Is WTI Crude Oil Outdoing Brent?

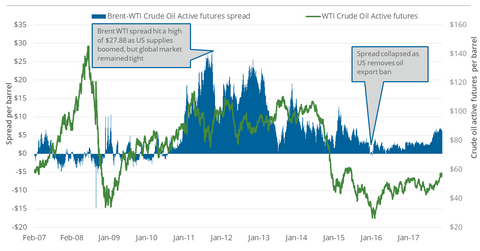

On November 21, Brent crude oil (BNO) active futures closed $5.74 above US crude oil (USO)(UCO) active futures. In other words, the Brent-WTI (West Texas Intermediate) spread was $5.74.

Nov. 20 2020, Updated 1:49 p.m. ET

Brent-WTI Spread

On November 21, Brent crude oil (BNO) active futures closed $5.74 above US crude oil (USO)(UCO) active futures. In other words, the Brent-WTI (West Texas Intermediate) spread was $5.74. The spread has fallen below the $6 mark for the first time since October 25.

On November 14, the Brent-WTI spread was $6.51. Between November 14 and 21, US crude oil active futures rose 1.7% and Brent crude oil active futures rose just 0.6%.

Brent underperforming WTI crude oil

In the trailing week, Brent crude oil active futures underperformed US crude oil futures. The falling US inventories spread that we discussed in Part 3, and the OPEC meeting on November 30, could be behind this underperformance. If the outcome of the meeting fails to meet market expectations, Brent crude oil active futures could fall more than US crude oil futures.

US oil exports

In the week ended November 10, US crude oil exports were ~1.13 million barrels per day.

In 2017 to date, US crude oil exports are up by 0.4 million barrels per day versus the same period last year. Over that period, the Brent-WTI spread expanded by $1.92 on average. The widening of the spread makes US crude oil exporters more profitable.

Usually, a higher Brent-WTI spread is a positive development for US crude oil exporters. But, according to the EIA’s STEO (“Short-Term Energy Outlook”) report, the Brent-WTI spread may stay around the $6 level until 1Q18. For the last six months of 2018, the spread could stay near $4.

However, cheaper US crude oil compared to international prices causes US oil producers (XOP)(DRIP)(IEO) to earn lower revenues than their international peers. On the other hand, US refineries (CRAK) see increased profit margins because of cheaper US crude oil as their input and the higher prices of refined items are pegged to stronger Brent oil prices.

To understand more about the energy sector, see our Energy and Power page.