GlaxoSmithKline’s Segment Performances in 1Q17

GlaxoSmithKline (GSK) reported a 19.0% rise in 1Q17 revenues to ~7.4 billion pounds, driven by an operational rise of 5.0% and a favorable currency impact of 14.0%.

May 31 2017, Updated 5:35 p.m. ET

1Q17 performance

GlaxoSmithKline (GSK) reported a 19.0% rise in 1Q17 revenues to ~7.4 billion pounds, driven by an operational rise of 5.0% and a favorable currency impact of 14.0%. The growth was due to the strong performance of all segments and new pharmaceutical products and vaccines.

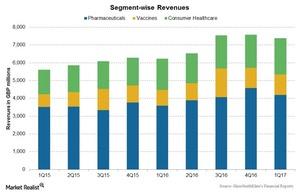

The above graph shows revenues for GlaxoSmithKline over the last nine quarters. Since the company reports its financial statements in sterling pounds, and since the sterling pound weakened against all major currencies in 1Q17, foreign exchange had a positive impact on overall revenues.

Geographical performance

US markets reported an operational growth of 11.0% in 1Q17 revenues to ~2.6 billion pounds, while revenues from Europe were nearly flat at ~2.0 billion pounds. The rest of its world revenues reported a rise of 4.0% to ~2.8 billion in 1Q17.

Segmental performance

GlaxoSmithKline’s (GSK) business is divided into three segments: Pharmaceuticals, Vaccines, and Consumer Healthcare.

Pharmaceuticals

Revenues for the Pharmaceuticals segment showed an operational growth of 4.0% to ~4.2 billion pounds in 1Q17, driven by the strong performance of its new pharmaceutical products, including Relvar Ellipta/Breo Ellipta and Nucala, and its HIV (human immunodeficiency virus) products Triumeq and Tivicay.

Vaccines

The Vaccines segment reported an operational growth of 16.0% to ~1.2 billion pounds in 1Q17, driven by the strong performance of vaccines such as Rotarix, Boostrix, Bexsero, Menveo, Infanrix, and Pediarix.

Consumer Healthcare

Consumer Healthcare revenues reported an operational growth of 2.0% to ~2.0 billion pounds, driven by wellness products and skin healthcare products.

To divest the risk, you can consider ETFs such as the iShares MSCI ACWI Ex-US (ACWX), which holds 0.60% of its total assets in GlaxoSmithKline. ACWX also holds 1.3% of its total assets in Novartis (NVS), 0.60% in Novo Nordisk (NVO), and 0.30% in Teva Pharmaceutical Industries (TEVA).