AstraZeneca PLC

Latest AstraZeneca PLC News and Updates

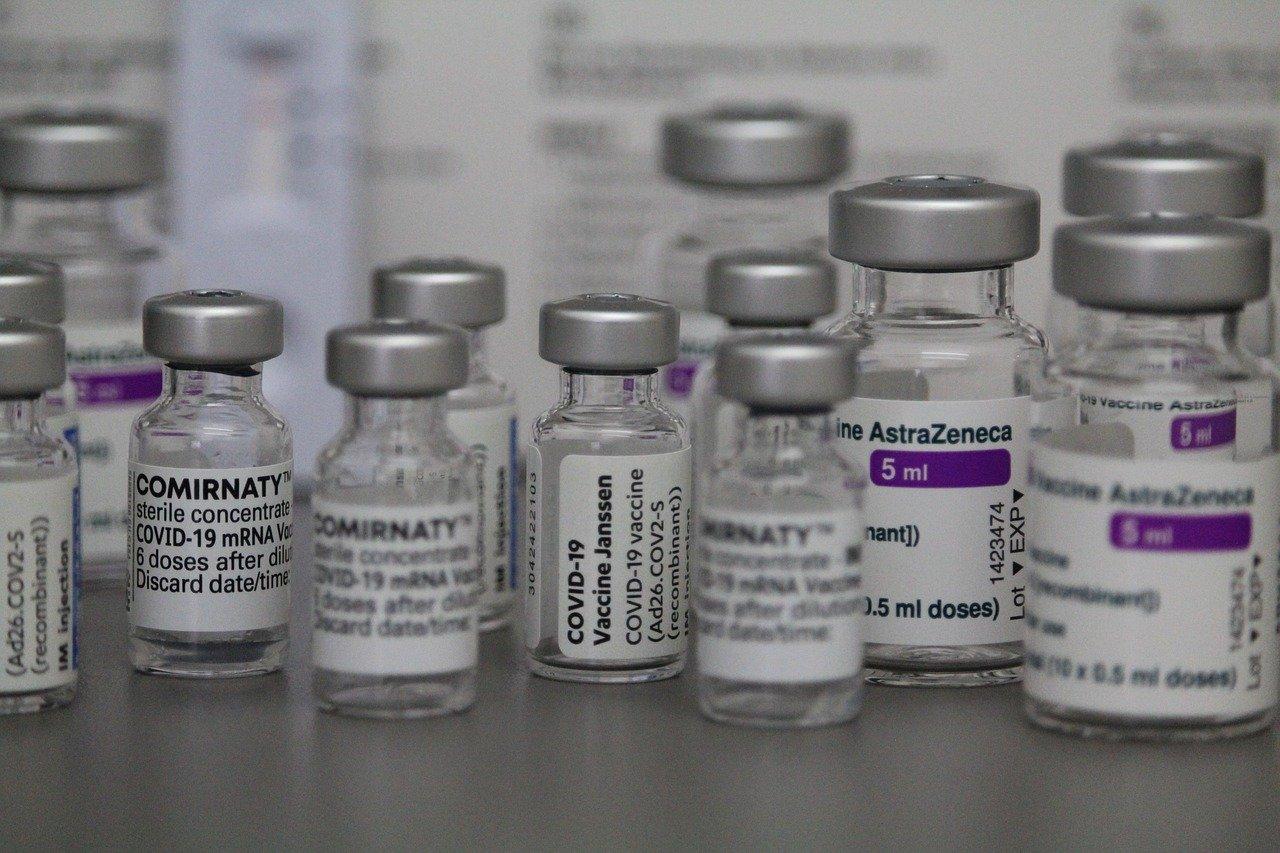

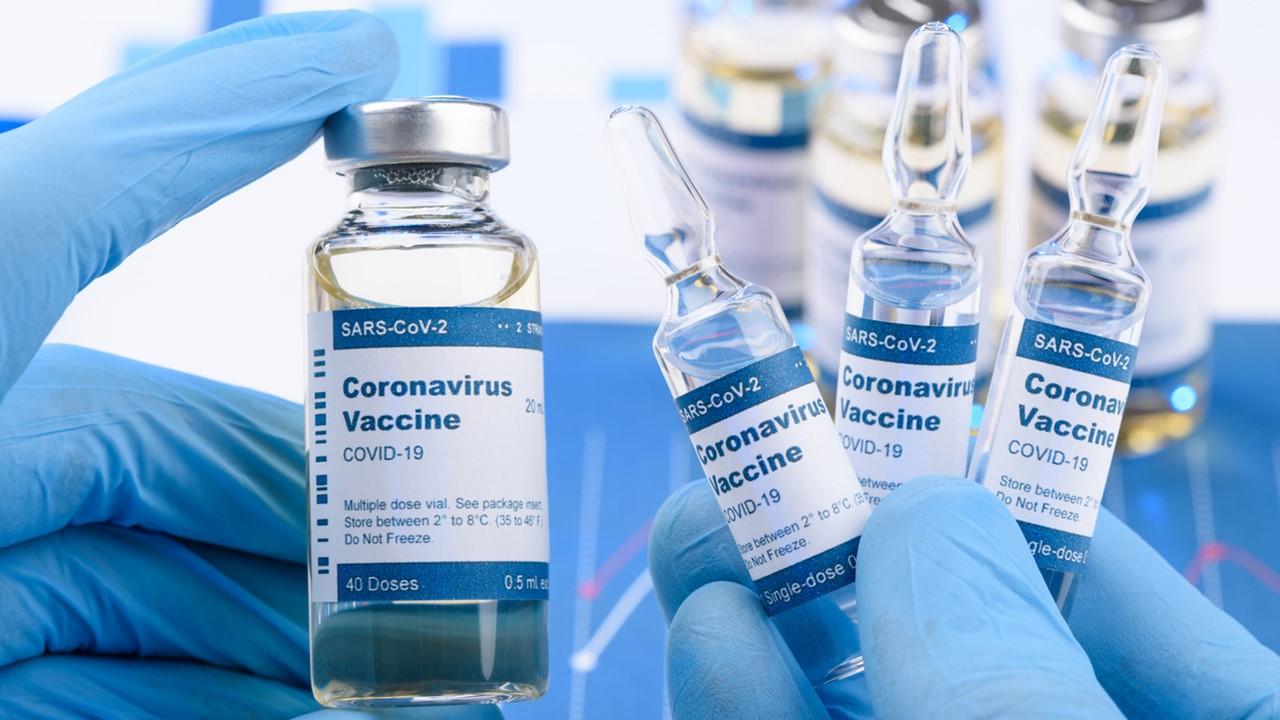

AstraZeneca COVID-19 Vaccine Originated in the U.K., Is Used Globally

According to a recent study, a booster dose of AstraZeneca works against the omicron variant. What's the AstraZeneca vaccine’s country of origin?

AstraZeneca Will Profit From Its COVID-19 Vaccine—Why It Matters

AstraZeneca plans to profit off its COVID-19 vaccine. Here's what that means and why it matters.

Will the FDA Approve AstraZeneca's COVID-19 Cocktail?

AstraZeneca's COVID-19 vaccine never received emergency-use authorization in the U.S. Will the FDA approve its antibody cocktail?

How to Get Help With Your Prescriptions With AstraZeneca Patient Assistance

You may not even realize it, but you may be eligible to save money on AstraZeneca prescriptions from the AZ&Me prescription savings program.

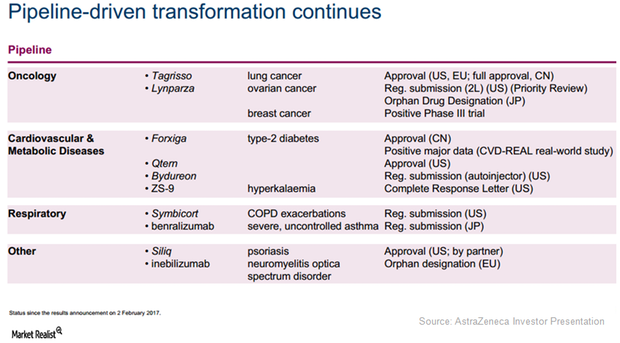

What Drugs Does AstraZeneca Make?

AstraZeneca is a leading biopharmaceutical company that focuses on developing drugs to treat cancer, heart disease, and COPD. What drugs does the company make?

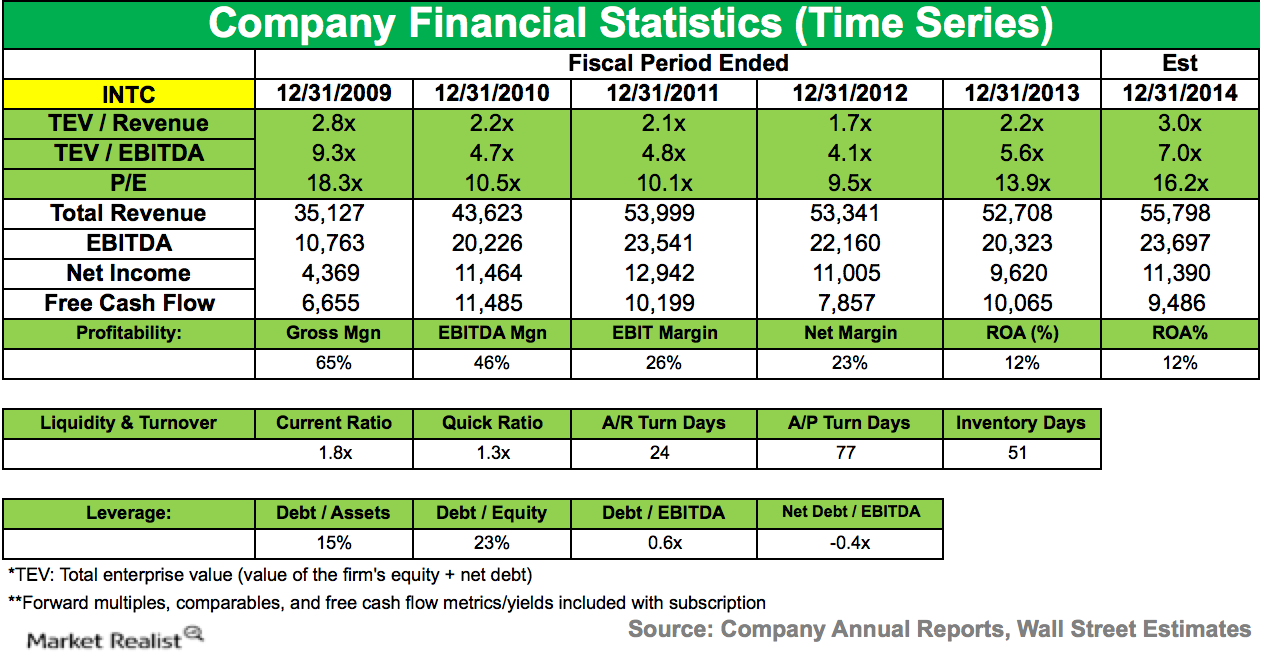

AQR Capital increases stake in Intel

Intel generated ~$5.7 billion in cash from operations. The company paid quarterly dividends of $1.1 billion and repurchased 122 million shares for $4.2 billion.

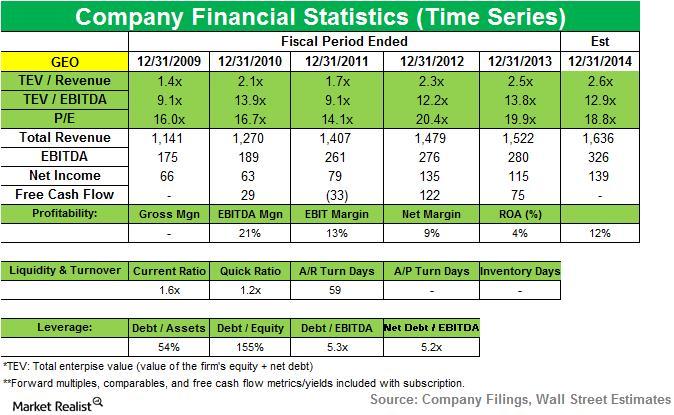

Why AQR Capital exits its position in Geo Group Inc.

AQR Capital sold a position in GEO Group Inc. in 2Q14. The company accounted for a 0.0206% position in the fund’s first quarter U.S. long portfolio.

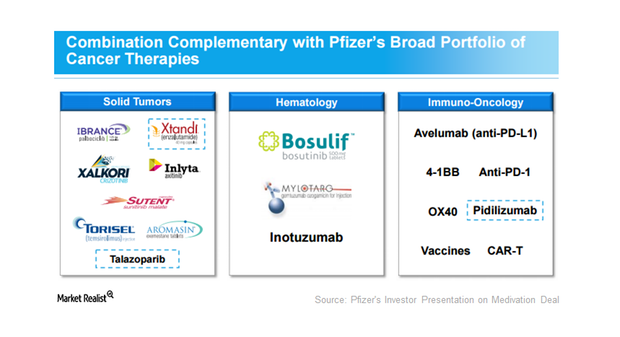

What’s the Story behind the Pfizer-Medivation Deal?

Medivation’s portfolio complements Pfizer’s existing oncology portfolio that includes solid tumors, hematology, and immunology-oncology.

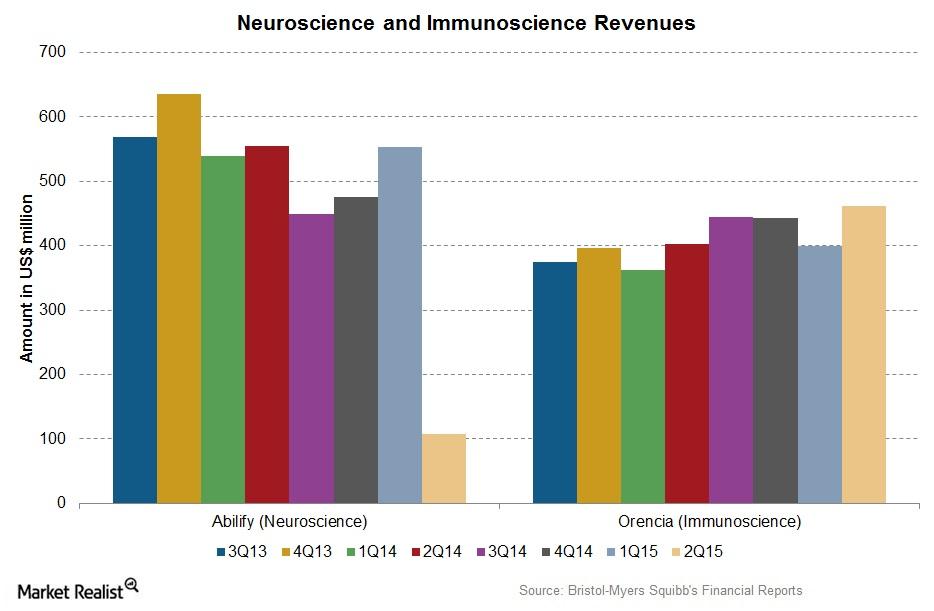

Bristol-Myers Squibb’s Neuroscience and Immunoscience Segments

Sales for Bristol-Myers Squibb’s (BMY) neuroscience segment declined over 80% in 2Q15, while the immunoscience segment’s sales improved ~15% in 2Q15 as compared to 2Q14.

Understanding Bristol-Myers Squibb’s Other Segments

Sales from Bristol-Myers Squibb’s Neuroscience segment declined by 94% in 1Q16. Sales from the Immunoscience segment improved by ~18.7% in 1Q16 over 1Q15.

Novartis Receives 2 Breakthrough Therapy Designations in January

In January 2018, the FDA granted a BTD to Novartis’s (NVS) Promacta for use along with standard immunosuppressive therapy.

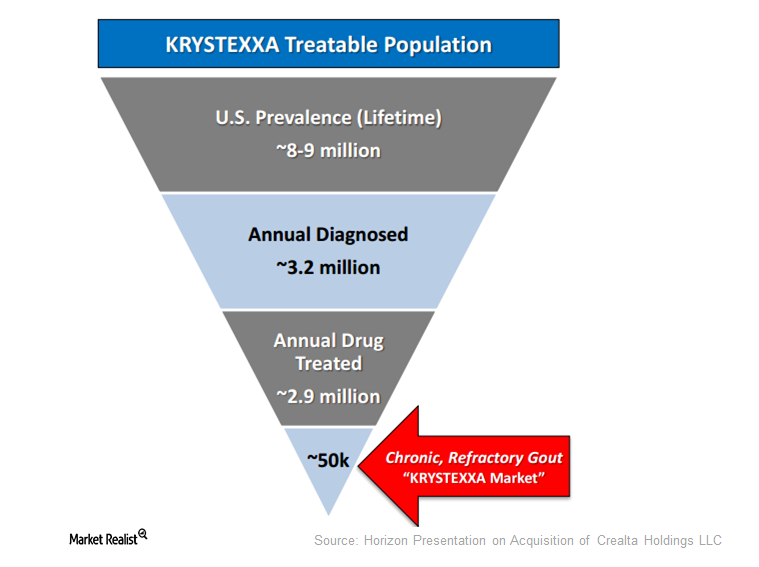

Introducing Krystexxa, the Latest Addition to Horizon’s Orphan Portfolio

In January 2016, Horizon acquired Krystexxa from Crealta Holdings. The drug has been approved by the FDA for the treatment of chronic refractory gout.

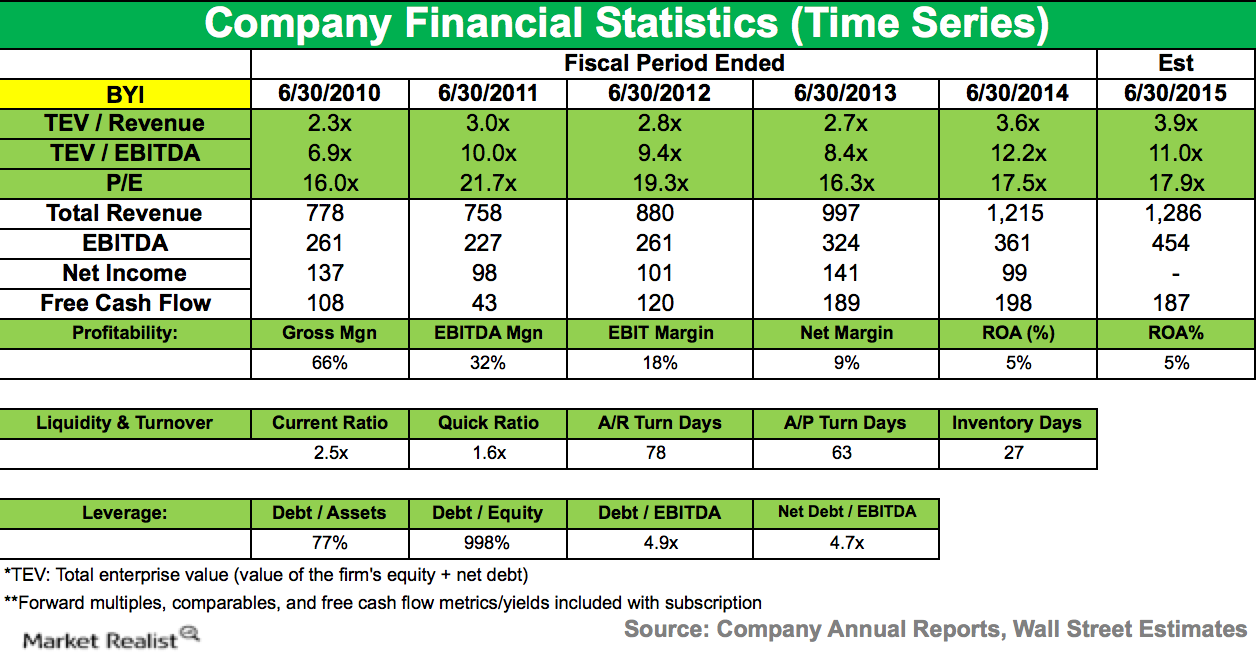

AQR Capital initiated position in Bally Technologies Inc.

AQR Capital initiated a position in Bally Technologies during the third quarter of 2014 that accounts for 0.22% of the fund’s 3Q14 portfolio.

What Are Generic Drugs and Why Are They Important?

TOM BUTCHER: What are generic drugs, and why are they important? JAMES DUFFY: Generic drugs are drugs that are comparable to their brand-name counterparts. They are comparable in terms of the dosage, effectiveness, and intended use. Generics are important because they are essentially a less-expensive alternative to their brand-name counterparts. This, of course, is expected […]

AstraZeneca May Witness a Fall in 2017 Net Profit Margin

Wall Street analysts have projected AstraZeneca’s (AZN) 2017 net profit margins at about 12.2%, which is lower by 300 basis points on a YoY basis.

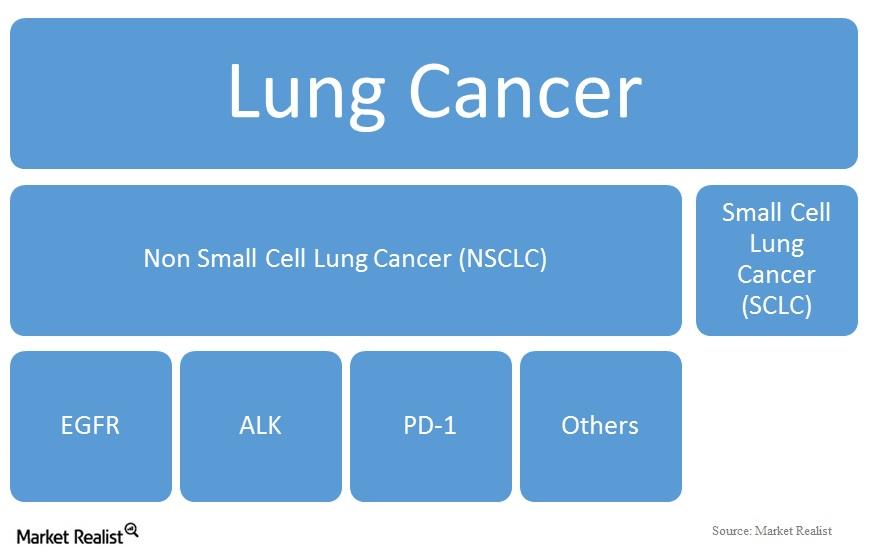

Other Drugs for Non-small Cell Lung Cancer

Approximately 85% of all lung cancers in the United States are non-small cell lung cancers, and 10% to 15% of these are EGFR mutation-positive.

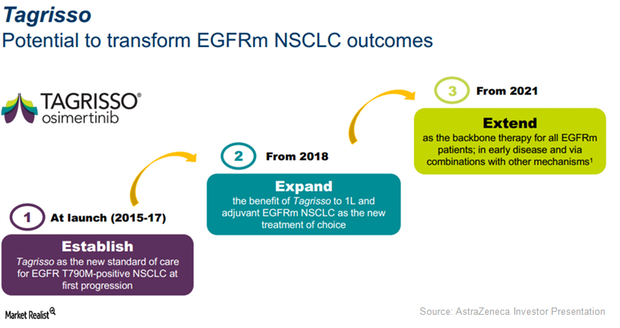

Tagrisso Expected to Be a Key Growth Driver for AstraZeneca in 2017

Launched in Japan in 2Q16, AstraZeneca’s (AZN) 1Q17 revenues for Tagrisso approached $39 million in this major emerging market.

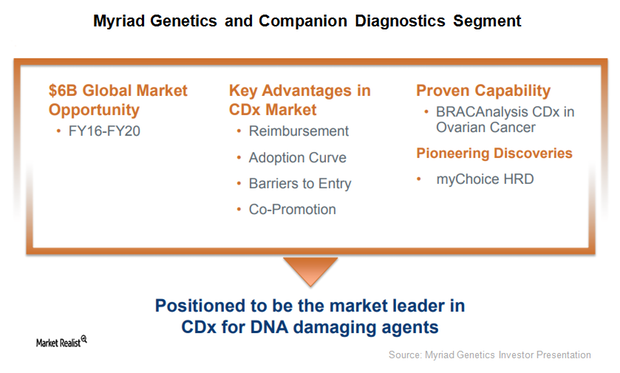

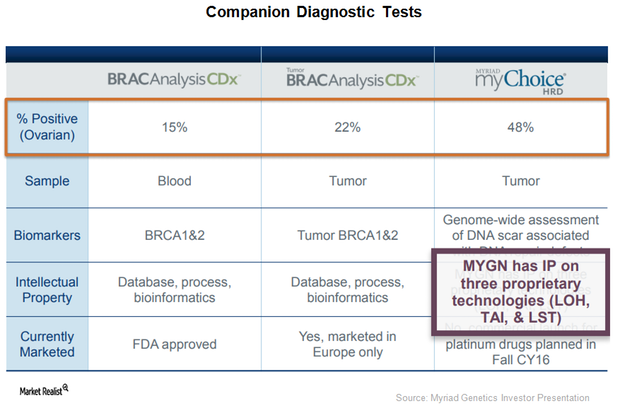

This Could Be a Solid Growth Driver for Myriad Genetics in 2018

Myriad Genetics (MYGN) announced the U.S. Food and Drug Administration’s (or FDA) acceptance of its supplementary premarket approval application for BRACAnalysis CDx, a DNA sequencing companion diagnostic test.

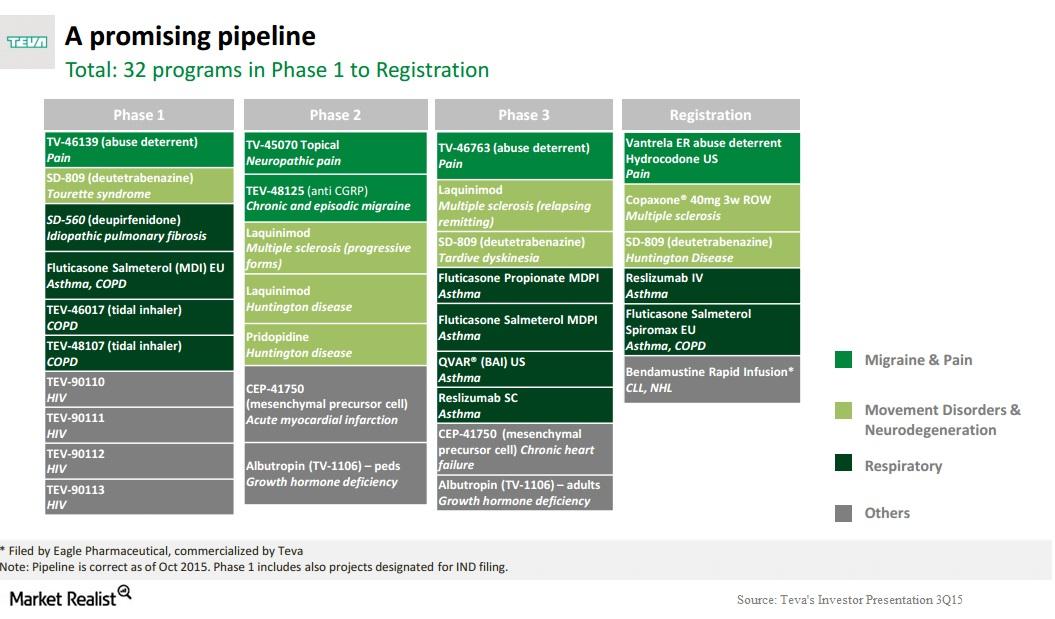

Teva’s Respiratory Drugs Contribute 11% to Specialty Medicines

Teva’s respiratory drugs franchise provides solutions for asthma, COPD, and allergic rhinitis. Respiratory drugs contributed nearly 11% of total revenues for Teva’s Specialty Medicines in 2014.

Is AstraZeneca Stock a Good Buy at These Prices?

AstraZeneca was founded in 1999 through the merger of Astra AB and Zeneca Group. Is AstraZeneca a good stock to buy?

Operation Warp Speed Has Invested Billions in Potential COVID-19 Vaccines

The U.S. government’s Operation Warp Speed program has already invested billions in six potential coronavirus vaccine candidates.

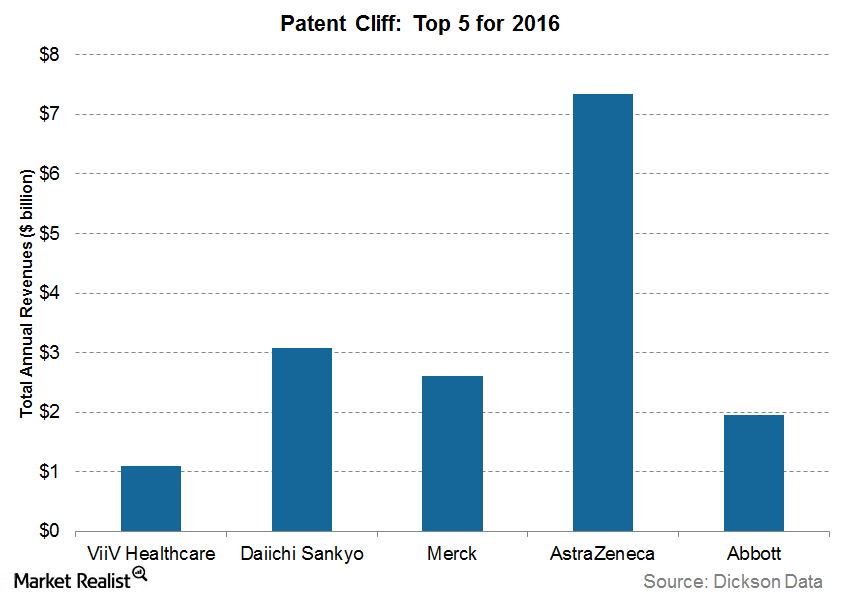

Why the Patent Cliff Is a Key Driver of Generic Drug Growth

Over the last several years, patent cliffs have led to steep revenue losses for traditional pharmaceuticals as well as created a gateway for smaller companies to come to market with generics.

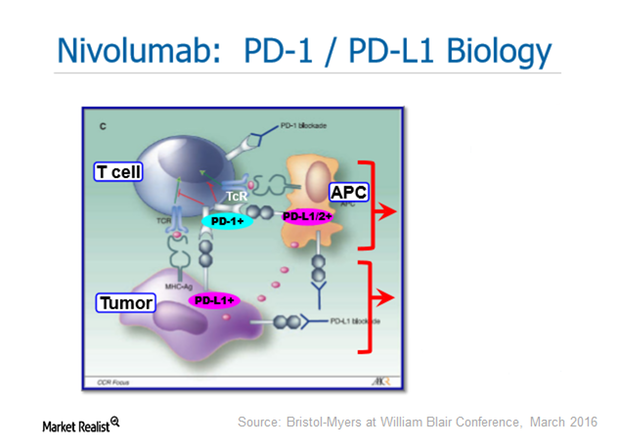

Brace Yourself: AstraZeneca Could Be a Fourth Entrant into the PD-1/PD-L1 Drug Class

The PD-1 (programmed death-1)/PD-L1 (programmed death-ligand 1) class consists of Bristol-Myers Squibb’s Opdivo, Merck’s Keytruda, and Roche’s Tecentriq.

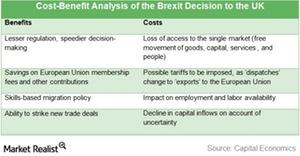

A Cost-Benefit Analysis of the Brexit Decision

To understand how the Brexit result stands to impact your portfolio or your willingness to invest in the United Kingdom, a cost-benefit analysis is pertinent.

How Are AstraZeneca’s Revenues Trending in 2019?

On its first-quarter earnings conference call, AstraZeneca (AZN) guided for year-over-year product sales growth in high-single-digit percentage in 2019. The company, however, expects modest product sales growth in the second half of 2019 due to higher oncology revenue in the previous period.

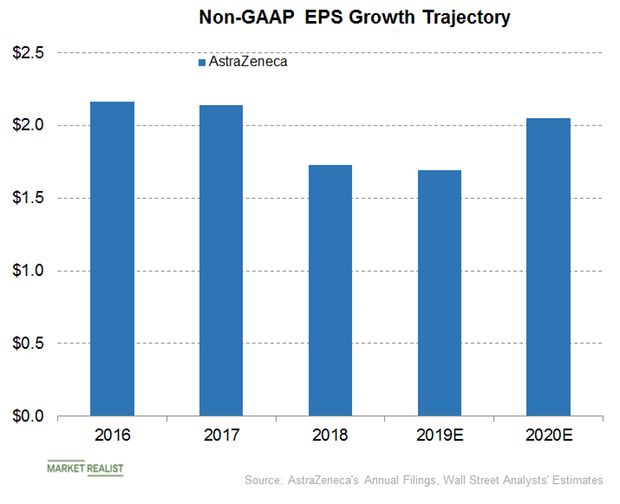

What AstraZeneca Expects for EPS in Fiscal 2019

In its first-quarter press release, AstraZeneca (AZN) reiterated its guidance for core EPS of $3.50–$3.70 in fiscal 2019.

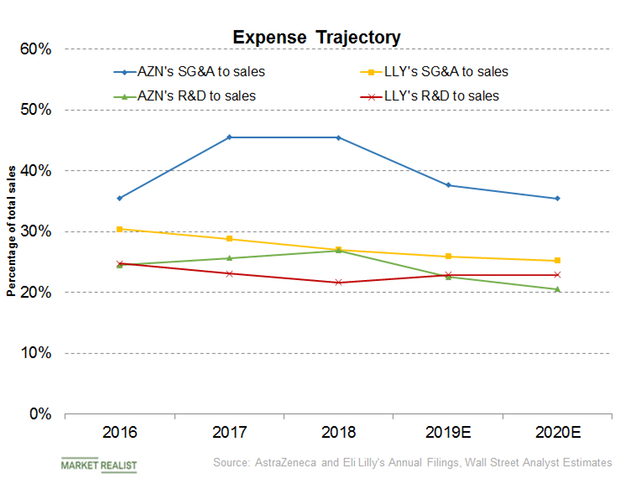

AstraZeneca or Eli Lilly: Which Is Controlling Expenses Better?

In its fourth-quarter earnings press release, AstraZeneca (AZN) guided for a low single-digit YoY (year-over-year) rise in core operating expenses in fiscal 2019.

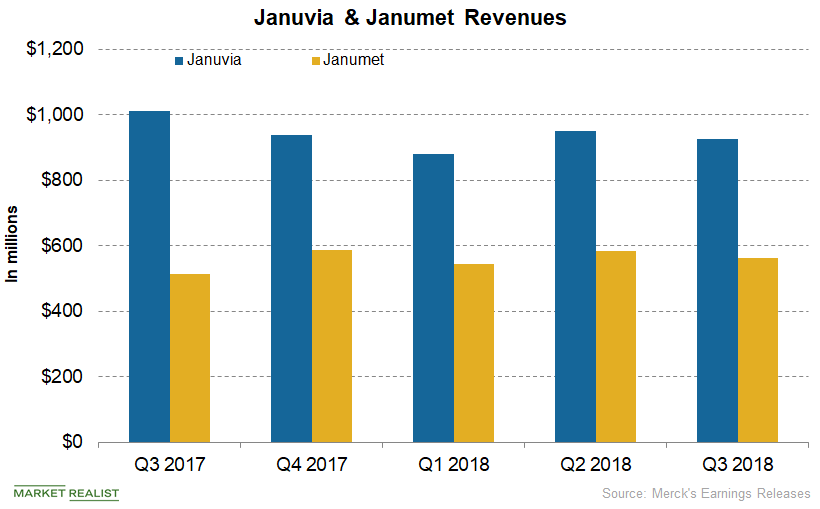

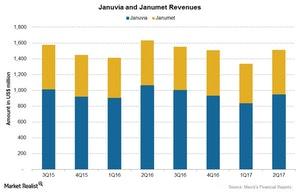

A Look at Merck’s Diabetes and Women’s Health Business

Merck & Co.’s (MRK) Januvia generated revenues of $927 million in the third quarter, reflecting an ~8% YoY (year-over-year) decline.

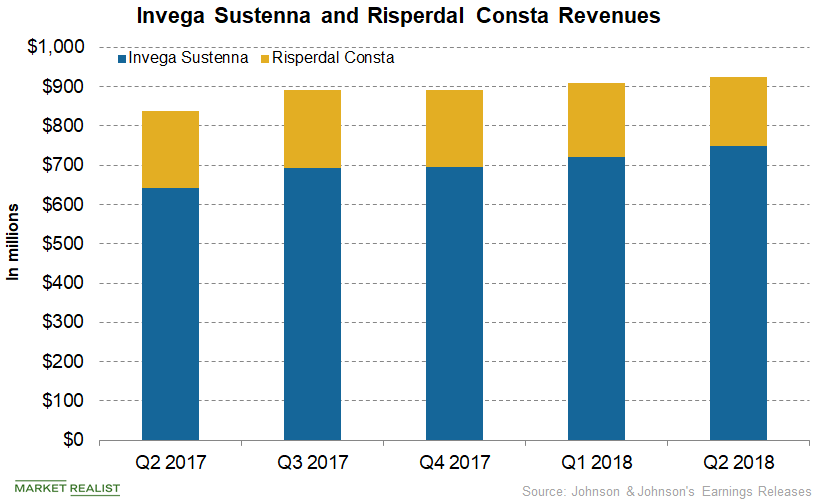

How JNJ’s Invega Sustenna and Risperdal Consta Performed

Johnson & Johnson’s (JNJ) Invega Sustenna, Xeplion, Trinza, and Trevicta combined witnessed solid growth in the third quarter.

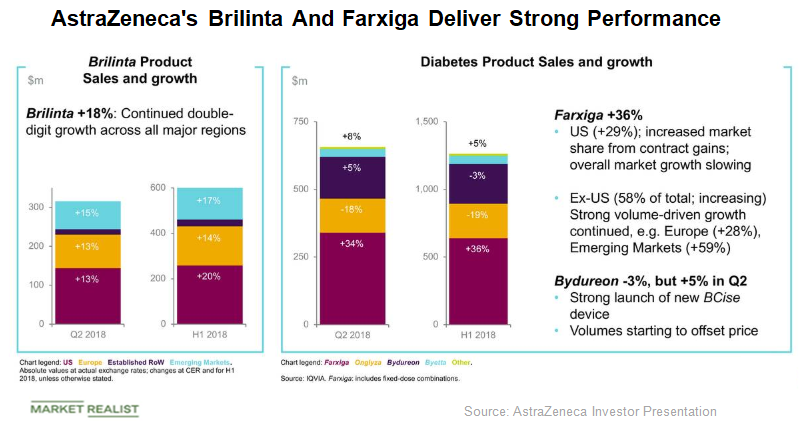

How Did AstraZeneca’s CVRM and Respiratory Products Perform?

Brilinta’s sales increased by 13.0% to $316.0 million, and Farxiga’s sales grew 34.0% to $340.0 million in the second quarter.

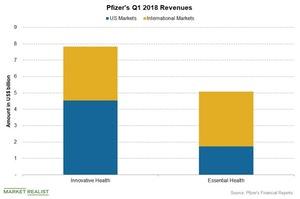

How Pfizer’s Business Segments Have Performed

As discussed, Pfizer’s (PFE) business is divided into two business segments, Innovative Health and Essential Health.

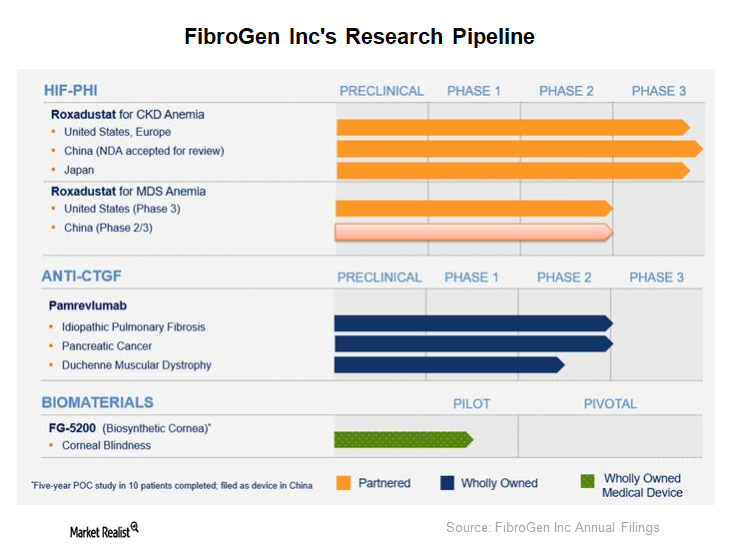

Understanding FibroGen’s Research Pipeline

Apart from Roxadustat, other products in FibroGen’s pipeline include Pamrevlumab (or FG-3019) and FG-5200.

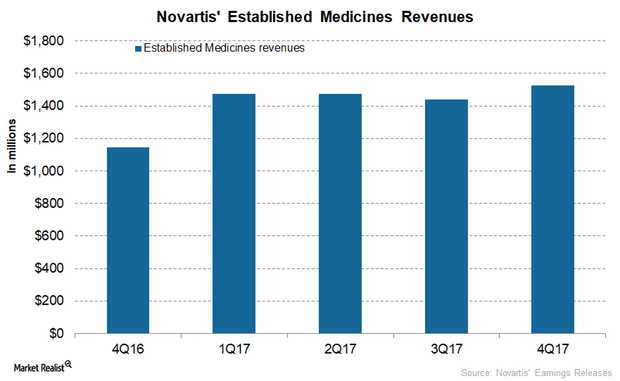

How Did Novartis’s Established Medicines Segment Perform in 2017?

In 4Q17, Novartis’s (NVS) Galvus generated revenues of $327 million, which is ~10% growth on a year-over-year (or YoY) basis and 5% growth quarter-over-quarter.

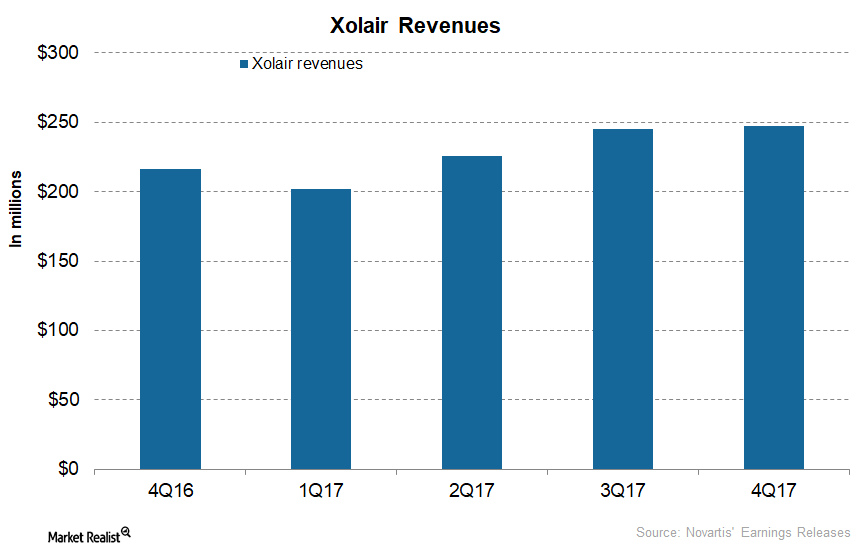

How Is Novartis’s Xolair Positioned after 4Q17?

In 4Q17, Novartis’s (NVS) Xolair generated revenues of $247 million, which reflected ~14% growth on a year-over-year (or YoY) basis and ~1% growth on a quarter-over-quarter basis.

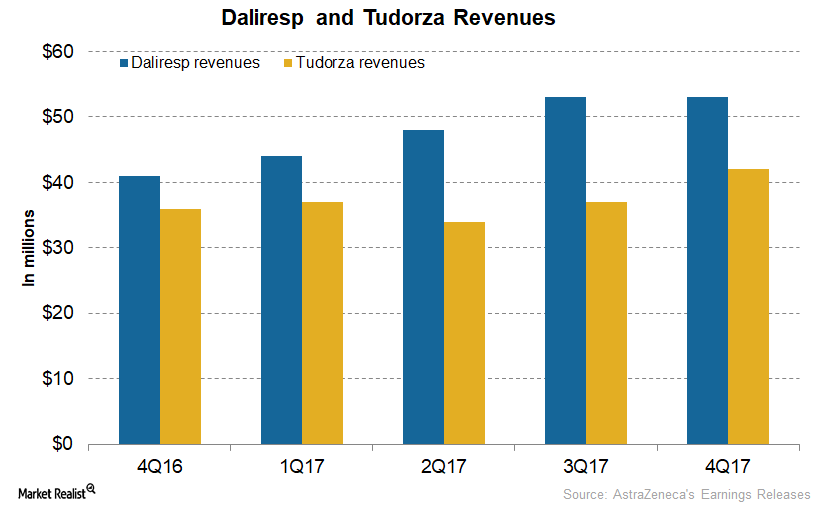

Behind the Performance of AZN’s Daliresp, Tudorza, and Duaklir

In 4Q17, AstraZeneca’s (AZN) Daliresp reported revenues of $53.0 million, which reflected ~29.0% year-over-year (or YoY) growth.

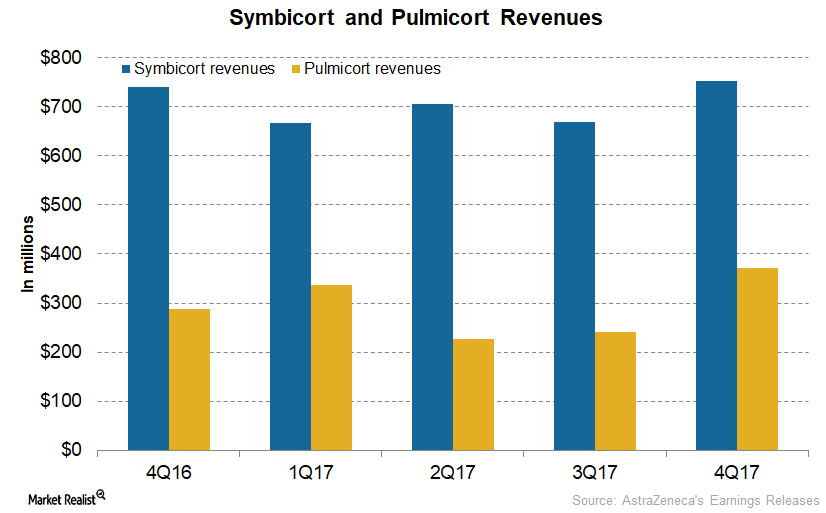

The Performance of AstraZeneca’s Symbicort and Pulmicort in 2017

In 4Q17, AstraZeneca’s (AZN) Symbicort generated revenues of $752.0 million, which is ~2.0% growth on a year-over-year basis.

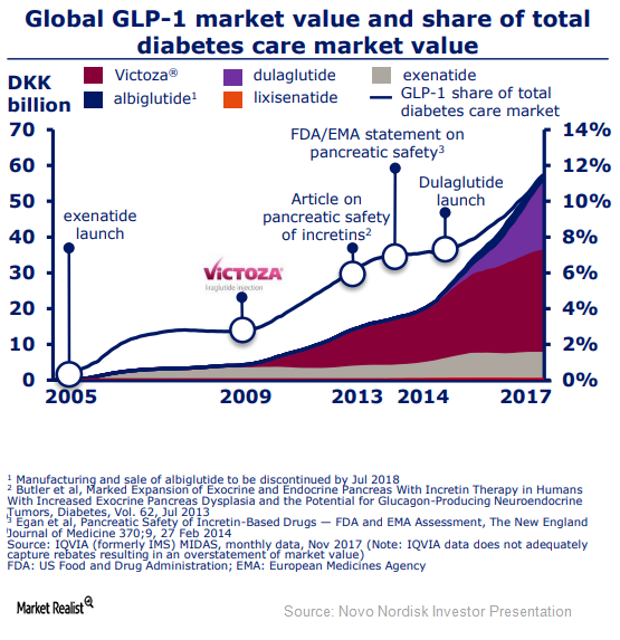

Victoza Continues to Lead in the GLP-1 Segment in 2018

In 3Q17, Novo Nordisk managed to update Victoza’s label in the United States and Europe.

AstraZeneca’s Tagrisso Witnessed Solid Growth in 2017

In 4Q17, AstraZeneca’s (AZN) Tagrisso reported revenues of $304.0 million compared to $147.0 million in 4Q16.

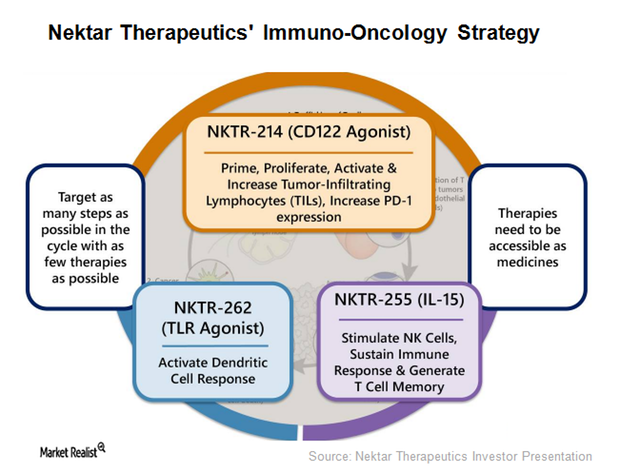

A Deeper Look at Nektar Therapeutics’ Licensing Agreements

License and collaboration agreements Nektar Therapeutics (NKTR) has entered into a number of licensing and collaboration agreements for research, development, and commercialization with various healthcare companies, including Eli Lilly (LLY), AstraZeneca (AZN), and Amgen (AMGN). Under these agreements, Nektar is entitled to receive license fees, milestone payments, royalties, and payments for manufacturing and supplying Nektar’s […]

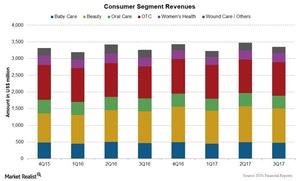

Johnson & Johnson’s Consumer Segment: 4Q17 Estimates

Johnson & Johnson’s beauty franchise is expected to report growth in revenues in 4Q17 due to the strong performance of products acquired from Vogue International.

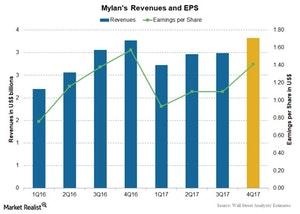

Mylan’s Valuation in January 2018

Mylan (MYL) is a leading pharmaceutical company with over 1,400 generic and specialty pharmaceutical products in its portfolio.

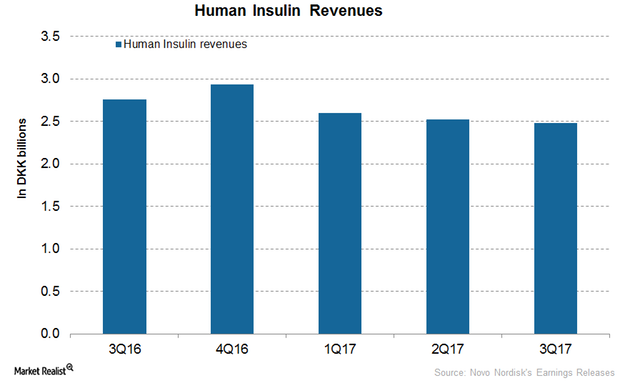

How Did Novo Nordisk’s NovoMix and Human Insulin Perform in 2017?

In 3Q17, Novo Nordisk’s (NVO) NovoMix reported revenues of 2.4 billion Danish krone (or DKK), which reflected ~1% growth on year-over-year (or YoY) basis.

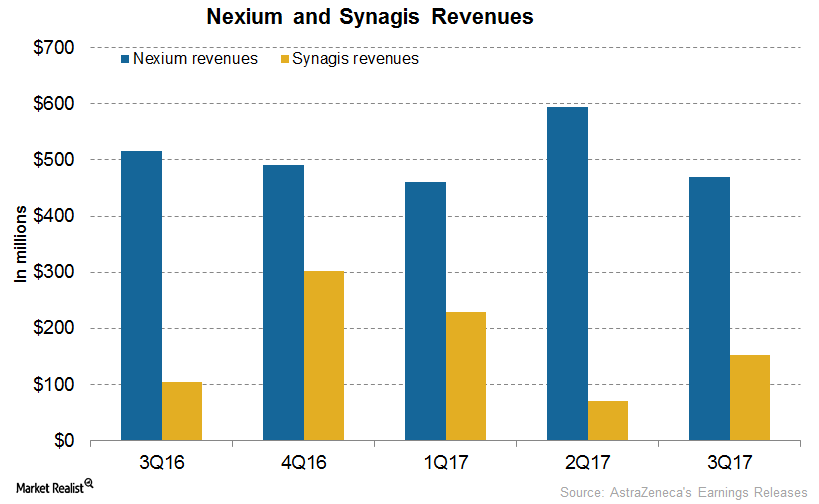

How AstraZeneca’s Nexium, Synagis, and Losec Have Performed in 2017

In 3Q17, AstraZeneca’s (AZN) Nexium generated revenues of $469.0 million, which reflected an ~9.0% decline on a year-over-year basis.

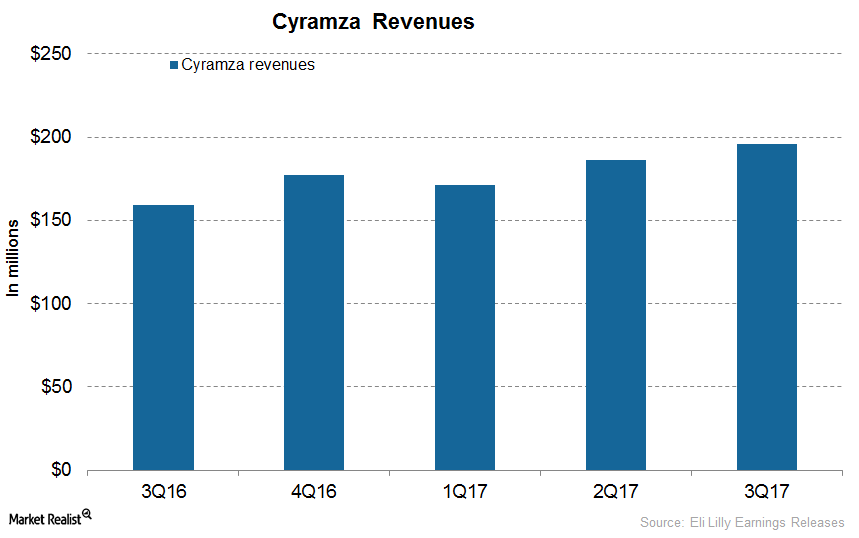

How Has Eli Lilly’s Cyramza Performed

In 3Q17, Eli Lilly’s (LLY) Cyramza generated revenues of $196 million, which reflected ~23% growth on a YoY basis and 5% growth on a quarter-over-quarter basis.

BRACAnalysis CDx Received FDA Approval for Ovarian Cancer Indication

On March 27, 2017, the FDA also approved BRACAnalysis CDX test as a complementary diagnostic test to be used with ovarian cancer maintenance therapy Tesaro’s (TSRO) Zejula (miraparib).

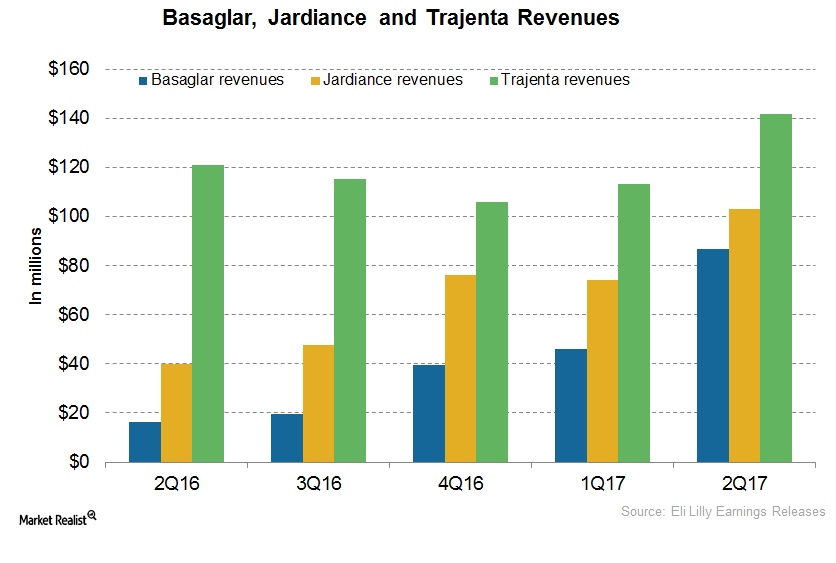

Why Eli Lilly’s Basaglar, Jardiance, and Trajenta Could Witness Steady Growth in 2018

In 1H17, Eli Lilly’s (LLY) Basaglar generated revenues of around $132.6 million, compared with $27.2 million in 1H16.

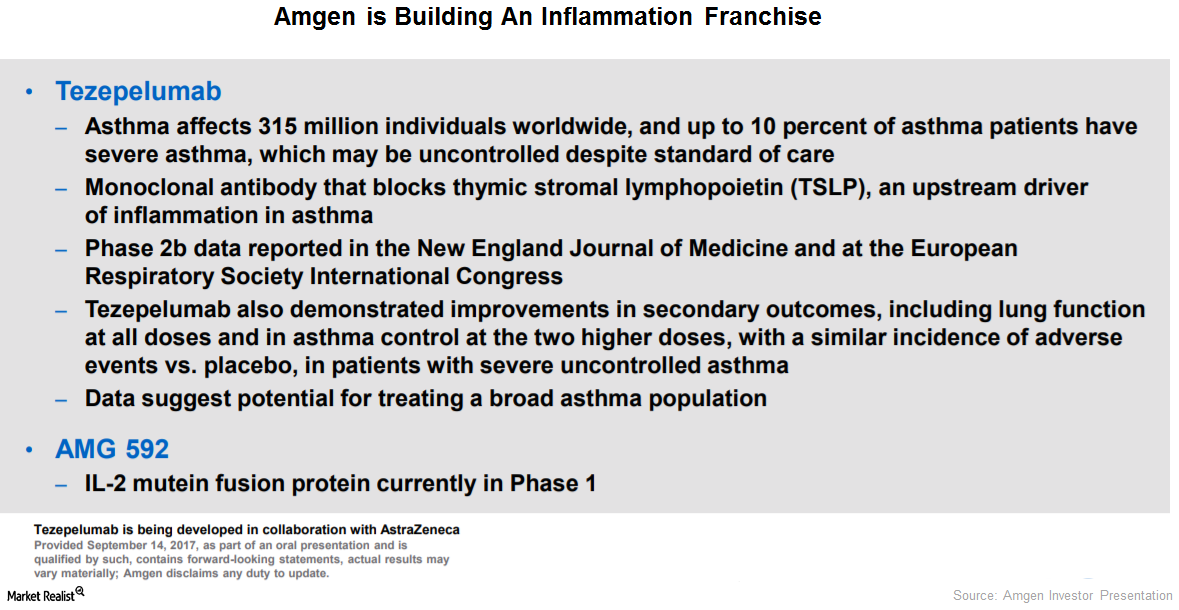

Tezepelumab Could Help Amgen Develop Its Inflammation Franchise

According to World Health Organization (or WHO), around 235 million individuals worldwide have asthma.

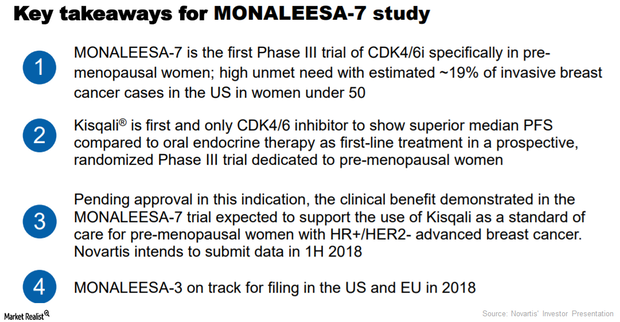

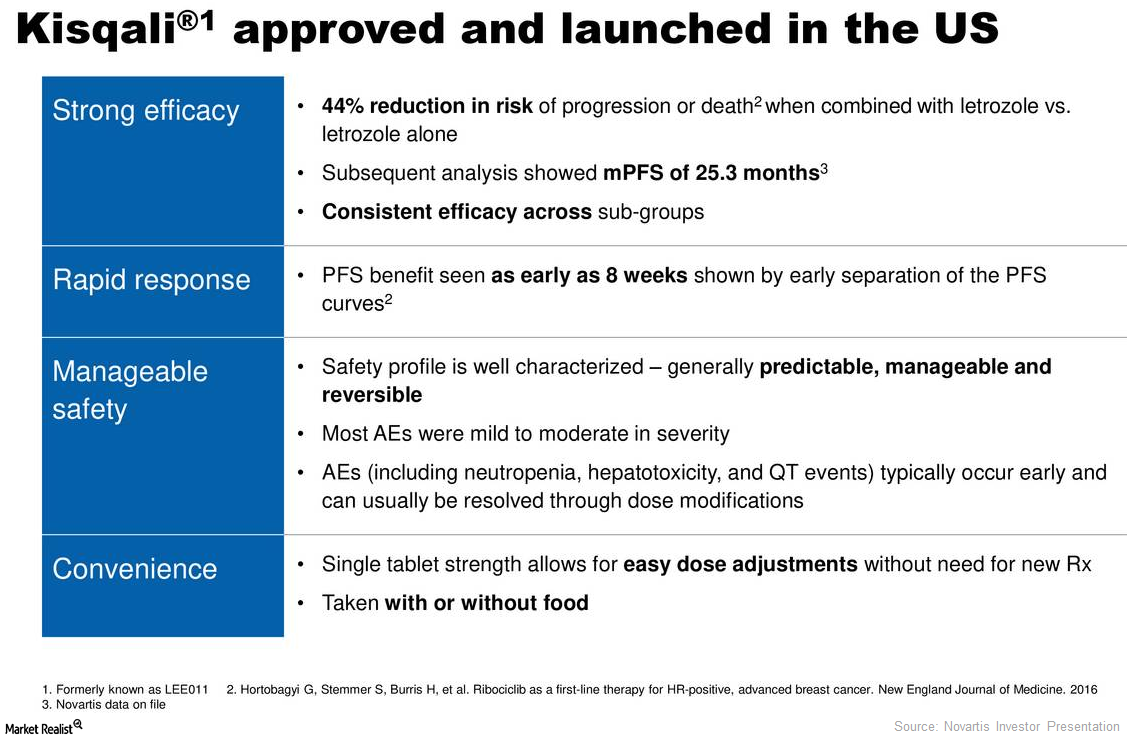

Kisqali Could Significantly Boost Novartis’s Revenue Growth

In 1H17 and 2Q17, Novartis’s (NVS) Kisqali reported revenues of around $15 million and $8 million, respectively.

How Merck’s Diabetes Portfolio Performed in 2Q17

Merck’s (MRK) diabetes portfolio includes drugs used for controlling the blood sugar levels for patients with diabetes.

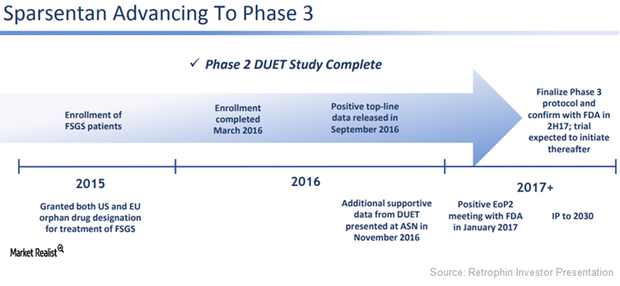

Sparsentan May Be Solid Near-Term Growth Driver for Ligand

With Sparsentan, Retrophin and Ligand Pharmaceuticals could become major nephrology players similar to peers such as Amgen (AMGN), AstraZeneca (AZN), and Bristol-Myers Squibb (BMY).