Dogs of the Dow: A Classic Investment Strategy

The Dogs of the Dow strategy involves ranking the 30 stocks comprising the Dow Jones Industrial Average index on the basis of their dividend yields and selecting the top ten.

Jan. 14 2016, Published 12:25 p.m. ET

Origin of the Dogs of the Dow

The Dogs of the Dow investment strategy was popularized by Michael B. O’Higgins in Beating the Dow, his 1991 book with John Downes. O’Higgins, currently the president and chief investment officer of O’Higgins Asset Management, was widely considered one of the top money managers when he came out with the book. The strategy involves ranking the 30 stocks comprising the Dow Jones Industrial Average index on the basis of their dividend yields and selecting the top ten. An equal dollar amount is attributed to each of these ten high-dividend-yielding stocks, and the portfolio should be rebalanced annually.

The rationale behind the theory

The rationale behind the Dogs of the Dow investment strategy is simple. The universe of selection is limited to the 30 stocks comprising the Dow Jones Industrial Average index (or DIA). These stocks are of well known, large companies with vast financial resources and robust track records. They are widely considered resilient during down times and economic stress and thus make for solid investments.

The strategy focuses on identifying the “Dogs”—undervalued companies that are currently out of favor with the markets. O’Higgins used dividend yields (current annual dividend per share divided by share price) to identify these companies. He propagated dividend yields to be a better and more effective indicator of a company’s actual worth than book values and price-to-earnings ratios. He argued that price-to-earnings ratios and book values are subject to distortions on account of short-term earnings fluctuations and varying accounting interpretations. Dividend yields, on the other hand, tend to remain stable and are thus a more appropriate measure than share prices.[1. “Blue Chip Value Investing: Dogs of the Dow” by Maria Crawford Scott, July 1998]

O’Higgins implies that dividend yields increase in the short term when the stock is oversold and the market doubts the immediate prospects of the company. However, over the long term, the prices are driven back up if the dividend stream remains robust and the companies start recovering from their down times. Investing in the strategy aims to benefit from both the high dividend yield of the stock and the price appreciation as it regains favor in the markets. So every year, investors invest in high-quality, out-of-favor stocks in hopes that they will regain their swagger in the next year.

What if high dividend yields actually depict real problems unlikely to go away? O’Higgins and Downes explain this away, too. They believe that Dow stocks have an enormous market presence and are constantly analyzed and scrutinized, making the possibility of a surprise financial adversity extremely rare.[2. “Blue Chip Value Investing: Dogs of the Dow” by Maria Crawford Scott, July 1998]

Moreover, in case of a black swan event, the companies have the resources and wherewithal to weather the storm. O’Higgins and Downes highlight the cases of the Union Carbide (DOW) Bhopal gas tragedy and the Valdez Exxon oil spill, both unanticipated financial risks that the companies were able to weather over the long term.[3. Maria Crawford Scott, Michael B. O’Higgins]

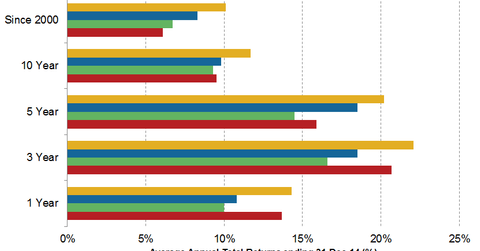

Historical performance of the Dogs of the Dow

The Dogs of the Dow strategy has performed well over the long term. The strategy clocks a decent 9.8% return over a ten-year period and 18.5% over a five-year period. The strategy beats both the S&P 500 (VOO) (IVV) and the DJIA (Dow Jones Industrial Average), which have returned an average of 9.3% and 9.5%, respectively, over the ten-year period and 15.9% and 14.5%, respectively, over the five-year period.[3. dogsofthedow.com] The small Dogs of the Dow, or the five Dogs with the lowest share price, have outperformed all three, as you can see in the above graph.