Understanding the Rising US Gasoline Inventories

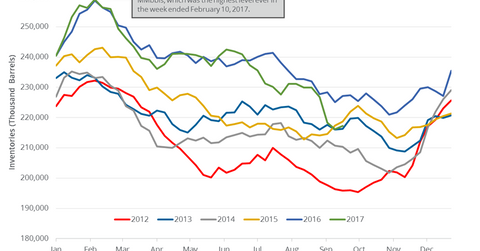

The EIA estimated on September 27 that US gasoline inventories rose 1.1 MMbbls (million barrels) to 217.2 MMbbls from September 15–22, 2017.

Sept. 28 2017, Published 11:00 a.m. ET

US gasoline inventories

The EIA (US Energy Information Administration) released its Weekly Petroleum Status Report on September 27, 2017, estimating that US gasoline inventories rose 1.1 MMbbls (million barrels) to 217.2 MMbbls from September 15–22, 2017. However, inventories have fallen 4.4%, or 9.9 MMbbls YoY (year-over-year). US gasoline inventories have risen for the second time in five weeks.

The market expected a draw in US gasoline inventories by 0.9 MMbbls from September 15–22, 2017. US gasoline (UGA) futures fell ~2.6% to $1.65 per gallon on September 27, 2017, and gasoline futures fell due to the unexpected rise in gasoline inventories. The rise in gasoline inventories also limited the upside for US crude oil (USO) (UCO) (DBO) prices on September 27, 2017.

Meanwhile, Brent (BNO) and US crude oil (USL) (DTO) futures are at multi-month highs, and higher crude oil prices have a positive impact on oil and gas producers (FENY) (IEO) like SM Energy (SM), ConocoPhillips (COP), and Denbury Resources (DNR).

US gasoline futures are near a two-year high, and higher gasoline prices have a positive impact on refiners (CRAK) such as Phillips 66 (PSX), Tesoro (TSO), and Valero Energy (VLO).

US gasoline production, imports, and demand

US gasoline production rose 62,000 bpd (barrels per day) to 9.8 MMbpd (million barrels per day) from September 15–22, 2017. Production rose 300,000 bpd, or 3.1% YoY.

US gasoline imports rose 354,000 bpd to 1.04 MMbpd from September 15–22, 2017, while imports rose 263,000 bpd, or 34% YoY.

US gasoline demand rose 81,000 bpd to 9.5 MMbpd from September 15–22, 2017, while demand rose 642,000 bpd, or 7.2% YoY.

Impact of gasoline inventories

US gasoline inventories have fallen 24.5 MMbbls, or 10.2% over the past 15 weeks. A fall in gasoline inventories could support gasoline (UGA) prices, but higher gasoline prices are bullish for crude oil (UWT) (DWT) prices.

In the next and final part of this series, we’ll analyze US distillate inventories.