Vanguard S&P 500 ETF

Latest Vanguard S&P 500 ETF News and Updates

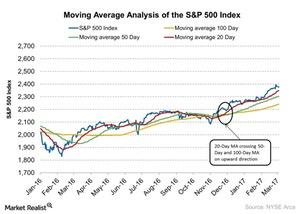

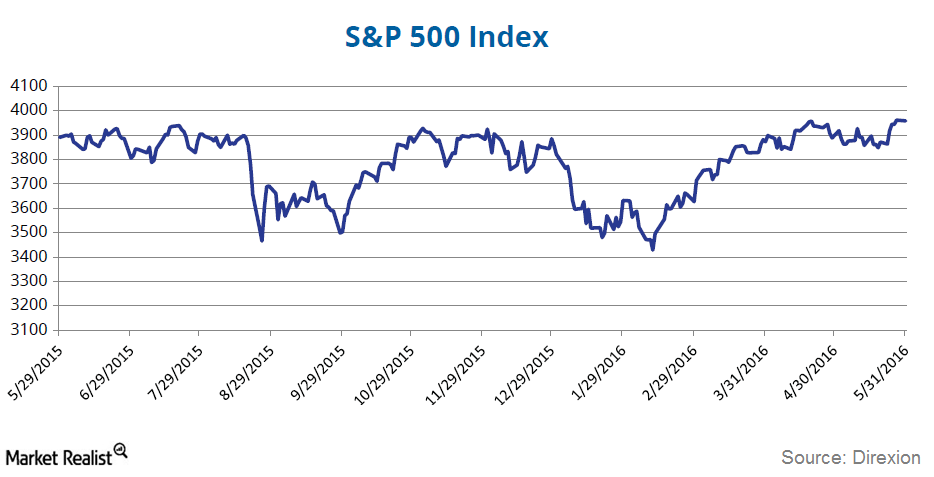

What S&P 500 Index Moving Averages Could Indicate

The S&P 500 Index is trading 1.2% above its 20-day moving average and 6% above its 100-day moving average.

Will We See a Recession within the Next 2 Years?

In a recent interview, Jim Rogers said, “I’m on record as saying that we’re going to have a recession certainly within a year or two.”

Why Larry Fink Thinks Markets Could See Some Setbacks

In a recent interview with CNBC, Larry Fink, CEO of BlackRock (BLK), shared his views on market movement, the US economy, and the dangerous impact of the lower interest rates.

Why Investors Are Optimistic about Tech Stocks

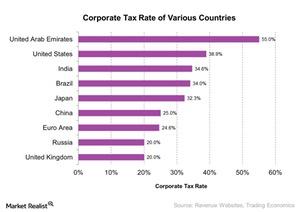

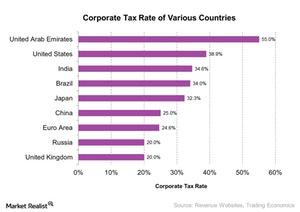

The tech sector’s competitive edge So far in this series, we’ve discussed the potential effects of Trump’s proposed tax reform on prominent tech stocks such as Apple (AAPL), Microsoft (MSFT), IBM (IBM), and Amazon (AMZN). Tech companies continue to be preferred by investors due to their proprietary technological expertise and large cash balances. Their technical […]

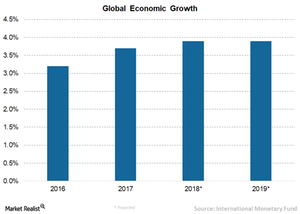

Are Tougher Days ahead for Global Equities?

The IMF revealed that emerging Asia is expected to grow ~6.5% in 2018 and 2019.

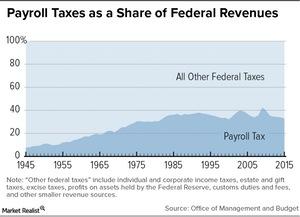

Why Buffett Believes US Businesses Aren’t Really Hurting from the US Corporate Tax

The US economy has been improving gradually, but some businesses in the US have suffered a lot over the years.

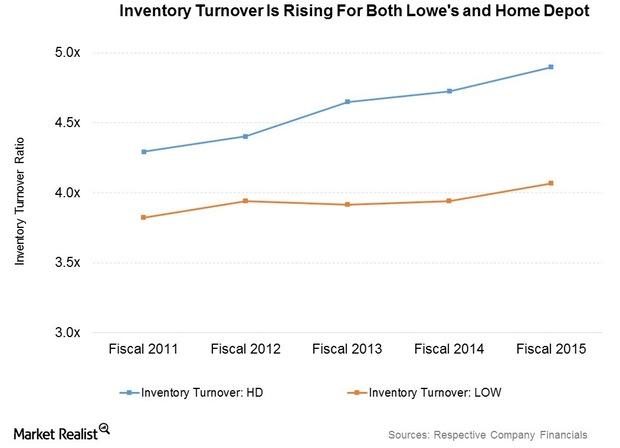

What Are Lowe’s Supply Chain and Inventory Management Policies?

Lowe’s inventory turnover came in at 4.1x in fiscal 2015 compared to 4.9x for Home Depot (HD).

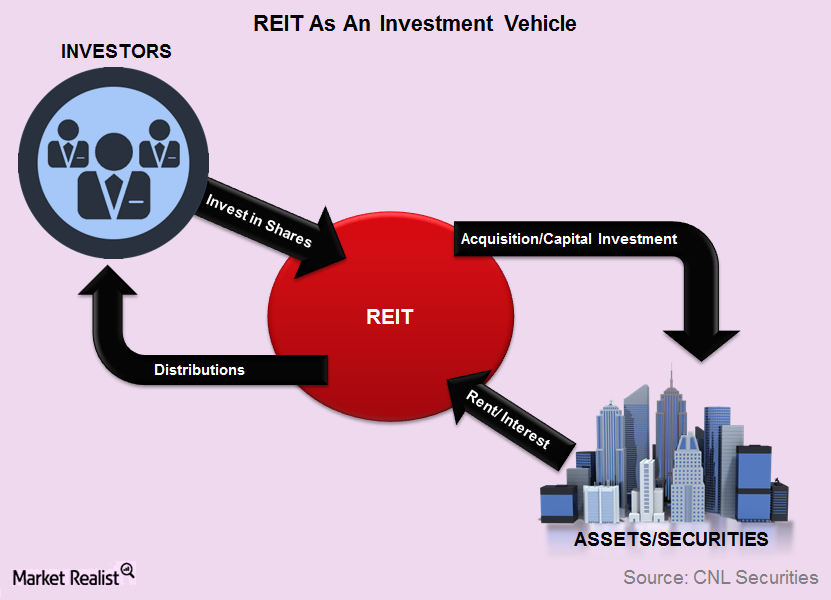

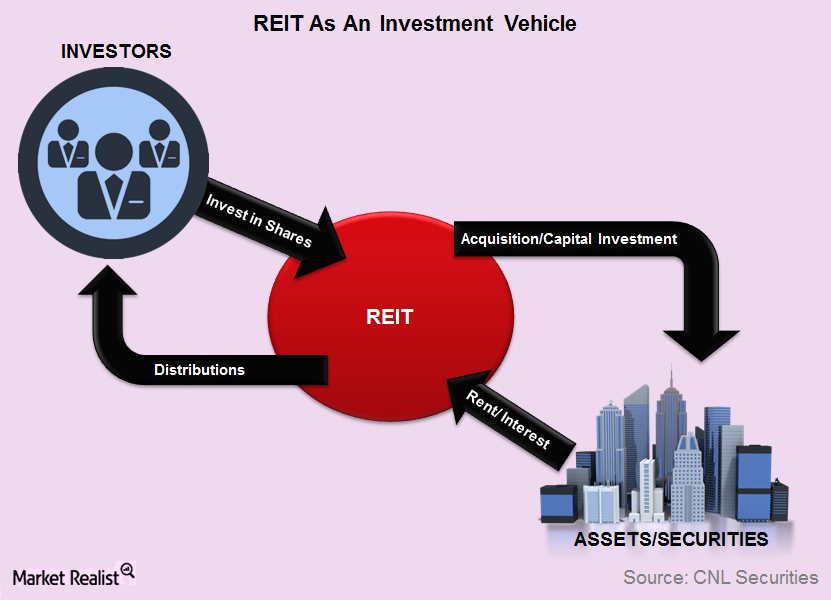

REITs 101: Understanding this Investment Vehicle

In this series, we’ll get down to the brass tacks of investing in the REIT sector, the market’s current landscape, and the benefits you can expect from this type of investment.

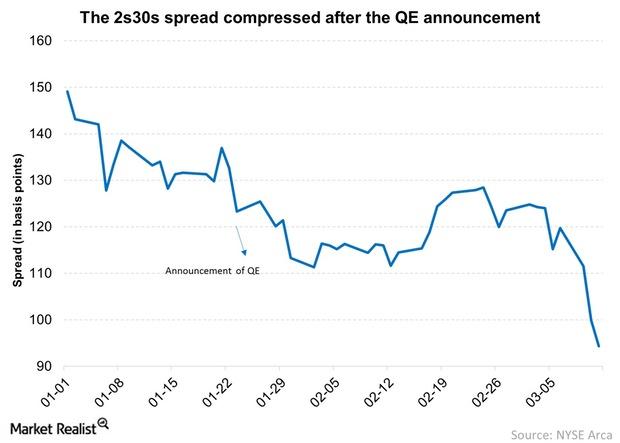

Why Did the German 2s30s Spread Dip on Quantitative Easing?

The 2s30s spread is the difference between the yield on the 30-year bond (TLT) and the yield on the two-year bond (SHY).

We’re in ‘an Environment of Abnormally Slow Growth,’ Says Dalio

This isn’t a normal business cycle Billionaire hedge fund manager Seth Klarman said, “the stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.” Ray Dalio believes that this isn’t a normal business cycle. In our April 2015 series Business Cycle Investing: What Should You Look […]

REITs 101: Understanding this Vehicle

By Michael Orzano, Director, Global Equity Indices Publicly traded property stocks, including real estate investment trusts (or REITs) and real estate operating companies (or REOCs), allow investors to gain exposure to real estate, which is generally an illiquid asset class, without sacrificing the liquidity benefits of listed equities. They also typically offer higher yields than […]

Which International Opportunities Is Lowe’s Betting On?

Lowe’s (LOW) operates stores in the select international markets of Canada and Mexico.

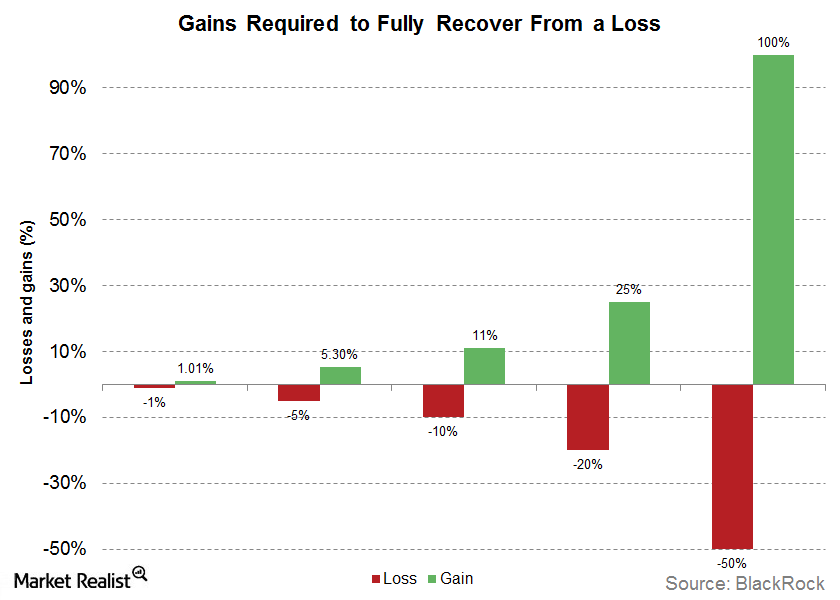

How You Can Win More By Losing Less

Most investors focus much of their time on picking assets that have the potential to win. However, limiting downside risk is just as important.

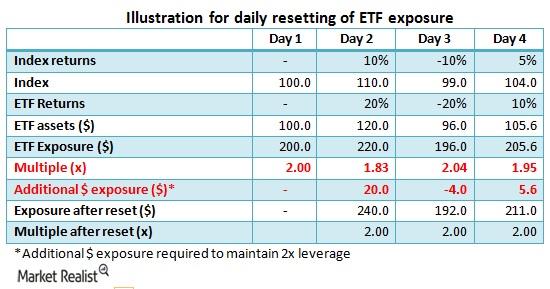

How daily re-balancing affects returns on leveraged ETFs

Leveraged ETFs seek to provide a certain multiple (generally 2x or 3x) of daily returns on the underlying index. The daily movements in the underlying index and subsequent changes in ETF exposure may mean the ETF manager needs to rebalance the portfolio daily.

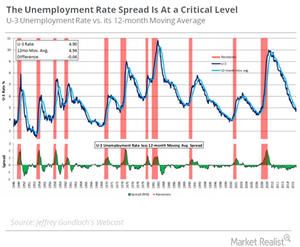

Gundlach Says This Chart Is ‘Early Warning Indicator’ of Recession

Jeffrey Gundlach seems quite bearish in his views about the US economy (IWM) (QQQ).

Ray Dalio: ‘Risks Are Asymmetric on the Downside’

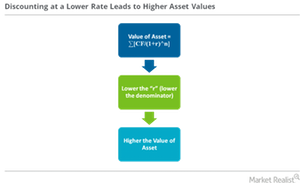

“Risks are asymmetric on the downside” On the economy, Ray Dalio stated that “the risks are asymmetric on the downside, because asset prices are comparatively high at the same time there’s not an ability to ease.” Courtesy of the current global monetary policy’s low interest rates, asset prices are artificially inflated—so much so that they’ve […]Financials Issuers like Wells Fargo and Verizon take advantage of low yields

Major deals included debt issues by Wells Fargo (WFC), Baidu, AT&T, and Verizon (VZ).

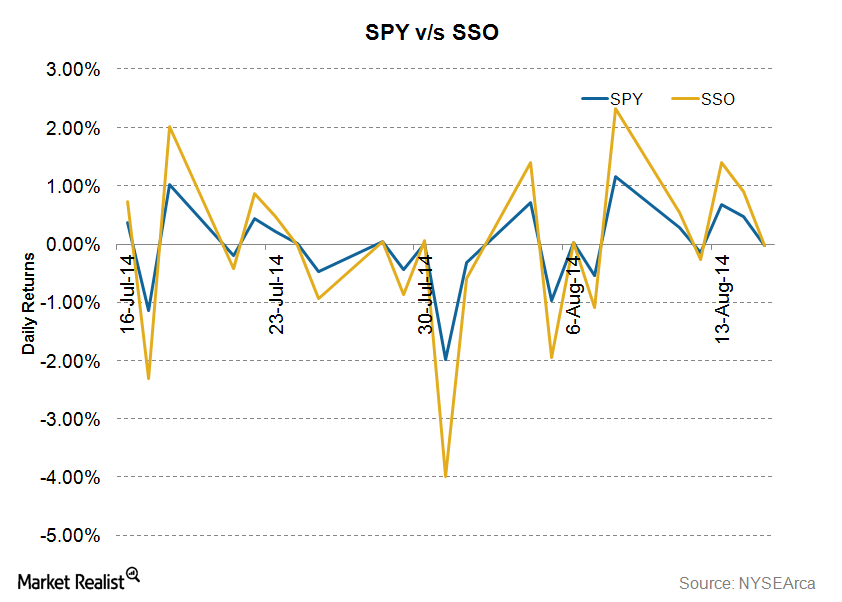

How daily compounding works in case of inverse and leveraged ETFs?

If SPY rises 5% each on two consecutive days, SSO will rise 10% each day due to the 2x leverage achieved using derivative products and external borrowings. While the compounding works even for SPY, it’s magnified in SSO due to the 2x multiplier effect.

What Are the Implications of Iran Nuclear Deal Exit?

In this series, we’ll analyze how the US exit from the Iran deal has affected markets and how recent developments could affect oil prices and volatility.

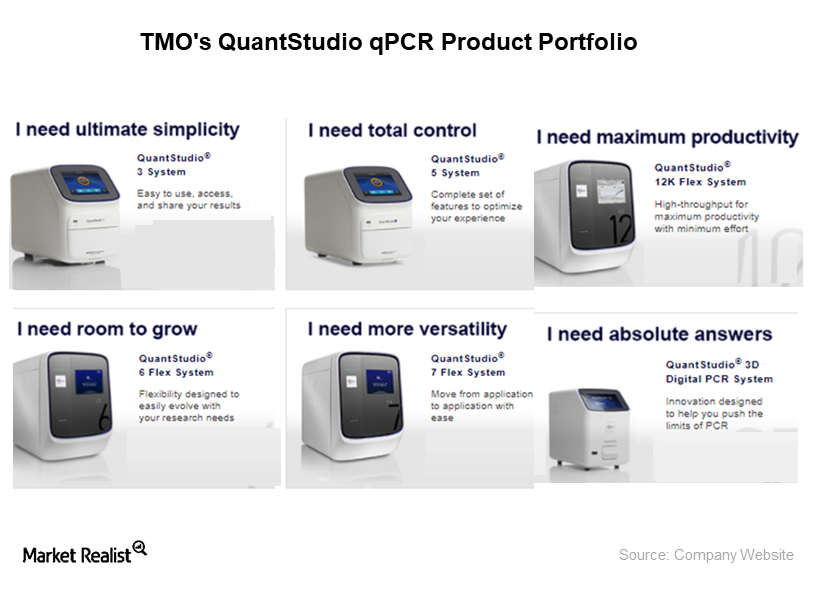

Thermo Fisher Expands Its Partnership with Genome Diagnostics

In December 2017, Thermo Fisher Scientific (TMO) expanded its partnership with Genome Diagnostics (or GenDx), a Netherlands-based firm offering molecular diagnostics solutions.

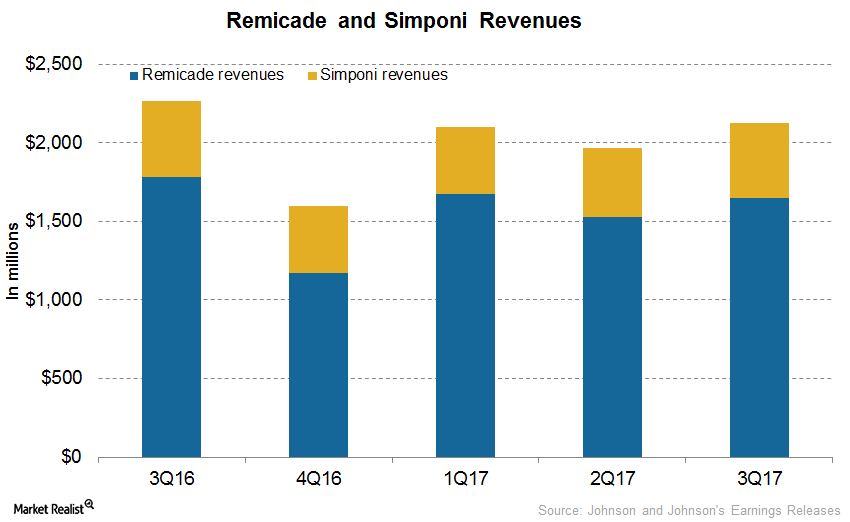

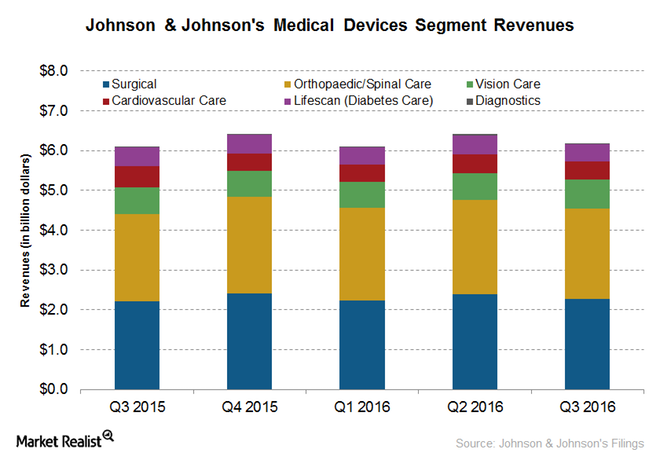

How Johnson & Johnson’s Remicade and Simponi Performed in 3Q17

In 3Q17, Johnson & Johnson’s (JNJ) Remicade generated revenues of $1.6 billion, which reflected a ~8% decline on a year-over-year (or YoY) basis and 8% growth on a quarter-over-quarter basis.

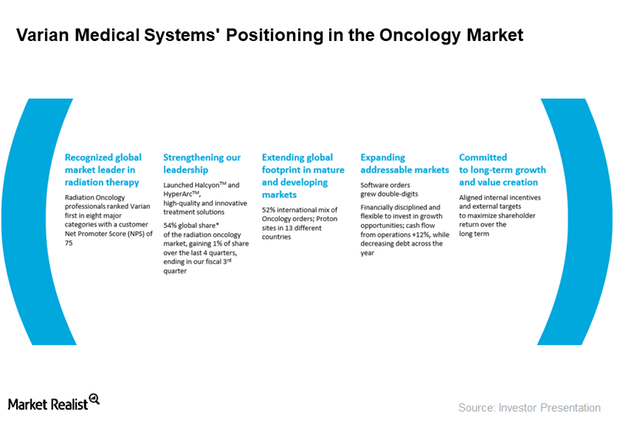

A Look at Varian Medical Systems’ Long-Term Objectives

Varian Medical Systems (VAR) spun off its imaging components business into Varex Imaging in January 2017, thus strengthening its positioning in the oncology market.

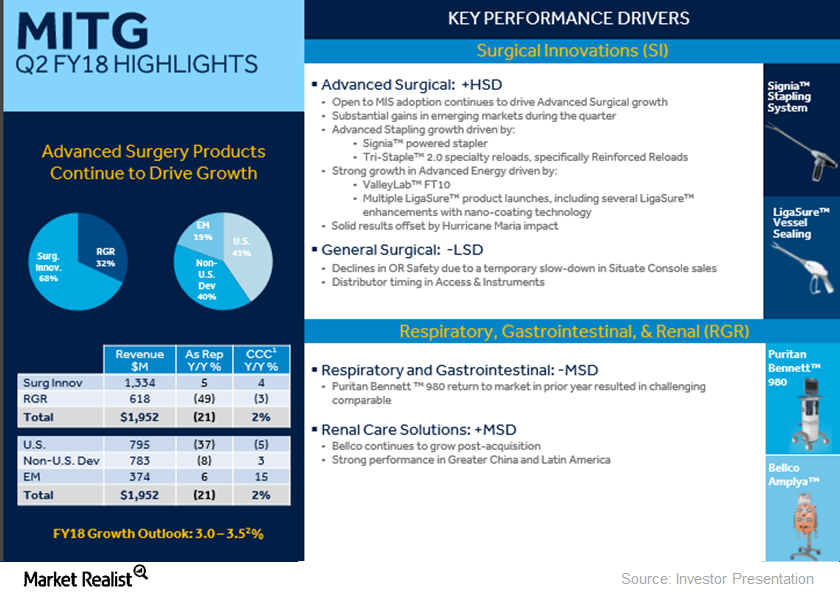

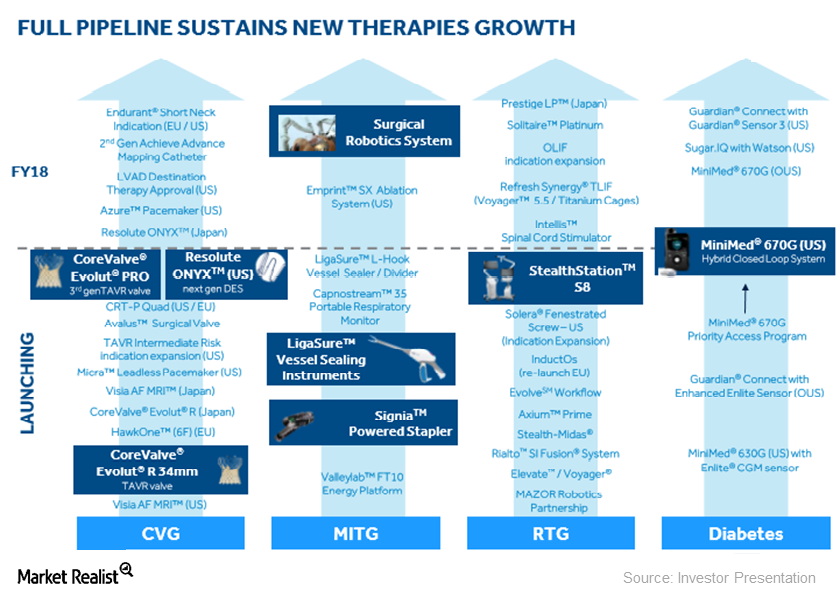

Medtronic’s Disappointing MITG Business Performance in Fiscal 2Q18

Due to the disappointing fiscal 2Q18 results, Medtronic made a downward revision to its estimates for MITG sales growth in fiscal 2018 to 3.0%–3.5%.

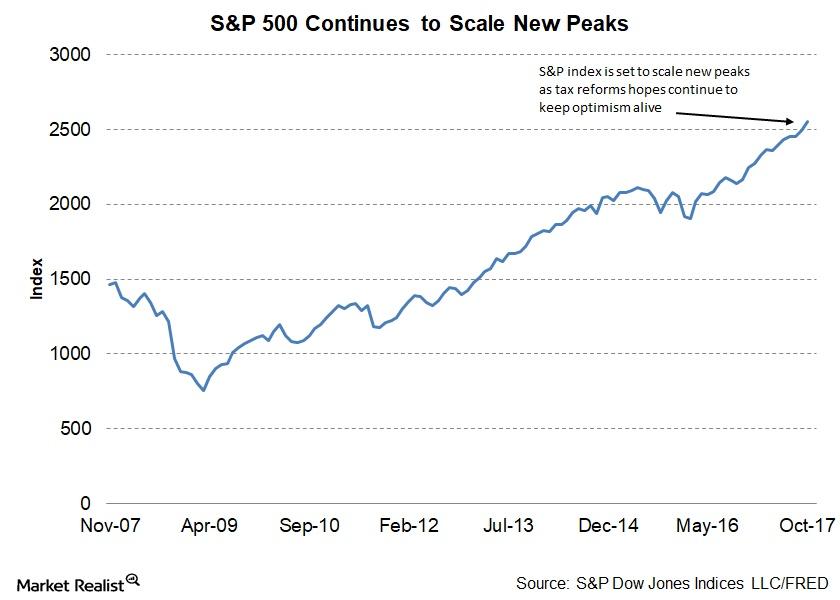

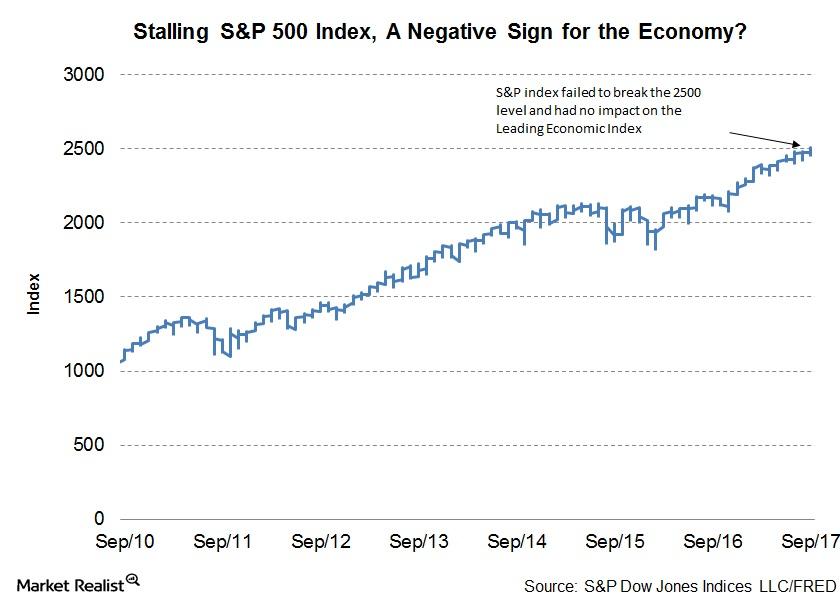

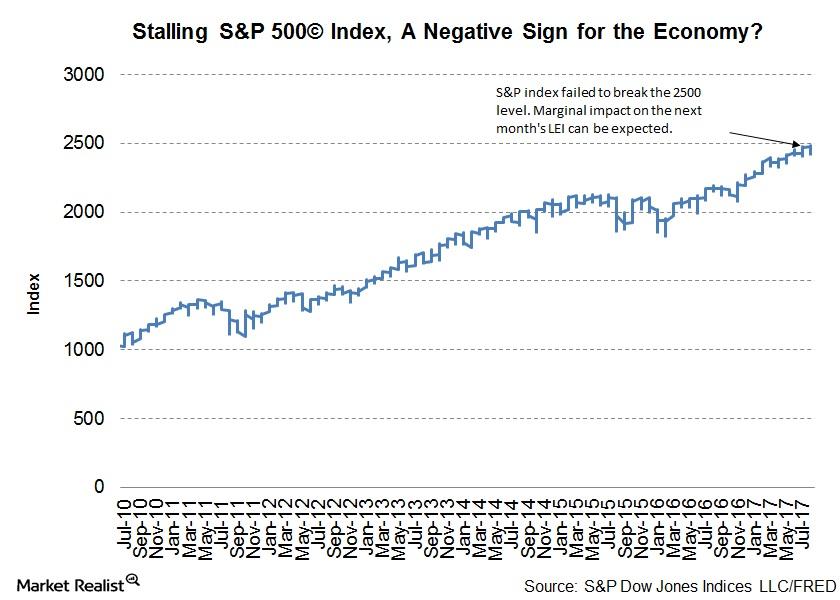

Why the S&P 500 Index Is Considered a Leading Indicator

The S&P 500 Index has risen 2.2% in October and is en route to its eighth straight positive monthly close.

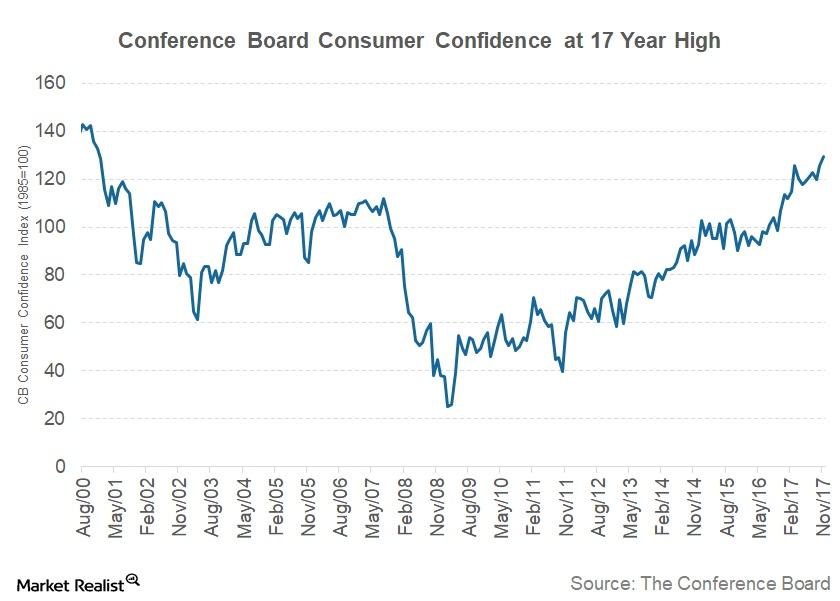

Conference Board Consumer Confidence Rose in November

The Conference Board Consumer Confidence Index for November came in at 129.5, up from 126.2 in October.

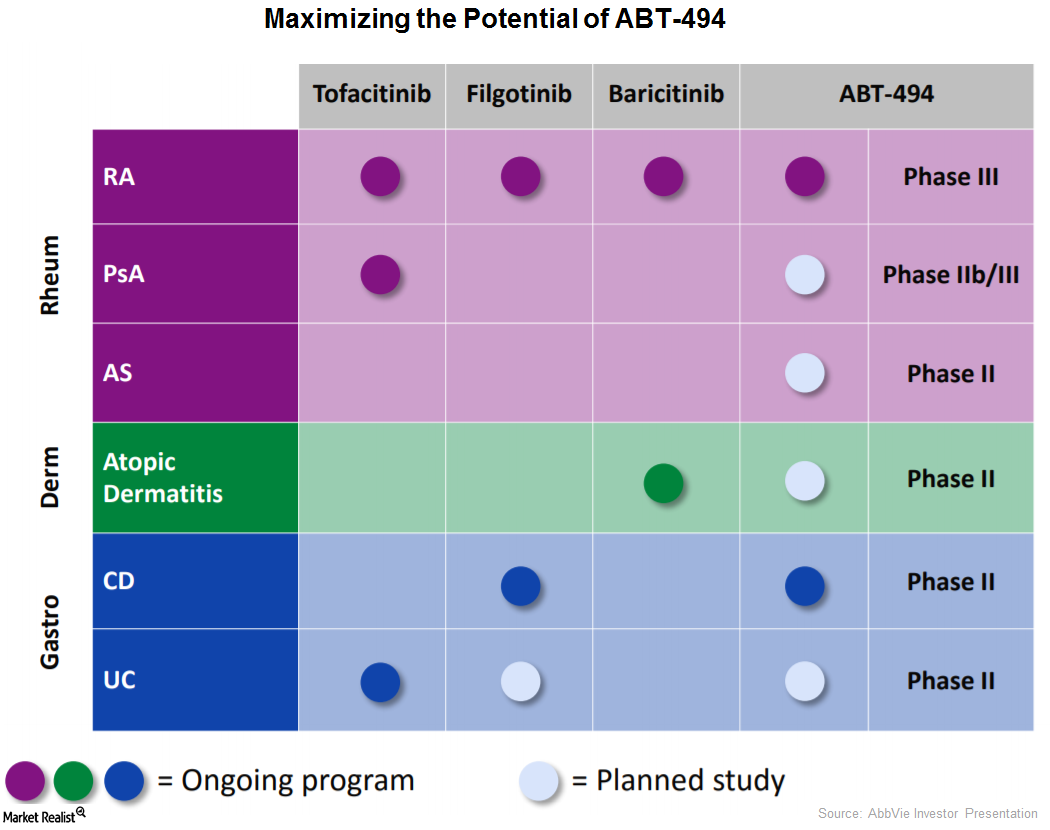

Why Upadacitinib Could Be AbbVie’s Long-Term Growth Driver

In September 2017, AbbVie (ABBV) presented successful results from its phase 3 SELECT-BEYOND trial.

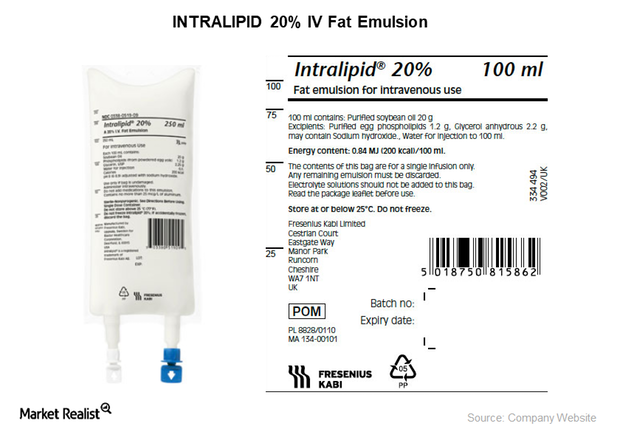

Chart in Focus: Baxter International’s Intralipid 20% Recall

On October 5, 2017, Baxter International (BAX) announced the voluntary recall of a shipment from a lot of Intralipid 20% IV Fat Emulsion, 100 mL. This lot was distributed from August 11 to August 31, 2017.

The Link between the S&P 500 and the Leading Economic Index

The S&P 500 is stuck The S&P 500 (IVV) index has been stuck near the 2,500 level for more than a month now. The recent war of words between US president Donald Trump and North Korean foreign minister Ri Yong Ho has increased risk aversion. However, the index has been resilient despite the rise in volatility. […]

US Retail Sales Dropped: How Will It Affect the S&P 500 Index?

According to data provided by the U.S. Census Bureau, US retail sales fell 0.2% in August 2017.

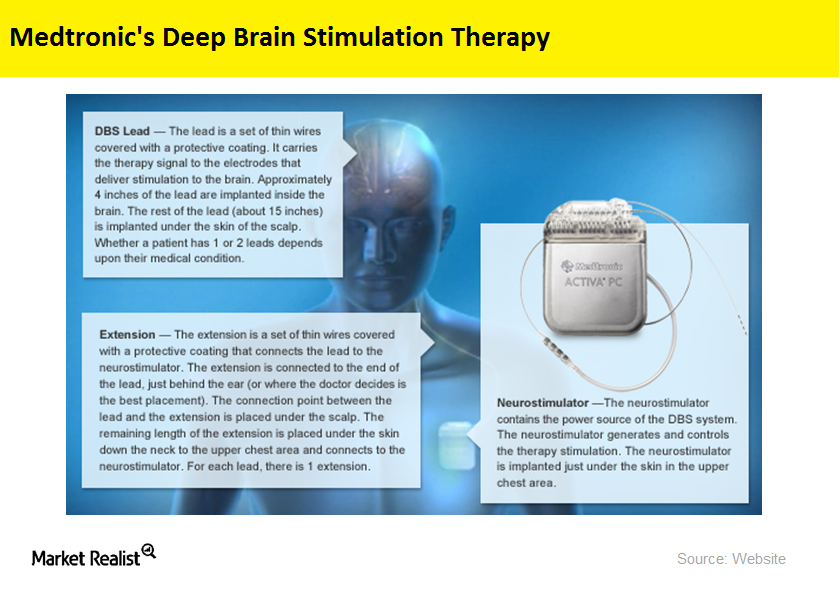

Medtronic’s Robust Product Pipeline

On May 1, 2017, Medtronic announced the FDA approval of its Resolute Onyx DES (drug eluting stent) for adult patients suffering from coronary artery disease.

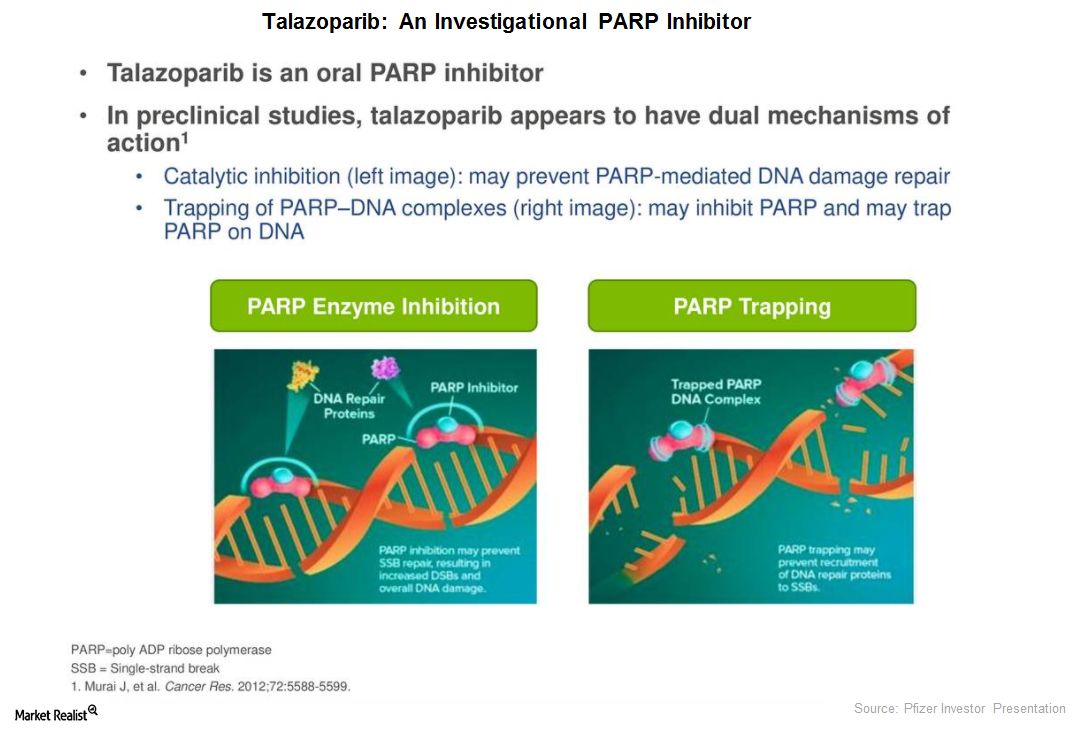

Talazoparib Could Be a Significant Long-Term Growth Driver for Pfizer

In June 2017, Pfizer (PFE) presented the results from the Phase 2 ABRAZO trial.

Could the S&P 500’s Stalled Ascent Derail Economic Expansion?

The risk scenario The S&P 500’s rally has stalled just shy of 2,500. Investors are drawn to to riskier assets such as equities when they expect further expansion in the economy. The S&P 500 (SPY), which comprises the 500 largest stocks in the United States, is a constituent of the Conference Board Leading Economic Index […]

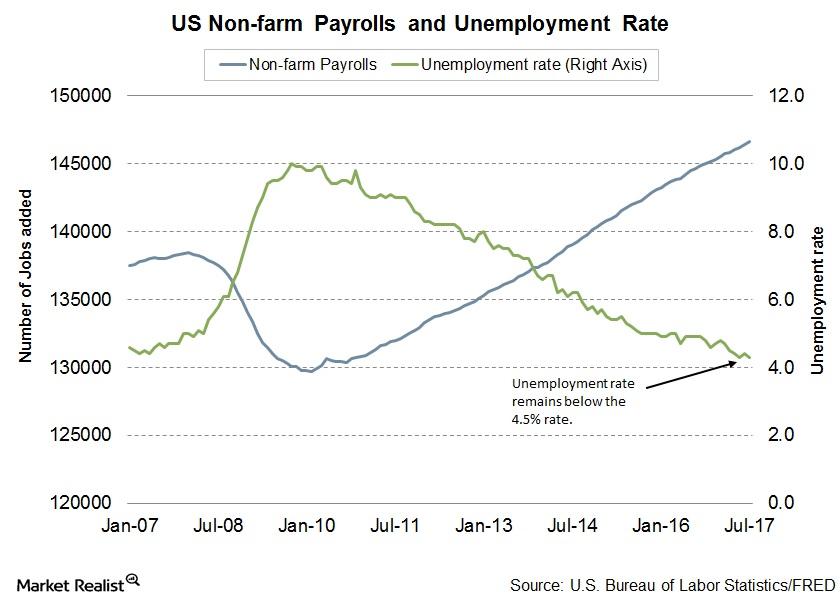

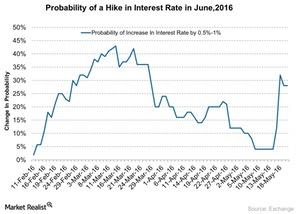

Tax Reforms and Jobs Could Drive the Last Week of Summer

Any negative news from the jobs report will be foreshadowed by the tax reform news. It’s the last jobs report before the September FOMC meeting.

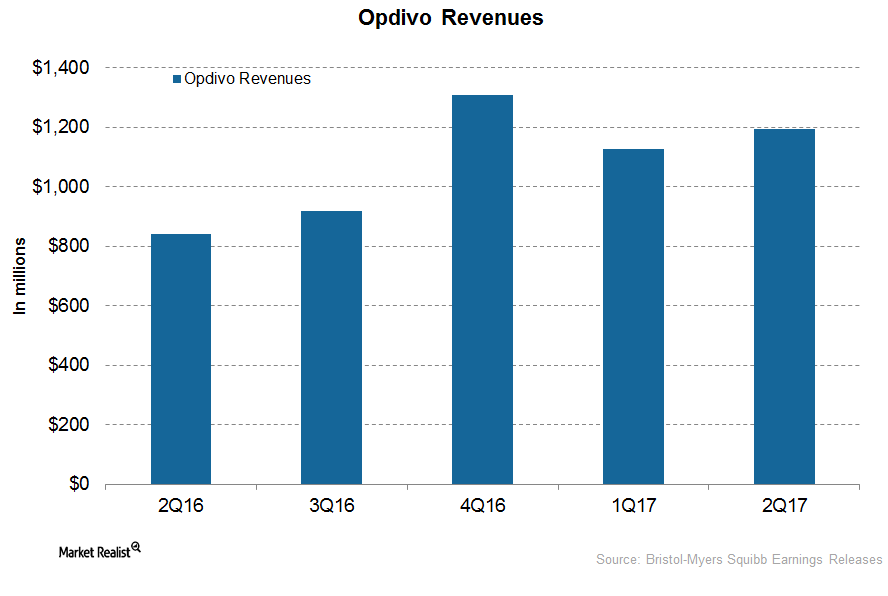

Opdivo Could Drive Bristol-Myers Squibb’s Revenue Growth in 2017

In 2Q17, Bristol-Myers Squibb’s (BMY) Opdivo generated revenues of around $1.2 billion, which reflected ~45% growth on a year-over-year basis.

Medtronic Received Health Canada License for SureTune3

On June 6, 2017, Medtronic (MDT) received the Health Canada license for its SureTune3 software for DBS (deep brain stimulation) therapy.

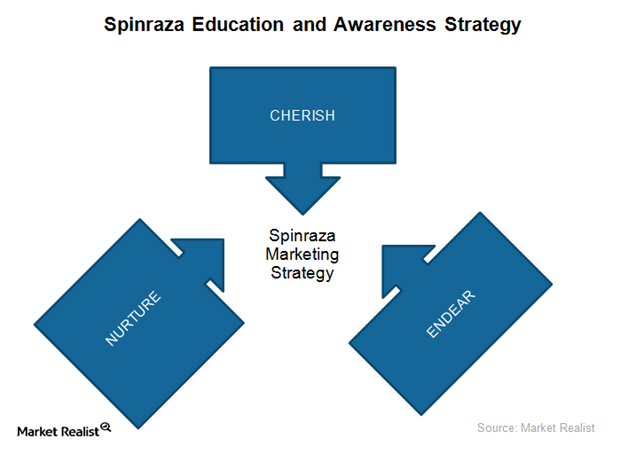

Biogen’s Targeted Marketing Strategy for Spinraza in 1Q17

To promote the use of Spinraza for SMA, Biogen (BIIB) has been actively educating and creating awareness for the drug among physician and patient communities.

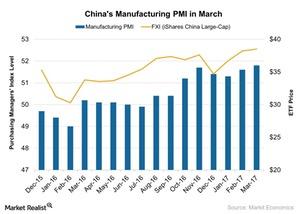

China’s Manufacturing PMI Improved: How It Could Drive Investor Sentiment

China’s final manufacturing PMI (purchasing managers’ index) stood at 51.8 in March 2017 compared to 51.6 in February, beating market expectations of 51.6.

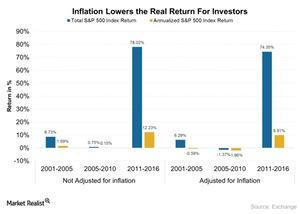

Ron Baron’s Investment Strategy to Beat Inflation in the Long Run

Inflation is expected to reduce the value of assets if the price rise of the asset doesn’t catch up with inflation. Core inflation in the United States is growing at a rate of ~2%.

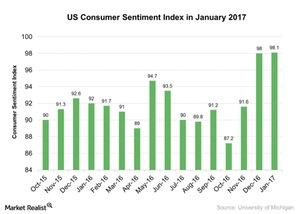

What Does the Rising US Consumer Sentiment Index Mean for the Economy?

The US Consumer Sentiment Index improved in January 2017. It stood at 98.1 in January 2017 compared to 98.2 in December 2016.

Johnson & Johnson’s Expandable Cage Acquisition to Accelerate the Spine Division

On January 3, DePuy Synthes, a subsidiary of Johnson & Johnson (JNJ), entered into an asset purchase and development agreement with Interventional Spine.

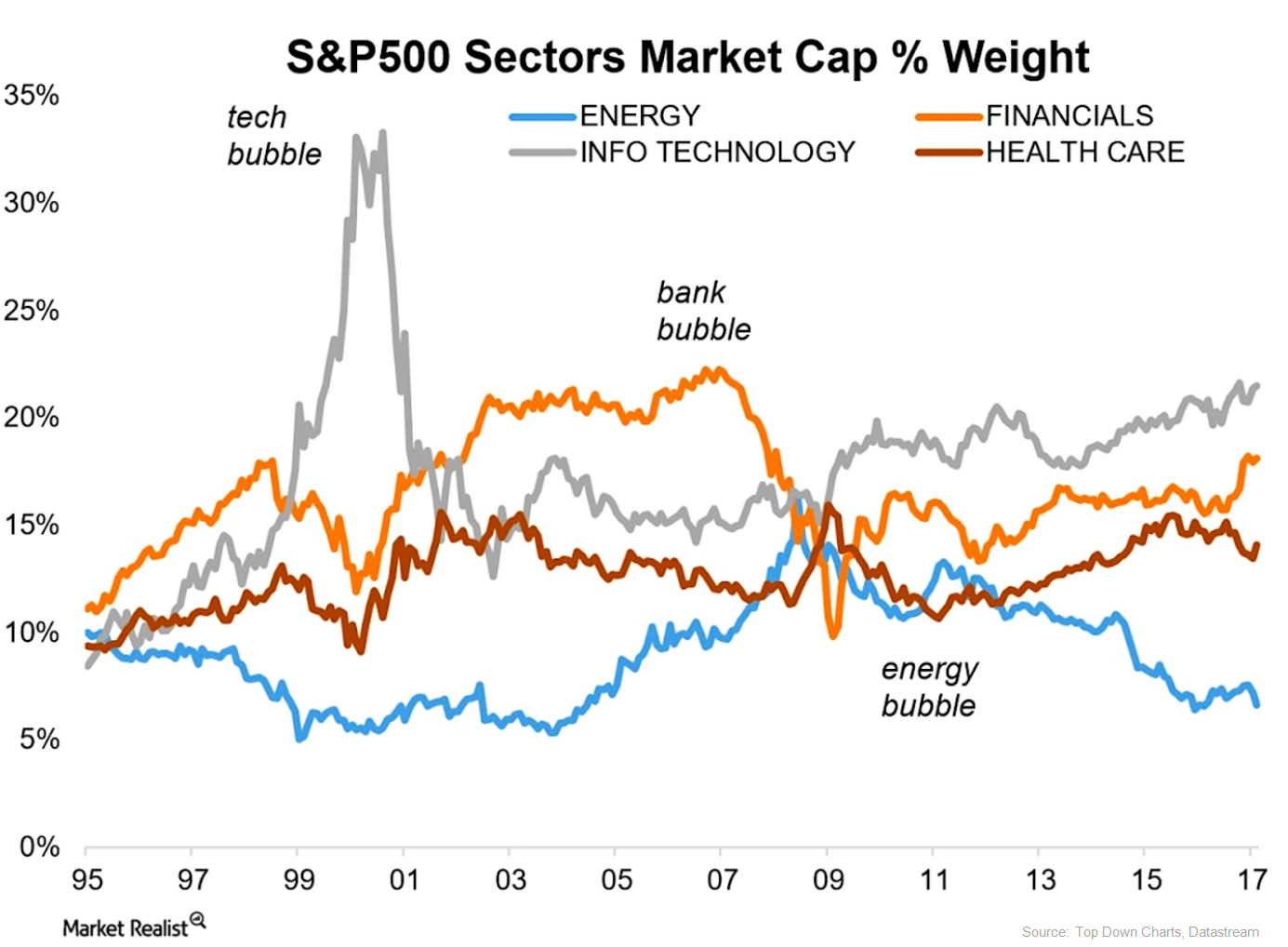

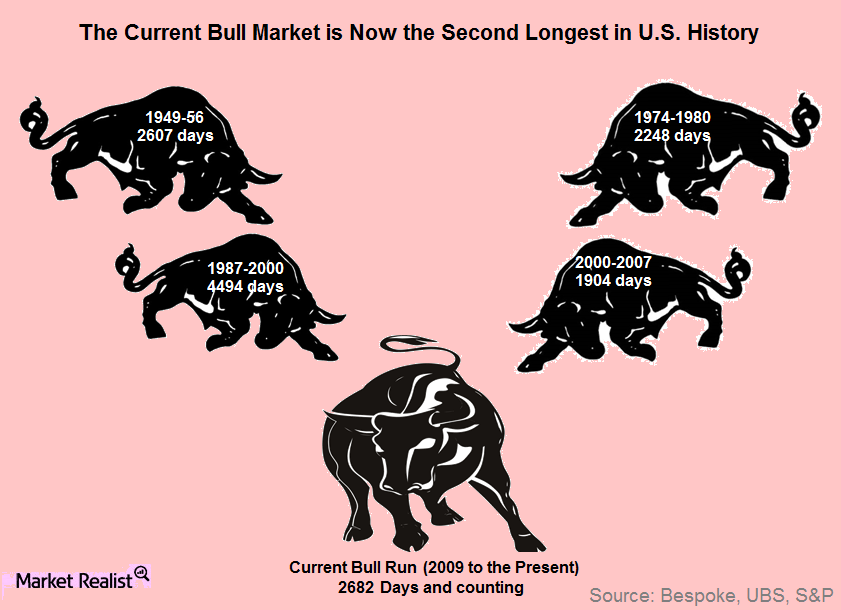

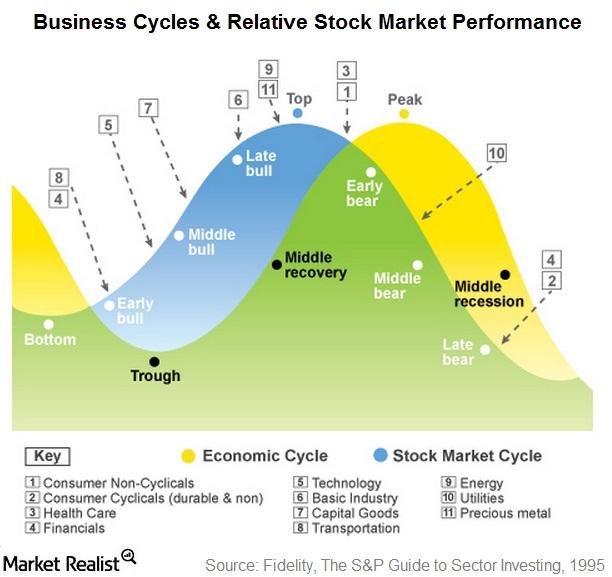

Investors Are Worried about an Impending Squall

Inverse ETFs can help protect against a squall US stocks bumped up against all-time highs again this year. After hitting a new intraday high of 2,178 on August 1, the S&P 500 was unable to hold onto the gains. Sector performances offer a glimpse of where we are in the market cycle. The top performing […]

Where Is the Market Headed: Double Bottom? Triple Top?

Double bottom? From a technical standpoint, the current environment may have been viewed as either bullish or bearish. Those on the bull side of the equation took heart in a technical indicator known as the double bottom. The double bottom reversal is a bullish reversal pattern that traders use to anticipate possible upside movements. As its […]

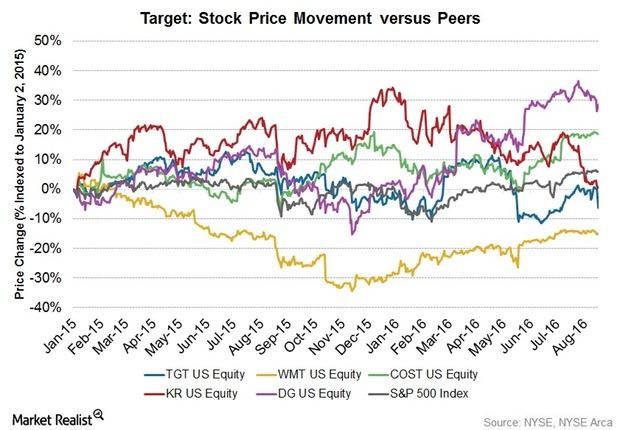

Target’s Stock Price Fell 6.4% after Fiscal 2Q16 Earnings

Target’s (TGT) stock price fell 6.4% to $70.63 on August 17, 2016, after the company released its fiscal 2Q16 earnings.

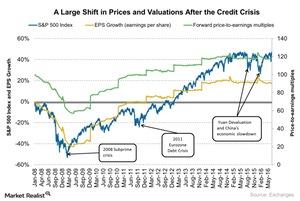

In Retrospect: How the 2008 Crisis Affected SPY’s Valuation

When the 2008 credit crisis affected the S&P 500 Index (SPY), we saw a large shift in valuations and the index level.

How Did the Consumer Price Index Affect Crude Oil Prices?

The US (SPY) (VOO) CPI (consumer price index) rose 0.4% on a month-over-month basis in April, according to a US Department of Labor report on May 17, 2016.

What Phase of the Business Cycle Are We In?

Studied in conjunction, stock market and economic conditions give clear indications of the business cycle phase we are in.

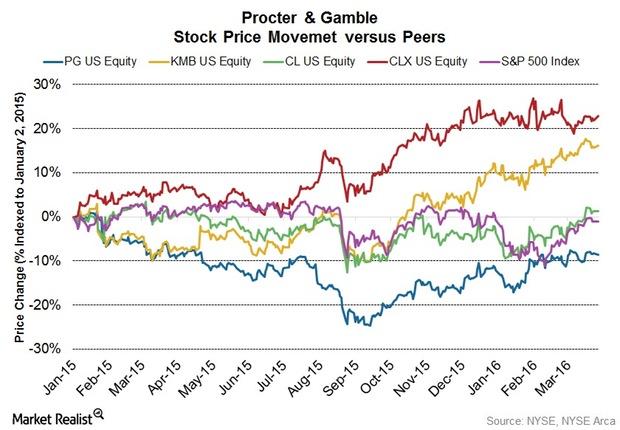

P&G’s Stock Price Reaction to the Old Spice Lawsuit

After a lawsuit was filed against Procter & Gamble (PG), or P&G, for its Old Spice deodorant, P&G’s stock price opened with a fall of 0.4% to $82.46 on March 24, 2016.

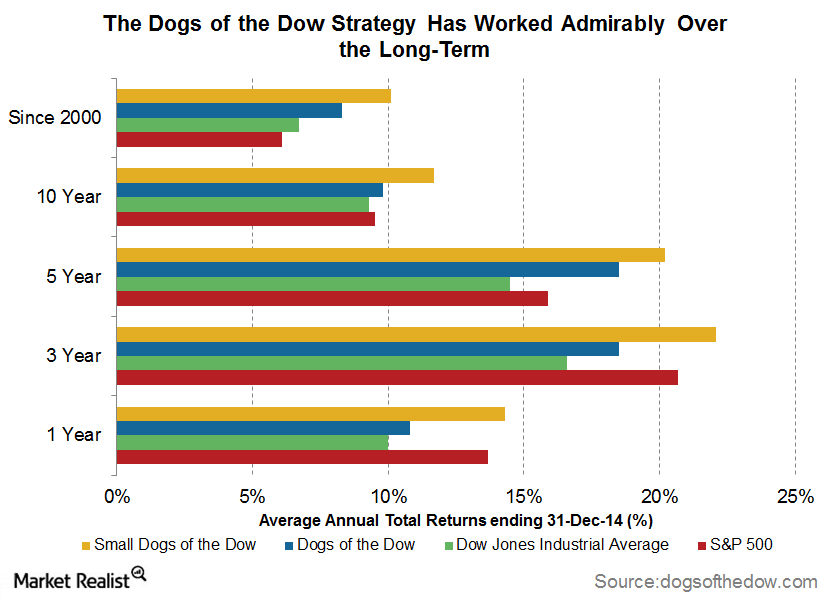

Dogs of the Dow: A Classic Investment Strategy

The Dogs of the Dow strategy involves ranking the 30 stocks comprising the Dow Jones Industrial Average index on the basis of their dividend yields and selecting the top ten.

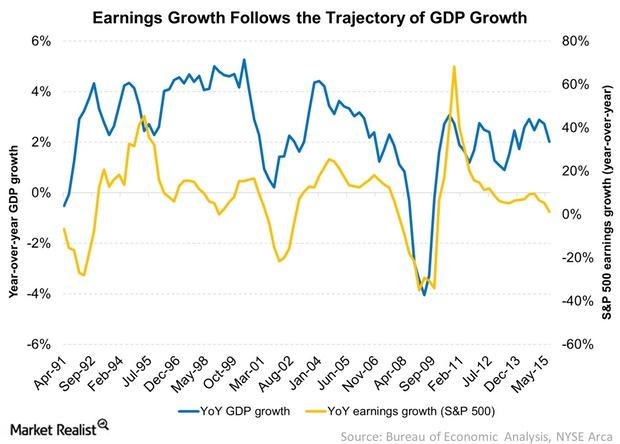

What’s the Biggest Driver of Earnings Growth?

Economic growth is the biggest driver of earnings growth. Earnings growth seems to follow the same trajectory of GDP growth.

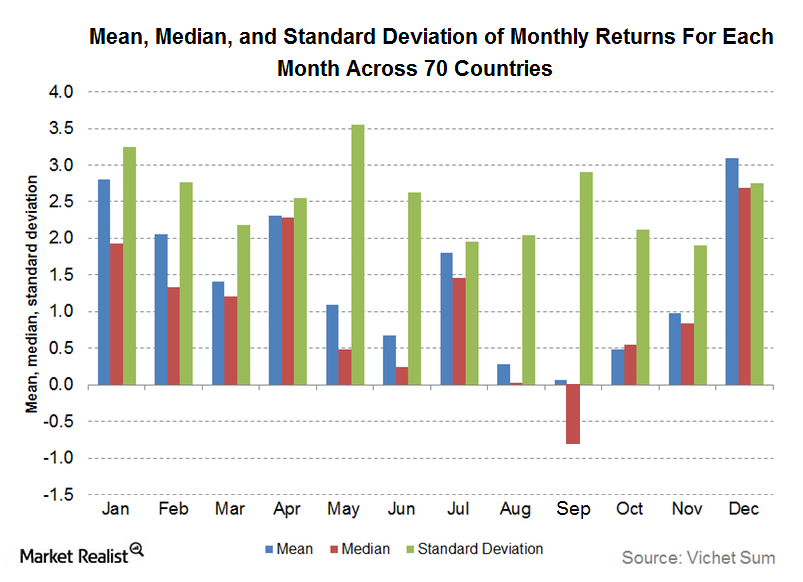

Making Sense of the ‘September Effect’ on Equities

The dreaded September effect is not limited to US stocks (SPY). It’s relevant to markets around the globe (ACWI).