How Major Refiners’ Cash Flows Fared in 1Q17

Refiners’ cash flows have turned volatile over the past few quarters due to volatile refining earnings.

May 24 2017, Updated 6:06 p.m. ET

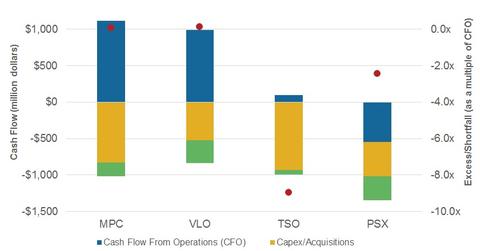

Refiners’ cash flow comparison

Refiners’ cash flows have turned volatile over the past few quarters due to volatile refining earnings. So, to gauge the health of these cash flows, we’ll assess here how deficient or in excess our four select refiners’ CFOs (cash flow from operations) appear to be in covering their vital capex (including acquisition and turnarounds costs) and indispensable dividend outflows.

The VLO and MPC comparison

In 1Q17, Valero Energy’s (VLO) CFO stood at $988 million. The company’s capital expenditure or capex and dividends outflows stood at $524 million and $315 million, respectively, and so its excess in cash flow stands at $149 million. This excess has put VLO in a comparatively better flow position.

But while some refiners are lagging behind with cash flow shortfalls, others are leading with cash flow surpluses. When we measure these as multiple of CFO, we can see who’s better placed to handle periods of turbulent refining.

Valero’s cash flow excess as a percentage of CFO stands at 0.2x. Marathon Petroleum’s (MPC) excess stands at 0.1x, which shows that VLO’s excess is higher than MPC’s, placing VLO in a relatively favorable position. This is because MPC’s capex outflows are higher than VLO’s, led by MPC’s expansion activities. However, it could also mean higher CFO for MPC in the future.

TSO’s cash flow shortage

Tesoro’s (TSO) cash flow shortfall stands at whopping 9.0x of its CFO—the highest among peers—due to its acquisition cash outflows in 1Q17. The acquisition outflow was primarily related to Tesoro Logistics’ (TLLP) acquisition of North Dakota Gathering and Processing Assets.

Tesoro is meanwhile in the process of acquiring Western Refining (WNR). Upon closure of the acquisition, its cash inflows should improve due to higher capacity and operational synergies. TSO expects around $350 million–$425 million of annual savings in the form of operational synergies upon completion of the acquisition.

PSX’s cash flow

Phillips 66’s (PSX) cash flow shortfall stands at 2.4x due to its negative CFO, which was led by a huge inventory pileup in 1Q17. As its inventory buildup reduces over the next couple of quarters, PSX’s cash flow position will likely improve.

If you’re looking for exposure to mid-cap stocks, you might consider the SPDR S&P MIDCAP 400 ETF (MDY) (MID-INDEX), which has ~3% exposure to energy sector stocks like WNR. The iShares Core S&P 500 ETF (IVV) and the SPDR Dow Jones Industrial Average ETF (DIA) both have ~6% exposure to big US energy sector stocks.

To sum up this facet of our inquiry, with its higher cash flow excess, Valero appears to be the best placed among our select group of four major US refiners to face the currently volatile refining environment.