Mike Benson

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Mike Benson

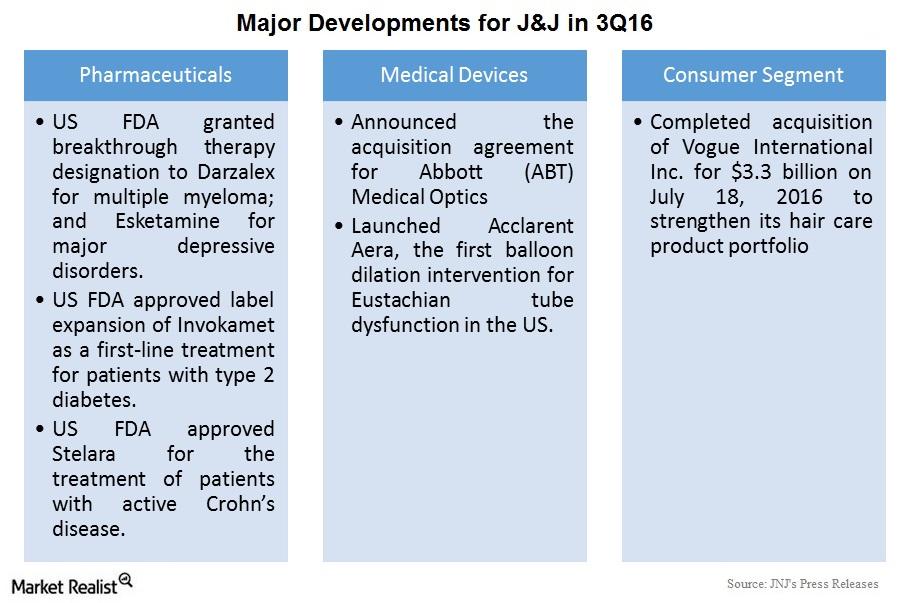

Major Developments for Johnson & Johnson in 3Q16

Major developments As discussed previously in this series, Johnson & Johnson’s (JNJ) 3Q16 performance was positive across all of its segments. However, the Consumer segment reported a decline in revenue, as the negative impact of foreign exchange more than offset operational growth. There were several major developments for JNJ during 3Q16. Pharmaceuticals segment In 3Q16, the […]

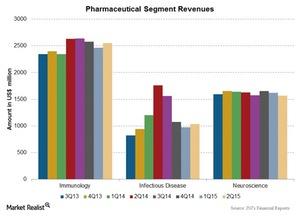

Johnson & Johnson’s Pharmaceuticals Segment Grows in 2Q15

Johnson & Johnson’s (JNJ) Pharmaceuticals segment grew by 1.0% at constant exchange rates, reporting a revenue of $7,946 million for 2Q15 over 2Q14.

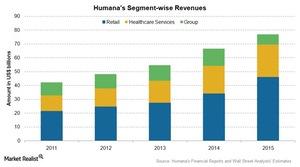

Decoding Humana’s Revenue Stream in 2015

Humana reported revenues of about $54.3 billion in its 2015 results. This amounts to a 12% revenue growth in 2015, compared to ~$48.1 billion in 2014.

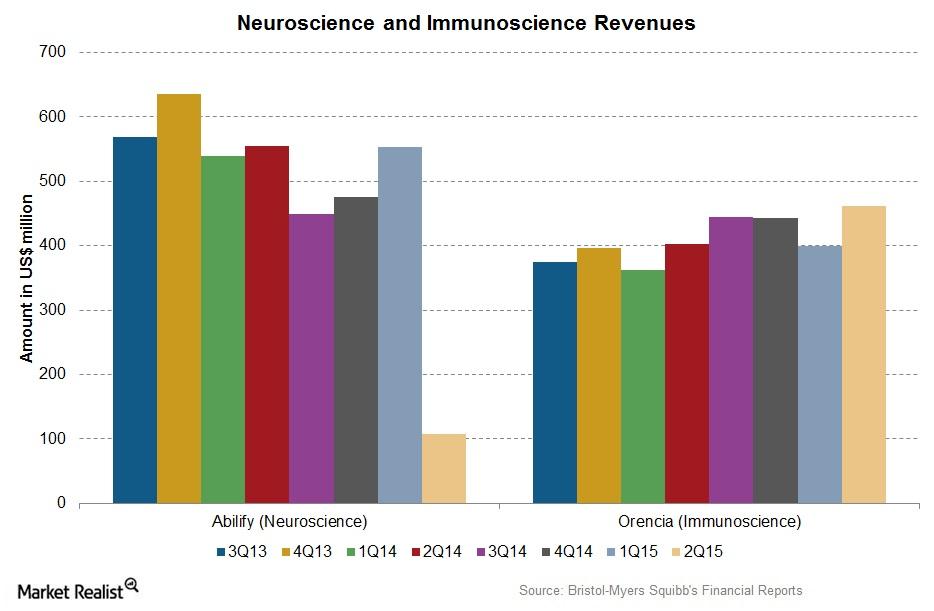

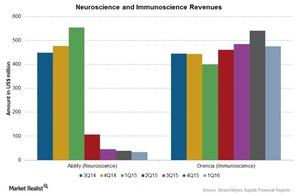

Bristol-Myers Squibb’s Neuroscience and Immunoscience Segments

Sales for Bristol-Myers Squibb’s (BMY) neuroscience segment declined over 80% in 2Q15, while the immunoscience segment’s sales improved ~15% in 2Q15 as compared to 2Q14.

Understanding Bristol-Myers Squibb’s Other Segments

Sales from Bristol-Myers Squibb’s Neuroscience segment declined by 94% in 1Q16. Sales from the Immunoscience segment improved by ~18.7% in 1Q16 over 1Q15.

GlaxoSmithKline Increases Top Line in 2Q16

GlaxoSmithKline (GSK) reported a 10.9% increase in its top line in its 2Q16 earnings on July 27, 2016. It met Wall Street analysts’ estimates for revenues and EPS.

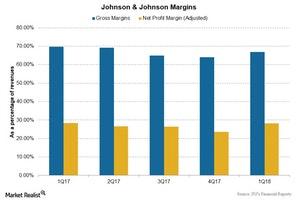

Analyzing Johnson & Johnson’s 1Q18 Profitability

Johnson & Johnson (JNJ) reported revenues of $20.0 billion during 1Q18, 12.6% growth as compared to revenues of $17.8 billion during 1Q17.

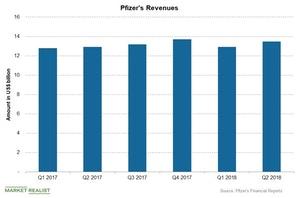

Pfizer’s Growth Rate and Estimates

Pfizer (PFE) reported an EPS of $0.74 on revenues of ~$13.5 billion during the second quarter, which beat analysts’ estimate of ~$13.3 billion.

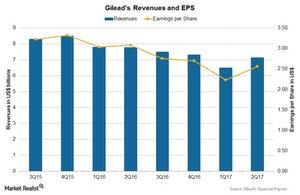

What’s Gilead Sciences’ Valuation?

Gilead’s stock price has risen ~8.9% in the last 12 months. Wall Street analysts estimate that the stock price will fall ~4.5% over the next 12 months.

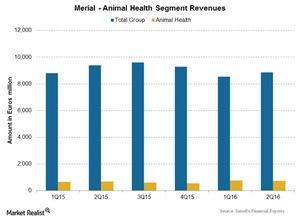

How Merial Contributes to Sanofi’s Growth

Merial, Sanofi’s (SNY) Animal Health segment, reported total revenues of 725 million euros (about $818.6 million), which is a 9.1% increase over 2Q15.

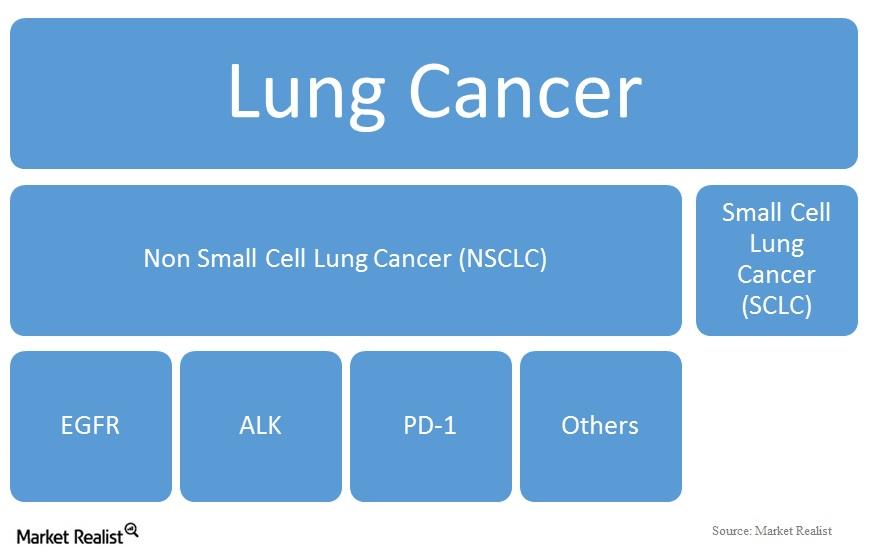

Other Drugs for Non-small Cell Lung Cancer

Approximately 85% of all lung cancers in the United States are non-small cell lung cancers, and 10% to 15% of these are EGFR mutation-positive.

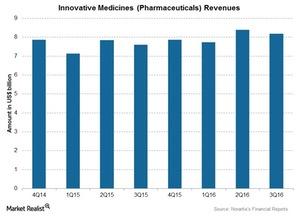

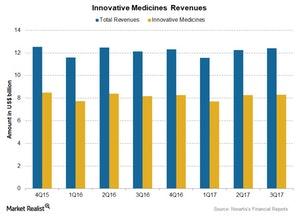

Novartis’s 3Q16 Estimates: Innovative Medicines Segment

Novartis’s Innovative Medicines segment, formerly referred to as the Pharmaceutical segment, consists of products for a variety of therapeutic areas.

Novartis’s 4Q16 Estimates: Innovative Medicines Segment

The overall contribution of the Innovative Medicines segment is ~67% of Novartis’s total revenues.

Allergan’s 1Q18 Earnings: Analysts’ Estimates

Allergan (AGN) plans to release its 1Q18 earnings on April 30. Wall Street expect AGN’s earnings per share to reach $3.36.

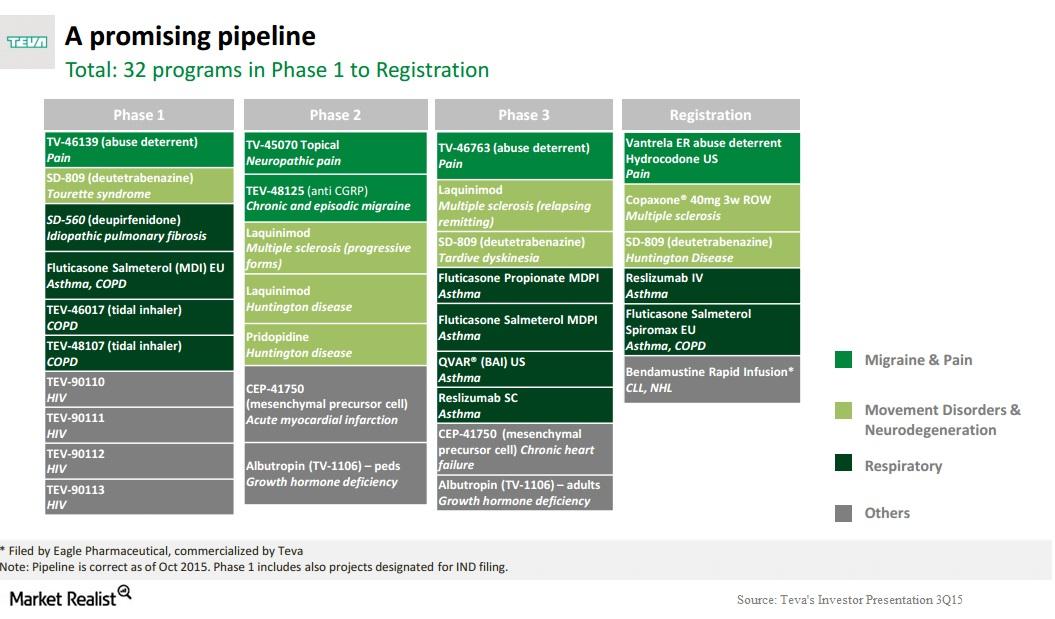

Teva’s Respiratory Drugs Contribute 11% to Specialty Medicines

Teva’s respiratory drugs franchise provides solutions for asthma, COPD, and allergic rhinitis. Respiratory drugs contributed nearly 11% of total revenues for Teva’s Specialty Medicines in 2014.

Pfizer Reports 1Q18 Earnings and Revenue Growth

Pfizer (PFE) released its 1Q18 earnings today, reporting another strong quarter for the Innovative health business.

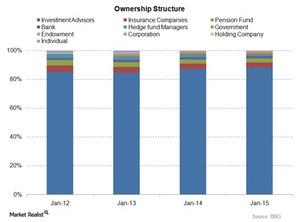

Understanding Johnson & Johnson’s Ownership Structure

As of January 2015, Johnson & Johnson’s ownership structure is dominated by passive investments. They account for more than 80% of the total ownership structure.

Analyzing 22nd Century Group’s Year-to-Date Performance

Analysts expect 22nd Century Group to report revenue of $23.3 million in 2018, a 40.3% rise compared to $16.6 million in 2017.

What Are Pfizer’s Revenue Drivers?

Pfizer reported revenues of $13.5 billion during the second quarter—4% growth YoY compared to $12.9 million during the second quarter of 2017.

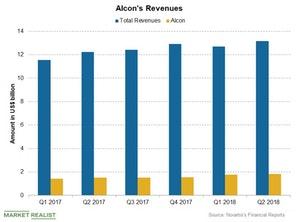

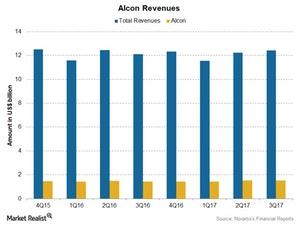

A Look at the Performance of Novartis’s Alcon

Alcon reported revenue of ~$1.82 billion in the second quarter, a 7% rise.

Marijuana-Focused Biotech Companies in Q3: Are They Performing?

In this series, we’ll look at biotechnology companies focused on marijuana-based products and how they performed in the third quarter.

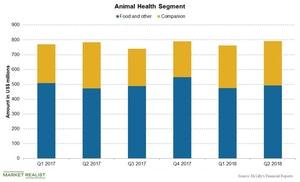

A Look at Elanco, Eli Lilly’s Animal Health Business

Eli Lilly’s Elanco reported a 1% YoY (year-over-year) rise in revenue to $792.1 million in the second quarter.

A Look at Pfizer’s Market Cap and Shareholding Pattern

The total number of Pfizer’s outstanding shares is ~5.862 billion. Of these, its free-floating shares total ~5.859 billion.

Pharma Stocks: Pfizer’s Revenue Trend and 2018 Estimates

Pfizer (PFE) reported revenue of ~$13.5 billion in the second quarter, a 4% YoY (year-over-year) rise in revenue.

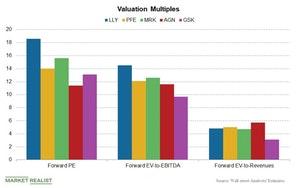

Pharma Stocks in Review: A Valuation Comparison

In this article, we’ll compare the valuations of Eli Lilly and Company (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

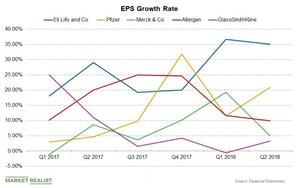

A Review of Pharma Stocks’ EPS Growth Rates

In this article, we’ll compare the EPS growth rates of Eli Lilly (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

Do Abiomed’s Valuations Look Attractive?

Abiomed’s (ABMD) revenues rose 36% YoY to ~$180 million in fiscal Q1 2019 compared to $133 million in Q1 2018.

Analysts Have Mixed Opinions about Ionis

Wall Street analysts estimate that Ionis’s (IONS) Q2 2018 revenues will rise ~30.0% to $135.5 million as compared to $104.2 million in Q2 2017.

What Analysts Expect from Haemonetics in Q1 2019

Haemonetics is expected to report 4.3% growth in revenues to $219.9 million during Q1 2019 as compared to $210.9 million during Q1 2018.

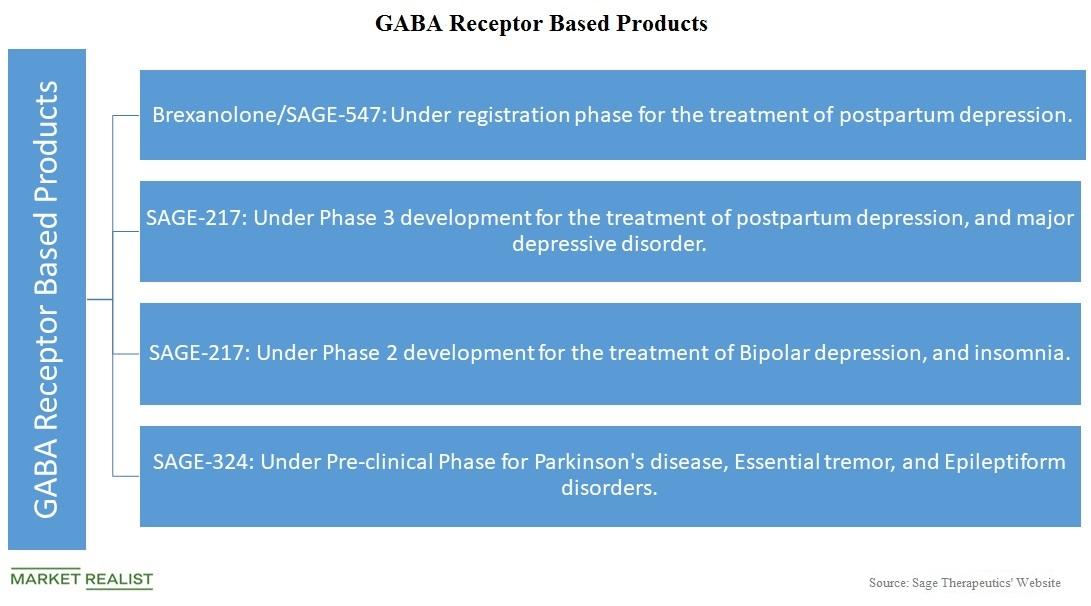

Sage Therapeutics’ GABA Receptor–Based Products

On June 12, Sage Therapeutics announced its expedited development plan for SAGE-217.

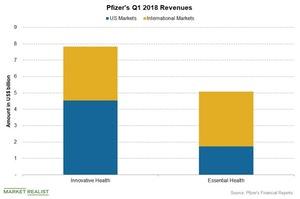

How Pfizer’s Business Segments Have Performed

As discussed, Pfizer’s (PFE) business is divided into two business segments, Innovative Health and Essential Health.

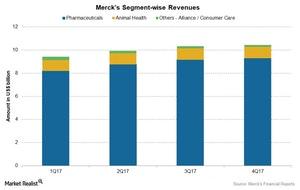

How Merck’s Business Segments Performed

Merck reported 3% growth in revenues to ~$10.4 billion during 4Q17 as compared to 4Q16.

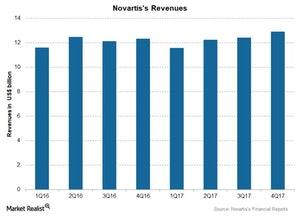

How Novartis’s Revenues Trended in 4Q17

Novartis surpassed Wall Street analysts’ estimates for earnings per share (or EPS) with reported EPS of $4.86 as compared to estimates of $4.82 for 2017.

Changes in Johnson & Johnson’s Profit Margins in 4Q17

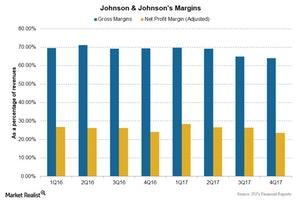

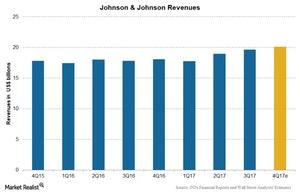

Johnson & Johnson’s gross profit margin decreased to 64.1% in 4Q17, a ~5% decrease compared to 69.1% in 4Q16.

GlaxoSmithKline’s Valuations after Its 4Q17 Earnings

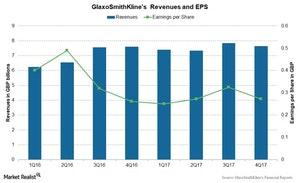

On February 15, 2018, GlaxoSmithKline traded at a forward PE multiple of 12.9x, which is lower than the industry average of 13.3x.

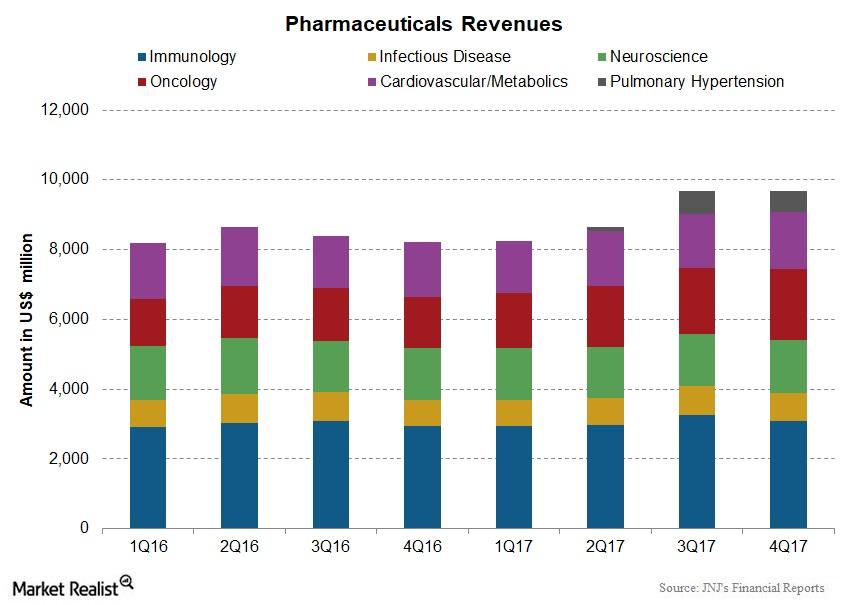

Johnson & Johnson’s Pharmaceuticals Business in 4Q17

Johnson & Johnson (JNJ) reported ~48.0% of its total revenues from the Pharmaceuticals business during 4Q17, making it the company’s largest revenue contributor.

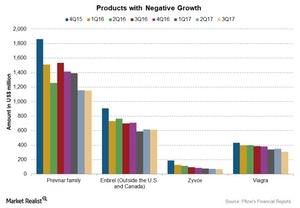

Pfizer’s 4Q17 Estimates: Products with Lower Sales

In Pfizer’s (PFE) portfolio, a few of the products reported a lower sales trend due to competition from other products in the markets.

Reading the Estimates for Novartis’s Alcon in 4Q17

For 4Q17, Alcon is expected to report growth in revenues, driven by the increased demand for contact lenses and surgical products.

Behind Novartis’s 4Q17 Estimates: Innovative Medicines

The Innovative Medicines segment is expected to report growth in operating revenues for 4Q17.

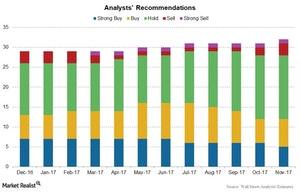

Analyst Ratings and Recommendations for Johnson & Johnson

JNJ stock has risen 27.9% in the last 12 months. Analysts estimate that the stock could rise 1.4% over the next 12 months.

Behind Novartis’s 4Q17 Earnings: Why Some Expect Revenue Growth

Analysts expect Novartis’s revenues to rise ~3.9% to $12.8 billion in 4Q17, driven by growth in operating revenues across all three segments.

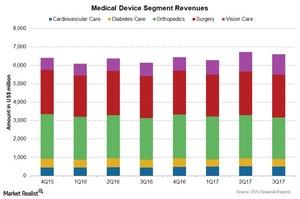

Johnson & Johnson’s Medical Devices Segment: 4Q17 Estimates

Johnson & Johnson’s (JNJ) Medical Devices segment includes products for specialty surgery, orthopedics, cardiovascular care, surgical care, diabetes care, and vision care.

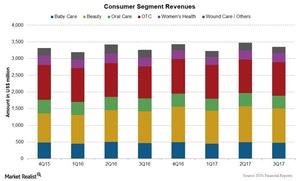

Johnson & Johnson’s Consumer Segment: 4Q17 Estimates

Johnson & Johnson’s beauty franchise is expected to report growth in revenues in 4Q17 due to the strong performance of products acquired from Vogue International.

Johnson & Johnson’s Revenue Estimates for 4Q17

Johnson & Johnson’s (JNJ) Pharmaceutical segment contributes more than 45% to total revenues. In 4Q17, it’s expected to report growth in operating revenues.

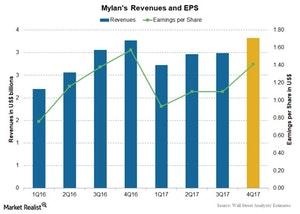

Wall Street Recommendations for Mylan in January 2018

As we discussed earlier in this series, Mylan (MYL) reported revenues of $2.98 billion in 3Q17, a 2.3% decline in revenues compared to $3.06 billion in 3Q16.

Mylan’s Valuation in January 2018

Mylan (MYL) is a leading pharmaceutical company with over 1,400 generic and specialty pharmaceutical products in its portfolio.

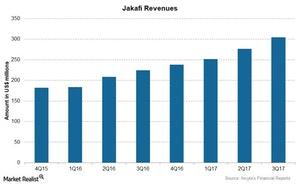

How Incyte’s Jakafi Performed in 3Q17

Incyte’s (INCY) oncology drug Jakafi (ruxolitinib) is approved for the treatment of myelofibrosis and polycythemia vera, two rare types of blood cancer.

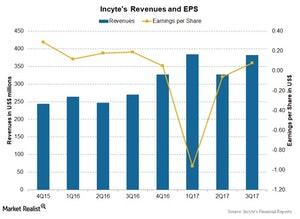

How’s Incyte’s Valuation in January 2018?

Analysts expect Incyte Corporation’s revenue to rise ~26.7% to $413.8 million in 4Q17 compared to $326.5 million in 4Q16.

A Look at Pfizer’s Valuation

Pfizer (PFE) reported revenue of $13.2 billion in 3Q17, ~1% growth from its 3Q16 revenue of $13.0 billion.

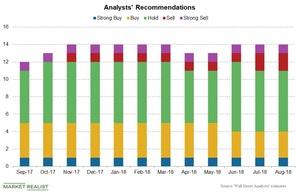

Analysts’ Recommendations for GlaxoSmithKline in November 2017

Wall Street analysts estimate that GlaxoSmithKline’s (GSK) top line could fall 0.8% to ~7.5 billion pounds in 4Q17.