Mike Benson

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Mike Benson

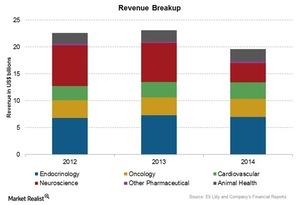

Analyzing Eli Lilly and Company’s Associated Business Segments

The human pharmaceutical segment includes the discovery, development, manufacturing, marketing, and sales of human pharmaceutical products.

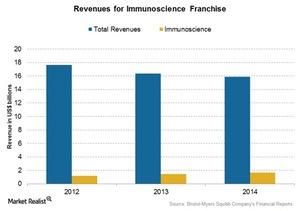

Bristol-Myers Squibb’s Immunoscience Franchise

Bristol-Myers Squibb’s (BMY) immunoscience franchise deals with medicines that help defend the body against invading pathogens like bacteria, viruses, and cancer cells.

AstraZeneca’s Position Compared to Its Peers

The forward EV/EBIDTA multiple for AstraZeneca is ~13x, which is slightly lower than the industry average of ~14x.

Risks Facing Merck & Co.

Merck faces risks from other governments. In Japan, the pharmaceutical industry is subject to government-mandated biennial price reductions of pharmaceutical products and vaccines.

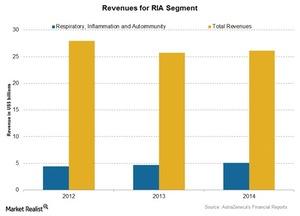

AstraZeneca’s Respiratory, Inflammation, and Autoimmunity Segment

The respiratory, inflammation, and autoimmunity (or RI&A) franchise contributed nearly 19.2% of AstraZeneca’s (AZN) total assets in 2014.

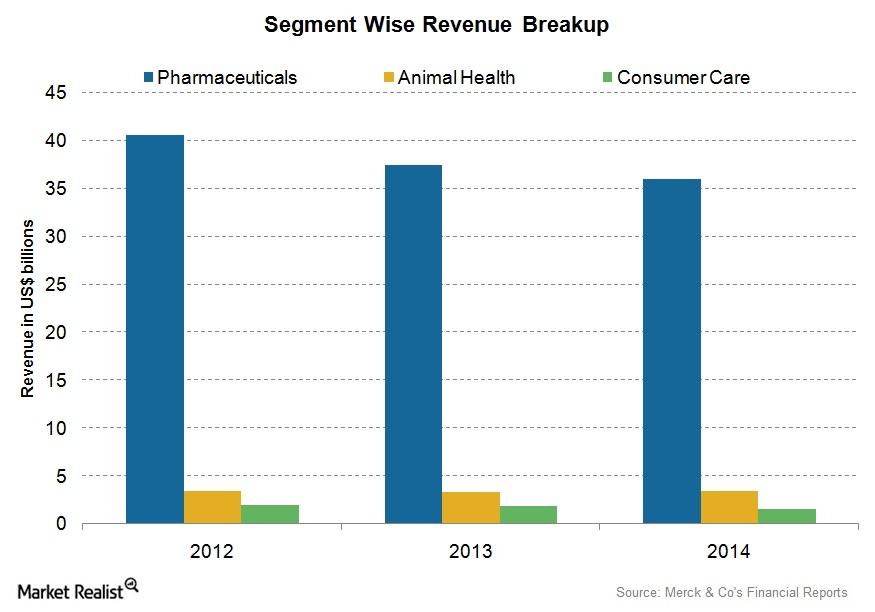

Merck’s Associated Business Segments

Merck’s Pharmaceuticals division accounted for $36.0 billion, or 85%, of group net sales during 2014.

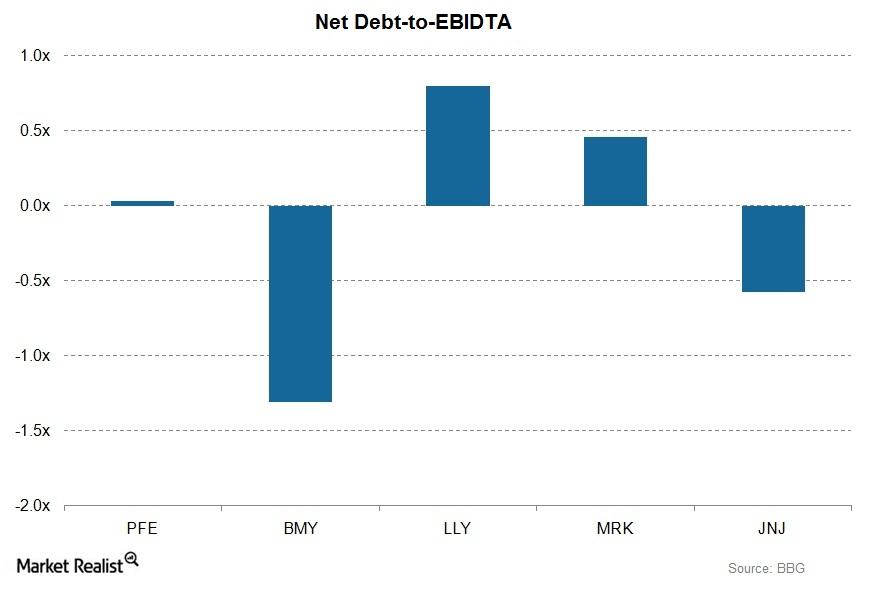

Why Pfizer’s Leverage Is Important to Investors

Leverage ratios determine the company’s ability to repay its debt. Leverage ratios directly affect the credit ratings. Pfizer has good credit ratings.

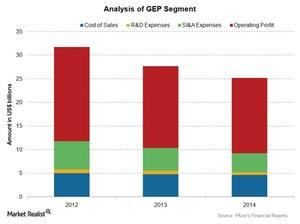

Pfizer’s Global Established Pharmaceutical Segment

The Global Established Pharmaceutical segment deals with products that have or are expected to lose market exclusivity through 2015 in most major markets.

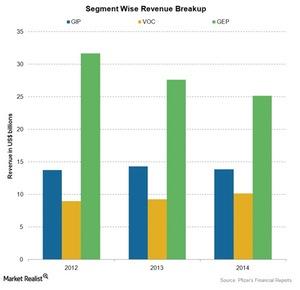

Analyzing Pfizer’s Business Segments

Pfizer (PFE) is one of the oldest and largest pharmaceutical companies in the US. The company deals in two major business segments.

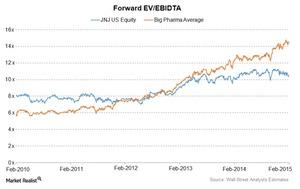

Where Does Johnson & Johnson Stand in the Industry?

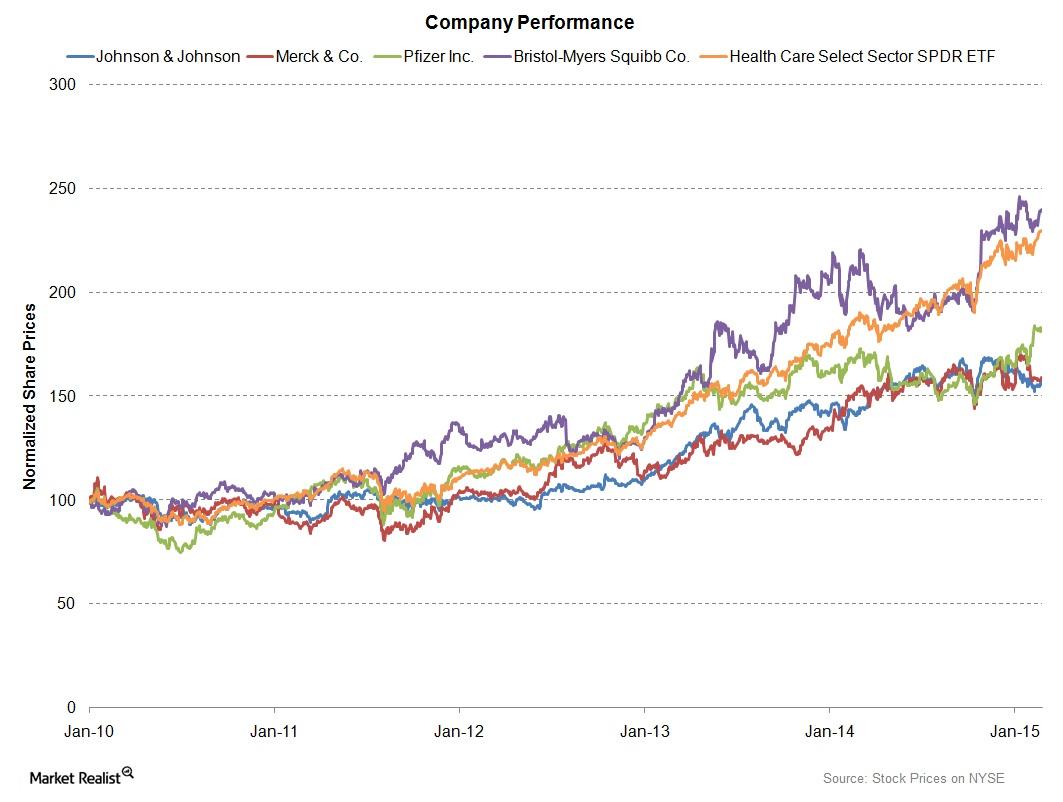

Estimates suggest that Johnson & Johnson’s forward PE ratio increased from 15.5x in 2014 to 16.1x in 2015. The PE ratio is hovering around 19x for the industry.

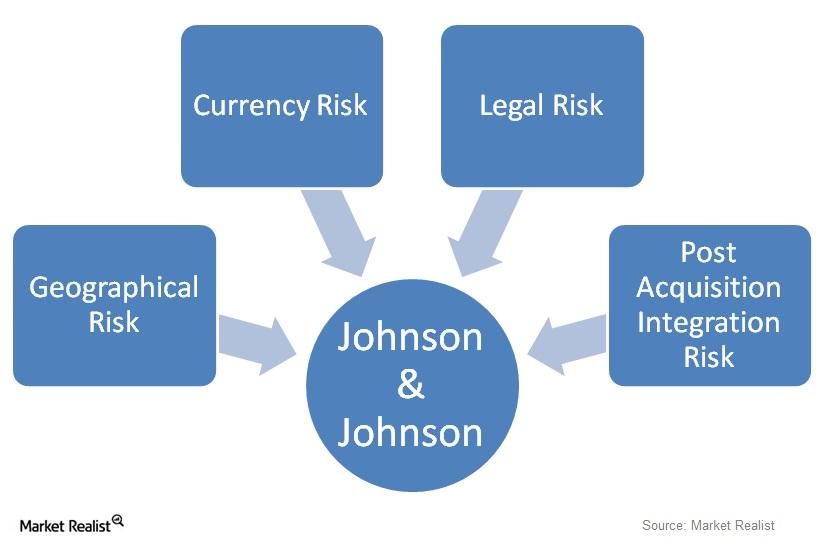

What Risks Does Johnson & Johnson Face?

Johnson & Johnson (JNJ) faces a unique combination of risks. The risks are in addition to specific risks in the pharmaceutical industry.

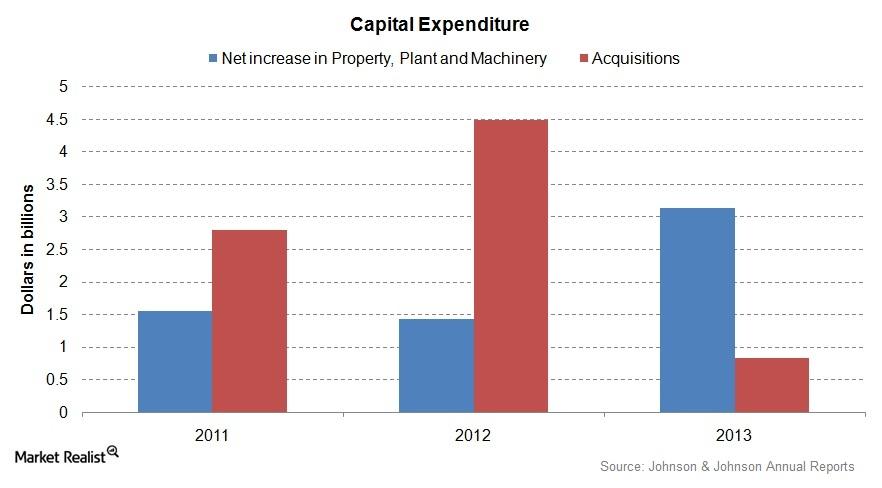

Understanding Johnson & Johnson’s Growth Strategies

Johnson & Johnson (JNJ) is working on various organic and inorganic growth strategies in order to maintain its position as a leading pharmaceutical company worldwide.

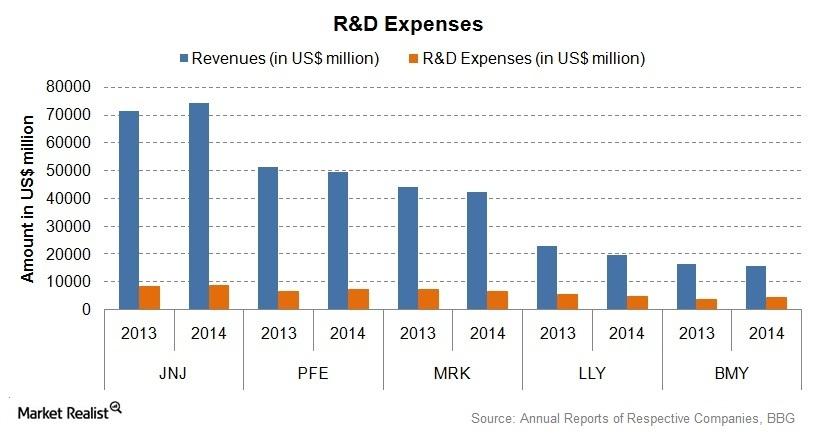

Johnson & Johnson Invested in Research and Development

For a big pharma company like Johnson & Johnson (JNJ), research and development plays a vital role in maintaining a healthy revenue stream.

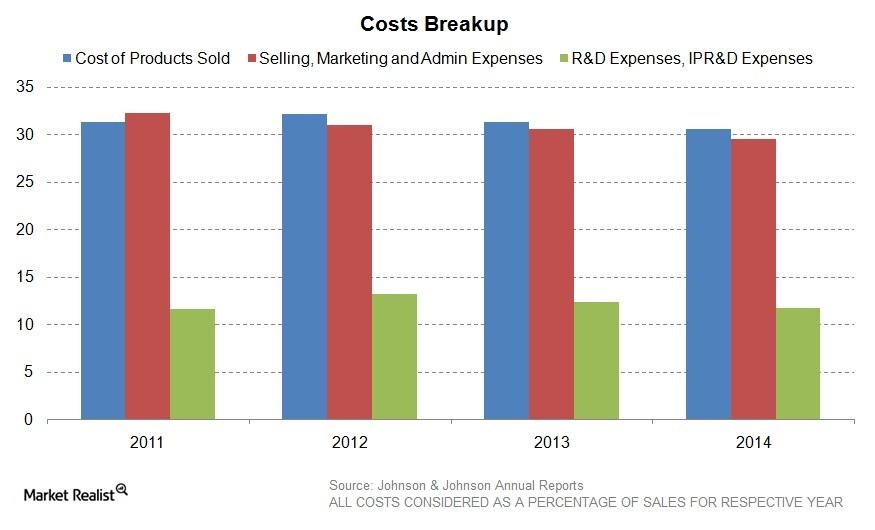

What Were Johnson & Johnson’s Outstanding Expenses?

As a percentage of sales, Johnson & Johnson achieved lower expenses for 2014—compared to 2013. It was able to improve its gross profit margins.

Johnson & Johnson’s Revenue Stream Increased in 2014

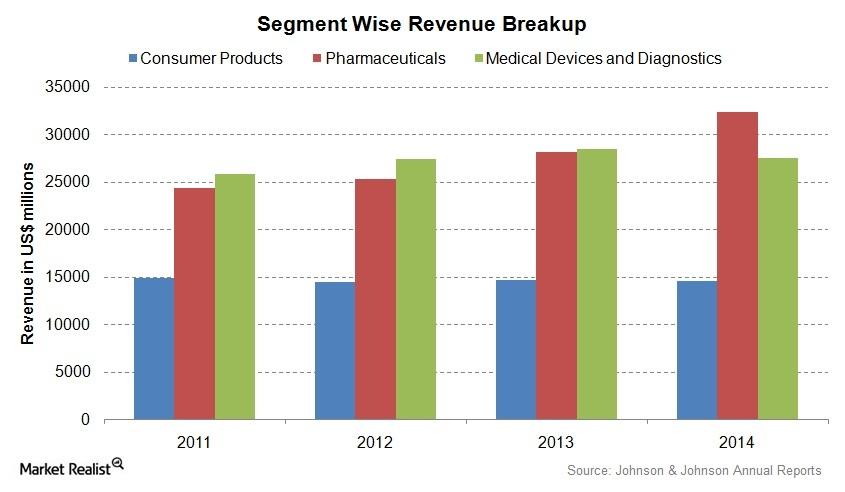

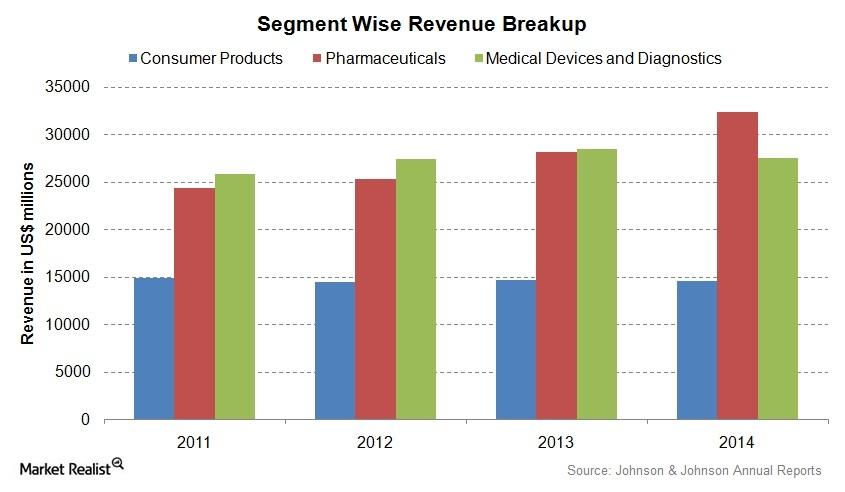

Johnson & Johnson’s (JNJ) net revenue increased by 4.2% from $71.3 billion in 2013 to $74.3 billion in 2014. There was an operational increase of 6.1%.

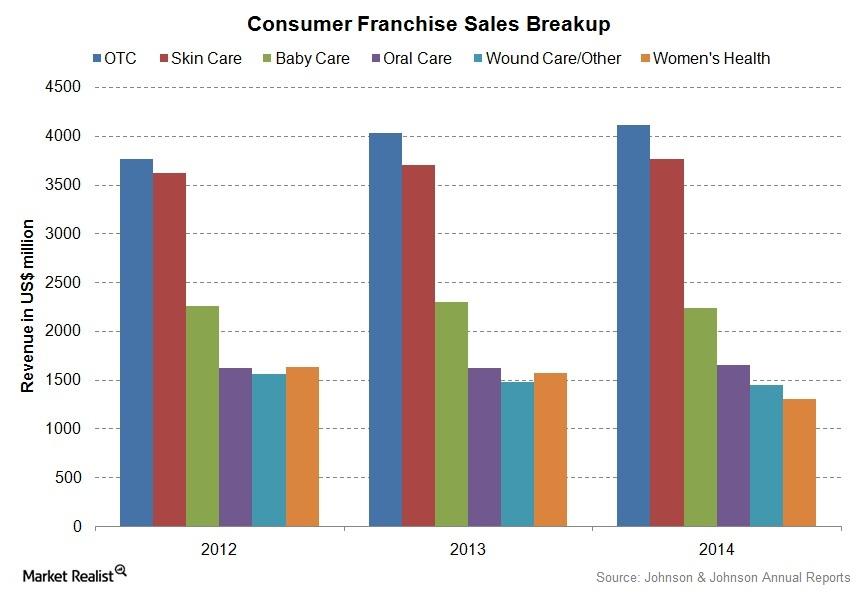

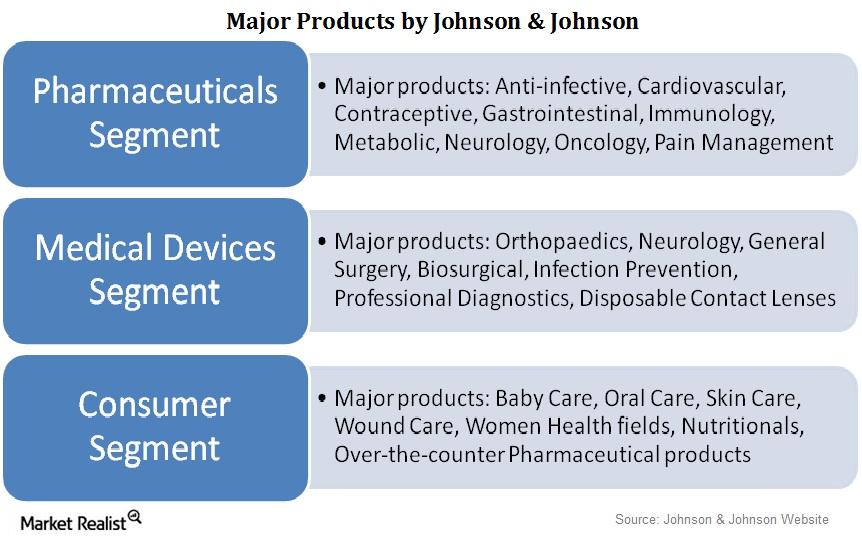

A Snapshot of Johnson & Johnson’s Consumer Segment

Johnson & Johnson’s Consumer segment focuses on baby care, oral care, skin care, and other consumer products. It contributes ~19–20% of the company’s revenue.

Johnson & Johnson’s Global Business Strategy Promotes Growth

Johnson & Johnson (JNJ) operates in nearly 60 countries. Its products are sold in about 200 countries. Almost 55% of its total business comes from outside the US.

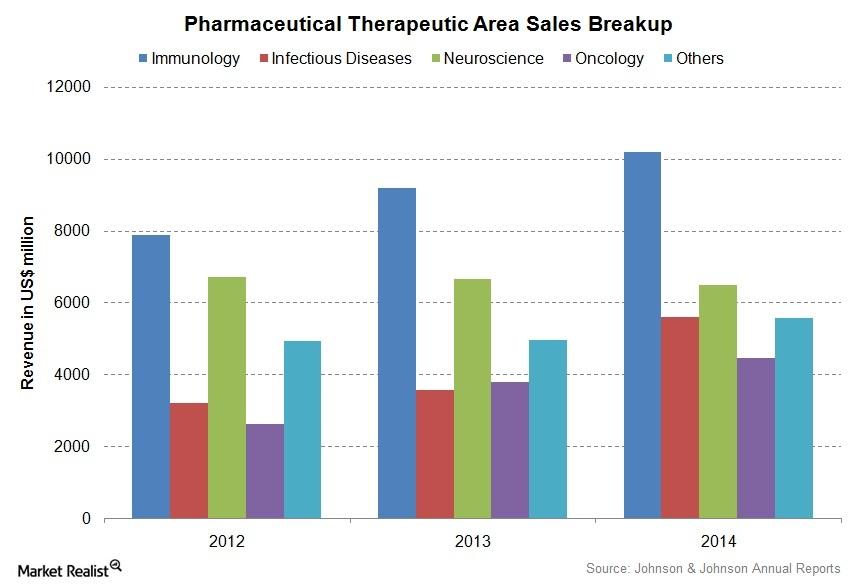

Exploring Johnson & Johnson’s Pharmaceuticals Segment

Johnson & Johnson (JNJ) is the largest pharmaceutical company in the US. The Pharmaceuticals segment contributes over 43% of the company’s revenue.

Analyzing Johnson & Johnson’s Three Main Business Segments

Over a period of 128 years, Johnson & Johnson (JNJ) diversified its business into three business segments.

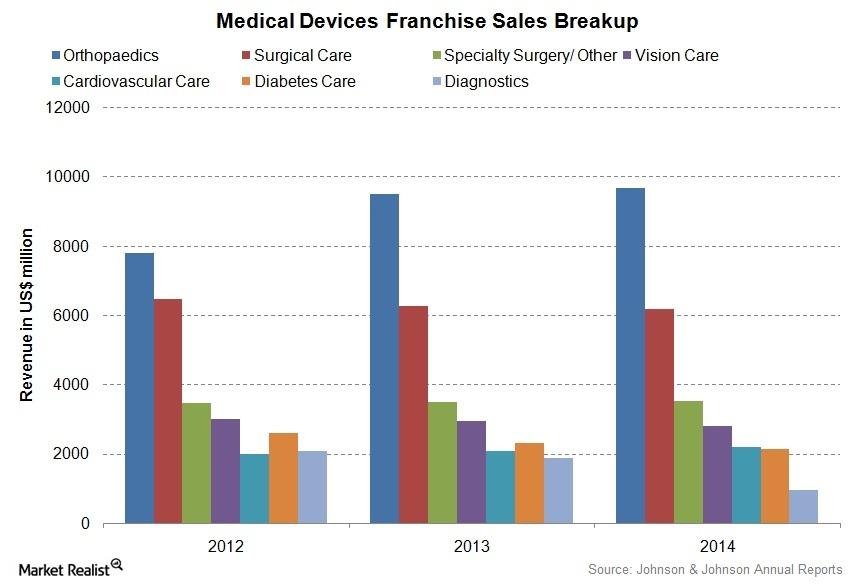

Johnson & Johnson’s Medical Devices and Diagnostics Segment

The Medical Devices and Diagnostics segment contributes over 37% of Johnson & Johnson’s revenue. In 2014, the segment generated about $27.5 billion in revenue.

Johnson & Johnson: A Leading Pharmaceuticals Company

Johnson & Johnson is a leading pharmaceuticals and healthcare company in the US. It delivered returns of 13.4% from February 2010 to February 2015.

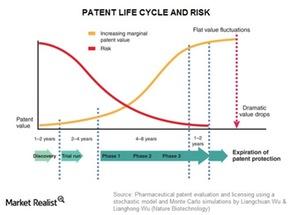

Patents mean big business to big pharma

When a drug goes off patent, companies see revenues decline. There was a bumpy ride for the industry in 2011–2012 when 16 major patents expired.

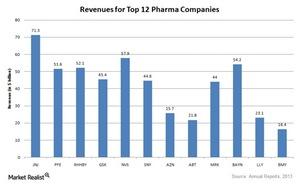

What it takes to be called ‘big pharma’

Pharmaceutical companies either deal with patented drugs, generic drugs, or both. Most big pharma companies deal with both.