SPDR Dow Jones Industrial Average ETF

Latest SPDR Dow Jones Industrial Average ETF News and Updates

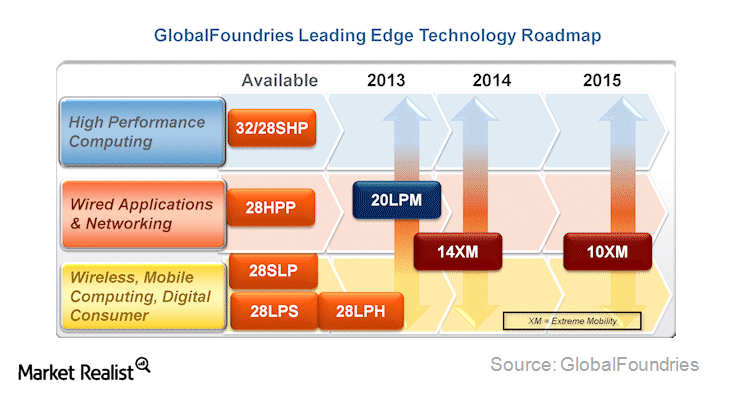

Why IBM sold its semiconductor division to Globalfoundries

In its 3Q14 results, IBM (IBM) announced the sale of its semiconductor operations to Globalfoundries. IBM will pay Globalfoundries $1.5 billion over next three years.Financials Key drivers affecting investment-grade bond funds flows

Bond yields and prices move in opposite directions. As a result, returns on high-quality corporate bonds were positive. This year, demand for U.S. investment-grade debt benefited from geopolitical tensions overseas and economic growth fears in the first quarter. This raised prices and lowered yields on high-quality corporate bonds.Financials Why you should pay attention to Scottish referendum opinion polls

As I write in my new weekly commentary, over the past two weeks, several polls have suggested a realistic chance that the people of Scotland will vote for independence in this week’s referendum.Financials Why the banking sector is better, but with room for improvement

Russ explains the good news behind his upgrade of the global financial sector as well as the bad news keeping his sector outlook somewhat subdued.

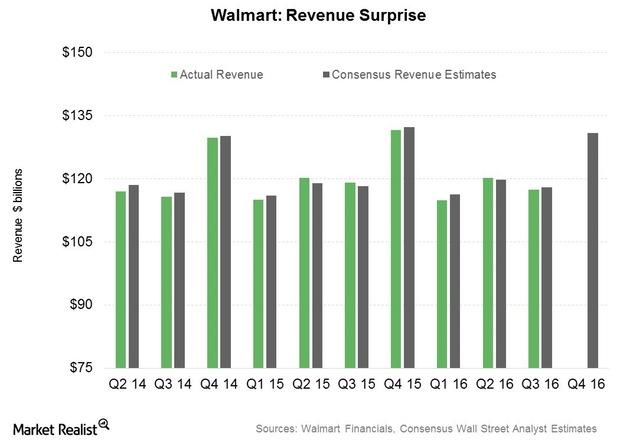

Why Foreign Currency Headwinds Have Hurt Walmart in Fiscal 2016

Adverse foreign currency movements due to an appreciating US dollar have reduced Walmart’s top line by $12.3 billion in the last three quarters.

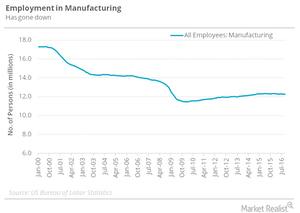

Why Krugman Doesn’t Understand the Focus on Trade All of a Sudden

Trade has been a key focus with respect to the US elections lately.

Why Tesla Chose Germany for Its European Gigafactory

In its Q3 results, Tesla said it would announce the location of its European Gigafactory before the end of this year. It fulfilled that promise yesterday.

Dow and S&P 500 Get Good News from the Economy

The Dow Jones Industrial Average and the S&P 500 have opened higher today. October’s non-farm payroll data came out, shattering expectations.

Dow Jones Futures Are Flat: Watch Out for Data!

Dow Jones Futures are pointing to a flat opening for the day. The flash PMI data and other economic data releases might impact markets today.

Dow Jones and SPY Trade Lower, Retail Data Disappoints

All of the major indexes and ETFs are trading lower today. The Dow Jones Industrial Average has fallen by 44 points or 0.16% at the time of this writing.

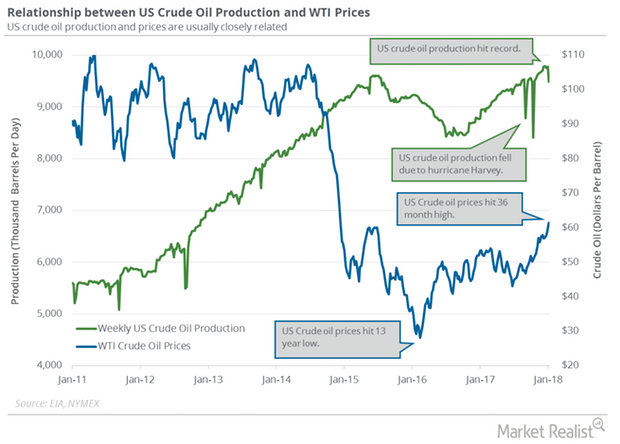

Will US Oil Production Pressure Crude Oil Futures?

February WTI crude oil futures contracts fell 0.9% to $63.73 per barrel on January 16. Brent oil futures fell 1.6% to $69.15 per barrel on the same day.

China’s De-Dollarization amid Trade War: Gold’s Upside?

China continued buying gold for the tenth consecutive month in September. The country also continued its de-dollarization bid.

Trade War Hits Consumer Confidence, Stocks Retreat

Today, the Consumer Confidence Index data fell sharply to 125.1 in September from August’s 134.2. The reading was below the expected 133.5.

Gundlach Discussed the Fed, Trade Deal, and Gold

Gundlach thinks that we’ve already seen a bottom in interest rates for 2019. US Treasury yields have been hitting lows in 2019.

Could Apple and Microsoft Lead a Market Rally?

Jim Cramer believes Apple and Microsoft stocks are ready to boost equity markets to new highs. Both stocks’ market cap has crossed the $1 trillion mark.

Dow Jones Index Falls after Rising for Eight Days

The Dow Jones Industrial Average Index has fallen 0.4% or by 115 points today. The index is trading lower after rising for eight consecutive trading sessions.

Boeing 777X Failed a Stress Test, More 737 MAX Concerns

In another setback, Boeing’s (BA) long-haul and wide-body 777X variant failed a stress test. The test was part of the FAA’s certification process.

JPMorgan and Bank of America: Time to Buy Stocks

In August, JPMorgan Chase (JPM) and Bank of America Merrill Lynch (BAC) suggested that investors not buy just yet. Their opinions are now changing.

Trump, Trade War, Powell: More Upside for Gold Prices?

Gold hit a fresh six-year high on Friday as trade tensions between the US and China escalated. The SPDR Gold Shares ETF (GLD) closed up 2%.

JPMorgan and BofA: Don’t Buy the Market Dip Just Yet

JPMorgan Chase suggests waiting until September before returning to stocks. The markets will likely make new all-time highs in the first half of 2020.

Ackman Makes Berkshire Bet: What It Means for Investors

According to the regulatory filing from Bill Ackman’s Pershing Square Capital, the fund has taken a new stake in Berkshire Hathaway (BRK.B).

Dow Jones, Boeing, and GE Fall: Hard Landing Ahead?

On Wednesday, US stock indexes fell due to recession signals. The Dow Jones Industrial Average (DIA) was the worst performer with a 3.05% fall.

How Could a Recession Affect the US Auto Industry?

Auto stocks and the US equity market slumped with fresh fears of an economic recession. Today, the Dow Jones Industrial Average fell more than 600 points.

Morgan Stanley Sees Ford’s Dip as a ‘Buying Opportunity’

Yesterday, Morgan Stanley upgraded Ford Motor Company stock from “equal weight” to “overweight” and increased its target price.

Morgan Stanley Is Skeptical about the S&P 500’s Upside

Morgan Stanley doesn’t believe the S&P 500’s current breakout above 3,000 will last. It also doesn’t expect Fed rate cuts to rekindle growth.

Why Ray Dalio’s Bridgewater Is Underperforming in 2019

Pure Alpha, the flagship fund of Ray Dalio’s Bridgewater Associates, fell 4.9% in the first half, the Financial Times reported.

Oil Prices: Implied Volatility Suggests Upside Is Intact

On June 27, US crude oil’s implied volatility was 33.7%—12.7% below its 15-day average. Lower implied volatility might support oil prices.

Caterpillar Got a Downgrade, Global Growth Stalled Last Week

Atlantic Equities downgraded Caterpillar (CAT) from “neutral” to “underweight.” Atlantic Equities analyst Richard Radbourne also lowered Caterpillar’s earnings estimates for fiscal 2019 and fiscal 2020.

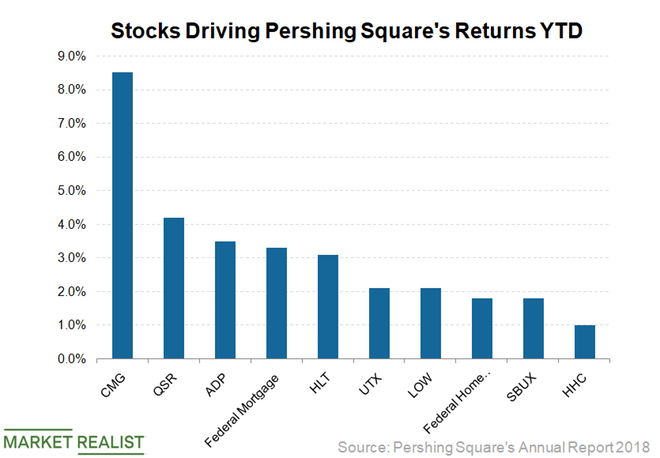

Bill Ackman Thanks Warren Buffett for His Fund’s Comeback in 2019

Bill Ackman has made a huge comeback in 2019.

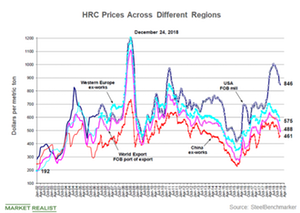

What China’s Steel Price Trends Could Mean for Iron Ore Miners

Bumper margins prompted Chinese steel mills to continue increasing their output.

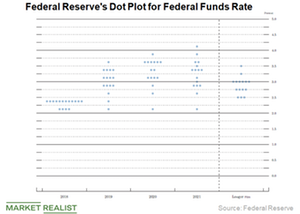

Powell’s Speech Ignites a Rally in Equities and Metals

Markets had been worried about the Fed’s continued aggressive stance on rate hikes, which could shorten economic expansion.

3M’s Unfunded Pension Funds: Analyzing the Trend

3M offers pension and post-retirement benefit plans to its employees. The company has more than 75 defined benefit plans in 27 countries.

Is the Market Worried about an Overheating US Economy?

Federal Reserve Chair Jerome Powell’s speech did little to assuage investors’ concerns regarding the overheating of the US economy.

Cold War 2.0: Why It Looks Like a Real Possibility

The trade war is expected to be a long-term affair, according to several observers including Alibaba’s (BABA) Jack Ma.

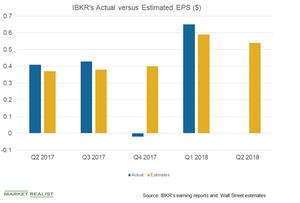

Brokerages in 2018: What to Expect

The final week of the second quarter might help brokerages, primarily because of higher client participation.

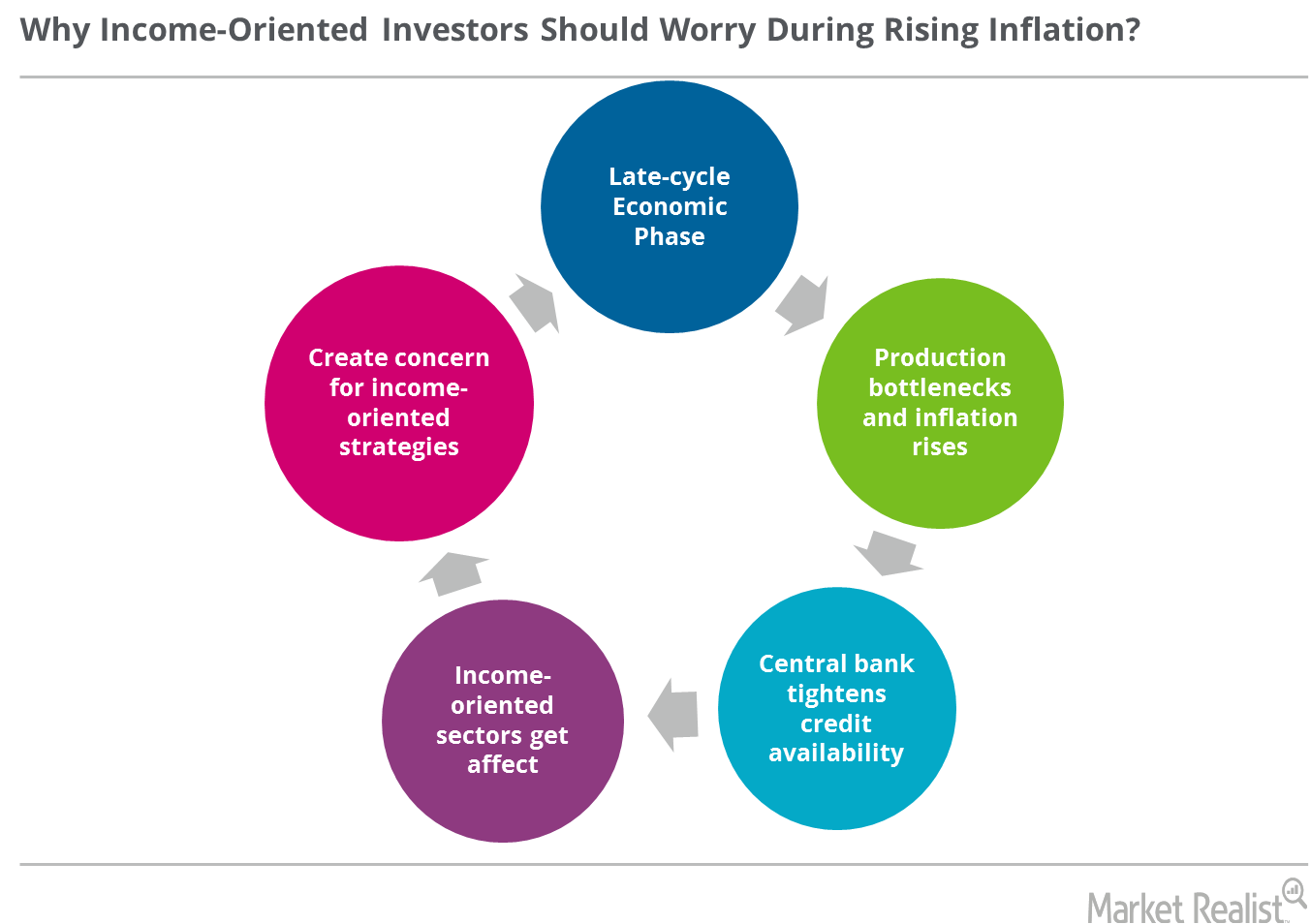

Bernstein: Income-Oriented Investors Should Worry about Inflation

In the late-cycle phase, production activity shows blockages, inflation shoots up, and the central bank tightens credit availability.

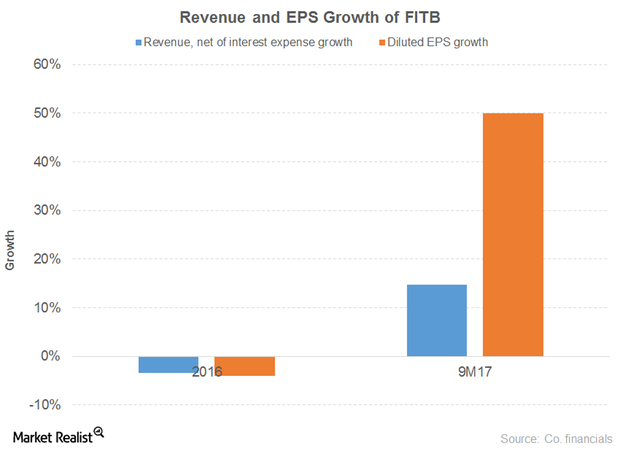

How Fifth Third Bancorp Has Performed Recently

Fifth Third Bancorp has an impressive free cash flow position.

A Look at Bank of America’s Key Growth Drivers

Bank of America’s dividend yield of 1.5% and PE of 20.6x compares to a sector average dividend yield of 2% and PE of 20.7x.

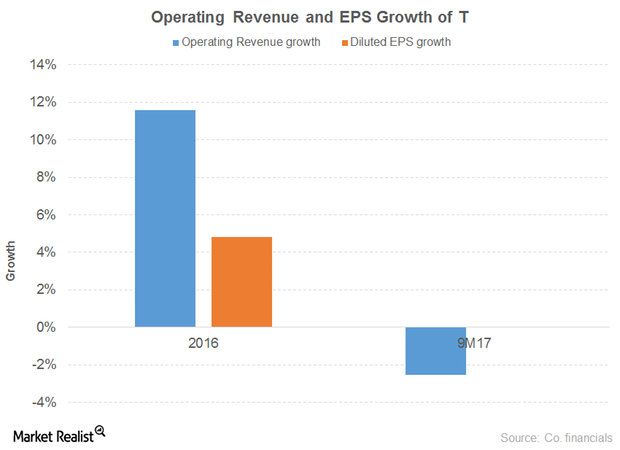

How AT&T Is Preparing for the Price War

AT&T’s cost of revenue rose 15% in 2016 before decreasing 1% in 9M17. That led to a 9% growth in gross profit for 2016 before falling 4% in 9M17.

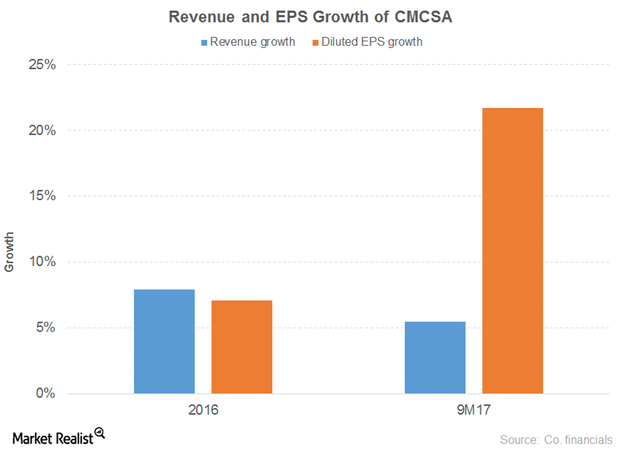

A Look at Comcast’s Strategy

Comcast’s (CMCSA) revenue grew 8% and 5% in 2016 and 9M17, respectively. The broadcast of the Rio Olympics in 3Q16 drove the 2016 numbers.

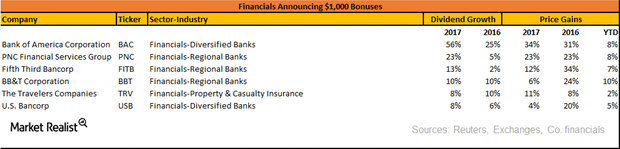

Which Stocks Have Announced $1,000 Bonuses?

In this series, we’ll be taking a look at the companies that have announced $1,000 dollar bonuses, pay raises, increased dividends, and buybacks in the last two months.

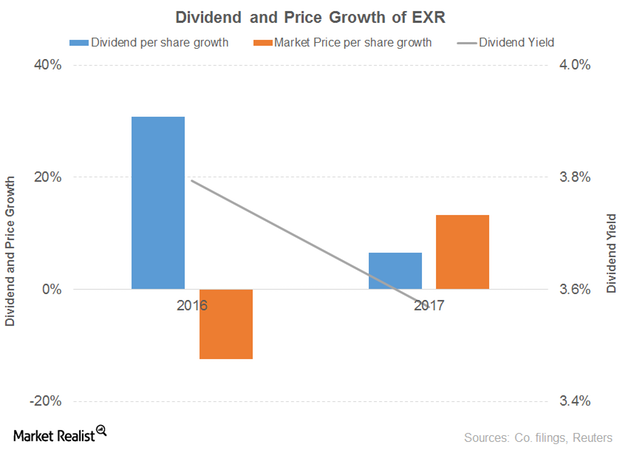

What’s the Outlook for Extra Space Storage?

Extra Space Storage’s (EXR) revenue grew 27% and 13% in 2016 and 9M17, respectively.

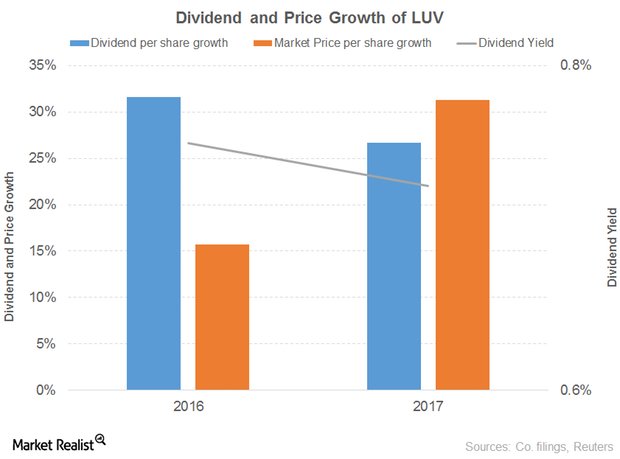

Here’s What Influenced the Outlook for Southwest Airlines

Southwest Airlines’ (LUV) operating revenue grew 3% and 4% in 2016 and 9M17, respectively.

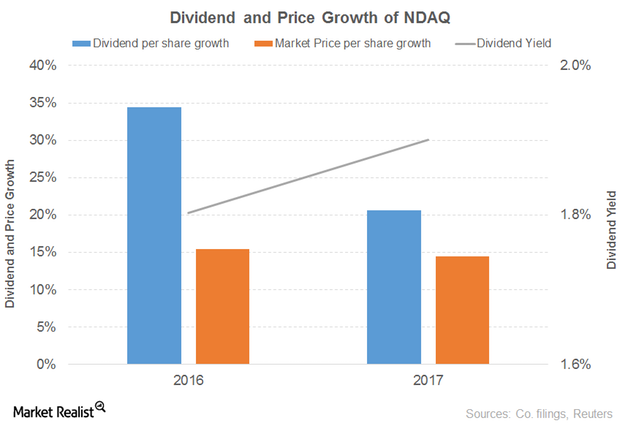

What’s behind the Outlook for Nasdaq?

Nasdaq (NDAQ) revenue rose 9% and 8% in 2016 and 9M17, respectively.

These Factors Are Contributing to Gilead Sciences’ Weak Outlook

Gilead Sciences’ (GILD) revenue fell 7% and 13% in 2016 and 9M17, respectively. The fall was due to lower product sales. Both antiviral products and other products recorded declines in both the periods.

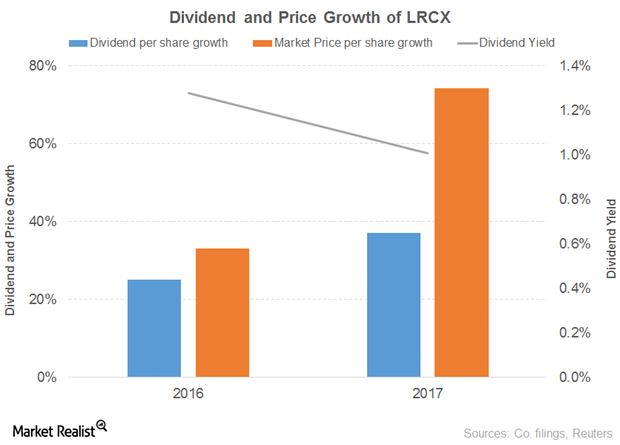

What’s Contributing to Promising Outlook for Lam Research?

Lam Research’s (LRCX) revenue rose 12% and 36% in 2016 and 2017, respectively. It rose 52% in 1Q18.

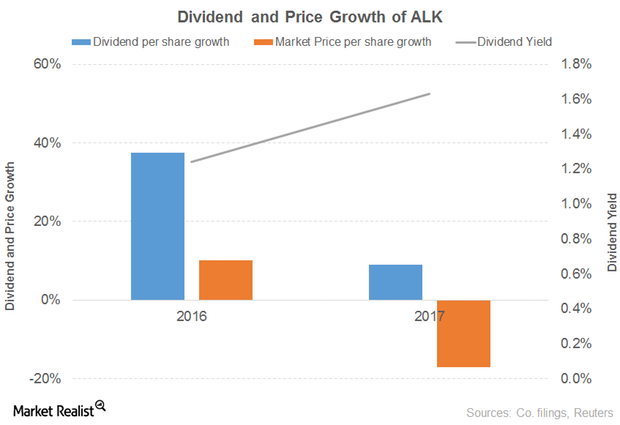

What’s the Outlook for Alaska Air Group?

Alaska Air Group’s (ALK) operating revenue rose 6% and 35% in 2016 and 9M17, respectively.

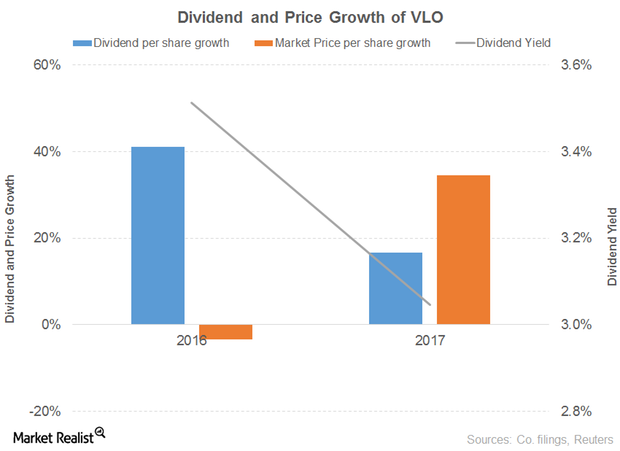

What Has Influenced the Outlook for Valero Energy?

Valero Energy’s operating revenue fell 14% in 2016 before rising 23% in 9M17. Refining revenues drove the decline in 2016, offset by ethanol revenues.

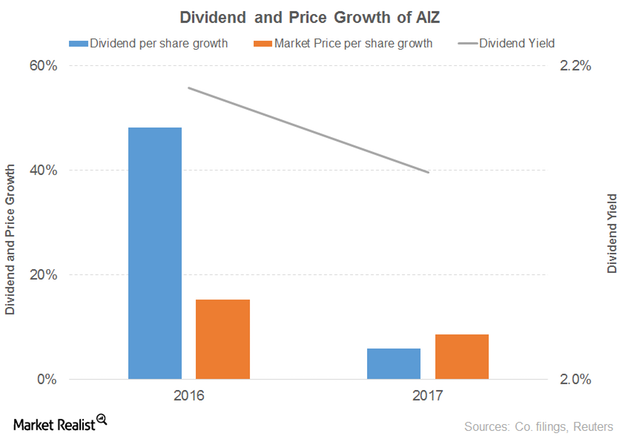

Why Assurant Has a Positive Outlook despite a Weak 2017

Assurant’s (AIZ) revenue fell 27% and 18% in 2016 and 9M17, respectively.

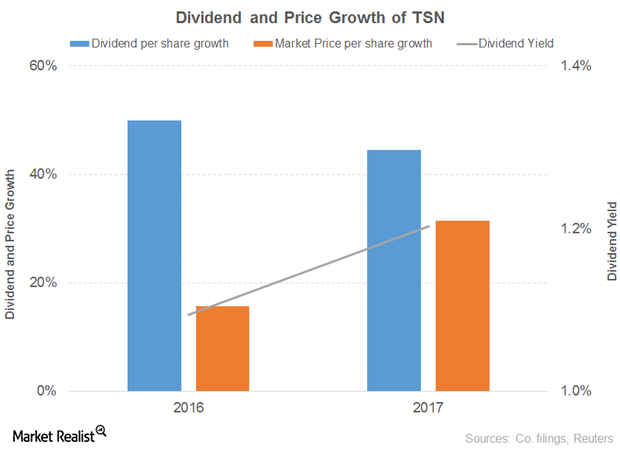

What’s the Outlook for Tyson?

Tyson Foods’ (TSN) sales dropped 11% in 2016 before gaining 4% in 2017.