SPDR Dow Jones Industrial Average ETF

Latest SPDR Dow Jones Industrial Average ETF News and Updates

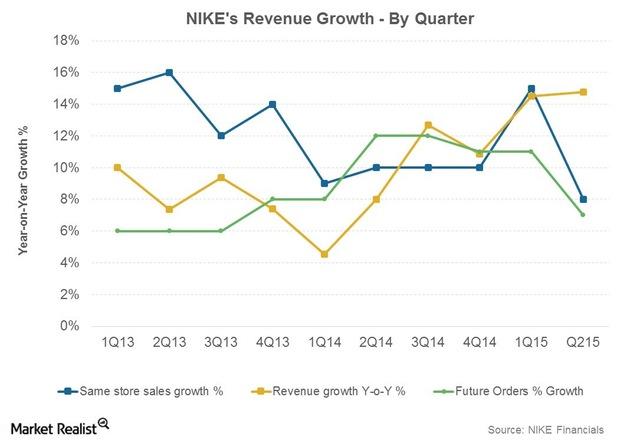

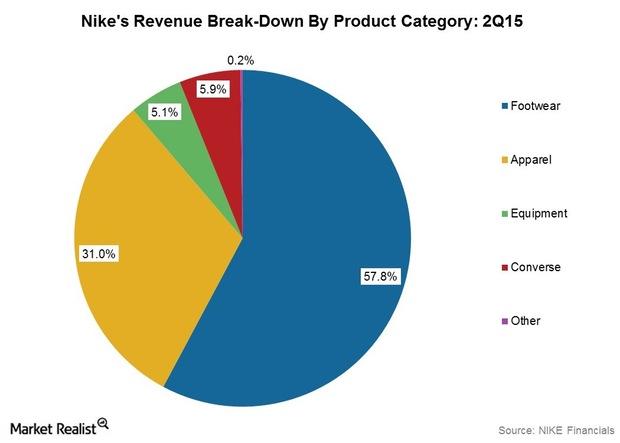

Analyzing the Prospects of Nike’s Geographic Segments

Most of Nike’s (NKE) incremental revenue was recorded in its North America market, Nike’s largest geographical segment.

Why DIA Is the Best Dow Jones ETF Among the Pack

There are only a few ETFs that track the Dow 30. One of the ETFs in particular is the right choice. Why does the ETF stand out from the others?

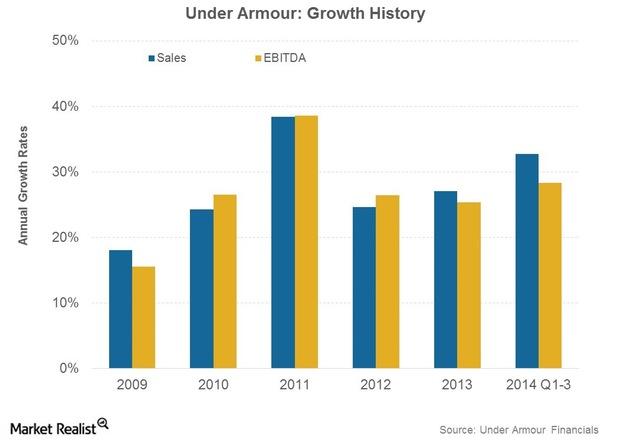

Where NIKE And Under Armour Win In The Market Share Stakes

Under Armour’s share of the apparel market rose from 14% to 16%, year-over-year, in the first nine months of 2014.

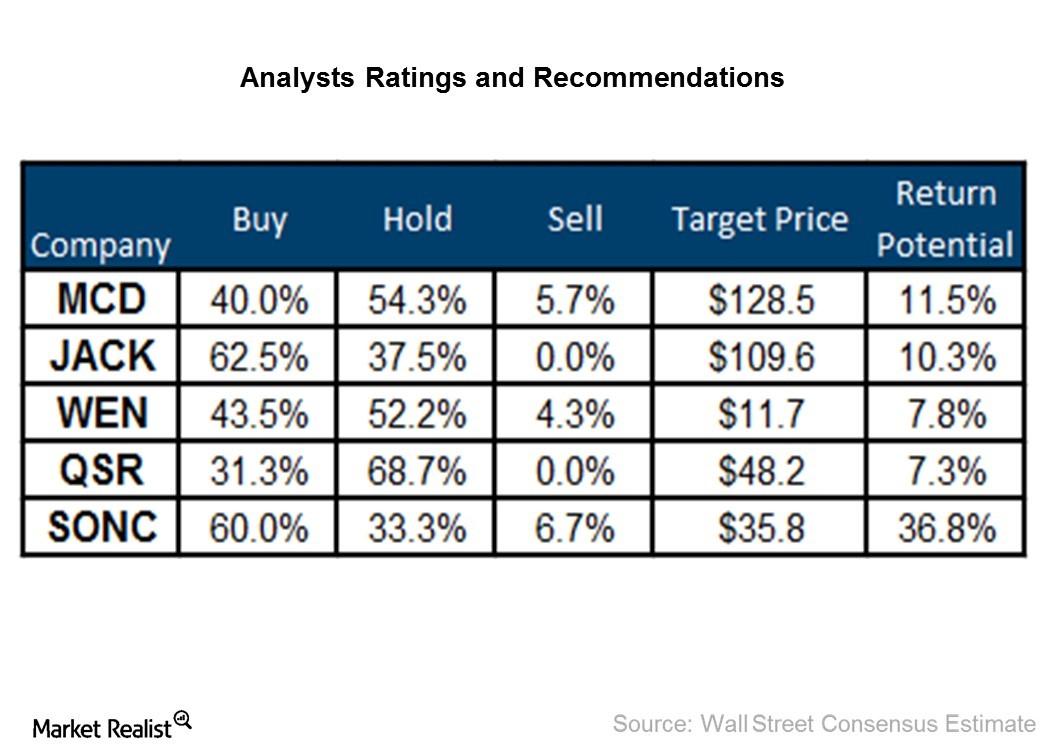

Which Fast Food Restaurants Do Analysts Favor?

Jack in the Box (JACK) and Restaurant Brands International (QSR) are analysts’ favorites among the companies we’ve reviewed in this series.

Nucor Looks to Contract Resets to Further Improve Performance

Nucor (NUE) expects its 3Q16 performance to improve as compared to 2Q16. The key driver of Nucor’s 3Q16 performance would be the reset of contracts.

Why Larry Fink Thinks Markets Could See Some Setbacks

In a recent interview with CNBC, Larry Fink, CEO of BlackRock (BLK), shared his views on market movement, the US economy, and the dangerous impact of the lower interest rates.

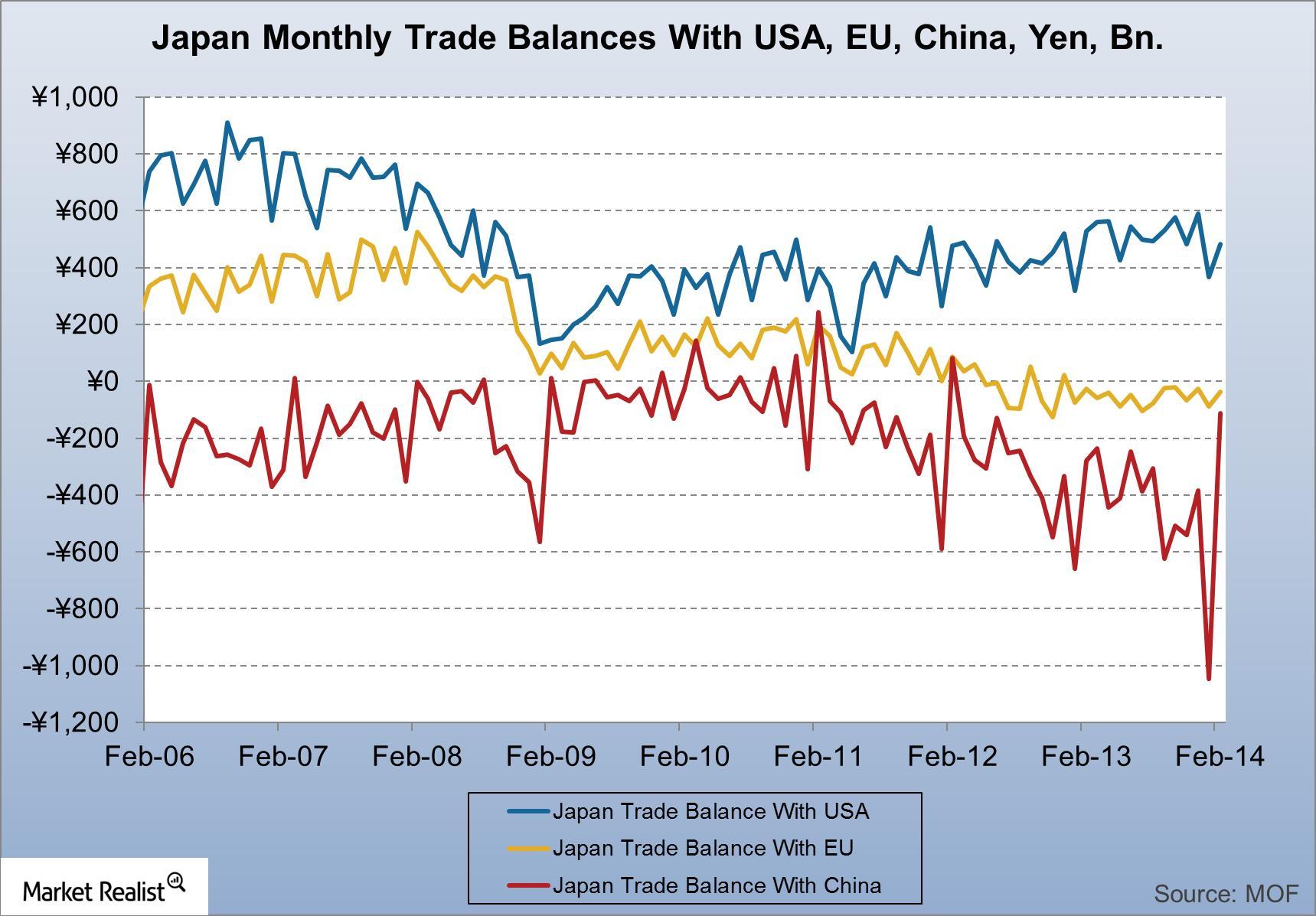

Japan’s trade deficit with China: Worse for GM than the recall

This article considers the impact of Japan’s trade dynamics on Japanese automakers like Toyota (TM) versus General Motors (GM) from a macroeconomic perspective.

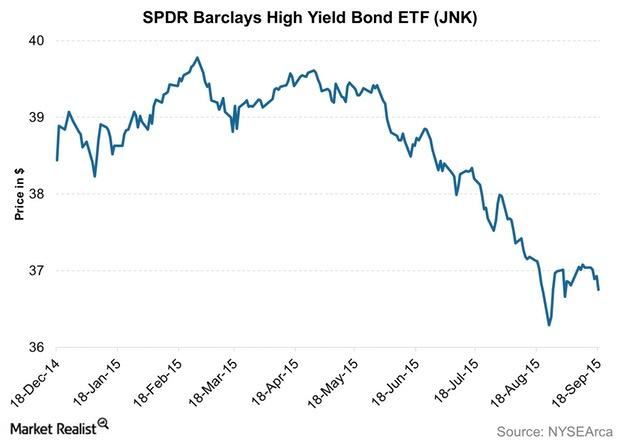

Lack of Rate Hike in September Leads US Stocks Down

The US Federal Reserve met on September 16 and 17 in one of the most anticipated monetary policy meetings in recent memory.

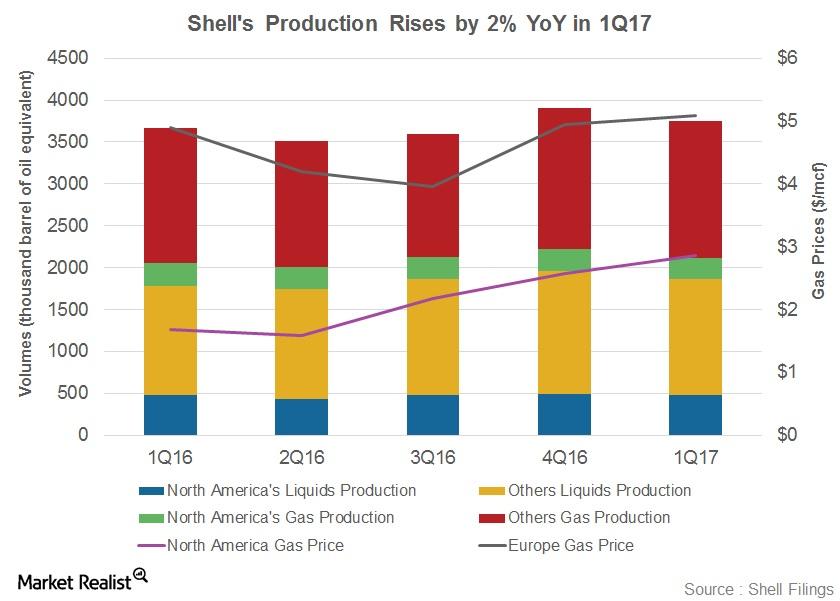

Shell’s Upstream Portfolio: Is it Poised to Grow?

Royal Dutch Shell (RDS.A) produced 3.8 MMboepd in 1Q17 from its worldwide operations, compared to 3.7 MMboepd in 1Q16.

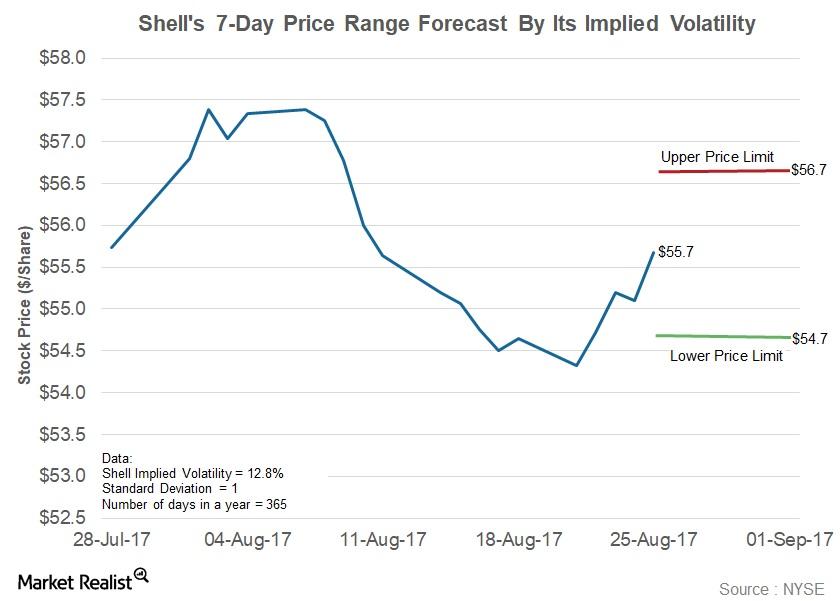

What’s the Forecast for Shell Stock for the Next 7 Days?

Implied volatility in Royal Dutch Shell (RDS.A) has fallen 4.9% since July 3, 2017, to the current level of 12.8%.Real Estate Why the housing market impacts consumption and equity investors

This article considers the importance of investment, including residential investment, in the support of U.S. consumption data and the implications for investors.

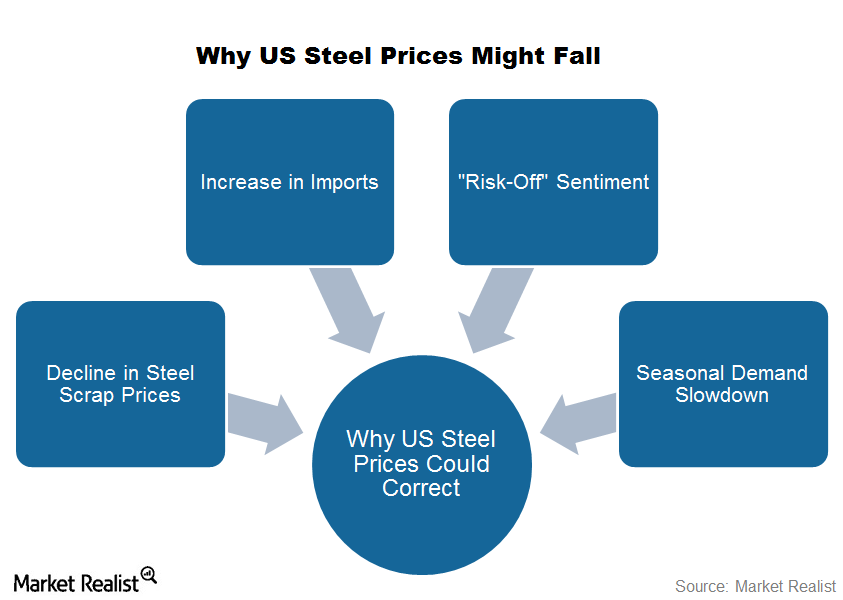

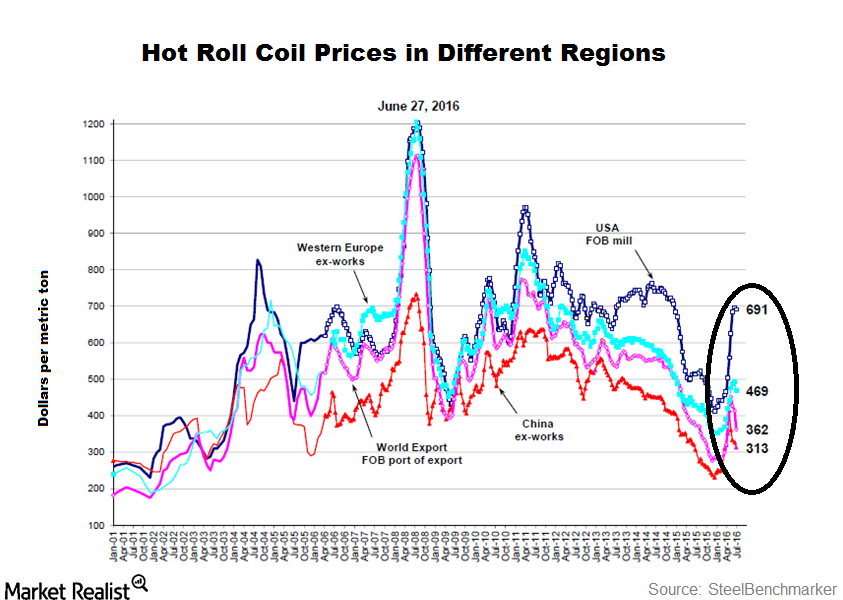

Why US Steelmakers’ Party Might Not Last Long

Due to trade cases, the US steel industry has turned into a virtual island largely immune to global steel prices—at least in the short term.

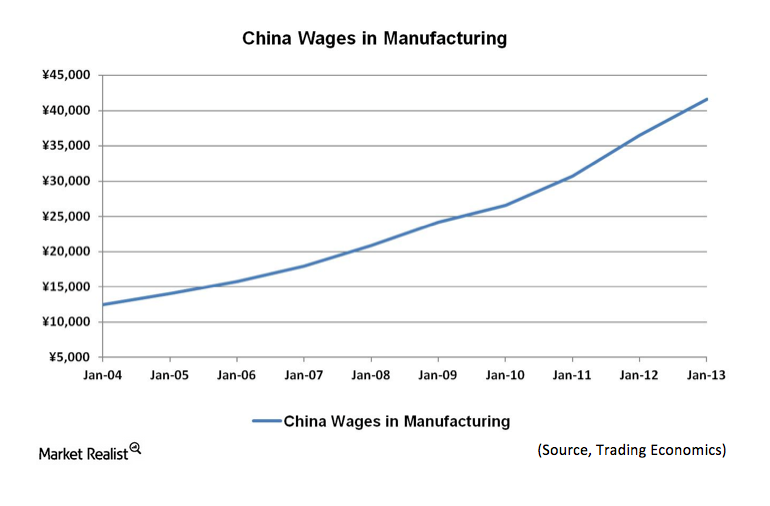

China’s wage inflation: Bad news for corporate profits and banks

Wage inflation in Chinese manufacturing With an appreciating currency and growing economy, Chinese manufacturers have experienced wage inflation. The cost of Chinese labor is simply becoming more expensive, as the below graph indicates. Private sector wage growth in China was 14% in 2012, while GDP growth is slowing to around 7.5% per annum. Wages are […]

China’s Economic Data Might Drag Oil Prices

On December 14, China reported the November industrial output growth at 5.4% on a year-over-year basis—the lowest growth since early 2016.

Stocks versus ETFs: Which Should Investors Choose?

Every investor faces some tough choices. Should you turn to stocks, exchange-traded funds (ETFs), index funds, mutual funds, or bonds?

Natural Gas Prices: What Could Happen on January 24?

On January 24, at 5:39 AM EST, natural gas prices have risen 1.7% from the last closing level.

Strong Economy and a Rate Cut: Can Trump Have It Both Ways?

Today, President Donald Trump told reporters, “Our country’s doing unbelievably well economically.”

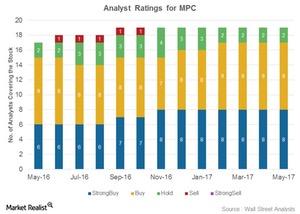

Why Most Analysts Are Calling Marathon Petroleum a ‘Buy’

Marathon Petroleum (MPC) has been rated by 19 Wall Street analysts. Seventeen analysts (or 89%) have rated it as a “buy” so far in May 2017.

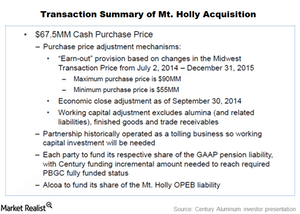

Was Alcoa Smart to Sell Mt. Holly Smelter to Century Aluminum?

In 2014, Alcoa (AA) sold its stake in the Mt. Holly smelter to Century Aluminum (CENX).

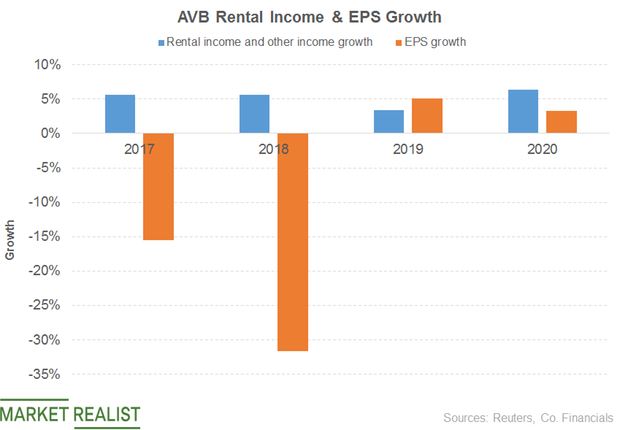

AvalonBay: What’s Driving the Dividend and Valuations?

AvalonBay’s revenue grew 7% in the first quarter, driven by rental and other income.

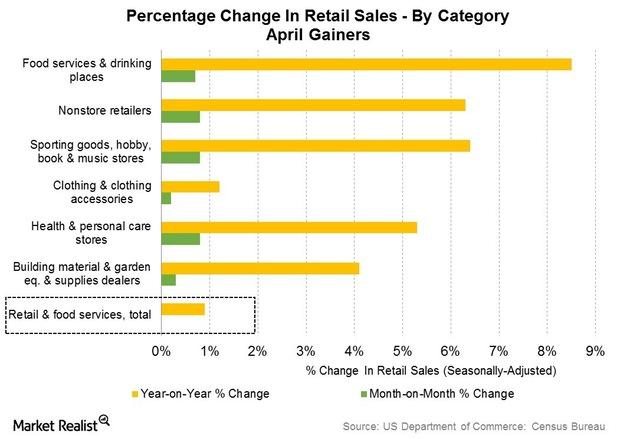

The 6 Positive Things about April’s Retail Sales Report

The advance retail sales report for April 2015 was on the whole, mixed. The mixed readings in the retail sales report brought about indifferent reactions from markets.

Worried about a US Stock Market Crash? So Is Everyone!

Investors are concerned that US stock markets might crash. Notably, markets have staged a remarkable comeback from their March lows.

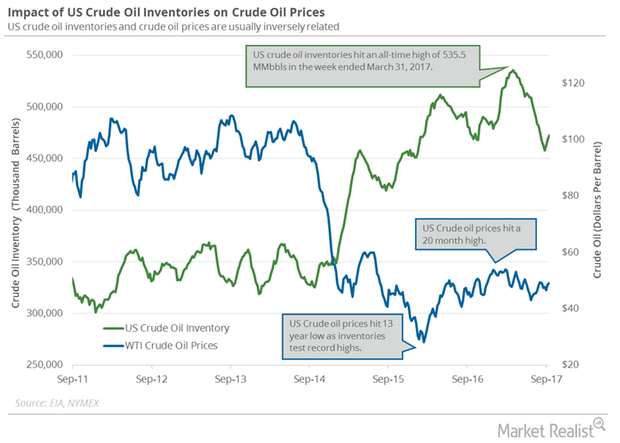

Will Crude Oil Futures and S&P 500 Move in the Same Direction?

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

S&P 500 Index Nears Record High amid Earnings Season

The S&P 500 Index, represented by the SPDR S&P 500 ETF (SPY), rose 0.3% on October 23, nearing the all-time high it saw in July.

Crude Tanker Stocks and the BDTI Index in Week 39

In week 39, the week ending September 29, the BDTI rose to 776 from 772. In week 38, the index rose by 28 points. It rose for the fifth consecutive week.

Oil: Famous Recession Indicator Might Be a Concern

On January 2, US crude oil active futures settled at $46.54 per barrel—2.5% higher than the last closing level due to short covering.

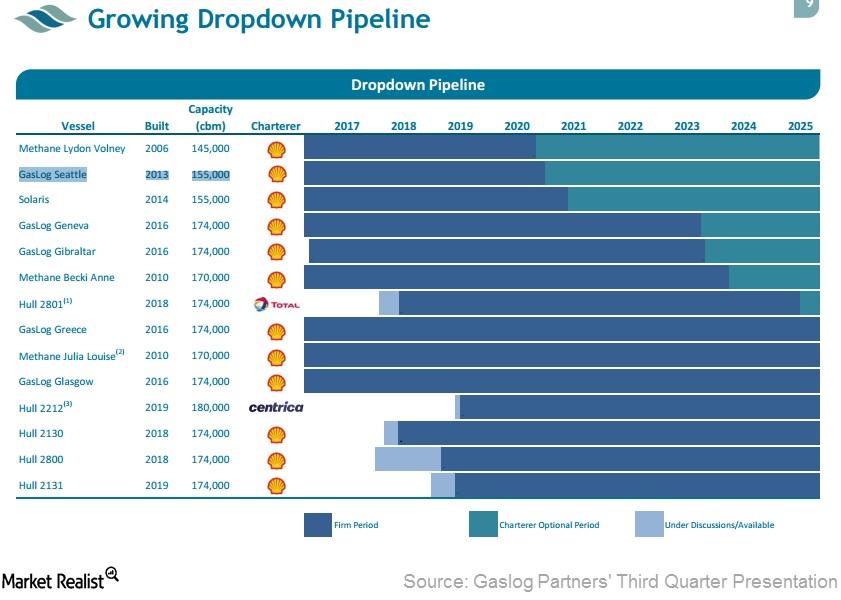

What Are GasLog Partners’ Asset Dropdown and Dropdown Options?

GasLog, GasLog Partners’ general partner (or GP), has entered into a seven-year time charter contract with Total, which will commence in mid-2018.

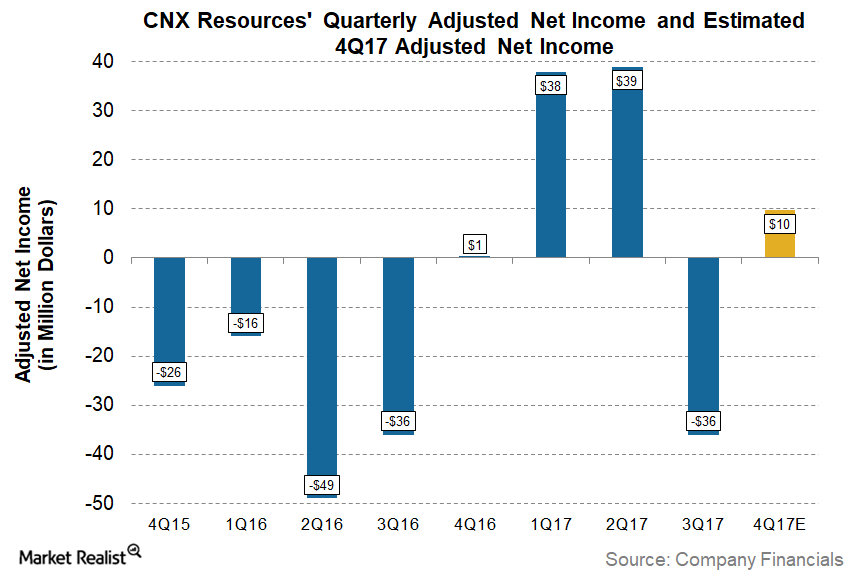

Can CNX Resources Report Higher Profits in 4Q17?

CNX Resources (CNX) is set to report its 4Q17 and 2017 earnings on February 6, 2018, before the market opens. CNX is expected to report 1,000% higher profits YoY than 4Q16.

Will OPEC Meeting in Vienna Affect Crude Oil Futures?

November US crude oil (UWT) (SCO) (DBO) futures contracts rose 1.6% and closed at $49.3 per barrel on September 20, 2017.

JPMorgan Chase’s 2020 Market Outlook

On Wednesday, JPMorgan Chase’s strategists discussed the market’s 2020 outlook. These strategists expect stocks to rise next year, while gold could decline.

Market Share Gain Spurs NIKE’s North American Footwear Revenues

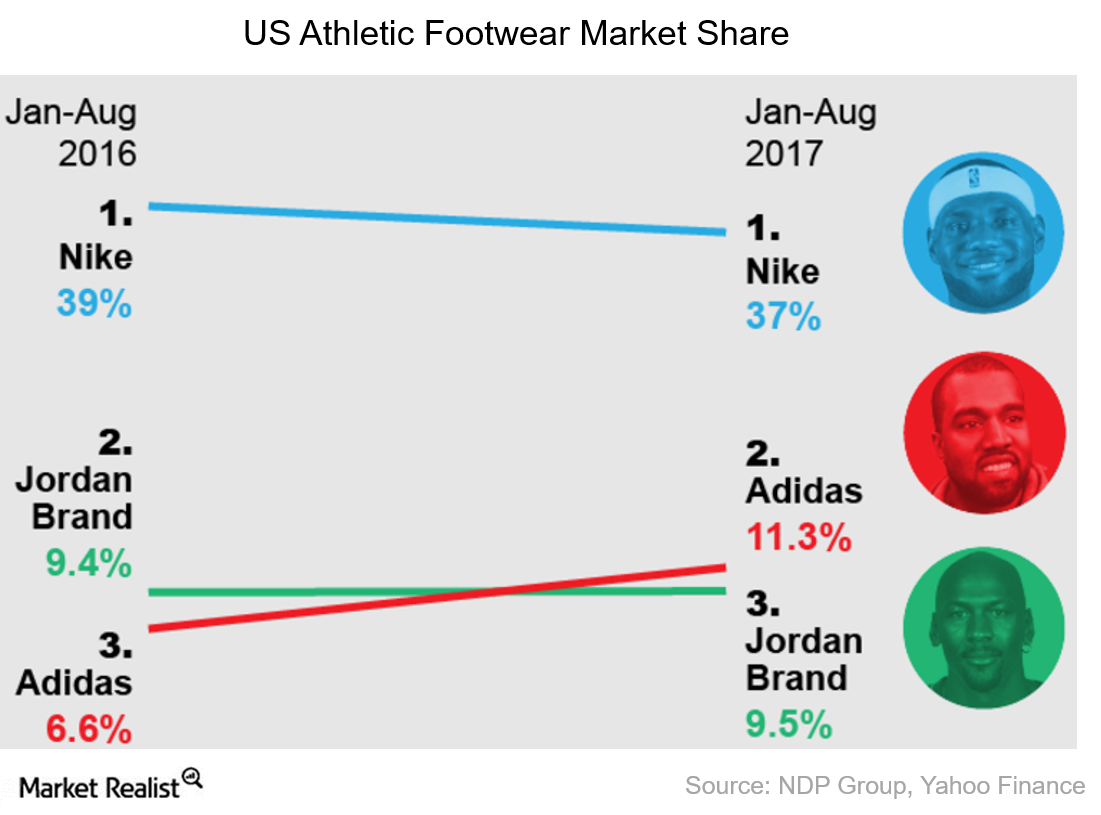

In the US, in 2014 year-to-date, NIKE, Converse, and the Jordan brands combined accounted for over 60% of market share in athletic footwear.Financials Why unemployment data moves bond yields

Private and government construction both reported declines. The construction value chain has a multiplier effect on other sectors of the economy, and can significantly impact both stock and bond markets.

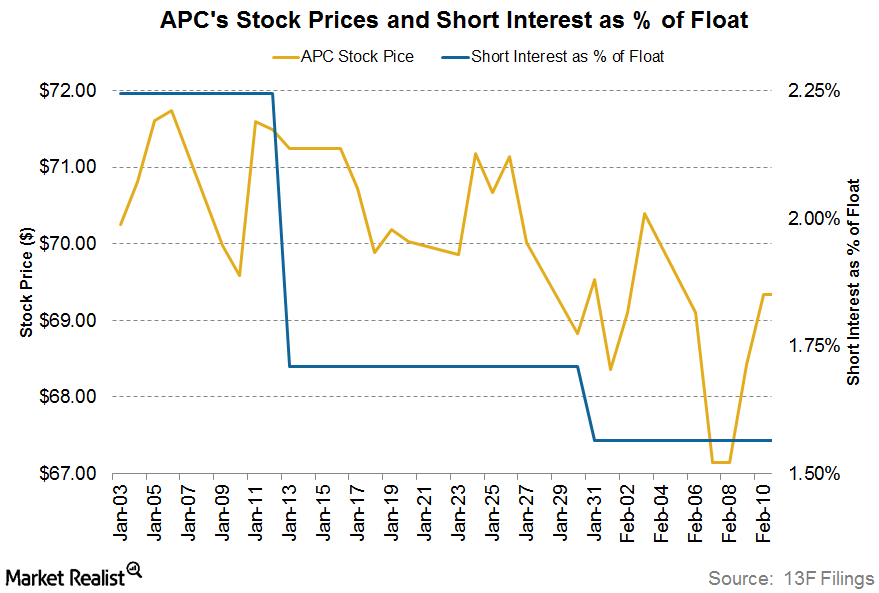

Anadarko Petroleum: Key Short Interest Trends

Anadarko Petroleum’s (APC) short interest ratio on February 10, 2017, was ~1.6%. At the beginning of the year, its short interest ratio was ~2.2%.

Will Fox’s ‘Biggest Story of 2016’ Be Important Driver for 2017?

On Friday, December 30, 2016, Fox Business Network’s David Asman, Dagen McDowell, and Lauren Simonetti talked about the “biggest business story of 2016.”

Will US Stock Markets Crash? IMF and Rogers Weigh In

Several analysts have said that US stock markets are ripe for a crash. They called out the disconnect between financial markets and the economy.

Musk Might Consider Another Stock Offering for Tesla

Tesla raised over $2 billion through equity issuance in February. On February 13, Tesla stock closed with gains after it announced the capital raise.

Goldman Sachs Warns about a US Stock Market Crash

Goldman Sachs expects the S&P 500 to crash to 2,400. However, the firm expects the S&P 500 to end the year at 3,000 level.

COVID-19 Impacts US Stock Markets and Economy

COVID-19 has taken a toll on the US and global economy. US stock markets finally ended their longest bull market in history amid coronavirus fears.

Gold or Crude Oil: Where to Hide amid US-Iran Tensions?

Active gold futures have risen to their highest level since 2013 after the renewal of US-Iran tensions. Last week, active gold futures rose by 1.1%.

China’s PMI: More Signs Emerge of Bottoming Out

Today, China released its official December manufacturing PMI. The PMI was 50.2 for December. The analysts polled by Reuters expected the PMI to be 50.1.

The 2019 US Stock Market Crash that Never Came!

Global stock markets added $17 trillion in value this year. A year back, most economists saw dismal stock market returns in 2019.

A Look at Analysts’ Top 5 US Steel Stocks

In this overview article, we’ll see how analysts are rating the leading steel stocks, and we’ll also compare performance from the top five steel companies.

Why China Trade Deal Won’t End the Trade War

Although phase one of the China trade deal won’t end the US-China trade war, it will help restore market sentiments. The trade war is almost two years old.

AAPL, FFIV, FB, GOOGL, ETSY: Top 5 Tech Calls Today

AAPL and other tech stocks are trending! Let’s take a look at what drove revised price targets, downgrades, and upgrades for today’s top tech stocks.

Options Traders Think AT&T Stock Will Climb Higher

AT&T stock (T) closed trading at $38.10 on December 4, rising 1.44% from the previous trading session, and I’m seeing more upside ahead.

Get Real: New Targets and Turnaround Hopes

In this morning’s edition of our daily market newsletter, Get Real, we looked at Trump’s new tariff targets, a 5G network launch, and turnaround hopes.

Warren Buffett Has Loads of Cash and No Takers

Berkshire Hathaway’s huge cash pile might stay in place for a while. Warren Buffett was outbid by Apollo Global Management in his efforts to buy Tech Data.

Can Tesla Create a New Market with the Cybertruck?

Tesla’s (TSLA) electric pickup truck, also known as the Cybertruck, has been one of the most polarizing vehicles recently unveiled.

Will Tesla Solar’s Israel Expansion Bring Success?

Tesla registered a wholly-owned subsidiary in Israel last month. Along with expanding its EV business, its foray will be important for its Solar segment.

Nike Rating Lowered on Concerns of Rising Competitive Pressure

Nike (NKE), the world’s largest apparel company and America’s leading sportswear brand, faced analyst downgrades and target price revisions in September.