Opdivo Could Drive Bristol-Myers Squibb’s Revenue Growth in 2017

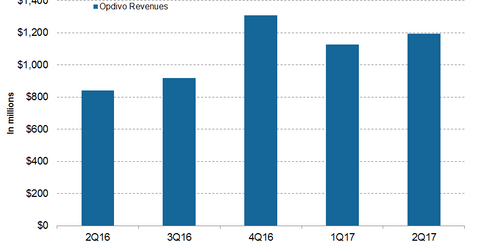

In 2Q17, Bristol-Myers Squibb’s (BMY) Opdivo generated revenues of around $1.2 billion, which reflected ~45% growth on a year-over-year basis.

Aug. 18 2017, Updated 10:38 a.m. ET

Opdivo revenue trends

In 2Q17, Bristol-Myers Squibb’s (BMY) Opdivo generated revenues of around $1.2 billion, which reflected ~45% growth on a year-over-year (or YoY) basis and ~6% growth quarter-over-quarter. In 2Q17, Opdivo contributed around 23% of Bristol-Myers Squibb’s net revenues.

In 2Q17, Opdivo generated revenues of ~$768 million in the US market, which reflected ~19% growth on a YoY basis. Outside the US market, Opdivo generated revenues of ~$427 million in 2Q17 compared to $197 million in 2Q16.

The chart above represents the revenue curve of Bristol-Myers Squibb’s Opdivo from 2Q16 to 2Q17. To learn more about Opdivo, please read How BMY’s Opdivo Is Expected to Perform in 2017.

Recent regulatory approval

In August 2017, the FDA approved the Opdivo injection for the treatment of individuals aged above 12 years with microsatellite instability-high (or MSI-H) or mismatch repair deficient (or dMMR) metastatic colorectal cancer (or mCRC) that has progressed after fluoropyrimidine, oxaliplatin, and irinotecan therapy.

This regulatory approval was based on the results from the CheckMate-142 trial, where Opdivo demonstrated an objective response rate (or ORR) of 28% among patients who were previously treated with fluoropyrimidine, oxaliplatin, and irinotecan therapy.

In the Checkmate-142 trial, among the 74 patients who received Opdivo, 72% of the patients were previously treated with fluoropyrimidine, oxaliplatin, and irinotecan therapy. Among patients who previously received fluoropyrimidine, oxaliplatin, and irinotecan therapy, 28% responded to Opdivo therapy.

Among all 74 enrolled individuals, 32% responded to Opdivo treatment, 2.7% of these patients experienced complete response (or CR), and 30% of the patients experienced partial response (or PR).

Bristol-Myers Squibb’s Opdivo faces stiff competition from Merck’s (MRK) Keytruda, Roche’s (RHHBY) Tecentriq, and Eli Lilly’s (LLY) Alimta.

Bristol-Myers Squibb comprises ~0.46% of the portfolio holdings of the Vanguard S&P 500 ETF (VOO).