Major Developments for Johnson & Johnson in 3Q16

Major developments As discussed previously in this series, Johnson & Johnson’s (JNJ) 3Q16 performance was positive across all of its segments. However, the Consumer segment reported a decline in revenue, as the negative impact of foreign exchange more than offset operational growth. There were several major developments for JNJ during 3Q16. Pharmaceuticals segment In 3Q16, the […]

Dec. 4 2020, Updated 10:53 a.m. ET

Major developments

As discussed previously in this series, Johnson & Johnson’s (JNJ) 3Q16 performance was positive across all of its segments. However, the Consumer segment reported a decline in revenue, as the negative impact of foreign exchange more than offset operational growth. There were several major developments for JNJ during 3Q16.

Pharmaceuticals segment

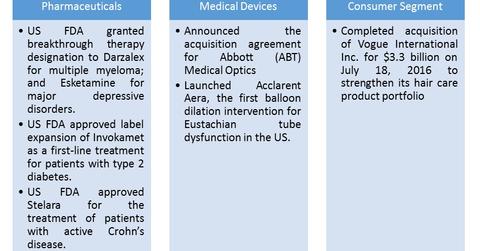

In 3Q16, the Pharmaceuticals segment reported the following major developments:

- the FDA granted breakthrough therapy designation to Darzalex for the treatment of patients with multiple myeloma, and Esketamine for the treatment of major depressive disorders

- the FDA approved the label expansion of Invokamet as a first-line treatment for patients with type 2 diabetes

- the FDA approved Stelara for the treatment of patients with active Crohn’s disease

- the company submitted a supplemental biologics license agreement for the use of Darzalex in combination with other drugs for the treatment of multiple-myeloma patients who have undergone at least one treatment

- the company submitted a biologics license agreement for the use of Sirukumab for the treatment of rheumatoid arthritis

- the company submitted a marketing authorization application for a Darunavir-based single tablet treatment for HIV-1

Medical Devices segment

- announced the Abbott Medical Optics acquisition agreement

- launched Acclarent Aera, the first balloon dilation intervention for eustachian tube dysfunction in the United States

Consumer segment

- completed the acquisition of Vogue International on July 18, 2016, to strengthen its haircare and personal care product portfolio, for a total of $3.3 billion

Abbott Laboratories’ (ABT) Humira competes with JNJ’s Stelara, while Bristol-Myers Squibb’s (BMY) and Pfizer’s (PFE) Eliquis competes with JNJ’s Xarelto. Investors could consider the VanEck Vectors Pharmaceutical ETF (PPH), which has a 5.1% exposure to Johnson & Johnson.