SPDR Dow Jones Industrial Average ETF

Latest SPDR Dow Jones Industrial Average ETF News and Updates

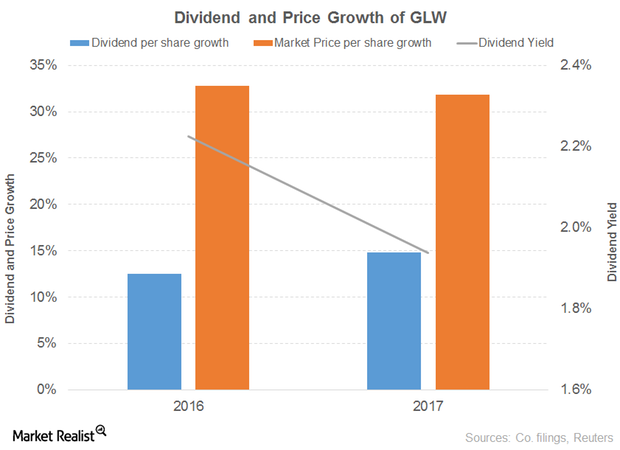

What Are Corning’s Key Growth Drivers?

Corning’s gross margin grew 3% and 9% in 2016 and 9M17, respectively.

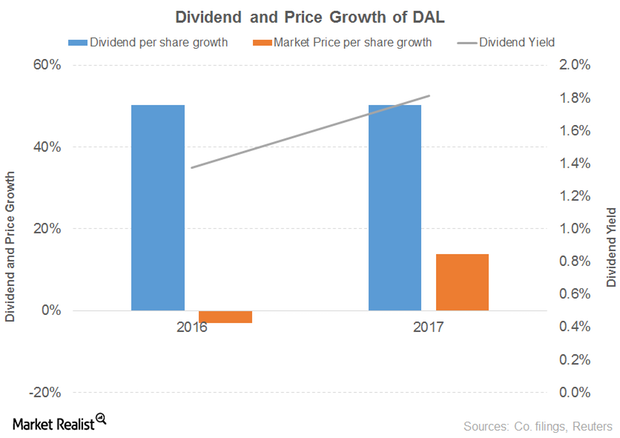

What to Expect from Delta Air Lines

Delta Air Lines’ (DAL) operating revenue fell 3% in 2016 before gaining 3% in 9M17 (or the first nine months of 2017).

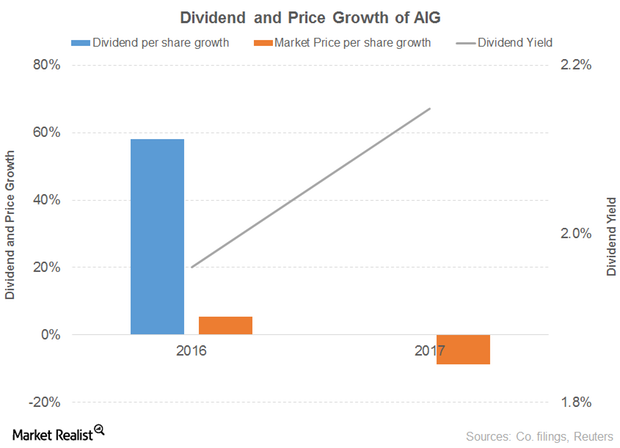

What’s the Outlook for American International Group?

American International Group’s dividend per share rose 58% in 2016 and was flat in 2017.

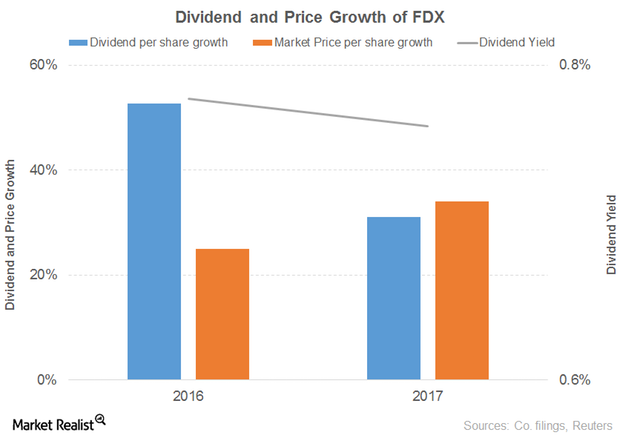

How FedEx’s Performance Influenced Its Outlook

FedEx’s (FDX) revenue grew 6% and 20% in 2016 and 2017, respectively. The FedEx Ground, FedEx Freight, and FedEx Services segments drove the 2016 growth, offset by the FedEx Express segment.

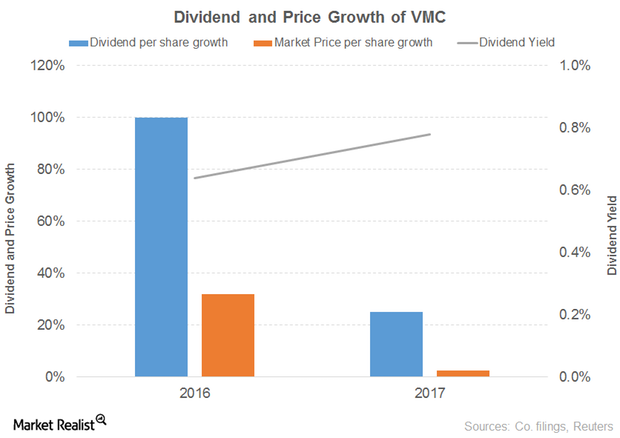

The Outlook for the Vulcan Materials Company

The Vulcan Materials Company’s (VMC) revenue grew 5% and 7% in 2016 and 9M17, respectively. Aggregates, concrete, and calcium drove the growth in 2016, offset by asphalt mix.

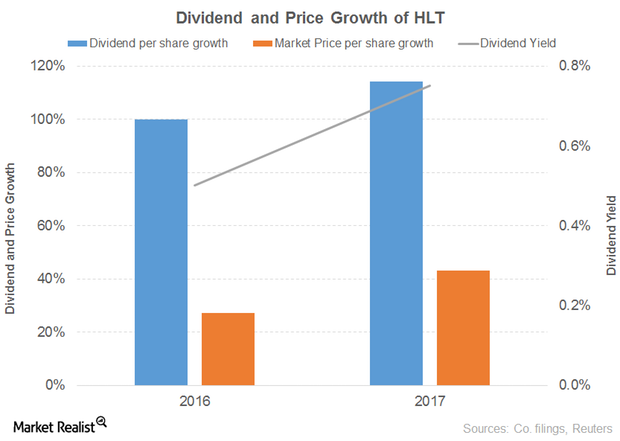

Hilton Worldwide Holdings Looks Promising despite a Tough 2017

Hilton Worldwide Holdings’ (HLT) revenue grew 3% in 2016. Management and franchise fees, timeshare, and other revenues from managed and franchised properties drove the growth in 2016, offset by owned and leased hotels.

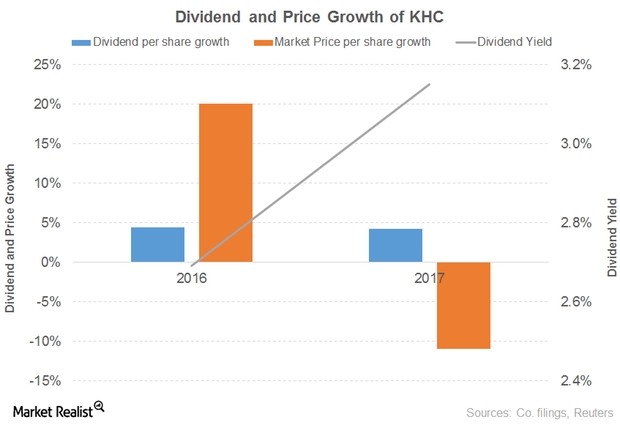

Why The Kraft Heinz Company’s Outlook Still Seems Promising

The Kraft Heinz Company’s (KHC) net sales grew 44% in 2016 before falling 1% in 9M17. Every product category drove the growth in 2016, offset by a decline in the infant and nutrition segments.

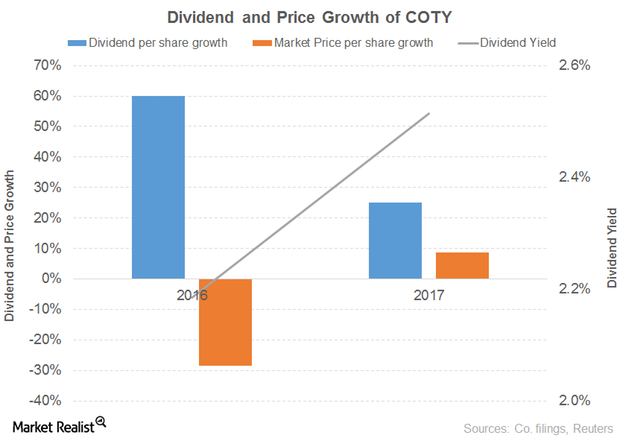

How Coty’s Performance Affected Its Outlook

Coty (COTY) net revenue fell 1% in 2016 before climbing 76% in 2017. The Consumer Beauty segment drove the growth in both years.

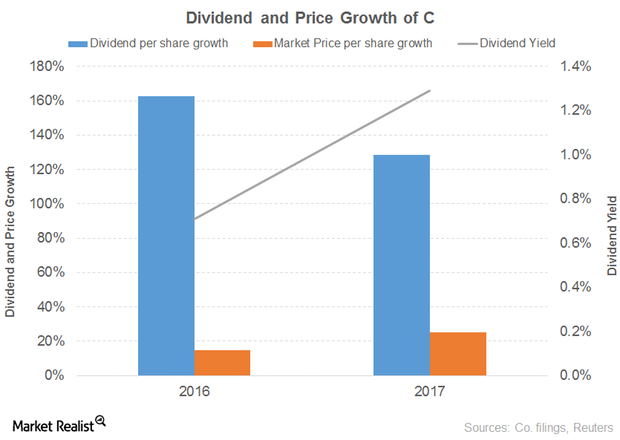

Why Citigroup’s Outlook Seems Promising

Citigroup is projected to grow its revenue 2% and 4% in 2017 and 2018, respectively. The 2017 and 2018 diluted EPS are projected to grow 12% and 14%, respectively.

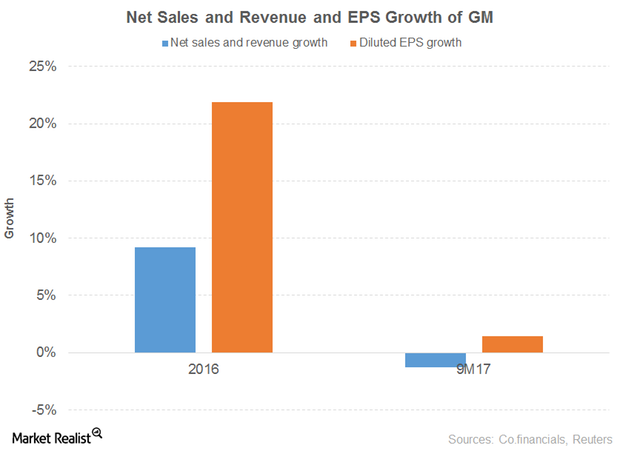

A Look at GM’s Stock Performance

In this part of our focus on the top 18 cheap S&P 500 stocks, we’ll discuss another six stocks: General Motors (GM), Ford Motor (F), Owens-Illinois (OI), The Goodyear Tire & Rubber Company (GT), Navient (NAVI), and Brighthouse Financial (BHF).

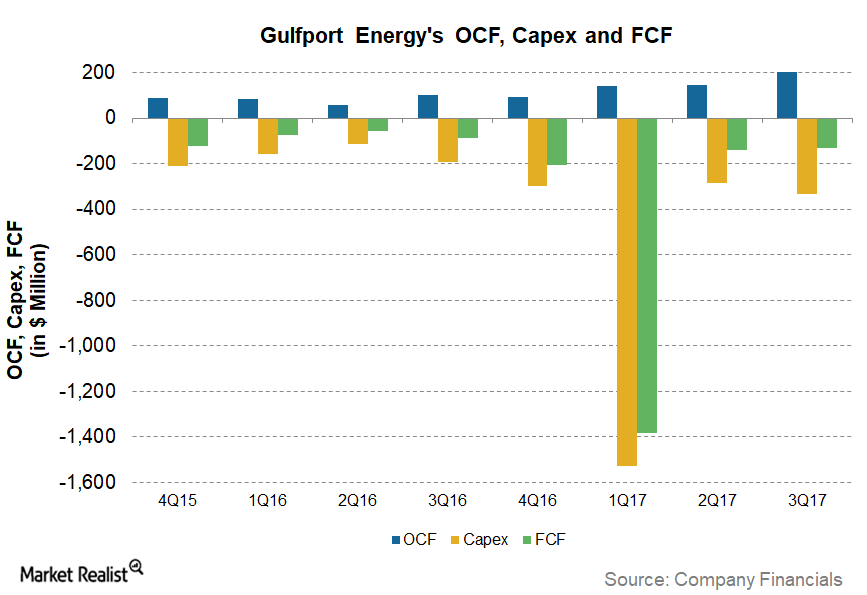

Is Gulfport Energy’s Normalized Free Cash Flow Trending Up?

For 9M17 (the first nine months of 2017), Gulfport Energy (GPOR) had normalized FCF (free cash flow) of -336%, the fourth lowest among the upstream producers we have been tracking.

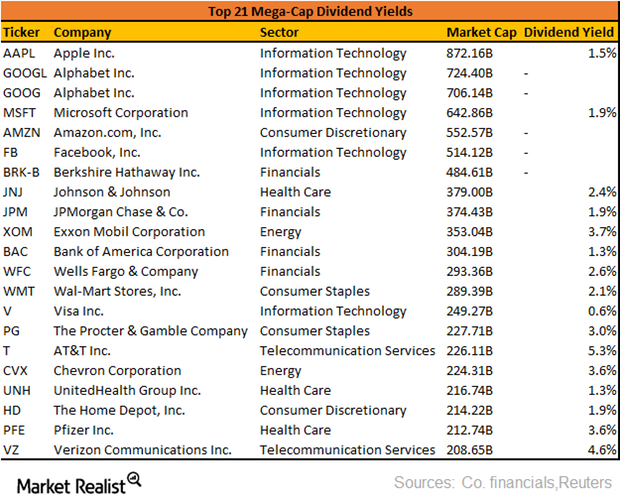

What Are the Dividend Yields of the Top 10 Mega-Cap Stocks?

Donald Trump’s promises of financial deregulation, infrastructure spending, and tax cuts played a major role in the stock market rally this year.

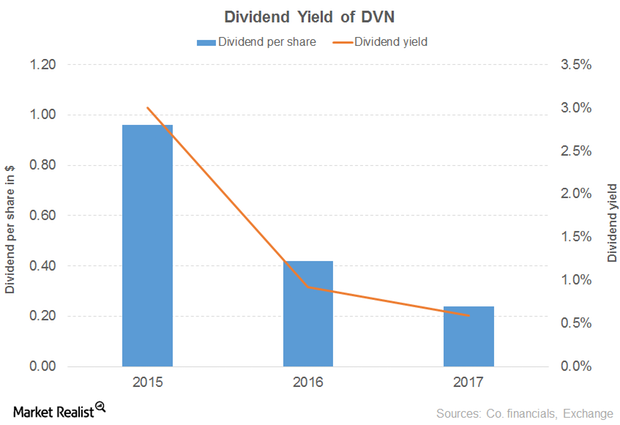

How Did DVN’s Dividend Cut Affect Its Dividend Yield?

Devon Energy Corporation’s 56.0% dividend cut in 2016 was followed by a 43.0% cut in 2017.

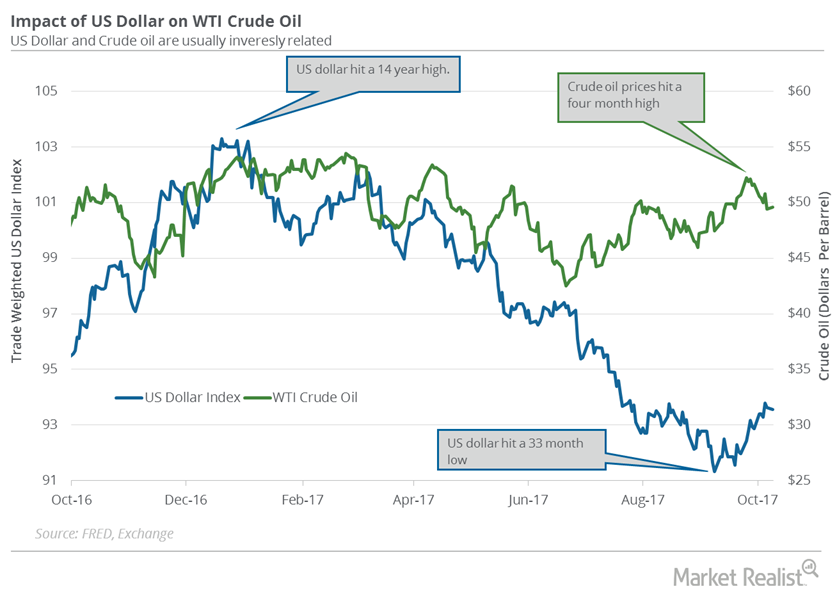

US Dollar Is near a 10-Week High, Could Upset Crude Oil Bulls

The US Dollar Index fell 0.1% to 93.55 on October 9, 2017. However, it rose almost 1.1% last week. The US dollar (UUP) is near a ten-week high.

A Look at Trends in US Steel Production

US steel production As US (DIA) (DOW) steel production is US steelmakers’ major revenue driver, it’s very important to track it. In this part, we’ll discuss domestic production and capacity utilization. According to the World Steel Association, the United States produced 7.1 million tons of steel in August 2017, an increase of 6.3% YoY (year-over-year). Production rose 5.6% in […]

Will RH’s 2Q17 Earnings Boost Its Stock Price?

Luxury home furnishings retailer RH (RH) will announce its 2Q17 earnings after the market closes on September 6, 2017.

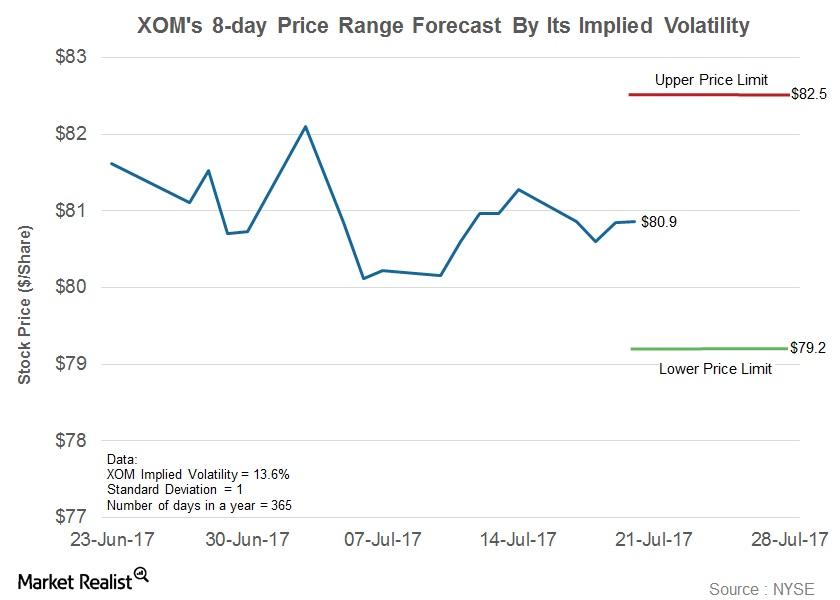

What’s the Forecast for ExxonMobil’s Stock Price?

Implied volatility in ExxonMobil has fallen from 14.9% on April 3, 2017, to 13.6% to date.

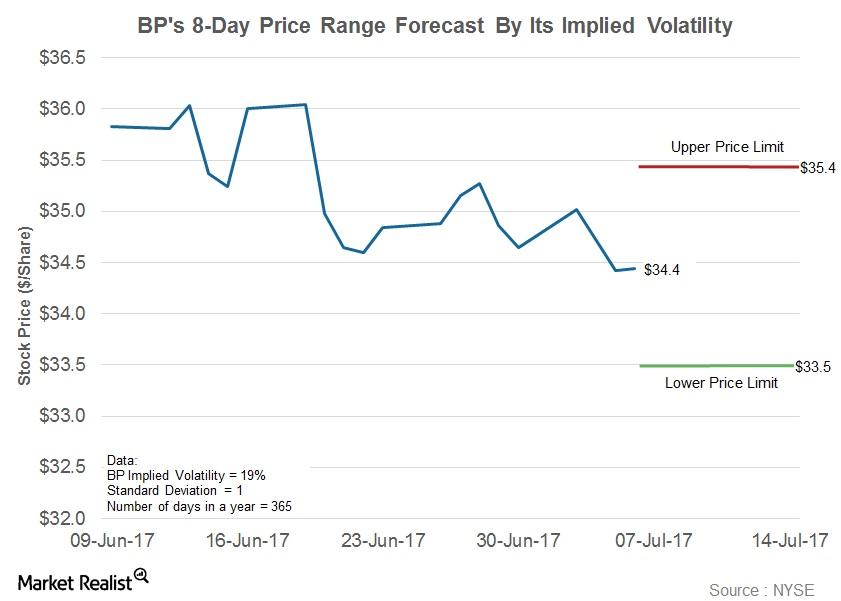

Estimating BP’s Stock Price Using Implied Volatility

What is implied volatility? Volatility gauges changes in a stock’s return over a period. When estimated based on historical stock prices, it is called historical volatility. We can estimate the future volatility, or implied volatility, of security using an option pricing model. A high implied volatility would indicate that a stock price is expected to move […]

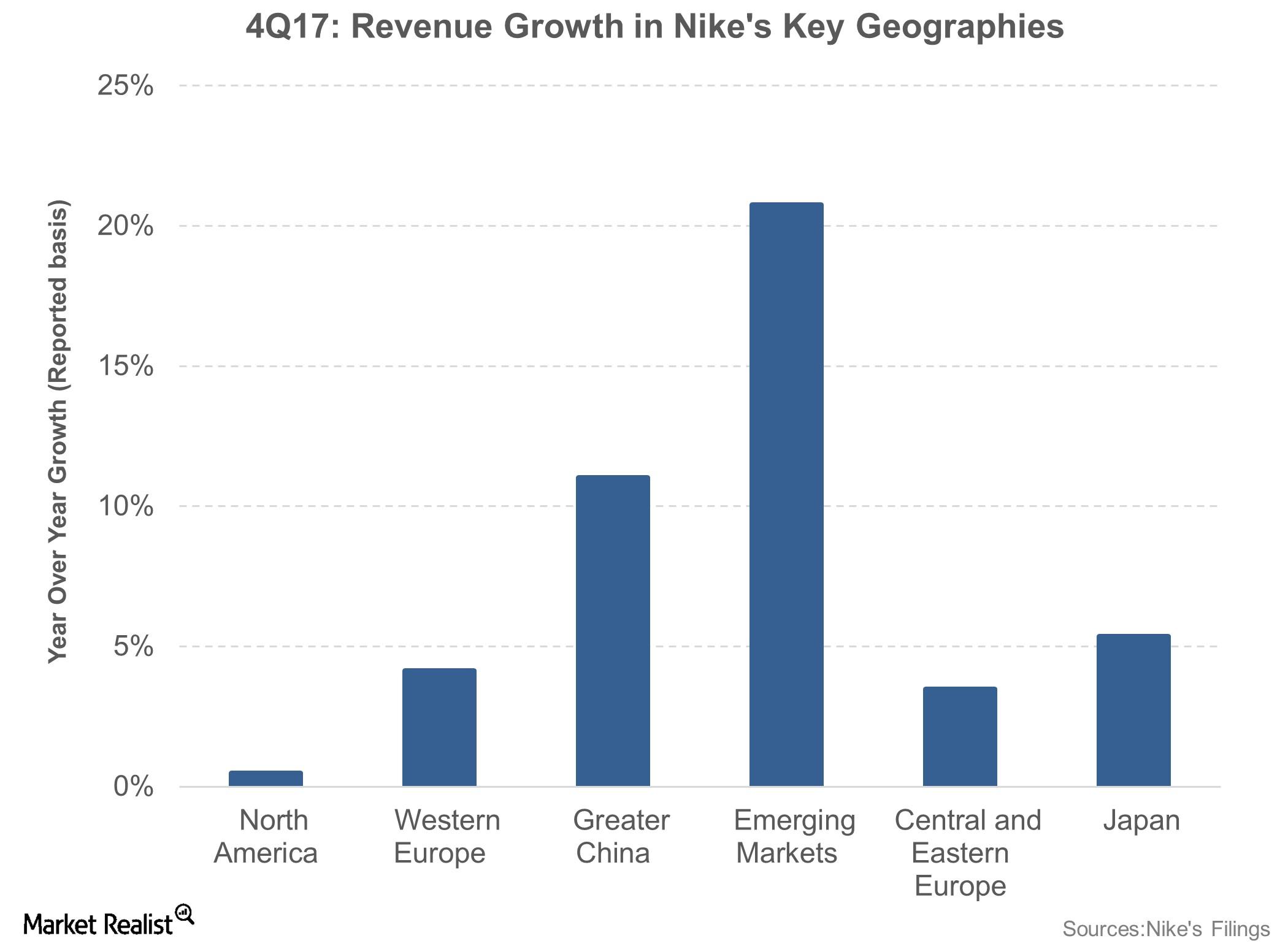

Inside Nike’s Double-Digit International Market Growth in Fiscal 2017

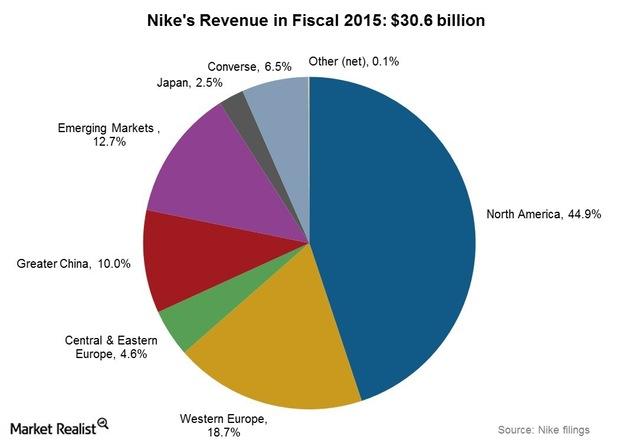

Nike’s key brand, Nike, which accounts for ~95% of the company’s business, saw a 7% YoY rise in its fiscal 4Q17 sales on a currency-neutral basis.

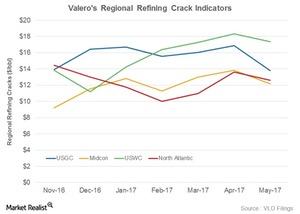

What Valero Needs to Soar in 2Q17

Valero’s crack indicators have fallen in all of these areas in May 2017 (as of May 23) as compared to April 2017.

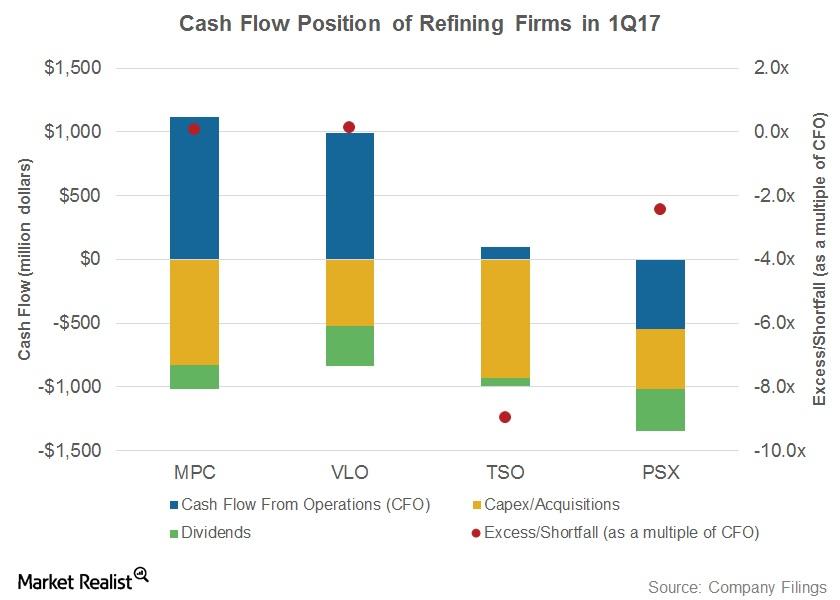

How Major Refiners’ Cash Flows Fared in 1Q17

Refiners’ cash flows have turned volatile over the past few quarters due to volatile refining earnings.

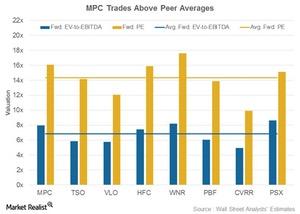

Why MPC’s Valuation Commands a Premium over the Peer Average

MPC’s valuations are above the peer averages likely because it’s now in the process of restructuring its organization to unlock value.

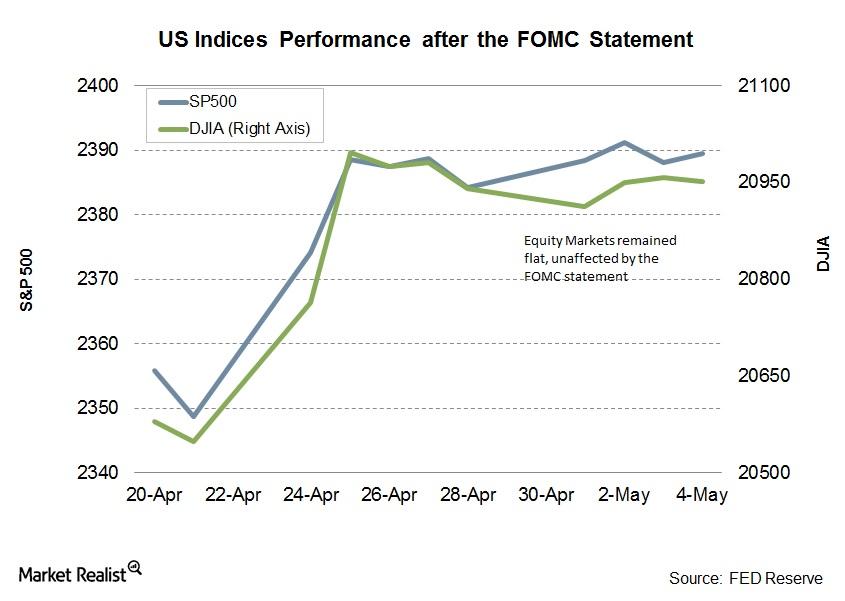

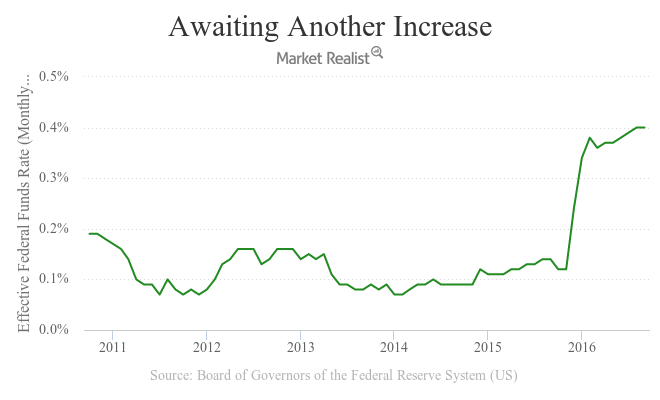

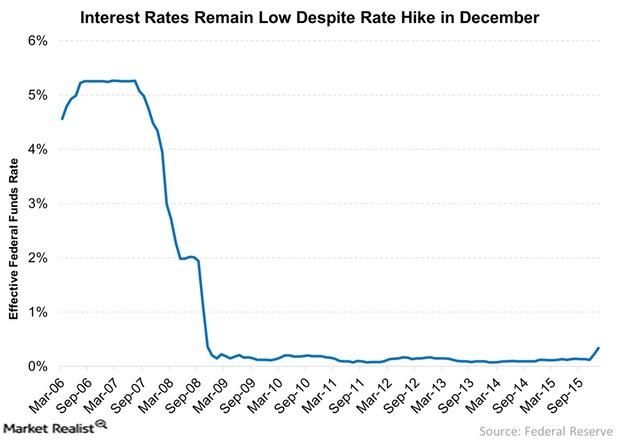

Why the FOMC Statement Didn’t Affect Equity Markets

Since the previous Fed meeting in March, where the Fed announced a 0.25% rate hike, equity markets (IWV) around the globe remained dovish.

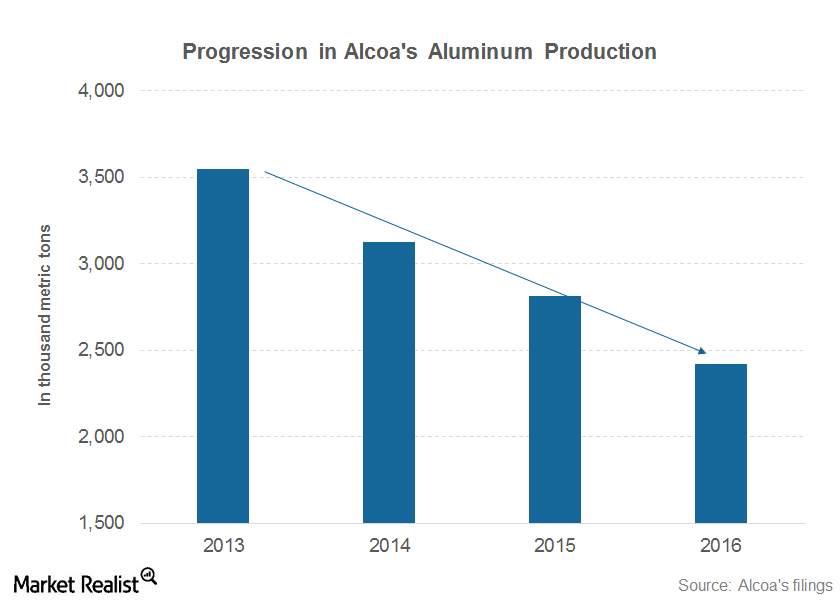

Could Wilbur Ross and Donald Trump Be Alcoa’s Saviors?

Alcoa and Century Aluminum (CENX) survives the commodity price slump by closing their high-cost capacities and negotiating better power deals for several operating plants.

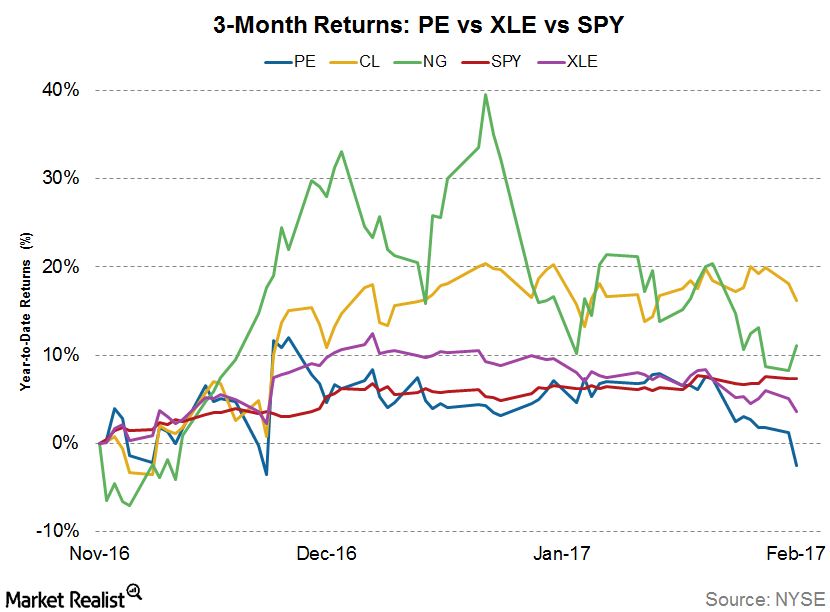

How Did Parsley Energy’s Stock React to Acquisition News?

Parsley Energy’s (PE) latest acquisition news came after markets closed on February 7, 2017.

Narayana Kocherlakota on Trump and the Federal Reserve

Narayana Kocherlakota, 12th president of the Federal Reserve Bank of Minneapolis, said central banks have been able to control inflation better when left alone by the government.

How Delayed Monetary Accommodation Can Cause a Recession

Retracting monetary accommodation on time is crucial as well. This was the chief reason why three dissents took place in the September FOMC.

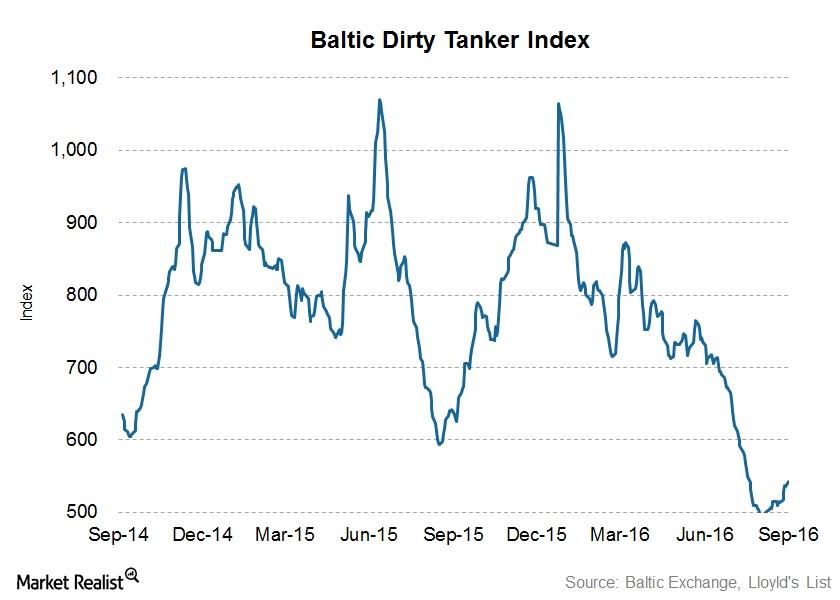

Performance of Baltic Dirty Tanker Index in Focus

The BDTI (Baltic Dirty Tanker Index) stood at 554 on September 12, 2016. For the week ended September 9 (Week 36), the BDTI rose to 542 from 516 at the beginning of the week.

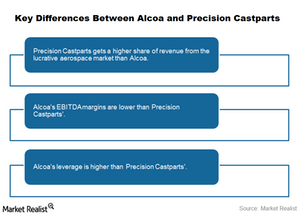

Arconic Isn’t Precision Castparts, and the Market Knows That!

Market participants who are bullish on Alcoa (AA) point to Berkshire Hathaway’s (BRK-B) acquisition of Precision Castparts.

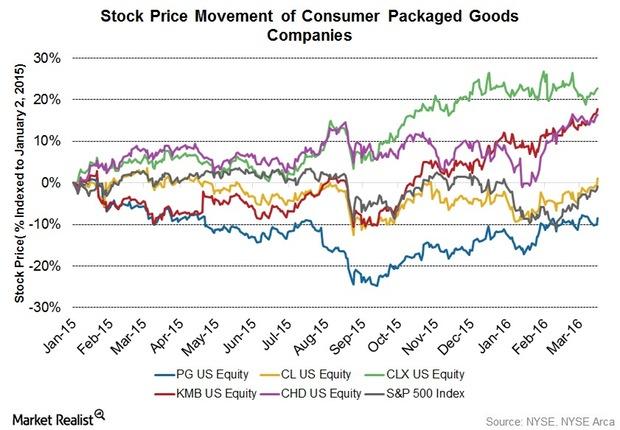

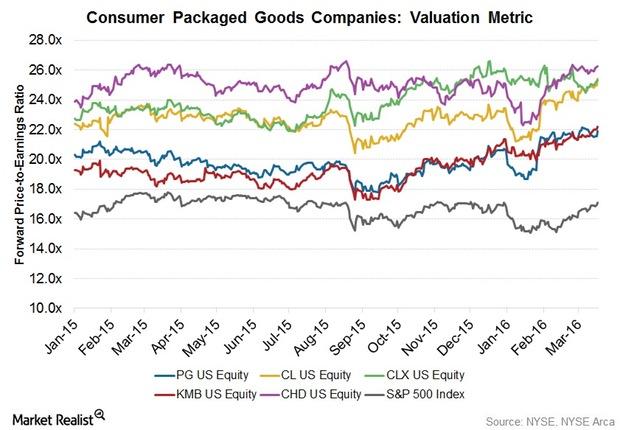

Valuation Multiples Higher for Consumer Packaged Goods in 1Q16

Consumer packaged goods (or CPG) companies are trading at higher valuations compared to the S&P 500 Index (IVV) (SPY) (VOO) and the Dow Jones Industrial Average (DIA).

Behind CPG Companies’ High Valuation Multiples in 4Q15

As of March 17, 2016, CPG companies were trading at higher valuations relative to the S&P 500 Index (SPY) and the Dow Jones Industrial Average (DIA).

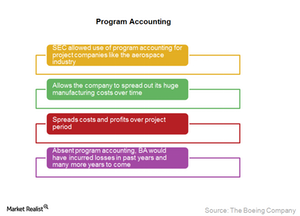

What Is Boeing’s Program Accounting Issue About?

Boeing (BA) uses program accounting, a technique that allows the company to spread out its huge manufacturing costs over time by cutting the cost per plane in the early stages of a project, and smoothening profit margins over time.

What Can You Expect from Markets in 2016?

While I don’t have a crystal ball, here are three things I believe all investors need to know about returns in 2016.

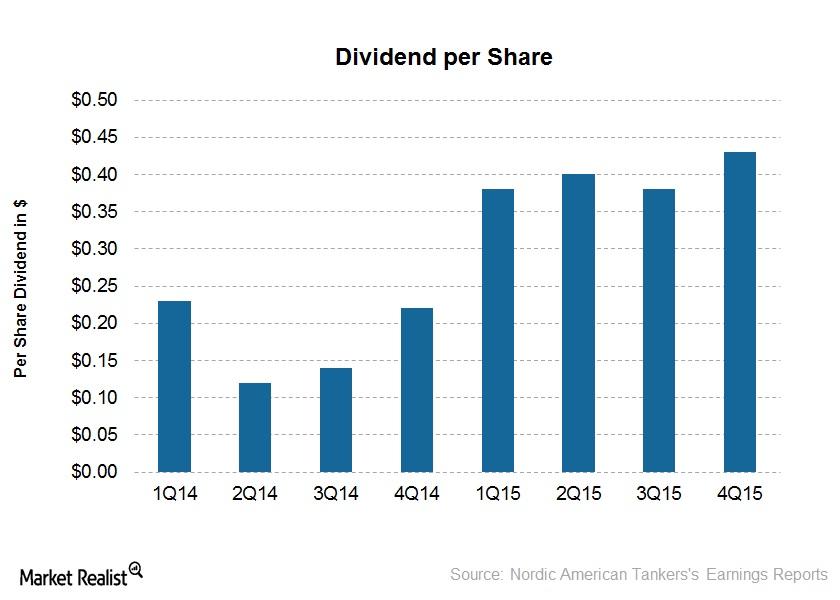

NAT’s Dividends: 74 Straight Quarters of Payouts to Investors

Nordic American Tankers’ (NAT) dividend yield has ranged from 6.3%–10.36% in the past four quarters. NAT had a dividend yield of 14.17% as of February 11, 2016, one of the highest dividend yields in the industry.

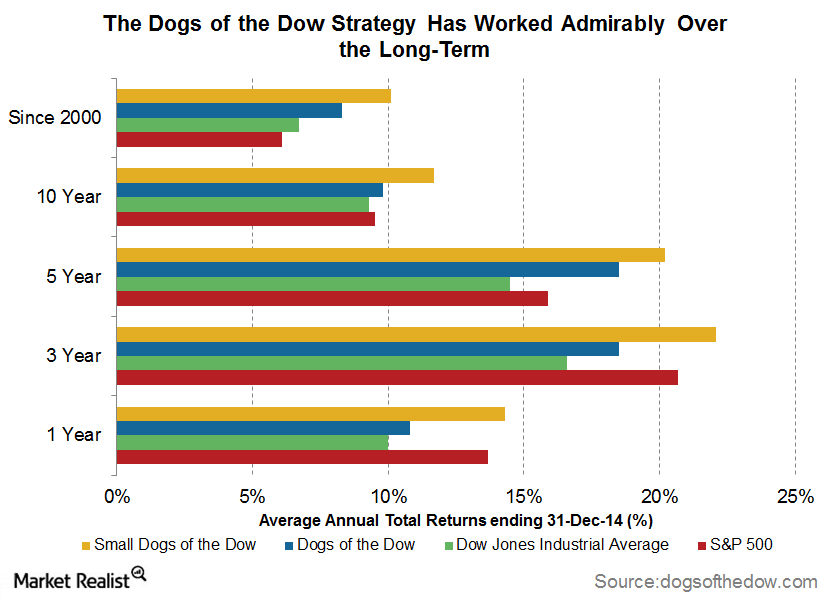

Dogs of the Dow: A Classic Investment Strategy

The Dogs of the Dow strategy involves ranking the 30 stocks comprising the Dow Jones Industrial Average index on the basis of their dividend yields and selecting the top ten.

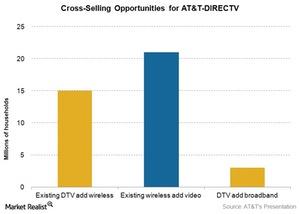

What Kind of Value Does Verizon See in Quad-Play Services?

Verizon’s (VZ) Marni Walden talked about how the company currently views quad-play offerings.

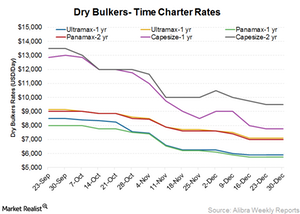

Dry Bulk Time Charter Rates Paint a Grim Picture

Time charter rates for dry bulk vessels have fallen considerably over the last few months. Capesize one-year rates have fallen by 40% in the last three months to $7,750 per day.

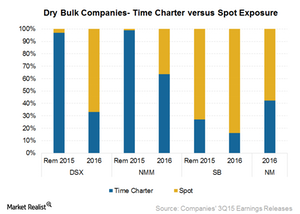

How Are Dry Bulk Companies Changing Their Chartering Strategies?

Navios Maritime Partners (NMM) and Diana Shipping (DSX) have a chartering strategy to charter the bulk of their vessels for the long term, thus holding high fixed-rate exposure.

P&G’s Gillette Files a Lawsuit against Dollar Shave Club

P&G alleges that Dollar Shave Club is violating Gillette’s intellectual property by selling its razors.

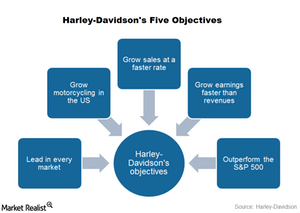

Harley-Davidson’s 5 Objectives: Investor Takeaways

In its 3Q15 earnings conference call, Harley-Davidson outlined five objectives for the company, including growing sales and outperforming the S&P 500 Index.

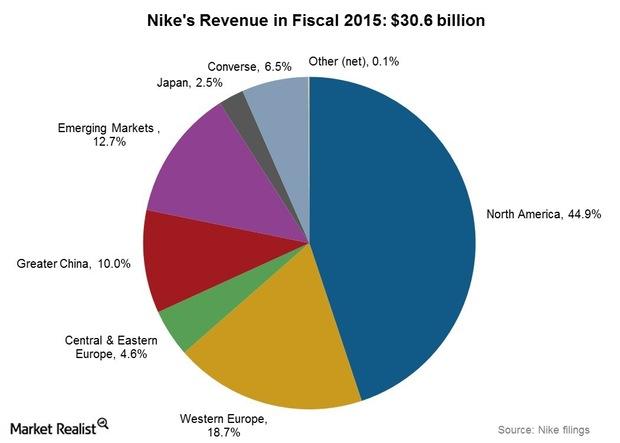

Can Nike Grow North American Sales to $20 Billion by 2020?

Performance for Nike and peers has been strong in North America over the past few years. The sports gear category has benefited from the improving US economy.

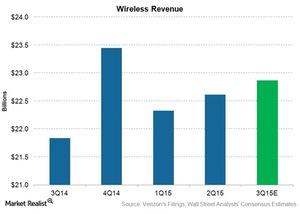

Verizon’s Wireless Revenue in 3Q15

Verizon’s wireline segment revenue decreased ~2.2% year-over-year to ~$9.4 billion during the quarter.

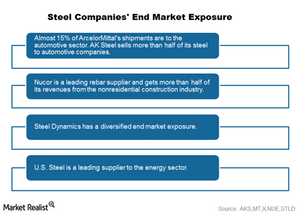

The Importance of Diversified End Market Exposure

Steel companies’ product portfolios and end market exposures can have significant impacts on company performance.

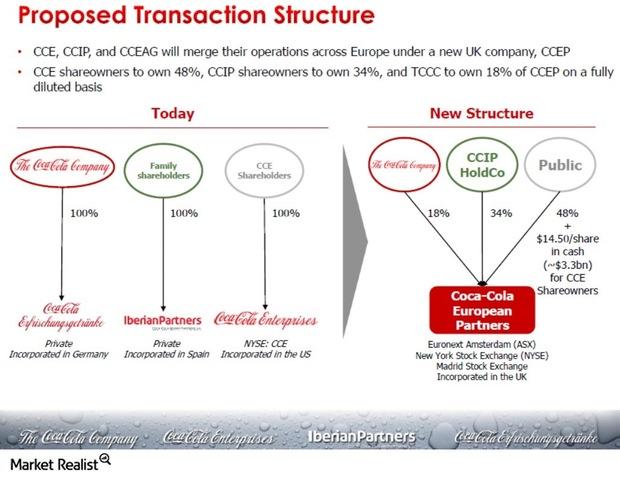

Coca-Cola Bottler Merger: Analyzing the Deal’s Economics

The new company, Coca-Cola European Partners PLC (or CCEP), would be based in the United Kindgom with CCE, CCIP, and The Coca-Cola Company (KO) holding 48%, 34%, and 18% of shares, respectively.

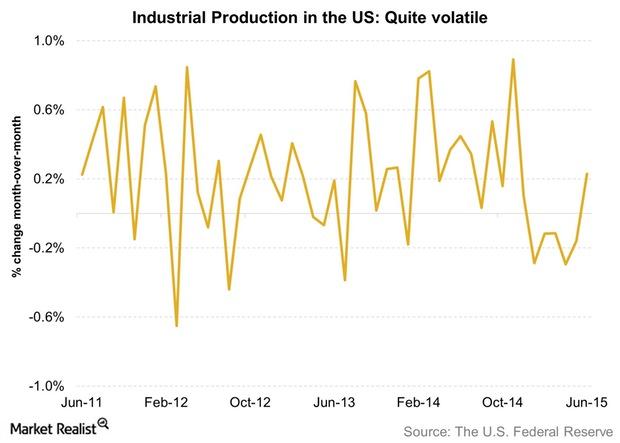

What Does Industrial Production Say about an Economy?

Industrial production—or in some cases, manufacturing production—provides important input about a nation’s economic output, irrespective of its business cycle.

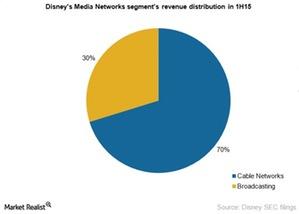

Disney’s Media Networks: The Largest Segment for Revenue

The Walt Disney Company’s (DIS) Media Networks segment is the company’s largest segment in terms of revenue. It had 45% revenue share in 1H15.

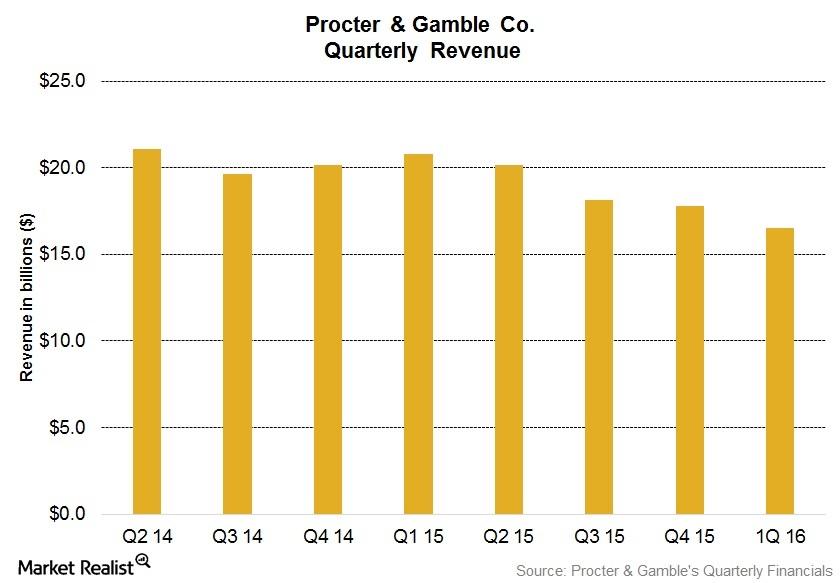

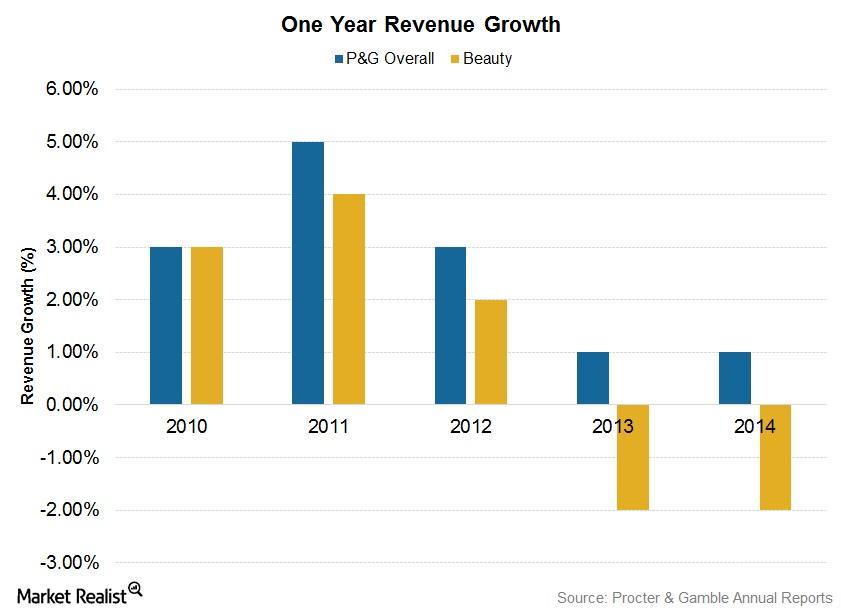

Procter & Gamble: Beauty Segment Sales Trail Overall Growth

Procter & Gamble’s Beauty segment includes products such as deodorants, cosmetics, personal cleansing, skin care, and hair care.

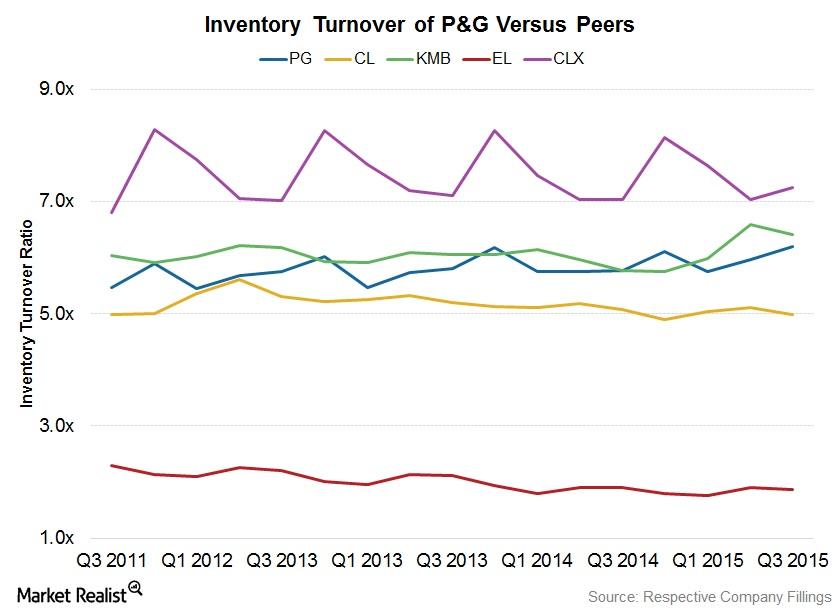

Procter & Gamble Supply Chain Initiatives Improve Productivity

In an effort to partially digitize its supply chain, P&G has introduced an automated re-ordering system. It maintains a count of inventory in stores and relays the information to its suppliers.

How Was Nike’s 4Q15 and 2014 Sales Performance in North America?

Nike’s sales performance was the strongest in the key markets of North America, Western Europe, and Greater China.

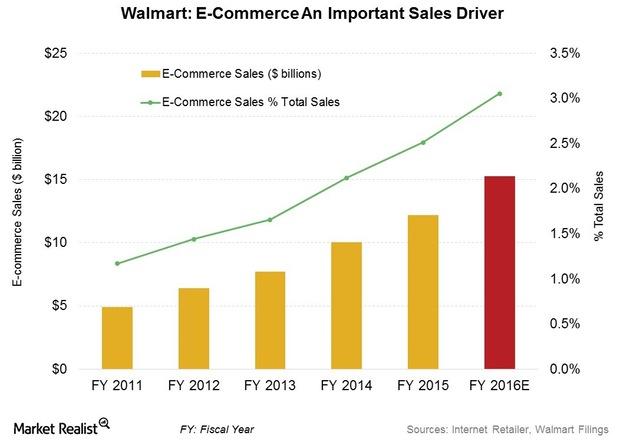

E-Commerce Should Spark Walmart’s Fiscal 1Q16 Performance

Walmart announced it was testing unlimited shipping for $50 per year, presenting significant competition to Amazon’s Prime service.