Mike Benson

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Mike Benson

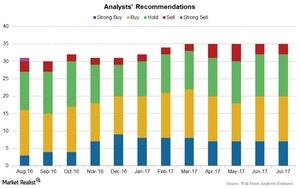

Analysts’ Recommendations for AstraZeneca in 2Q17

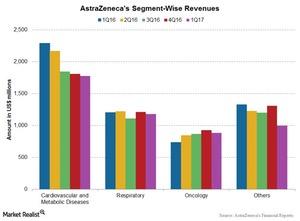

Wall Street analysts expect AstraZeneca’s top line to fall ~9.5% to $5.1 billion in 2Q17, compared to $5.6 billion in 2Q16. Its earnings per share are expected to be $0.42 in 2Q17.

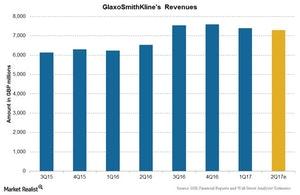

Unpacking GlaxoSmithKline’s 2Q17 Revenue Expectations

Analysts expect to see a growth of ~11.4% in GlaxoSmithKline’s (GSK) 2Q17 revenues, which are expected to total nearly 7.3 billion British pounds.

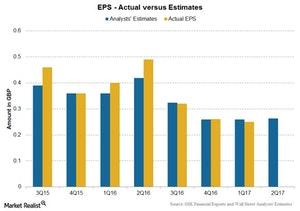

Inside GlaxoSmithKline’s 2Q17 Earnings Estimates

For 2Q17, analysts estimate that GSK’s revenues will rise ~11.4% to ~7.3 billion pounds, as compared to ~6.5 billion pounds for 2Q16.

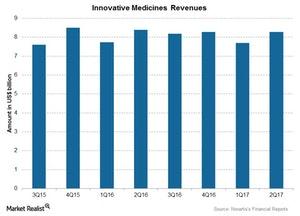

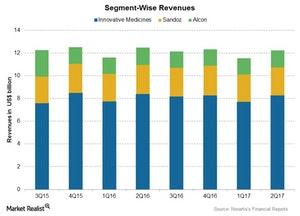

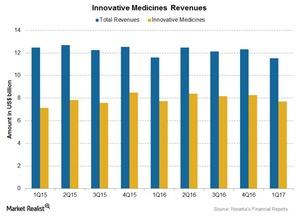

Novartis in 2Q17: Performance of Innovative Medicines

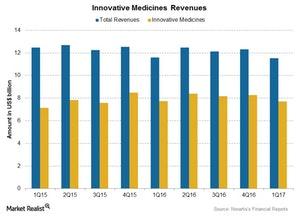

The overall contribution of the Innovative Medicines segment was ~67.6% at $8.28 billion for 2Q17.

Foreign Exchange Impacts Novartis’s Growth in 2Q17

In its earnings release on July 8, 2017, Novartis (NVS) reported flat revenues at constant currencies for 2Q17.

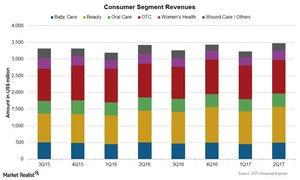

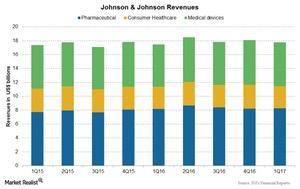

Johnson & Johnson: Consumer Products in 2Q17

The consumer segment Johnson & Johnson’s (JNJ) consumer segment revenue rose 1.7% to $3.5 billion in 2Q17, compared with $3.4 billion in 2Q16. This rise includes operational growth of 2.3%, which was offset by a 0.6% impact of foreign exchange. Baby care franchise The baby care franchise reported revenue of $494 million in 2Q17, a […]

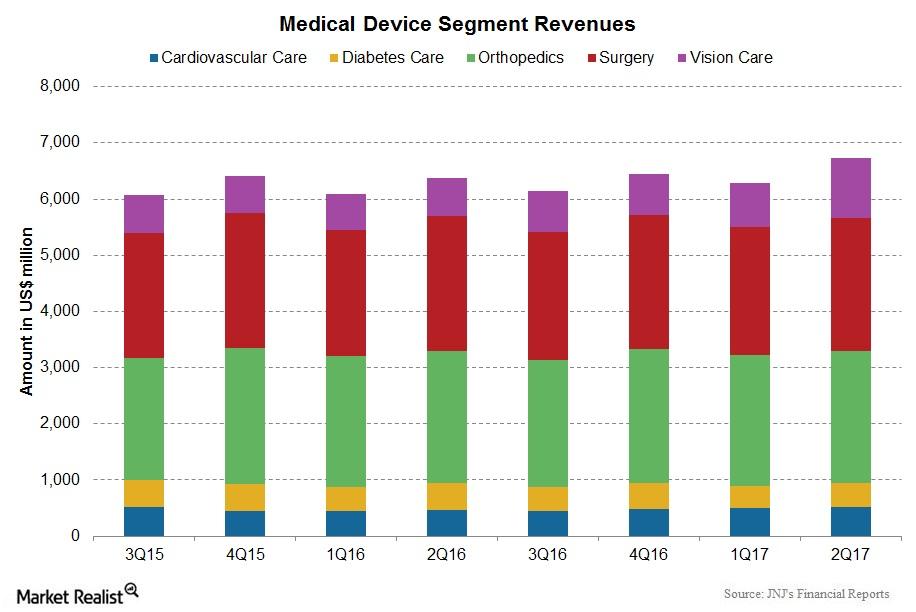

Johnson & Johnson: Medical Devices in 2Q17

Medical devices segment Johnson & Johnson’s (JNJ) medical devices segment grew ~4.9% to ~$6.7 billion for 2Q17, compared with $6.4 billion in 2Q16. This rise included an operational increase of 5.9%, and was offset by a 1% impact of foreign exchange. Cardiovascular care franchise Cardiovascular care franchise sales rose 11.3% to $523 million for 2Q17. This […]

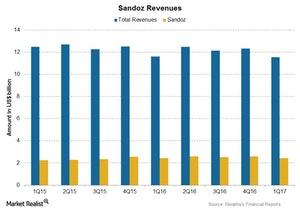

Novartis’s 2Q17 Estimates: How Sandoz Might Perform

Revenues for Sandoz are expected to report operational growth in 2Q17 following an increased demand for biopharmaceuticals.

Novartis’s 2Q17 Estimates: Innovative Medicines Segment

The overall contribution of Novartis’s (NVS) Innovative Medicines segment is ~67.0% of its total revenues.

Analysts Expect Novartis’s Revenues to Fall in 2Q17

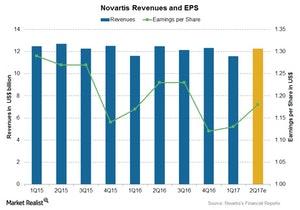

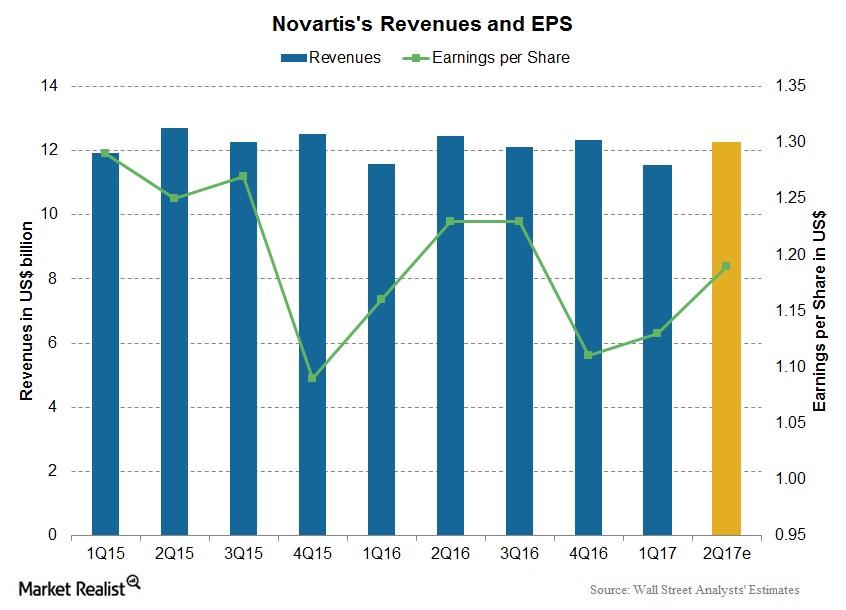

Analysts expect Novartis’s (NVS) revenues to fall ~1.6% to $12.3 billion in 2Q17 due to the effects of the acquisition and divestiture of some of its products.

Analysts’ Latest Recommendations for Johnson & Johnson

Johnson & Johnson (JNJ) missed Wall Street analysts’ revenue estimates in 1Q17. It reported revenue of $17.8 billion in the quarter.

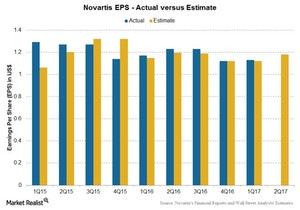

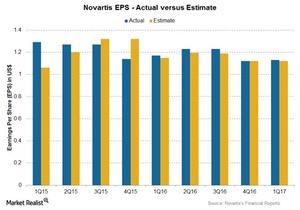

Novartis’s 2Q17 Earnings: Analyst Estimates

Novartis is set to release its 2Q17 earnings on July 18, 2017. Analysts estimate EPS (earnings per share) of $1.18 and revenues of $12.3 billion.

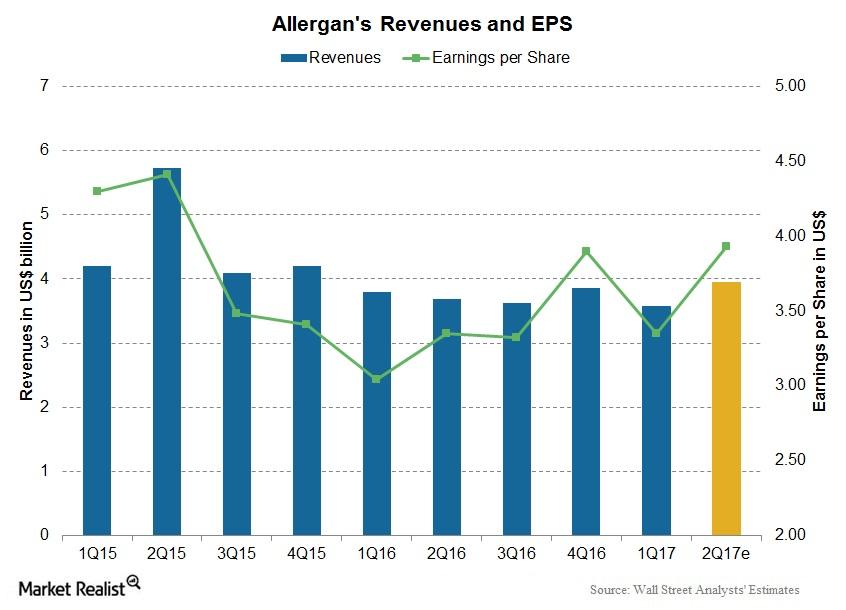

Behind Allergan’s Business Segments and Revenues

Allergan’s (AGN) business has undergone several changes over the past few years due to acquisitions and divestitures.

A Look at Allergan’s Performance in 2Q17

Allergan Headquartered in Dublin, Ireland, Allergan (AGN) is a leading pharmaceutical company focused on generic and specialty pharmaceutical products. The company has divided its business into three segments: US Specialized Therapeutics, US General Medicine, and International. Stock price performance Allergan’s stock price has risen ~1.4% in 2Q17, and 15.0% year-to-date as of July 7, 2017. […]

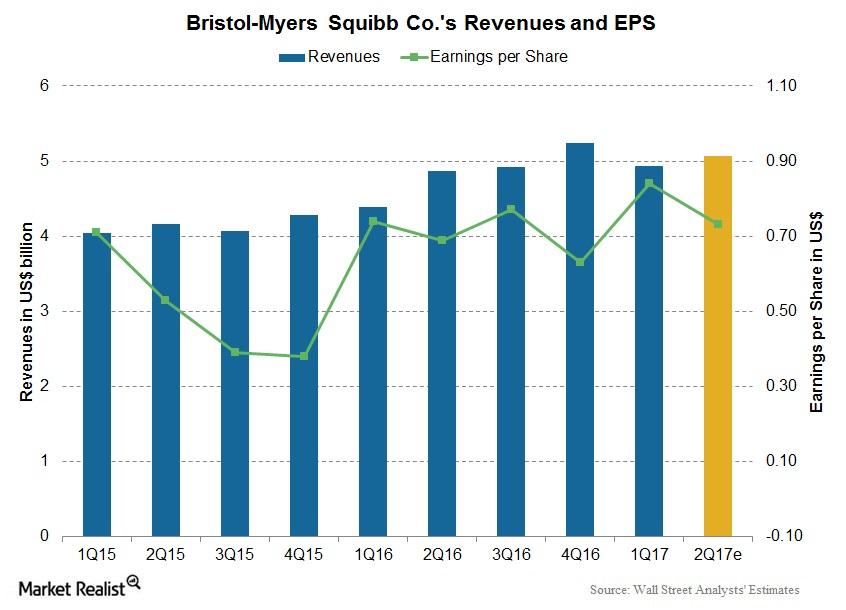

How Bristol-Myers Squibb Stock Has Performed in 2Q17

A look at Bristol-Myers Squibb Headquartered in New York City, Bristol-Myers Squibb (BMY) is an American pharmaceutical company that develops innovative medicines in various therapeutic areas, including cardiovascular, neuroscience, immunoscience, oncology, and virology. Stock price performance While Bristol-Myers Squibb’s stock price has risen ~3.8% in 2Q17, it had fallen ~5.4% year-to-date as of July 7, […]

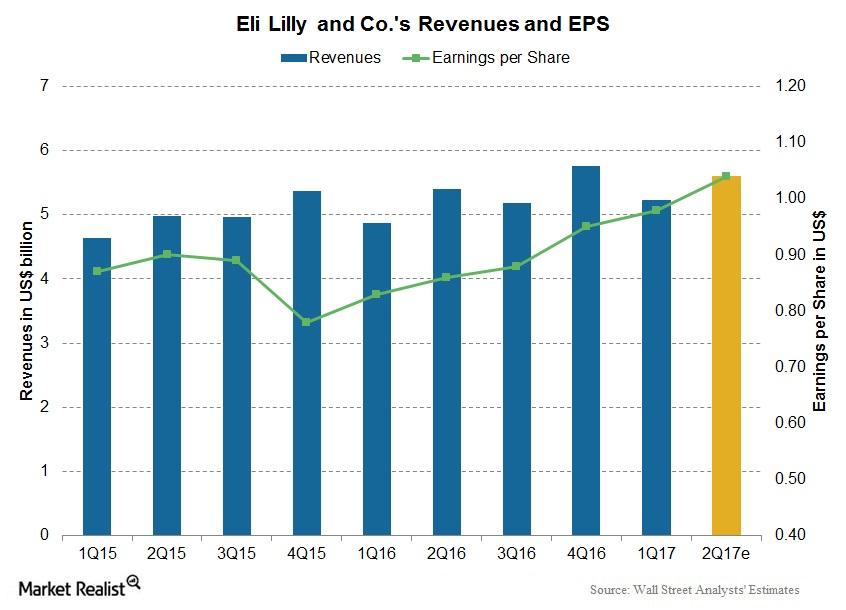

What We Can Expect from Eli Lilly and Company in 2Q17

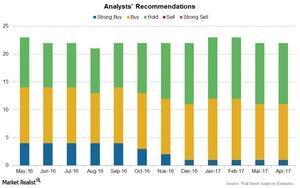

A look at Eli Lilly and Company Headquartered in Indianapolis, Indiana, Eli Lilly and Company (LLY) is a US pharmaceutical company focused on human pharmaceuticals and animal health. Stock price performance Eli Lilly’s stock price has fallen ~4.4% in 2Q17. However, the stock price had risen 10.9% year-to-date as of July 7, 2017. Analysts’ recommendations Wall […]

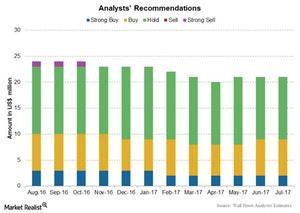

Novartis Stock in 2Q17: How Has It Performed?

A look at Novartis Headquartered in Basel, Switzerland, Novartis (NVS) is a pharmaceutical company specializing in the research, development, manufacturing, and marketing of a broad range of healthcare products, mainly pharmaceuticals. The company has segregated its business into three segments: Innovative Medicines, Sandoz (generic), and Alcon (eye care). Stock price performance Novartis’s stock price has […]

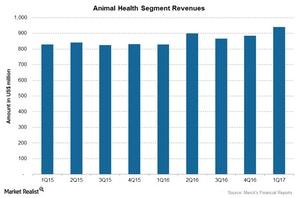

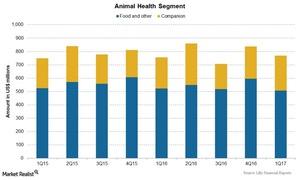

Merck & Co.’s Animal Health Segment’s 1Q17 Revenues

The global revenues from Merck’s Animal Health business totaled $939 million during 1Q17—13% growth over 1Q16.

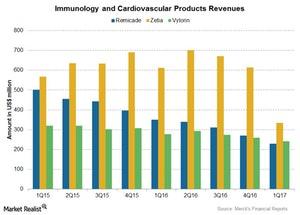

Merck’s Immunology and Cardiovascular Franchise in 1Q17

The combined revenues for Zetia and Vytorin fell 35% to $575 million in 1Q17, compared to $889 million in 1Q16.

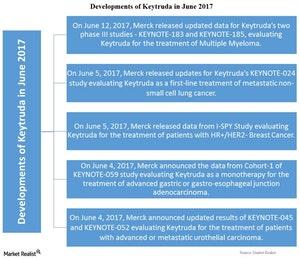

Keytruda’s Developments in June 2017

On June 12, 2017, Merck released updated data for Keytruda’s two phase III studies—KEYNOTE-183 and KEYNOTE-185—which evaluate Keytruda in combination with other drugs for the treatment of multiple myeloma.

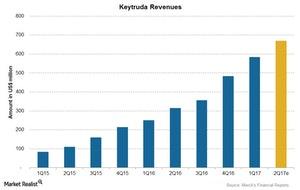

How Did Keytruda Perform in 1Q17?

Merck (MRK) launched Keytruda in 4Q14 and reported global sales of $584 million for 1Q17. As a result, the company reported ~134% growth in revenues compared to $249 million in 1Q16.

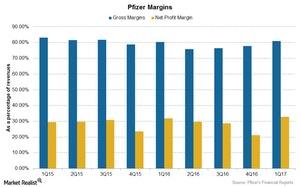

Pfizer’s Profitability in 1Q17

Pfizer’s gross margin for 1Q17 was 81.0%, a 0.70% rise compared to 80.3% in 1Q16.

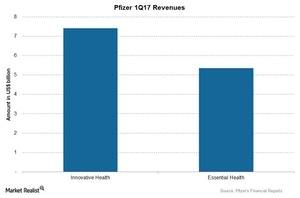

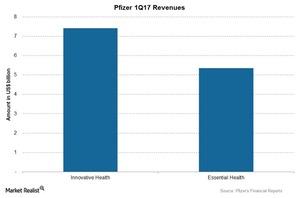

Pfizer’s Segment Performance in 1Q17

Pfizer Innovative Health contributed $7.4 billion, or about 58.0% of Pfizer’s total revenues in 1Q17.

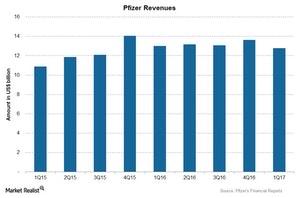

A Look at Pfizer’s Revenue for 1Q17

Pfizer (PFE) reported a 2.0% fall in 1Q17 revenues to ~$12.8 billion, with a 1.0% operational fall in revenues and a 1.0% negative impact of foreign exchange.

Analyzing Bristol-Myers Squibb’s Valuation on June 20

As of June 20, 2017, Bristol-Myers Squibb was trading at a forward PE multiple of ~18.0x—compared to the industry average of 16.0x.

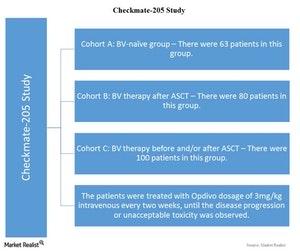

Data from the Checkmate-205 Study Evaluating Opdivo

Follow-up data were released from the Checkmate-205 study. It evaluated long-term effects of PD-1 inhibitors in patients with classical Hodgkin Lymphoma.

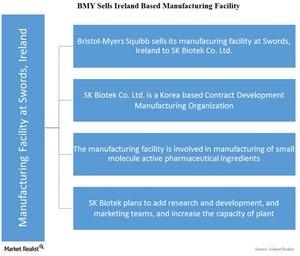

SK Biotek to Acquire Manufacturing Facility in Swords, Ireland

In its press release on June 16, 2017, Bristol-Myers Squibb (BMY) announced that it entered into a definitive purchase agreement with SK Biotek.

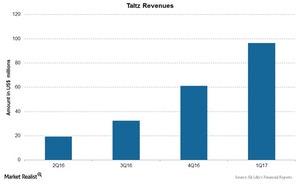

How Eli Lilly’s Taltz Performed in Clinical Trials

On June 15, 2017, Eli Lilly announced data from a study that evaluated the safety and efficacy of Taltz in patients with active psoriatic arthritis.

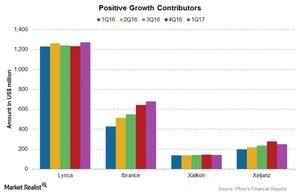

What Drove Pfizer in 1Q17?

Growth drivers for Pfizer (PFE) include products contributing to operational growth, such as BMP2, Celebrex, Ibrance, Lyrica, and Xeljanz.

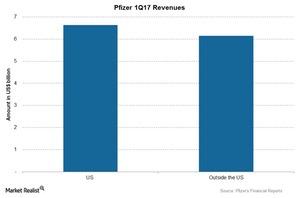

Understanding Pfizer’s 1Q17 Performance by Geography

Pfizer (PFE) reported a 2% decline in revenues to ~$12.8 billion for 1Q17, as compared to $13.0 billion in 1Q16.

Behind Pfizer’s Business Segments in 1Q17

Pfizer’s Innovative Health segment contributes ~58% of PFE’s total revenues and reported an operational growth of 6% to $7.4 billion for 1Q17.

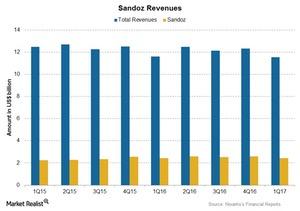

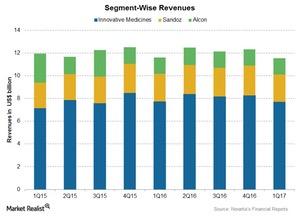

Inside Novartis’s Generics Business Now

Sandoz is also a leader in differentiated generics. Its contribution made up ~21% of Novartis’s total revenues in 1Q17.

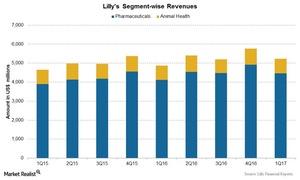

Eli Lilly’s Business Segments’ Performance in 1Q17

Elanco, Eli Lilly’s Animal Health business, reported growth of 2% to $769.4 million during 1Q17.

Inside Novartis’s Innovative Medicines Segment in 1Q17

Novartis’s (NVS) Innovative Medicines segment contributed ~67% of NVS’s total revenues in 1Q17.

Inside Novartis’s Segment-Wise Performance in 1Q17

Novartis is largely exposed to currency risk, as ~50% of its total revenues are reported from international markets.

What Happened to Novartis’s Valuation after 1Q17?

Novartis reported EPS of $1.13 on revenues of $11.54 billion for 1Q17, which represents 2% YoY operational growth in revenues.

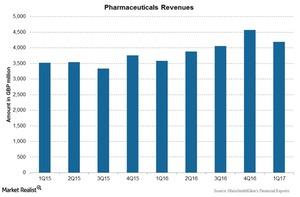

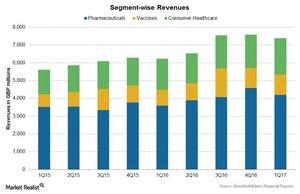

GlaxoSmithKline’s Pharmaceuticals Segment in 1Q17

The Pharmaceuticals segment reported an operational growth of 4.0% and a 13.0% positive impact of foreign exchange, resulting in a rise of 17.0% in revenues.

GlaxoSmithKline’s Segment Performances in 1Q17

GlaxoSmithKline (GSK) reported a 19.0% rise in 1Q17 revenues to ~7.4 billion pounds, driven by an operational rise of 5.0% and a favorable currency impact of 14.0%.

Johnson & Johnson’s Business Segments in 1Q17

Johnson & Johnson’s business includes three segments: Pharmaceuticals, Consumer, and Medical Devices.

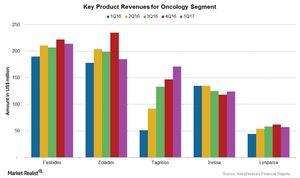

How AstraZeneca’s Oncology Segment Performed in 1Q17

AstraZeneca’s (AZN) Oncology segment has consistently reported revenue growth over the last few years, and it’s one of the company’s key areas of focus.

How AstraZeneca’s Growth Platforms Performed in 1Q17

A few of the segments AstraZeneca identifies as growth platforms include Respiratory products, new Cardiovascular and Metabolic Diseases products, and new Oncology products.

AstraZeneca’s Segment-by-Segment Performance in 1Q17

AstraZeneca’s (AZN) business is separated into four segments: Respiratory, Cardiovascular and Metabolic Diseases (or CVMD), Oncology, and Other.

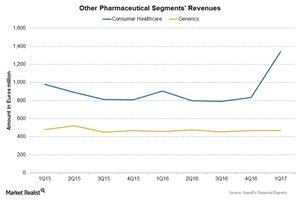

Sanofi’s Generics and Consumer Healthcare Business in 1Q17

Sanofi’s (SNY) Generics business contributes ~5% to the group’s total revenues.

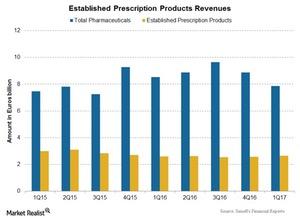

Performance of Sanofi’s Established Prescription Products in 1Q17

Revenues from Sanofi’s Established Prescription Products rose 0.6% at constant exchange rates during 1Q17 and reported revenues of ~2.6 billion euros in 1Q17.

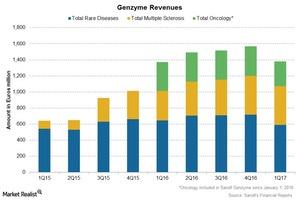

Performance of Sanofi Genzyme in 1Q17

Sanofi (SNY) reported growth of over 15% at constant exchange rates in its 1Q17 revenues from Genzyme.

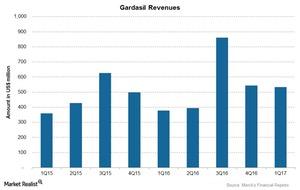

Gardasil and Merck’s Vaccines Business in 1Q17

Gardasil is Merck’s (MRK) leading vaccine franchise. Total sales for Gardasil in 1Q17 were $532.0 million, a ~41.0% rise over $378.0 million in 1Q16.

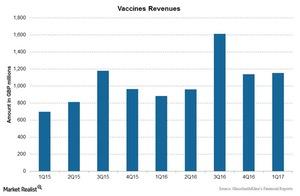

How GlaxoSmithKline’s Vaccines Business Performed in 1Q17

GlaxoSmithKline (GSK) is focused on strengthening its vaccines business, so it acquired the meningitis and other vaccines business from Novartis (NVS).

Performance of Eli Lilly & Co.’s Elanco in 1Q17

Eli Lilly & Co.’s (LLY) Animal Health company, Elanco, reported an increase of 2% in revenues to $769.4 million in 1Q17, compared to $754.6 million in 1Q16.

Analysts’ Ratings and Recommendations for Pfizer

Wall Street analysts expect Pfizer’s (PFE) top line to rise 0.6% to ~$13.1 billion in 1Q17. Its earnings per share are expected to be $0.67 in the quarter.

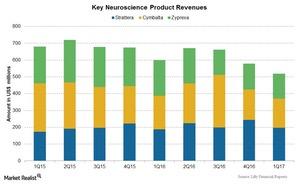

Eli Lilly’s 1Q17 Earnings: Strattera and Other Neuroscience Products

Strattera, a drug for attention-deficit hyperactivity disorder, reported a 4% increase in revenues to $196.2 million in 1Q17, compared to $188.1 million in 1Q16.