Teva Pharmaceutical Industries Ltd

Latest Teva Pharmaceutical Industries Ltd News and Updates

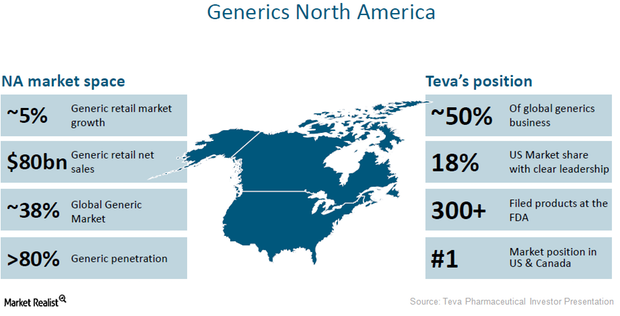

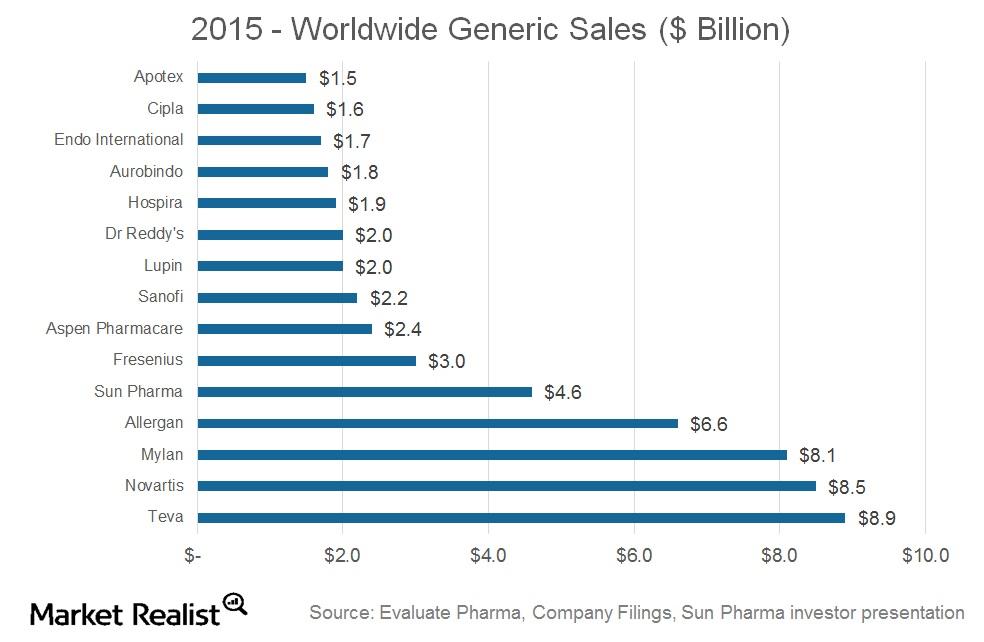

Teva Can Benefit by Acquiring Allergan Generics

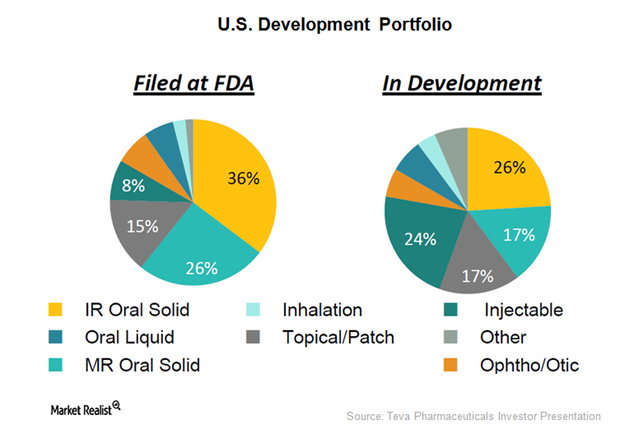

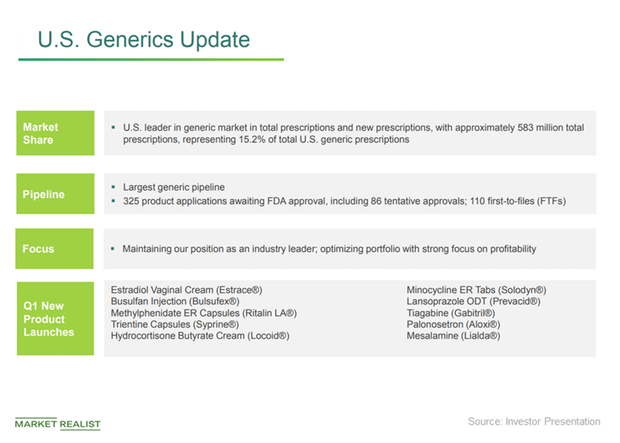

The combined Teva–Allergan generics entity should have approximately 320 Abbreviated New Drug Applications (or ANDAs), including 110 first-to-file ANDAs (or FTF) in the US.

Teva Pharmaceutical: Earnings Trends and Recent Developments

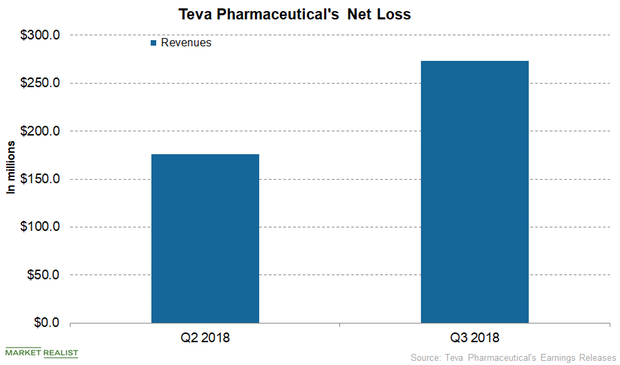

Teva Pharmaceutical’s net income and diluted EPS in the first nine months of 2018 amounted to $541.0 million and $0.53, respectively.

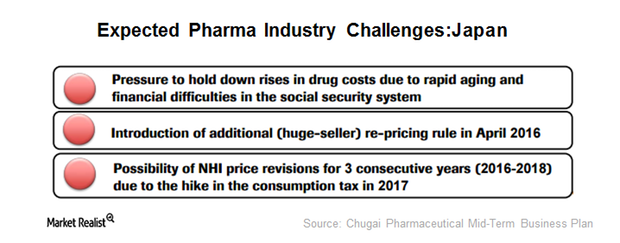

What Are the Challenges for the Pharmaceutical Industry in Japan?

Japan is the second-largest individual pharmaceutical market in the world. It accounts for less than 10% of the total global pharma market.

This Space Presents a Market Opportunity for Valeant

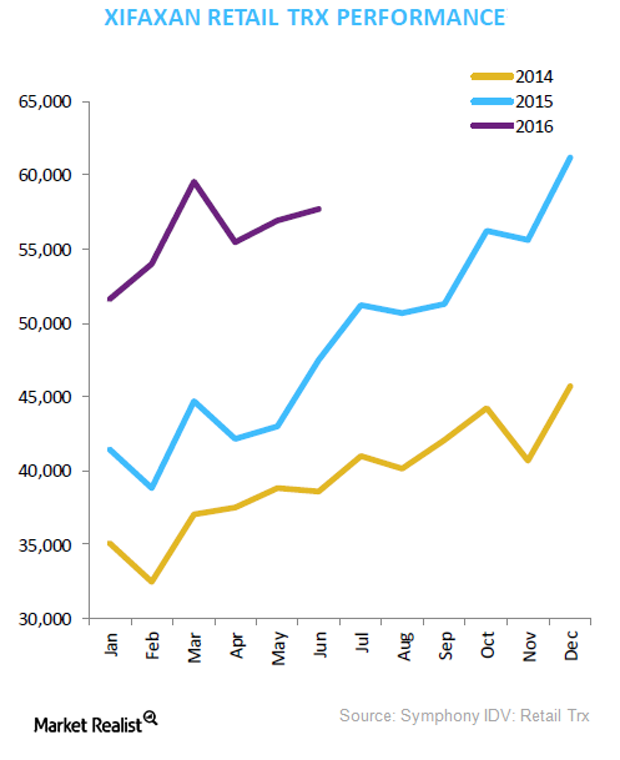

In Valeant’s 2Q16 earnings, Xifaxan reported a year-over-year (or YoY) increase in monthly prescriptions of about 28.0%.

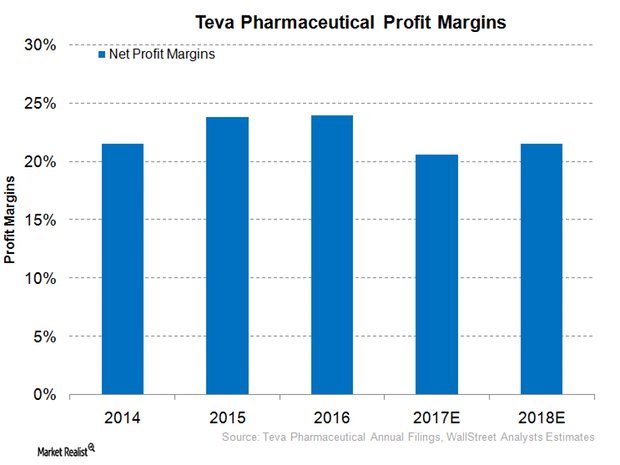

Teva Is Expected to See a Fall in Its Profit Margins in 2017

Teva Pharmaceutical (TEVA) expects its 2017 non-generally accepted accounting principles (non-GAAP) earnings per share (or EPS) to fall in the range of $4.9–$5.3.

Teva’s Granix Gets FDA Approval for Expanded Indication

Today, Teva Pharmaceutical Industries (TEVA) announced that its Granix (tbo-filgrastim) injection has received FDA approval for a new presentation and indication.

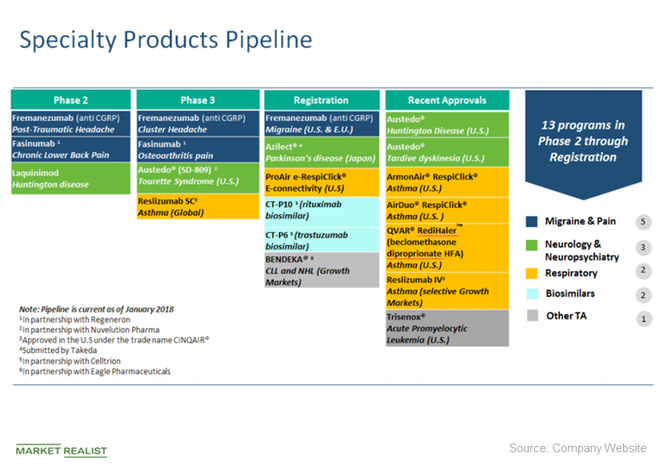

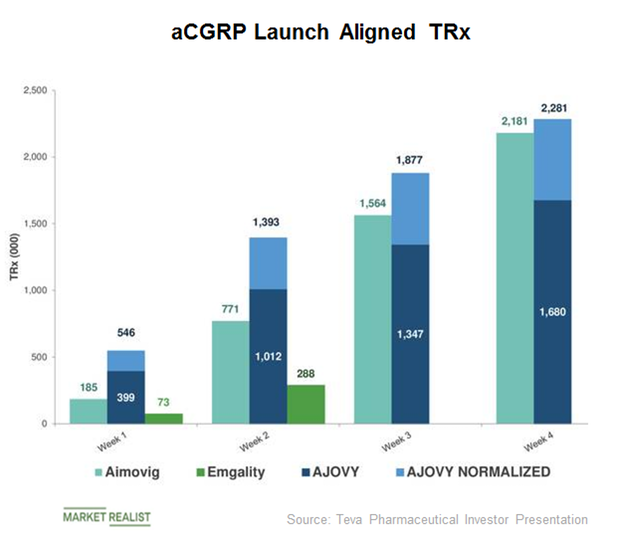

Competition Dynamics for Ajovy—Teva’s Migraine Drug

Approved by the FDA on September 14, Teva’s Ajovy has multiple competitors set to enter the market.

Non-Opioid Pain Therapy Market Opportunity for Teva

The Trump administration proposed production cuts in some of the most abused opioid compounds by 10% next year.

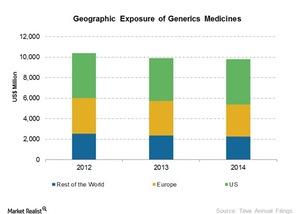

Teva’s Share of the US Generics Market Could Boost Its Stock

Teva Pharmaceutical Industries accounts for 18% of the US generic drug market. This share is significantly higher than those of Mylan, Novartis, and Pfizer.

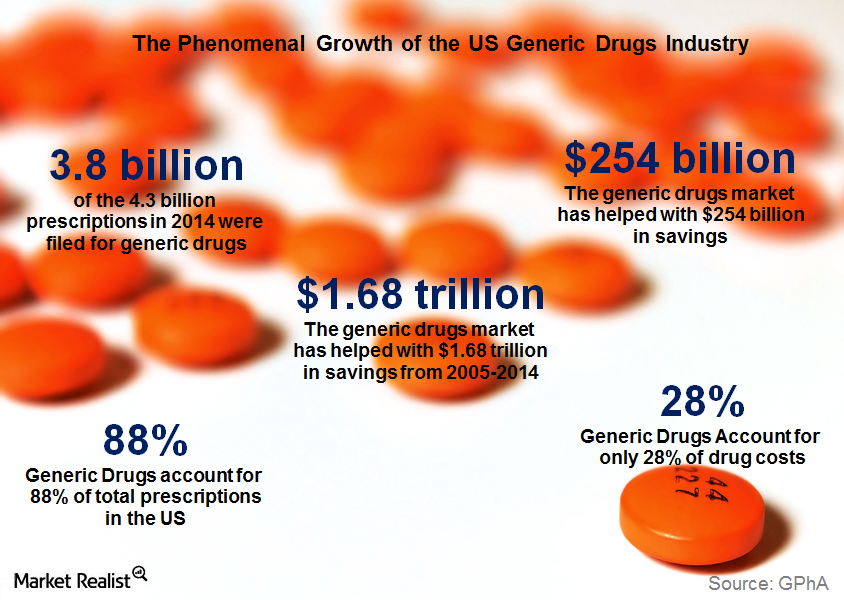

Rx for Growth? Why Generic Drugs Are Gaining Traction

Rx for Growth? The trillion-dollar pharmaceutical industry has historically been dominated by a few major companies that create and supply the most important branded prescriptions on the market. Recent trends, however, point to the growth of the newest pharma blockbusters: generics. Today, approximately 60% of Americans take prescription drugs;[1. “Trends in Prescription Drug Use Among […]

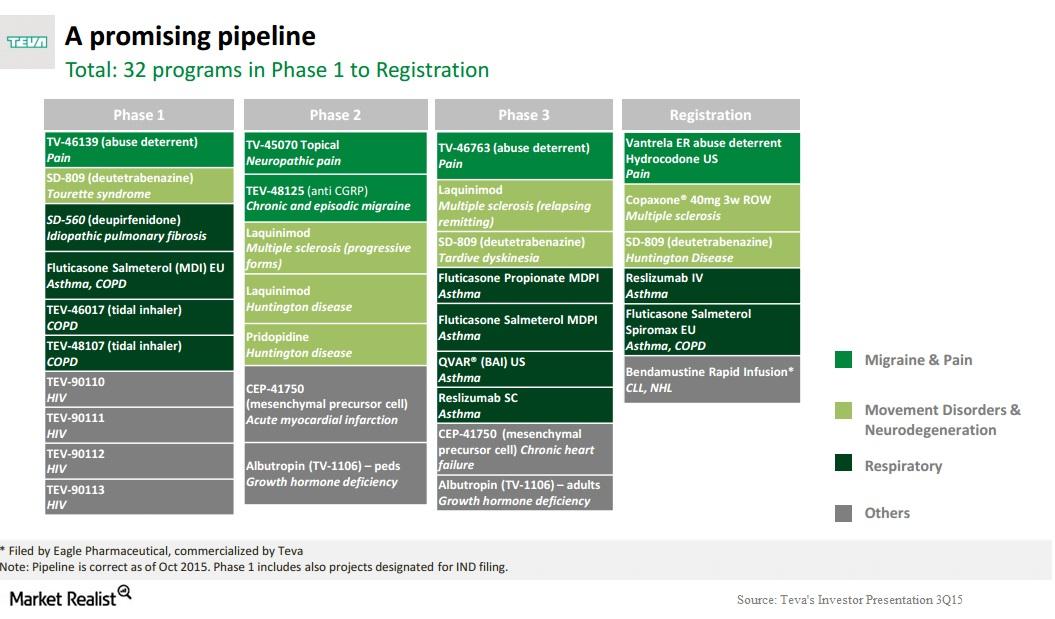

A Look at Teva’s Generic Drugs Research Pipeline

Teva Pharmaceutical Industries has the largest generics product pipeline in the industry. It has 325 applications that are awaiting FDA approval.

Central Nervous System Is Key to Teva’s Specialty Medicines

Revenues for Teva’s (TEVA) Specialty Medicines segment grew by 2.1% to $8,560 million in 2014, from $8,388 million in 2013.

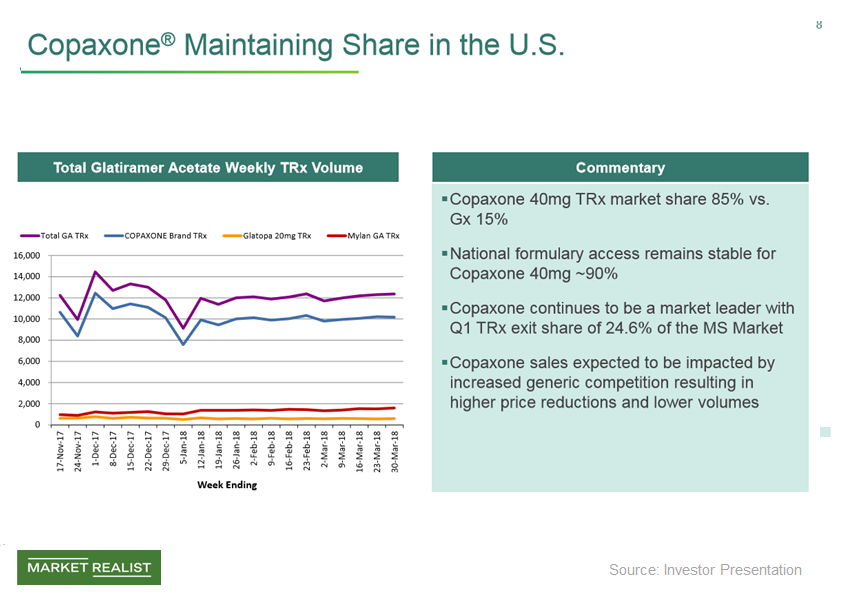

Teva’s Copaxone Maintains Market Share amid Intense Competition

In fiscal 1Q18, Teva (TEVA) reported sales of $645 million for its multiple sclerosis drug, Copaxone, a sequential decline of ~21%.

Teva’s Respiratory Drugs Contribute 11% to Specialty Medicines

Teva’s respiratory drugs franchise provides solutions for asthma, COPD, and allergic rhinitis. Respiratory drugs contributed nearly 11% of total revenues for Teva’s Specialty Medicines in 2014.

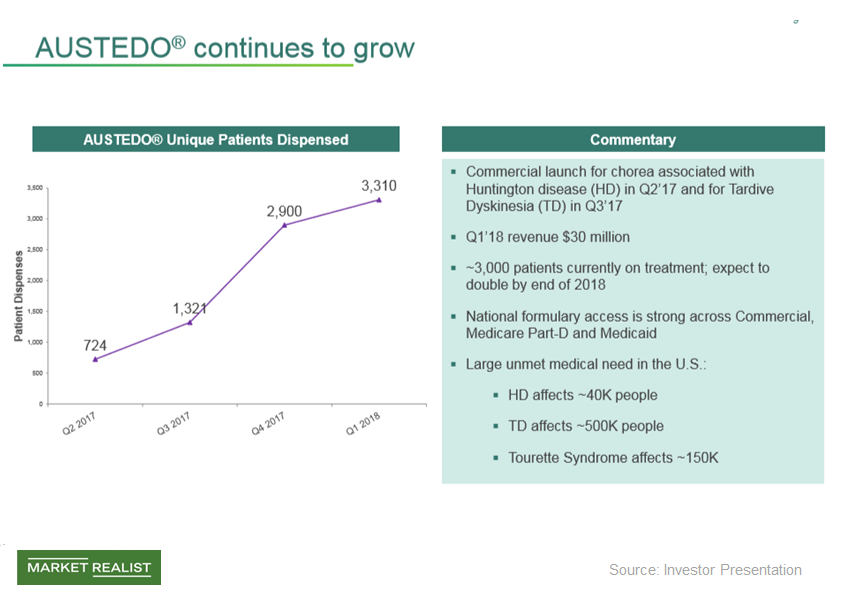

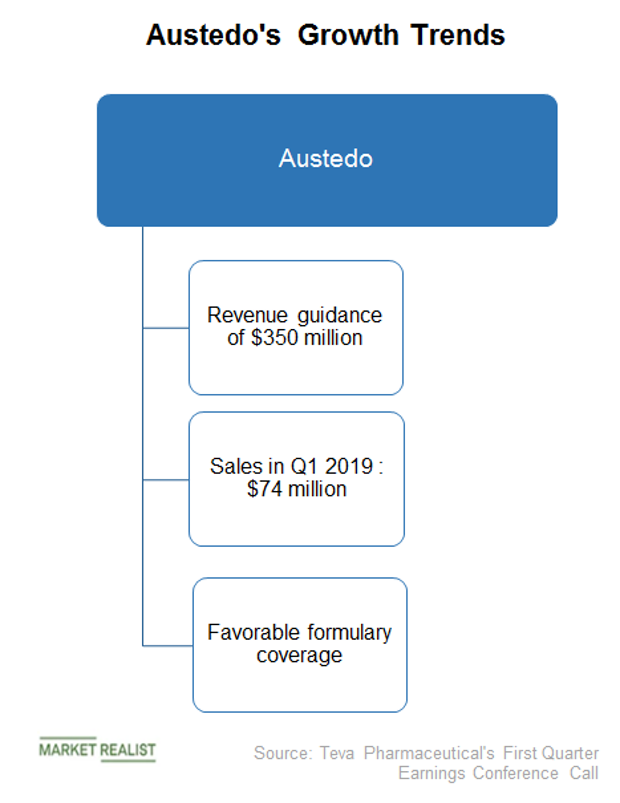

Teva’s Austedo Sales Continue to Gain Momentum in 2018

In 1Q18, Teva Pharmaceutical (TEVA) reported sales of $30 million from the sales of its Austedo drug.

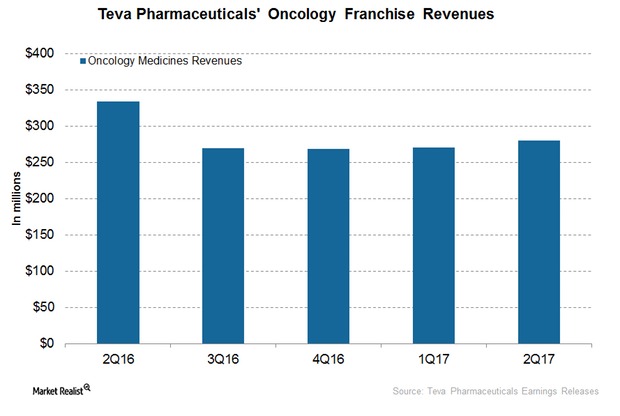

The Latest on TEVA’s Oncology Business

In 1H17, Teva Pharmaceutical’s (TEVA) oncology business generated revenues of ~$550 million, or ~9% lower YoY (year-over-year).

Teva Announces First-to-File Launch of Generic Cialis

Yesterday, Teva Pharmaceutical Industries (TEVA) announced the exclusive FTF (first-to-file) launch of the generic Cialis1 tablets in the US.

Expert Q&A: What to Know Before Investing in Generic Pharma? (Part 2)

(continued from Part 1) 4. What is the nature of the cash flows for generics companies? Stable, driven by a constant demand for prescription drugs? Or lumpy, driven by growth from drugs coming off patent? The larger companies in this sector tend to have stable, steadier cash flows due to established lineups of approved products. […]

Expert Q&A: What to Know Before Investing in Generic Pharma? (Part 1)

Market Realist analysts recently conducted a Q&A with experts from VanEck on the generic pharmaceutical industry, a space that has attracted investor interest due to upside potential from brand name drugs coming off patent, cost saving pressure in the healthcare industry, and increased worldwide demand for prescription drugs (for more on these topics, please see […]

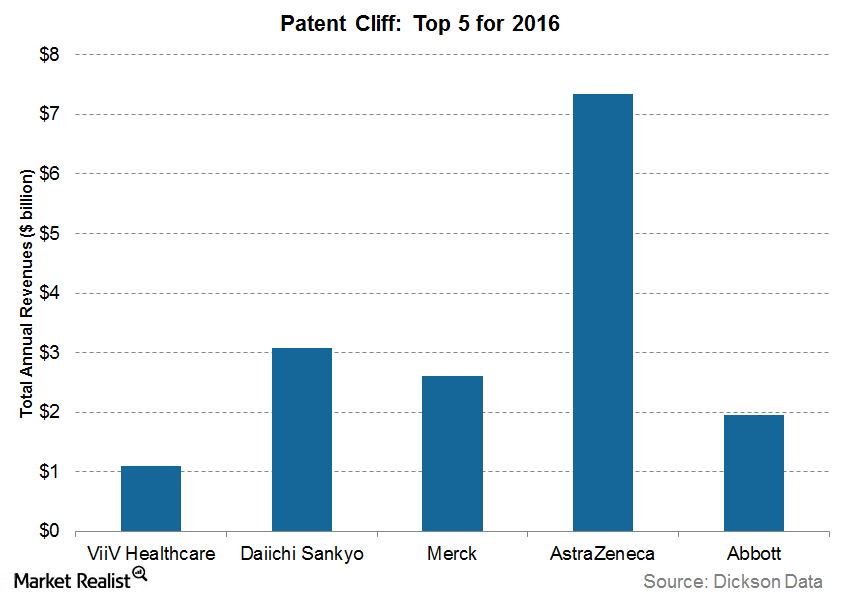

Why the Patent Cliff Is a Key Driver of Generic Drug Growth

Over the last several years, patent cliffs have led to steep revenue losses for traditional pharmaceuticals as well as created a gateway for smaller companies to come to market with generics.

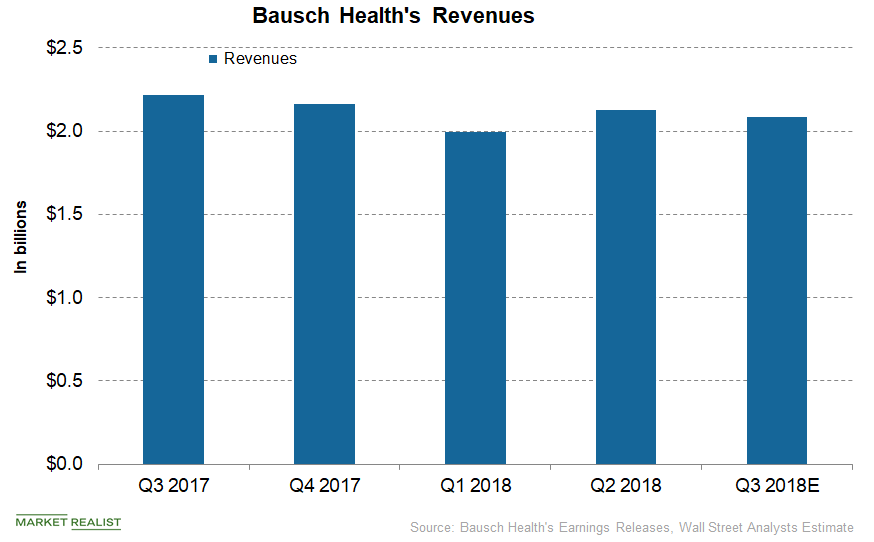

A Financial Overview of Bausch Health in October

Bausch Health’s (BHC) net revenues declined from $4.3 billion in H1 2017 to $4.1 billion in H1 2018, reflecting an ~5.0% year-over-year decline.

An Easier Way to Understand the Pharma Industry

In 2018, the global pharmaceutical industry stood at $1.2 trillion, and experts expect $1.5 trillion by 2023. Here’s everything investors need to know.

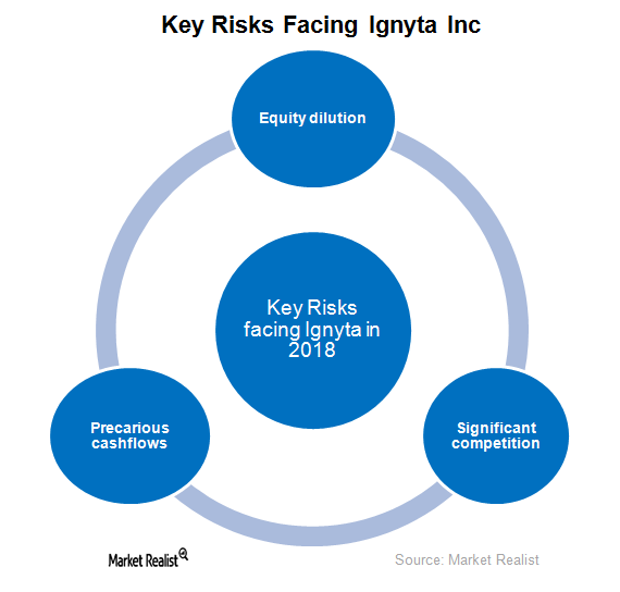

Ignyta and Its Key Risks in 2018

In October 2017, Ignyta (RXDX) raised $150 million by issuing 10 million shares of its common stock.

Ajovy and Austedo: Teva Pharmaceutical’s Growth Strategy

On April 2, Teva Pharmaceutical issued a press release announcing the European Union’s approval of its monthly and quarterly dosages of Ajovy for preventing migraines.

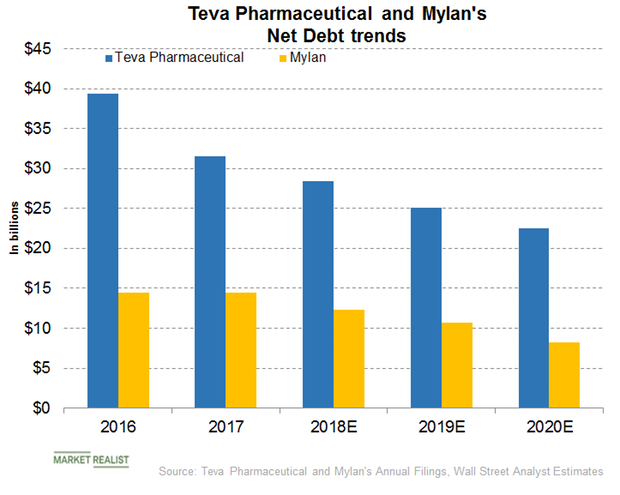

Teva Pharmaceutical or Mylan: Which Has the Better Debt Profile?

In the first nine months of 2018, Teva Pharmaceutical (TEVA) reduced its net debt level by $3.9 billion to $27.6 billion.

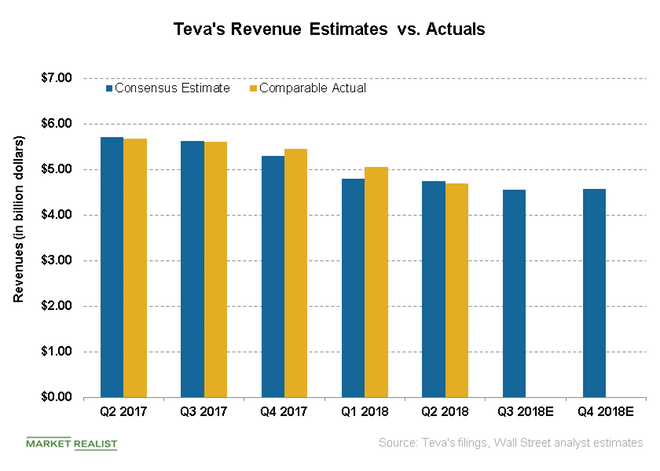

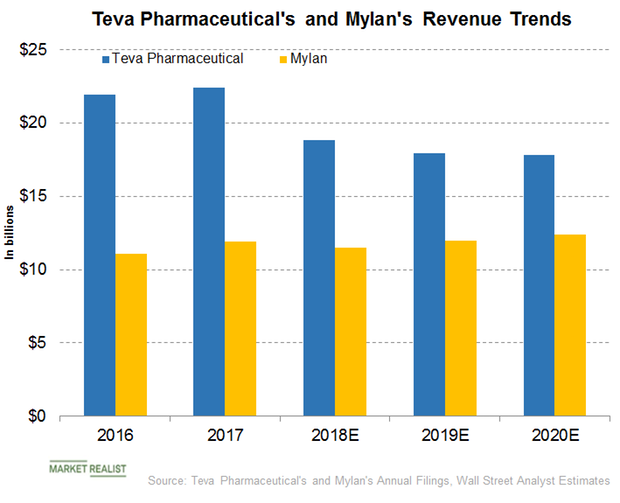

Teva or Mylan: Who Has the More Promising Revenue Trajectory?

In its third-quarter earnings investor presentation, Teva Pharmaceutical (TEVA) forecast total 2018 revenue in the range of $18.6 billion–$19.0 billion.

Ajovy Is a New Growth Driver for Teva Pharmaceutical

On September 14, Teva Pharmaceutical (TEVA) issued a press release announcing FDA approval of humanized monoclonal antibody and anti-calcitonin gene-related peptide (or CGRP) therapy.

Jazz Pharmaceuticals: How Are Xyrem and Erwinaze Positioned?

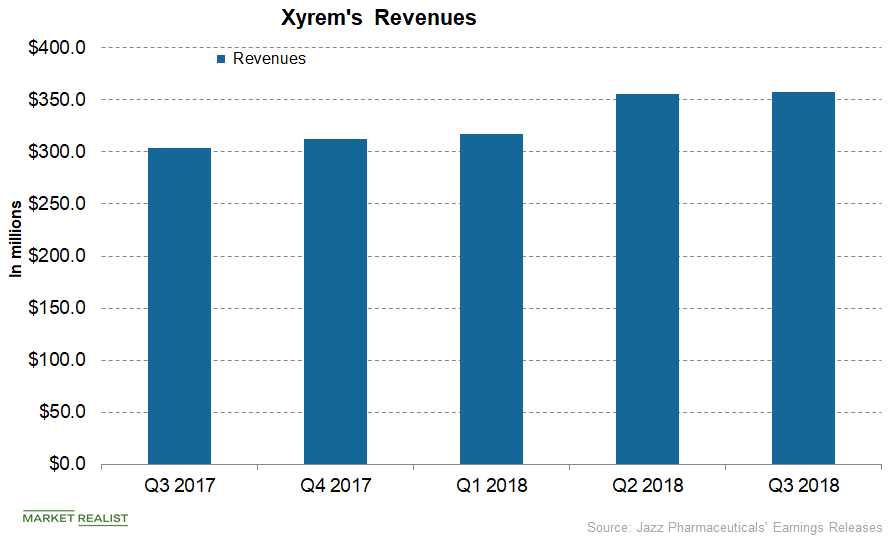

Jazz Pharmaceuticals’ Xyrem generated revenues of $357.3 million in the third quarter—compared to $303.9 million in the third quarter of 2017.

What Are Pfizer’s Revenue Drivers?

Pfizer reported revenues of $13.5 billion during the second quarter—4% growth YoY compared to $12.9 million during the second quarter of 2017.

How Amgen’s Nplate, Vectibix, and Neupogen Performed in 1Q18

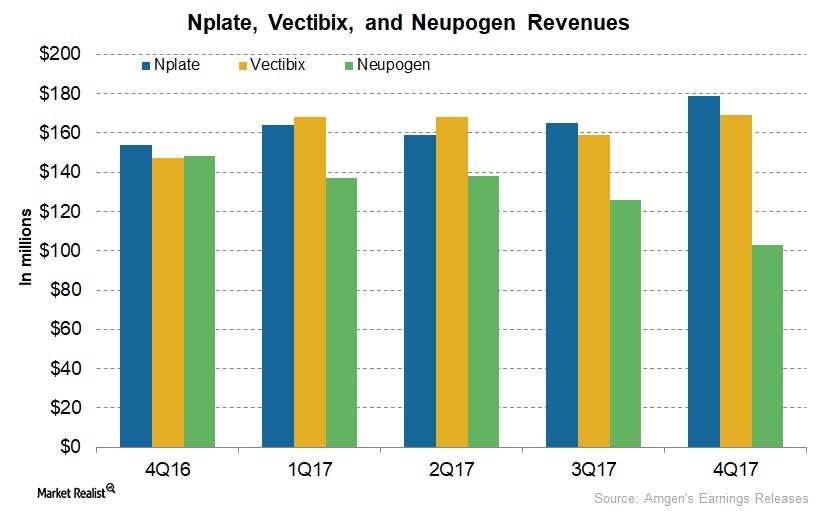

In 1Q18, Amgen’s (AMGN) Nplate revenue grew 16% YoY (year-over-year) to $179 million from $154 million, primarily driven by unit demand.

How Is Novartis’s Xolair Positioned after 4Q17?

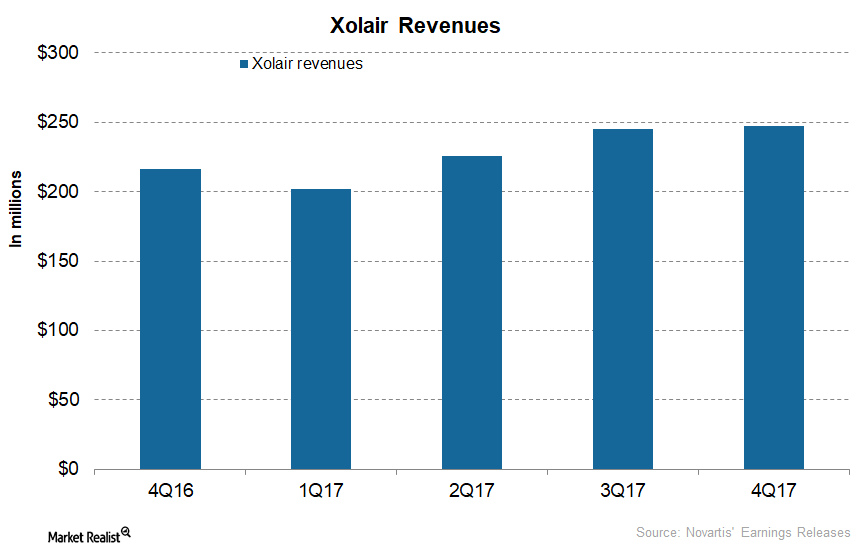

In 4Q17, Novartis’s (NVS) Xolair generated revenues of $247 million, which reflected ~14% growth on a year-over-year (or YoY) basis and ~1% growth on a quarter-over-quarter basis.

Teva’s Recent Launch of Generic Solodyn: What You Need to Know

On February 20, 2018, Teva Pharmaceutical announced the US launch of the generic version of Solodyn Extended Release tablets in two strengths.

How the Market Reacted to Teva’s Pricing of Its Generic Syprine

On February 9, 2018, Teva Pharmaceuticals (TEVA) announced the US launch of its generic version of 250 mg Syprine capsules.

Trelegy Ellipta May Emerge as Major Growth Driver for GlaxoSmithKline

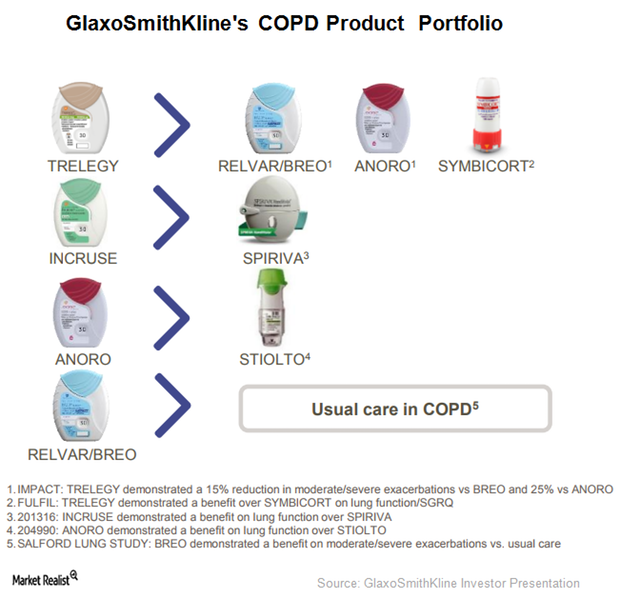

Trelegy Ellipta could enable GlaxoSmithKline to compete aggressively with other respiratory players such as Novartis (NVS).

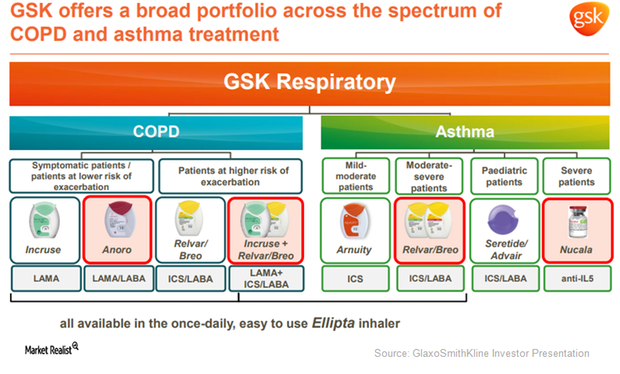

Anoro Ellipta May Boost GlaxoSmithKline’s Respiratory Franchise Revenues

Anoro Elipta earned revenues of close to 233 million pounds in the first nine months of 2017, which is 77% year-over-year (or YoY) growth on a reported basis and 63% YoY growth on a constant exchange rate (or CER) basis.

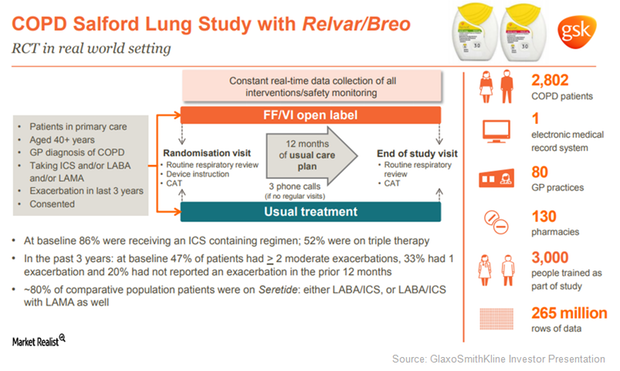

GlaxoSmithKline Is Focused on Maintaining Leadership in This Segment

To maintain its leadership in the chronic obstructive pulmonary disease (or COPD) segment, GlaxoSmithKline (GSK) has focused on shifting patients away from LAMA monotherapy to its LAMA/LABA bronchodilators.

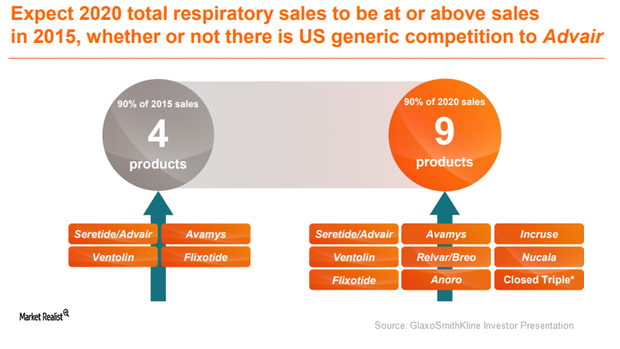

GlaxoSmithKline Has Developed a Broad Respiratory Portfolio

In 3Q17, GlaxoSmithKline (GSK) reported revenues close to 1.6 billion pounds from the sale of its respiratory products, which is year-over-year (or YoY) growth of 1% on a reported basis.

How Is Novartis’s Subsidiary Sandoz Positioned for 2018?

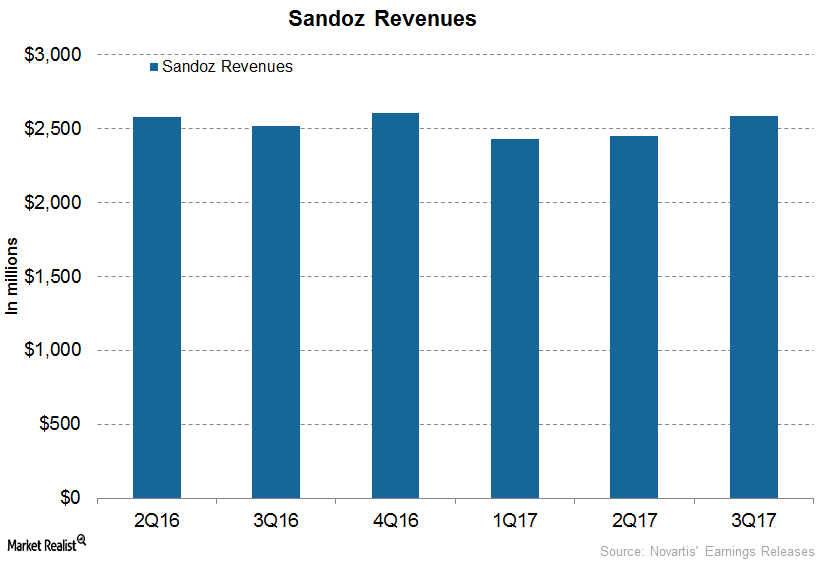

In 1Q17, 2Q17, and 3Q17, Novartis’s (NVS) subsidiary Sandoz generated revenues of $2.4 billion, $2.5 billion, and $2.6 billion, respectively.

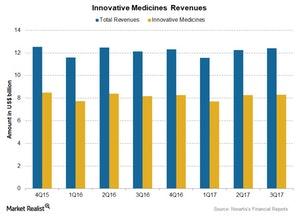

Behind Novartis’s 4Q17 Estimates: Innovative Medicines

The Innovative Medicines segment is expected to report growth in operating revenues for 4Q17.

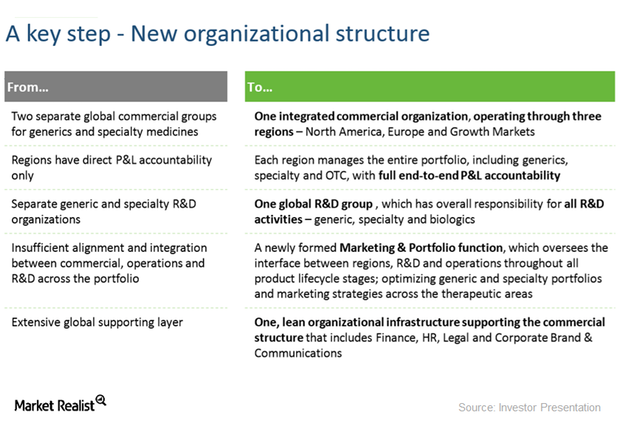

How Teva Pharmaceutical Is Realigning Organizational Structure

On December 14, 2017, Teva Pharmaceutical Industries (TEVA) announced its restructuring plan to cut costs by ~$3 billion over the next two years.

What to Expect from Roche’s Investigational Drug Polatuzumab Vedotin

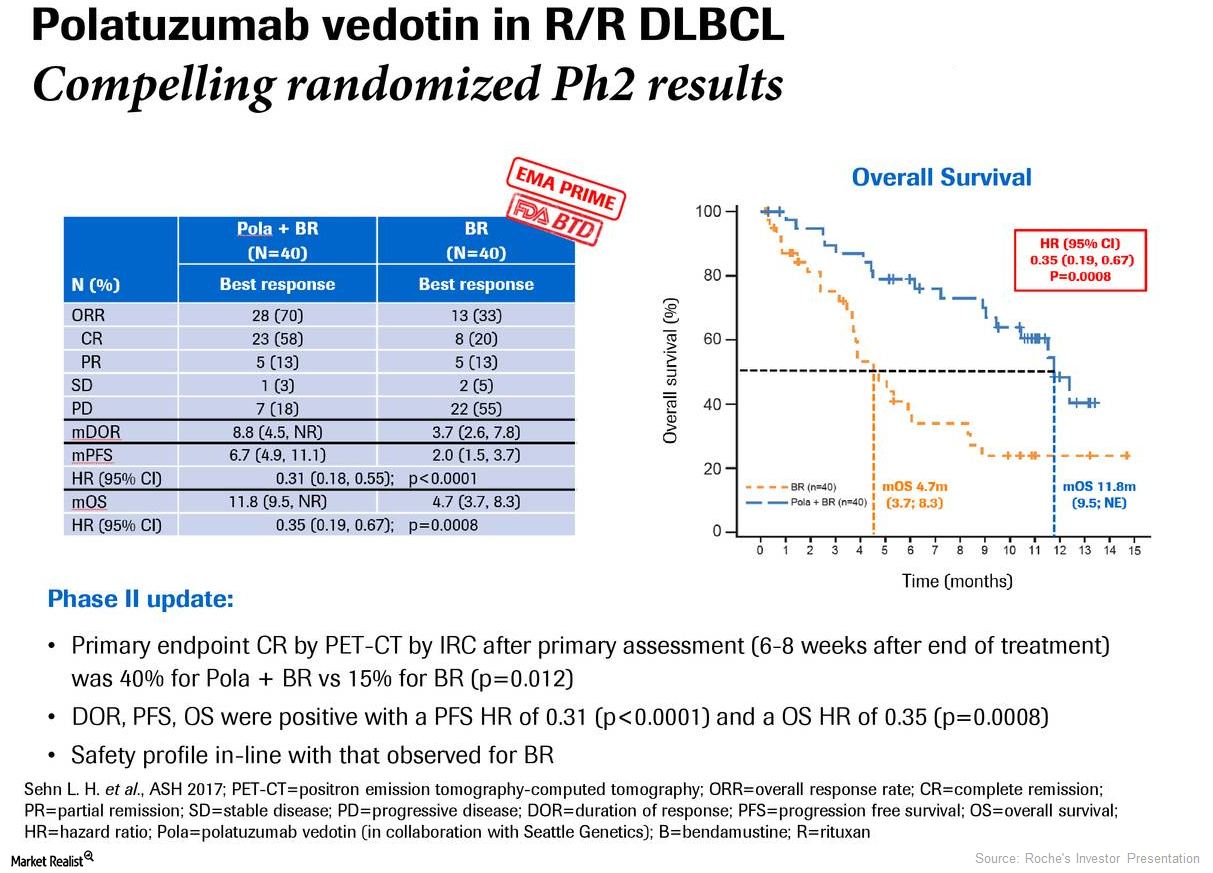

In December 2017, Roche (RHHBY) presented the results of its randomized phase two GO29365 trial.

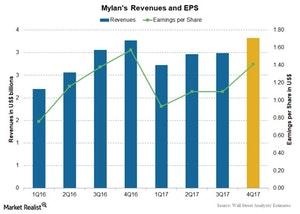

Mylan’s Valuation in January 2018

Mylan (MYL) is a leading pharmaceutical company with over 1,400 generic and specialty pharmaceutical products in its portfolio.

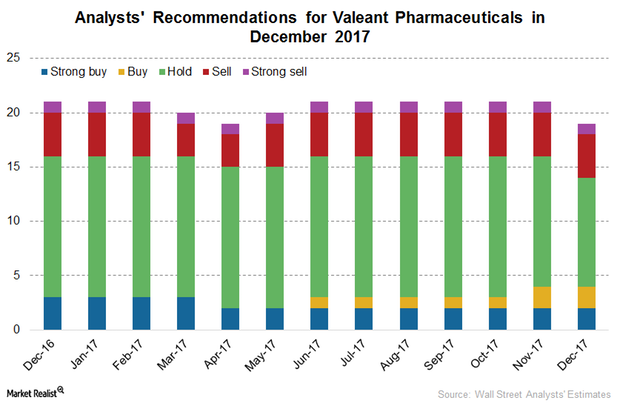

Valeant on the Street: Analyst Recommendations in December 2017

Of the 19 analysts tracking Valeant Pharmaceuticals in December 2017, two recommended a “strong buy,” while another two of recommended a “buy.”

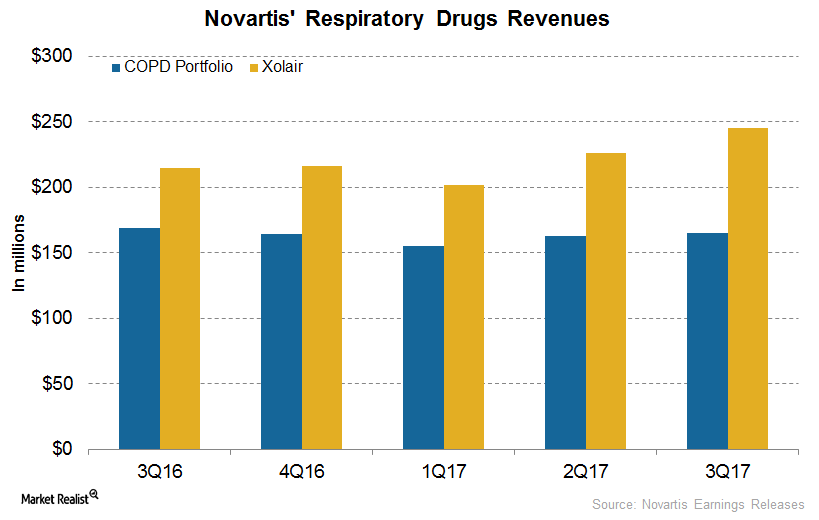

Behind Novartis’s Respiratory Drug Performance in 3Q17

In 3Q17, Novartis’s COPD (Chronic Obstructive Pulmonary Disorder) portfolio reported revenues of $165 million, which with ~2% higher YoY and 1% higher QoQ.

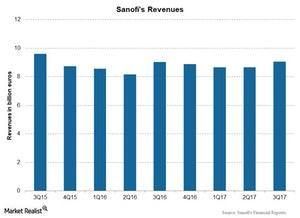

Behind Sanofi’s 3Q17 Revenue Growth

Sanofi (SNY) reported a growth of 4.7% in revenues at constant exchange rates to 9.05 billion euros, compared with 9.03 billion euros in 3Q16.

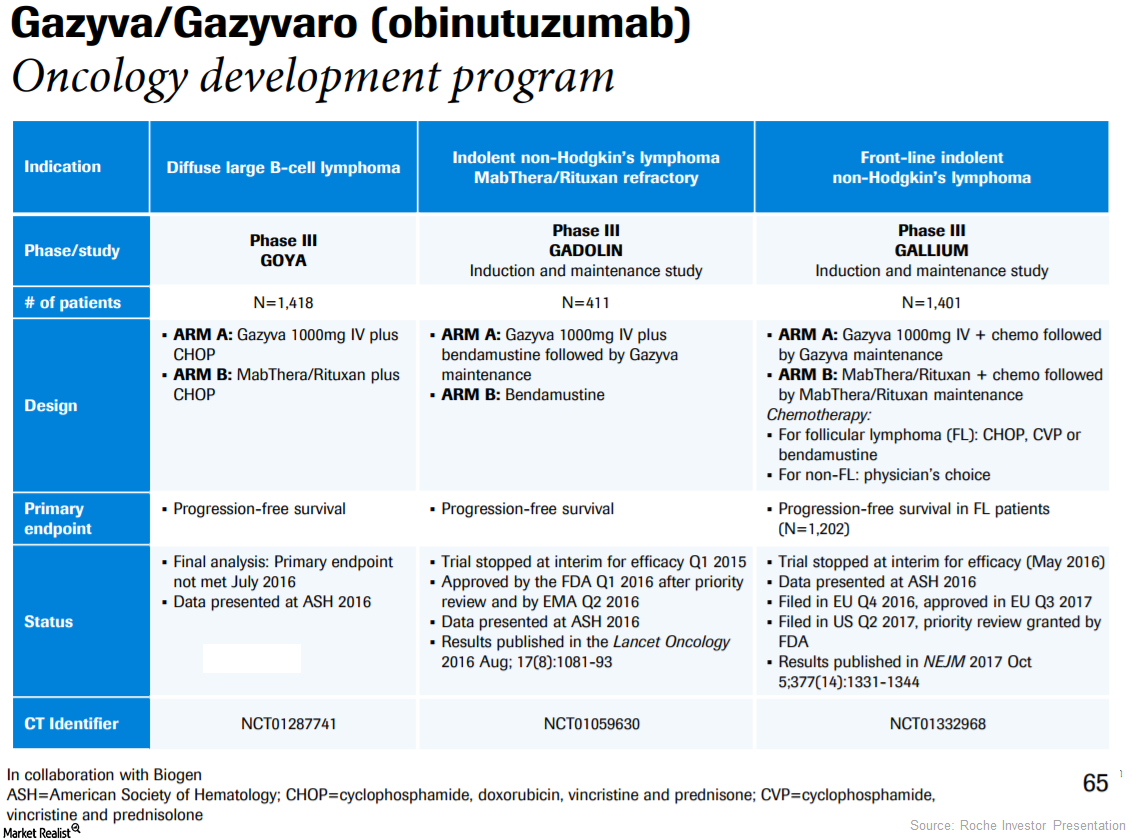

How Roche’s Oncology Drug Gazyva Is Positioned after 3Q17

In 3Q17, Roche’s (RHHBY) Gazyva generated revenues of 69 million Swiss francs, which reflected ~34% growth on a year-over-year (or YoY) basis.

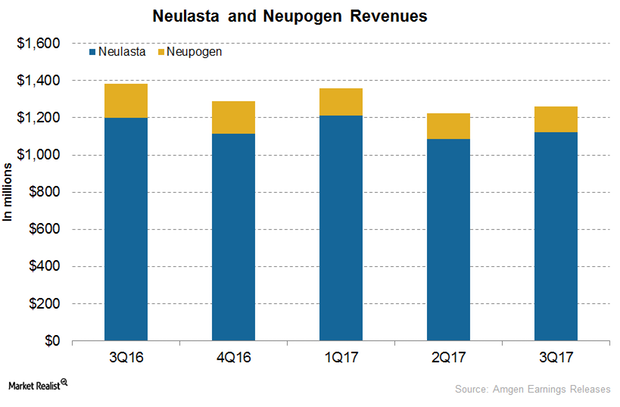

How Did Amgen’s Neulasta and Neupogen Perform in 3Q17?

In 3Q17, Amgen’s (AMGN) Neulasta generated revenues of around $1.1 billion, a ~6% decline on a year-over-year (or YoY) basis and ~3% growth on a quarter-over-quarter basis.

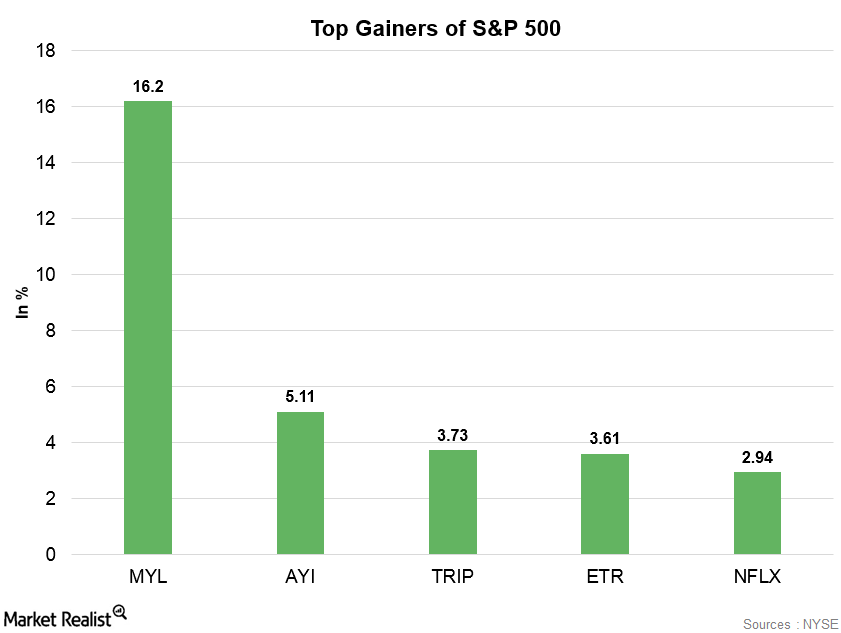

Mylan: S&P 500’s Top Gainer on October 4

Mylan, which is one of the leading global pharmaceutical companies in the world, was the S&P 500’s top gainer on October 4.

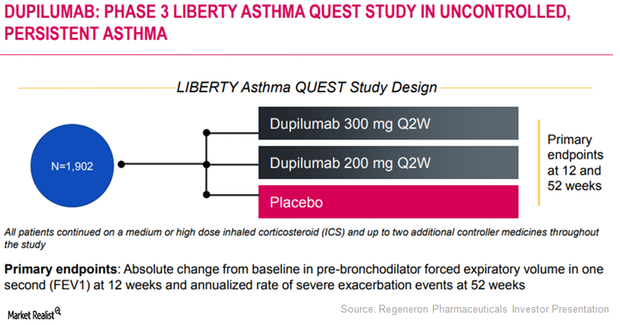

Regulatory Approval in Asthma Indication May Boost Dupixent’s Sales

In June 2017 and July 2017, healthcare providers wrote prescriptions for Regeneron (REGN) and Sanofi’s (SNY) Dupixent for 750 new patients on a weekly basis.

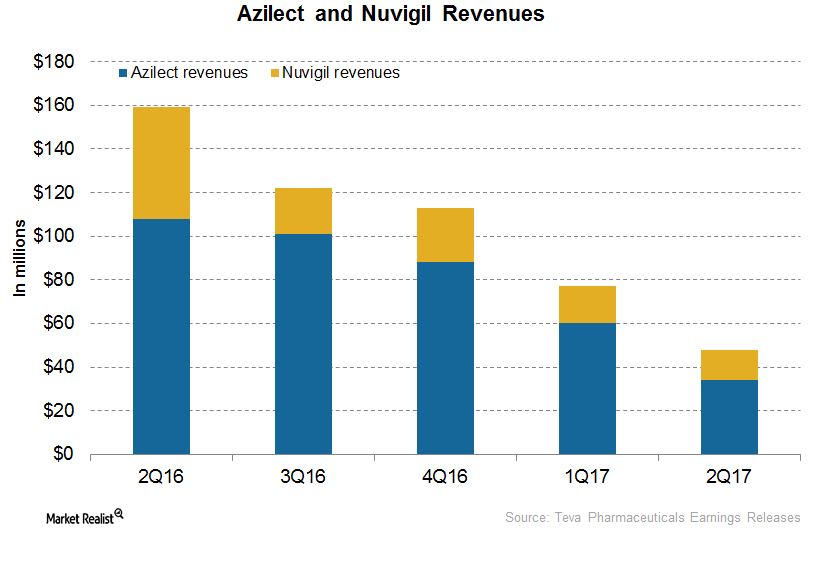

How TEVA’s CNS Drugs Performed in 1H17

In 1H17, Teva Pharmaceutical’s (TEVA) CNS (central nervous system) business generated revenues of ~$2.3 billion, or ~16% lower YoY (year-over-year).