AstraZeneca PLC

Latest AstraZeneca PLC News and Updates

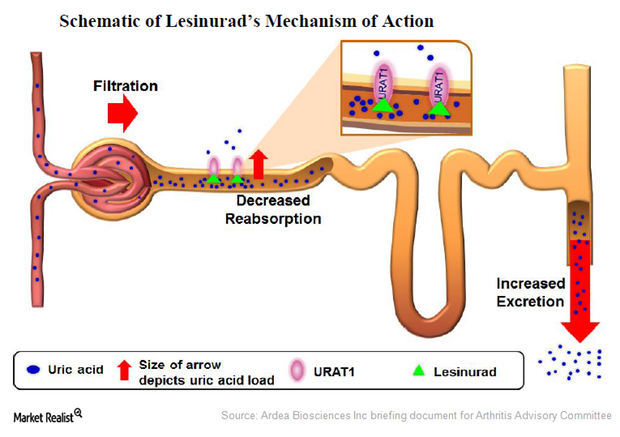

Lesinurad: A Selective Uric Acid Reabsorption Inhibitor for Gout

Lesinurad, originally developed by Ardea Biosciences, was acquired by AstraZeneca through the acquisition of Ardea in June 2012. It works to reduce the uric acid levels in gout patients.

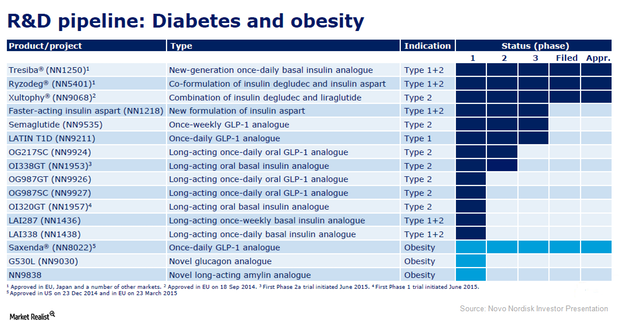

Novo Nordisk’s Innovative Research and Development Pipeline

Novo Nordisk’s research and development pipeline includes three late-stage insulin studies of faster-acting insulin aspart, semaglutide, and LATIN T1D.

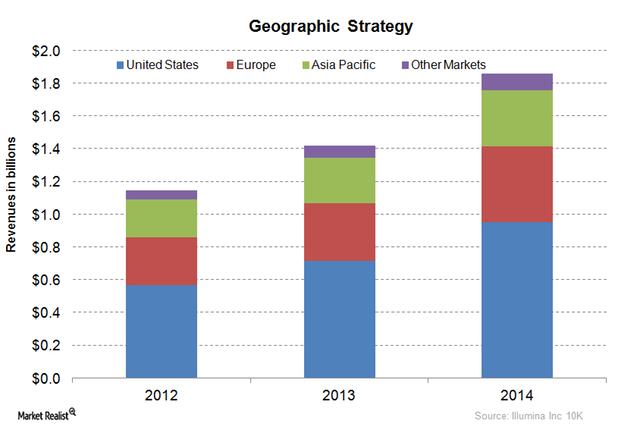

Illumina’s Market Expansion Strategy for Genome Sequencing

Illumina’s Market Expansion Strategy includes targeting the United States, Europe, and China for population sequencing projects.

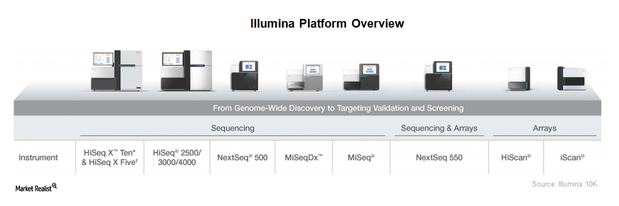

Illumina’s Key Products

Illumina’s key products are based on the company’s NGS (next-generation sequencing) technologies.

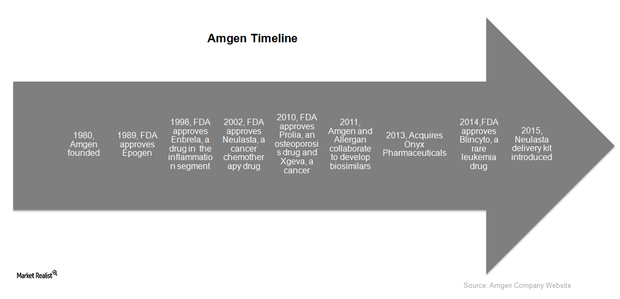

Amgen: An Investor’s Overview to a Leading Biotech Company

An overview of global biotechnology company Amgen shows a market capitalization of $127.2 billion. Headquartered in Thousand Oaks, California, Amgen has a presence in 75 countries.

Sanofi’s Position Compared to Its Peers

The forward PE ratio for Sanofi is ~15.1x for 2015, and ~18.1x for the industry.

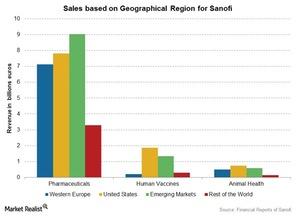

Sanofi’s Segment-Wise Sales by Region

Sanofi (SNY) products are sold in over 120 countries. The company’s markets are classified into four geographical regions for reporting purposes.

Comparing GlaxoSmithKline with Its Peers

Pharmaceutical companies like GlaxoSmithKline are capital-intensive, with high debt on their balance sheets due to heavy setup costs and huge research and development expenses.

AstraZeneca’s Position Compared to Its Peers

The forward EV/EBIDTA multiple for AstraZeneca is ~13x, which is slightly lower than the industry average of ~14x.

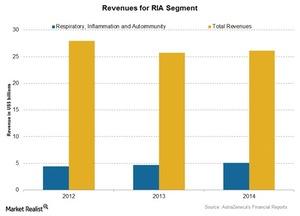

AstraZeneca’s Respiratory, Inflammation, and Autoimmunity Segment

The respiratory, inflammation, and autoimmunity (or RI&A) franchise contributed nearly 19.2% of AstraZeneca’s (AZN) total assets in 2014.

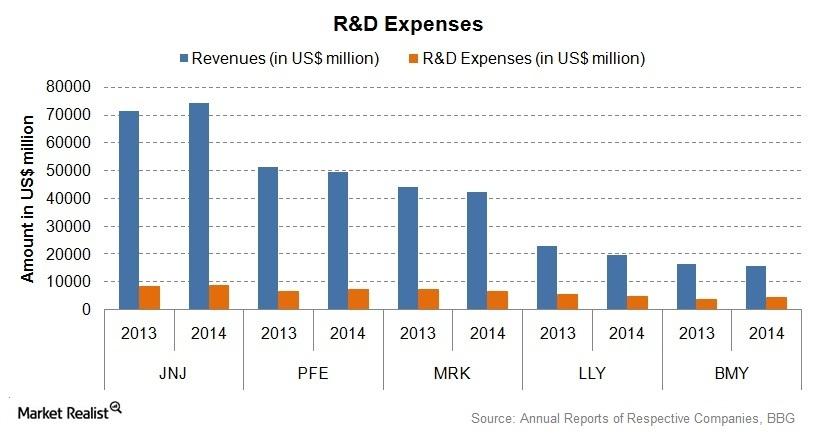

Johnson & Johnson Invested in Research and Development

For a big pharma company like Johnson & Johnson (JNJ), research and development plays a vital role in maintaining a healthy revenue stream.Healthcare The case for Pfizer’s proposed takeover of AstraZeneca

U.S. pharma giant Pfizer’s (PFE) second takeover proposal, of $106 billion (£64 billion), was rejected by Anglo-Swedish drug maker AstraZeneca (AZN) last week.