BTC iShares MSCI ACWI ex US ETF

Latest BTC iShares MSCI ACWI ex US ETF News and Updates

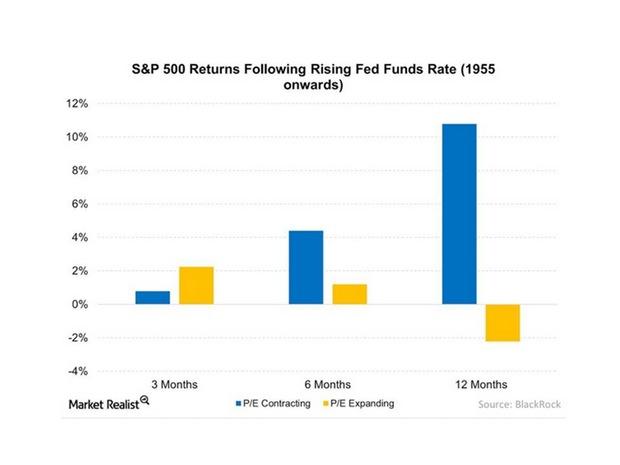

Why To Expect Muted Returns from US Equities

We can expect muted returns from US equities going forward. US stocks face the prospect of higher interest rates, albeit gradual and from unusually low levels.

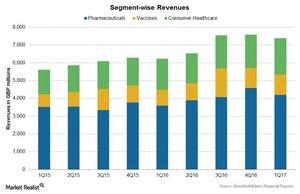

GlaxoSmithKline’s Segment Performances in 1Q17

GlaxoSmithKline (GSK) reported a 19.0% rise in 1Q17 revenues to ~7.4 billion pounds, driven by an operational rise of 5.0% and a favorable currency impact of 14.0%.

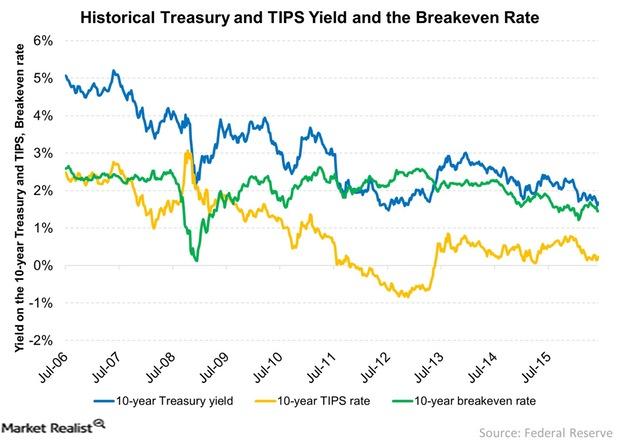

What Does the Break-Even Rate Suggest?

The break-even rate is the difference between the yields of ten-year Treasuries (IEF) (TLH) and ten-year TIPS (VTIP).