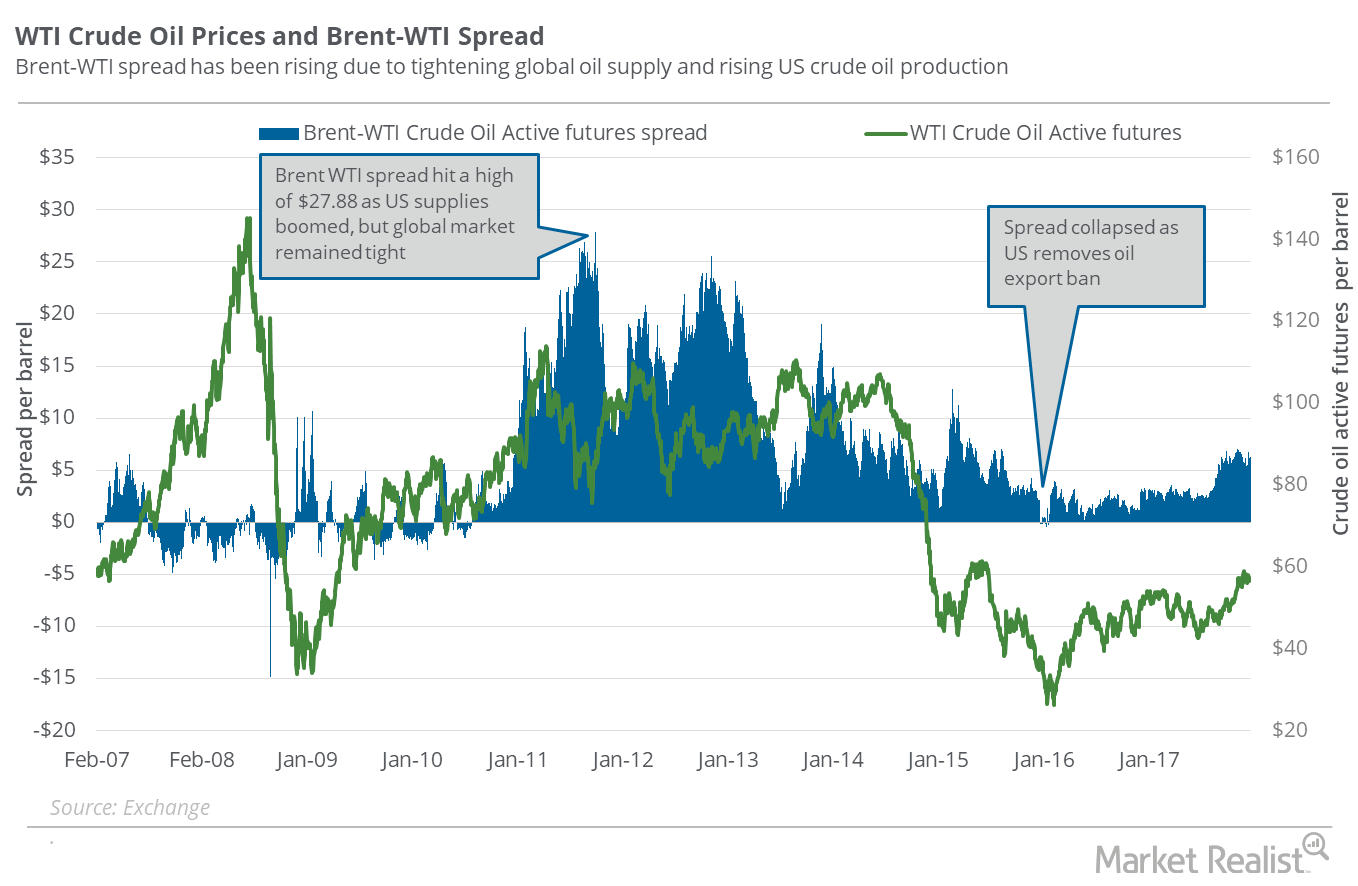

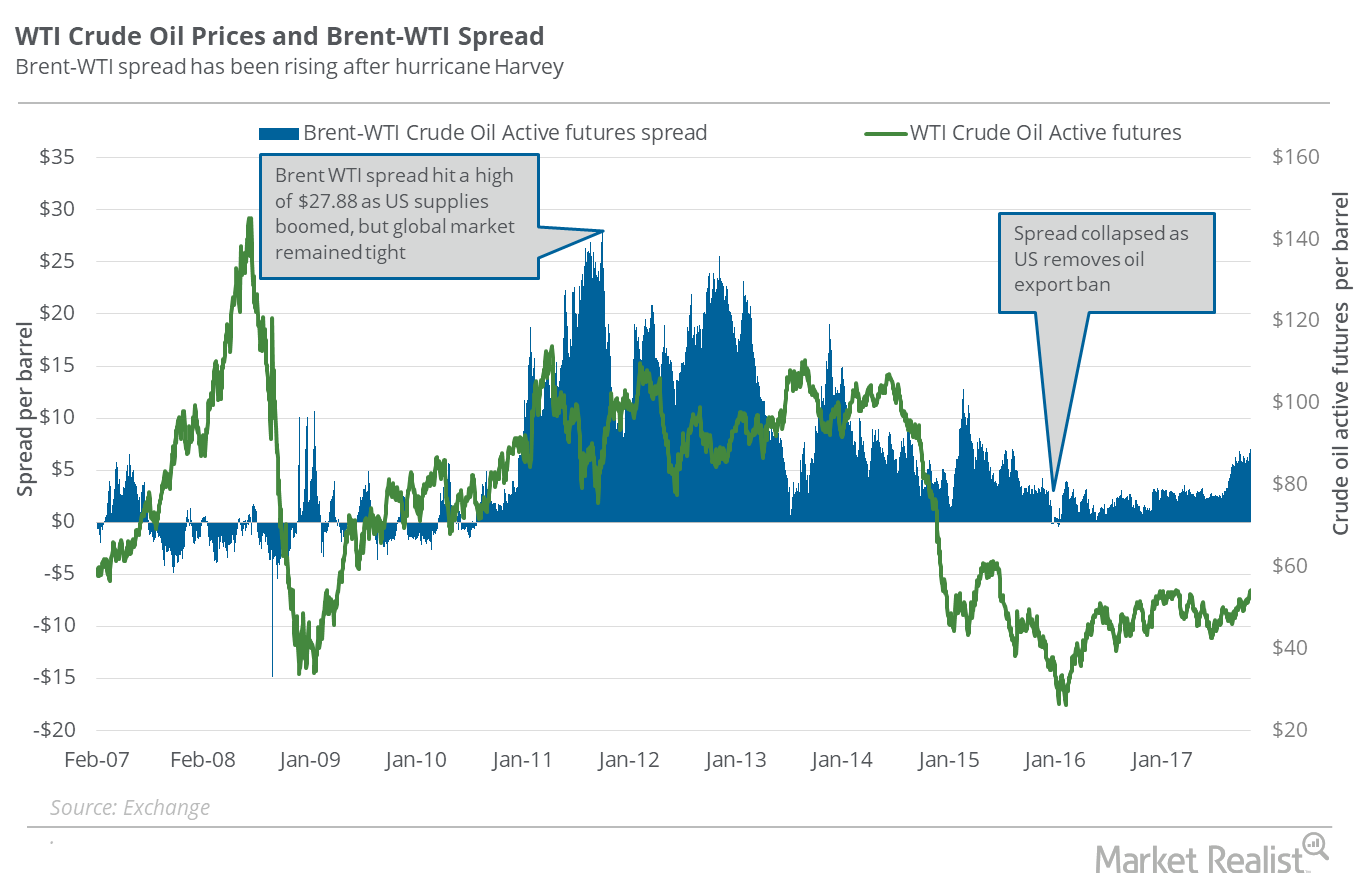

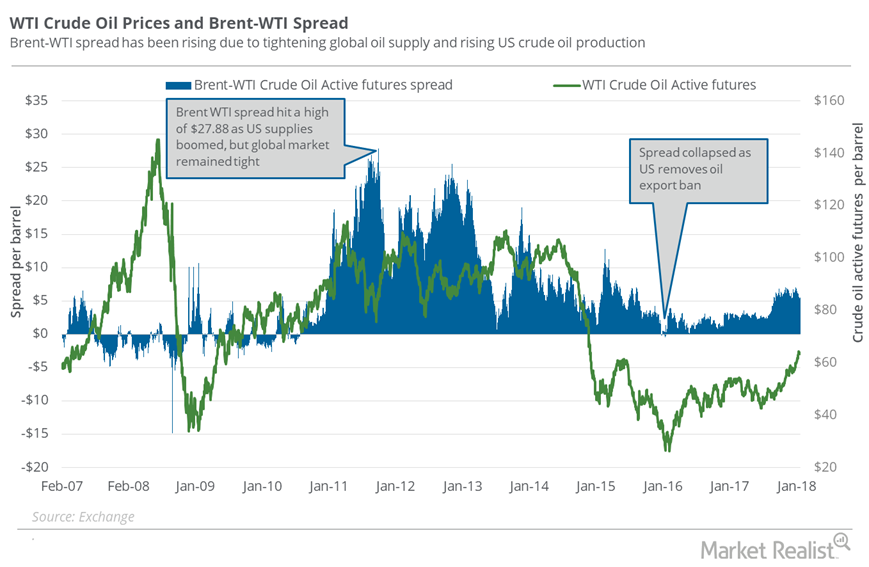

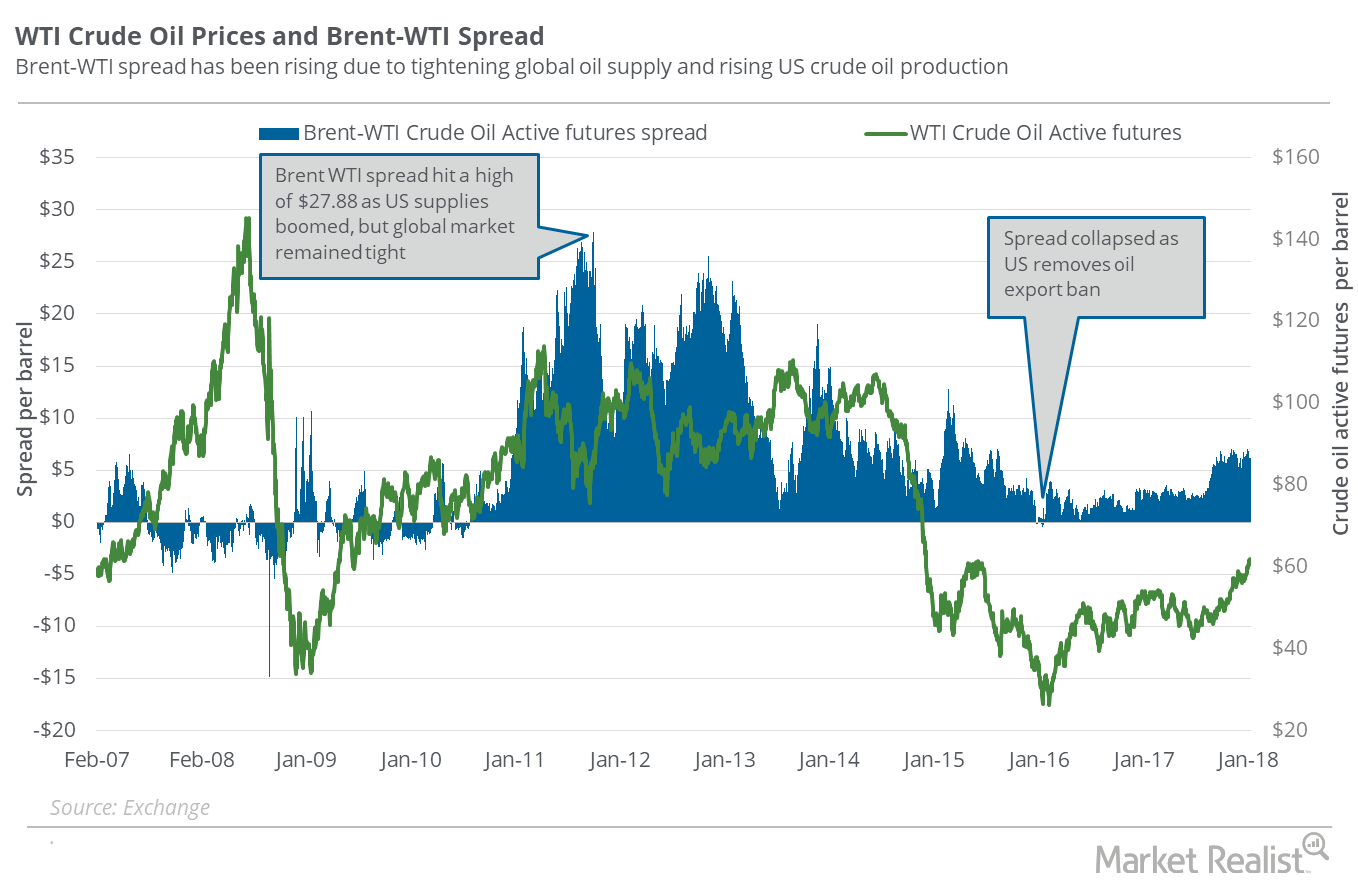

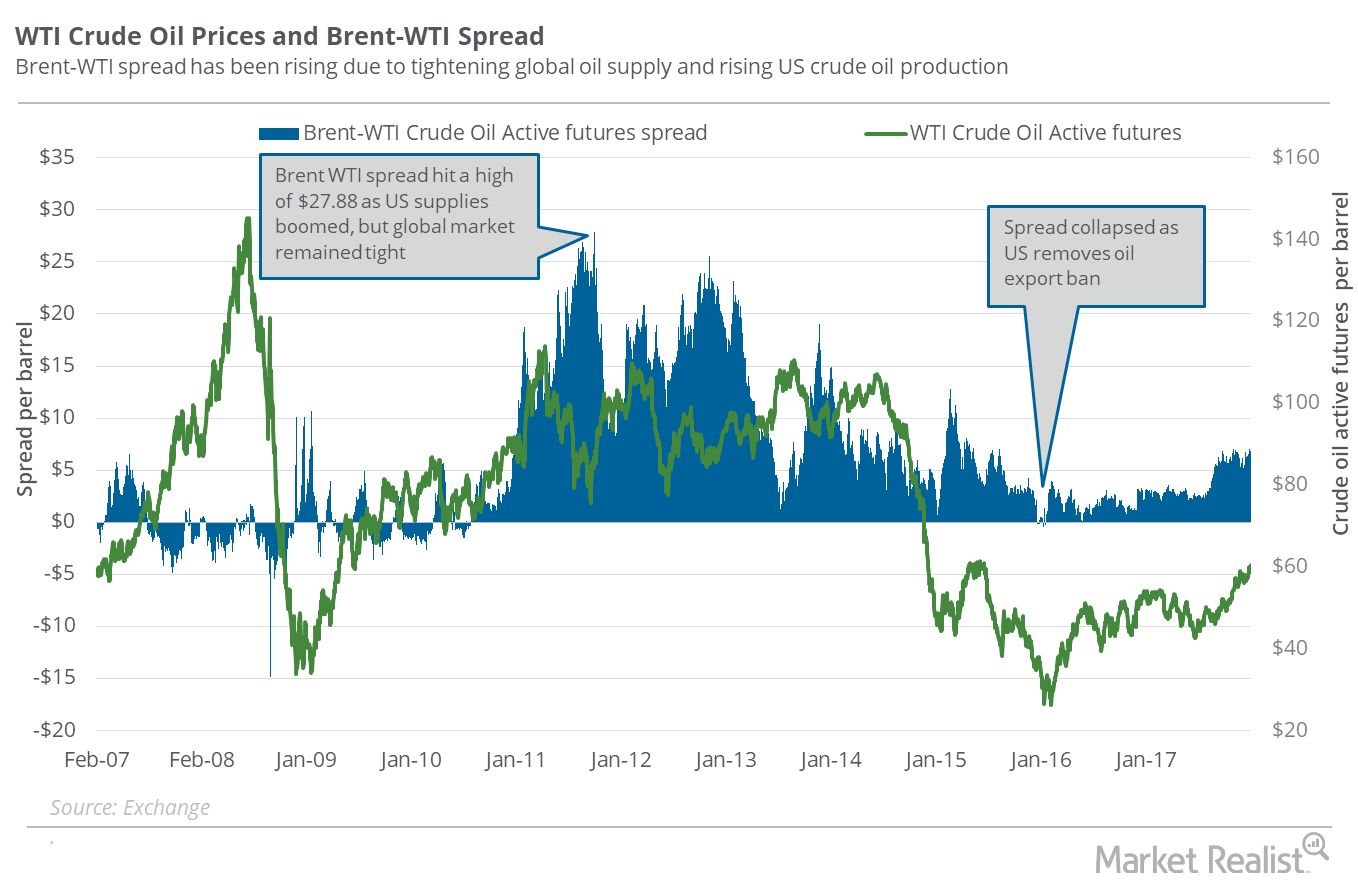

Brent-WTI Spread: Will US Oil Exports Rise Further?

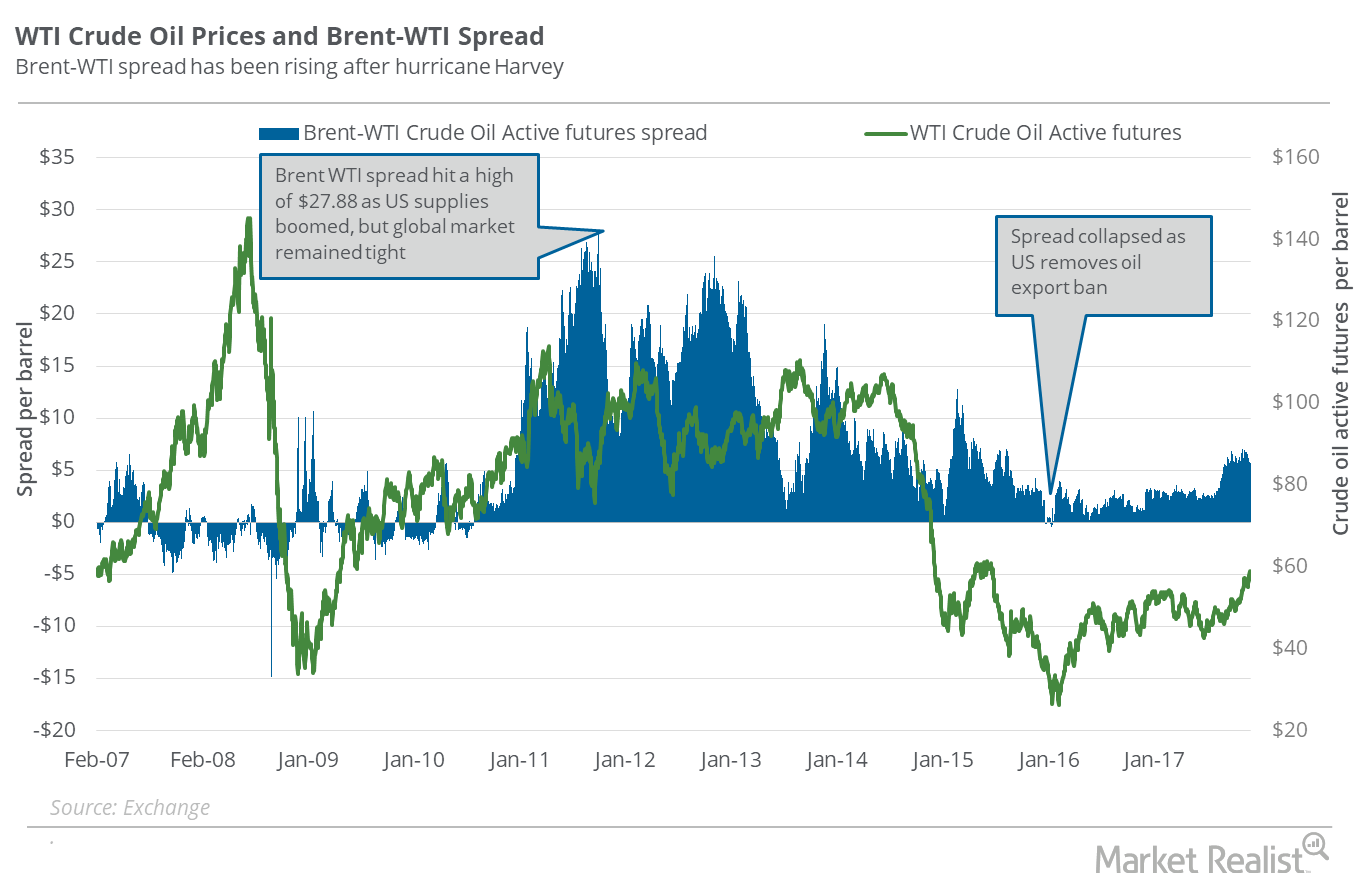

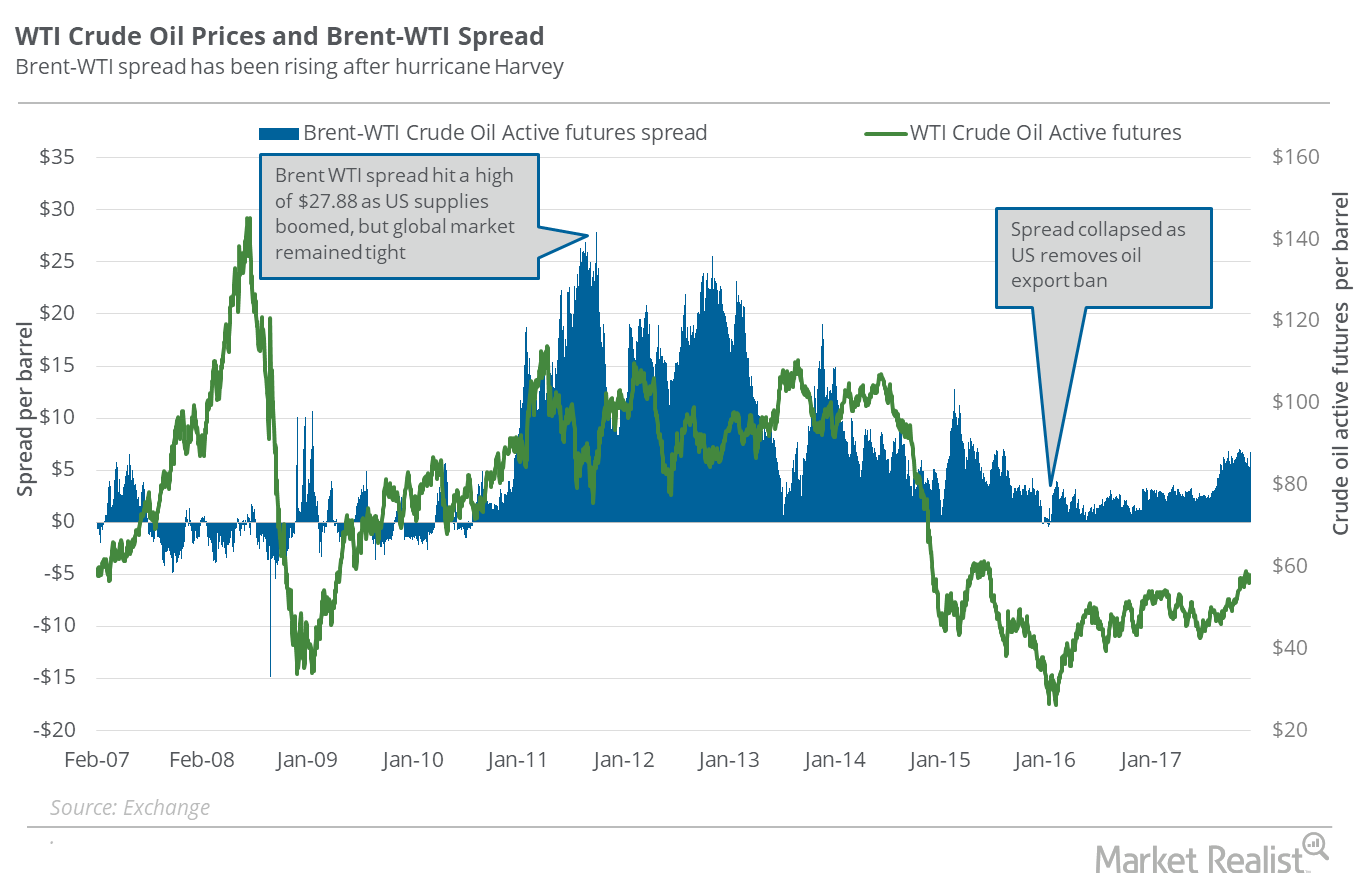

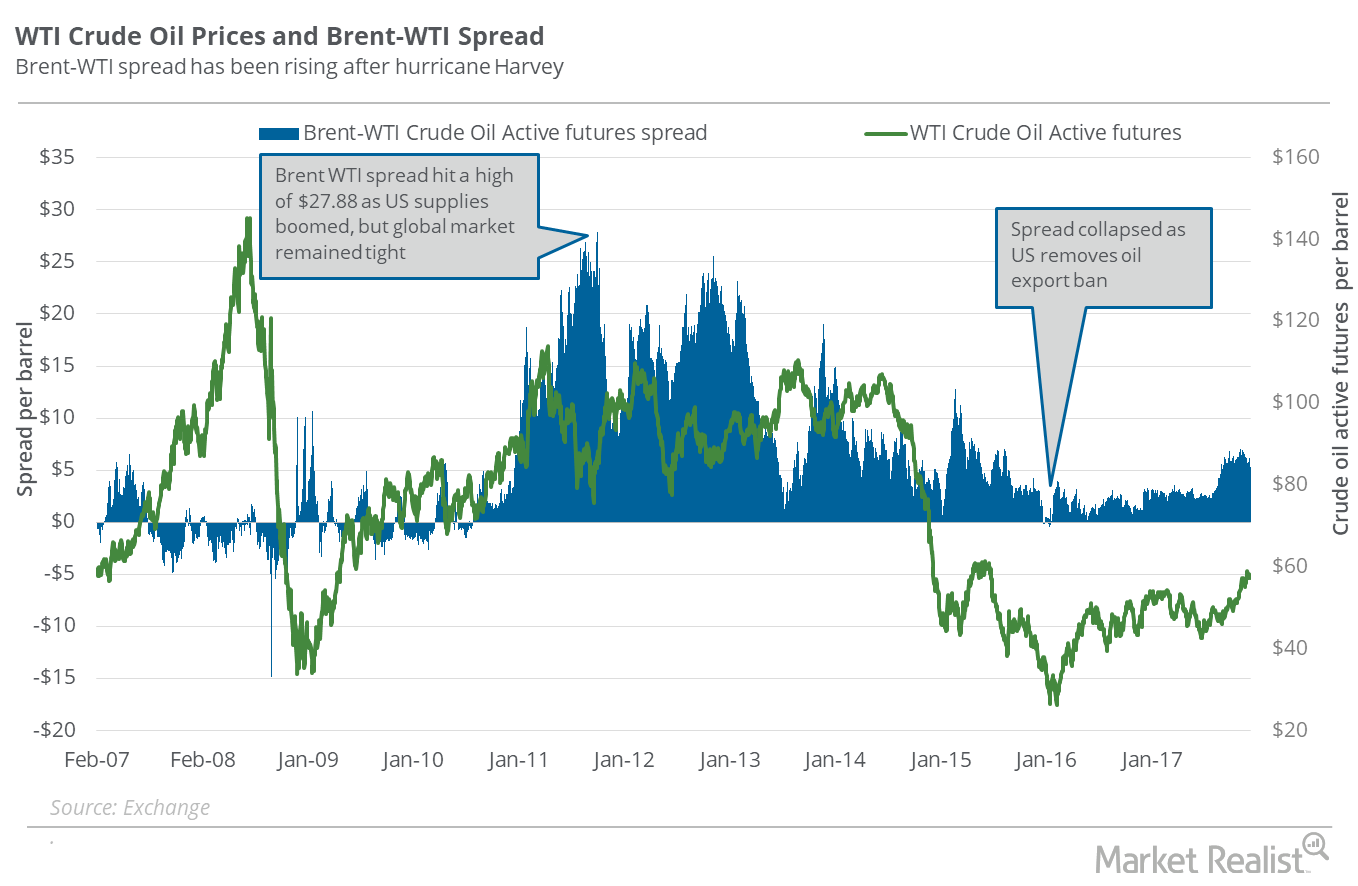

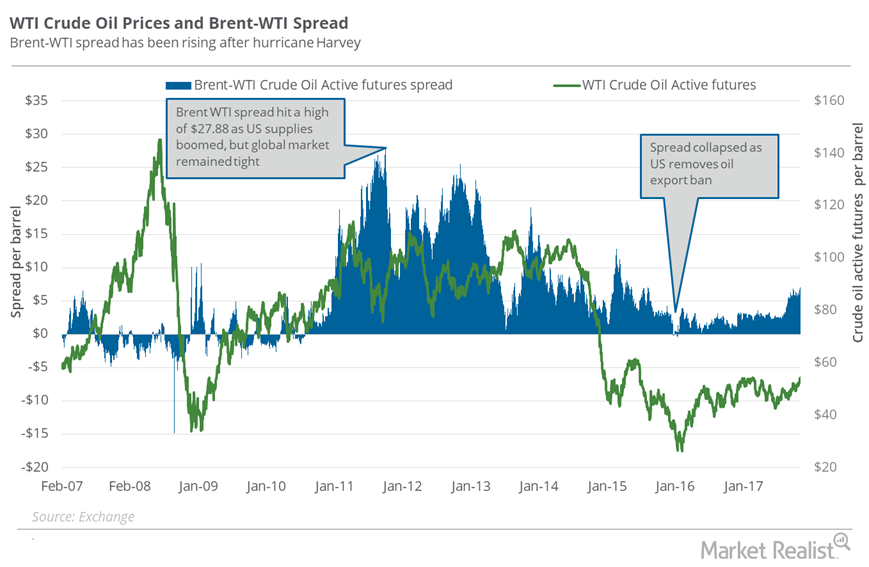

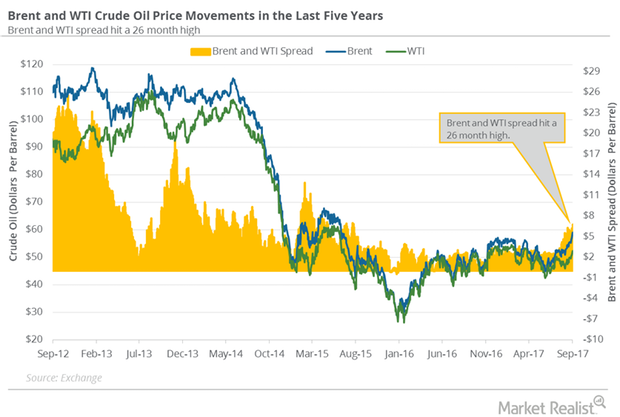

On October 24, 2017, Brent crude oil (BNO) active futures were $5.86 above WTI crude oil active futures.

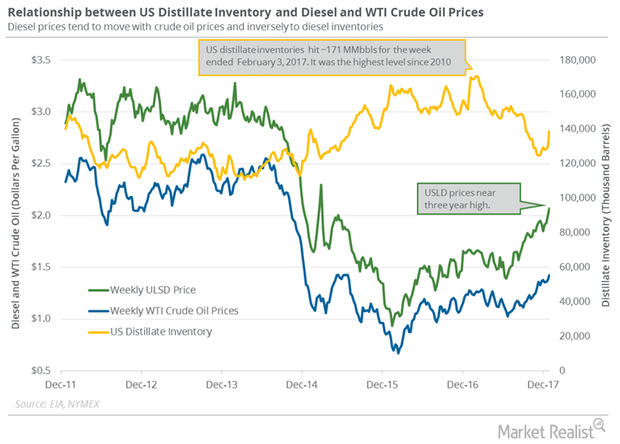

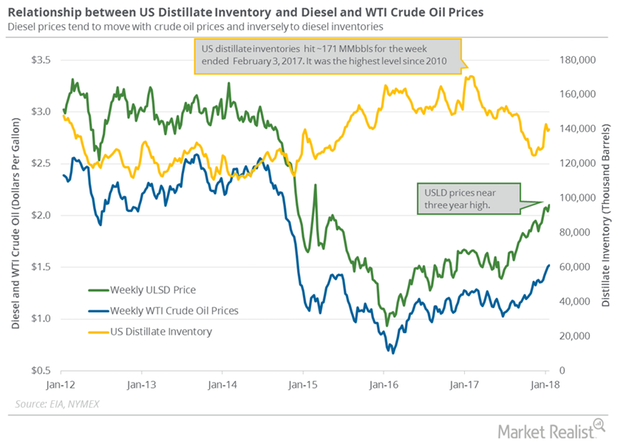

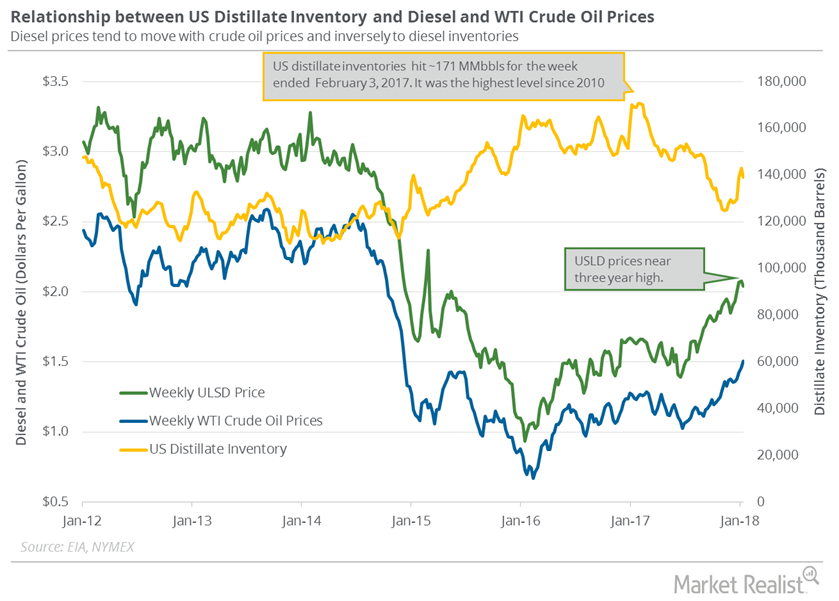

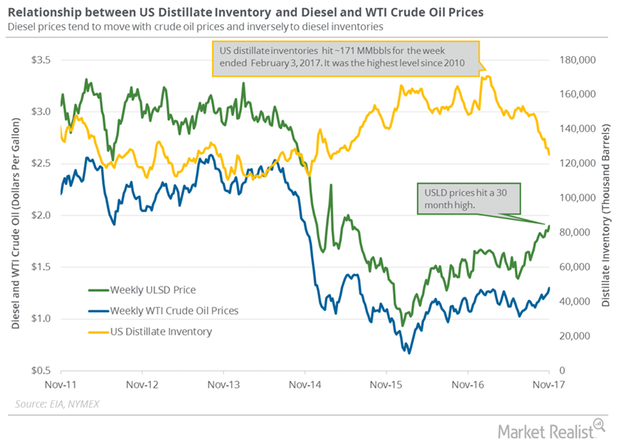

US Distillate Inventories Rose for the Sixth Time in 7 Weeks

US distillate inventories increased for the sixth time in the last seven weeks. The inventories rose ~11% in the last seven weeks.

What the Brent–WTI Spread Indicates

On August 15, Brent crude oil active futures were trading $3.25 more than the WTI crude oil active futures. On August 8, the spread stood at $2.97.

Brent-WTI Spread Impacts Your Oil-Related Investments

On February 14, WTI crude oil (USO) (USL) (OIIL) (SCO) active futures traded at a discount of $2.84 per barrel compared to Brent crude oil active futures.

Why the Brent-WTI Spread Could Make Global Oil Supplies Rise

On October 17, 2017, Brent crude oil (BNO) active futures closed $6 above the WTI (West Texas Intermediate) crude oil futures.

US Distillate Inventories Rose for the Eighth Time in 10 Weeks

US distillate inventories rose by 0.64 MMbbls (million barrels) to 139.8 MMbbls on January 12–19, 2018, according to the EIA.

Is WTI Crude Oil Outdoing Brent?

On November 21, Brent crude oil (BNO) active futures closed $5.74 above US crude oil (USO)(UCO) active futures. In other words, the Brent-WTI (West Texas Intermediate) spread was $5.74.

WTI Crude Oil Is Rising Faster than Brent

On November 28, 2017, Brent crude oil (BNO) active futures closed at $5.62 higher than US WTI crude oil (USO) (UCO) active futures.

Brent Is Outperforming WTI Crude Oil

On December 11, 2017, Brent crude oil (BNO) active futures settled $6.7 more than WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures.

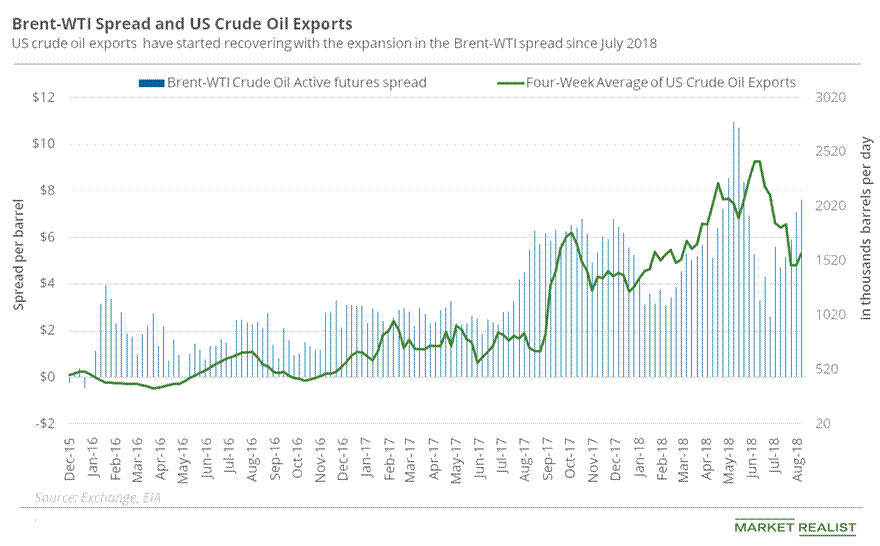

Oil Traders Should Watch US Oil Exports

On December 5, 2017, Brent crude oil (BNO) active futures were priced $5.24 higher compared to WTI crude oil (USO) (UCO) active futures.

US Crude Oil Exports Could Be at a Tipping Point

On October 31, 2017, Brent crude oil (BNO) active futures were ~$7 above US crude oil (UCO) futures.

Comparing WTI’s and Brent’s Performance

The Brent-WTI spread On December 18, 2017, Brent crude oil (BNO) active futures’ premium to WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures was $6.30. On December 11, 2017, the Brent-WTI spread was $6.70. On December 11, 2017, the shutdown of the Forties Pipeline System boosted Brent oil prices. That day, the spread expanded […]

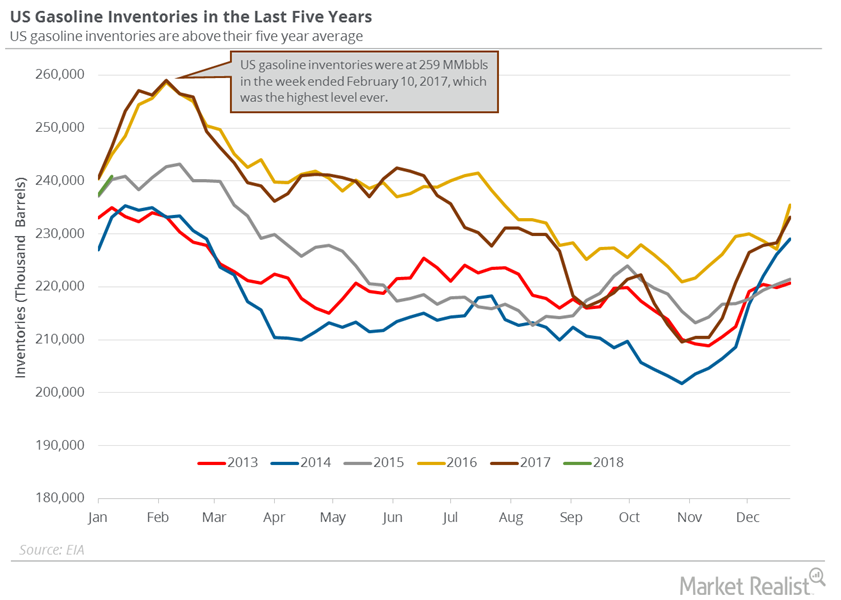

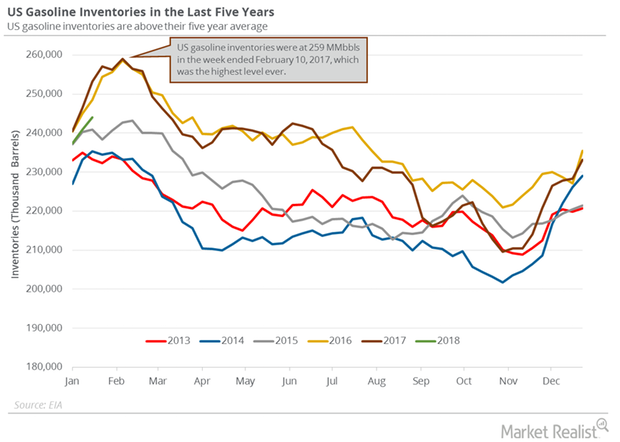

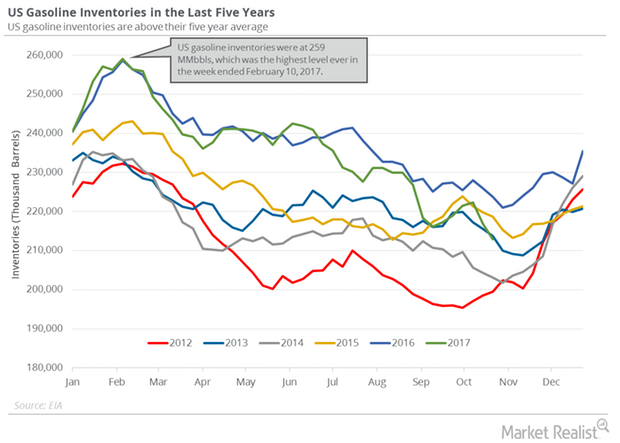

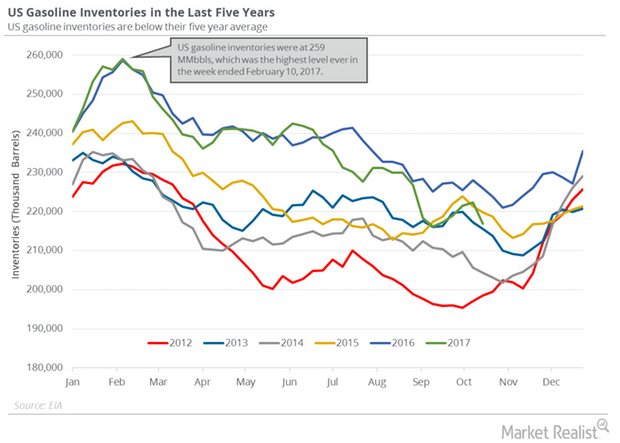

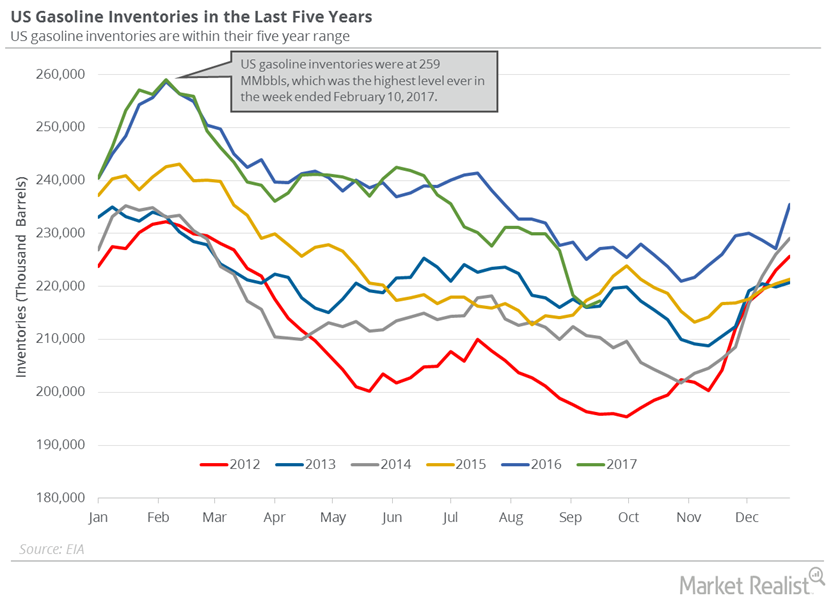

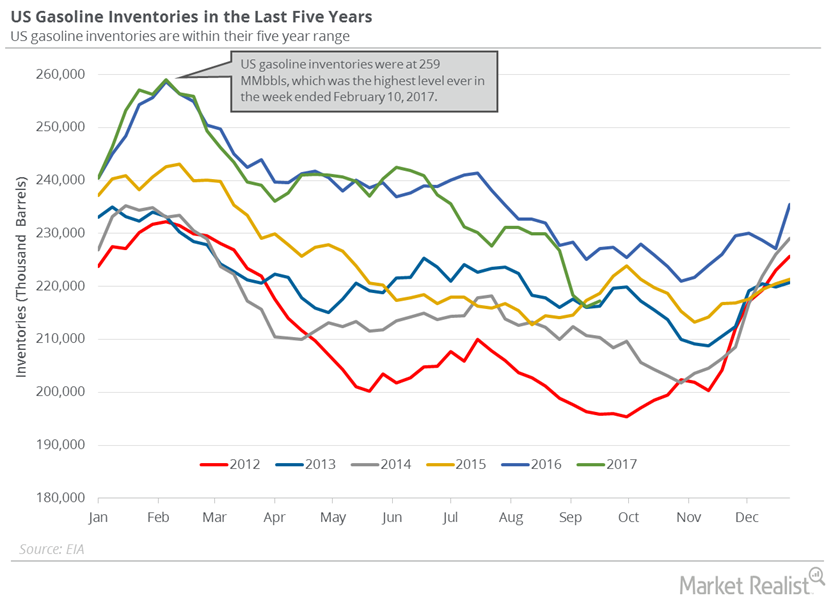

Gasoline Inventories Could Cap the Upside for Oil Prices

On January 23, 2018, the API released its crude oil inventory report. US gasoline inventories increased by 4.1 MMbbls on January 12–19, 2018.

US Distillate Inventories Fell for the Third Time in 10 Weeks

US distillate inventories fell by 3.8 MMbbls or 2.7% to 139.2 MMbbls on January 5–12, 2018. The inventories fell by 29.9 MMbbls or 18% from a year ago.

US Distillate Inventories Are at 32-Month Low

The EIA reported that US distillate inventories fell by 3,359,000 barrels to 125.5 MMbbls (million barrels) or 2.6% between October 27, 2017, and November 3, 2017.

US Crude Oil Exports: Will They Affect OPEC’s Production Cut Deal?

On November 7, 2017, the difference between Brent crude oil (BNO) active futures and US crude oil (USO) active futures, or the Brent-WTI (West Texas Intermediate) spread, was $6.50.

Where Is US Crude Oil Headed? An Energy Update

On August 30, US crude oil October futures settled at $55.1 per barrel. On a week-over-week basis, US crude oil prices rose 1.7%.

Brent-WTI Spread Might Push Oil Exports and Downstream Stocks Up

On September 10, 2018, Brent crude oil November futures settled ~$9.83 higher than WTI crude oil October futures, the highest level for the Brent-WTI spread since June 19, 2018.

US Gasoline Inventories Could Threaten Crude Oil Prices

According to the EIA, US gasoline inventories increased by 3.1 MMbbls (million barrels) to 244 MMbbls on January 12–19, 2018.

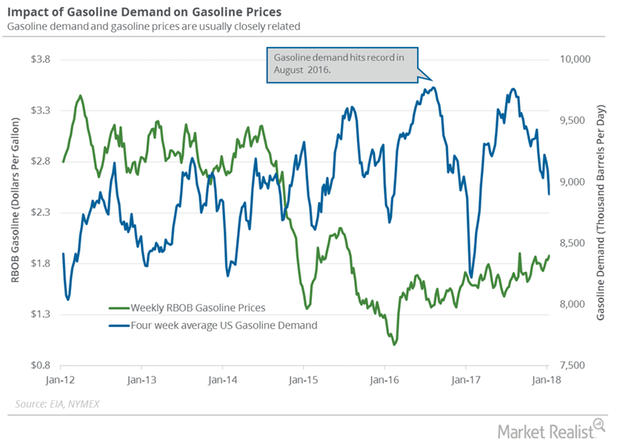

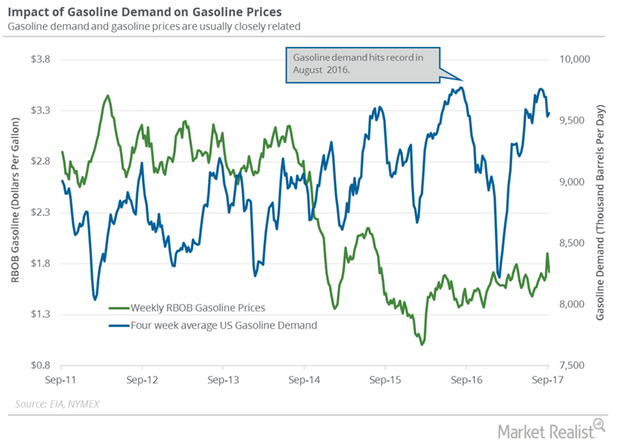

US Gasoline Demand Could Extend the Crude Oil Price Rally

The EIA estimated that four-week average US gasoline demand decreased by 190,000 bpd (barrels per day) to 8,904,000 bpd on January 5–12, 2018.

US Oil Exports Could Threaten International Oil Prices

In the week ending January 12, 2018, US crude oil exports were at ~1.25 MMbpd—234,000 barrels per day more than the previous week.

US Oil Exports Are Crucial for Oil Prices in 2018

On January 8, 2018, Brent crude oil (BNO) active futures were $6.05 stronger than WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures.

Should Oil Traders Follow US Oil Exports in 2018?

On December 29, 2017, the price difference between Brent crude oil (BNO) active futures and WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures was $6.45.

US Gasoline Inventories Fell 18%, Bullish for Crude Oil

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories fell by 4,020,000 barrels to 212.8 MMbbls on October 20–27, 2017.

Massive Fall in US Gasoline Inventories Drove Gasoline Futures

The EIA reported that US gasoline inventories fell by 5,465,000 barrels or 2.5% to 216.8 MMbbls (million barrels) on October 13–20, 2017.

Gasoline Inventories Could Pressure Crude Oil Prices

The API estimates that US gasoline inventories rose by 4.19 MMbbls on September 22–29, 2017. The market expected a build by 1.08 MMbbls.

Understanding the Rising US Gasoline Inventories

The EIA estimated on September 27 that US gasoline inventories rose 1.1 MMbbls (million barrels) to 217.2 MMbbls from September 15–22, 2017.

US Gasoline Demand Today: Bullish or Bearish for Crude?

The EIA estimates that weekly US gasoline demand fell 178,000 bpd (barrels per day) to 9.4 MMbpd between September 8 and September 15.

Why the Brent and WTI Crude Oil Spread Hit a 26-Month High

November WTI (West Texas Intermediate) crude oil (UWT)(DWT)(DBO) futures contracts fell 0.2% and were trading at $52.12 per barrel in electronic trading at 2:20 AM EST on September 26.