Johnson & Johnson

Latest Johnson & Johnson News and Updates

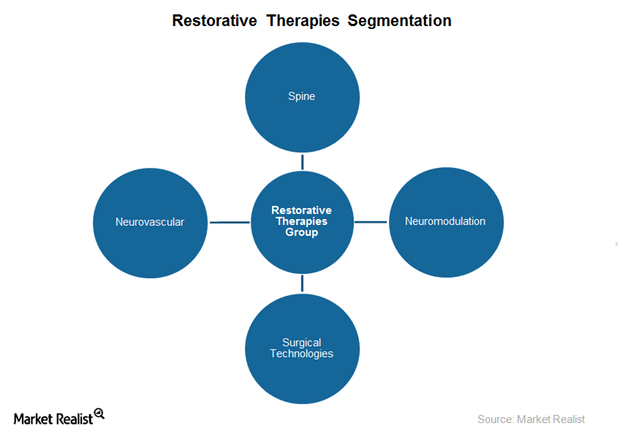

Analyzing Medtronic’s Restorative Therapies Group Segment

Medtronic’s Restorative Therapies Group’s net sales in fiscal 2015 reached ~$6.8 billion, which represents an increase of 4% over the prior fiscal year.

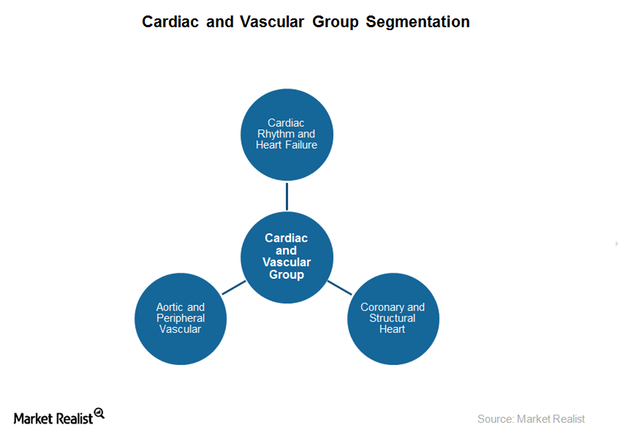

Evaluating Medtronic’s Cardiac and Vascular Devices Segment

Medtronic’s Cardiac and Vascular segment consists of Cardiac Rhythm and Heart Failure, Coronary and Structural Heart, and Aortic and Peripheral Vascular.

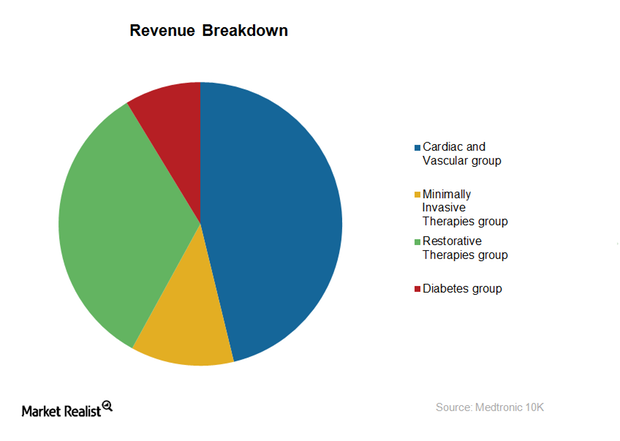

A Key Breakdown of Medtronic’s Business Model

Medtronic generates revenue through four segments: Cardiac and Vascular Group, Minimally Invasive Therapies, Restorative Therapies, and the Diabetes Group.

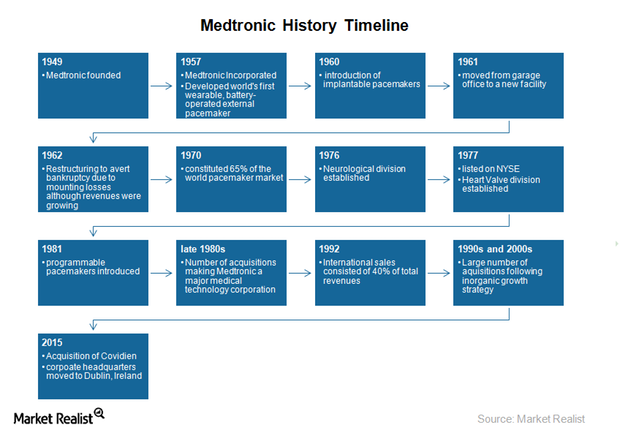

Introducing Medtronic, a Leading Medical Device Company

Headquartered in Minnesota, Medtronic is the world’s largest pure-play medical device company, with operations in 160 countries and over 85,000 employees.

Pfizer-Allergan Deal: Pfizer Will Combine with Allergan

On November 23, two of the big pharmaceutical companies—Pfizer and Allergan—announced the biggest merger transaction ever in pharmaceuticals.

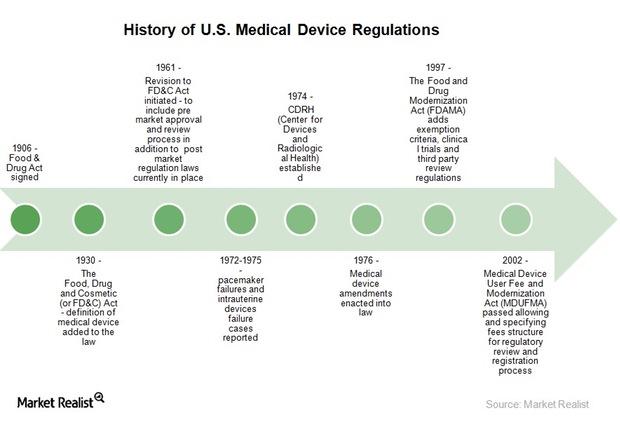

Key Regulations that Affect Medical Device Companies

The US Food and Drug Administration’s Center for Devices for Radiological Health (or USFDA/CDRH) regulates the medical device industry in the United States.

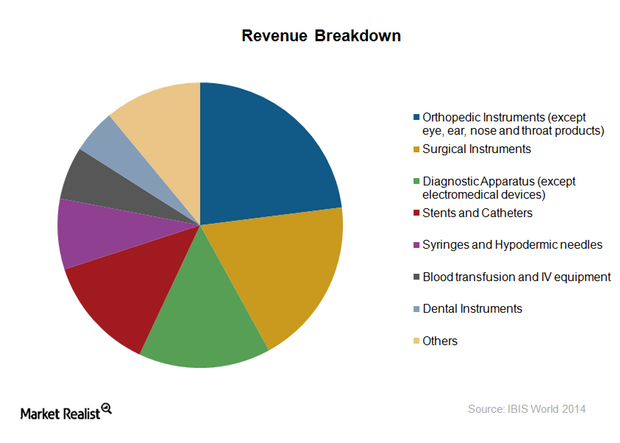

How Is the Medical Device Industry Segmented?

The US medical devices industry can be categorized according to the field of medicine in which a device is used.

A Must-Read Overview of the Medical Device Industry

The US medical device market is projected to grow at a compound annual growth rate of 6.1% between 2014 and 2017.

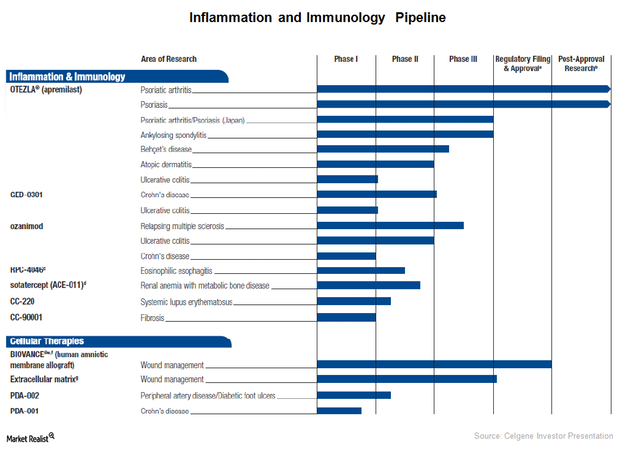

Celgene Has a Strong Inflammation and Immunology Pipeline

In 3Q15, Celgene had a strong inflammation and immunology pipeline. The company witnessed the progress of its key investigational drug GED-0301.

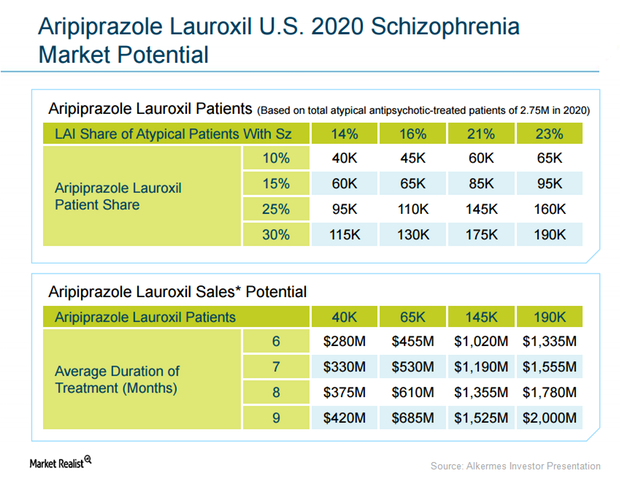

Alkermes’s Aristada and Its FDA Approval for Schizophrenia

Aristada was approved by the FDA and is projected to account for 10% to 30% of the LAI atypical antipsychotic market for schizophrenia patients in the US.

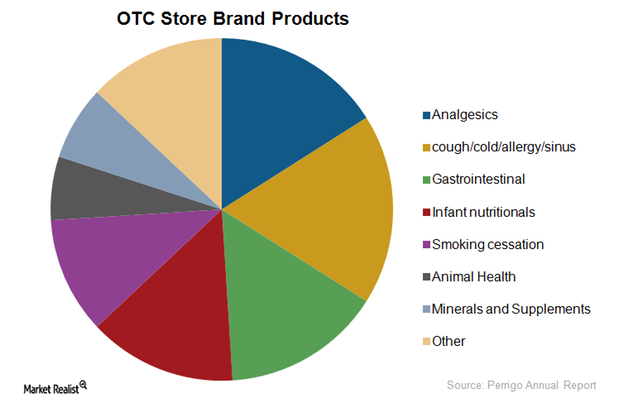

Perrigo Leads the Over-the-Counter Store-Branded Products Market

Perrigo is a market leader in over-the-counter store-branded products. Its leadership position extends to major geographies such as the US, the UK, and Mexico.

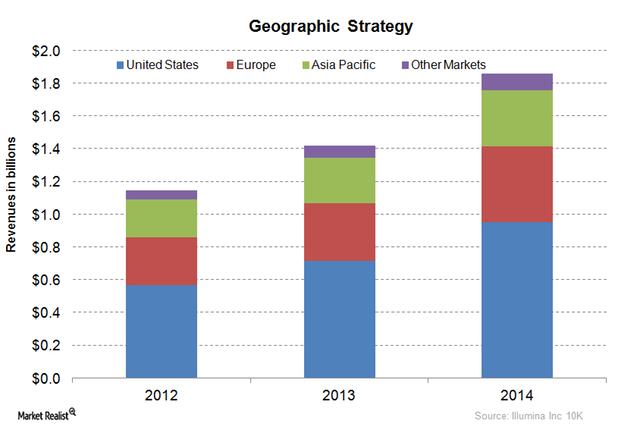

Illumina’s Market Expansion Strategy for Genome Sequencing

Illumina’s Market Expansion Strategy includes targeting the United States, Europe, and China for population sequencing projects.

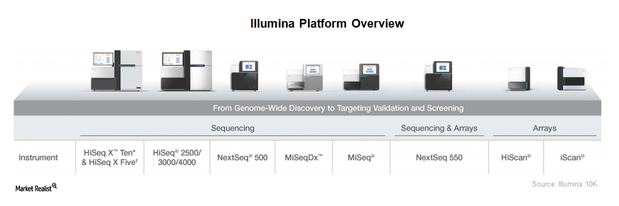

Illumina’s Key Products

Illumina’s key products are based on the company’s NGS (next-generation sequencing) technologies.

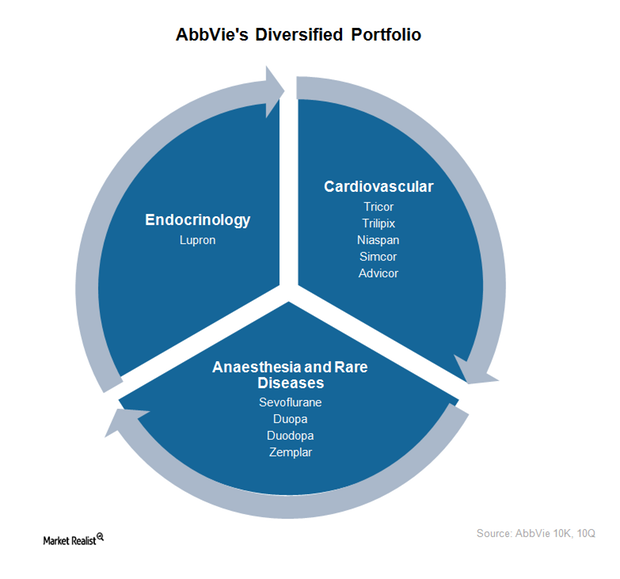

AbbVie’s Endocrinology, Cardiovascular, and Rare Disease Segments

AbbVie has a diversified offering of drugs for the treatment of conditions related to endocrinology, cardiovascular, and rare disease.

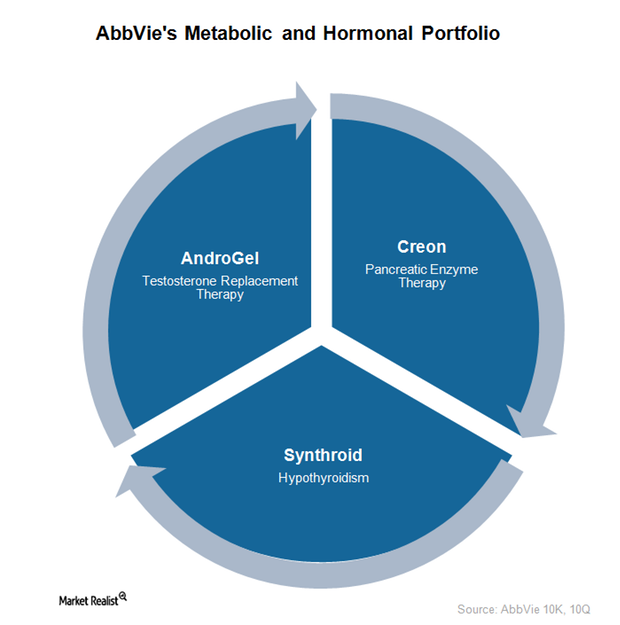

AbbVie Has a Strong Metabolic and Hormonal Portfolio

AbbVie’s metabolic and hormonal portfolio offers drugs such as AndroGel, Creon, and Synthroid to address various medical conditions.

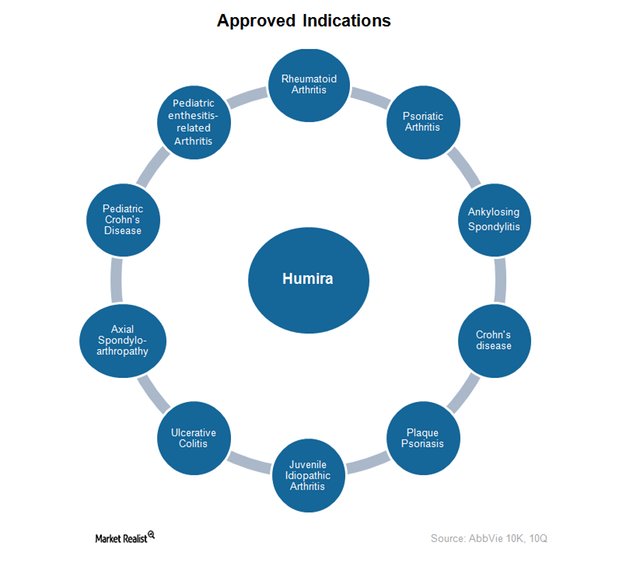

Humira Continues to Dominate AbbVie’s Revenues

Since Humira’s launch in the US market in 2002, Abbott Laboratories and its spin-off AbbVie have aggressively expanded the drug’s approved indications.

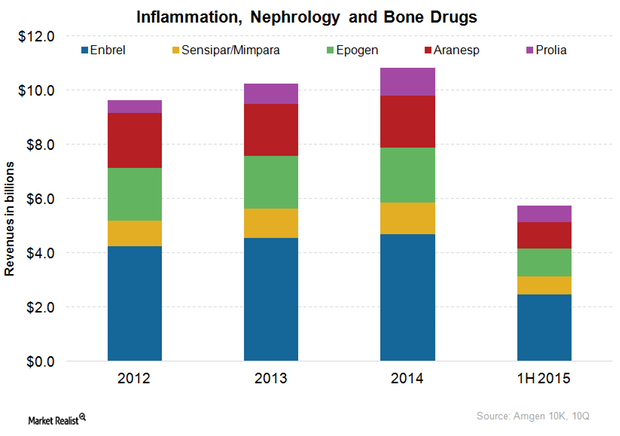

Amgen’s Presence in Inflammation, Nephrology, and Bone Segments

Amgen offers various nephrology drugs such as Epogen, Aranesp, Sensipar, and Mimpara. Both Epogen and Aranesp have been facing squeezed profits from tight competition.

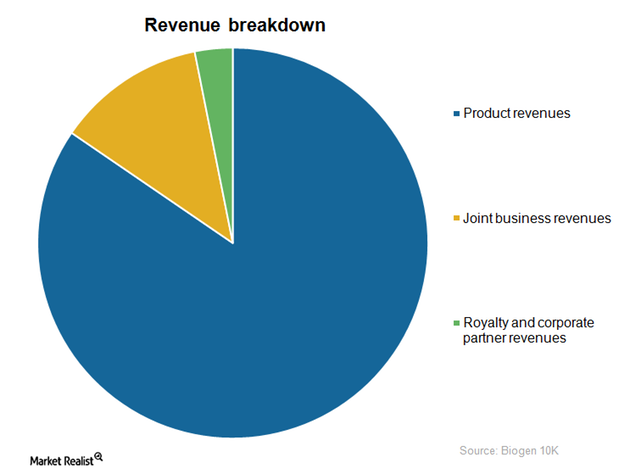

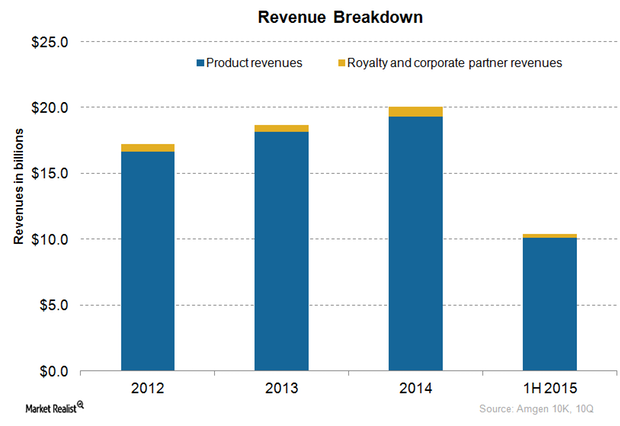

An Overview of Amgen’s Business Model

Amgen’s (AMGN) business model generates revenues in two ways: product sales and other revenues mainly comprised of royalties and corporate partner income.

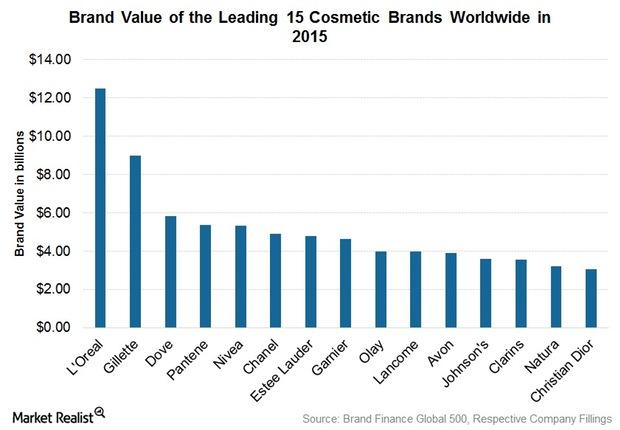

Assessing Estée Lauder’s Strengths and Opportunities

Estée Lauder’s large geographical footprint diversifies its revenue stream, which is one of its chief strengths.

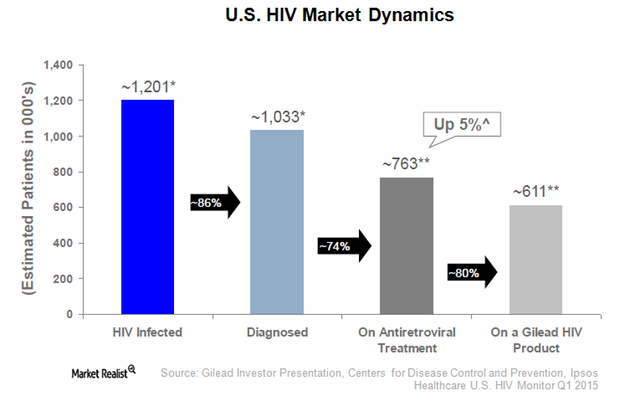

Gilead: Global Leader in the HIV Market

Gilead Sciences (GILD), a biotechnology leader in the human immunodeficiency virus, or HIV, market, offers drugs to eight out of every ten HIV naïve patients in the US.

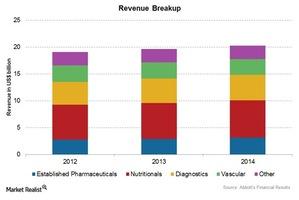

Abbott Laboratories’ Associated Business Segments

Abbott is organized around a broad portfolio—established pharmaceutical products, diagnostic products, nutritional products, and vascular products.

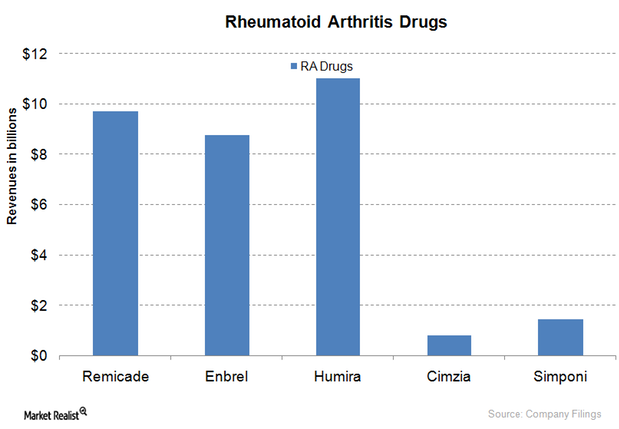

Humira Takes Top Spot for Rheumatoid Arthritis Drugs

There’s no complete cure for rheumatoid arthritis, so most RA drugs are part of disease-management therapy. Humira accounts for 23.5% of the RA market share.

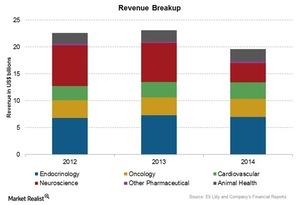

Analyzing Eli Lilly and Company’s Associated Business Segments

The human pharmaceutical segment includes the discovery, development, manufacturing, marketing, and sales of human pharmaceutical products.

Risks Facing Merck & Co.

Merck faces risks from other governments. In Japan, the pharmaceutical industry is subject to government-mandated biennial price reductions of pharmaceutical products and vaccines.

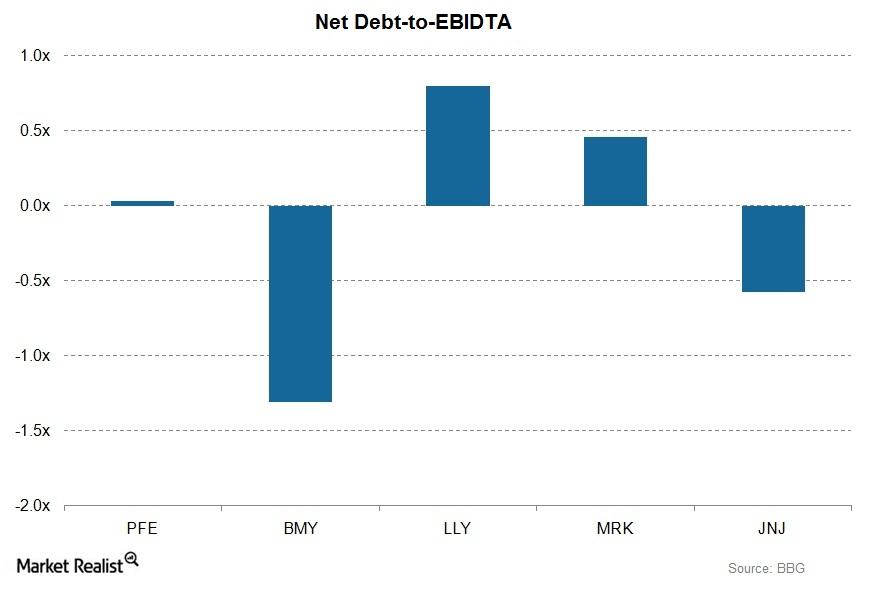

Why Pfizer’s Leverage Is Important to Investors

Leverage ratios determine the company’s ability to repay its debt. Leverage ratios directly affect the credit ratings. Pfizer has good credit ratings.

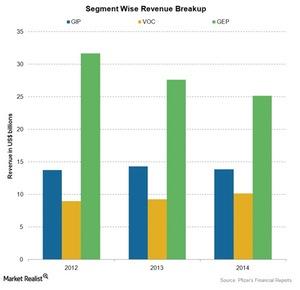

Analyzing Pfizer’s Business Segments

Pfizer (PFE) is one of the oldest and largest pharmaceutical companies in the US. The company deals in two major business segments.

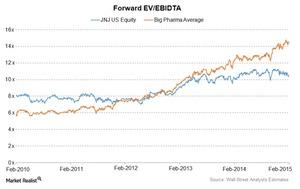

Where Does Johnson & Johnson Stand in the Industry?

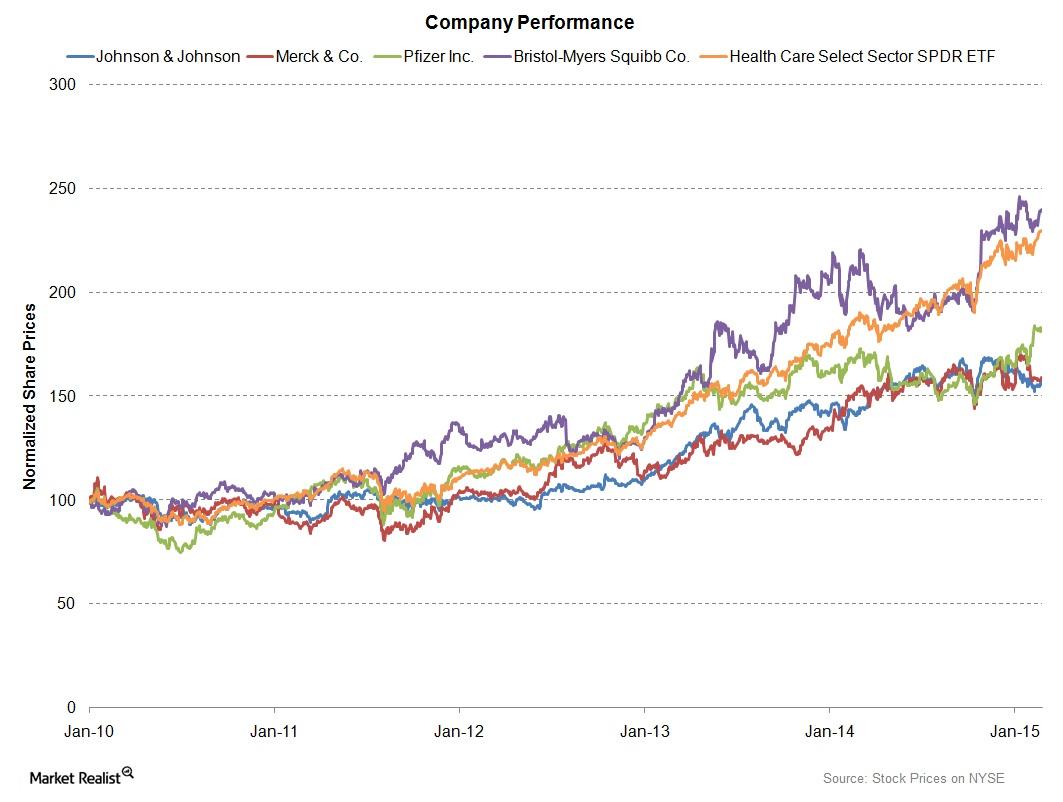

Estimates suggest that Johnson & Johnson’s forward PE ratio increased from 15.5x in 2014 to 16.1x in 2015. The PE ratio is hovering around 19x for the industry.

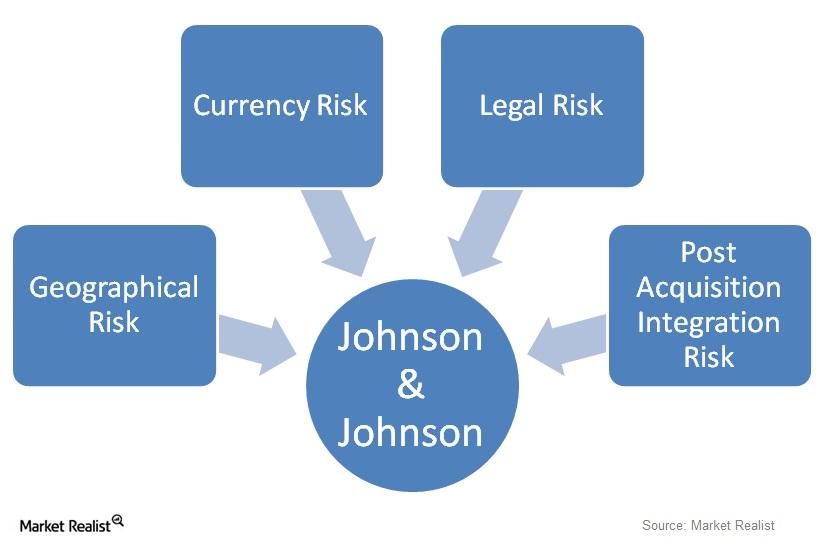

What Risks Does Johnson & Johnson Face?

Johnson & Johnson (JNJ) faces a unique combination of risks. The risks are in addition to specific risks in the pharmaceutical industry.

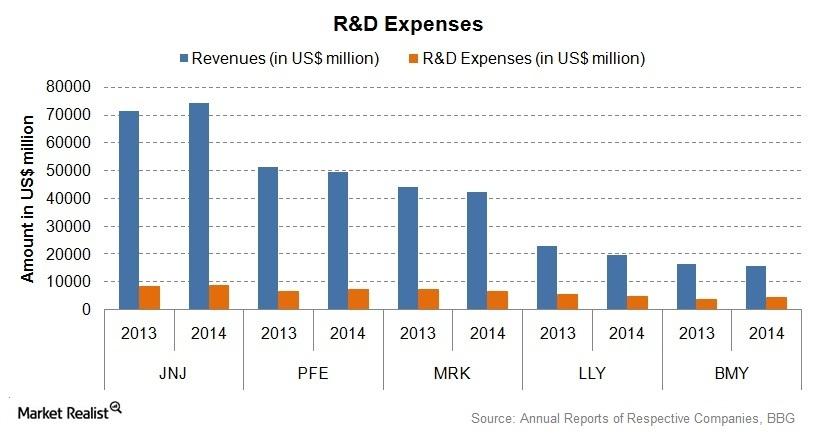

Johnson & Johnson Invested in Research and Development

For a big pharma company like Johnson & Johnson (JNJ), research and development plays a vital role in maintaining a healthy revenue stream.

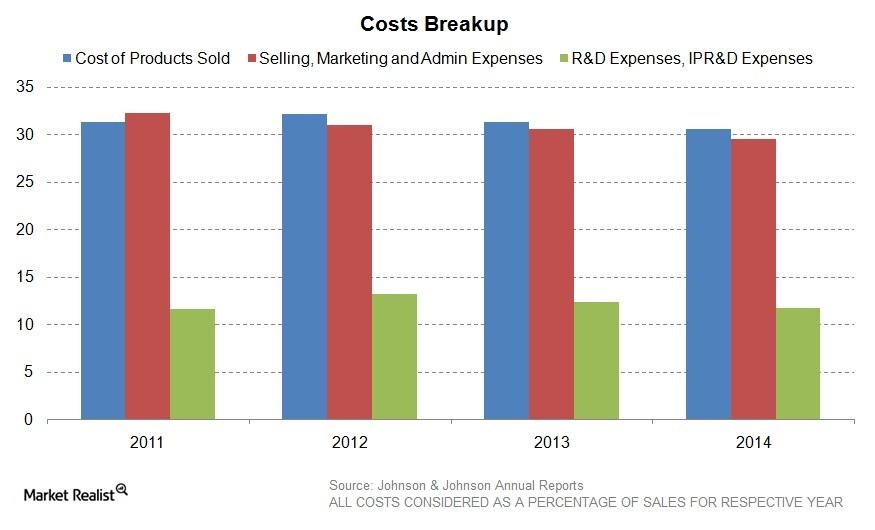

What Were Johnson & Johnson’s Outstanding Expenses?

As a percentage of sales, Johnson & Johnson achieved lower expenses for 2014—compared to 2013. It was able to improve its gross profit margins.

Johnson & Johnson’s Revenue Stream Increased in 2014

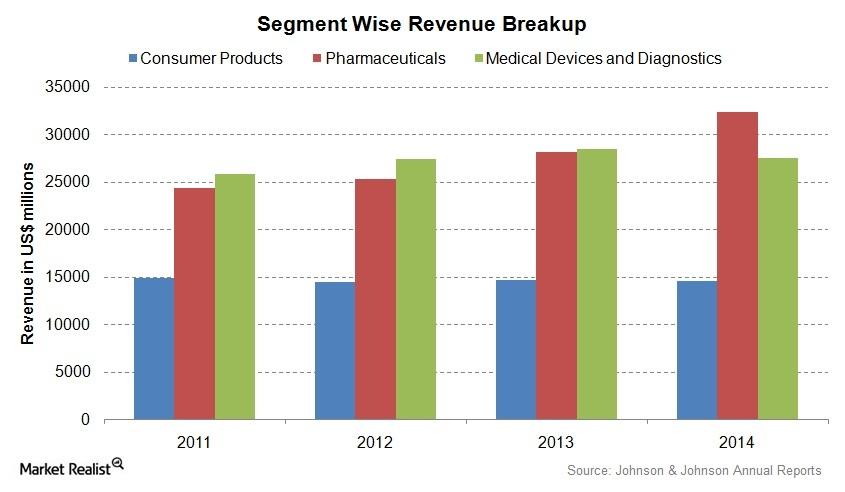

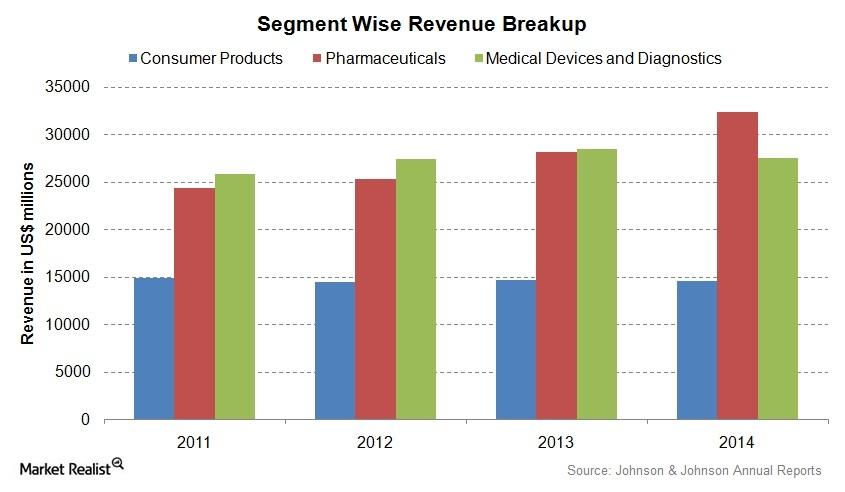

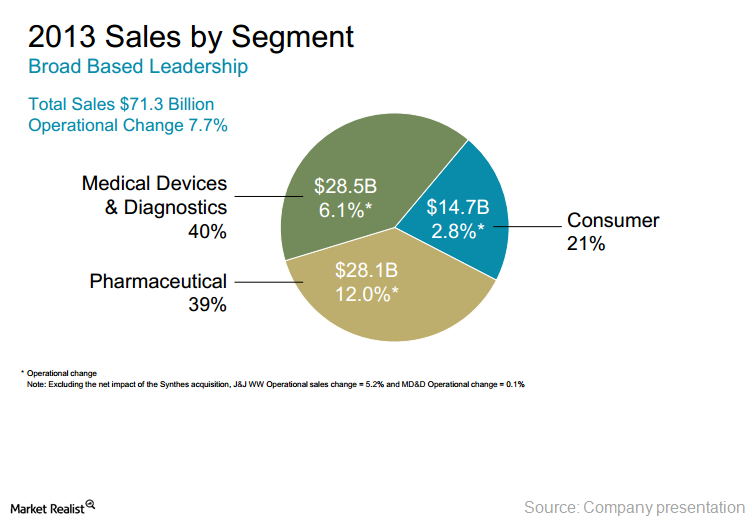

Johnson & Johnson’s (JNJ) net revenue increased by 4.2% from $71.3 billion in 2013 to $74.3 billion in 2014. There was an operational increase of 6.1%.

Johnson & Johnson’s Global Business Strategy Promotes Growth

Johnson & Johnson (JNJ) operates in nearly 60 countries. Its products are sold in about 200 countries. Almost 55% of its total business comes from outside the US.

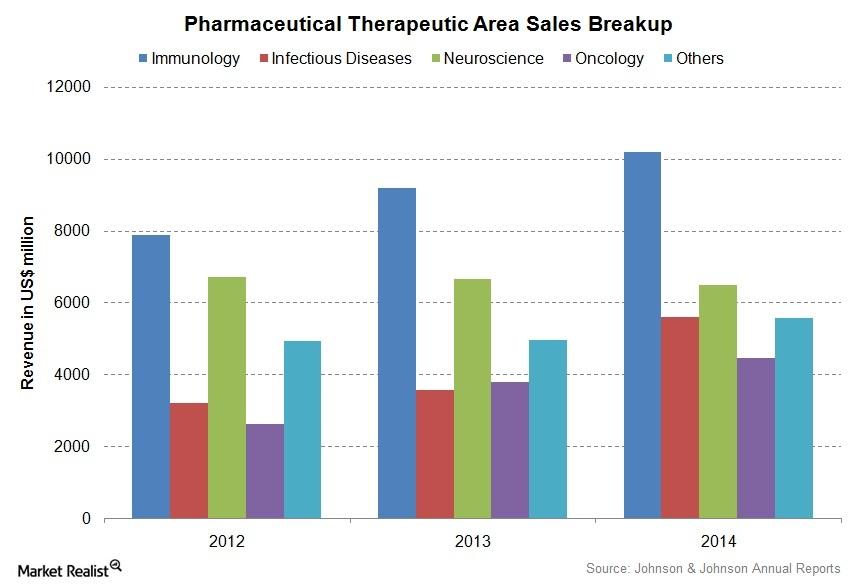

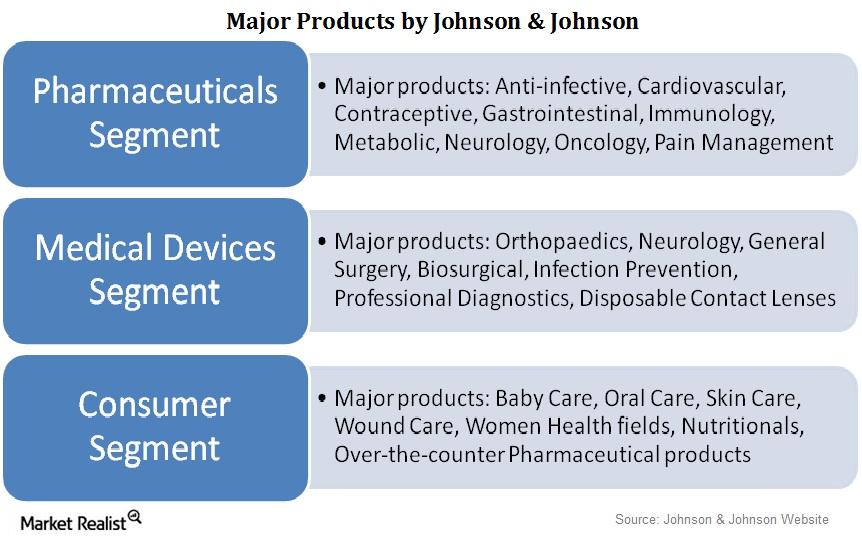

Exploring Johnson & Johnson’s Pharmaceuticals Segment

Johnson & Johnson (JNJ) is the largest pharmaceutical company in the US. The Pharmaceuticals segment contributes over 43% of the company’s revenue.

Analyzing Johnson & Johnson’s Three Main Business Segments

Over a period of 128 years, Johnson & Johnson (JNJ) diversified its business into three business segments.

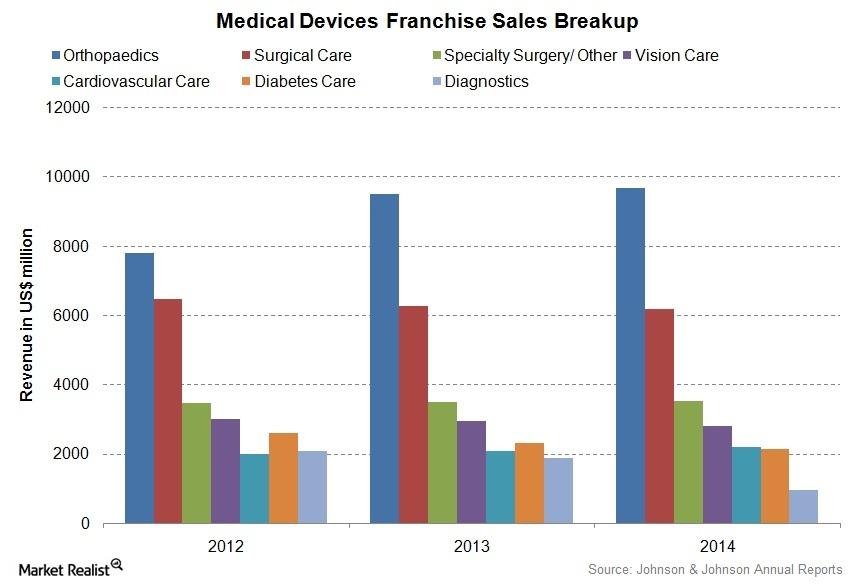

Johnson & Johnson’s Medical Devices and Diagnostics Segment

The Medical Devices and Diagnostics segment contributes over 37% of Johnson & Johnson’s revenue. In 2014, the segment generated about $27.5 billion in revenue.

Johnson & Johnson: A Leading Pharmaceuticals Company

Johnson & Johnson is a leading pharmaceuticals and healthcare company in the US. It delivered returns of 13.4% from February 2010 to February 2015.

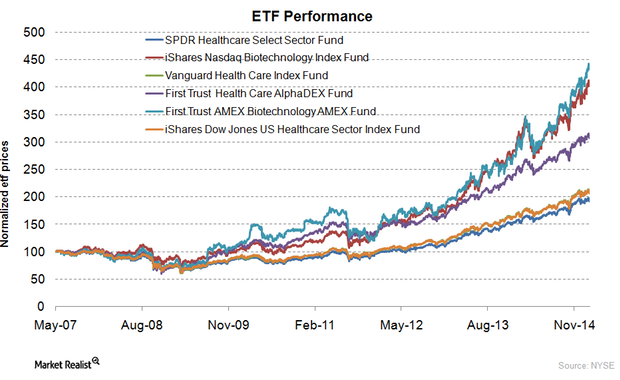

Why should you invest in healthcare ETFs?

Biotechnology funds have performed better than other healthcare ETFs. They invest in companies that use biological processes to produce medical products.

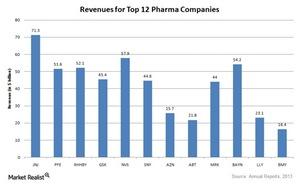

What it takes to be called ‘big pharma’

Pharmaceutical companies either deal with patented drugs, generic drugs, or both. Most big pharma companies deal with both.Healthcare Key differences between investment-grade and high-yield investments

Corporate debt is divided into investment-grade and high-yield on the basis of the credit risk associated with the issuer. Credit rating agencies issue ratings to corporations and debt issuance on the basis of associated credit risk.

Why George Soros sold his fund’s position in Johnson & Johnson

Soros sold its 1.20% position in Johnson & Johnson (JNJ) last quarter. Johnson & Johnson’s reported 37% increase in adjusted net earnings in 4Q was mainly driven by its pharmaceutical segment.