Performance of Sanofi Genzyme in 1Q17

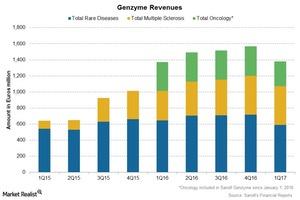

Sanofi (SNY) reported growth of over 15% at constant exchange rates in its 1Q17 revenues from Genzyme.

May 26 2017, Updated 3:59 p.m. ET

Sanofi Genzyme

Sanofi (SNY) reported growth of over 15% at constant exchange rates in its 1Q17 revenues from Genzyme. Sanofi Genzyme includes product revenues from three franchises: Multiple Sclerosis, Rare Diseases, and Oncology.

The company’s Genzyme sales increased ~18% to ~1.4 billion euros, driven by the strong performance of Aubagio and Lemtrada in the Multiple Sclerosis franchise; Fabrazyme, Myozyme, and Cerdelga in the Rare Diseases franchise; and Jevtana, Thymoglubin, and Mozobil in the Oncology franchise.

Multiple Sclerosis franchise

Sanofi holds two drugs—Aubagio and Lemtrada—in the Multiple Sclerosis franchise. The franchise’s revenues rose 32.8% at constant exchange rates to 483 million euros in 1Q17.

Aubagio is a once-daily oral drug for the treatment of multiple sclerosis. For 1Q17, Aubagio reported growth of 29.7% at constant exchange rates to 371 million euros due to strong performance worldwide. Lemtrada is also used in the treatment of relapsing forms of multiple sclerosis.

Lemtrada reported growth of 40.9% at constant exchange rates to 125 million euros during 1Q17, following increased demand worldwide.

Rare Diseases franchise

The Rare Diseases franchise include drugs like Cerezyme, Myozyme, Aldurazyme, Cerdelga, and Febrazyme. The franchise reported revenue growth of 7.6% at constant exchange rates to 712 million euros during 1Q17. Its revenue growth was driven by all the drugs in the franchise except Cerezyme.

Oncology franchise

The Oncology franchise includes six drugs and reported revenue growth of 12.8% at constant exchange rates to 412 million euros in 1Q17. This growth was driven by the strong sales of drugs including Taxotere, Jevtana, Thymoglobulin, Eloxatin, and Mozobil, partially offset by Zaltrap.

To divest any company-specific risk, investors can consider the Schwab International Equity ETF (SCHF) which holds ~0.7% of its total assets in Sanofi. SCHF also holds 0.7% of its total assets in GlaxoSmithKline (GSK), 0.6% of its total assets in AstraZeneca (AZN), and 0.6% of its total assets in Novo Nordisk (NVO).