Novartis AG

Latest Novartis AG News and Updates

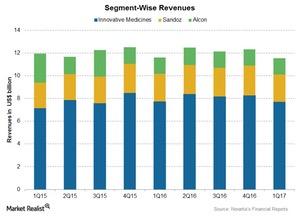

Inside Novartis’s Segment-Wise Performance in 1Q17

Novartis is largely exposed to currency risk, as ~50% of its total revenues are reported from international markets.

What Happened to Novartis’s Valuation after 1Q17?

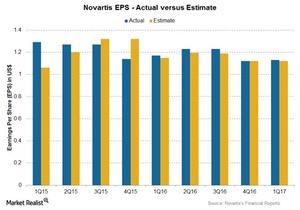

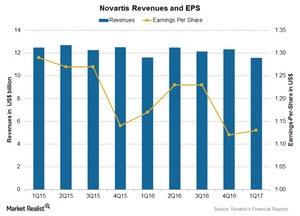

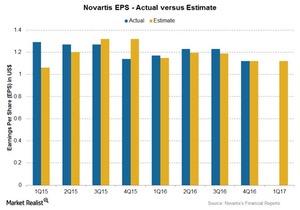

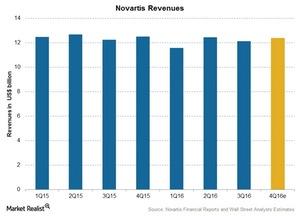

Novartis reported EPS of $1.13 on revenues of $11.54 billion for 1Q17, which represents 2% YoY operational growth in revenues.

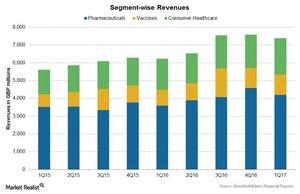

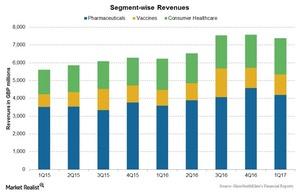

GlaxoSmithKline’s Segment Performances in 1Q17

GlaxoSmithKline (GSK) reported a 19.0% rise in 1Q17 revenues to ~7.4 billion pounds, driven by an operational rise of 5.0% and a favorable currency impact of 14.0%.

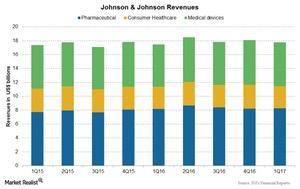

Johnson & Johnson’s Business Segments in 1Q17

Johnson & Johnson’s business includes three segments: Pharmaceuticals, Consumer, and Medical Devices.

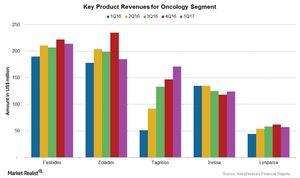

How AstraZeneca’s Oncology Segment Performed in 1Q17

AstraZeneca’s (AZN) Oncology segment has consistently reported revenue growth over the last few years, and it’s one of the company’s key areas of focus.

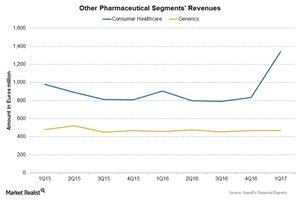

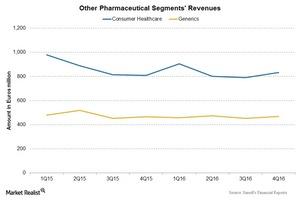

Sanofi’s Generics and Consumer Healthcare Business in 1Q17

Sanofi’s (SNY) Generics business contributes ~5% to the group’s total revenues.

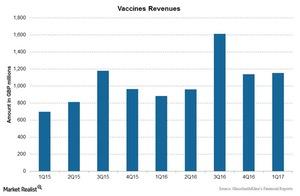

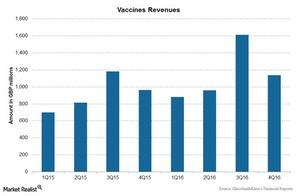

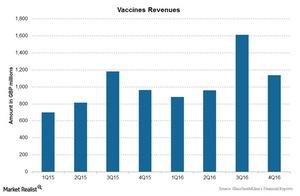

How GlaxoSmithKline’s Vaccines Business Performed in 1Q17

GlaxoSmithKline (GSK) is focused on strengthening its vaccines business, so it acquired the meningitis and other vaccines business from Novartis (NVS).

How GlaxoSmithKline’s Business Segments Performed in 1Q17

The company reported operational growth of 5% in its revenues to 7.4 billion pounds for 1Q17.

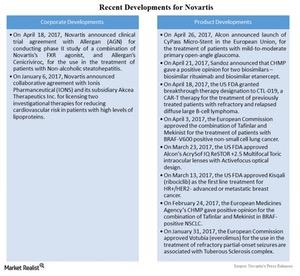

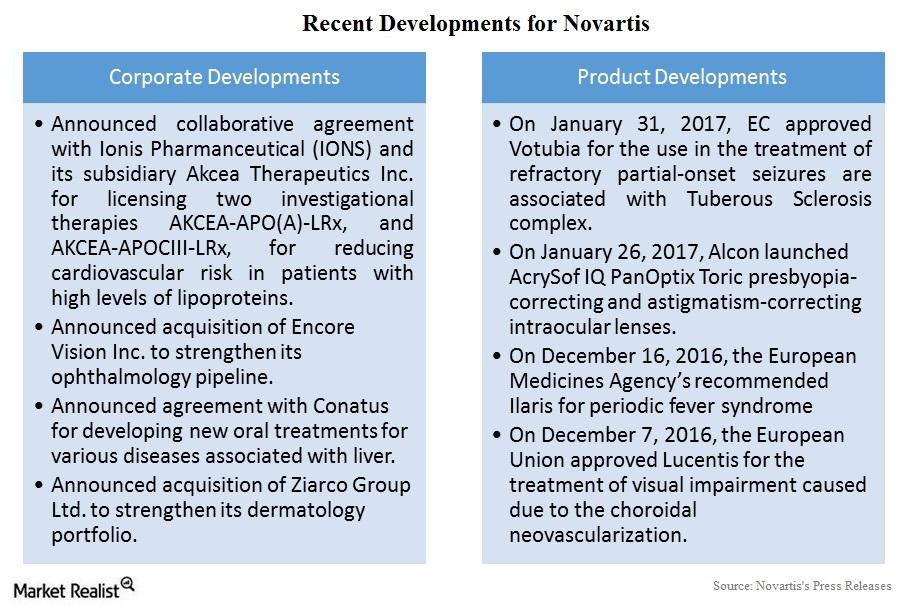

Novartis’s 1Q17 Earnings: Recent Developments

On January 6, 2017, Novartis announced the collaborative agreement with Ionis Pharmaceuticals (IONS) and its subsidiary Akcea Therapeutics.

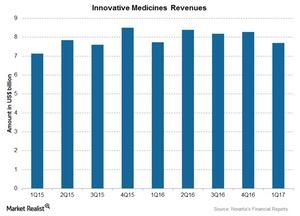

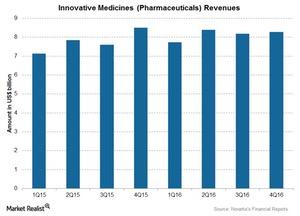

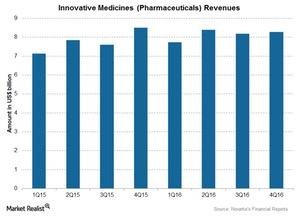

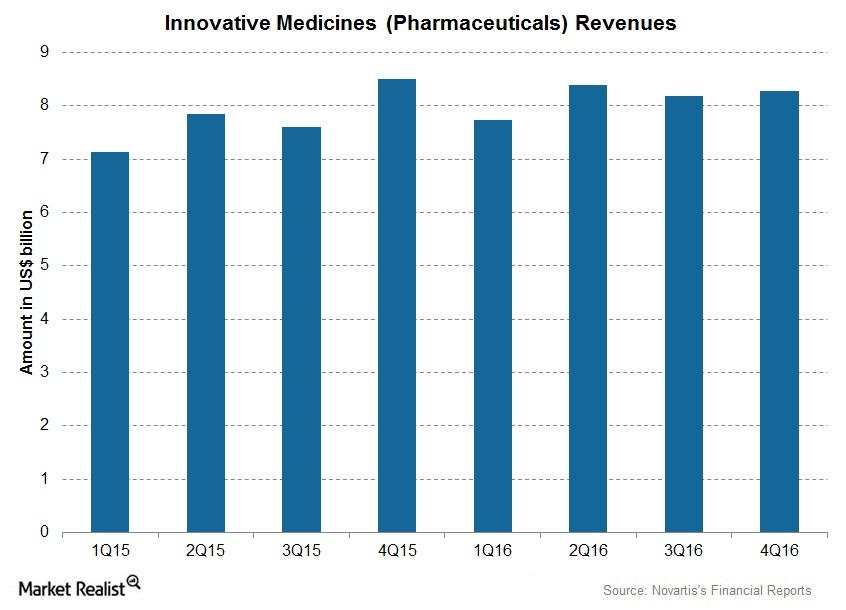

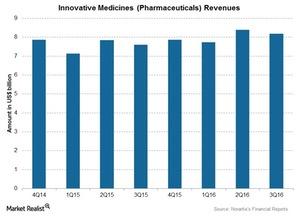

Novartis’s 1Q17 Earnings: Innovative Medicines Segment

Novartis’s (NVS) Innovative Medicines segment contributed ~66.6% to overall 1Q17 revenue, or $7.7 billion.

Why Novartis’s 1Q17 Revenues Missed Analysts’ Estimates

Novartis (NVS) released its 1Q17 earnings on April 25, 2017, reporting a 25.0% rise in revenues at constant exchange rates compared to 1Q16.

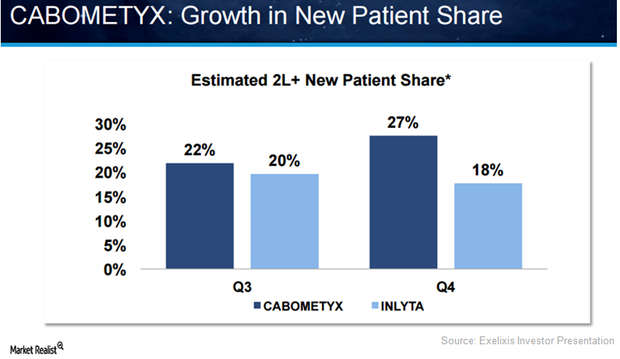

Behind Exelixis’s Successful Commercial Launch of Cabometyx in 2016

Launched in the US in 2Q16, Exelixis’s (EXEL) Cabometyx managed to fetch revenues of $31.2 million and $44.7 million in 3Q16 and 4Q16, respectively.

What Analysts Predict for AstraZeneca’s 1Q17 Earnings

Analysts estimate AstraZeneca will post EPS (or earnings per share) of $0.40 and revenues of $5.4 billion in 1Q17.

GlaxoSmithKline’s 1Q17 Estimates: Vaccines Business

The Novartis acquisition has improved sales for GSK’s Vaccines business, mainly driven by the sales of meningitis vaccines Bexsero in Europe and Menveo in the US and Europe.

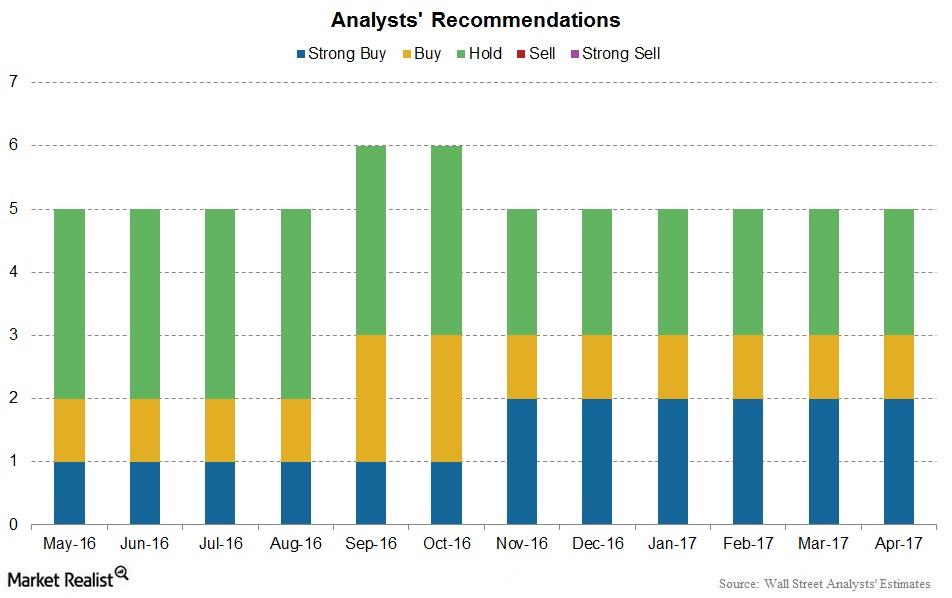

Analyst Ratings and Recommendations for Novartis

As of April 21, 2017, there are five analysts tracking Novartis. Of those, two have recommended a “strong buy,” and one has recommended a “buy.”

Novartis’s 1Q17 Estimates: Innovative Medicines Segment

Novartis’s (NVS) Innovative Medicines segment includes products for therapeutic areas such as oncology, cardiometabolic, immunology, and dermatology.

Analyst Estimates for Novartis’s 1Q17 Earnings

Novartis is set to release its 1Q17 earnings on April 25, 2017. Analysts estimate its 1Q17 EPS at $1.12 with revenues of ~$11.7 billion.

Why Sanofi’s Consumer Healthcare and Generics Segment Still Matters

Sanofi’s (SNY) Consumer Healthcare segment reported a 1.6% YoY (year-over-year) fall in revenues at 3.33 billion euros (about $3.56 billion) in 2016.

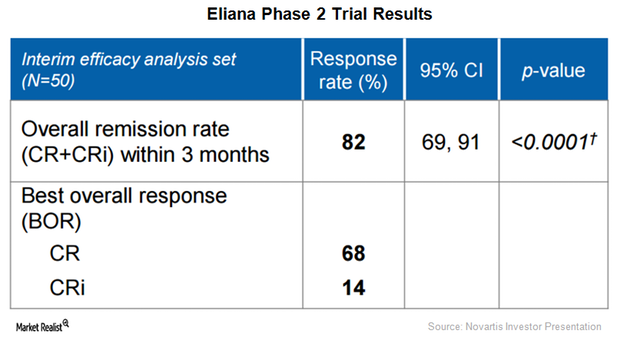

Could Novartis’s CTL019 Capture Significant Market Share?

Currently, an estimated 7,000 patients suffer from pediatric ALL in the US, Europe, Japan, Canada, and Israel.

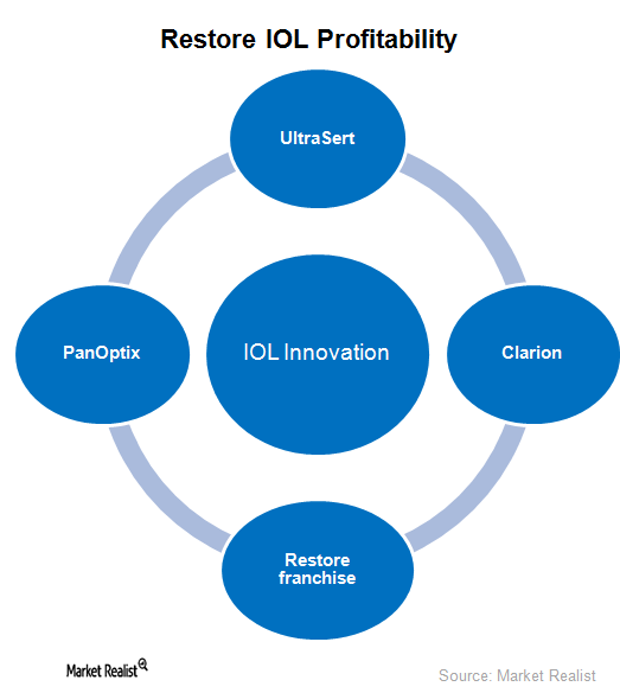

Novartis Expects to Restore Alcon’s Profitability in the Future

Novartis (NVS) has focused its efforts on improving its customer service levels and entering into lucrative partnering deals to boost profitability for its Alcon business.

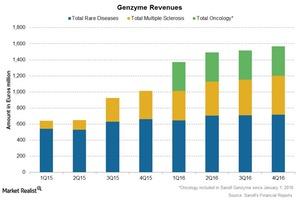

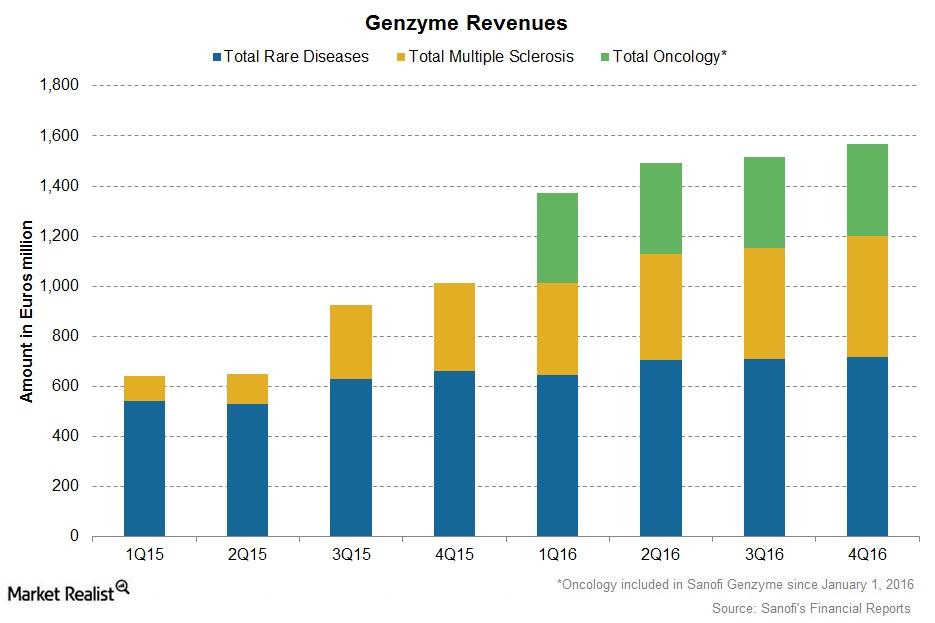

Sanofi Genzyme Continued Growth in 2016

Sanofi’s (SNY) 2016 revenues were mainly driven by Sanofi Genzyme and Sanofi Pasteur.

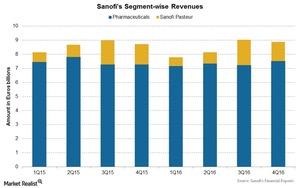

Inside Sanofi’s Overall Revenue Performance in 2016

Sanofi (SNY) reported a YoY (year-over-year) revenue growth of ~1.2% at constant exchange rates for 2016.

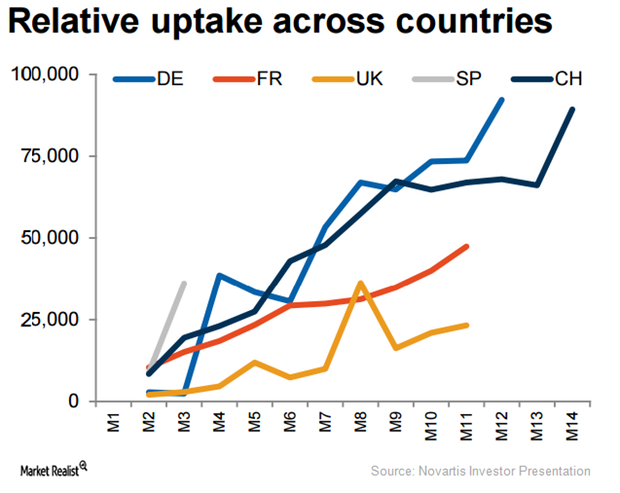

Entresto Could See Strong Uptake in European Markets in 2017

Novartis (NVS) has managed to secure reimbursement in 17 countries in Europe.

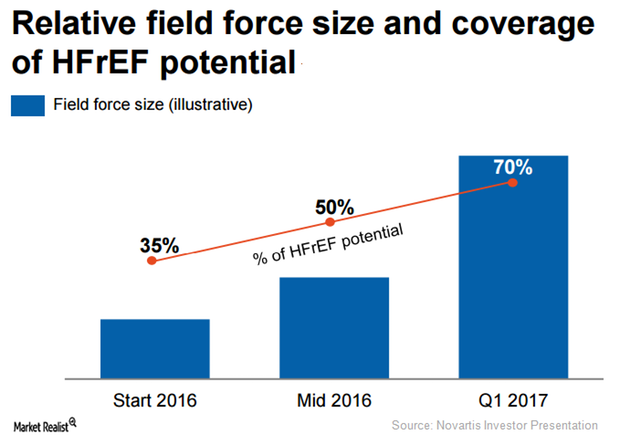

How Novartis Is Aiming to Increase Entresto Sales in 2017

In 2017, Novartis (NVS) expects its heart failure drug, Entresto, to earn revenues in excess of $500 million.

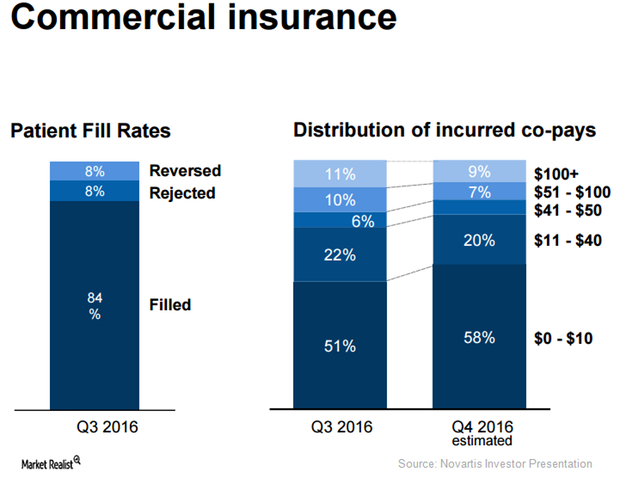

Reduced Co-pays May Boost Demand for Entresto

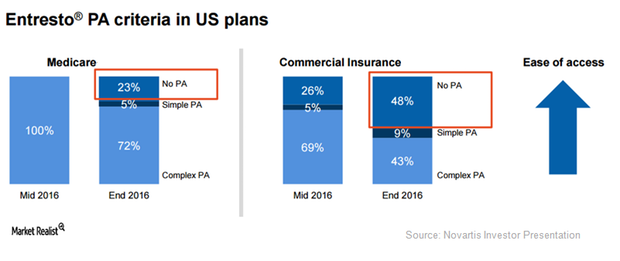

Compared to 43% at the end of 2015, Novartis’s (NVS) Entresto managed to attain a preferred formulary position in 66% of commercial plans in the US at the end of 2016.

Why Entresto Could Become Key Growth Driver for Novartis in 2017

Novartis (NVS) expects modest prescription growth for its heart failure drug, Entresto, in 1Q17.

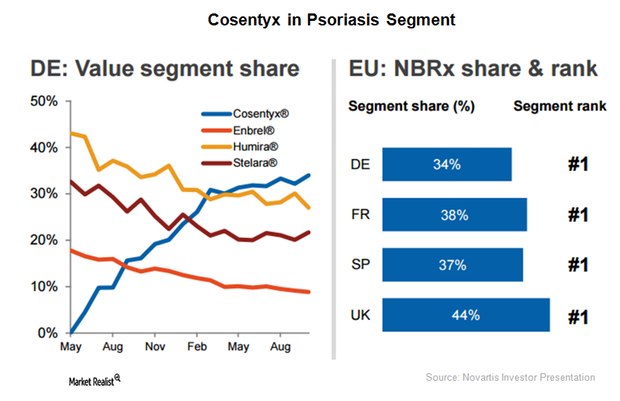

Cosentyx Enjoys Solid Demand as Psoriasis Therapy in Europe

In 2016, Novartis’s (NVS) Cosentyx surpassed its closest competitor, Eli Lilly’s (LLY) Taltz, in number of total weekly prescriptions in the US market.

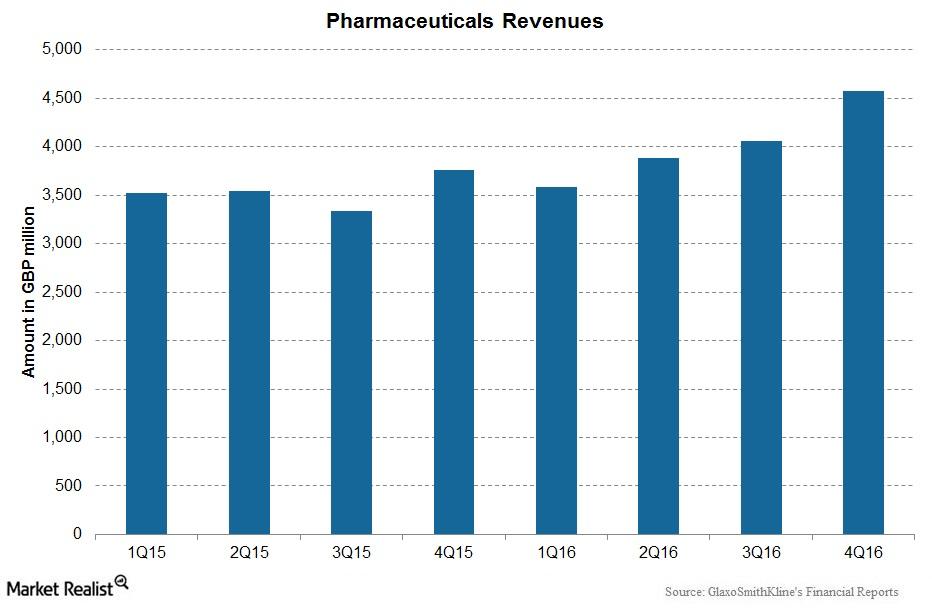

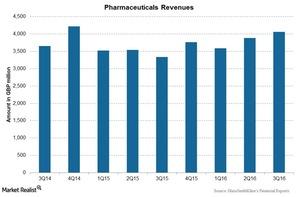

GlaxoSmithKline’s Pharmaceuticals Segment Performance

Overall, the Pharmaceutical segment’s contribution to GSK’s total revenues was 57.7% in 2016.

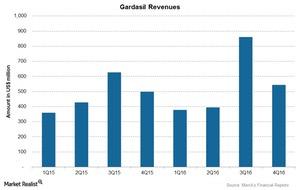

This Is Driving Merck’s Vaccines Business

The Gardasil franchise is Merck’s (MRK) leading vaccines franchise.

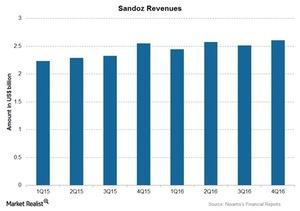

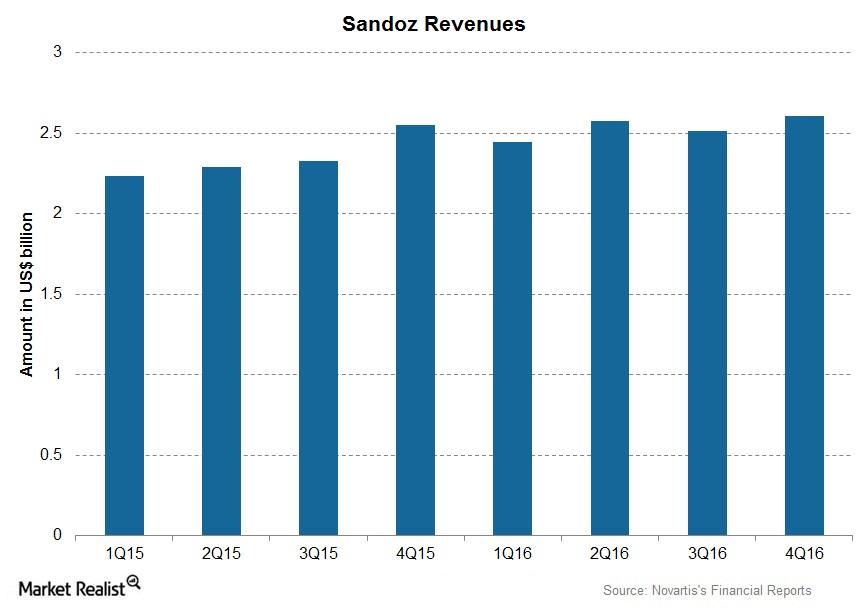

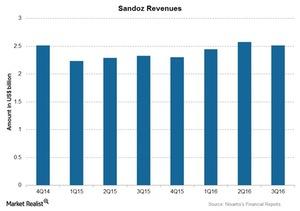

Sandoz: Novartis’s Generics Business in 2016

Sandoz, the generics arm of Novartis (NVS), is the number two generic medicines provider worldwide, and it’s number one in differentiated generics.

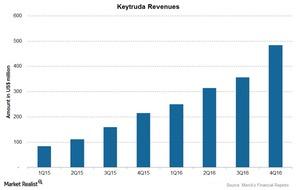

Merck’s Keytruda Saw Impressive Growth in 2016

Keytruda, a prescription medicine classified under Merck’s (MRK) immunooncology franchise, is used to treat non-small cell lung cancer as well as melanoma.

Novartis’s Innovative Medicines Segment in 2016

Novartis’s Innovative Medicines segment, formerly referred to as its Pharmaceuticals segment, consists of products for therapeutic areas including oncology, respiratory, and established medicines.

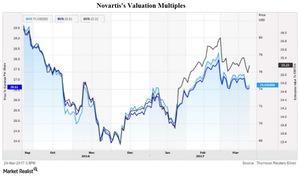

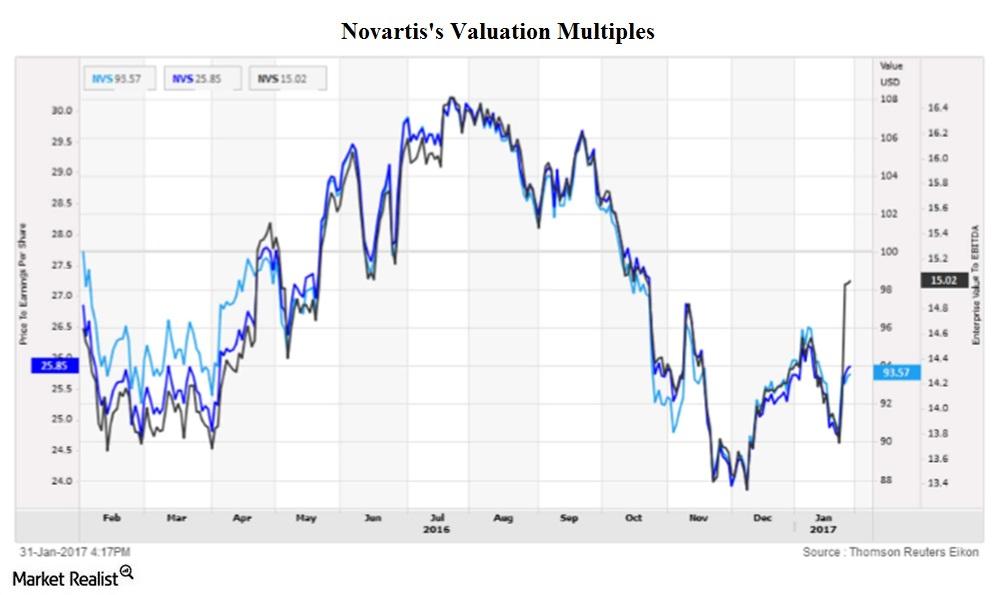

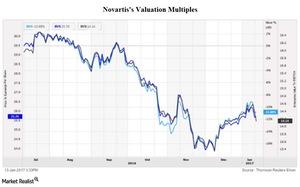

Novartis’s Valuation Compared to Its Peers’

Novartis’s valuation has followed the industry’s overall trend over the last five years. Whether the healthcare sector’s valuation rises or falls, Novartis will definitely be affected.

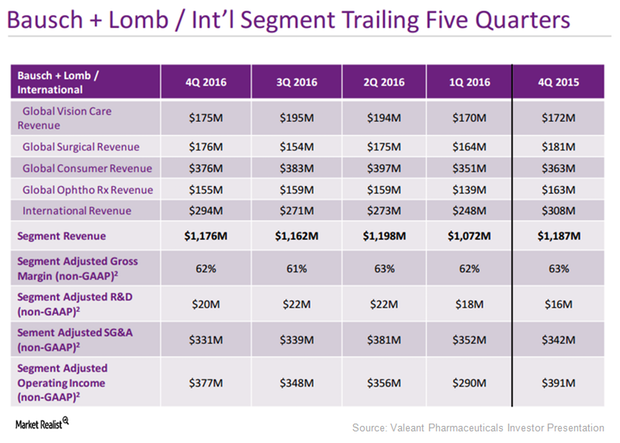

Bausch & Lomb Continues to be Key Growth Driver for Valeant

Bausch & Lomb projections Valeant Pharmaceuticals expects its Bausch & Lomb/International segment to grow at a CAGR (compound average growth rate) of 4%–6% between 2017 and 2020. In 2017, the company expects the segment to grow 5%–7% after adjusting for foreign exchange fluctuations and the impact of impending patent expiries. In 2017, the segment is also expected […]

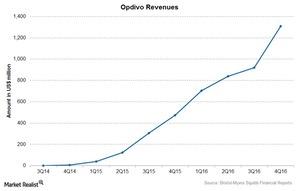

A Look at Opdivo’s Performance in 2016

Bristol-Myers Squibb’s (BMY) latest drug, Opdivo, was the seventh drug to be approved by the FDA for the treatment of melanoma.

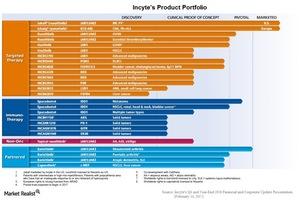

A Look at Incyte’s Product Portfolio

Incyte has classified its oncology product portfolio into targeted anti-cancer therapies and immuno-oncology or immunotherapies.

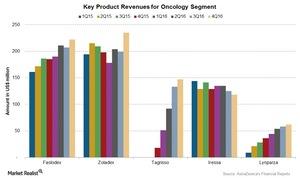

Growth of AstraZeneca’s Oncology Segment in 2016

The revenues for AstraZeneca’s (AZN) Oncology segment rose ~20% at constant exchange rates in 2016.

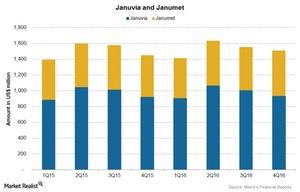

Januvia and Janumet: Merck & Co.’s Blockbuster Diabetes Products

Januvia and Janumet together contributed about 14.9% of Merck & Co.’s total revenues for 4Q16, an ~0.7% increase compared to 4Q15

This Keeps Driving Sanofi’s Growth

Sanofi’s (SNY) 4Q16 revenues were mainly driven by Genzyme and Sanofi Pasteur.

GlaxoSmithKline’s Vaccines Business Reported Growth in 4Q16

GSK’s Vaccines segment reported a rise of 18.0% to 1.1 billion pounds in 4Q16. The Novartis acquisition has improved sales for the segment.

4Q16 Performance of GlaxoSmithKline’s Business Segments

Revenues for GSK’s Pharmaceuticals segment saw a shift in product performance, falling due to lower sales of its key products Seretide and Advair.

Novartis’s Valuation after the 4Q16 Results

On January 31, 2017, Novartis was trading at a forward PE multiple of ~15.2x. Based on its last-five-year multiple range, this is neither high nor low.

Novartis’s Recent Developments

Novartis (NVS) reported flat revenues at constant exchange rates during 4Q16 as well as in fiscal 2016. This was driven by growth in Sandoz revenues.

Inside Novartis’s Generics Performance in 4Q16

Sandoz, the Generics segment of Novartis (NVS), is second-largest generic medicines provider worldwide and number one in differentiated generics.

Novartis’s Innovative Medicines Segment in 4Q16

The overall contribution from NVS’s Innovative Medicines segment was ~67%, reaching $8.3 billion in 4Q16.

Analysts Expect Negative Growth for Novartis in 4Q16

Analysts expect an ~1.1% decline in Novartis’s (NVS) 4Q16 revenues to ~$12.4 billion following the effects of the acquisition and divestiture of several products.

How Did Novartis’s Generics Business Perform in 3Q16?

Sandoz reported a decline of 1% in 3Q16 revenues at constant exchange rates.

How Did Novartis’s Innovative Medicines Segment Perform?

The overall contribution of the innovative medicines segment was ~67% at $8,173 million for 3Q16.

How Does Novartis’s Valuation Compare to Peers?

On January 13, 2017, Novartis was trading at a forward PE multiple of ~15.1x.

How GlaxoSmithKline’s Pharmaceuticals Segment Has Performed

GlaxoSmithKline’s (GSK) Pharmaceuticals segment fell substantially in 2015 due to its divestment of its oncology business to Novartis (NVS) in March 2015.