Mike Benson

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Mike Benson

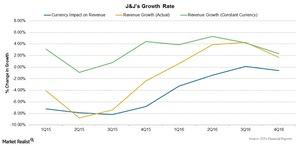

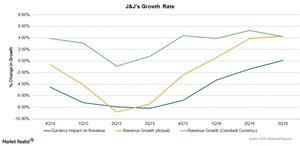

Changes in Johnson & Johnson’s Growth Rate in 4Q16

Johnson & Johnson (JNJ) reported a rise of ~2.3% in its revenue on a constant currency basis in 4Q16 compared to 4Q15.

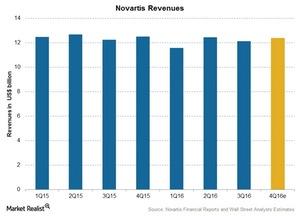

Analysts Expect Negative Growth for Novartis in 4Q16

Analysts expect an ~1.1% decline in Novartis’s (NVS) 4Q16 revenues to ~$12.4 billion following the effects of the acquisition and divestiture of several products.

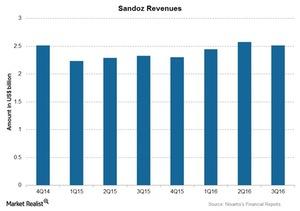

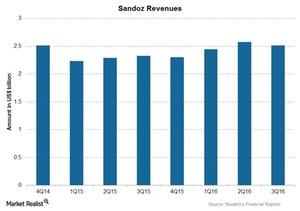

How Did Novartis’s Generics Business Perform in 3Q16?

Sandoz reported a decline of 1% in 3Q16 revenues at constant exchange rates.

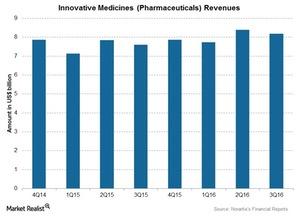

How Did Novartis’s Innovative Medicines Segment Perform?

The overall contribution of the innovative medicines segment was ~67% at $8,173 million for 3Q16.

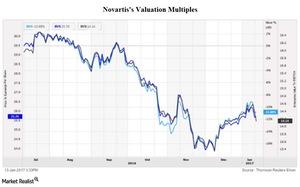

How Does Novartis’s Valuation Compare to Peers?

On January 13, 2017, Novartis was trading at a forward PE multiple of ~15.1x.

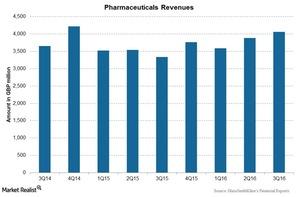

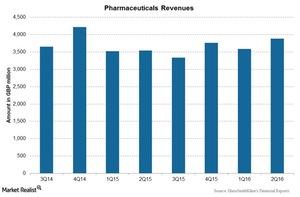

How GlaxoSmithKline’s Pharmaceuticals Segment Has Performed

GlaxoSmithKline’s (GSK) Pharmaceuticals segment fell substantially in 2015 due to its divestment of its oncology business to Novartis (NVS) in March 2015.

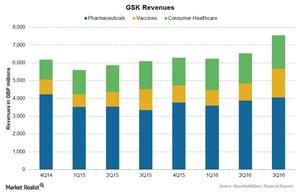

Exploring GlaxoSmithKline’s Business Segments

GlaxoSmithKline’s (GSK) business is divided into three business segments: Pharmaceuticals, Vaccines, and Consumer Health.

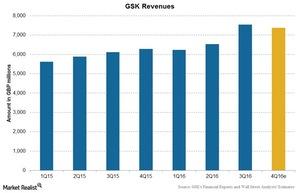

GlaxoSmithKline’s Revenue Trend

GlaxoSmithKline reported a rise of 23% in its 3Q16 revenue. The company met Wall Street analysts’ consensus 3Q16 estimates for revenue and earnings per share.

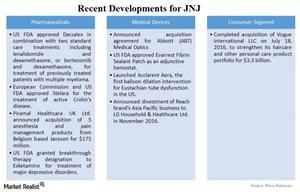

Recent Developments at Johnson & Johnson

Johnson & Johnson’s (JNJ) Consumer segment completed the acquisition of Vogue International LLC on July 18, 2016, to strengthen its Hair Care and Other Personal Care product portfolio.

Johnson & Johnson’s Revenue Trend in 3Q16

In 3Q16, Johnson & Johnson’s (JNJ) top line rose 4.2% to ~$17.8 billion, driven by 4.3% operational growth in revenues.

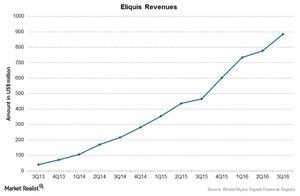

Bristol-Myers Squibb Saw Improved Eliquis Sales in 3Q16

Bristol-Myers Squibb’s (BMY) cardiovascular segment consists of key drug Eliquis. This segment contributed nearly 18% of total revenues for 3Q16.

How Sandoz Performed for Novartis in 3Q16

Sandoz, the generics arm of Novartis (NVS), is the number-two generic medicines provider worldwide. It’s number one in differentiated generics.

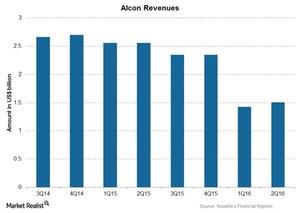

Novartis’s 3Q16 Estimates: Will Alcon Recover Its Growth?

Alcon, Novartis’s (NVS) eye care segment, researches, develops, manufactures, and markets eye care products in over 180 countries worldwide.

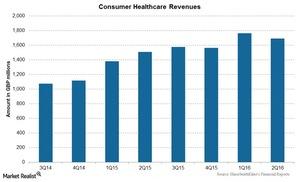

GSK Optimistic about Future of Its Consumer Healthcare Segment

With improvements in the supply chain and successful launch of new products, GlaxoSmithKline (GSK) is optimistic about its consumer healthcare segment performance.

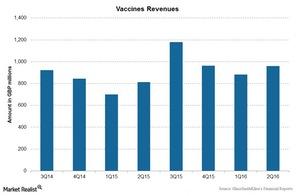

GlaxoSmithKline Giving a Shot to Its Vaccines Business

GlaxoSmithKline (GSK) is focused on strengthening its vaccines business, so it acquired Novartis’s (NVS) meningitis and other vaccines business.

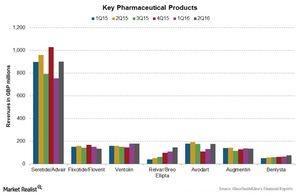

Performance of GSK’s Global Pharmaceuticals Franchises Mixed

The global pharmaceuticals franchise is GlaxoSmithKline’s (GSK) largest revenue contributor.

GlaxoSmithKline’s Combo Treatment for HIV Faces Stiff Competition

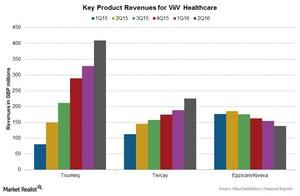

GlaxoSmithKline’s (GSK) HIV medicines business is managed by ViiV Healthcare, a global specialist company in HIV medicines.

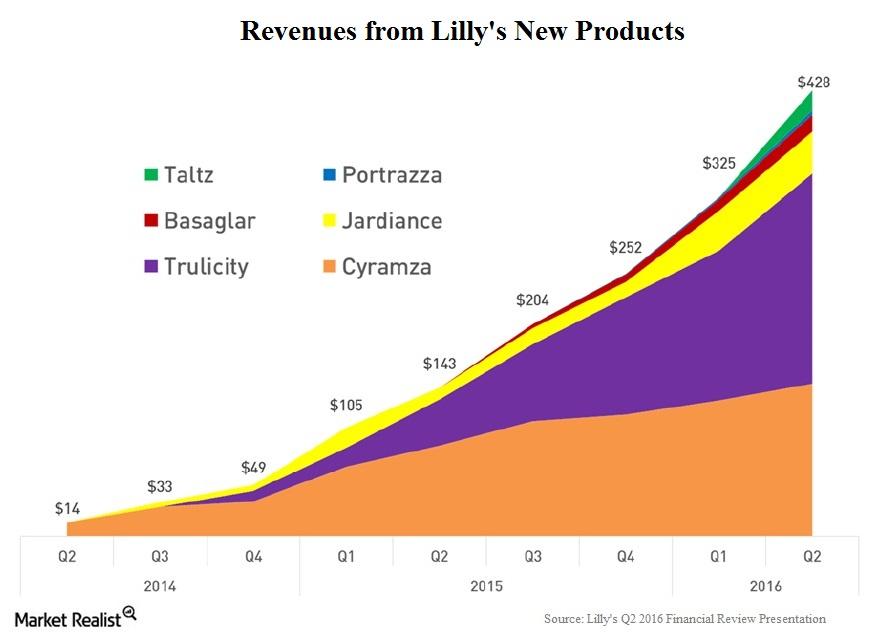

How Are Eli Lilly’s New Products Performing?

Eli Lilly launched various products under different franchises. A few of the new products include Portrazza, Cyramza, Basaglar, Jardiance, and Taltz.

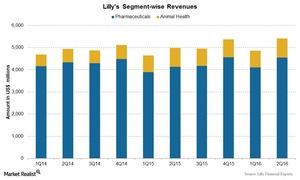

How Are Eli Lilly’s Business Segments Performing?

Eli Lilly and Co.’s (LLY) overall business is classified into two business segments—Human Pharmaceuticals and Animal Health.

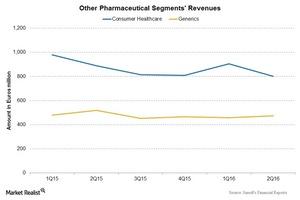

What Happened to Sanofi’s Consumer Healthcare and Generics Franchise in 2Q16?

Sanofi’s Consumer Healthcare segment includes Allegra, Doliprane, Nasacort, and other products. It reported a 4.3% decline in revenues to 800 million euros.

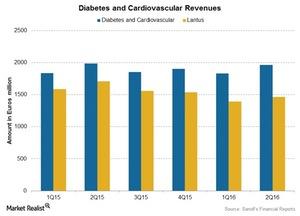

Behind Sanofi’s Diabetes and Cardiovascular Performance in 2Q16

Sanofi’s Diabetes and Cardiovascular revenues declined by ~2% at constant exchange rates to 1.96 billion euros (about $2.21 billion) in 2Q16.

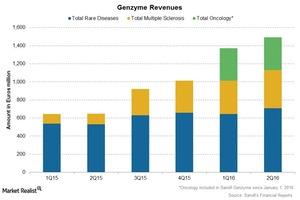

Genzyme Continued to Boost Growth for Sanofi in 2Q16

After Sanofi’s reorganization, Genzyme now includes products for multiple sclerosis, rare diseases, and oncology. Genzyme’s sales increased ~19.5% in 2Q16.

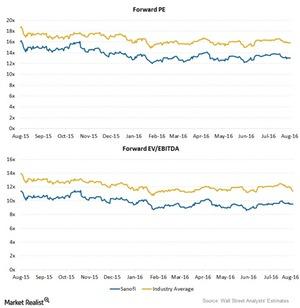

Inside Sanofi’s Valuation Changes

With rising sales of in its Genzyme, Animal Health, and Vaccines segments, Sanofi has reported a growing top line over the past few quarters.

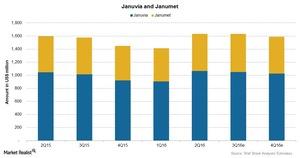

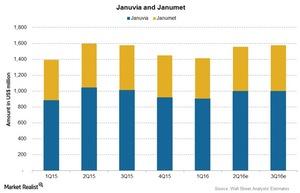

What Are Merck’s Key Diabetes Products?

Januvia and Janumet are two blockbuster drugs in Merck’s (MRK) diabetes franchise.

How Did GlaxoSmithKline’s Pharmaceuticals Segment Do in 2Q16?

GlaxoSmithKline’s (GSK) Pharmaceuticals segment declined substantially in 2015 due to the divestment of its oncology business to Novartis (NVS) in March 2015.

What Is Allergan’s Inorganic Growth Strategy?

Actavis acquired Allergan in March 2015, and the company changed its name from Actavis to Allergan (AGN).

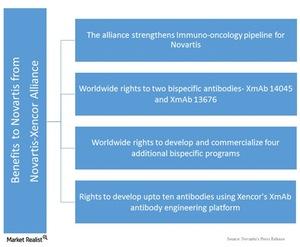

How Could the Novartis-Xencor Alliance Benefit Novartis?

As we’ve discussed, Novartis (NVS) is one of the largest pharmaceutical companies by revenue.

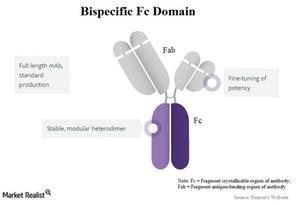

What Is Xencor’s XmAb Technology?

The XmAb antibody engineering platform is Xencor’s proprietary technology.

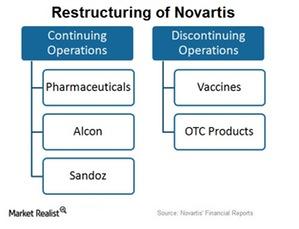

What’s Novartis’s New Structure?

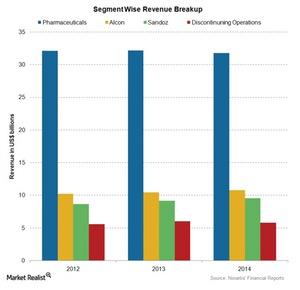

Novartis (NVS) has restructured its entire business into two parts: continuing operations and discontinuing operations.

What Risks Does Novartis Face?

Novartis is exposed to legal risks, including patent litigations, other product-related litigation, commercial litigation, government investigations, and prohibition rules.

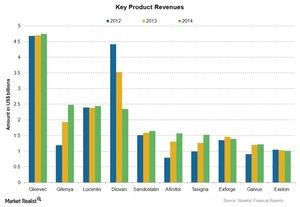

Which Products Contribute the Most to Novartis’s Revenues?

Novartis (NVS) has recorded direct product sales of over $1 billion for each of its ten pharmaceutical products in the last year.

What Are Novartis’s Key Business Segments?

Novartis’s new structure includes only three business segments: pharmaceuticals, Alcon, and Sandoz.

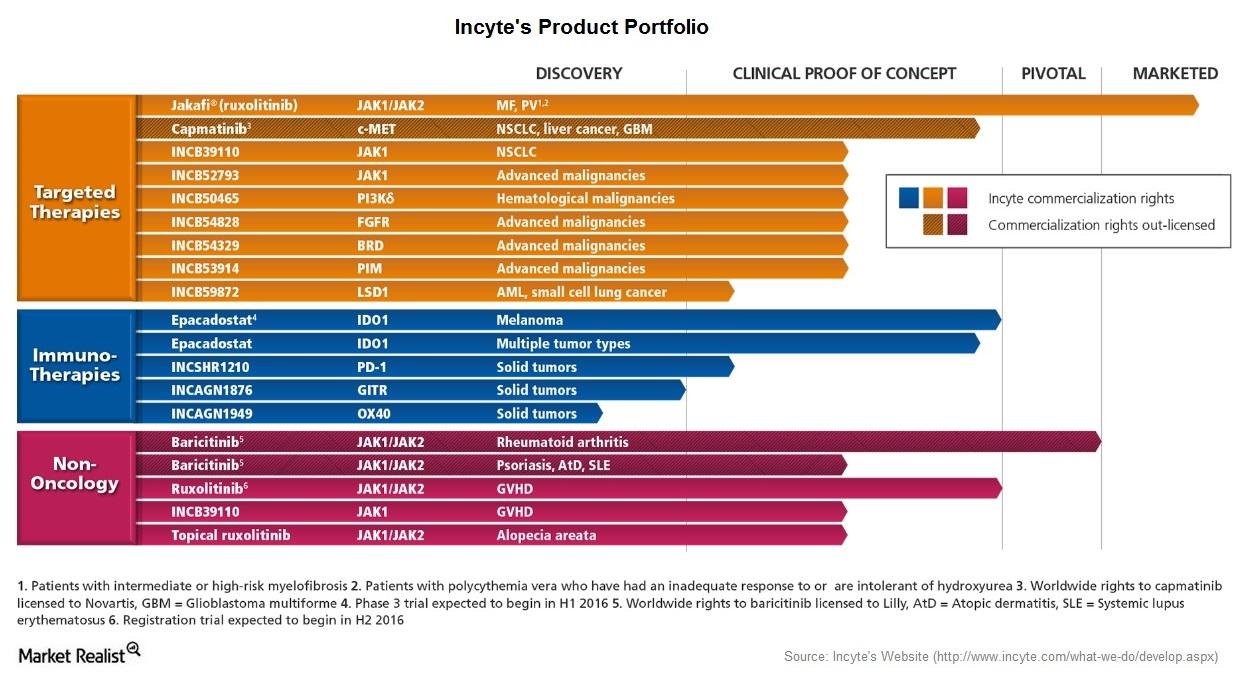

An Inside Look at Incyte’s Product Portfolio

Incyte’s (INCY) product portfolio includes drugs for oncology as well as non-oncology. For oncology, its product portfolio includes targeted therapies as well as immunotherapies.

What’s Allergan’s Growth Strategy?

Allergan’s new industry model, “growth pharma,” is based on identifying five characteristics that boost company growth and differentiate it from its peers.

Januvia and Janumet: Merck’s Blockbuster Diabetes Drugs

Januvia and Janumet are Merck & Co.’s (MRK) blockbuster diabetes drugs. They’re are used to lower blood sugar levels in patients with Type 2 diabetes.

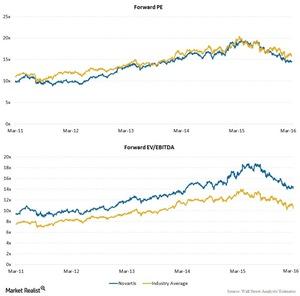

What Are Novartis’s Valuation Multiples?

Based on the last five-year multiple range of ~9x to ~20x, Novartis’s current valuation is neither high nor low.

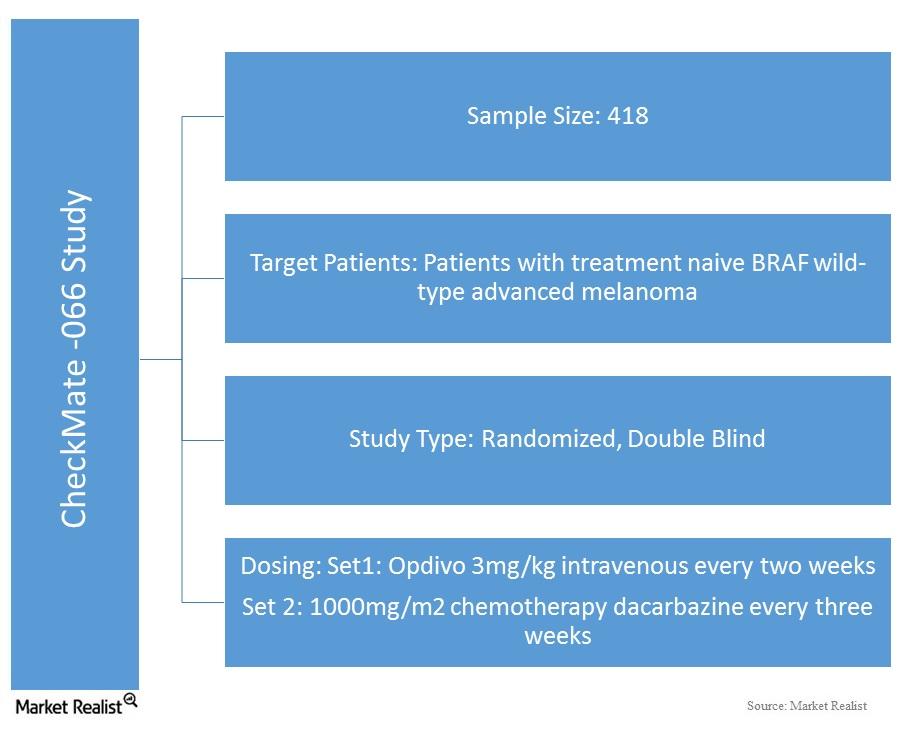

CheckMate -066 Study Supports Opdivo’s Approval

The FDA has now approved Opdivo for the treatment of BRAF WT (wild-type) melanoma, based on the results of a phase 3 study called CheckMate -066.

Pfizer-Allergan Deal: Pfizer Will Combine with Allergan

On November 23, two of the big pharmaceutical companies—Pfizer and Allergan—announced the biggest merger transaction ever in pharmaceuticals.

JAVELIN Series: Clinical Studies of Avelumab

The JAVELIN series is a clinical trial program for the use of Avelumab for treatment of multiple types of cancer, including Merkel cell carcinoma.

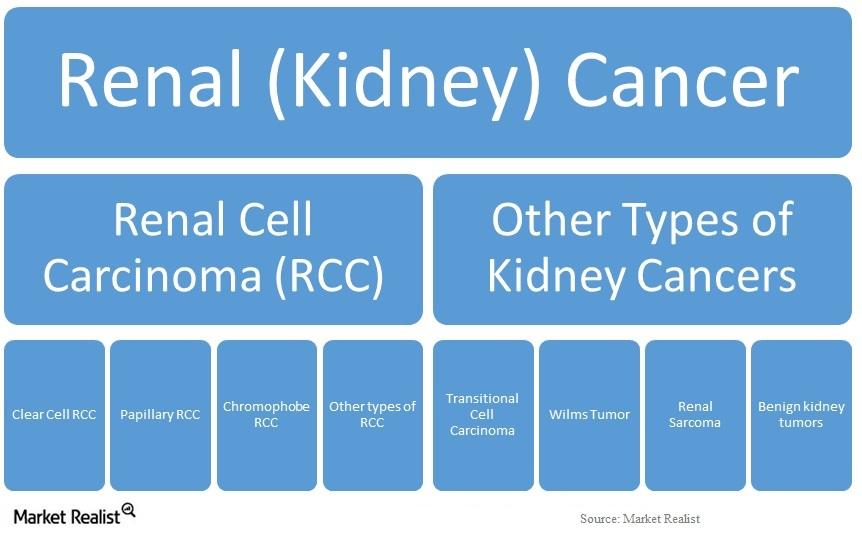

Existing Drugs for Renal Cell Carcinoma

The FDA has accepted Bristol-Myers Squibb’s (BMY) supplemental biologics license application, or sBLA, for Opdivo for the treatment of patients with advanced renal cell carcinoma.

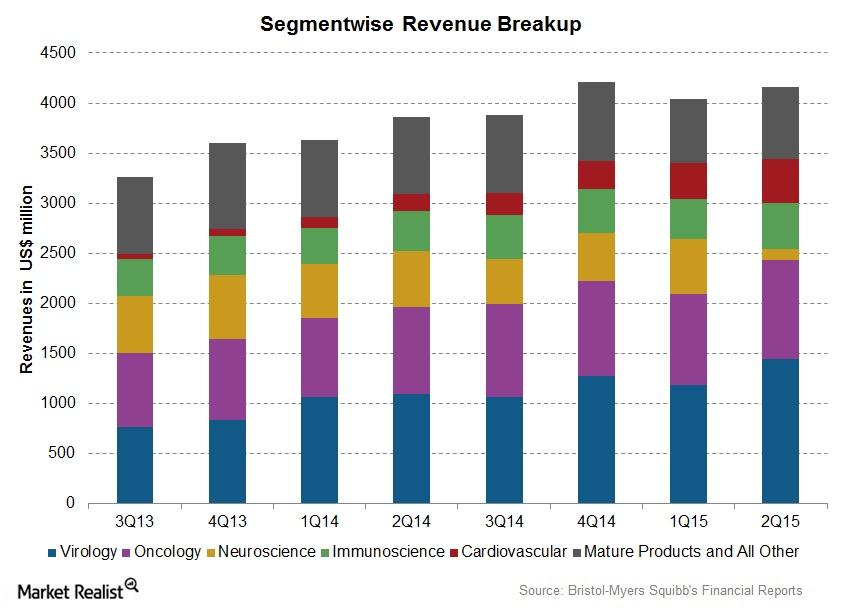

Bristol-Myers Squibb’s Business Segment Performance

Bristol-Myers Squibb (BMY) has classified its business into virology, oncology, immunoscience, cardiovascular, and neuroscience segments.

Why Abbott’s Business Is Susceptible to Numerous Risks

Abbott deals with innovative devices and established pharmaceutical products. Any infringement of intellectual property rights may lead to huge losses.

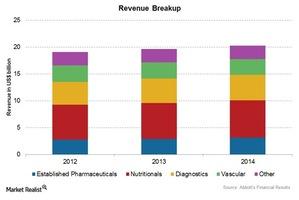

Abbott Laboratories’ Associated Business Segments

Abbott is organized around a broad portfolio—established pharmaceutical products, diagnostic products, nutritional products, and vascular products.

Sanofi’s Position Compared to Its Peers

The forward PE ratio for Sanofi is ~15.1x for 2015, and ~18.1x for the industry.

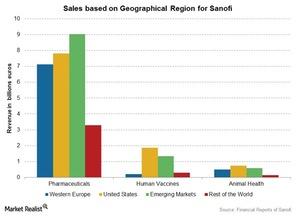

Sanofi’s Segment-Wise Sales by Region

Sanofi (SNY) products are sold in over 120 countries. The company’s markets are classified into four geographical regions for reporting purposes.

Risks for GlaxoSmithKline

GSK operates in over 170 countries and is subject to political, socioeconomic, and financial factors and risks across the globe.

Comparing GlaxoSmithKline with Its Peers

Pharmaceutical companies like GlaxoSmithKline are capital-intensive, with high debt on their balance sheets due to heavy setup costs and huge research and development expenses.

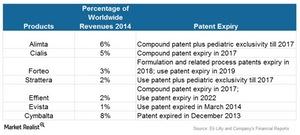

What Risks Does Eli Lilly and Company Face?

The risk of losing market share due to losing patents is the highest risk that Eli Lilly and other pharmaceutical companies face.

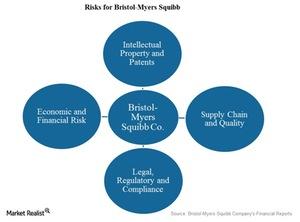

What Are the Risks for Bristol-Myers Squibb?

Bristol-Myers Squibb deals with innovative products, and any failure to secure or protect intellectual property rights is a huge risk and may lead to huge losses.

GlaxoSmithKline: The British Multinational Pharmaceutical Company

GlaxoSmithKline is a British multinational pharmaceutical company with a significant presence in the US. GSK has over 100,000 employees in operations around the world.