Novartis AG

Latest Novartis AG News and Updates

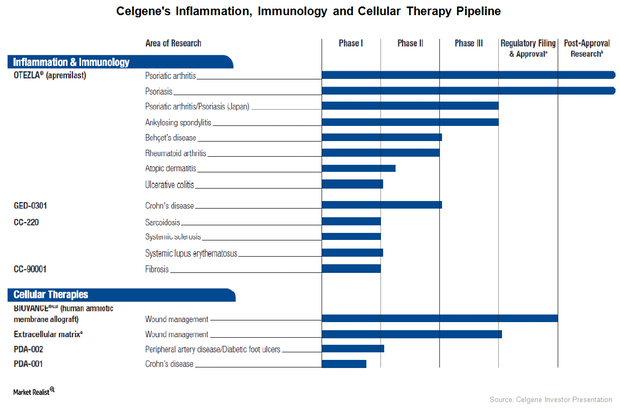

Celgene’s Growing Inflammation and Immunology Pipeline

Celgene has entered the inflammation and immunology drug market, as well as the cell therapies market, in order to be less dependent on MM drugs.

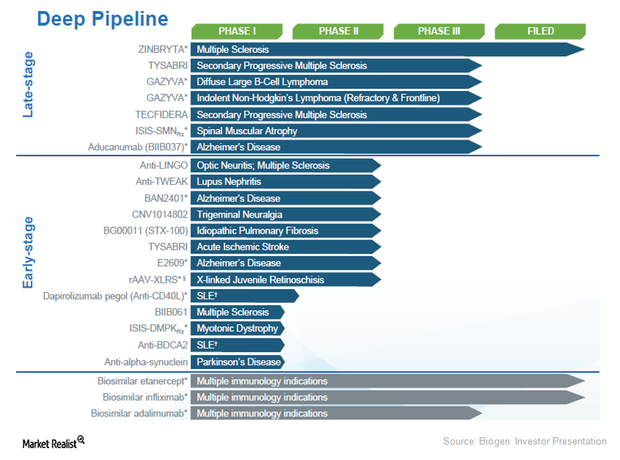

Biogen: Positive 2Q15 Results for Multiple Sclerosis Pipeline Drugs

In 2Q15, Biogen (BIIB) posted mixed results for its pipeline drugs. Investor sentiment remained favorable for its innovative multiple sclerosis (or MS) drugs.

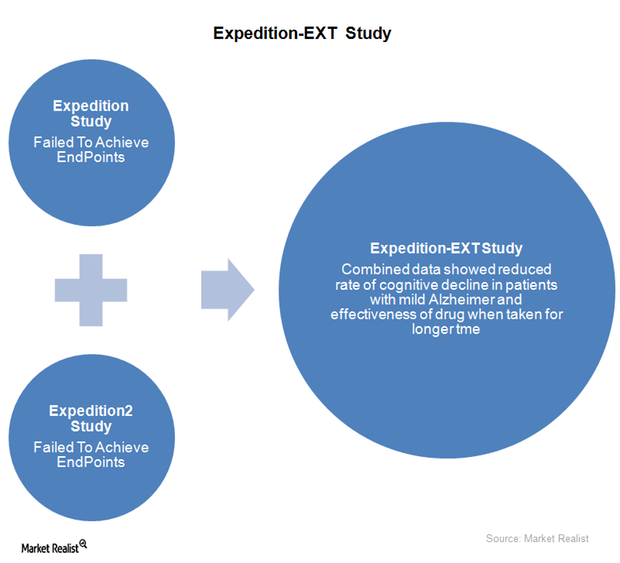

Eli Lilly’s Solanezumab: A Possible Cure for Alzheimer’s?

If approved, solanezumab would be a breakthrough therapy in the Alzheimer’s market. The drug actually seeks to cure the cognitive disease, not simply treat it.

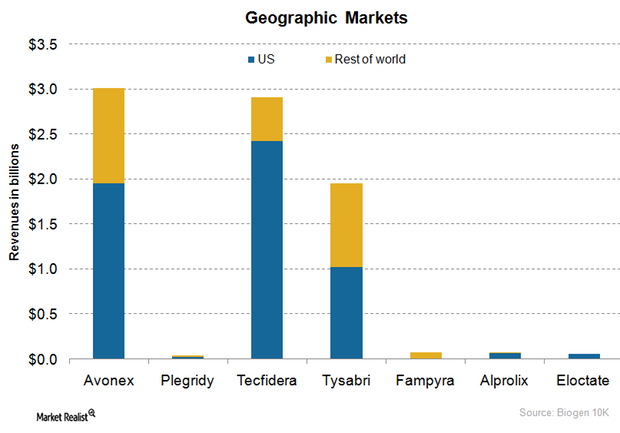

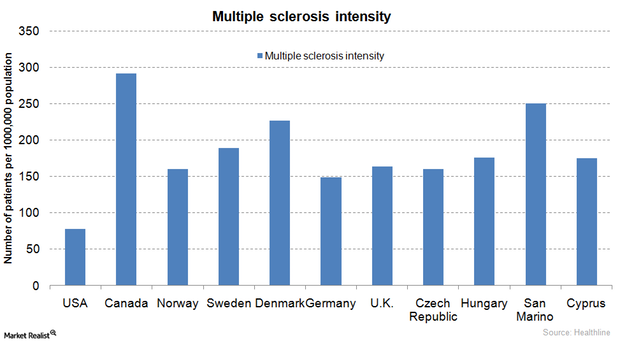

Biogen’s Geographic Market Strategy

In 2014, Biogen earned about 27% of its total revenues from international markets such as Canada, Europe, and emerging economies.

GlaxoSmithKline: The British Multinational Pharmaceutical Company

GlaxoSmithKline is a British multinational pharmaceutical company with a significant presence in the US. GSK has over 100,000 employees in operations around the world.

The Biotechnology Industry and Multiple Sclerosis Therapies

Most multiple sclerosis drugs are very costly at about $55,000 per year. The FDA’s April 2015 approval of a generic version of Copaxone is expected to lower the overall price of the therapy.

AstraZeneca’s Position Compared to Its Peers

The forward EV/EBIDTA multiple for AstraZeneca is ~13x, which is slightly lower than the industry average of ~14x.

Risks Facing Merck & Co.

Merck faces risks from other governments. In Japan, the pharmaceutical industry is subject to government-mandated biennial price reductions of pharmaceutical products and vaccines.

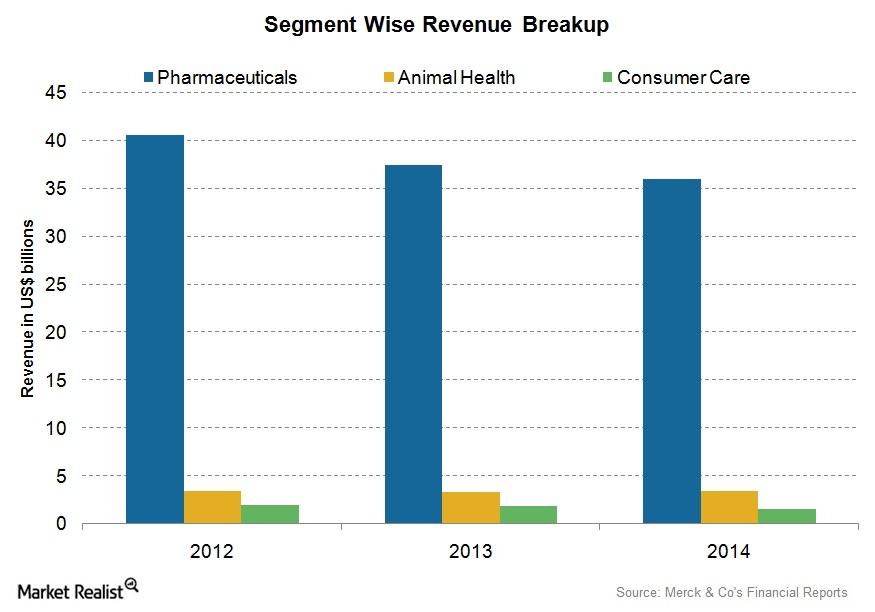

Merck’s Associated Business Segments

Merck’s Pharmaceuticals division accounted for $36.0 billion, or 85%, of group net sales during 2014.

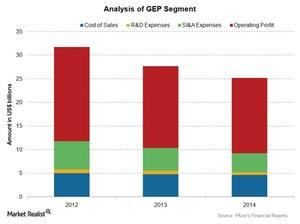

Pfizer’s Global Established Pharmaceutical Segment

The Global Established Pharmaceutical segment deals with products that have or are expected to lose market exclusivity through 2015 in most major markets.

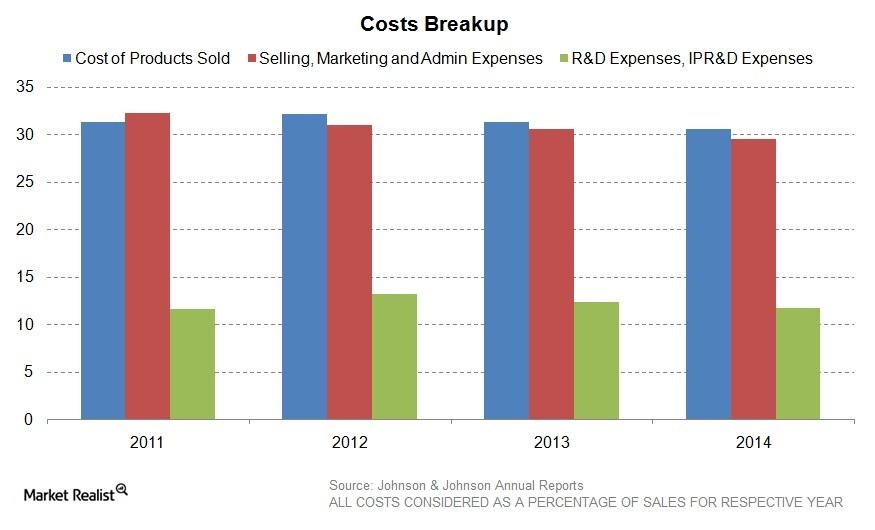

What Were Johnson & Johnson’s Outstanding Expenses?

As a percentage of sales, Johnson & Johnson achieved lower expenses for 2014—compared to 2013. It was able to improve its gross profit margins.

Johnson & Johnson’s Revenue Stream Increased in 2014

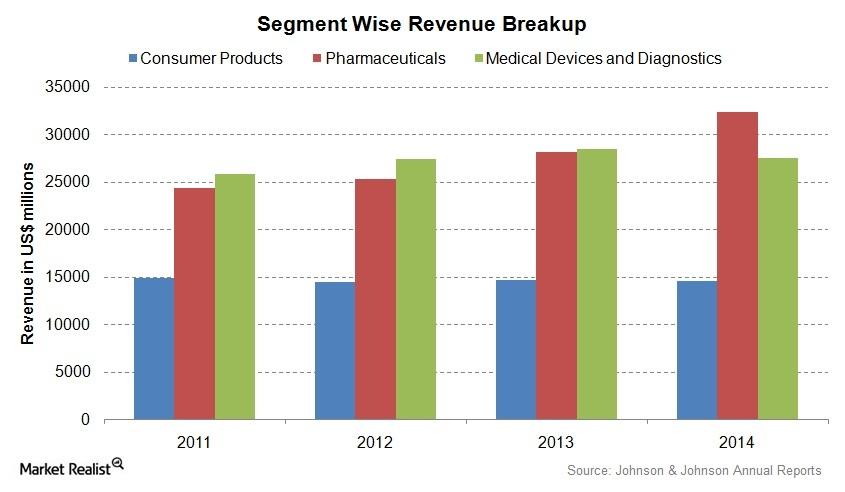

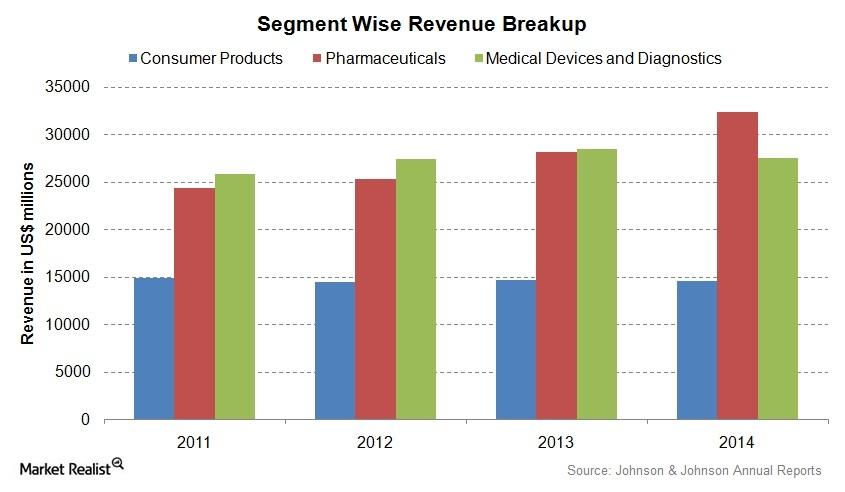

Johnson & Johnson’s (JNJ) net revenue increased by 4.2% from $71.3 billion in 2013 to $74.3 billion in 2014. There was an operational increase of 6.1%.

Johnson & Johnson’s Global Business Strategy Promotes Growth

Johnson & Johnson (JNJ) operates in nearly 60 countries. Its products are sold in about 200 countries. Almost 55% of its total business comes from outside the US.

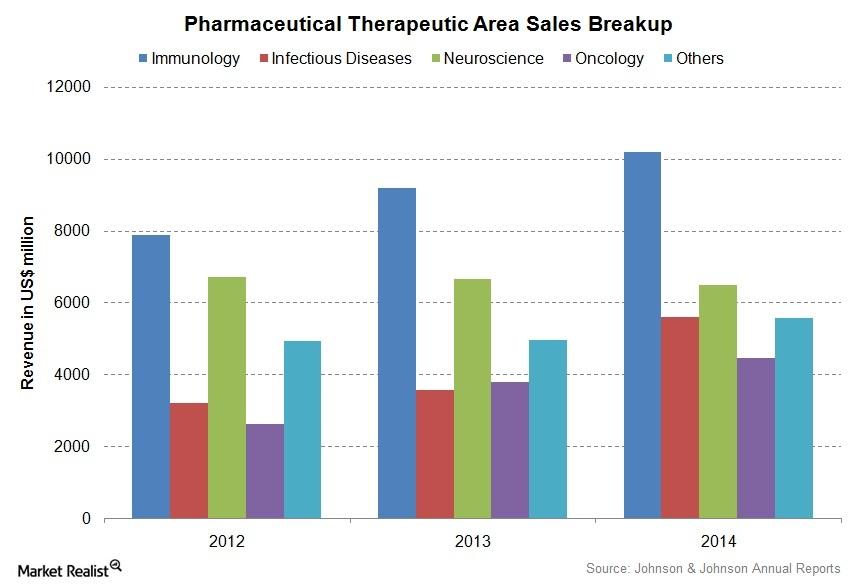

Exploring Johnson & Johnson’s Pharmaceuticals Segment

Johnson & Johnson (JNJ) is the largest pharmaceutical company in the US. The Pharmaceuticals segment contributes over 43% of the company’s revenue.Healthcare The case for Pfizer’s proposed takeover of AstraZeneca

U.S. pharma giant Pfizer’s (PFE) second takeover proposal, of $106 billion (£64 billion), was rejected by Anglo-Swedish drug maker AstraZeneca (AZN) last week.