Novartis AG

Latest Novartis AG News and Updates

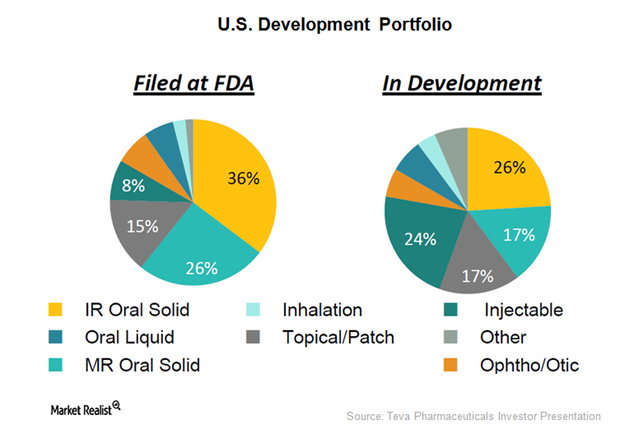

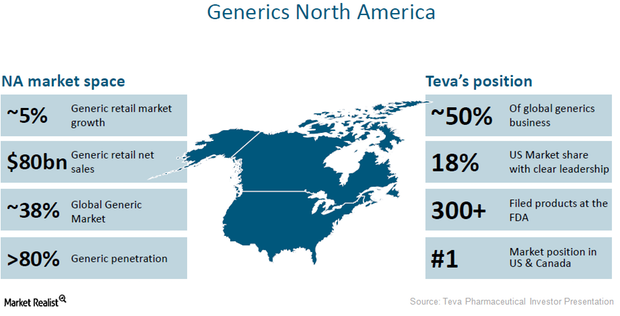

Teva Can Benefit by Acquiring Allergan Generics

The combined Teva–Allergan generics entity should have approximately 320 Abbreviated New Drug Applications (or ANDAs), including 110 first-to-file ANDAs (or FTF) in the US.

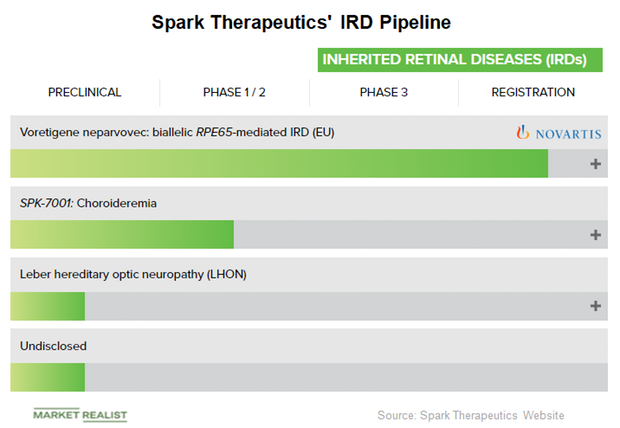

How Spark Therapeutics Is Positioned in 2018

Spark Therapeutics generated revenues of $25.18 million in the second quarter of 2018 compared to $1.48 million in Q2 2017.

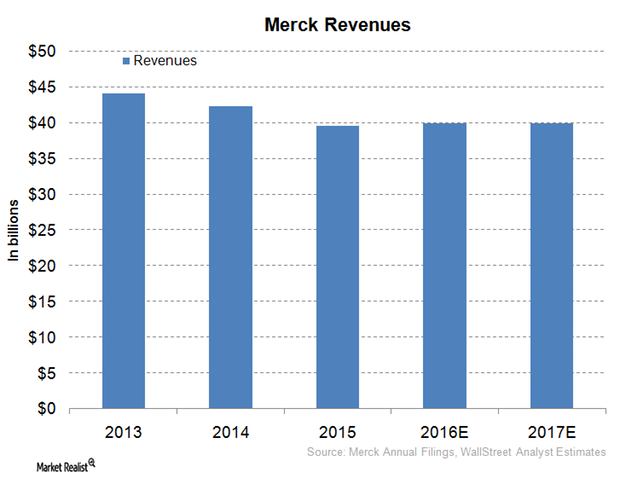

Merck Expects Modest Revenue Growth in Fiscal 2016

Merck provided revenue guidance of $39.7 billion–$40.2 billion in 2016. It expects negative foreign exchange fluctuations to reduce its fiscal 2016 revenue.

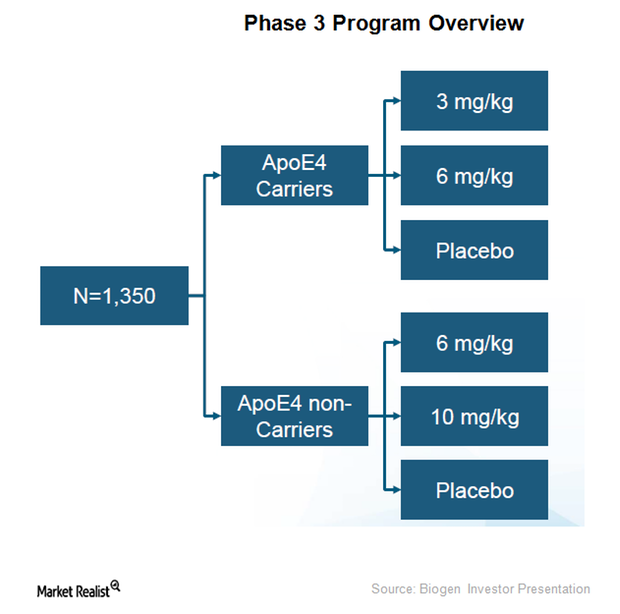

Biogen’s Experimental Alzheimer Therapy: Limited 2Q15 Success

On July 22, 2015, Biogen (BIIB) released data from a Phase 1b study, also called the PRIME Study, that looked at the effectiveness of its investigational Alzheimer’s drug, BIIB037.

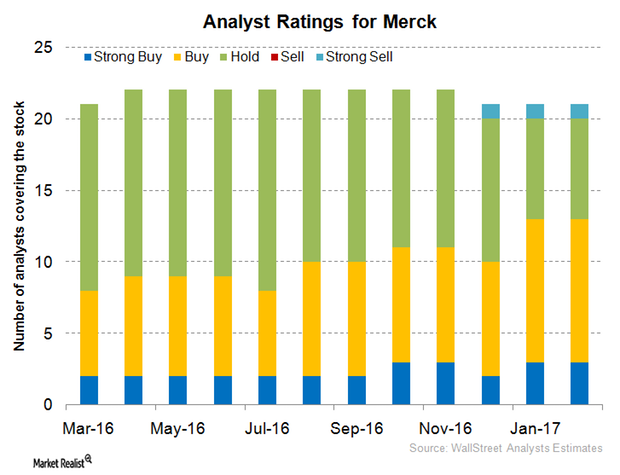

What Are Analysts’ Recommendations for Merck in 2017?

For 2016, Merck & Co. (MRK) reported revenue close to $39.8 billion, a year-over-year (or YoY) rise of ~1%. New product launches have played major roles in boosting Merck’s 2016 revenue.

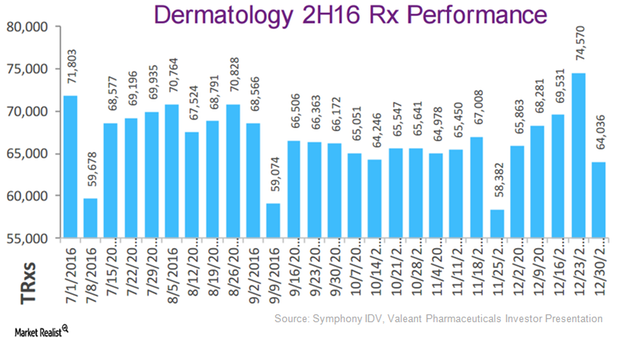

Valeant’s Dermatology Business Felt Pricing Pressure in 2016

Dermatology pricing trends Valeant Pharmaceuticals’ (VRX) dermatology business witnessed intense pricing pressure in 2016, due to a change in the company’s distribution model in 4Q15. While Valeant previously marketed its dermatology drugs through specialty pharmacies, the company now distributes its products through Walgreens. To learn about the company’s current distribution model, please refer to How Valeant Plans […]

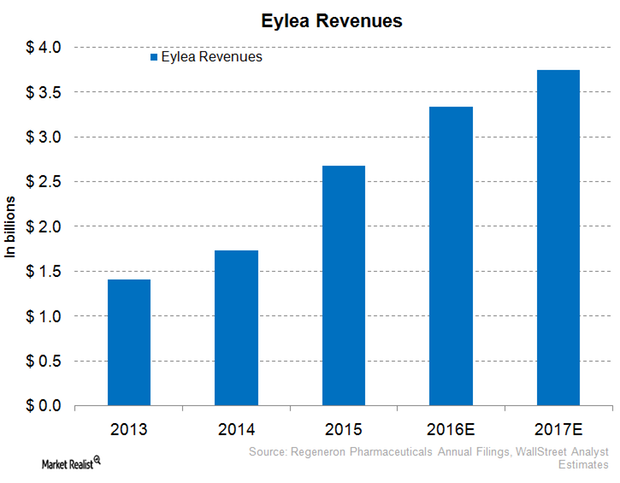

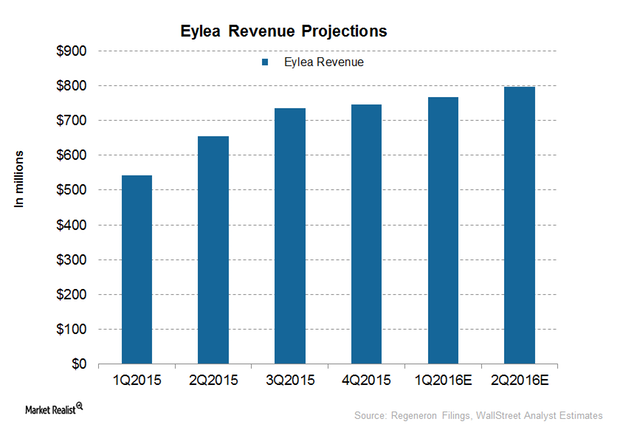

Why Eylea Could Face Tough Competition in 2016

In 2016, Regeneron expects to face increased competition from Roche Holding’s Lucentis (Ranibizumab) and Avastin (Bevacizumab) for Eylea.

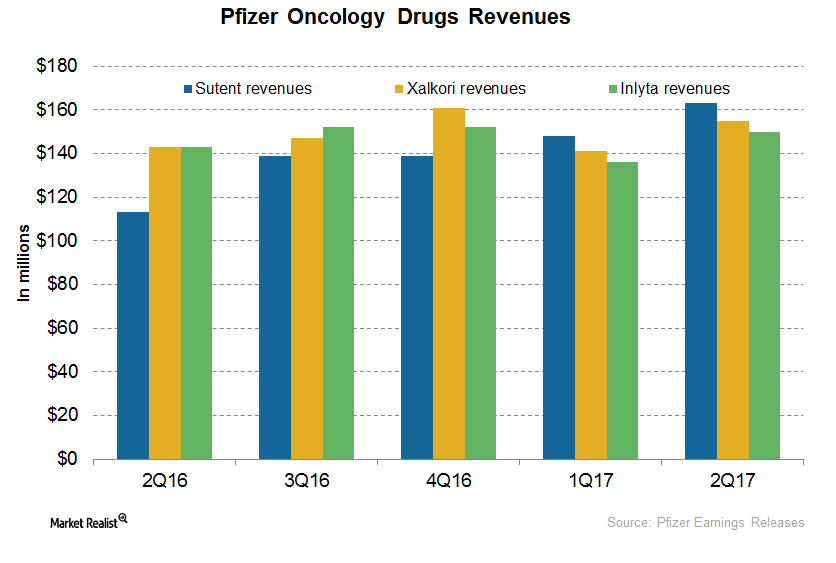

A Post-2Q17 Update on Pfizer’s Oncology Drugs: Sutent, Xalkori, and Inlyta

In 2Q17, Inlyta generated revenues of ~$88 million, which represents an ~19% decline on a YoY basis and ~4% growth on a quarter-over-quarter basis.

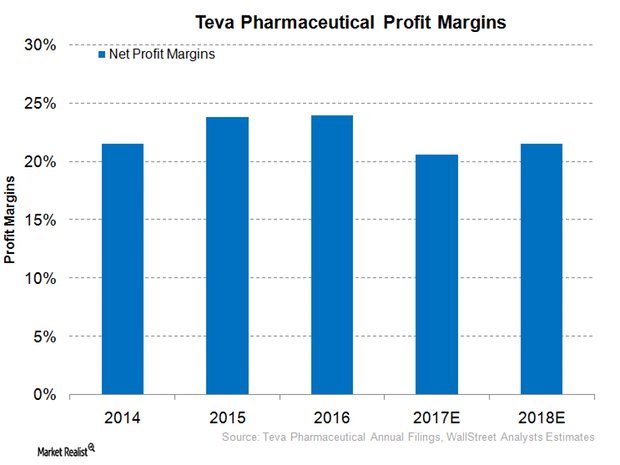

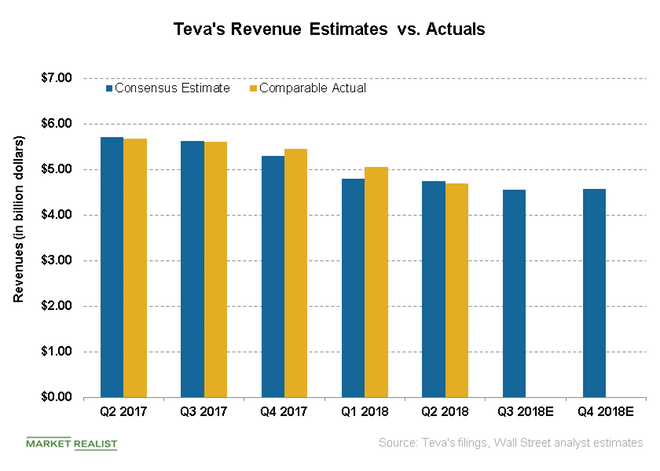

Teva Is Expected to See a Fall in Its Profit Margins in 2017

Teva Pharmaceutical (TEVA) expects its 2017 non-generally accepted accounting principles (non-GAAP) earnings per share (or EPS) to fall in the range of $4.9–$5.3.

Worst-Case Scenario for Regeneron: What If Eylea Sales Slow Down by 2018?

Regeneron Pharmaceuticals (REGN) depends heavily upon its key drug, Eylea, which recorded global sales of $4.1 billion during fiscal 2015.

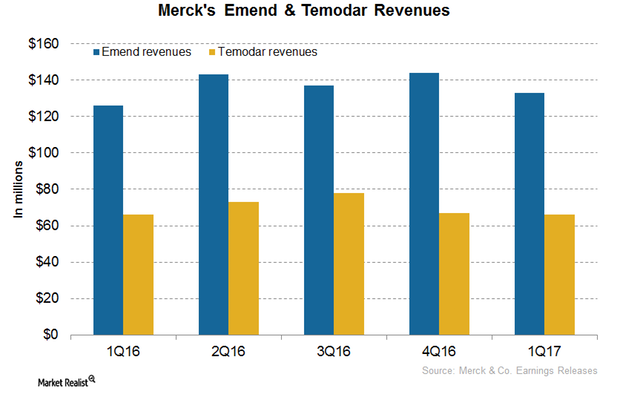

How Merck’s Oncology Drugs Emend and Temodar Could Perform in 2017

In 2016, Merck’s (MRK) Emend reported revenues of around $549 million, which reflected 3% year-over-year growth.

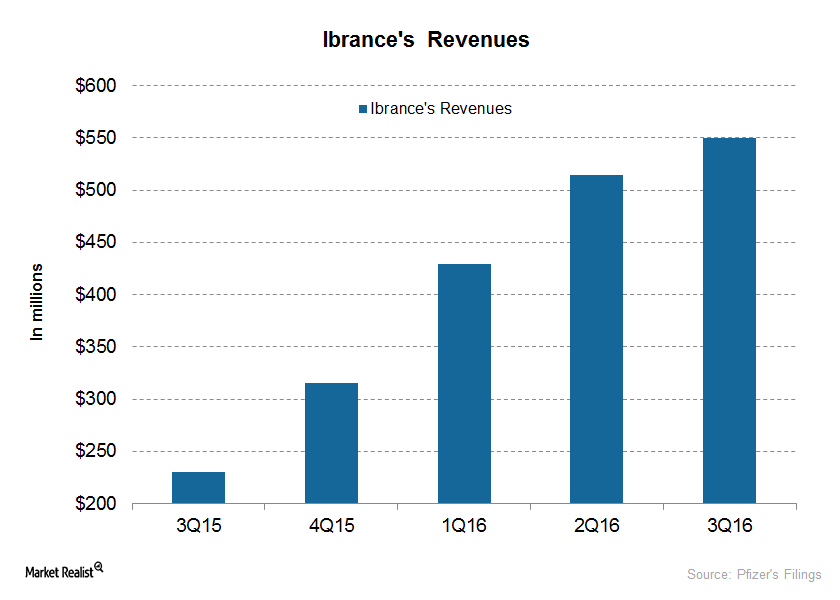

Ibrance Is the Only Registered CDK 4/6 Inhibitor for Breast Cancer

Since its launch in February 2015, Pfizer’s Ibrance has quickly captured the advanced breast cancer market and has reached more than 40,000 patients.

Teva’s Granix Gets FDA Approval for Expanded Indication

Today, Teva Pharmaceutical Industries (TEVA) announced that its Granix (tbo-filgrastim) injection has received FDA approval for a new presentation and indication.

Novartis Receives 2 Breakthrough Therapy Designations in January

In January 2018, the FDA granted a BTD to Novartis’s (NVS) Promacta for use along with standard immunosuppressive therapy.

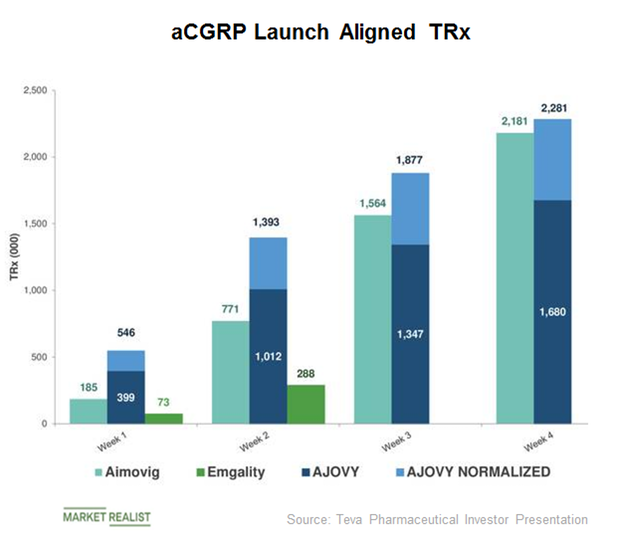

Competition Dynamics for Ajovy—Teva’s Migraine Drug

Approved by the FDA on September 14, Teva’s Ajovy has multiple competitors set to enter the market.

Novartis Focuses on Portfolio Prioritization to Boost Profitability

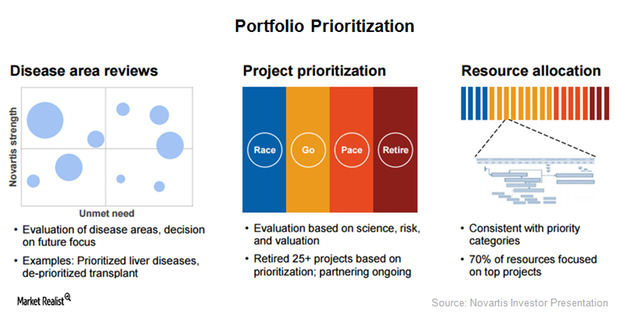

To ensure long-term relevance as well as quick adaptability to changing market needs, Novartis (NVS) is focusing on five major initiatives in 2017.

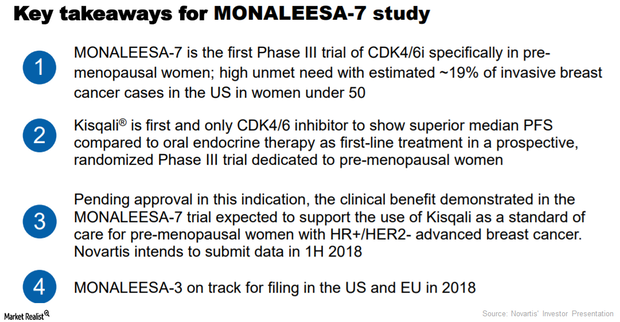

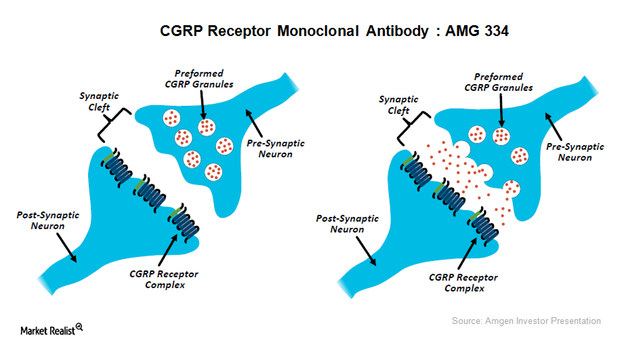

Entering Migraine Market Won’t Be Easy for Novartis, Amgen

Novartis (NVS) and Amgen (AMGN) recently announced that the CGRP inhibitor therapy, AMG 334, reported positive results in a Phase 2 clinical trial as a therapy for preventing chronic migraine.

Teva’s Share of the US Generics Market Could Boost Its Stock

Teva Pharmaceutical Industries accounts for 18% of the US generic drug market. This share is significantly higher than those of Mylan, Novartis, and Pfizer.

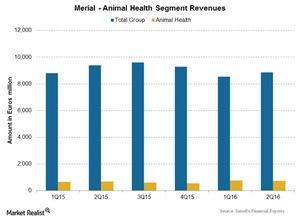

How Merial Contributes to Sanofi’s Growth

Merial, Sanofi’s (SNY) Animal Health segment, reported total revenues of 725 million euros (about $818.6 million), which is a 9.1% increase over 2Q15.

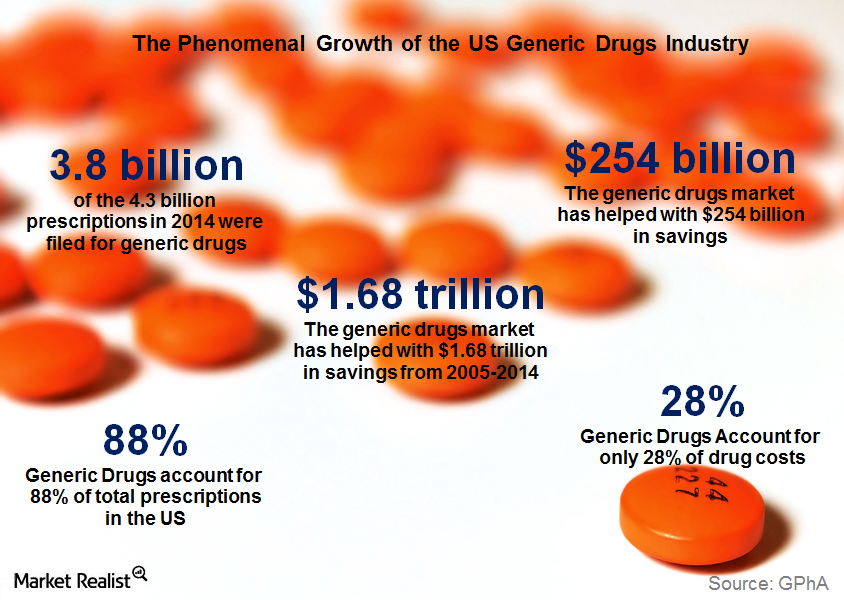

Rx for Growth? Why Generic Drugs Are Gaining Traction

Rx for Growth? The trillion-dollar pharmaceutical industry has historically been dominated by a few major companies that create and supply the most important branded prescriptions on the market. Recent trends, however, point to the growth of the newest pharma blockbusters: generics. Today, approximately 60% of Americans take prescription drugs;[1. “Trends in Prescription Drug Use Among […]

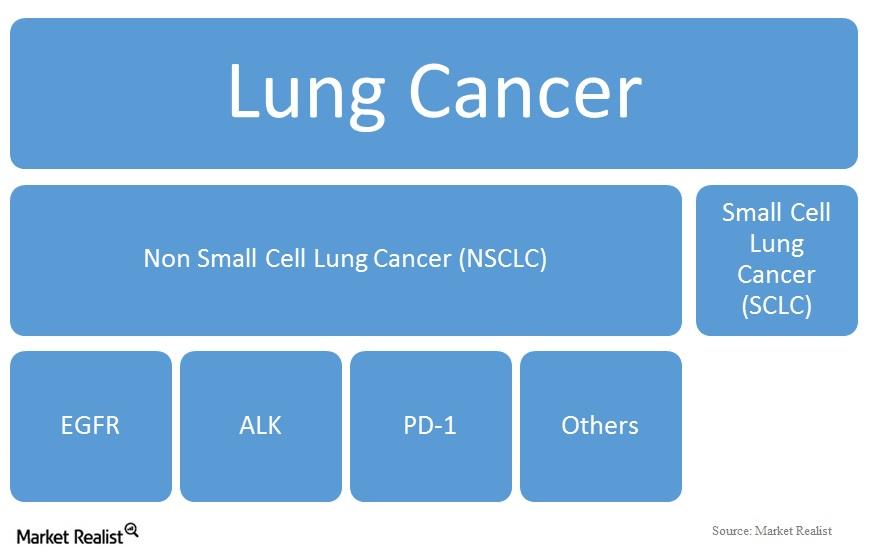

Other Drugs for Non-small Cell Lung Cancer

Approximately 85% of all lung cancers in the United States are non-small cell lung cancers, and 10% to 15% of these are EGFR mutation-positive.

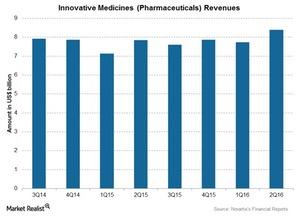

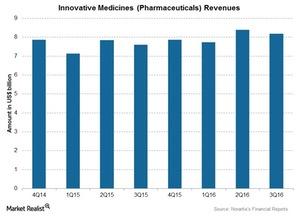

Novartis’s 3Q16 Estimates: Innovative Medicines Segment

Novartis’s Innovative Medicines segment, formerly referred to as the Pharmaceutical segment, consists of products for a variety of therapeutic areas.

What Else Could Drive Gilead’s Long-Term Growth?

In December 2017, Kite, a Gilead Sciences (GILD) company, presented long-term follow-up data from its pivotal ZUMA-1 trial of Yescarta.

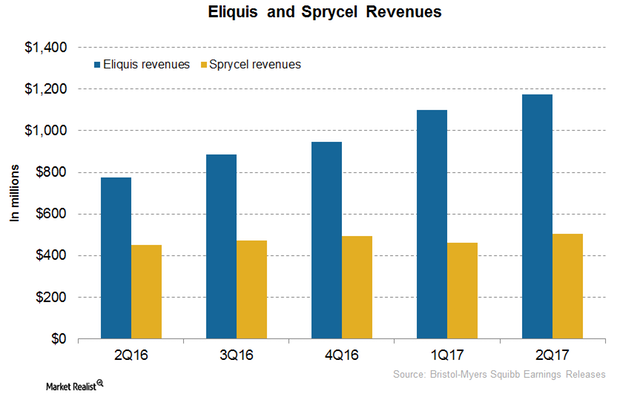

Eliquis and Sprycel Could Boost BMY’s Revenue Growth in 2H17

In July 2017, the FDA accepted Bristol-Myers Squibb’s supplemental New Drug Application (or sNDA) for expanding the indication of Sprycel.

Novartis’s 4Q16 Estimates: Innovative Medicines Segment

The overall contribution of the Innovative Medicines segment is ~67% of Novartis’s total revenues.

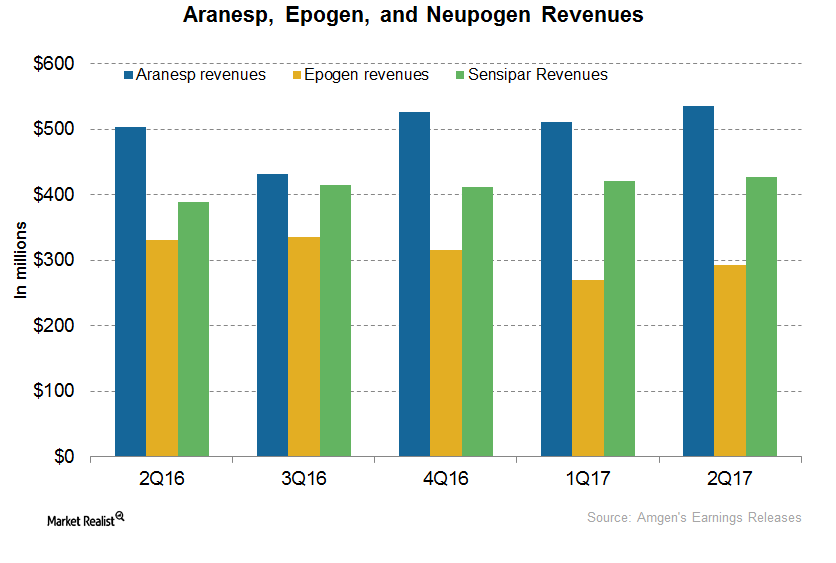

How Amgen’s Nephrology Drugs Are Positioned after 2Q17?

In 2Q17, Amgen’s (AMGN) Aranesp generated revenues of ~$535 million, which represented a 6% year-over-year rise.

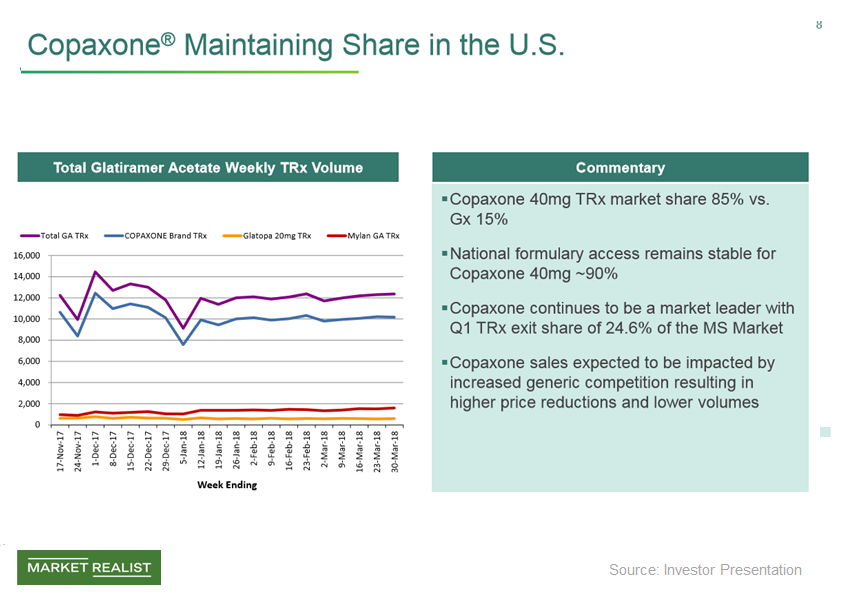

Teva’s Copaxone Maintains Market Share amid Intense Competition

In fiscal 1Q18, Teva (TEVA) reported sales of $645 million for its multiple sclerosis drug, Copaxone, a sequential decline of ~21%.

Teva Announces First-to-File Launch of Generic Cialis

Yesterday, Teva Pharmaceutical Industries (TEVA) announced the exclusive FTF (first-to-file) launch of the generic Cialis1 tablets in the US.

An Easier Way to Understand the Pharma Industry

In 2018, the global pharmaceutical industry stood at $1.2 trillion, and experts expect $1.5 trillion by 2023. Here’s everything investors need to know.

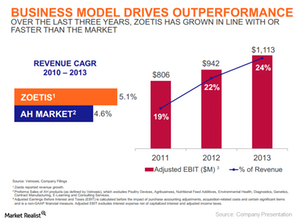

Zoetis: An attractive business model

Zoetis said in a recent statement that “its unique characteristics have established the company as the world leader in animal health, growing revenue faster than the market for the last three years.”

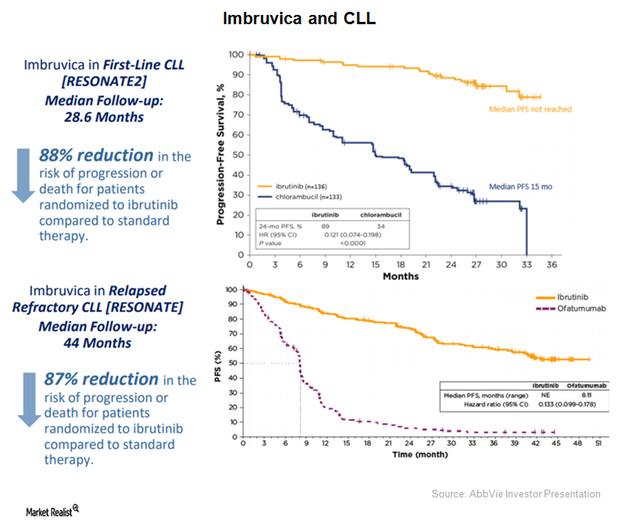

AbbVie Expects Peak Sales of $7 Billion for Imbruvica

AbbVie (ABBV) has projected Imbruvica’s annual revenues to be $5 billion by 2020. That would be driven by a rapid uptake in the first line chronic lymphocytic leukemia (or CLL) segment.

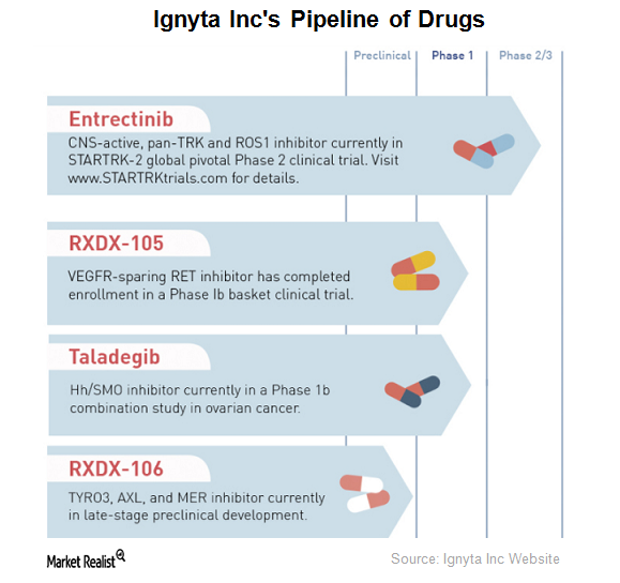

Ignyta’s Drug Pipeline

Ignyta (RXDX) has completed enrollment for a Phase 1 clinical trial of RXDX-105, an orally bioavailable small molecule tyrosine kinase inhibitor.

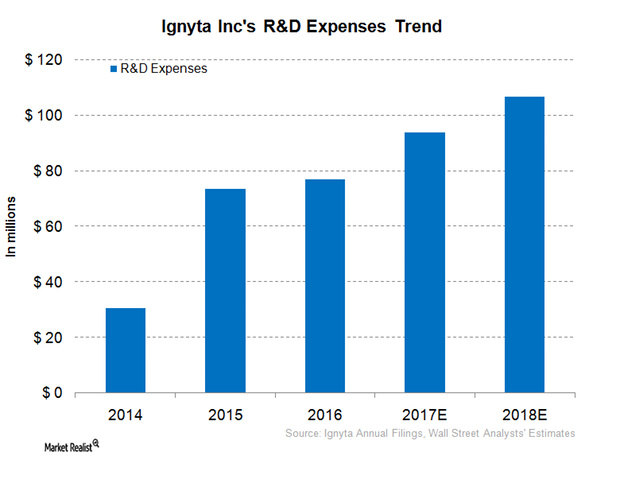

Inside Ignyta’s Financial Performance

Ignyta’s (RXDX) R&D (research and development) expenses increased from $16.6 million in 3Q16 to $21.7 million in 3Q17, a 30% rise.

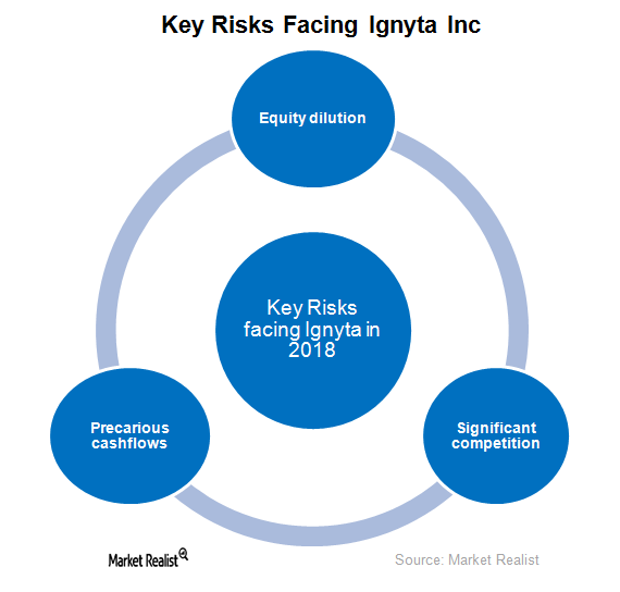

Ignyta and Its Key Risks in 2018

In October 2017, Ignyta (RXDX) raised $150 million by issuing 10 million shares of its common stock.

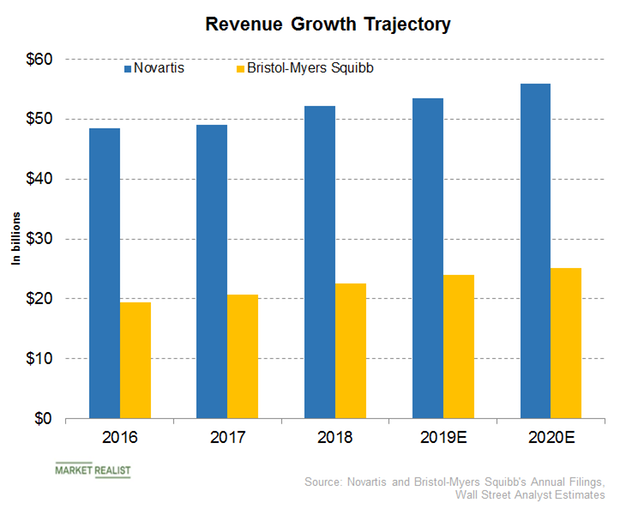

NVS or BMY: Who’s Expected to Post Faster Revenue Growth in 2019?

According to the company’s fourth-quarter earnings conference call, Novartis expects to complete the spin-off of its Alcon business in the second quarter of 2019.

How Novartis Is Transforming Its Structure in 2019

Since fiscal 2018, Novartis (NVS) has been focused on transforming itself into a new focused medicines company.

A Look at Cosentyx, Novartis’s Fast-Growing Immunology Drug

In the first quarter, Novartis’s (NVS) Cosentyx reported net sales of $791 million, a YoY (year-over-year) rise of 41% on a constant currency basis.

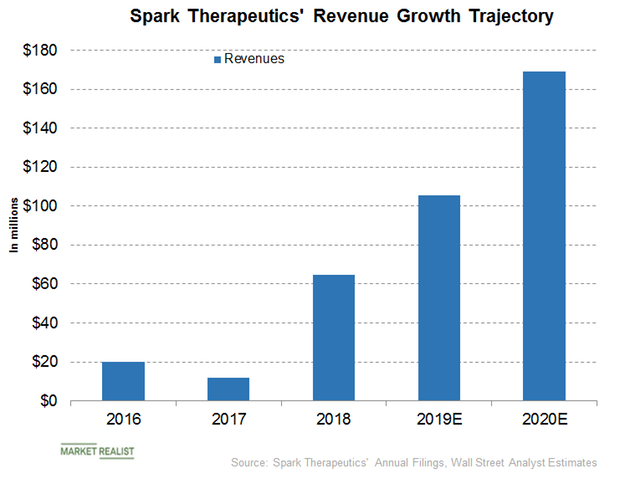

A Look at Spark’s Potential Revenue Contribution to Roche Holdings

Wall Street analysts have projected Spark Therapeutics’ revenues to be $105.64 million, $169.22 million, and $263.76 million for fiscal 2019, fiscal 2020, and fiscal 2021, respectively.

What Are the Key Growth Drivers for GlaxoSmithKline in 2019?

GSK highlighted the prioritization of research and development programs, business development, and new product launches as its key growth drivers in 2018.

Ajovy Is a New Growth Driver for Teva Pharmaceutical

On September 14, Teva Pharmaceutical (TEVA) issued a press release announcing FDA approval of humanized monoclonal antibody and anti-calcitonin gene-related peptide (or CGRP) therapy.

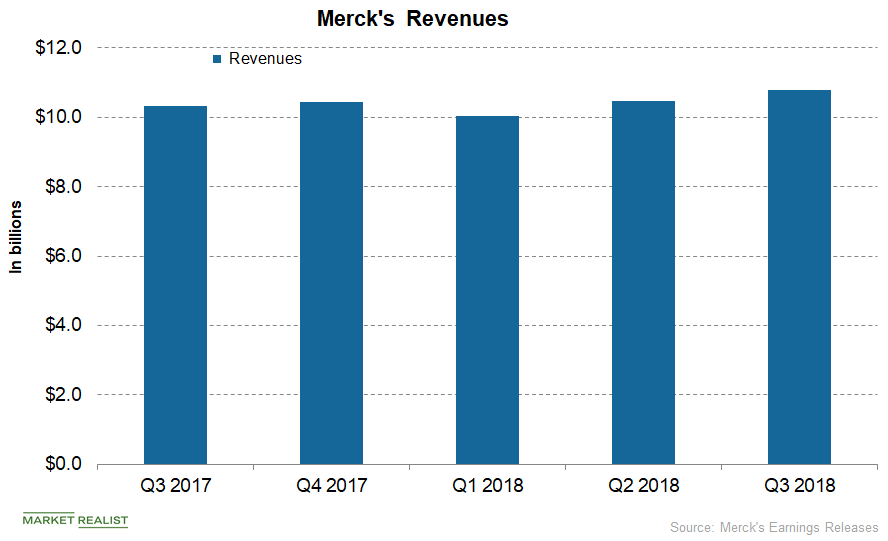

Merck’s Stock Price Has Increased ~34% in 2018

On November 16, Merck’s stock price closed at $76.06, which represents ~1.63% growth from its close of $74.84 on November 15.

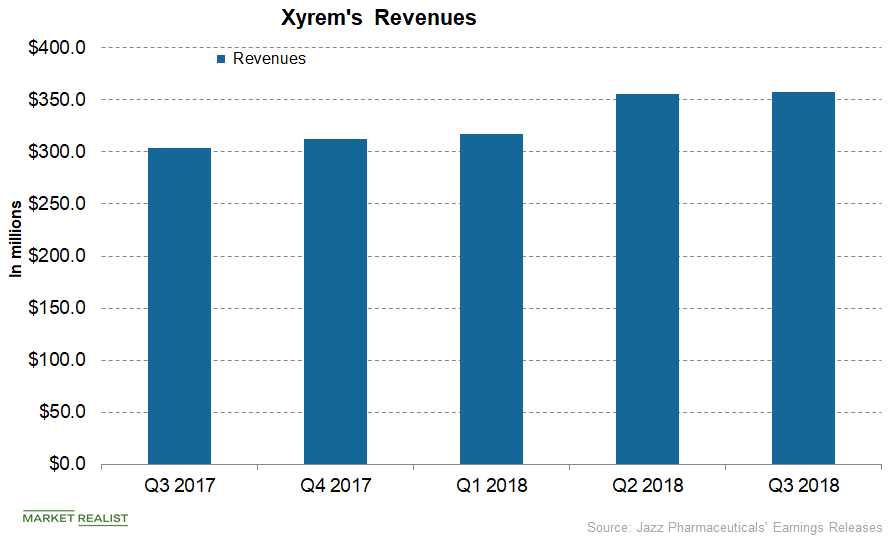

Jazz Pharmaceuticals: How Are Xyrem and Erwinaze Positioned?

Jazz Pharmaceuticals’ Xyrem generated revenues of $357.3 million in the third quarter—compared to $303.9 million in the third quarter of 2017.

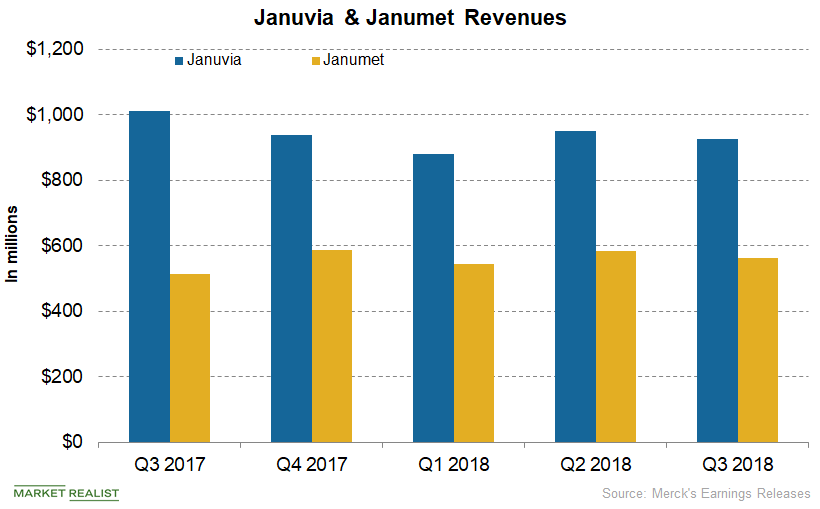

A Look at Merck’s Diabetes and Women’s Health Business

Merck & Co.’s (MRK) Januvia generated revenues of $927 million in the third quarter, reflecting an ~8% YoY (year-over-year) decline.

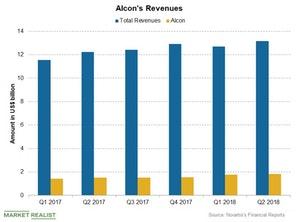

A Look at the Performance of Novartis’s Alcon

Alcon reported revenue of ~$1.82 billion in the second quarter, a 7% rise.

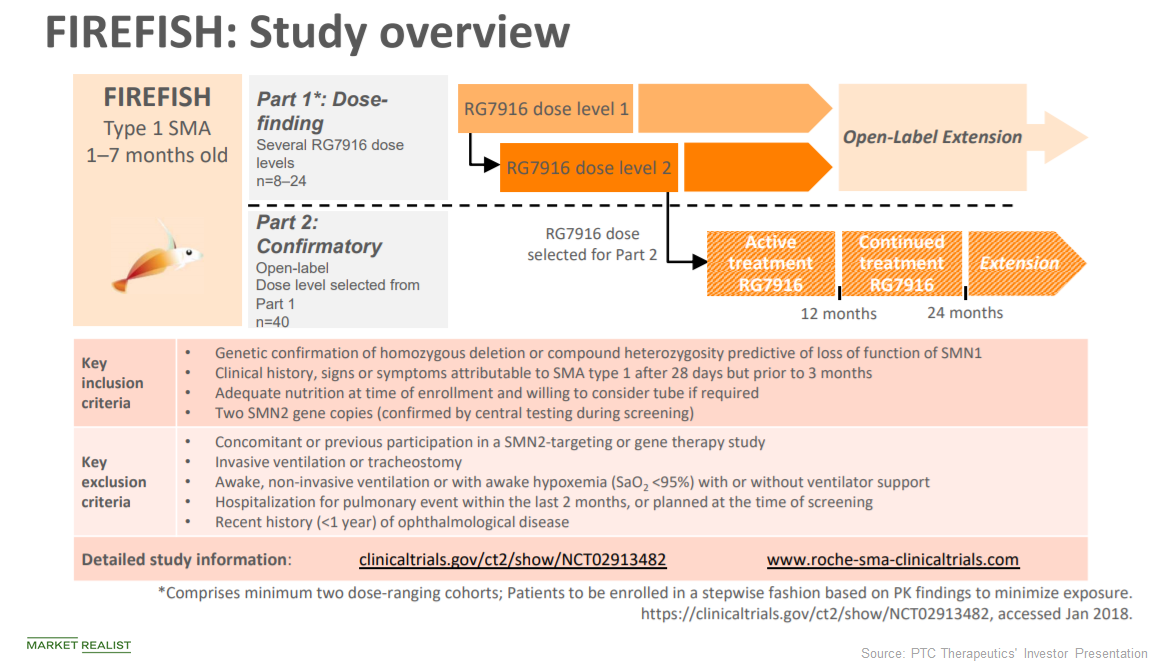

Risdiplam: Could It Be PTC Therapeutics’ Future Growth Driver?

In June, PTC Therapeutics (PTCT) presented its updated interim clinical data from the Phase 1 FIREFISH trial.

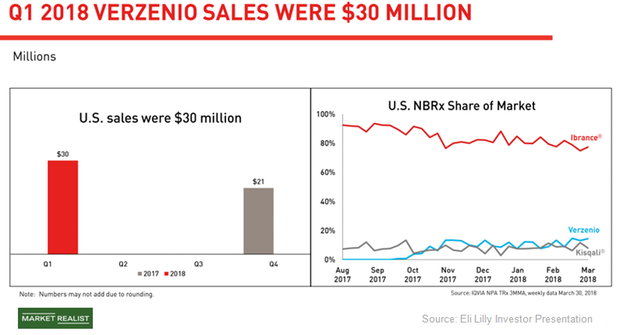

Verzenio: Major CDK4/6 Inhibitor in the Future

Verzenio has demonstrated double-digit growth in new patient usage in patient segments targeted by the drug’s first two approved indications.

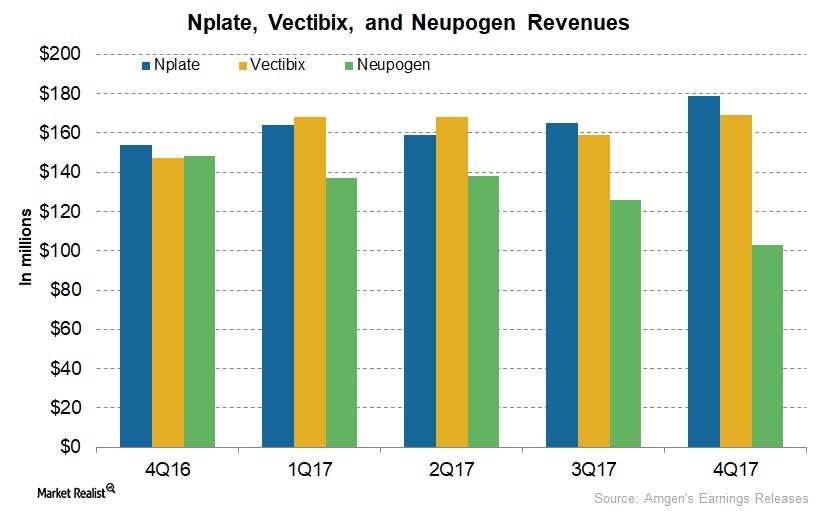

How Amgen’s Nplate, Vectibix, and Neupogen Performed in 1Q18

In 1Q18, Amgen’s (AMGN) Nplate revenue grew 16% YoY (year-over-year) to $179 million from $154 million, primarily driven by unit demand.

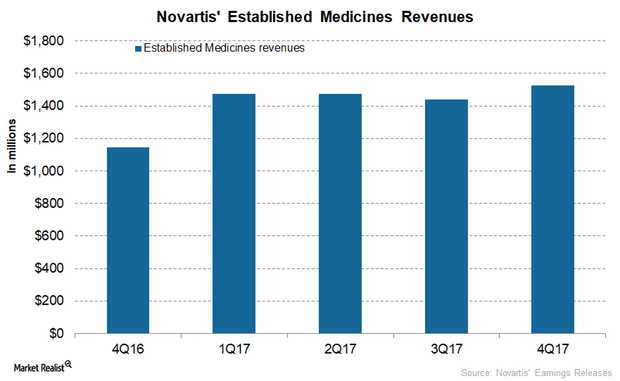

How Did Novartis’s Established Medicines Segment Perform in 2017?

In 4Q17, Novartis’s (NVS) Galvus generated revenues of $327 million, which is ~10% growth on a year-over-year (or YoY) basis and 5% growth quarter-over-quarter.

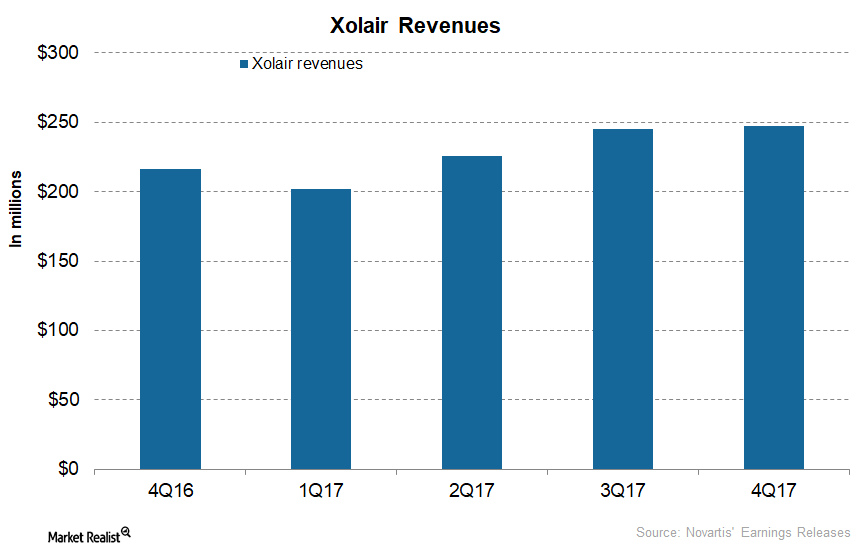

How Is Novartis’s Xolair Positioned after 4Q17?

In 4Q17, Novartis’s (NVS) Xolair generated revenues of $247 million, which reflected ~14% growth on a year-over-year (or YoY) basis and ~1% growth on a quarter-over-quarter basis.

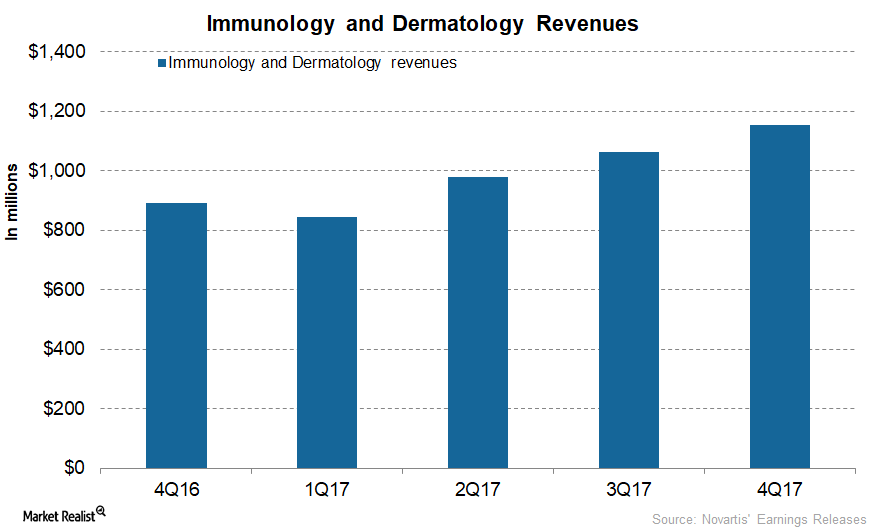

A Look at Novartis’s Immunology and Dermatology Segment’s Performance

In 4Q17, Novartis’s Immunology and Dermatology segment generated revenues of $1.2 billion, ~30% growth on a year-over-year (or YoY) basis and ~9% growth quarter-over-quarter.