Shelly Vinson

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Shelly Vinson

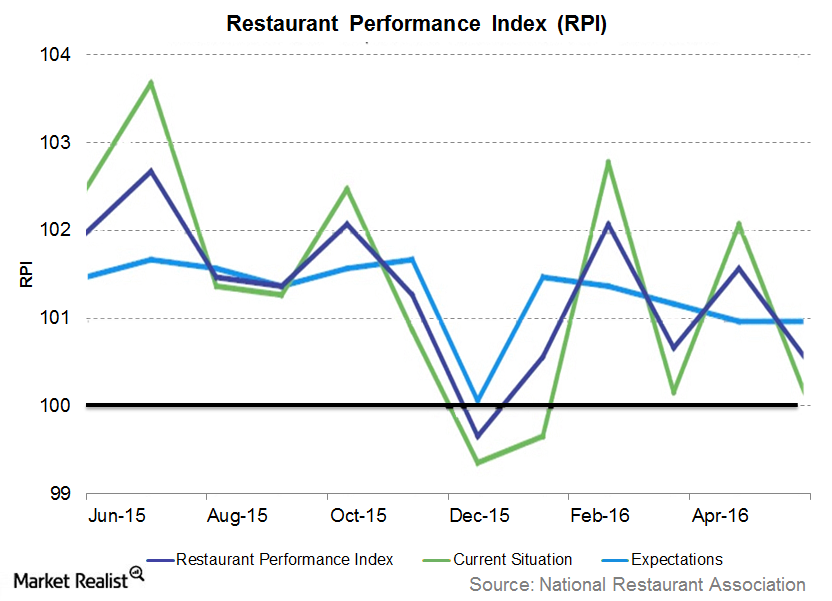

Investing in Restaurant Stocks: Tailwinds and Challenges

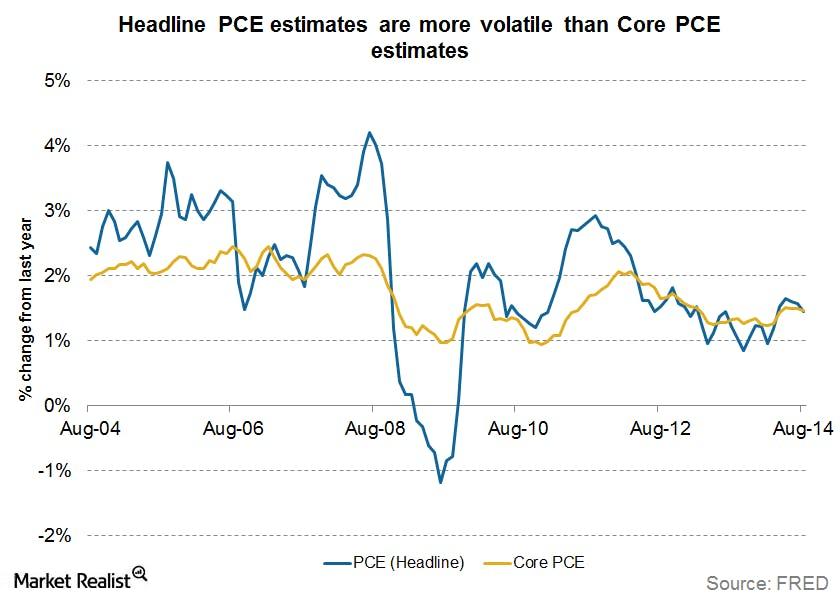

You could consider investing in restaurant stocks, given the solid fundamentals in the sector and the macroeconomic tailwinds favoring the industry.Financials Key differences between PCE and CPI as inflation measures

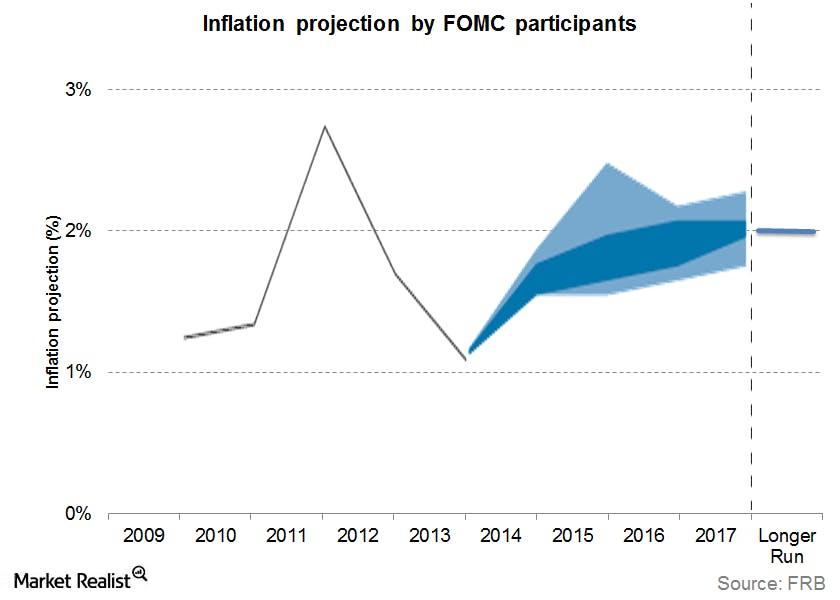

The CPI and PCE are both important indicators of U.S. inflation. CPI is more important from an individual perspective, while PCE is more important for monetary policy.

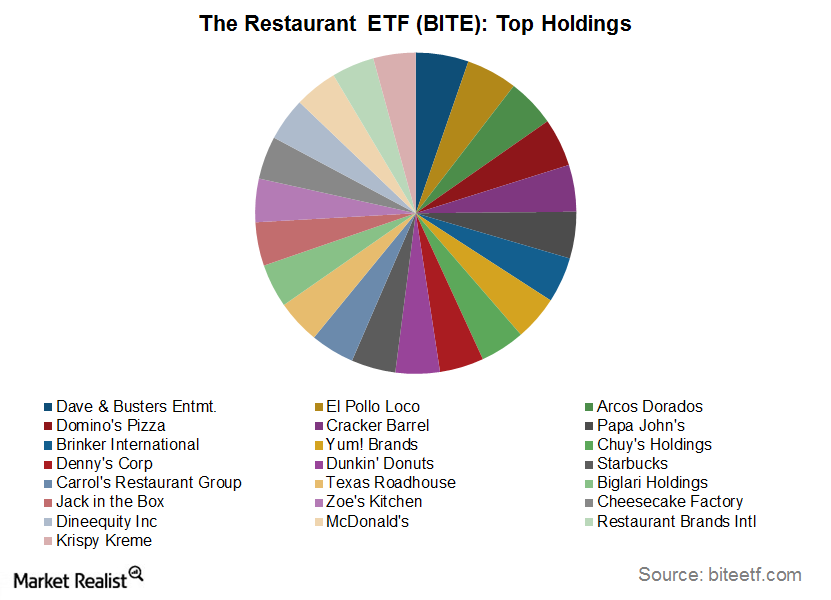

Everything You Need to Know about the BITE ETF

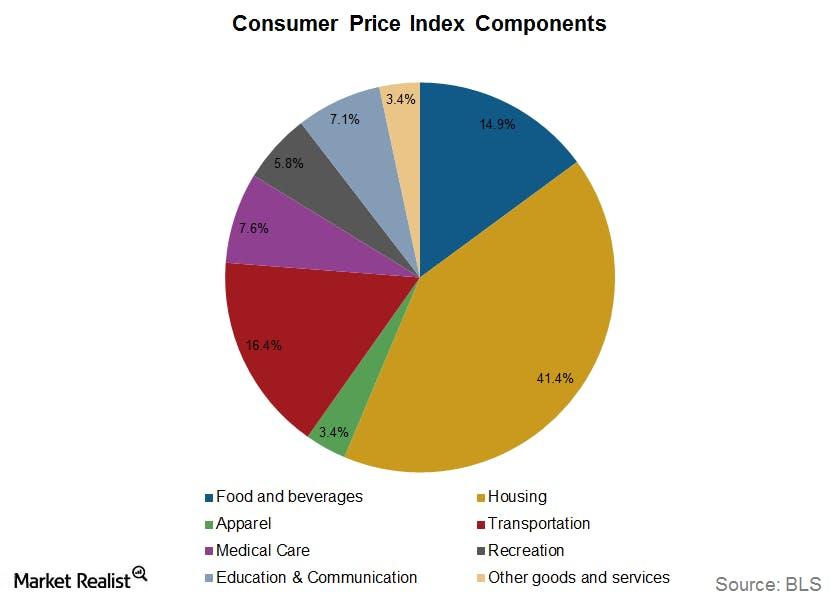

To reap the rewards at both ends of the spectrum, a fund like the Restaurant ETF (BITE) could come in handy!Must-know fundamentals about the US Consumer Price Index

The Bureau of Labor Statistics (or BLS) developed the U.S. CPI in 1913 to measure the change in prices.Why US inflation data is important and how we measure it

U.S. inflation is not just a measure of growth and price pressure in the U.S. economy. It has more far-reaching consequences.Why personal consumption expenditure is important to investors

The U.S. Bureau of Economic Analysis issues PCE data, and the price index is a measure of the average increase in prices for all domestic personal consumption.

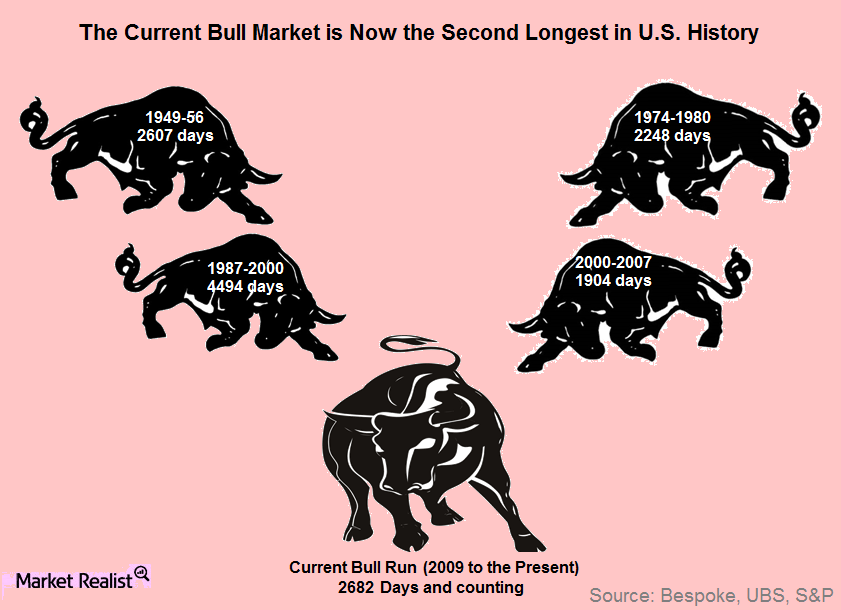

Investors Are Worried about an Impending Squall

Inverse ETFs can help protect against a squall US stocks bumped up against all-time highs again this year. After hitting a new intraday high of 2,178 on August 1, the S&P 500 was unable to hold onto the gains. Sector performances offer a glimpse of where we are in the market cycle. The top performing […]

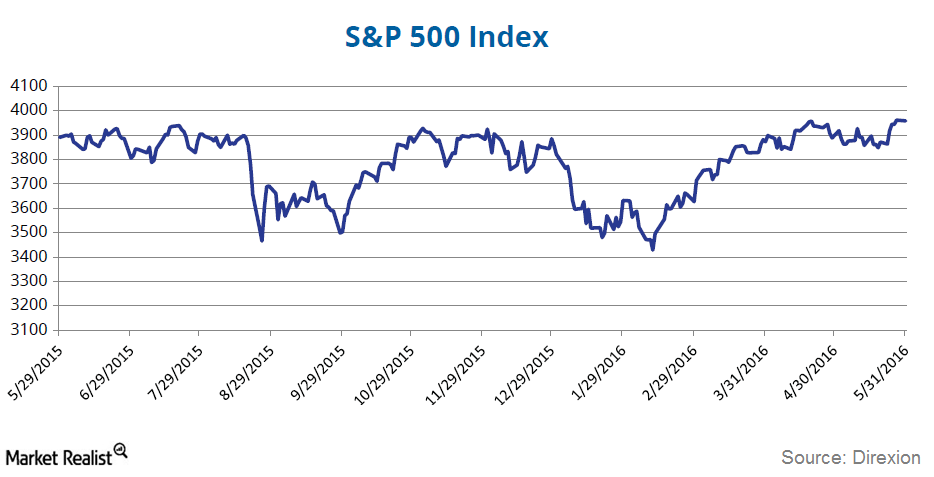

Where Is the Market Headed: Double Bottom? Triple Top?

Double bottom? From a technical standpoint, the current environment may have been viewed as either bullish or bearish. Those on the bull side of the equation took heart in a technical indicator known as the double bottom. The double bottom reversal is a bullish reversal pattern that traders use to anticipate possible upside movements. As its […]

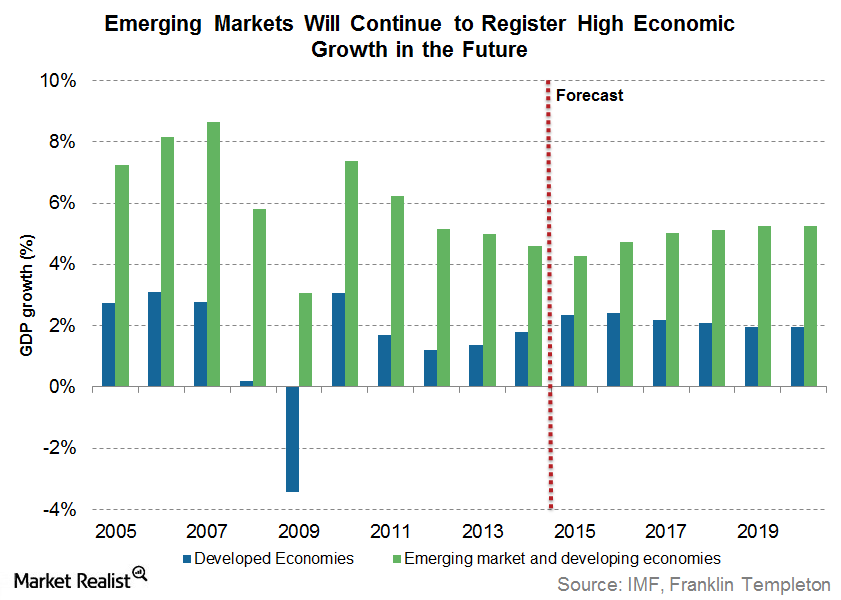

Market Focus: Time to Retest Emerging Market Waters

Emerging markets (VWO) have been on a tear this year! The past few years saw the asset class languish under fears of an economic downturn in China (YINN)(FXI), a US rate hike by the Federal Reserve, current account deficits, and currency volatility.

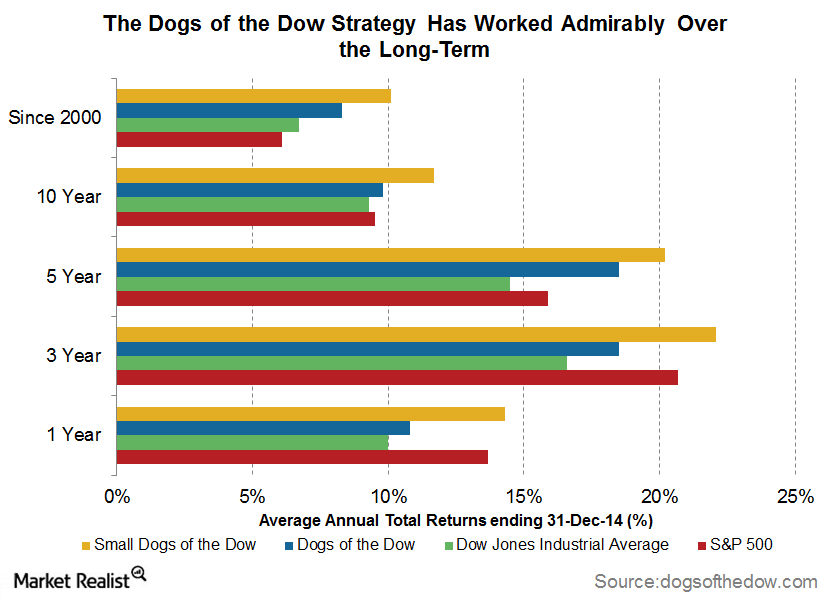

Dogs of the Dow: A Classic Investment Strategy

The Dogs of the Dow strategy involves ranking the 30 stocks comprising the Dow Jones Industrial Average index on the basis of their dividend yields and selecting the top ten.