Bristol-Myers Squibb Co.

Latest Bristol-Myers Squibb Co. News and Updates

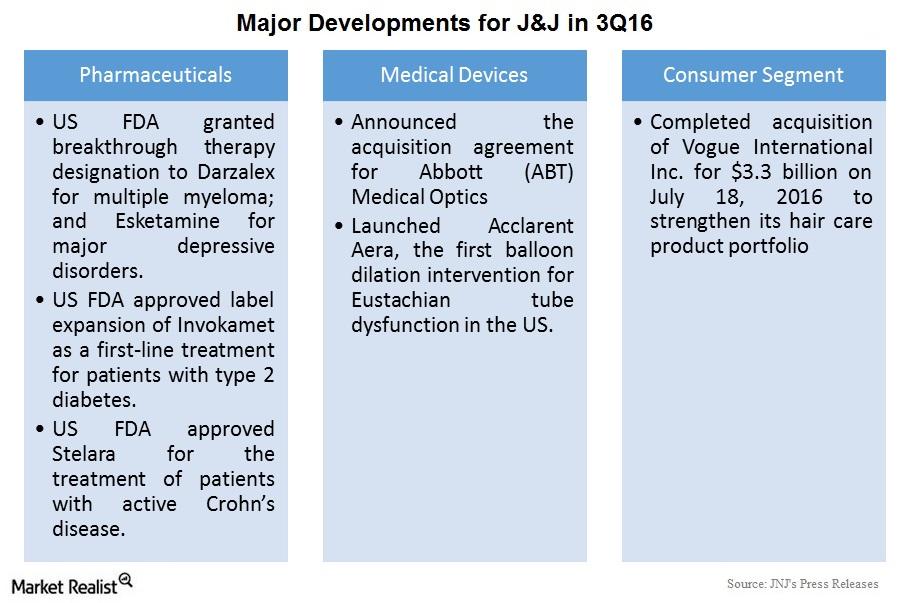

Major Developments for Johnson & Johnson in 3Q16

Major developments As discussed previously in this series, Johnson & Johnson’s (JNJ) 3Q16 performance was positive across all of its segments. However, the Consumer segment reported a decline in revenue, as the negative impact of foreign exchange more than offset operational growth. There were several major developments for JNJ during 3Q16. Pharmaceuticals segment In 3Q16, the […]

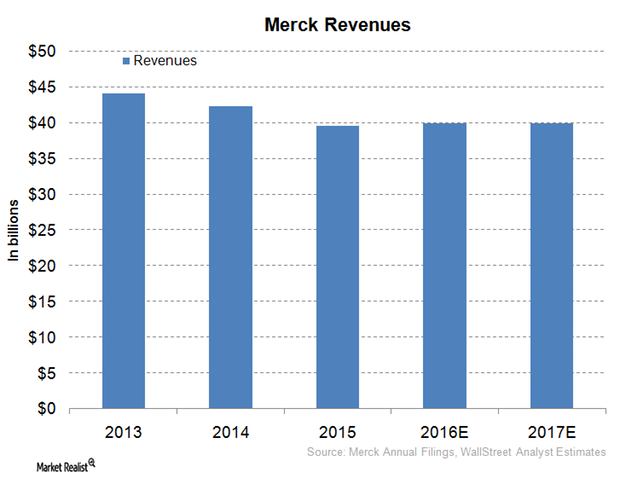

Merck Expects Modest Revenue Growth in Fiscal 2016

Merck provided revenue guidance of $39.7 billion–$40.2 billion in 2016. It expects negative foreign exchange fluctuations to reduce its fiscal 2016 revenue.

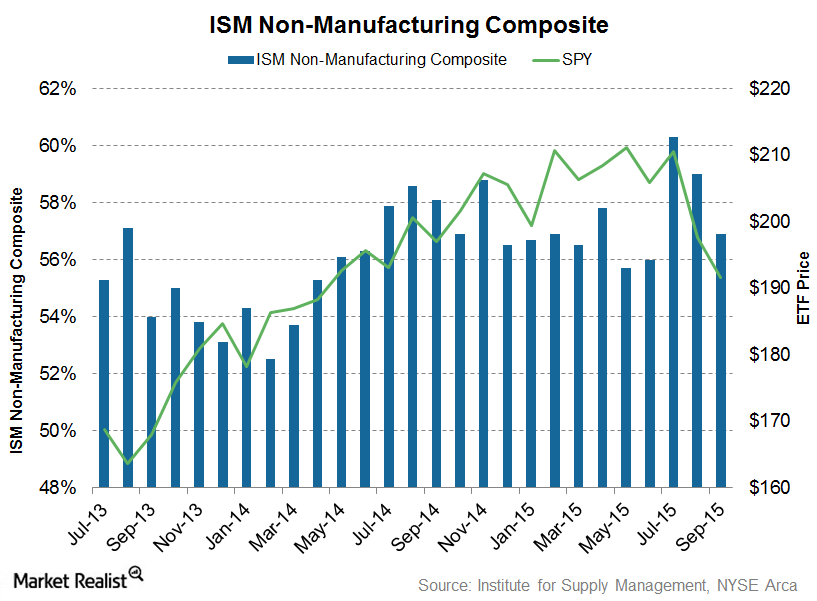

Expanding Service Sector Gives Relief to Economy in September

With manufacturing slowing, a reading of the Non-Manufacturing Index at an above-neutral level (56.9) may provide some relief to the US economy, which is highly dependent on the service sector for its economic growth.

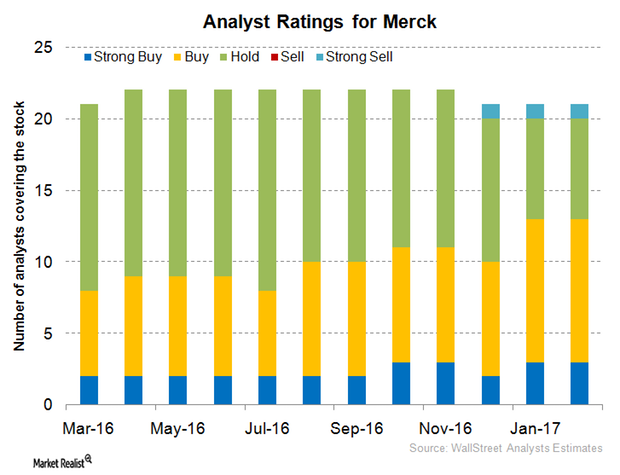

What Are Analysts’ Recommendations for Merck in 2017?

For 2016, Merck & Co. (MRK) reported revenue close to $39.8 billion, a year-over-year (or YoY) rise of ~1%. New product launches have played major roles in boosting Merck’s 2016 revenue.

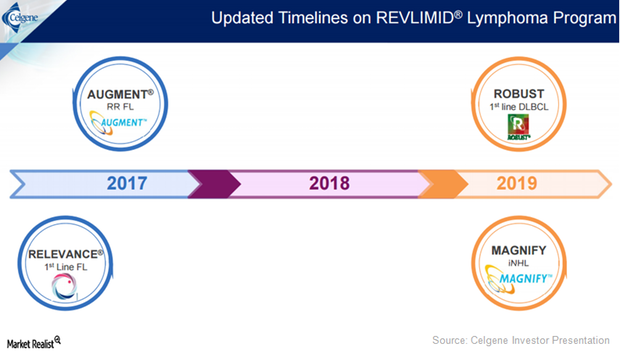

Celgene’s Revlimid Expected to Post Strong Revenue in 2017

According to unaudited financial results published by Celgene (CELG) on January 9, 2017, Revlimid sales for 2016 are about $7.0 billion, a YoY rise of about 20.0%.

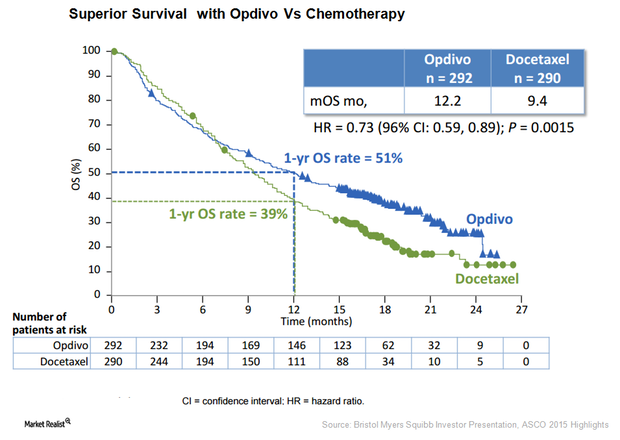

Bristol-Myer Squibb’s Opdivo Is Keytruda’s Strong Competitor

the U.S. Food and Drug Administration accepted the filing of a supplemental Biologics License Application for Bristol-Myers Squibb’s Opdivo.

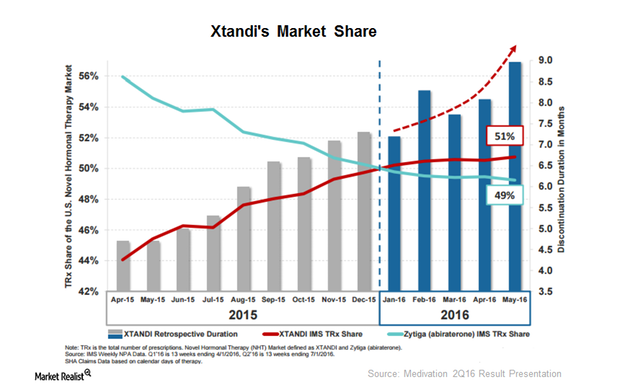

How Xtandi Fueled Big Pharmaceutical Interest in Medivation

Xtandi is the major factor behind Pfizer’s (PFE) interest in Medivation (MDVN). The drug, along with MDVN’s pipeline molecules, should strengthen Pfizer’s (PFE) oncology franchise.

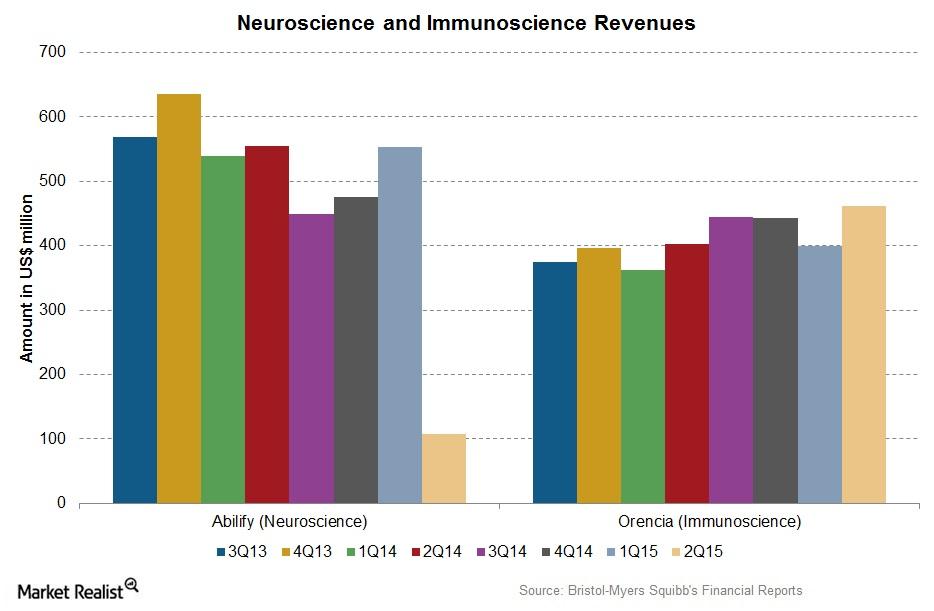

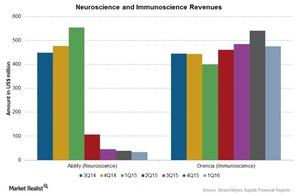

Bristol-Myers Squibb’s Neuroscience and Immunoscience Segments

Sales for Bristol-Myers Squibb’s (BMY) neuroscience segment declined over 80% in 2Q15, while the immunoscience segment’s sales improved ~15% in 2Q15 as compared to 2Q14.

Understanding Bristol-Myers Squibb’s Other Segments

Sales from Bristol-Myers Squibb’s Neuroscience segment declined by 94% in 1Q16. Sales from the Immunoscience segment improved by ~18.7% in 1Q16 over 1Q15.

Analyzing Johnson & Johnson’s 1Q18 Profitability

Johnson & Johnson (JNJ) reported revenues of $20.0 billion during 1Q18, 12.6% growth as compared to revenues of $17.8 billion during 1Q17.

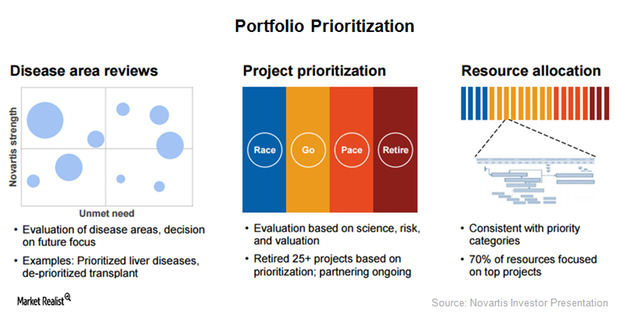

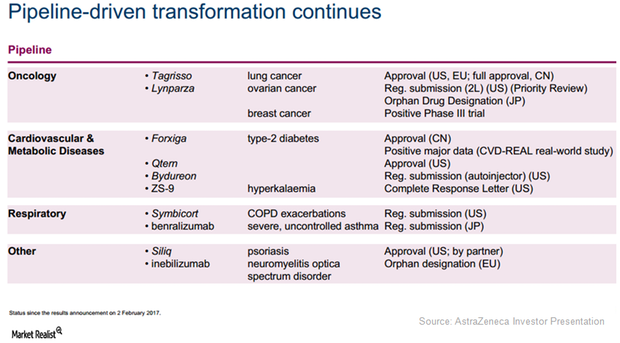

Novartis Focuses on Portfolio Prioritization to Boost Profitability

To ensure long-term relevance as well as quick adaptability to changing market needs, Novartis (NVS) is focusing on five major initiatives in 2017.

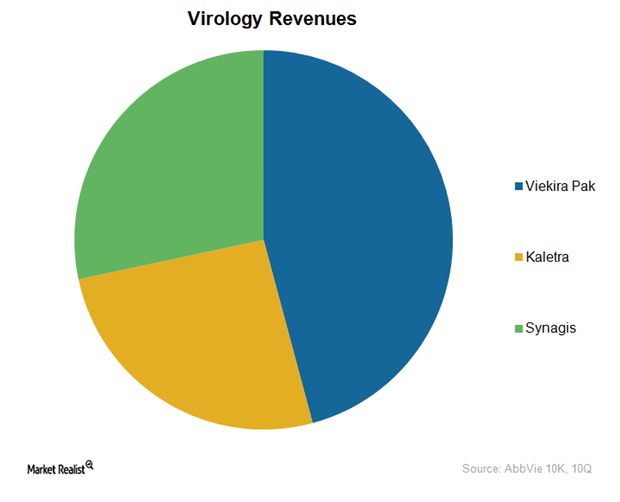

AbbVie Strengthens Its Position in the Virology Segment

In addition to Humira, AbbVie also offers several virology drugs targeting diseases such as hepatitis C, HIV, and respiratory syncytial virus.

AstraZeneca May Witness a Fall in 2017 Net Profit Margin

Wall Street analysts have projected AstraZeneca’s (AZN) 2017 net profit margins at about 12.2%, which is lower by 300 basis points on a YoY basis.

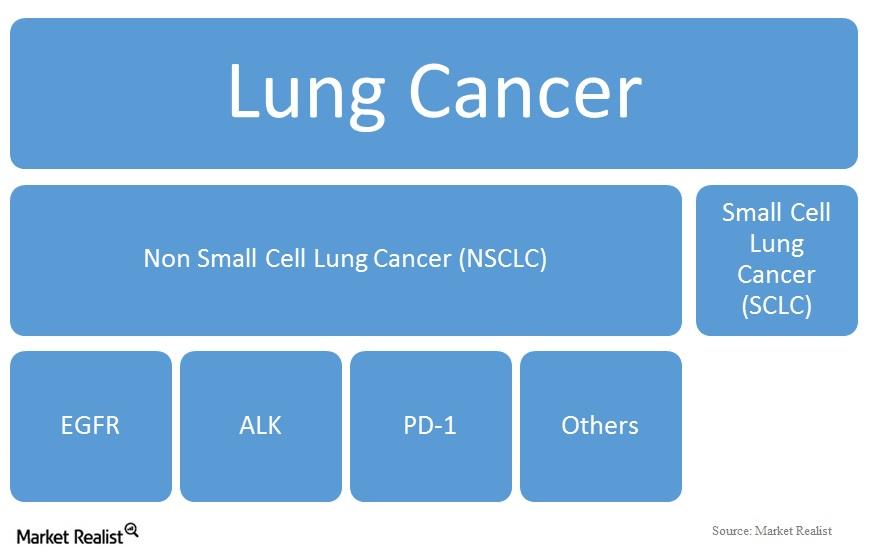

Other Drugs for Non-small Cell Lung Cancer

Approximately 85% of all lung cancers in the United States are non-small cell lung cancers, and 10% to 15% of these are EGFR mutation-positive.

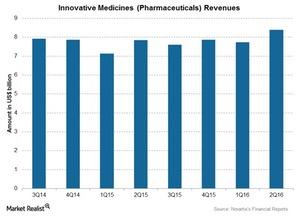

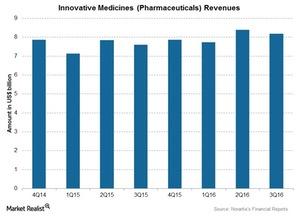

Novartis’s 3Q16 Estimates: Innovative Medicines Segment

Novartis’s Innovative Medicines segment, formerly referred to as the Pharmaceutical segment, consists of products for a variety of therapeutic areas.

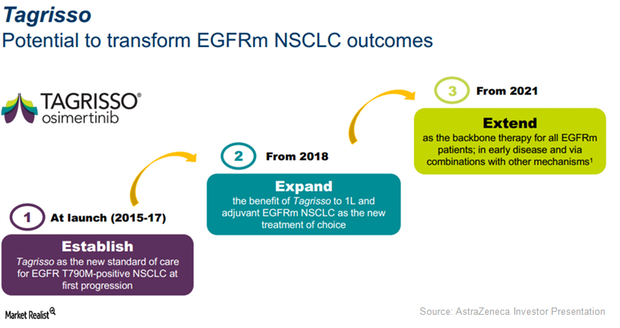

Tagrisso Expected to Be a Key Growth Driver for AstraZeneca in 2017

Launched in Japan in 2Q16, AstraZeneca’s (AZN) 1Q17 revenues for Tagrisso approached $39 million in this major emerging market.

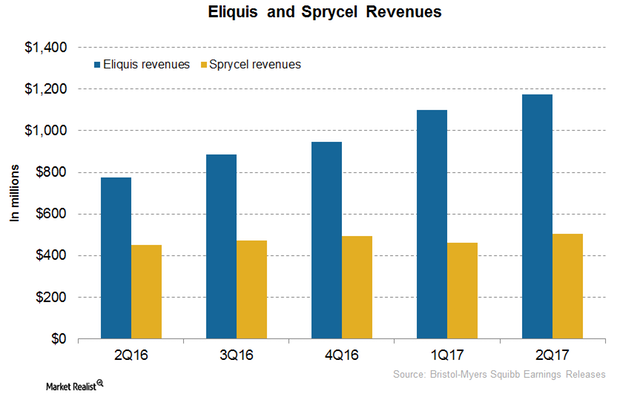

Eliquis and Sprycel Could Boost BMY’s Revenue Growth in 2H17

In July 2017, the FDA accepted Bristol-Myers Squibb’s supplemental New Drug Application (or sNDA) for expanding the indication of Sprycel.

Novartis’s 4Q16 Estimates: Innovative Medicines Segment

The overall contribution of the Innovative Medicines segment is ~67% of Novartis’s total revenues.

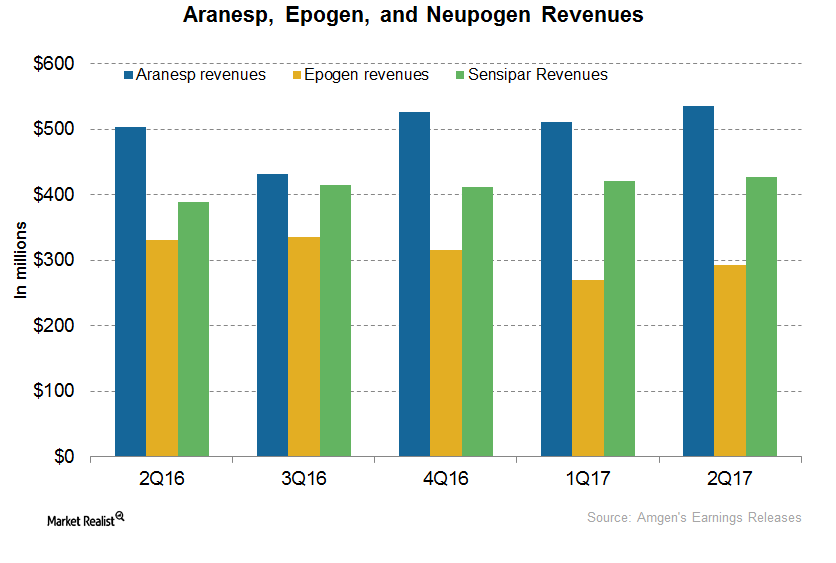

How Amgen’s Nephrology Drugs Are Positioned after 2Q17?

In 2Q17, Amgen’s (AMGN) Aranesp generated revenues of ~$535 million, which represented a 6% year-over-year rise.

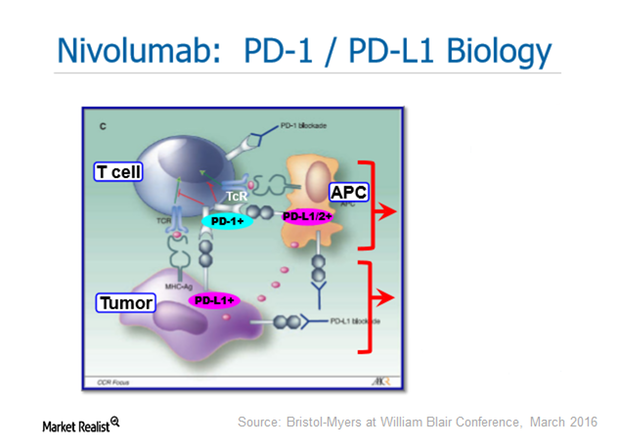

Brace Yourself: AstraZeneca Could Be a Fourth Entrant into the PD-1/PD-L1 Drug Class

The PD-1 (programmed death-1)/PD-L1 (programmed death-ligand 1) class consists of Bristol-Myers Squibb’s Opdivo, Merck’s Keytruda, and Roche’s Tecentriq.

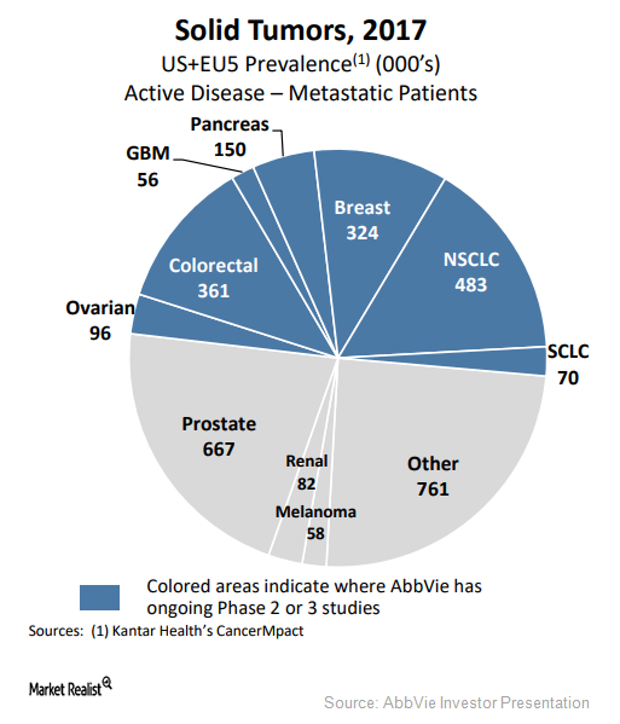

AbbVie Rapidly Advancing Its 2018 Solid Tumor Portfolio

AbbVie (ABBV) is currently evaluating more than 20 investigational therapies targeting solid tumors. Seventeen of them are in Phase 1 trials.

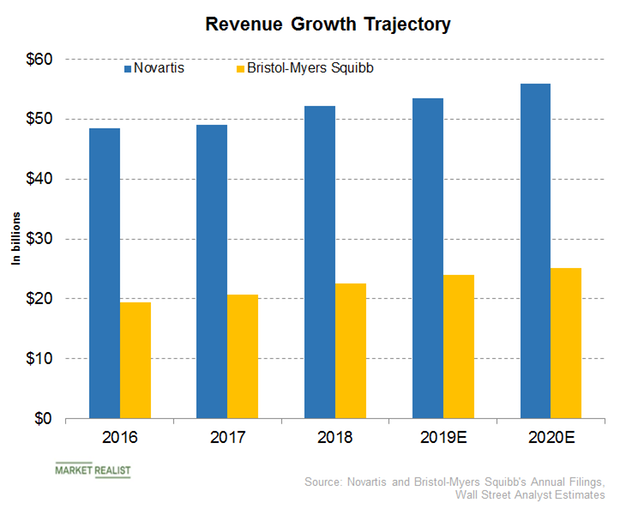

NVS or BMY: Who’s Expected to Post Faster Revenue Growth in 2019?

According to the company’s fourth-quarter earnings conference call, Novartis expects to complete the spin-off of its Alcon business in the second quarter of 2019.

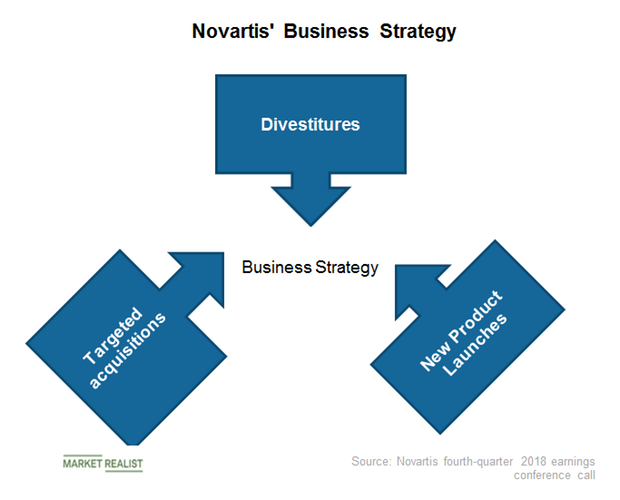

How Novartis Is Transforming Its Structure in 2019

Since fiscal 2018, Novartis (NVS) has been focused on transforming itself into a new focused medicines company.

What to Expect From Bristol-Myers Squibb in Q2

Bristol-Myers Squibb will release its second-quarter earnings on Thursday. The revenues will likely rise 7.16% YoY to $6.11 billion in the second quarter.

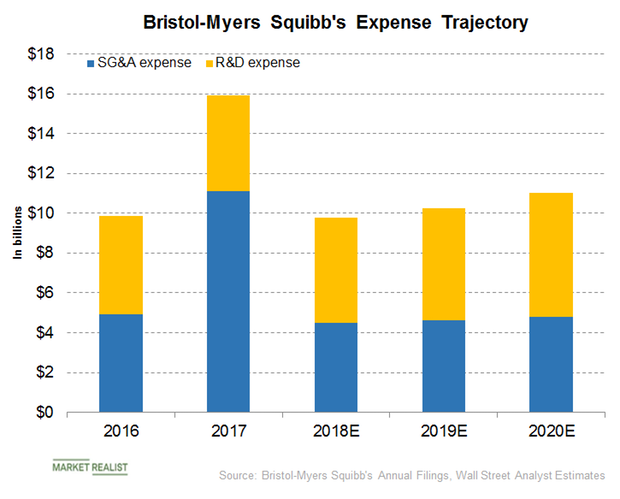

Bristol-Myers Squibbs and Celgene: Cost Synergies for Future Years

According to Bristol-Myers Squibb’s (BMY) press release, the company expects the acquisition of Celgene (CELG) to result in annual cost synergies close to $2.5 billion.

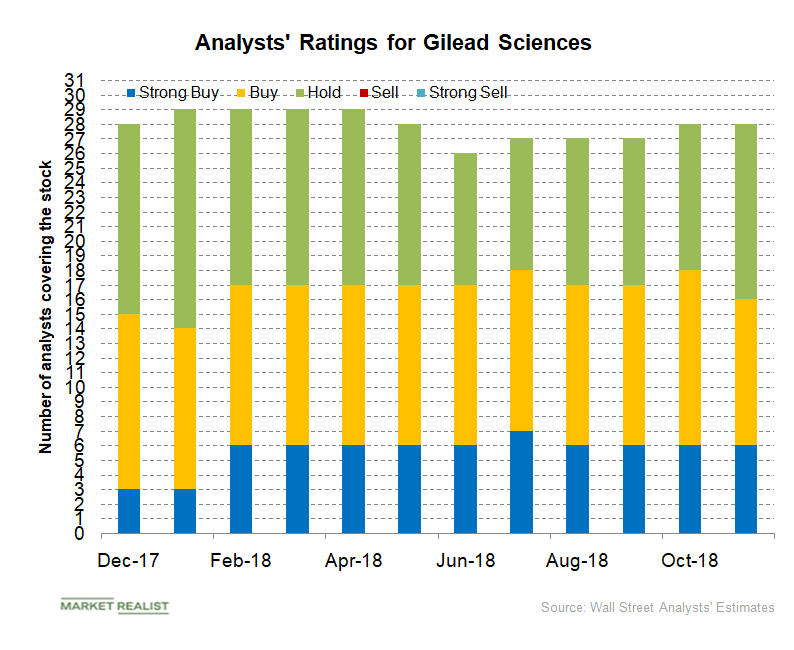

Gilead Sciences: Analysts’ Recommendations

In November, six analysts recommended a “strong buy,” ten recommended a “buy,” and 12 recommended a “hold” for Gilead Sciences.

How Wall Street Analysts View Merck

On October 25, Merck (MRK) announced a dividend of $0.55 per share for its outstanding common stock in the fourth quarter of 2018.

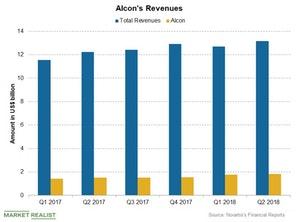

A Look at the Performance of Novartis’s Alcon

Alcon reported revenue of ~$1.82 billion in the second quarter, a 7% rise.

A Look at Pfizer’s Market Cap and Shareholding Pattern

The total number of Pfizer’s outstanding shares is ~5.862 billion. Of these, its free-floating shares total ~5.859 billion.

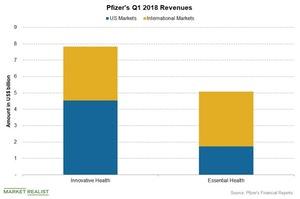

How Pfizer’s Business Segments Have Performed

As discussed, Pfizer’s (PFE) business is divided into two business segments, Innovative Health and Essential Health.

How Celgene Performed in 1Q18

In 1Q18, Celgene’s (CELG) revenue grew 20% year-over-year to $3.5 billion from $3.0 billion, boosted by Revlimid, Pomalyst, and Otezla sales.

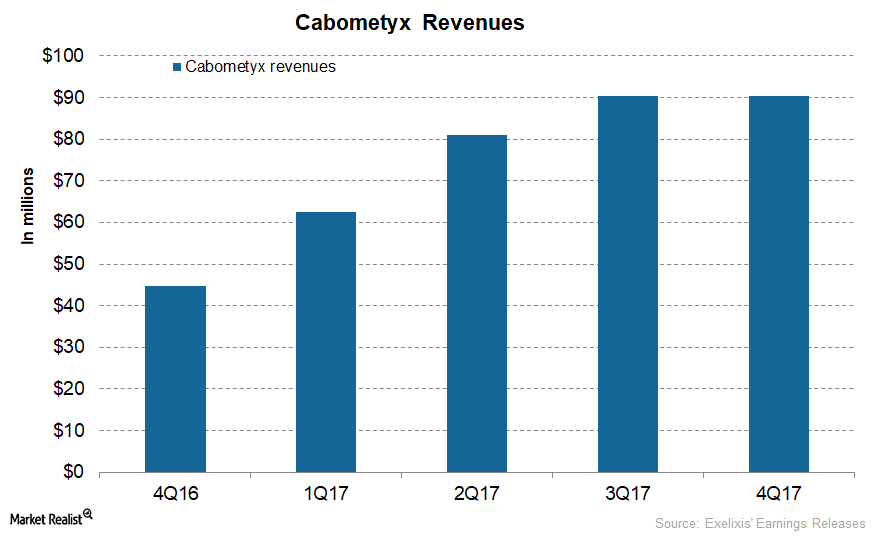

Cabometyx Could Be Exelixis’s Long-Term Growth Driver

In March 2018, the FDA accepted Exelixis’s (EXEL) supplemental New Drug Application (or sNDA) for Cabometyx.

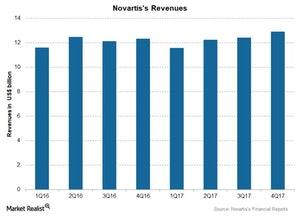

How Novartis’s Revenues Trended in 4Q17

Novartis surpassed Wall Street analysts’ estimates for earnings per share (or EPS) with reported EPS of $4.86 as compared to estimates of $4.82 for 2017.

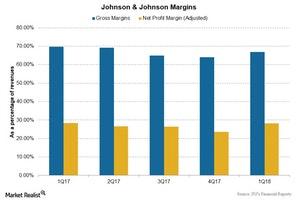

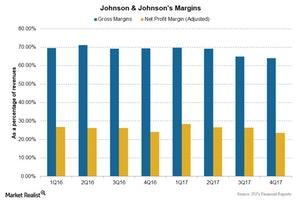

Changes in Johnson & Johnson’s Profit Margins in 4Q17

Johnson & Johnson’s gross profit margin decreased to 64.1% in 4Q17, a ~5% decrease compared to 69.1% in 4Q16.

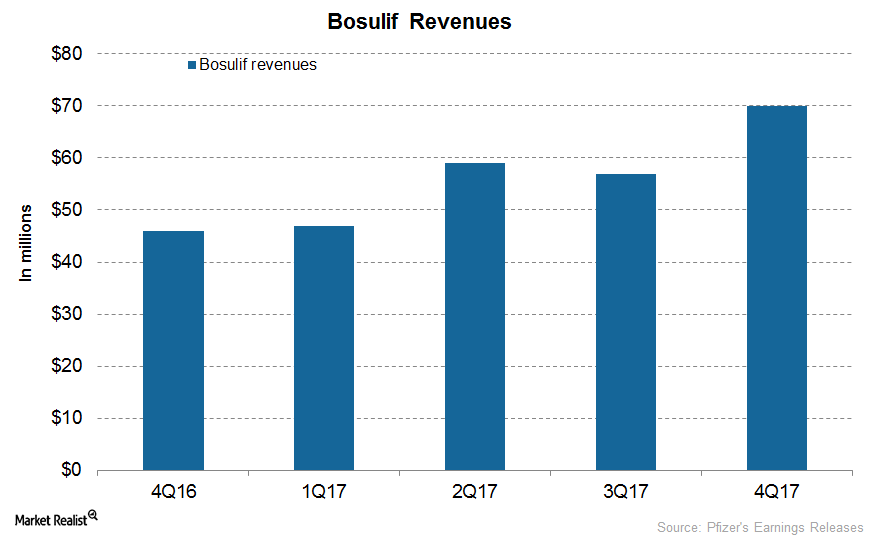

Pfizer’s Bosulif Had a Strong Performance in 4Q17 and 2017

In 4Q17, Pfizer’s (PFE) Bosulif generated revenues of $70 million, which reflected ~52% growth on a YoY (year-over-year) basis.

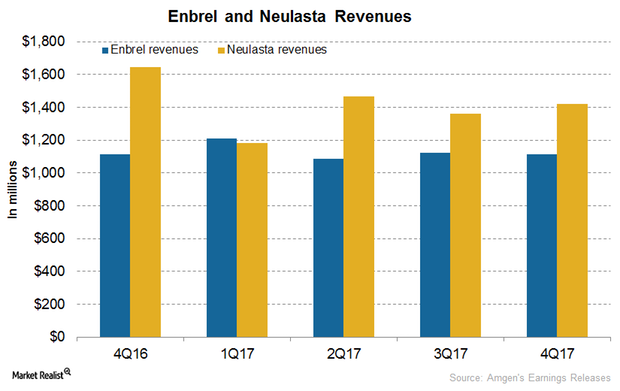

Amgen’s Neulasta and Enbrel in 4Q17 and 2017

In 4Q17, Amgen’s (AMGN) Neulasta generated revenues of $1.1 billion, which reflected a 1% decline on a quarter-over-quarter basis.

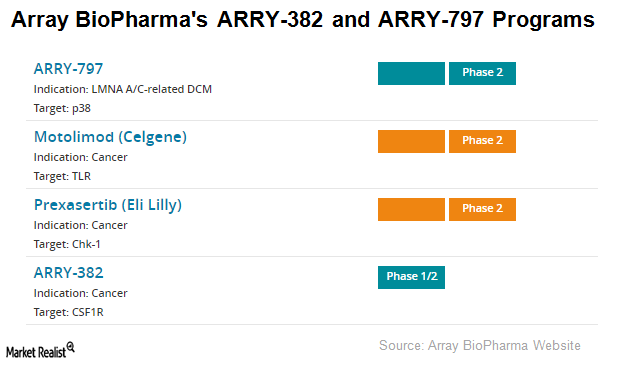

Array BioPharma’s ARRY-382 and ARRY-797

Array BioPharma (ARRY) completed its Phase 1b clinical trial of its investigational drug candidate ARRY-382 in combination with Merck’s (MRK) Keytruda for advanced tumor indications.

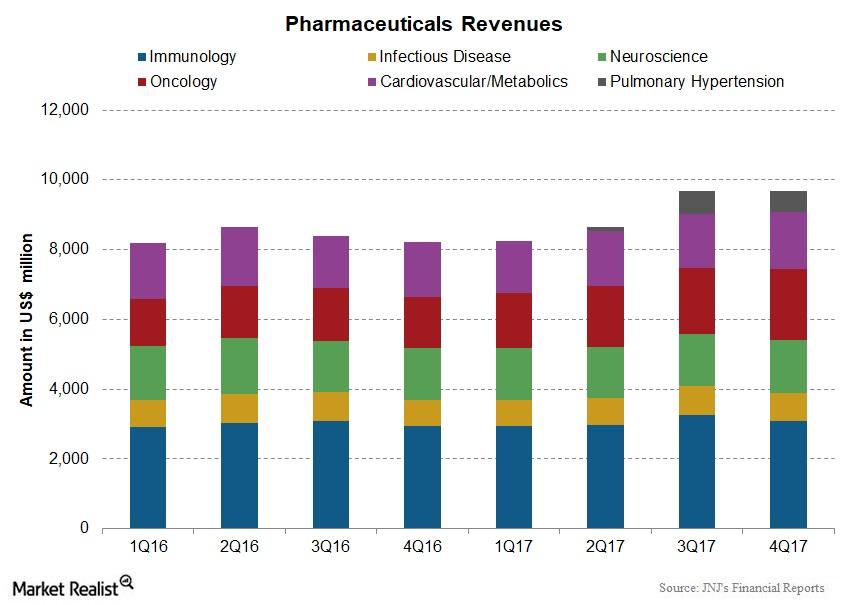

Johnson & Johnson’s Pharmaceuticals Business in 4Q17

Johnson & Johnson (JNJ) reported ~48.0% of its total revenues from the Pharmaceuticals business during 4Q17, making it the company’s largest revenue contributor.

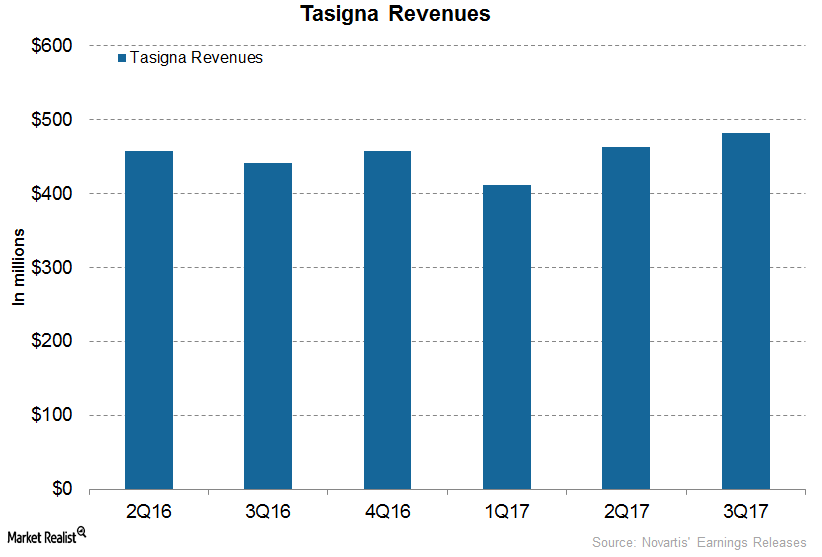

Tasigna Could Boost Novartis’s Revenue Growth in 2018

In 1Q17, 2Q17, and 3Q17, Tasigna generated revenues of $411 million, $463 million, and $482 million, respectively.

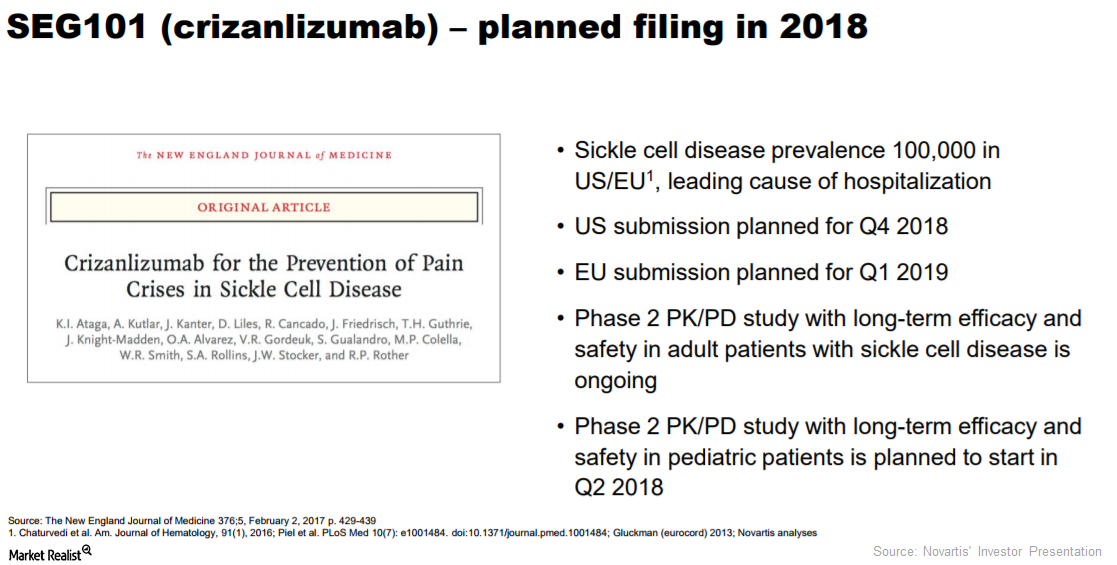

Novartis’s Crizanlizumab Demonstrates Positive Results in Trials

In December 2017, Novartis presented the results from the post-hoc subgroup analysis of the phase 2 Sustain trial.

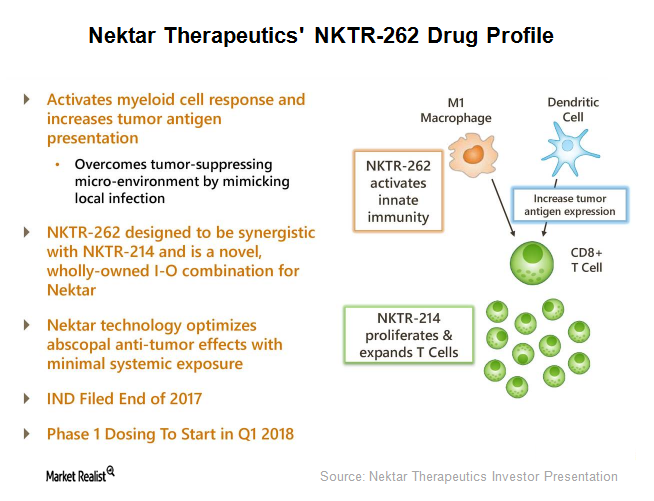

Nektar’s Deals: Daiichi Sankyo, Ophthotech, Bristol-Myers Squibb

Agreement with Daiichi Sankyo In May 2016, Nektar Therapeutics (NKTR) entered into a collaboration and licensing agreement with Daiichi Sankyo, under which Nektar granted exclusive commercialization rights for its product candidate, Onezeald, to Daiichi Sankyo in Europe. Onezeald is a long-acting topoisomerase-1 inhibitor in clinical development for treating adult patients with advanced breast cancer. Nektar […]

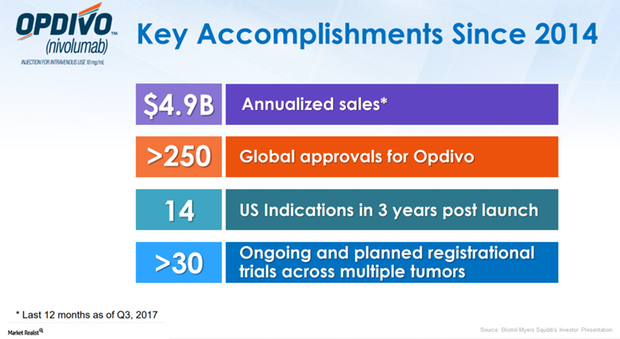

Opdivo Could Be Long-Term Growth Driver for Bristol-Myers Squibb

In 1Q17, 2Q17, and 3Q17, Opdivo reported revenues of $1.1 billion, $1.2 billion, and $1.3 billion, respectively.

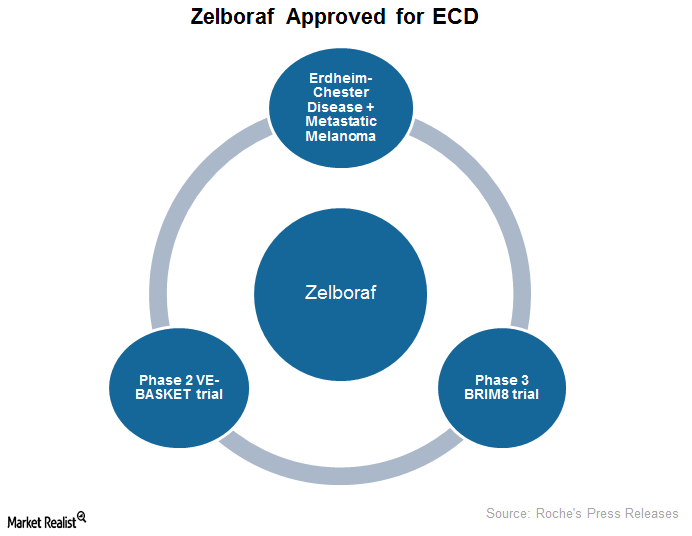

Zelboraf Could Boost Roche’s Sales Growth in 2018

Roche’s (RHHBY) Zelboraf (vemurafenib) is indicated for the treatment of individuals with unresectable or metastatic melanoma with the BRAF V600 mutation.

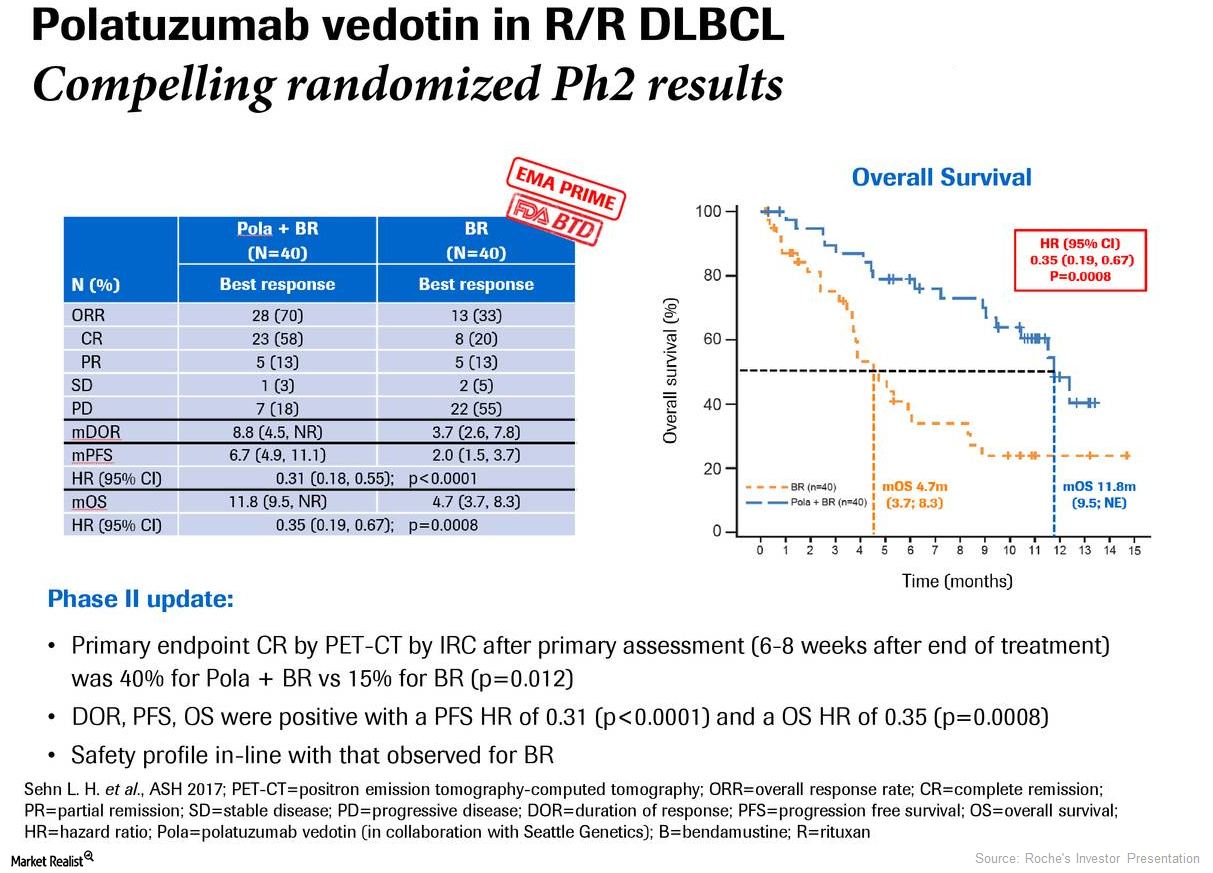

What to Expect from Roche’s Investigational Drug Polatuzumab Vedotin

In December 2017, Roche (RHHBY) presented the results of its randomized phase two GO29365 trial.

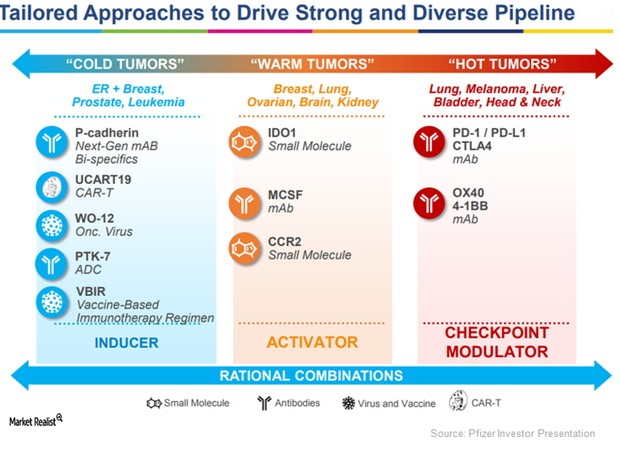

Pfizer Is Pursuing Oncology, Inflammation, and Immunology Research

On May 9, 2017, the US Food and Drug Administration (or FDA) approved Pfizer (PFE) and Merck’s Bavencio (avelumab) as a treatment option for patients suffering from locally advanced or metastatic urothelial carcinoma (or UC).

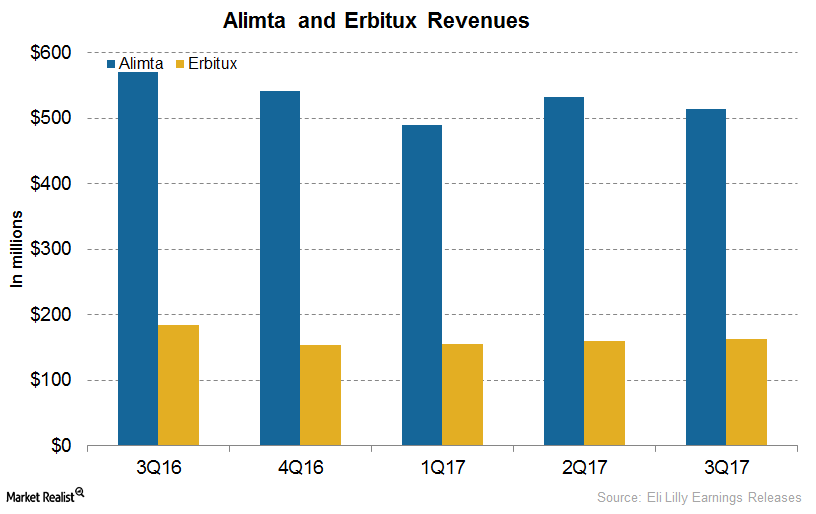

An Update on Eli Lilly’s Oncology Drugs: Alimta, Erbitux, and Gemzar

In 3Q17, Eli Lilly’s (LLY) Alimta generated revenues of $514.5 million, a ~10% increase on a year-over-year (or YoY) basis and a 3% decline on a quarter-over-quarter basis.

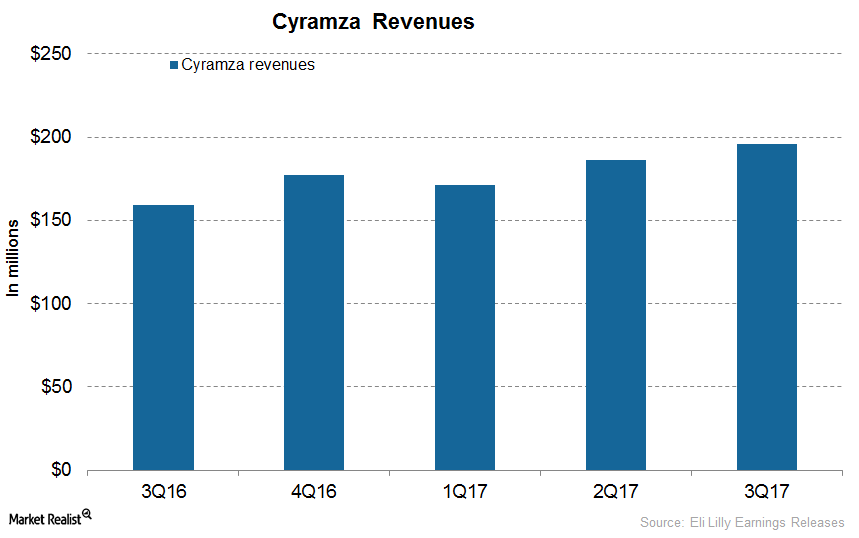

How Has Eli Lilly’s Cyramza Performed

In 3Q17, Eli Lilly’s (LLY) Cyramza generated revenues of $196 million, which reflected ~23% growth on a YoY basis and 5% growth on a quarter-over-quarter basis.

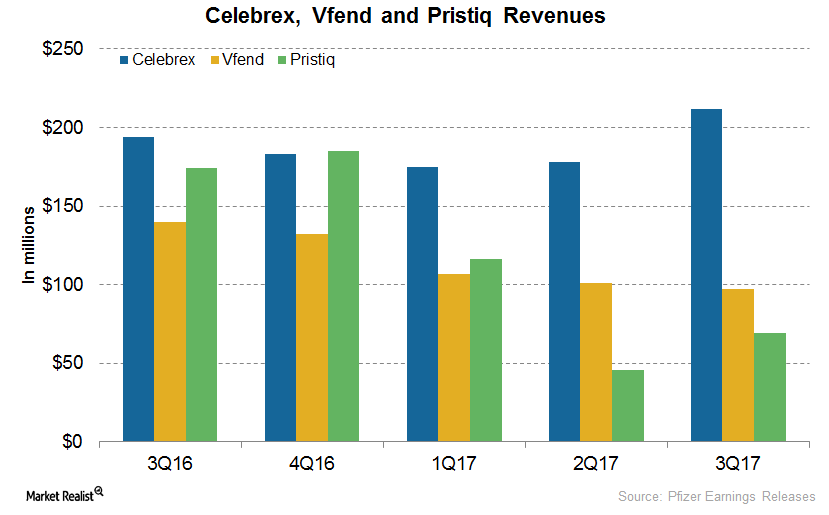

A Look at How These Pfizer Drugs Have Performed in 2017

In 3Q17, Pfizer’s (PFE) Celebrex generated revenues of $212 million, a ~9% increase on a year-over-year (or YoY) basis and a 19% increase on a quarter-over-quarter basis.

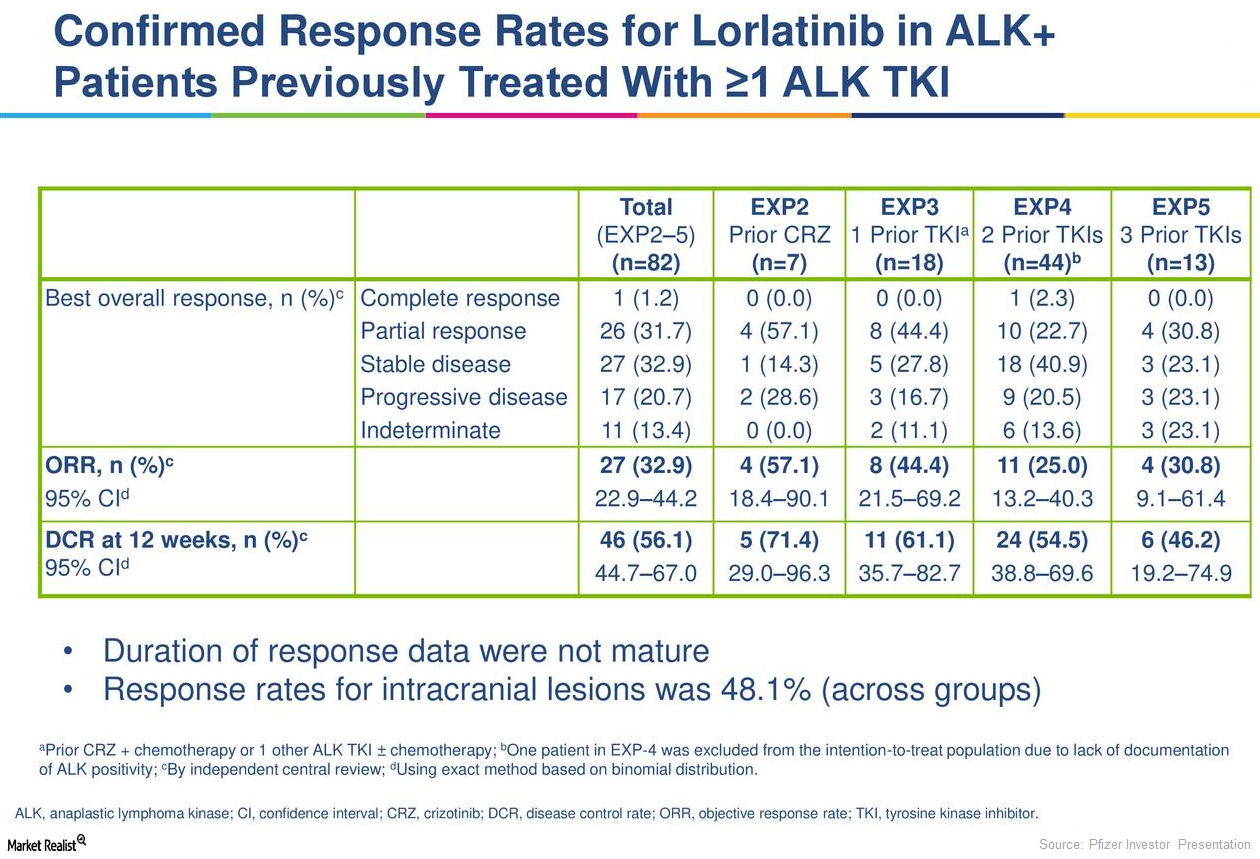

Could Lorlatinib Be a Long-Term Growth Driver for Pfizer?

Lorlatinib is Pfizer’s (PFE) investigational next-generation ALK/ROS-1 tyrosine kinase inhibitor in clinical trials to evaluate its safety and efficacy in the treatment of ALK-positive metastatic non-small cell lung cancer.

How Johnson & Johnson’s Profit Margins Trended in 3Q17

Johnson & Johnson (JNJ) reported revenues of $19.7 billion during 3Q17, a 10.3% increase as compared to revenues of $17.8 billion during 3Q16. However, the gross profit margins contracted in 3Q17.