Johnson & Johnson

Latest Johnson & Johnson News and Updates

Johnson & Johnson Will Split Its Company in Two, Segment Liabilities

Johnson & Johnson wants to focus on drugs. Does that mean it's going to split its company up?

Will Johnson & Johnson Settle Remaining Talcum Powder Cases?

Johnson & Johnson is still dealing with lawsuits related to its talcum powder product. Will the company settle?

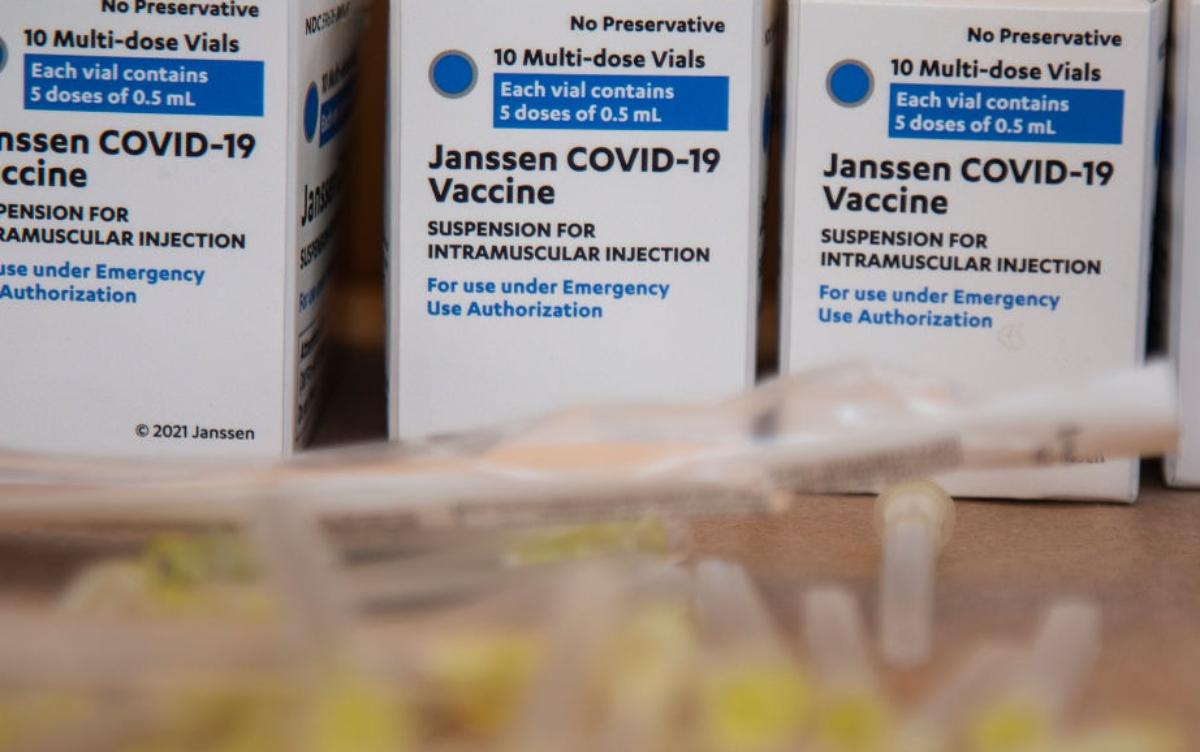

When Will the Johnson & Johnson COVID-19 Booster Be Available?

The NIH came out with recommendations about COVID-19 booster shots. Johnson & Johnson might not be the best option.

Johnson & Johnson Booster Shots Could Be Available Soon

If approved by the FDA for emergency use, the Johnson & Johnson booster shots could be available as soon as November. J&J says its booster provides 94 percent protection.

Will There Be a Johnson & Johnson (JNJ) Booster Shot for COVID-19?

Will there be a booster shot for those who got the Johnson & Johnson COVID-19 vaccine? Health agencies will allow boosters for Pfizer and Moderna soon.

COVID-19 Vaccine Maker Johnson & Johnson Has a Long History

Who owns Johnson & Johnson? The publicly-traded corporation’s top stakeholders include its CEO and multiple EVPs. Learn more about the company.

Investing in Janssen Pharmaceuticals Amid COVID-19 Vaccine Push

The FDA approved Janssen Pharmaceuticals’ application to conduct a clinical trial of its COVID vaccine candidate in the Philippines. Is Janssen Pharmaceuticals publicly traded?

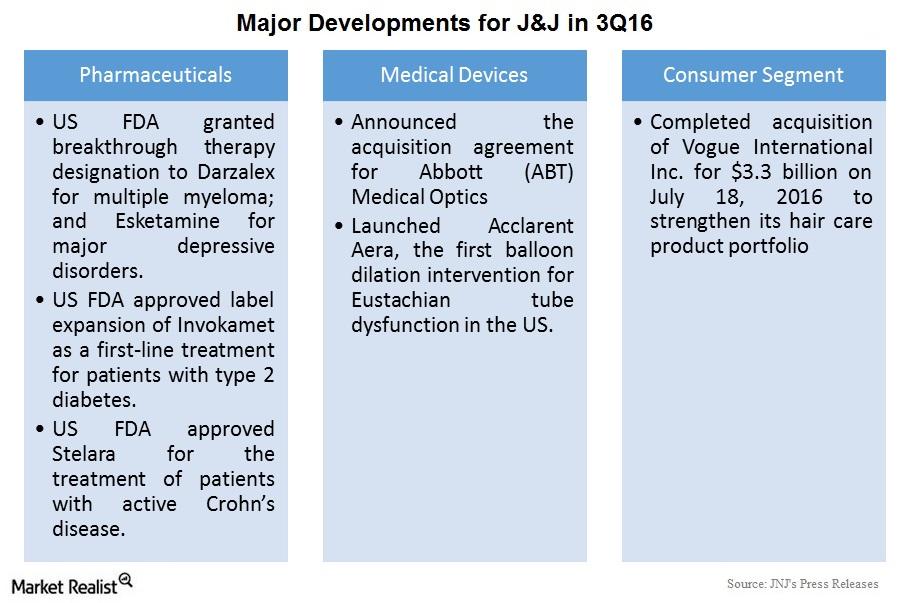

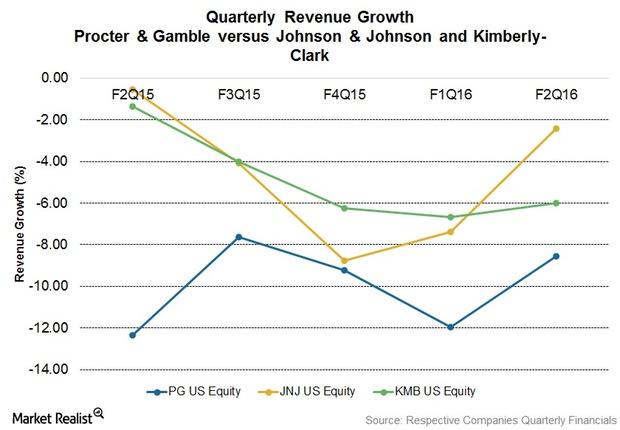

Major Developments for Johnson & Johnson in 3Q16

Major developments As discussed previously in this series, Johnson & Johnson’s (JNJ) 3Q16 performance was positive across all of its segments. However, the Consumer segment reported a decline in revenue, as the negative impact of foreign exchange more than offset operational growth. There were several major developments for JNJ during 3Q16. Pharmaceuticals segment In 3Q16, the […]

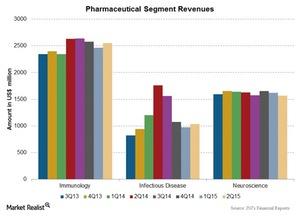

Johnson & Johnson’s Pharmaceuticals Segment Grows in 2Q15

Johnson & Johnson’s (JNJ) Pharmaceuticals segment grew by 1.0% at constant exchange rates, reporting a revenue of $7,946 million for 2Q15 over 2Q14.

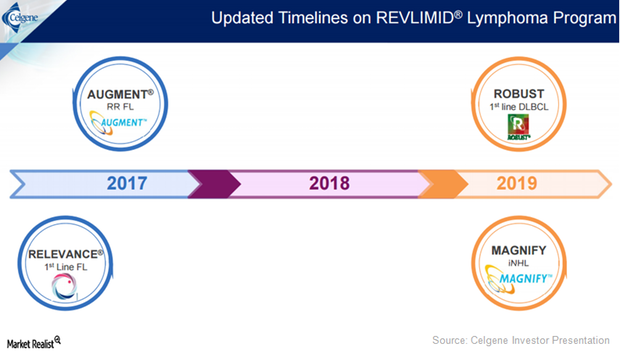

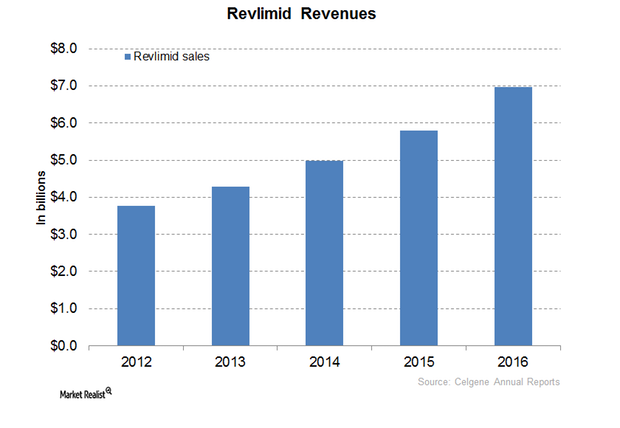

Celgene’s Revlimid Expected to Post Strong Revenue in 2017

According to unaudited financial results published by Celgene (CELG) on January 9, 2017, Revlimid sales for 2016 are about $7.0 billion, a YoY rise of about 20.0%.

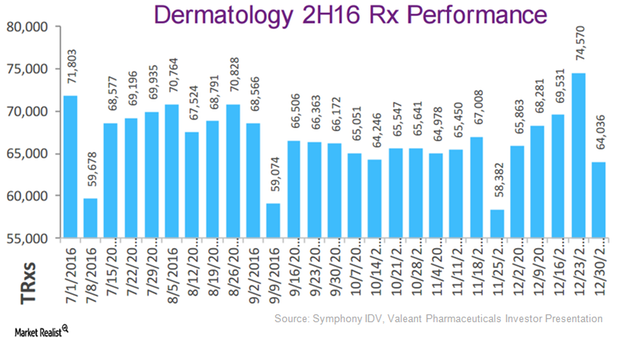

Valeant’s Dermatology Business Felt Pricing Pressure in 2016

Dermatology pricing trends Valeant Pharmaceuticals’ (VRX) dermatology business witnessed intense pricing pressure in 2016, due to a change in the company’s distribution model in 4Q15. While Valeant previously marketed its dermatology drugs through specialty pharmacies, the company now distributes its products through Walgreens. To learn about the company’s current distribution model, please refer to How Valeant Plans […]

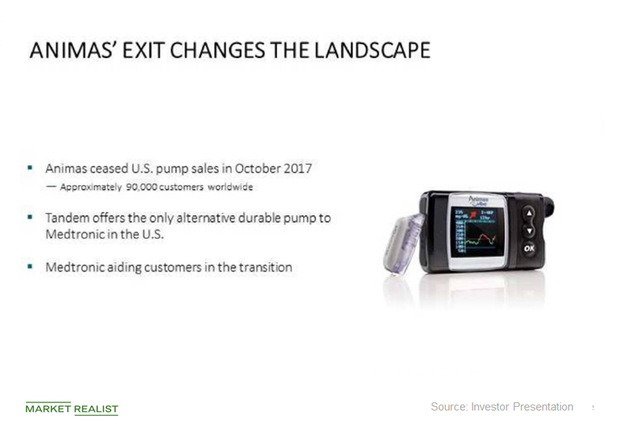

Tandem Diabetes Care’s International Expansion Strategy

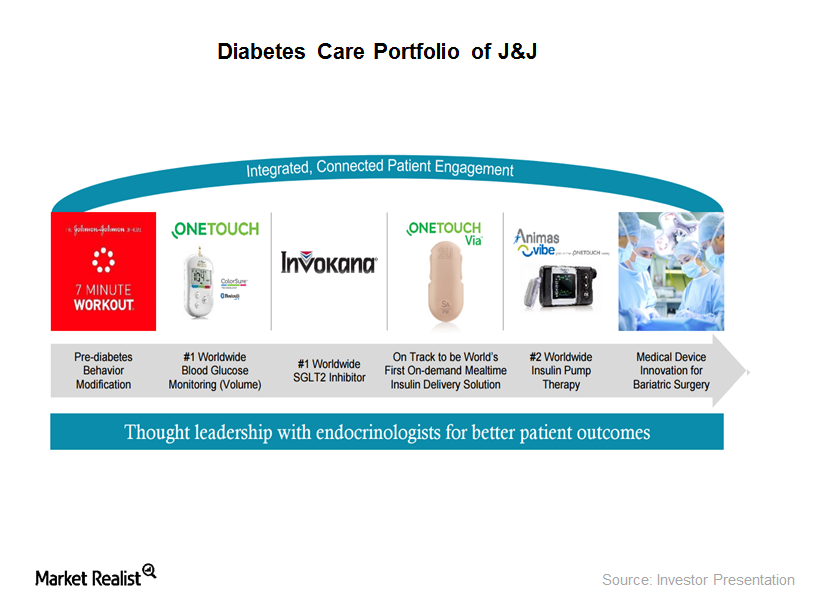

Tandem Diabetes Care (TNDM) is slated to begin its international expansion later this year to capture opportunities arising after Johnson & Johnson’s (JNJ) exit from the insulin pump market, which was announced in October 2017.

Emerging Markets Drive Abbott’s Nutritional Business Growth

In 1Q17, Abbott Laboratories’ (ABT) Nutritional segment reported revenue of nearly $1.6 billion, a year-over-year (or YoY) fall of ~1%.

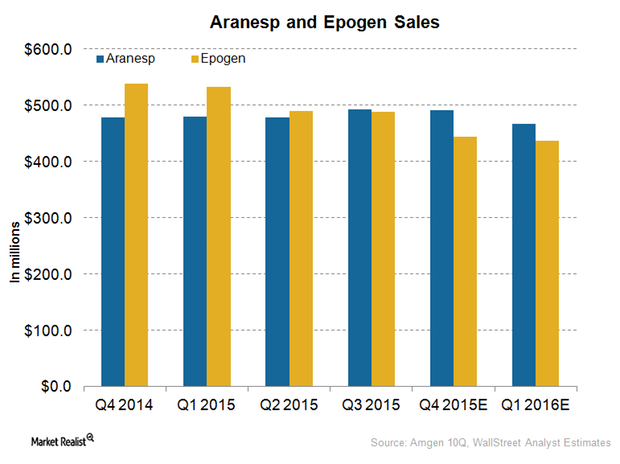

Amgen’s Nephrology Drugs Expect Falling Revenue in 4Q15

Analysts projected a fall in the revenue for Amgen’s nephrology drugs, Aranesp and Epogen, in 4Q15. The drugs are expected to suffer in the coming quarters.

Henkel Acquired Procter & Gamble’s Haircare Brands

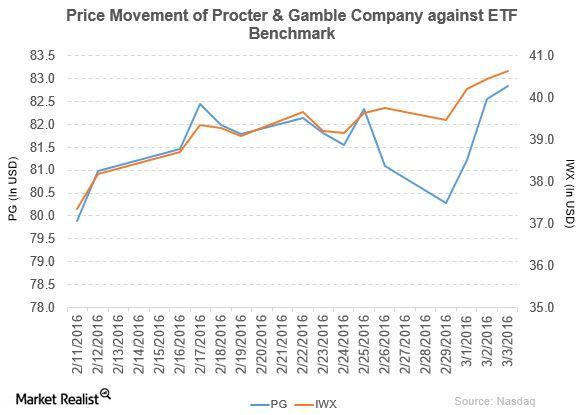

Procter & Gamble (PG) has a market cap of $224.1 billion. PG rose by 0.35% to close at $82.84 per share on March 3, 2016.

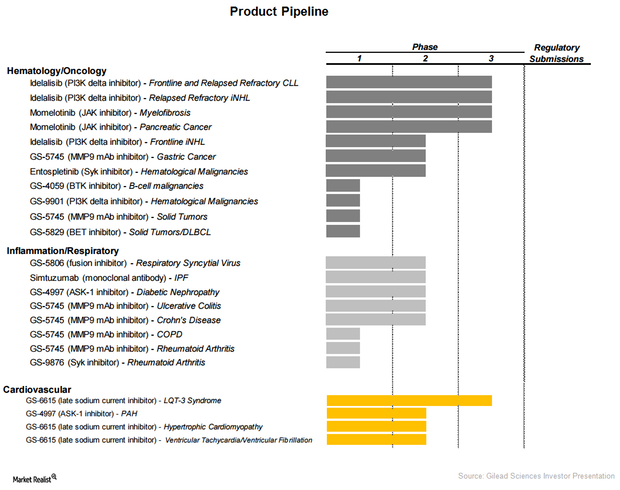

Gilead Sciences’ Product Line Extension

As part of its significant product line extension, Gilead Sciences (GILD) is entering therapeutic areas such as oncology, pulmonology, and cardiology.

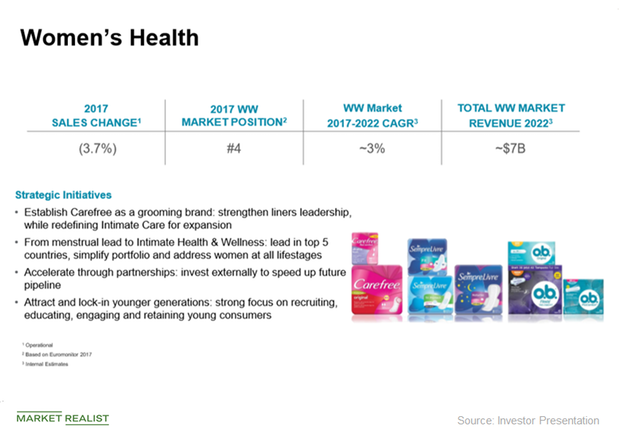

How Johnson & Johnson Plans to Restore Women’s Health Sales

Johnson & Johnson (JNJ) reported sales of $3.4 billion in its consumer business in the first quarter, with 7% of it from its women’s health business.

Johnson & Johnson’s Growth Strategy: Expand Emerging Channels

Amid the increasing presence of digital technology, Johnson & Johnson (JNJ) has recognized the need to expand its channel presence.

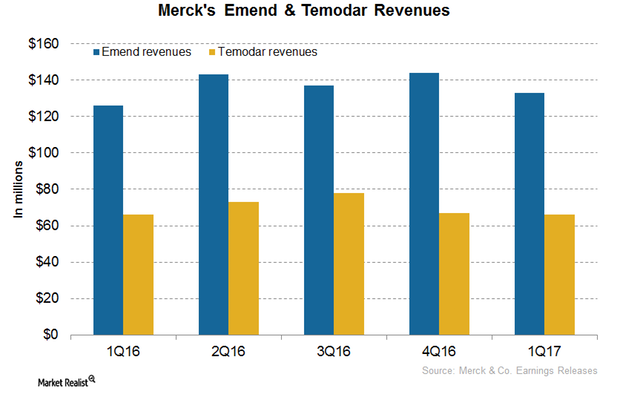

How Merck’s Oncology Drugs Emend and Temodar Could Perform in 2017

In 2016, Merck’s (MRK) Emend reported revenues of around $549 million, which reflected 3% year-over-year growth.

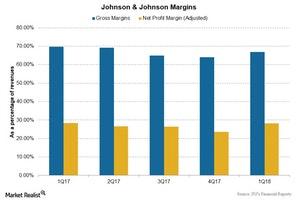

Analyzing Johnson & Johnson’s 1Q18 Profitability

Johnson & Johnson (JNJ) reported revenues of $20.0 billion during 1Q18, 12.6% growth as compared to revenues of $17.8 billion during 1Q17.

Johnson & Johnson Gets FDA Approval for Type 2 Diabetes Drug

On September 21, 2016, the FDA approved Jannsen Pharmaceuticals’ Invokamet XR for the treatment of adults suffering from Type 2 diabetes.

Revlimid Could Continue to Drive Celgene’s Revenue Growth in 2017

In 2016, Celgene’s (CELG) Revlimid generated revenues of around $6.9 billion, which reflected a ~20% year-over-year (or YOY) growth.

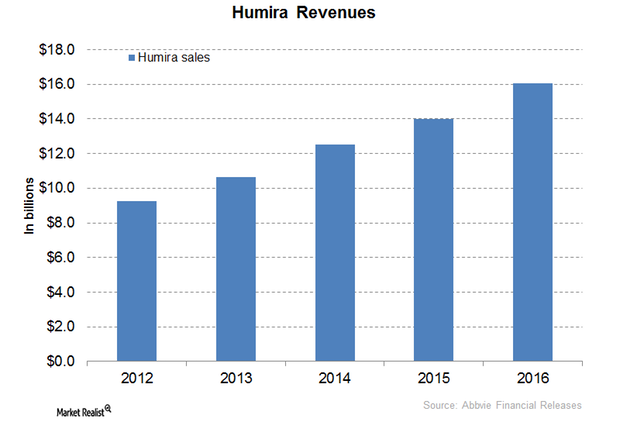

Humira May Continue to Drive AbbVie’s Revenue Growth

In 2016, AbbVie’s (ABBV) drug Humira reported revenue of ~$16.0 billion, which reflected a ~15% year-over-year (or YoY) rise.

Pfizer’s Growth Rate and Estimates

Pfizer (PFE) reported an EPS of $0.74 on revenues of ~$13.5 billion during the second quarter, which beat analysts’ estimate of ~$13.3 billion.

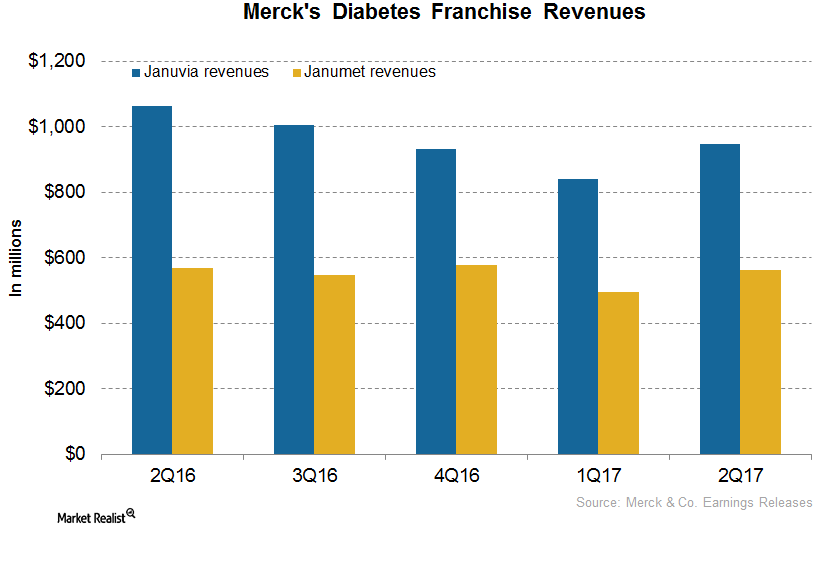

Januvia and Janument: An Update on Merck’s Diabetes Franchise after 2Q17

In 2Q17, Merck’s (MRK) Januvia generated revenues of around $948 million, which reflected an ~11% decline on a year-over-year basis and 13% growth on a quarter-over-quarter basis.

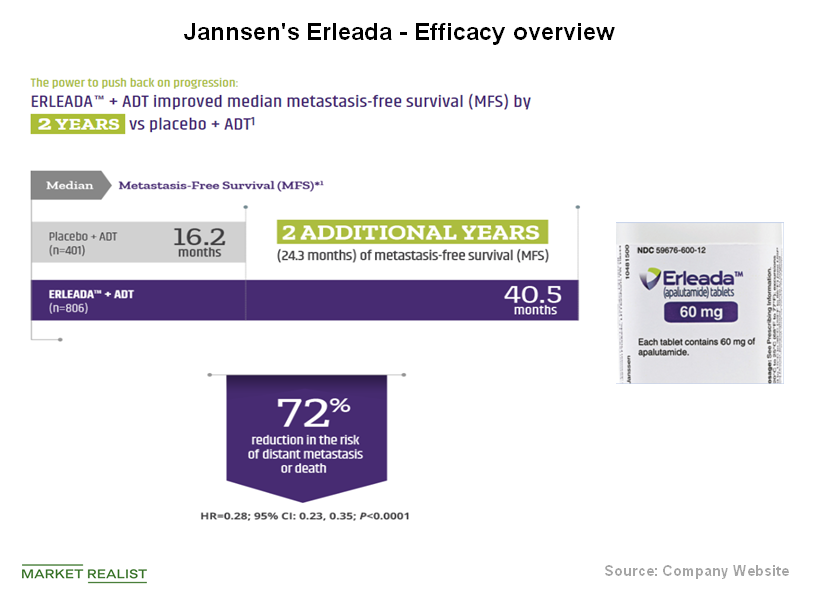

Johnson & Johnson’s Erleada Approved by Health Canada

On July 4, Johnson & Johnson’s (JNJ) pharmaceuticals division, Janssen, received Health Canada’s approval for its drug Erleada.

Johnson & Johnson in the Changing Consumer Market Landscape

Although changing consumer market dynamics pose challenges for Johnson & Johnson (JNJ), it’s confident it will be able to adapt.

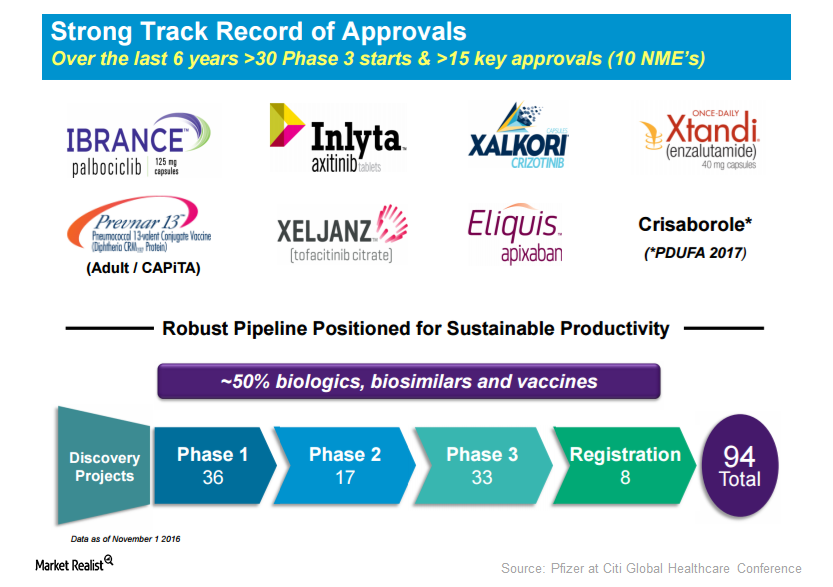

Pfizer Has Strong Track Record since 2010

As of November 1, Pfizer had ~94 projects in various development stages. More than 40% of these projects are in phase three or the registration phase.

How Johnson & Johnson’s Partnerships Enhance Customer Value

Johnson & Johnson’s key innovation strategies include creating value through strategic customer partnerships and solutions.

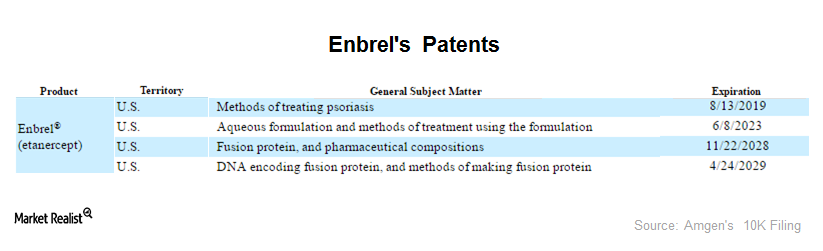

Why Is Enbrel So Important for Amgen?

YTD, Amgen’s (AMGN) stock has already fallen 9%. Perhaps the pressure that Enbrel (etanercept) is seeing is to blame for the negative investor sentiment.

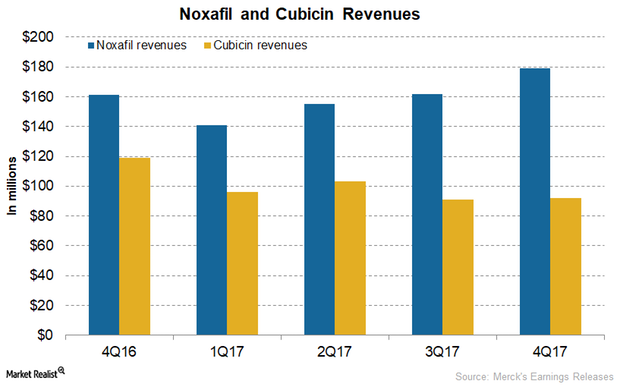

Understanding the Performance of Merck’s Hospital Acute Care Drugs Noxafil and Cubicin

In 4Q17, Merck’s (MRK) Cubicin reported revenues of $92 million, which was ~23% lower on a YoY (year-over-year) basis.

Pfizer Reports 1Q18 Earnings and Revenue Growth

Pfizer (PFE) released its 1Q18 earnings today, reporting another strong quarter for the Innovative health business.

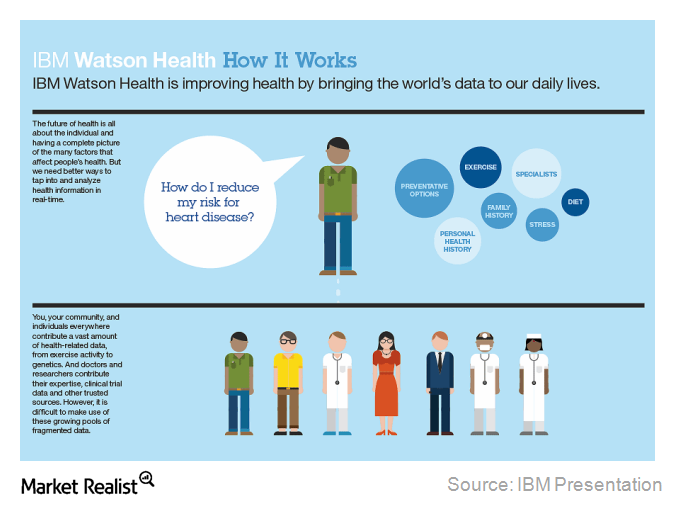

IBM Is Paving the Way for Watson Health: Acquisitions and Deals

IBM’s partnership with Apple is especially appealing. Watson Health will bring cloud services and analytics to Apple’s HealthKit and ResearchKit.

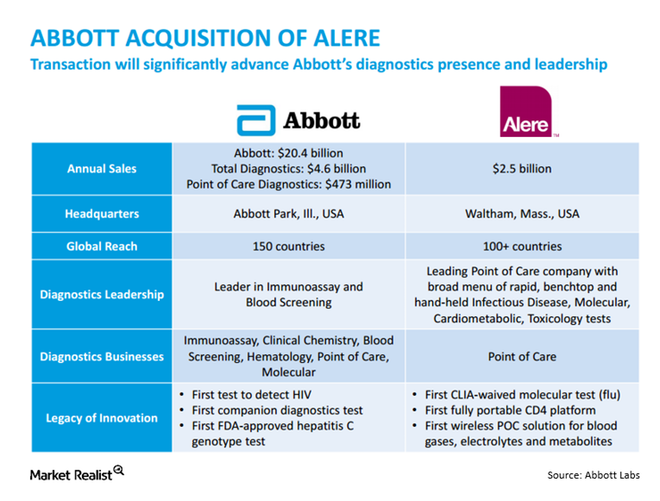

A Brief Recap of the Abbott–Alere Deal Developments

Three months after announcing a $5.8 billion deal in which Abbott Laboratories (ABT) would buy Alere (ALR), Alere rejected Abbott’s $50 million offer to end the deal. On December 7, Abbott sued Alere to terminate the deal.

Why P&G Transferred Its Duracell Business to Berkshire Hathaway

On February 29, 2016, Procter & Gamble (PG) announced the completion of the transfer of its Duracell business to Berkshire Hathaway (BRK-B).

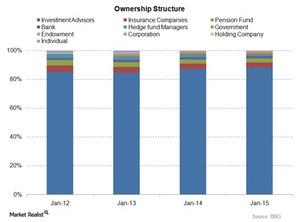

Understanding Johnson & Johnson’s Ownership Structure

As of January 2015, Johnson & Johnson’s ownership structure is dominated by passive investments. They account for more than 80% of the total ownership structure.

An Easier Way to Understand the Pharma Industry

In 2018, the global pharmaceutical industry stood at $1.2 trillion, and experts expect $1.5 trillion by 2023. Here’s everything investors need to know.

How to Make Money with Dividend Investing

If you’re an income investor, I’ve got a strategy for you. Dividend investing is a time-tested way to grow your account over the long haul.

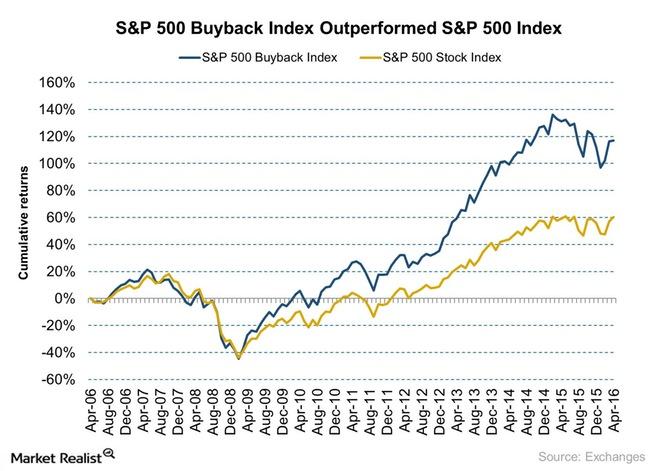

Carl Icahn’s View on Share Buybacks Is Divided

Apple (AAPL) is one of the most cash-rich companies in the US. While Carl Icahn has been talking about share buybacks artificially inflating the Market and asset values, some buybacks have occurred as a result of his push.Consumer Must-know: An overview of Interpublic Group’s businesses

Interpublic Group’s (IPG) companies specialize in consumer advertising, digital marketing, communications planning and media buying, public relations, and specialized communications disciplines.

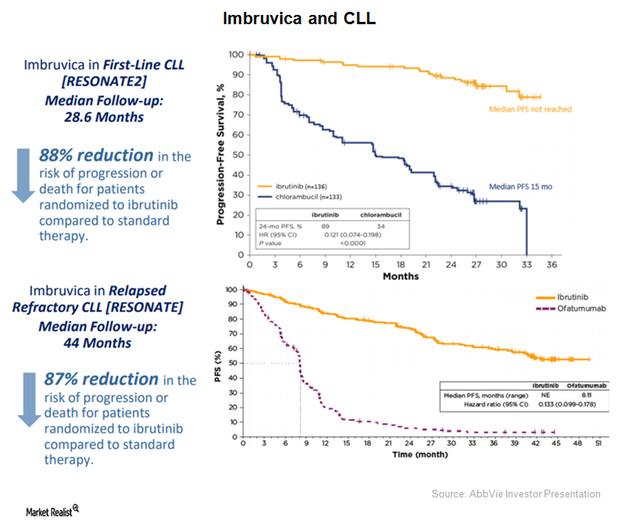

AbbVie Expects Peak Sales of $7 Billion for Imbruvica

AbbVie (ABBV) has projected Imbruvica’s annual revenues to be $5 billion by 2020. That would be driven by a rapid uptake in the first line chronic lymphocytic leukemia (or CLL) segment.

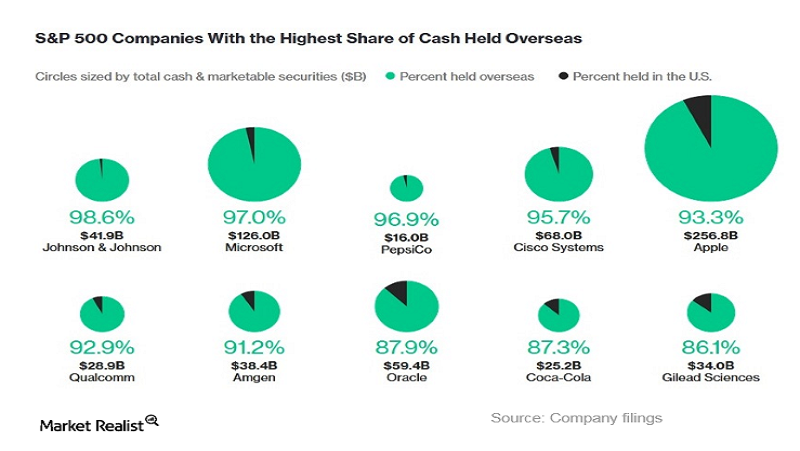

How Much Cash Is Amazon Holding Abroad?

Apple (AAPL) is said to hold 93.3% of its cash outside the US.

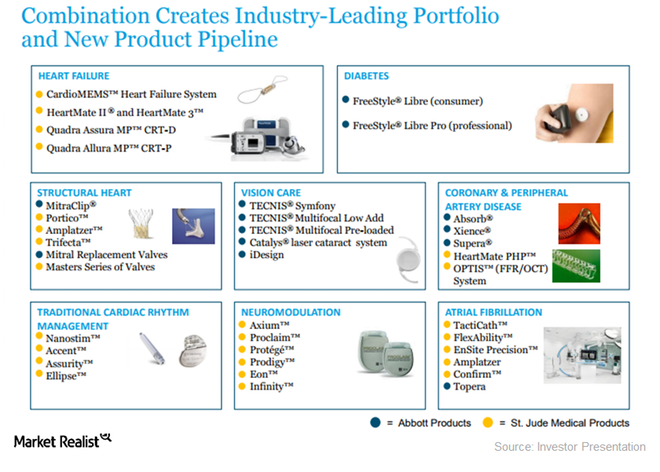

These Developments Impacted Abbott Laboratories the Most in Fiscal 2017

Abbott Laboratories posted a strong earnings results on January 24, surpassing Wall Street estimates and posting earnings at the high end of its guidance.

Why Pfizer Stock Continues to Tank after Mylan Deal

Pfizer stock (PFE) has fallen 10% in the past two days on its deal with Mylan (MYL) and its lower earnings guidance.

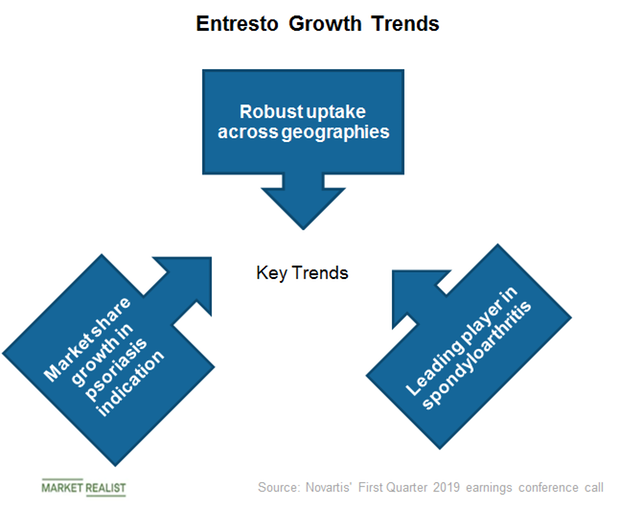

A Look at Cosentyx, Novartis’s Fast-Growing Immunology Drug

In the first quarter, Novartis’s (NVS) Cosentyx reported net sales of $791 million, a YoY (year-over-year) rise of 41% on a constant currency basis.

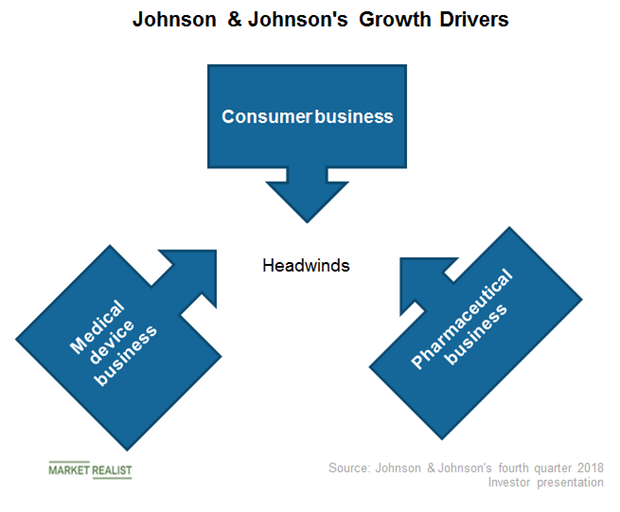

Here Are Some Possible Headwinds and Tailwinds for JNJ in 2019

In its fourth-quarter earnings investor presentation, Johnson & Johnson (JNJ) highlighted increasing biosimilar and generic competition, pricing pressure, and the strengthening of the US dollar as key challenges for the company in fiscal 2019.

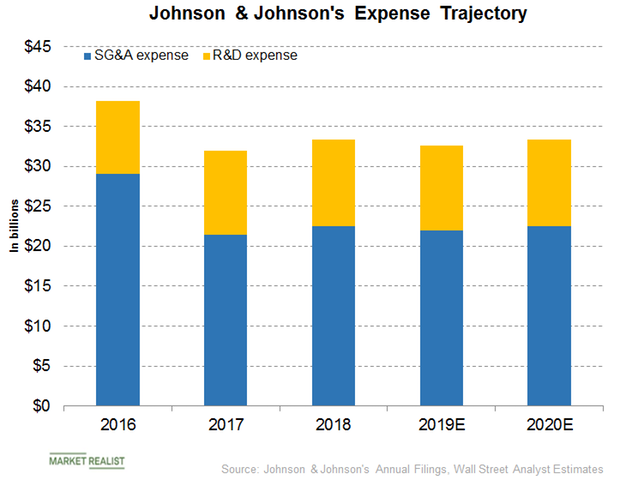

Johnson & Johnson to Focus on Increasing Research and Development

In its fourth-quarter earnings investor presentation, Johnson & Johnson (JNJ) has projected its effective tax rate for fiscal 2019 to fall in the range of 17% to 18%.

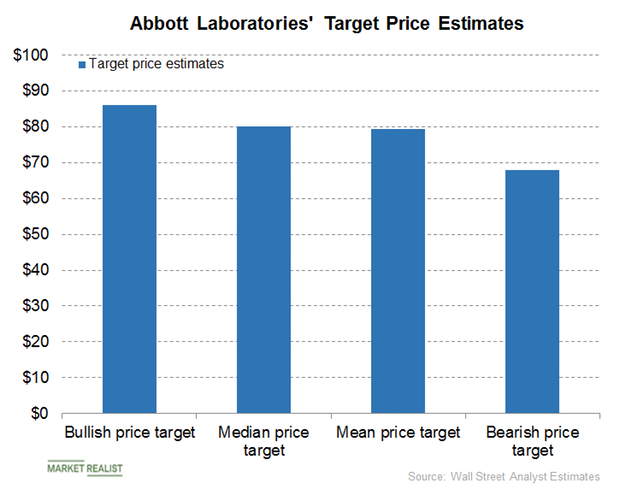

What Do Analysts Recommend for Abbott Laboratories in January?

The 12-month consensus analyst recommendation for Abbott Laboratories on January 18 is a “buy.”

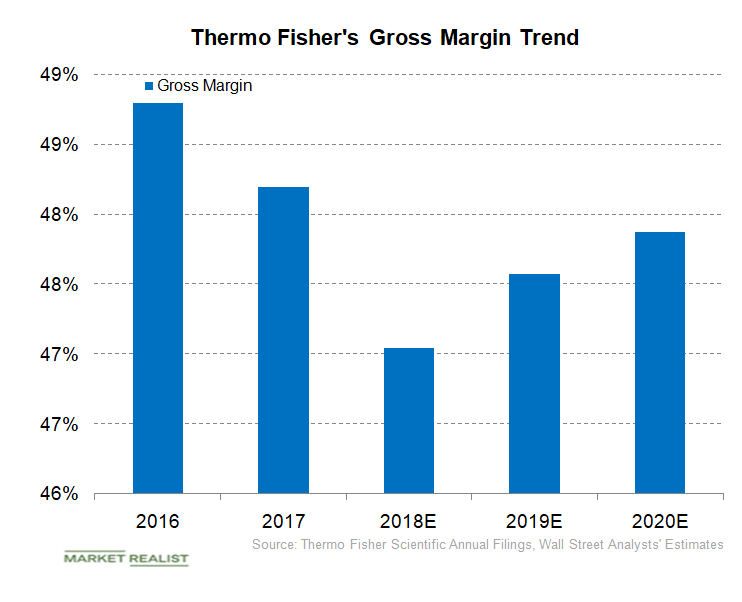

Thermo Fisher Scientific’s Gross Margin Trends

In fiscal 2018 and fiscal 2019, Thermo Fisher Scientific (TMO) is expected to generate revenue of $24.08 billion and $25.19 billion, respectively, compared with revenue of $20.92 billion in fiscal 2017.

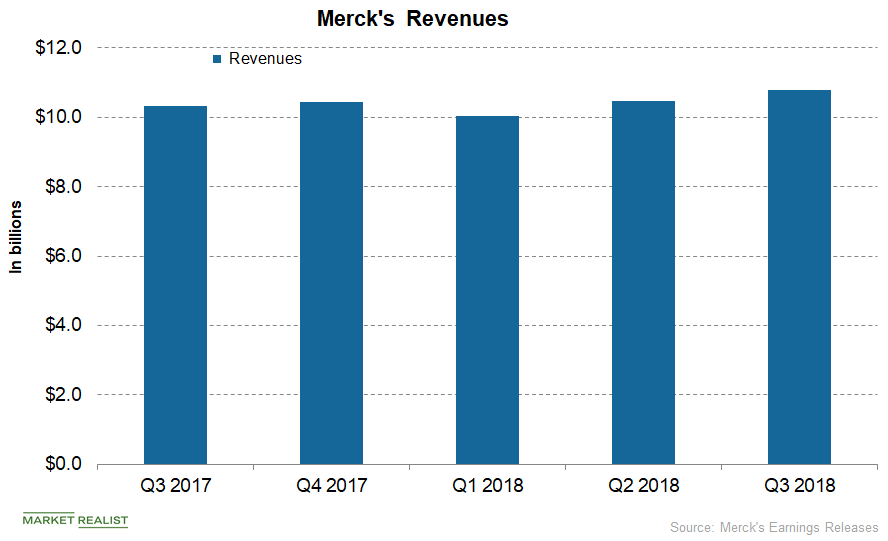

Merck’s Stock Price Has Increased ~34% in 2018

On November 16, Merck’s stock price closed at $76.06, which represents ~1.63% growth from its close of $74.84 on November 15.