Changes in Johnson & Johnson’s Profit Margins in 4Q17

Johnson & Johnson’s gross profit margin decreased to 64.1% in 4Q17, a ~5% decrease compared to 69.1% in 4Q16.

March 8 2018, Updated 7:31 a.m. ET

Johnson & Johnson’s profit margins

Johnson & Johnson (JNJ) reported an 11.5% growth in revenues to ~$20.2 billion in 4Q17 compared to ~$18.1 billion in 4Q16. However, it reported a decrease in its gross profit margin and its net profit margin for 4Q17 compared to 4Q16.

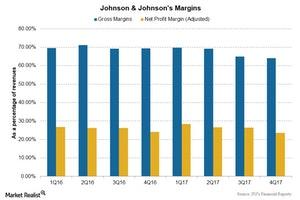

The above chart shows the profit margins for Johnson & Johnson since 1Q16. The details about each of them are discussed below.

Profit margins

Let’s look now at the changes in Johnson & Johnson’s profit margins in 4Q17. Its gross profit margin decreased to 64.1% in 4Q17, a ~5% decrease compared to 69.1% in 4Q16. The decrease in its gross profit margin was driven by the higher cost of products sold following the inclusion of new products in the product portfolio.

An increase in research and development expenses and an increase in selling, marketing, and administrative expenses also drove a lower net profit margin. Johnson & Johnson reported other income of ~$9 million in 4Q17 compared to expenses of ~$20 million in 4Q16. The adjusted net profit margin decreased to ~23.7% in 4Q17, a marginal decrease compared to ~24.1% in 4Q16. However, it reported a net loss of ~$10.7 billion in 4Q17 compared to ~$3.8 billion in 4Q16.

Financial guidance for 2018

Johnson & Johnson released its financial guidance for 2018 in January 2018. It estimates sales of $80.6 billion–$81.4 billion for 2018. That includes an operational increase of 3.5%–4.5% and a ~2% positive impact of foreign exchange. It also expects a negative impact of ~1% on revenues due to acquisitions and divestitures in 2018.

Adjusted EPS (earnings per share) is expected to be $8–$8.20 in 2018. The company also expects to improve its pre-tax operating margin by ~100 basis points during the year.

The Vanguard Healthcare ETF (VHT) has 10.3% of its total investments in Johnson & Johnson (JNJ), 2.7% in Bristol-Myers Squibb (BMY), 4.2% in Merck & Co. (MRK), and 2.6% in Gilead Sciences (GILD).