A Look at Spark’s Potential Revenue Contribution to Roche Holdings

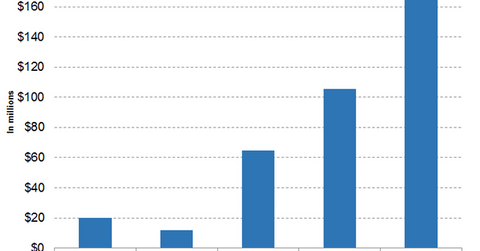

Wall Street analysts have projected Spark Therapeutics’ revenues to be $105.64 million, $169.22 million, and $263.76 million for fiscal 2019, fiscal 2020, and fiscal 2021, respectively.

Feb. 27 2019, Updated 11:10 a.m. ET

First commercialized asset

On December 19, 2017, Spark Therapeutics (ONCE) issued a press release announcing FDA approval for its gene therapy, Luxturna, to treat patients with retinal dystrophy associated with biallelic RPE65 mutation. According to Spark Therapeutics’ fourth-quarter earnings conference call, the company managed to successfully launch the therapy in the US market in fiscal 2018 by appropriately defining the target audience, developing centers capable of delivering the therapy, and ensuring access to this therapy by adopting an outcomes-based reimbursement model.

According to Spark Therapeutics’ fourth-quarter earnings conference call, the company shipped 75 vials of Luxturna in fiscal 2018, across the ten treatment centers in the US.

On January 24, 2018, Novartis (NVS) issued a press release announcing a licensing agreement with Spark Therapeutics to develop and commercialize Luxturna in ex-US markets, in exchange for upfront payment and milestone payments. On November 23, 2018, Novartis issued a press release announcing the European Commission’s approval of Luxturna in the same indication.

According to Spark Therapeutics’ fourth-quarter earnings conference call, the company’s performance-based outcomes model for reimbursing Luxturna has enabled the company to secure coverage for the drug from multiple national payers. To further boost the uptake of Luxturna, the company has planned to focus more on identifying eligible patients through genetic testing.

The acquisition of Spark Therapeutics is thus adding not only a successfully commercialized product, Luxturna, but also the company’s expertise and experience related to gene-therapy specific manufacturing, delivery models, and market access to Roche Holdings’ (RHHBY) portfolio.

Wall Street projections

Wall Street analysts have projected Spark Therapeutics’ revenues to be $105.64 million, $169.22 million, and $263.76 million for fiscal 2019, fiscal 2020, and fiscal 2021, respectively. This implies a YoY (year-over-year) revenue change of 63.21%, 60.19%, and 55.86% for fiscal 2019, fiscal 2020, and fiscal 2021, respectively. These projections may not be relevant after the completion of Roche Holdings’ acquisition of Spark Therapeutics. However, they are indicative of the revenue potential of Spark Therapeutics on a standalone basis.