Phillips 66

Latest Phillips 66 News and Updates

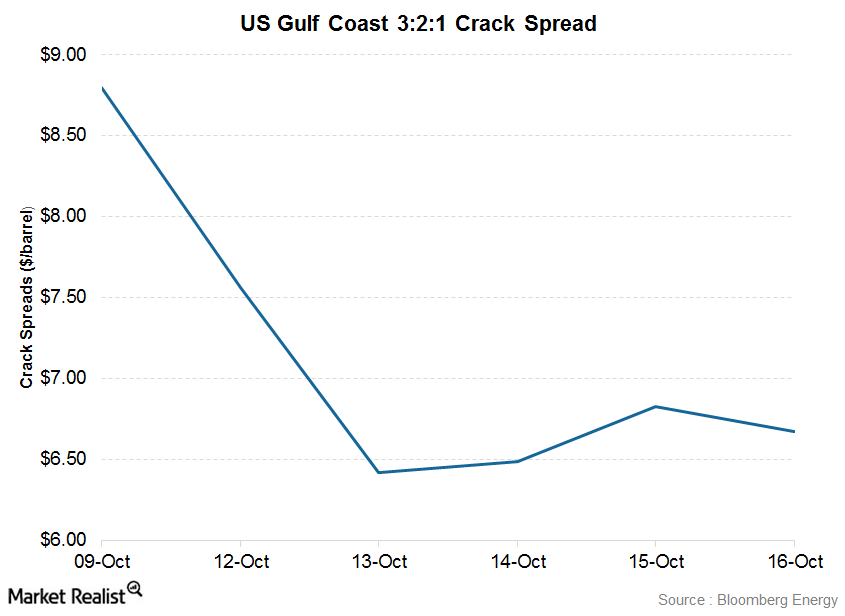

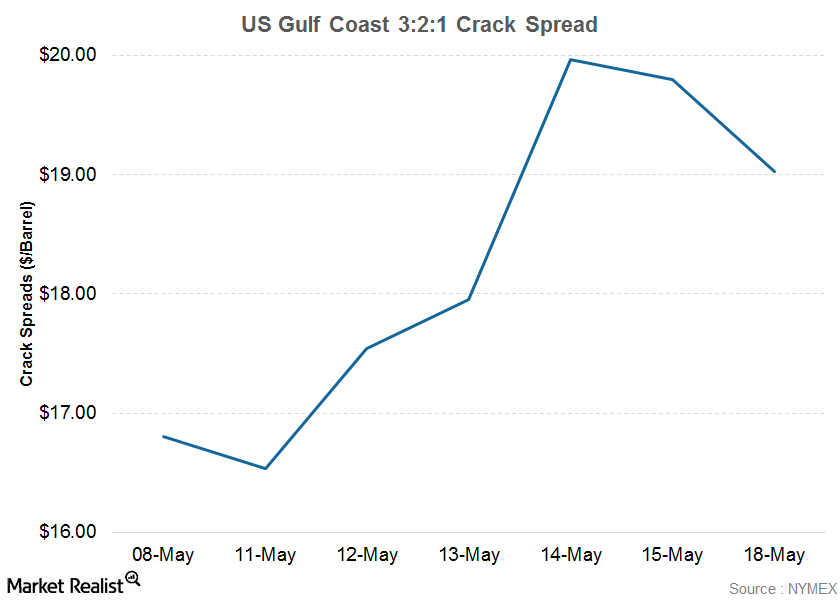

Overview of US Gulf Coast 3:2:1 Crack Spread

Crack spreads usually fall when crude oil prices (USO) increase by more than product prices, or when product prices fall more than crude oil prices.

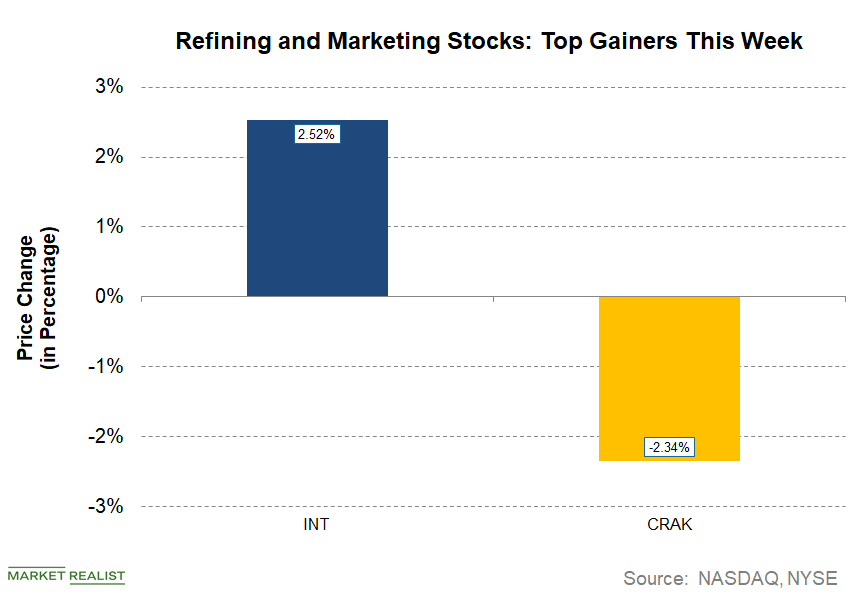

Which Refining and Marketing Energy Stocks Are Rising This Week?

World Fuel Services (INT) increased from last week’s close of $21.80 to $22.35 on June 14—an increase of more than 2.5%.

HFC and PSX: Which Company Could Post the Most Gains?

After HollyFrontier’s earnings, RBC lowered its target price on the stock from $68 to $66.

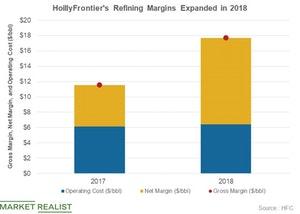

Analyzing HollyFrontier’s Refining Margin in 2018

HollyFrontier’s refining segment is critical for its overall earnings. The refining segment’s adjusted EBITDA rose 127% to $1.7 billion in 2018.

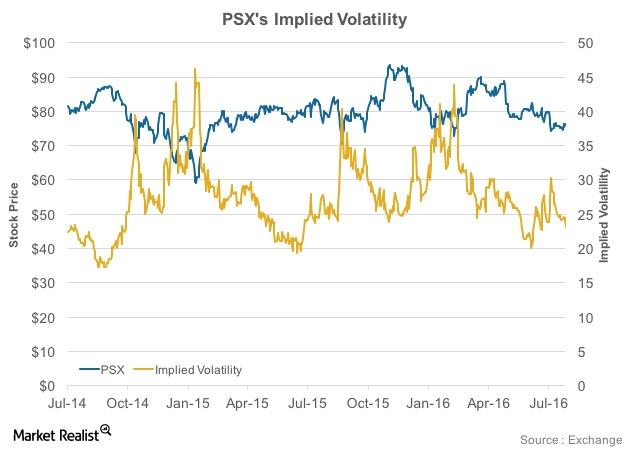

How PSX’s Implied Volatility Trended Post-Earnings

Phillips 66 (PSX) posted its earnings on July 29, 2016. On the day, PSX’s implied volatility fell by 5% to 23.2 compared to the previous day.

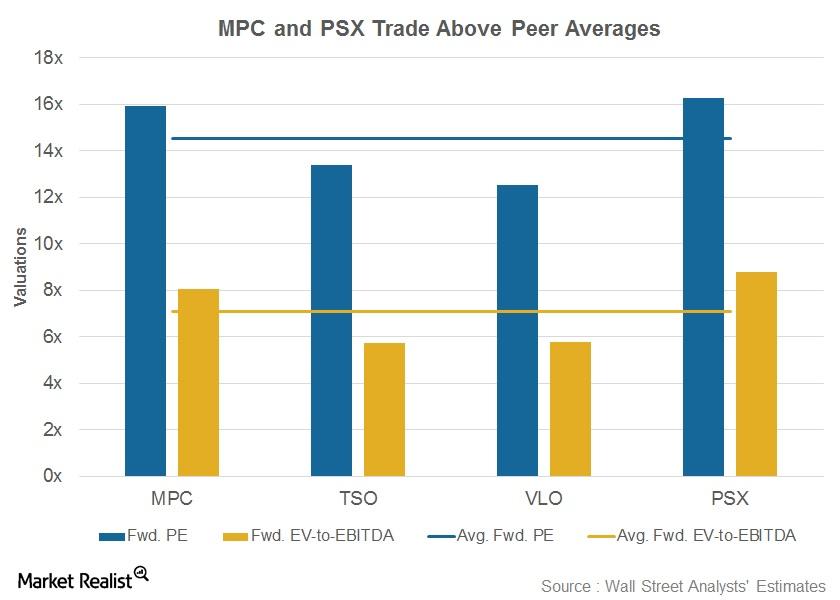

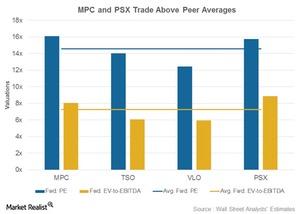

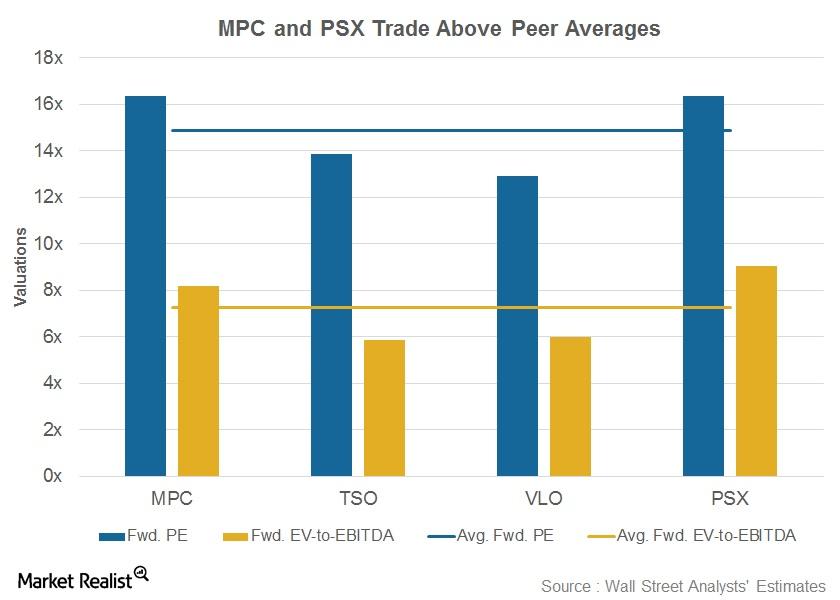

MPC, TSO, VLO, PSX: Which Refining Stock Is Trading at a Premium?

Now, let’s look at the forward valuations of Marathon Petroleum (MPC), Tesoro (TSO), Valero Energy (VLO), and Phillips 66 (PSX).

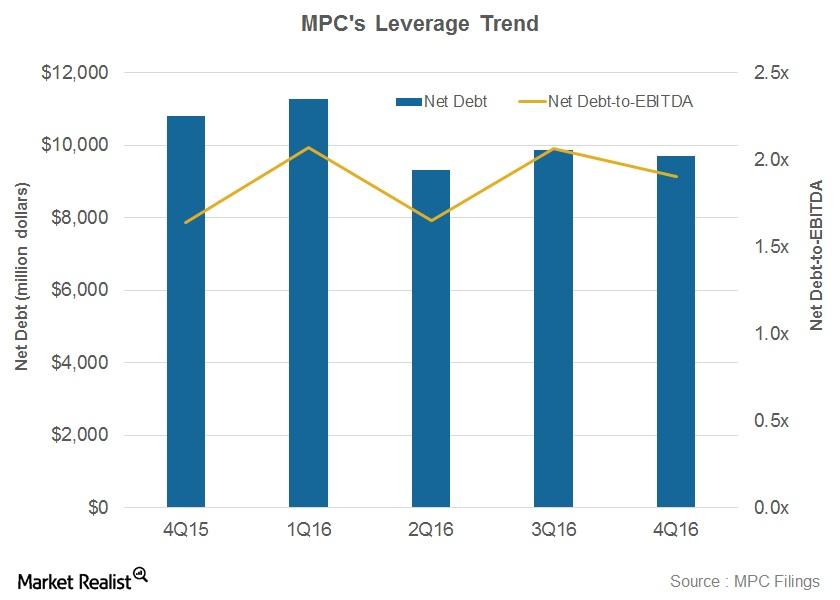

Marathon Petroleum’s Debt Is Lower than Industry Averages

Marathon Petroluem’s net debt-to-EBITDA ratio stood at 1.9x in 4Q16. It’s lower than the average industry ratio of 2.8x.

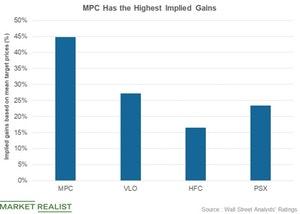

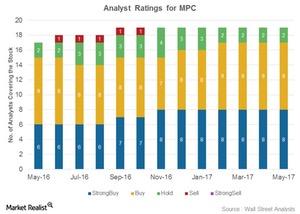

Why Most Analysts Are Calling Marathon Petroleum a ‘Buy’

Marathon Petroleum (MPC) has been rated by 19 Wall Street analysts. Seventeen analysts (or 89%) have rated it as a “buy” so far in May 2017.

Comparing MPC’s, TSO’s, VLO’s, and PSX’s Valuation

Average valuation multiples Earlier, we discussed refining stocks’ performance in 1Q17 and compared their dividend yields. In this part, we’ll look at Marathon Petroleum’s (MPC), Tesoro’s (TSO), Valero Energy’s (VLO), and Phillips 66’s (PSX) forward valuation. The average forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiples and average forward PE […]

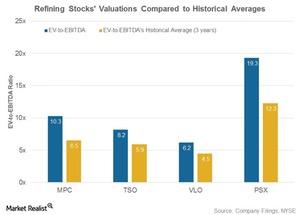

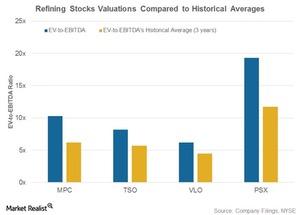

How Refining Stocks’ Historical Valuation Compares

Refining stocks’ valuation In this part, we’ll compare refining stocks’ EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) ratios with their three-year averages. Marathon Petroleum (MPC), Valero Energy (VLO), Phillips 66 (PSX), and Tesoro (TSO) are trading higher than their historical valuation. MPC was trading at a 10.3x EV-to-EBITDA ratio in 1Q17, compared […]

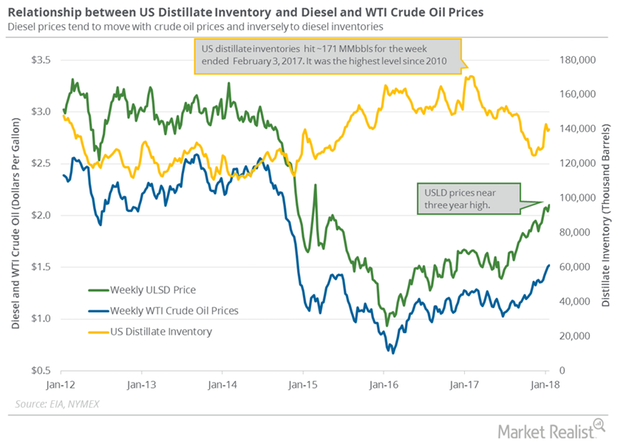

US Distillate Inventories Rose for the Eighth Time in 10 Weeks

US distillate inventories rose by 0.64 MMbbls (million barrels) to 139.8 MMbbls on January 12–19, 2018, according to the EIA.

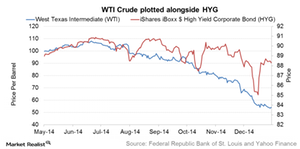

Credit Default Swaps as Insurance against Junk Bond Market Crash

Carl Icahn mentions the use of credit default swaps as a form of protection against credit events. He implies that investors should possess sophisticated knowledge of the fixed income markets to enter that playing field.

How Refining Stocks’ Valuations Compare to Historical Averages

In this article, we’ll look at refining stocks’ EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) ratios compared to their three-year historical averages.

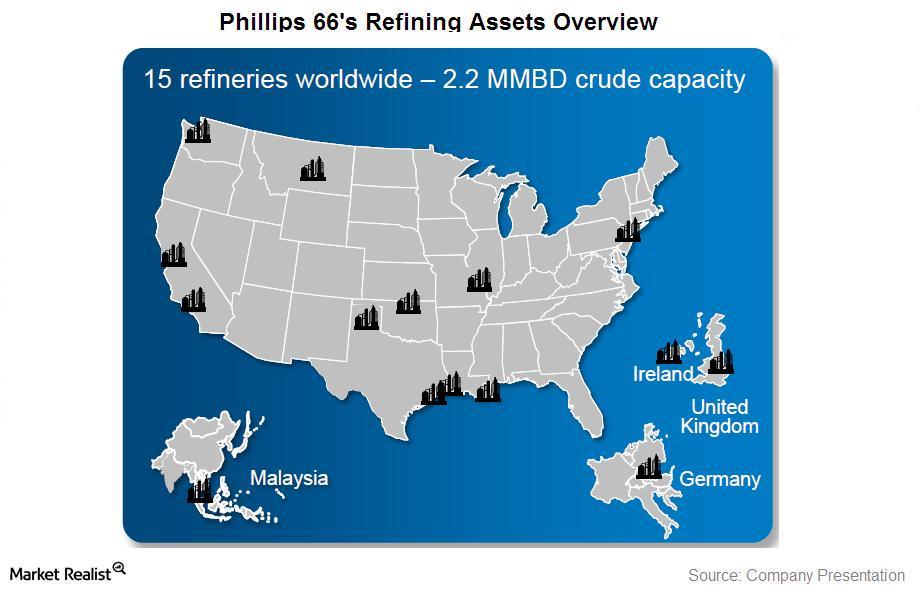

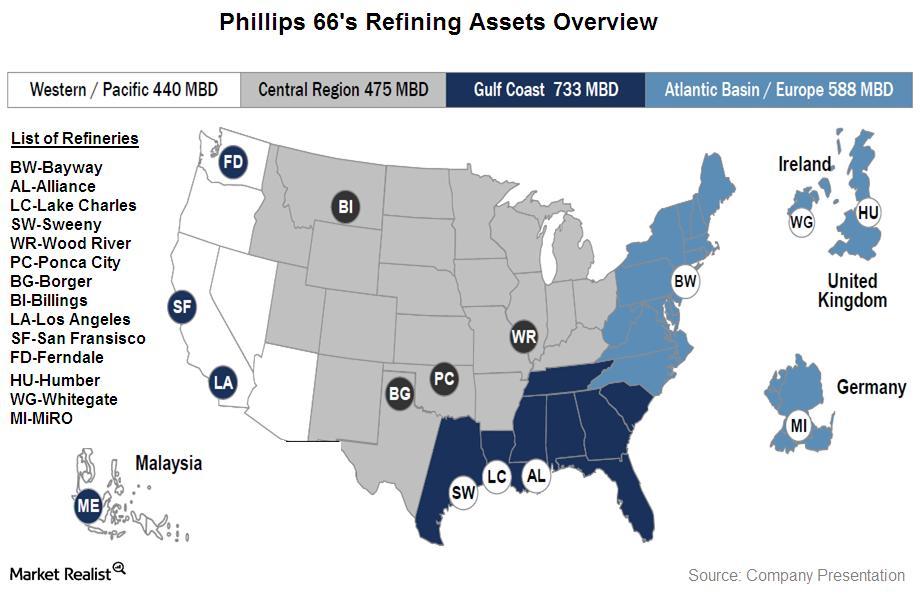

Phillips 66: An overview

In 2013, Phillips 66 generated 67%, 13%, and 6% of its revenues from the United States, the United Kingdom, and Germany, respectively. The company’s other foreign operations contributed ~16%.

These Refining Stocks Are Trading at a Premium

PSX is trading at 9x its forward EV-to-EBITDA ratio and at 16.4x its forward PE ratio, which is above the peer averages.

Must-know: An introduction to Phillips 66

Phillips 66 (PSX) is an energy company. It’s based in Texas. Phillips 66 started operating independently as a publicly-traded company on April 4, 2012, when it separated from ConocoPhillips (or COP).

What a Wider Crack Spread in Mid-May Means for American Refiners

A crack spread represents the price difference between refiners’ revenues—achieved through the sale of finished refined products—and refiner costs—that is, the price of crude oil.

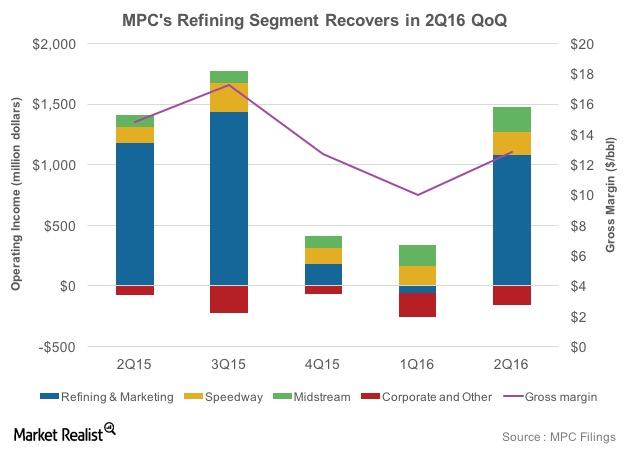

How Will Marathon Petroleum’s Refining Earnings Fare in 3Q16?

According to MPC, a dollar-per-barrel change in the blended LLS 6-3-2-1 crack spread affects its annual net income by $450 million.

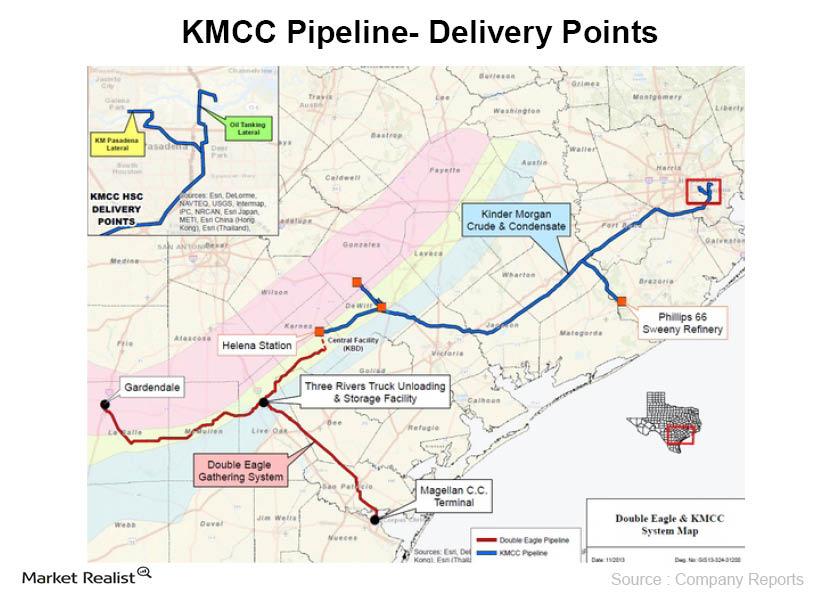

Must-know: Why the Kinder Morgan Eagle Ford expansion is positive

Kinder Morgan Energy Partners plans several major Eagle Ford joint ventures and projects that could reach almost $900 million in expenditures if company reports are to be believed.

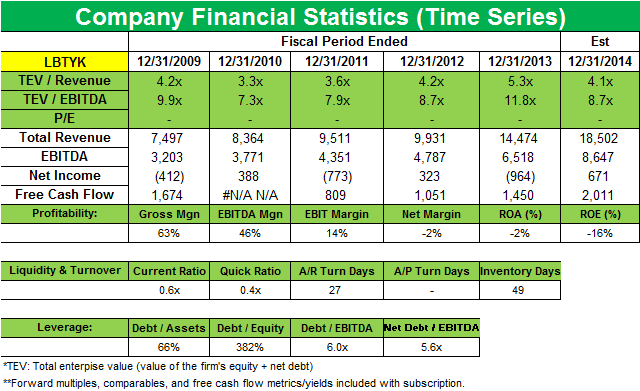

Warren Buffett’s Berkshire Hathaway ups its Liberty Global stake

Berkshire Hathaway added to its position in Liberty Global PLC (LBTYK) last quarter. The position now accounts for 0.57% of Berkshire’s 1Q 2014 portfolio, up from 0.25% last quarter.

Best Refining Stocks: Comparing MPC, VLO, PSX, HFC

Refining stocks’ performance was mixed in the fourth quarter. While Marathon Petroleum and HollyFrontier fell, Valero Energy and Phillips 66 rose.

Valero Stock Rises 12% before IMO 2020

Valero Energy (VLO) stock has risen 11.6% sequentially. The stock has risen due to stronger refining conditions in the current quarter.

VLO, MPC, and PSX: Are Refining Cracks, Oil Spreads Rising?

The refining industry, including cracks and oil spreads, is going through a massive change in the current quarter. The change resulted in sharp changes in refining stocks’ prices. Notably, the industry seems to be ready for IMO 2020. While Valero Energy (VLO) and Phillips 66 (PSX) stocks have risen by 11.6% and 13.6% sequentially, Marathon […]

MPC Stock Forecast until the End of 2019

Marathon Petroleum’s (MPC) stock price has fallen 6.0% so far in Q4, likely influenced by the uncertainty regarding the company’s strategic path.

Refining Crack Spread Overview: All You Ever Wanted to Know

The crack spread is a major component that drives refiners’ valuation. In this article, we’ll look at the metric’s different aspects.

Best Oil Refining Stocks: MPC, VLO, PSX, HFC, PBF, and DK

Oil refining and marketing stocks have been on investors’ radar. Valero Energy (VLO) and Phillips 66 (PSX) have risen 29.0% and 29.7%, respectively, YTD.

MPC Stock: How Institutional Ownership Changed in Q3

Institutional ownership of Marathon Petroleum (MPC) stock changed quite a bit in Q3, which was eventful for MPC due to Elliot Management’s recommendations.

MPC: Elliott Ups Stake by 86% in Marathon Petroleum

In the third quarter, Elliott Management raised its stake in Marathon Petroleum by about 86%. Elliott has criticized MPC’s management on several occasions.Consumer Berkshire Hathaway buys a new stake in Verizon Communications

Berkshire Hathaway took a new position in Verizon Communications (VZ) last quarter. The position accounts for 2.04% of the fund’s portfolio.

These 5 Refiners Make Half the Crude Oil in the US

The total refiners capacity in the US is around 18.8 million barrels per calendar day. The refinery utilization rate in 2018 was 93%.

Valero or Marathon Petroleum: Which Is a Better Buy?

Valero (VLO) and Marathon Petroleum’s (MPC) stocks have fallen 2.9% and 0.7%, respectively, so far in Q3. Here, we review which refiner is a better buy.

The US Energy Sector: An Overview

To understand the US energy sector, it’s essential first to understand the country’s energy needs. The US uses various energy sources to meet its energy needs.

Why MPC Stock Fell despite Earnings Beat

MPC stock performed in line with the equity market and its peers on Thursday. The SPDR S&P 500 ETF (SPY), which represents the S&P 500 Index, fell 0.9%.

Why Is Delek Stock Falling?

Analysts expect Delek’s EPS to fall by 38% YoY and 45% quarter-over-quarter to $0.84 in the second quarter of 2019.

Phillips 66 Stock, SPY, and USGC WTI 3-2-1 Crack Returns

Phillips 66 is expected to post its second-quarter earnings on July 26. Since June 7, the implied volatility has declined by 0.8 percentage points.

How Has Phillips 66’s Dividend Yield Trended?

Phillips 66’s dividend payments have risen in the past few years. In the first quarter, the company will pay a dividend of $0.8 per share on March 1.

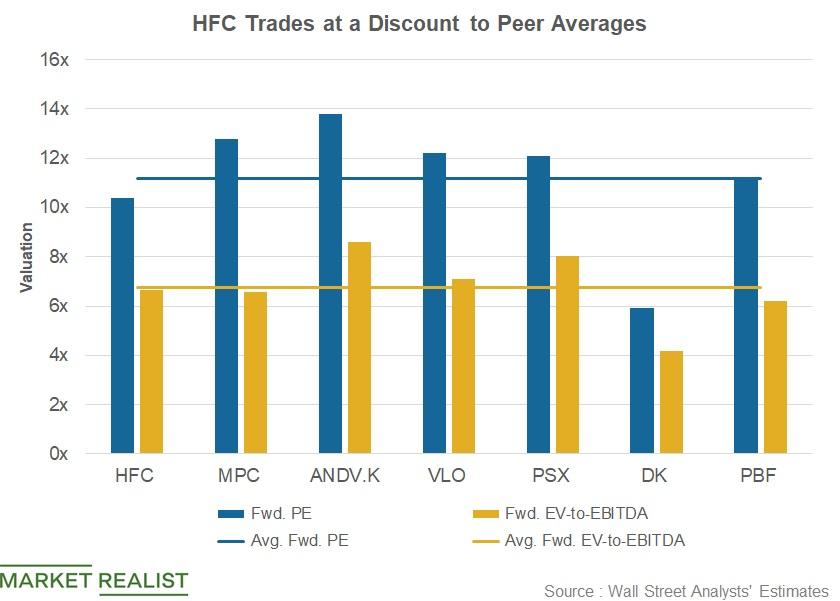

Comparing HollyFrontier’s Valuation with Peers’

HollyFrontier’s (HFC) forward PE ratio is 10.4x, below peers’ average of 11.2x. Marathon Petroleum’s (MPC), Andeavor’s (ANDV), and Phillips 66’s (PSX) forward PE ratios are higher than the average, at 12.8x, 13.8x, and 12.1x, respectively.

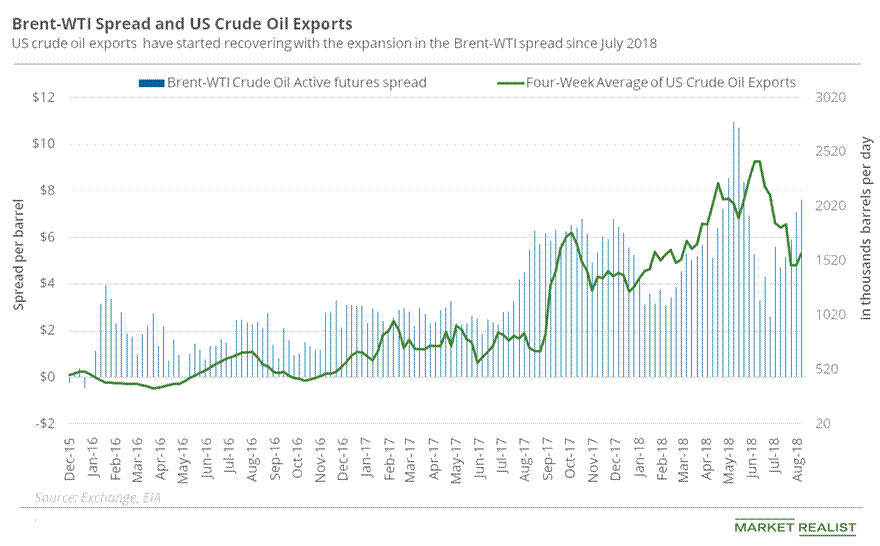

Brent-WTI Spread Might Push Oil Exports and Downstream Stocks Up

On September 10, 2018, Brent crude oil November futures settled ~$9.83 higher than WTI crude oil October futures, the highest level for the Brent-WTI spread since June 19, 2018.

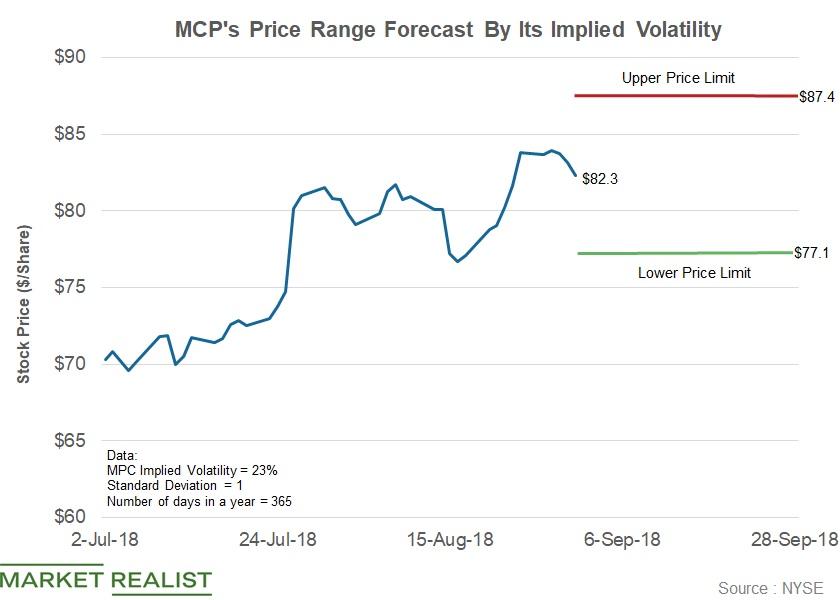

Marathon Petroleum Stock: Price Range until September 28

The implied volatility in Marathon Petroleum has fallen by eight percentage points since July 2 to the current level of 23%.

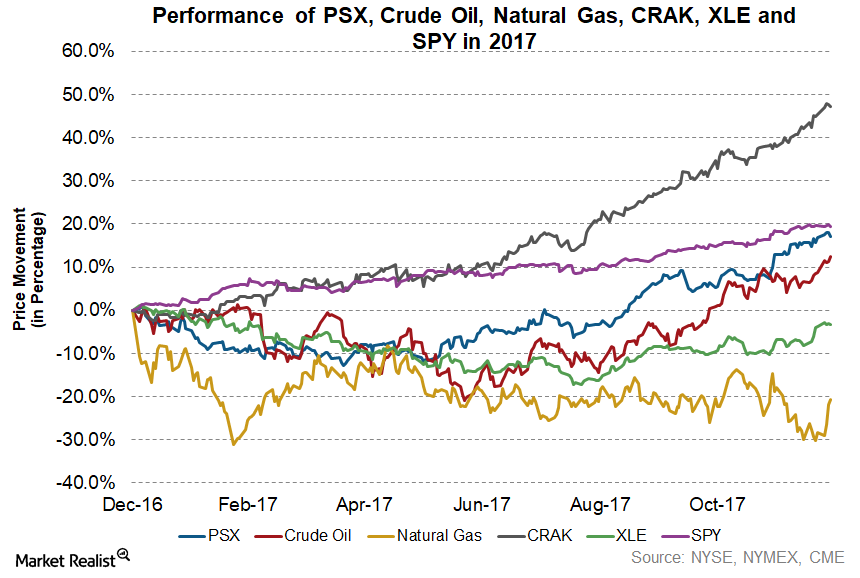

Phillips 66’s Strong Performance in 2017

In 2017, Phillips 66 (PSX) was the fifth-best-performing energy stock of the Energy Select Sector SPDR ETF (XLE).

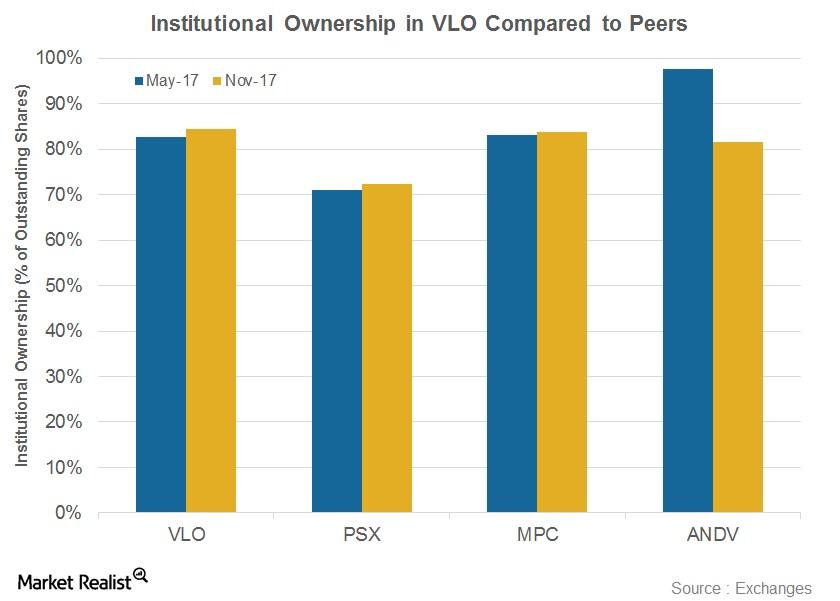

Valero’s Institutional Ownership Trends

What is institutional ownership? In this part, we’ll look at changes in institutional ownership in Valero Energy (VLO). Institutional ownership is a measure of how many shares of a company are owned by institutions such as banks and mutual funds. Institutional ownership suggests these institutions’ confidence level in a stock. Usually, everything else being equal, higher […]

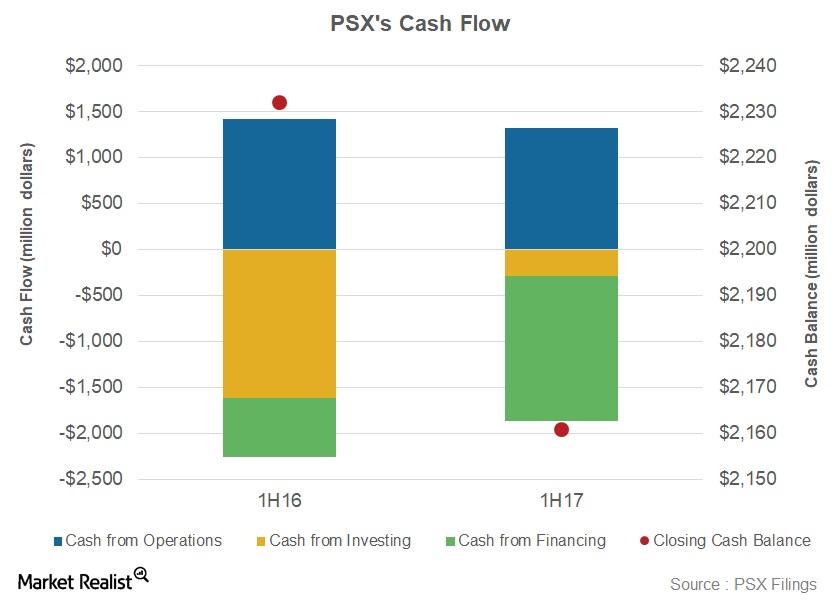

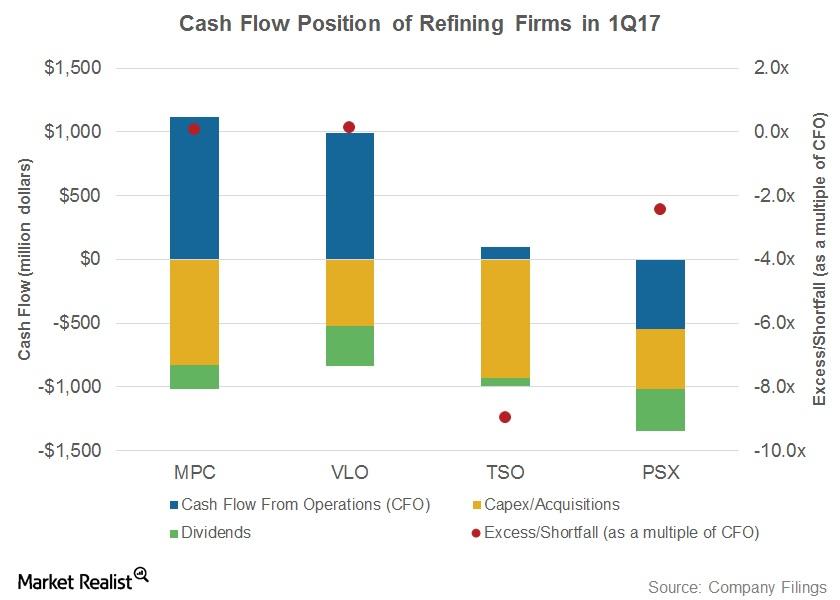

Understanding Phillips 66’s Cash Flow

In 1H17, Phillips 66 saw its cash from operations fall 7% YoY to ~$1.3 billion. This was due to negative cash flow in 1Q17, led by seasonal inventory build-up.

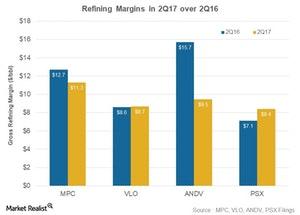

Refining Margins in 2Q17: A Comparison

Refining margins in 2Q17 In this part, we’ll compare leading US downstream companies’ GRMs (gross refining margins). Marathon Petroleum (MPC) had the widest GRM in 2Q17, followed by Andeavor (ANDV), Phillips 66 (PSX), and Valero Energy (VLO). The companies saw mixed GRM trends in 2Q17—let’s look at them more closely. Marathon Petroleum’s refining margin MPC’s gross […]

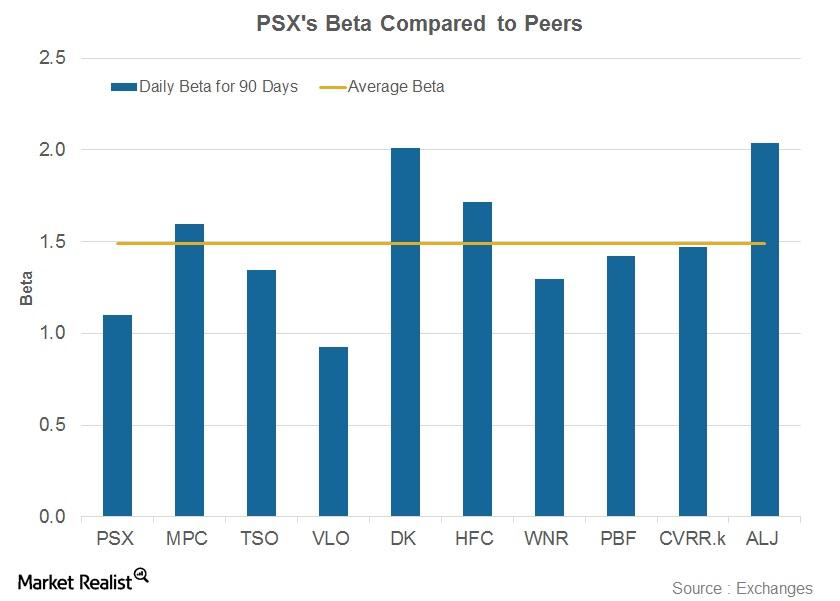

Phillips 66’s Beta: Does It Imply the Company Is Less Volatile?

Phillips 66’s 90-day daily beta stands at 1.1, which is below its peer average of 1.5.

How Major Refiners’ Cash Flows Fared in 1Q17

Refiners’ cash flows have turned volatile over the past few quarters due to volatile refining earnings.

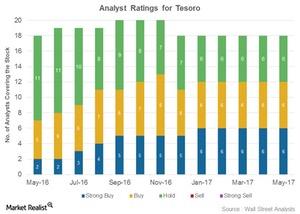

How Analysts Rated Tesoro on Its 1Q17 Earnings Day

Tesoro (TSO) has been rated by 18 analysts. Of those, 12 have assigned the stock a “buy” or “strong buy” rating.

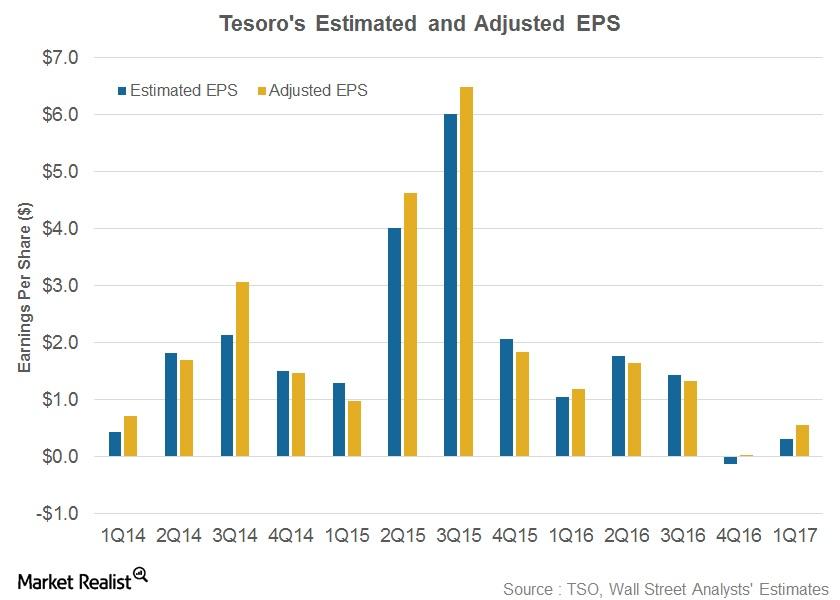

Tesoro Beats 1Q17 Earnings

Tesoro (TSO) posted its 1Q17 results on May 8, 2017. Revenues missed analysts’ estimate, but adjusted EPS of $0.55 surpassed the estimate of $0.31.

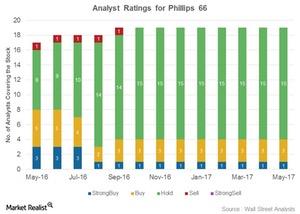

Analysts’ Ratings for Phillips 66 after Its 1Q17 Earnings

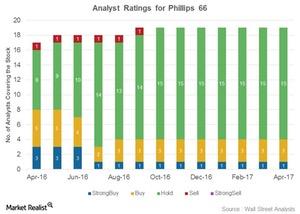

After its earnings, Phillips 66 was rated by 19 analysts. Four analysts gave it a “buy,” 15 gave it a “hold,” and no analysts gave it a “sell.”

How Are Analysts Rating Phillips 66 before Its 1Q17 Earnings?

Phillips 66 has been rated by 19 analysts. Of those, four (or 21.0%) have given it a “buy” or “strong buy” rating.

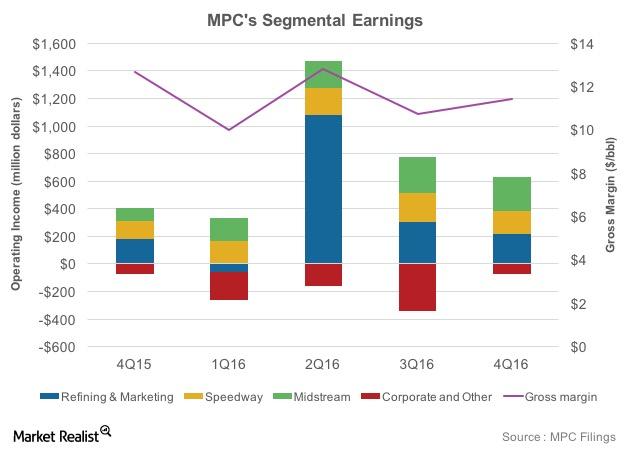

Which Way Will MPC’s Refining Earnings Swing in 1Q17?

MPC’s operating income rose 64% YoY to $553 million in 4Q16. The Refining segment’s operating income rose to $219 million in 4Q16 from $179 million in 4Q15.