Teva Pharmaceutical Industries Ltd

Latest Teva Pharmaceutical Industries Ltd News and Updates

What’s Allergan’s Growth Strategy?

Allergan’s new industry model, “growth pharma,” is based on identifying five characteristics that boost company growth and differentiate it from its peers.

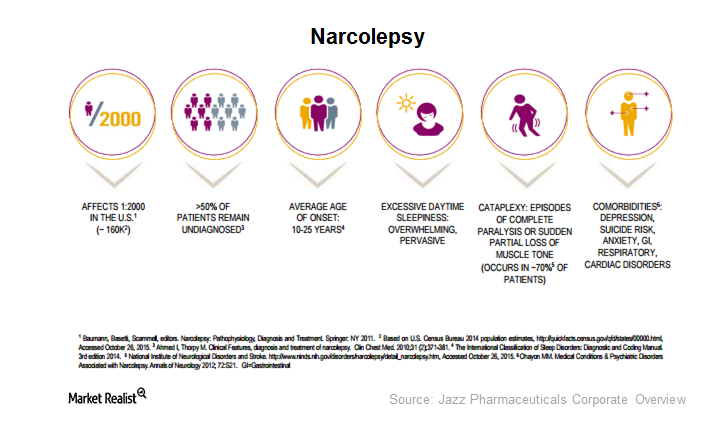

Can Xyrem Maintain Leadership in the Narcolepsy Space?

Jazz Pharmaceuticals’ (JAZZ) Xyrem is a drug for cataplexy and excessive daytime sleepiness occurring in patients with narcolepsy, a serious orphan disease.

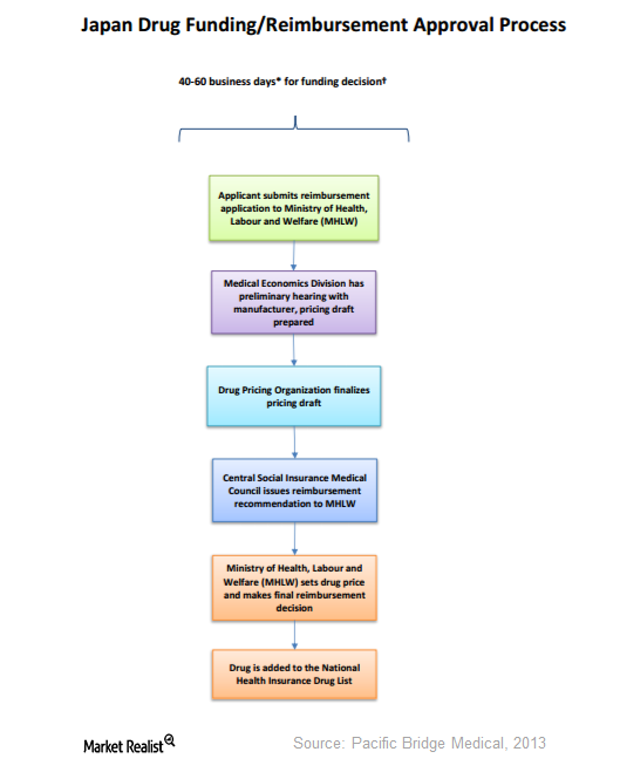

How Are Drugs Priced in Japan?

The NHI revises drug prices every two years. During fiscal 2016, a 6.8% reduction in drug prices is expected.

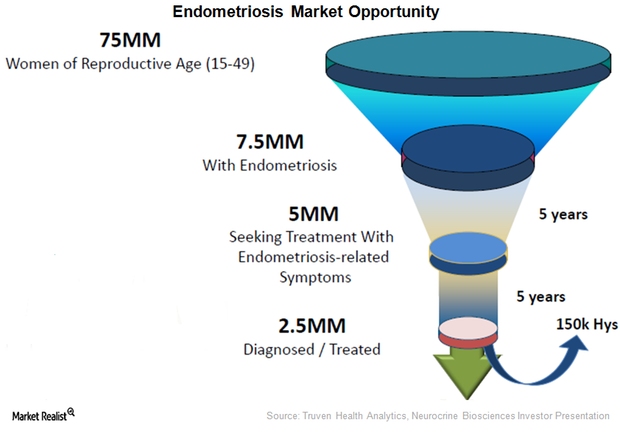

Will Elagolix Make Neurocrine Biosciences a Key Women’s Health Name?

If approved, Elagolix could present fierce competition for existing drugs like Teva Pharmaceuticals’ (TEVA) Aygestin and Astrazeneca’s (AZN) Zoladex.

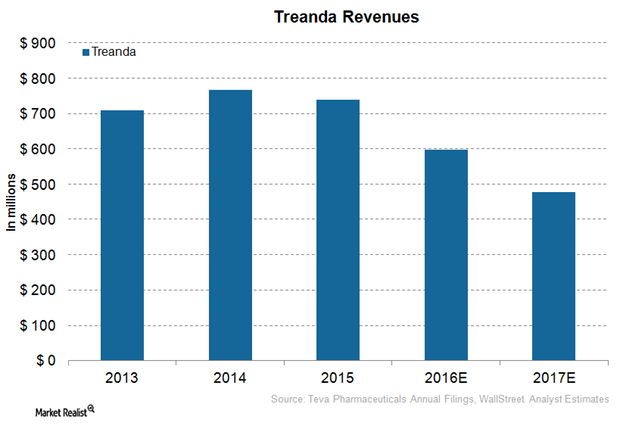

Bendeka: How Teva Plans to Safeguard Oncology Revenues

In the first quarter of 2016, Teva Pharmaceutical Industries (TEVA) launched a new drug, Bendeka, in partnership with Eagle Pharmaceuticals.

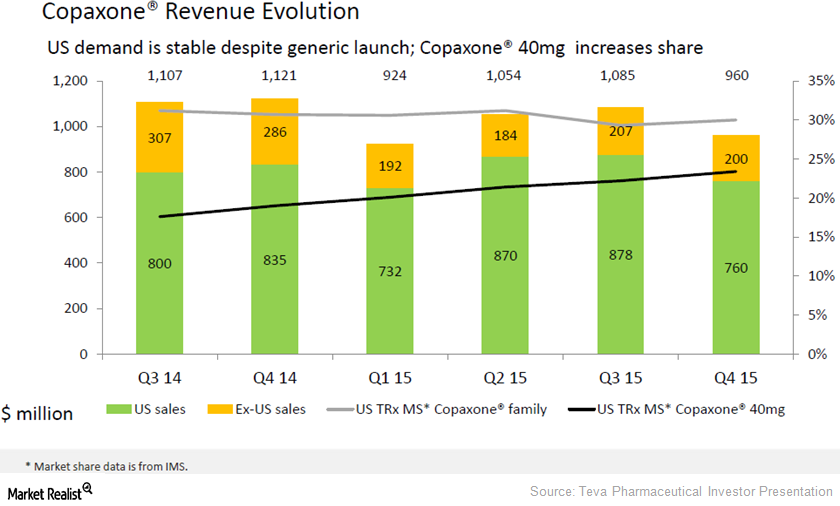

How Could Generic Competition Affect Copaxone’s Revenues in 2016?

Wall Street analysts have projected that Teva Pharmaceutical Industries (TEVA) will earn about $3.5 billion in revenues from Copaxone sales in 2016

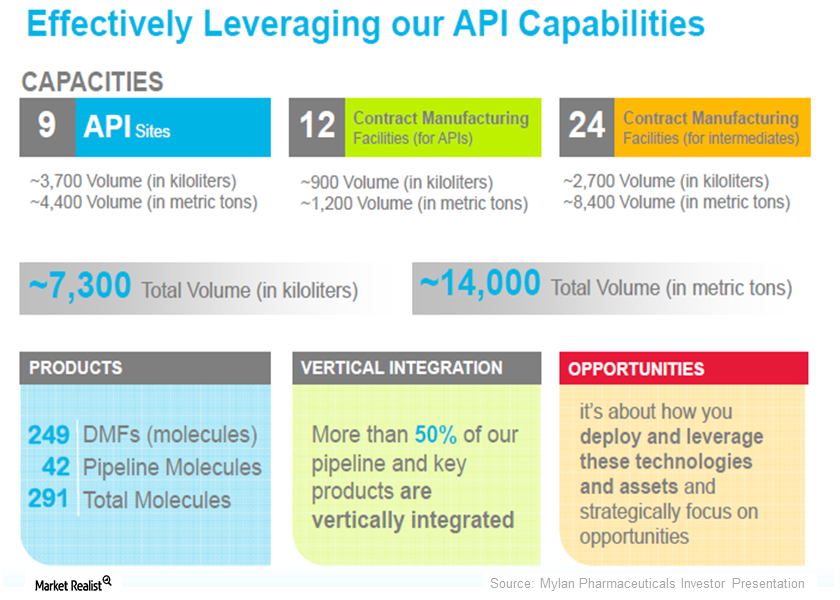

How Has Manufacturing Its Own Active Pharmaceutical Ingredients Helped Mylan?

Mylan is one of largest API (active pharmaceutical ingredient) manufacturers in the world, with nine API and intermediate manufacturing facilities.

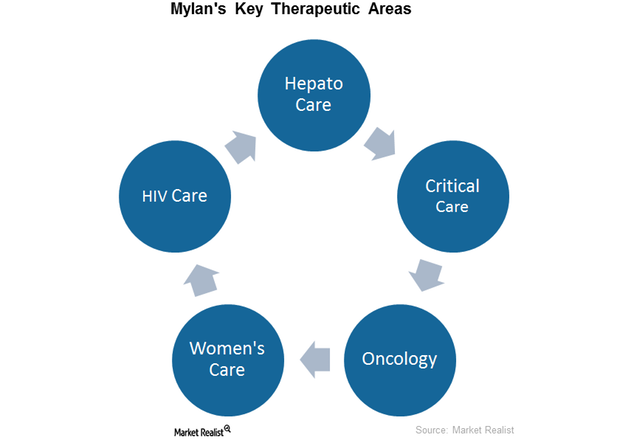

Mylan Product Portfolio across Key Therapeutic Areas

Mylan is a leading pharmaceutical company that operates in more than 140 countries and operates across five different therapeutic areas.

Pfizer-Allergan Deal: Pfizer Will Combine with Allergan

On November 23, two of the big pharmaceutical companies—Pfizer and Allergan—announced the biggest merger transaction ever in pharmaceuticals.

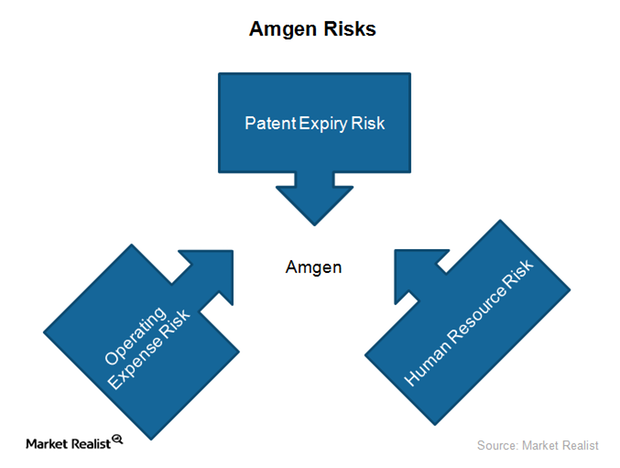

Amgen’s Key Risks

Amgen’s key risks include market erosion due to generic competition for Neulasta and Neupogen. Its restructuring also involves a reduction of about 3,500–4,000 employees.

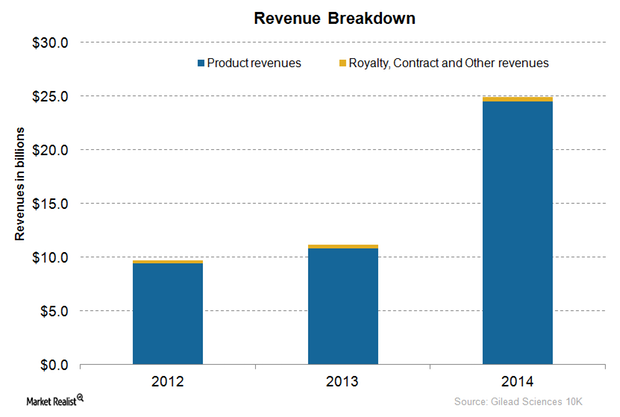

An Overview of Gilead Sciences’ Business Model

Gilead Sciences’ business model consists of product sales in the HIV and HCV markets, as well as royalty, contract, and other revenues.

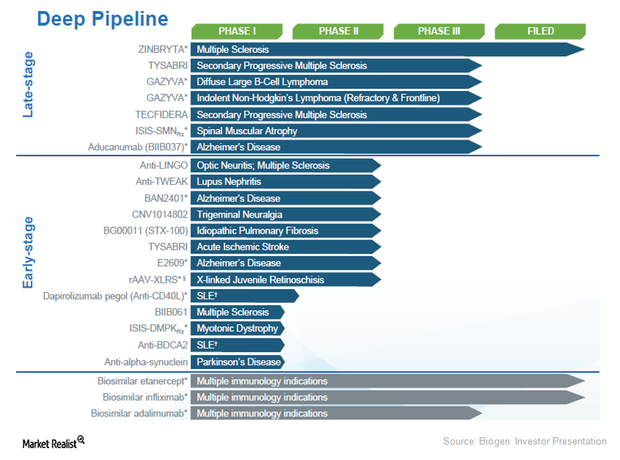

Biogen: Positive 2Q15 Results for Multiple Sclerosis Pipeline Drugs

In 2Q15, Biogen (BIIB) posted mixed results for its pipeline drugs. Investor sentiment remained favorable for its innovative multiple sclerosis (or MS) drugs.

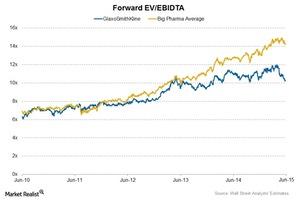

Comparing GlaxoSmithKline with Its Peers

Pharmaceutical companies like GlaxoSmithKline are capital-intensive, with high debt on their balance sheets due to heavy setup costs and huge research and development expenses.

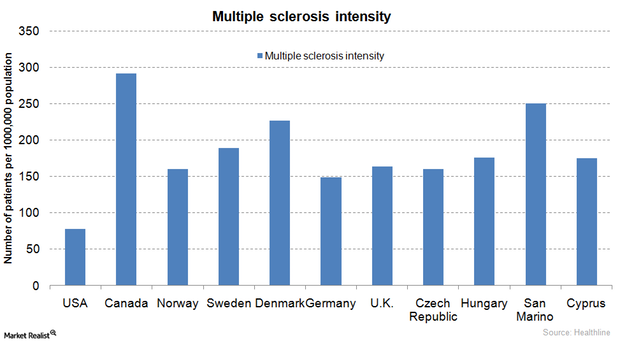

The Biotechnology Industry and Multiple Sclerosis Therapies

Most multiple sclerosis drugs are very costly at about $55,000 per year. The FDA’s April 2015 approval of a generic version of Copaxone is expected to lower the overall price of the therapy.

Patents and the Biotechnology Sector

The biotechnology industry will witness 12 blockbuster drugs worth $67 billion in annual revenues lose their patents by 2020. This is the so-called patent cliff.

AstraZeneca’s Position Compared to Its Peers

The forward EV/EBIDTA multiple for AstraZeneca is ~13x, which is slightly lower than the industry average of ~14x.

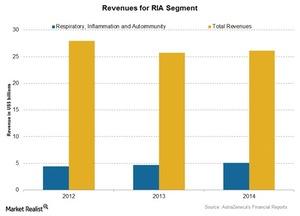

AstraZeneca’s Respiratory, Inflammation, and Autoimmunity Segment

The respiratory, inflammation, and autoimmunity (or RI&A) franchise contributed nearly 19.2% of AstraZeneca’s (AZN) total assets in 2014.

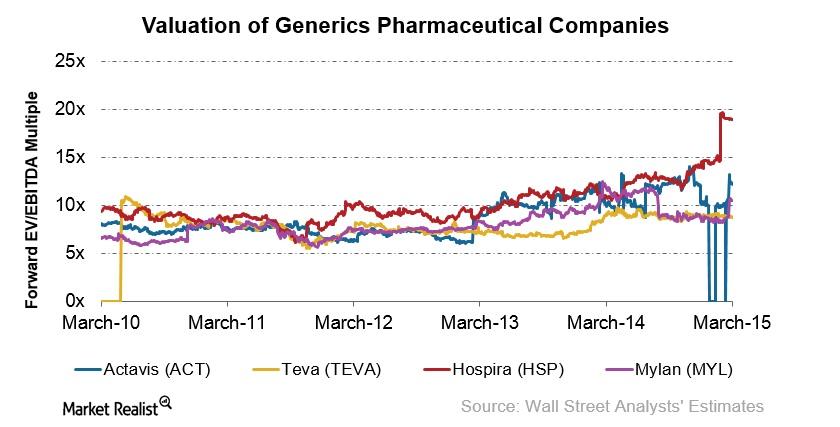

How Actavis Has Emerged through Mergers and Acquisitions

In October 2012, Actavis completed the acquisition of Actavis Group. In 2013, the company’s revenues outside the US increased to 29% from 16% in 2012.

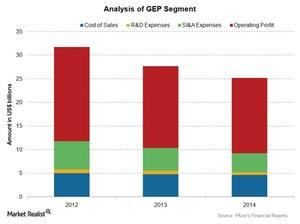

Pfizer’s Global Established Pharmaceutical Segment

The Global Established Pharmaceutical segment deals with products that have or are expected to lose market exclusivity through 2015 in most major markets.

What Drives Generic Pharmaceuticals’ Valuation?

Valuation reflects the market’s perceptions of the industry’s growth prospects. The major value drivers for valuation are ROIC and the growth rate.

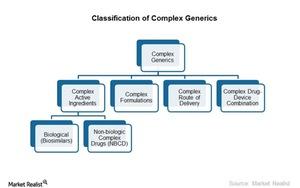

Complex Generics Are Attractive Due to High Margins

Complex generics are large and complex formulations or active ingredients used to treat chronic and life threatening diseases like cancer, Hepatitis C, and HIV.

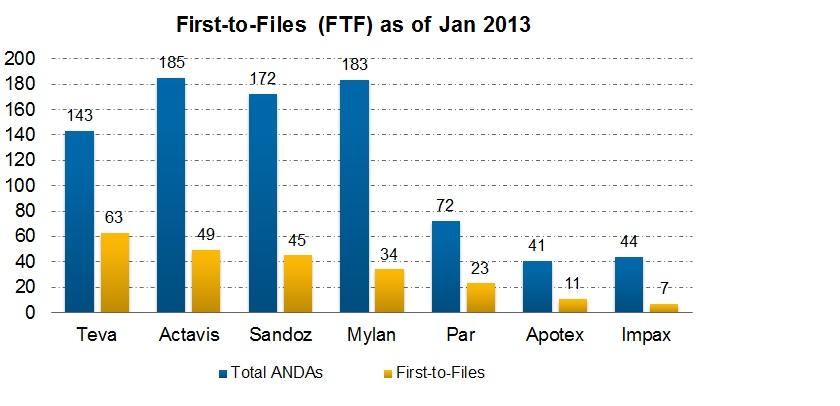

Is a Para IV Filing Rewarding for a Generic Company?

A generic company is rewarded for a Para IV filing. The first applicant to submit a substantially completed ANDA is given marketing exclusivity for 180 days.

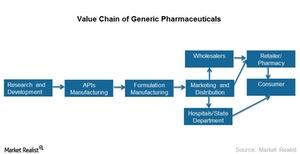

Generics Are Climbing up the Value Chain

Severe cost pressure can lead to the commoditization of generics. it’s important to adjust the value chain to achieve higher efficiencies, flexibility, and reliability.

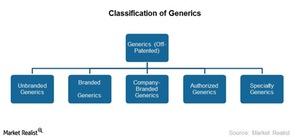

Why the Generic Industry’s Classification Is Still Evolving

The generics industry primarily caters to several large diseases in primary care. Healthcare is organized into three categories—primary, secondary, and tertiary.

Are Generics the Only Affordable Drugs?

Drugs are used to treat, cure, or prevent diseases. The drug market is broadly categorized into prescription drugs and OTC (over-the-counter) drugs.

What Investors Need to Know about Branded and Generic Drugs

The prescription drug market is divided into two categories—branded or generic drugs. Branded drugs are patented drugs. Generics are off-patented drugs.

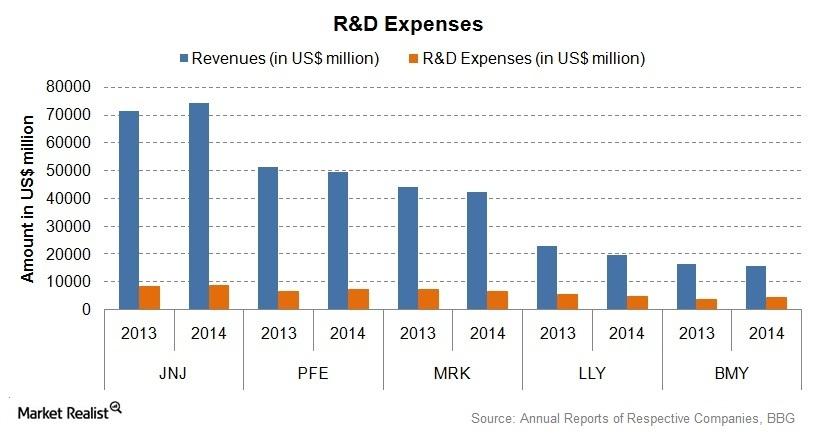

Johnson & Johnson Invested in Research and Development

For a big pharma company like Johnson & Johnson (JNJ), research and development plays a vital role in maintaining a healthy revenue stream.

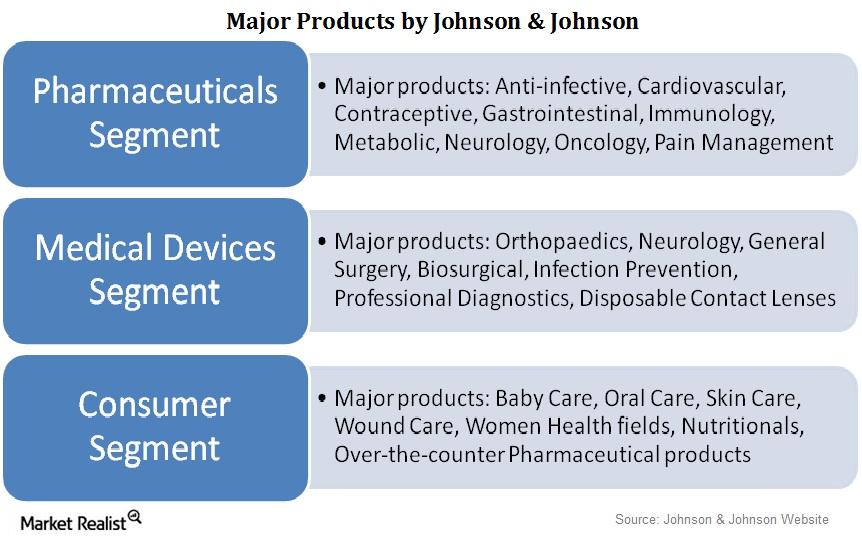

Analyzing Johnson & Johnson’s Three Main Business Segments

Over a period of 128 years, Johnson & Johnson (JNJ) diversified its business into three business segments.