Gilead Sciences Inc

Latest Gilead Sciences Inc News and Updates

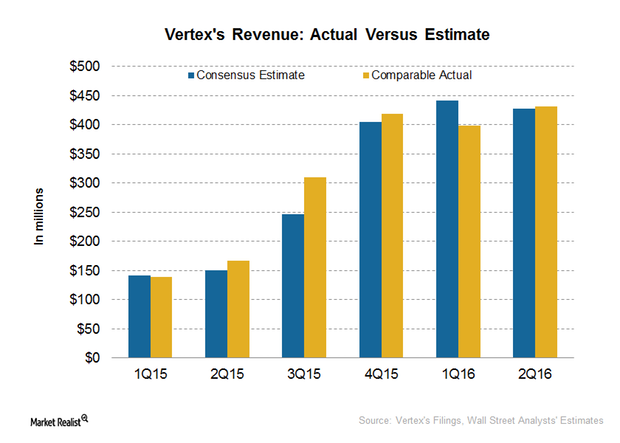

How Vertex’s Revenue and Earnings Surprised in 2Q16

Vertex Pharmaceuticals (VRTX) reported its 2Q16 earnings on July 27, 2016. VRTX surpassed Wall Street analysts’ projections and reported revenue of $431.6 million.

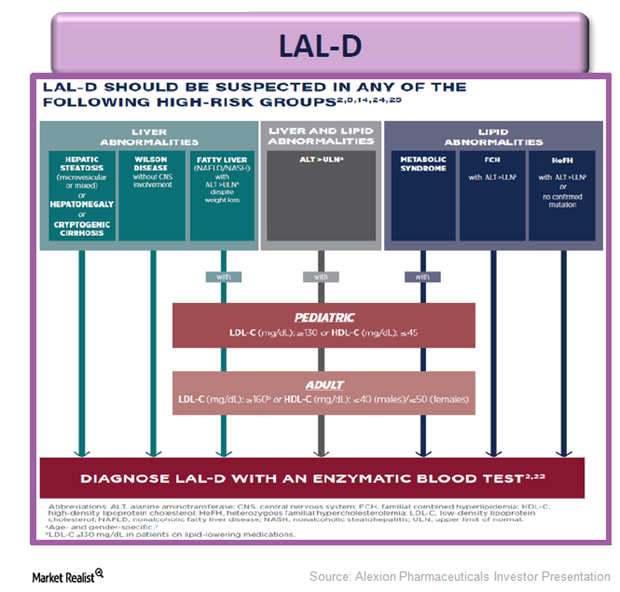

Alexion Pharmaceuticals Adds Metabolic Drug Kanuma to Portfolio

Kanuma was acquired by Alexion Pharmaceuticals on completion of the acquisition of Synageva Pharmaceuticals in June 2015.

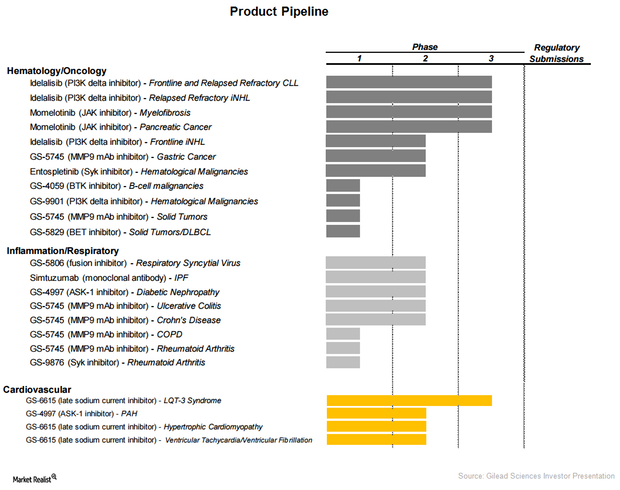

Gilead Sciences’ Product Line Extension

As part of its significant product line extension, Gilead Sciences (GILD) is entering therapeutic areas such as oncology, pulmonology, and cardiology.

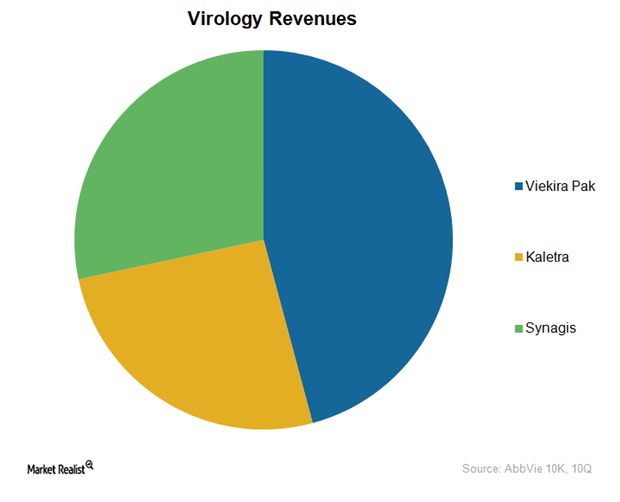

AbbVie Strengthens Its Position in the Virology Segment

In addition to Humira, AbbVie also offers several virology drugs targeting diseases such as hepatitis C, HIV, and respiratory syncytial virus.

What’s Gilead Sciences’ Valuation?

Gilead’s stock price has risen ~8.9% in the last 12 months. Wall Street analysts estimate that the stock price will fall ~4.5% over the next 12 months.

What Else Could Drive Gilead’s Long-Term Growth?

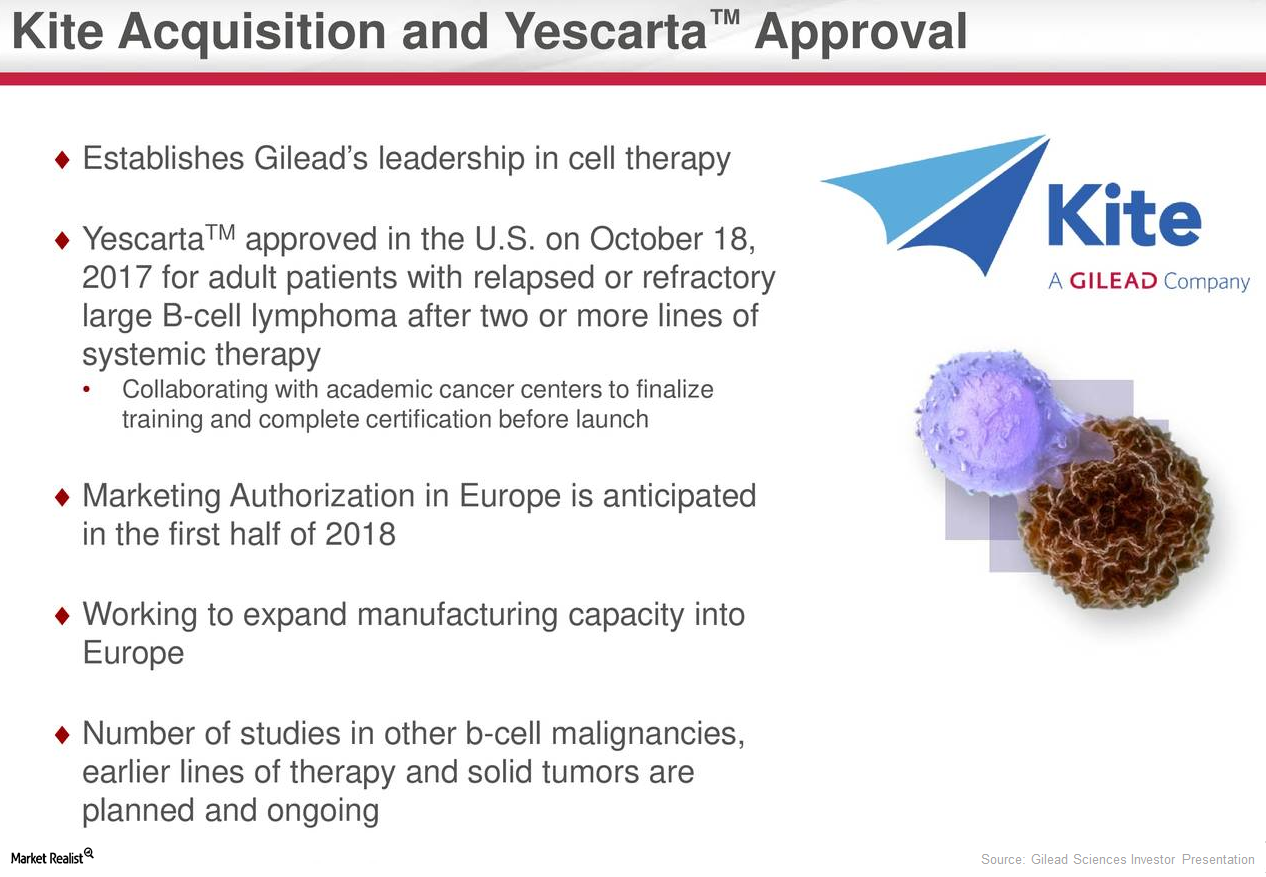

In December 2017, Kite, a Gilead Sciences (GILD) company, presented long-term follow-up data from its pivotal ZUMA-1 trial of Yescarta.

Allergan’s 1Q18 Earnings: Analysts’ Estimates

Allergan (AGN) plans to release its 1Q18 earnings on April 30. Wall Street expect AGN’s earnings per share to reach $3.36.

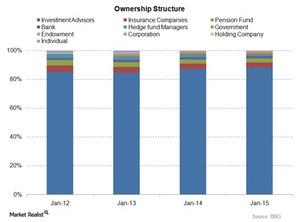

Understanding Johnson & Johnson’s Ownership Structure

As of January 2015, Johnson & Johnson’s ownership structure is dominated by passive investments. They account for more than 80% of the total ownership structure.

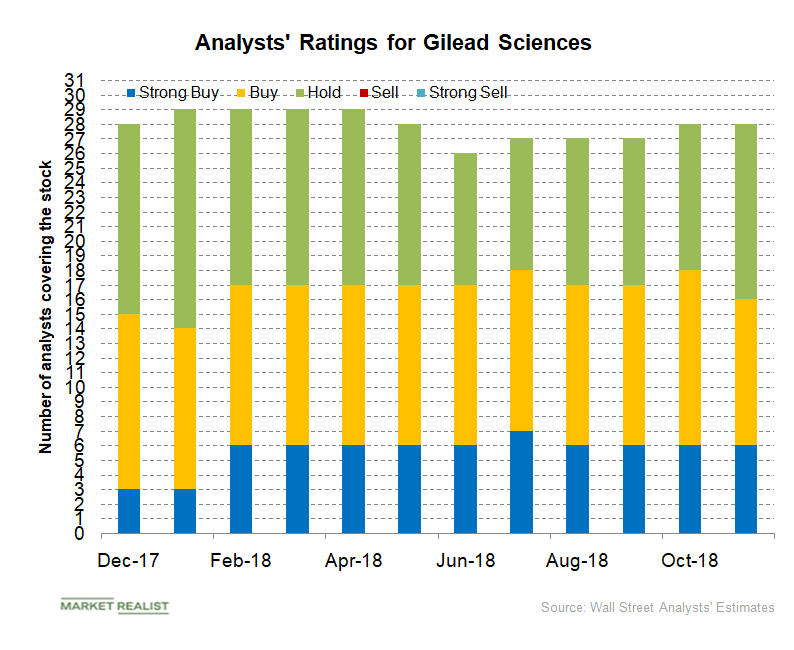

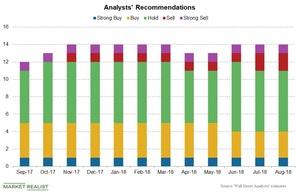

Gilead Sciences: Analysts’ Recommendations

In November, six analysts recommended a “strong buy,” ten recommended a “buy,” and 12 recommended a “hold” for Gilead Sciences.

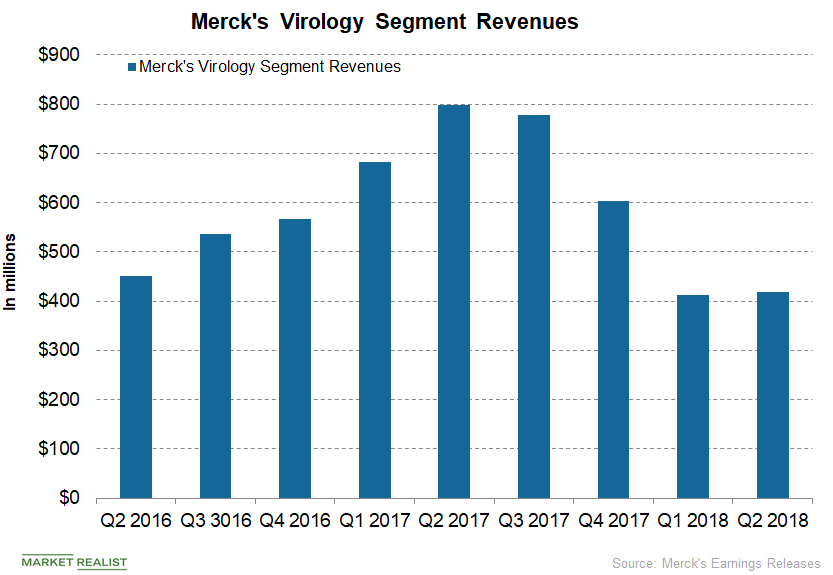

Delstrigo, Pifeltro, and Merck’s Antiviral Therapy Portfolio

Gilead Sciences’ Atripla, Genvoya, and Stribild generated revenues of $663.0 million, $2.2 billion, and $361.0 million, respectively, in the first half of 2018.

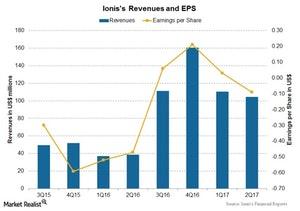

Analysts Have Mixed Opinions about Ionis

Wall Street analysts estimate that Ionis’s (IONS) Q2 2018 revenues will rise ~30.0% to $135.5 million as compared to $104.2 million in Q2 2017.

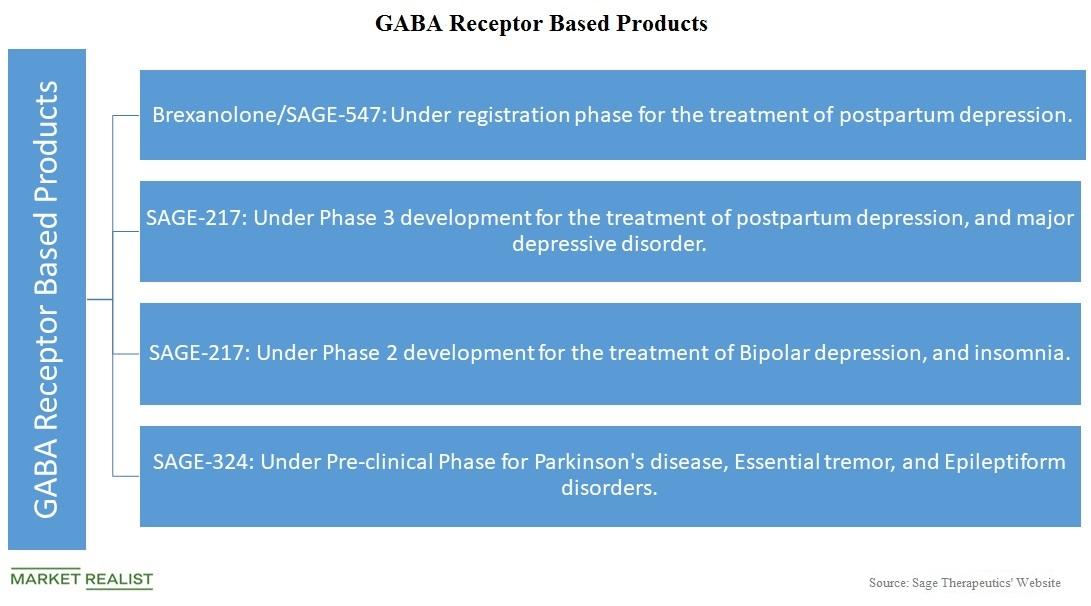

Sage Therapeutics’ GABA Receptor–Based Products

On June 12, Sage Therapeutics announced its expedited development plan for SAGE-217.

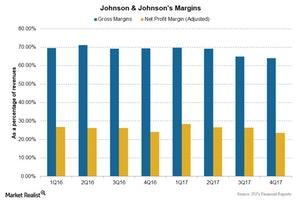

Changes in Johnson & Johnson’s Profit Margins in 4Q17

Johnson & Johnson’s gross profit margin decreased to 64.1% in 4Q17, a ~5% decrease compared to 69.1% in 4Q16.

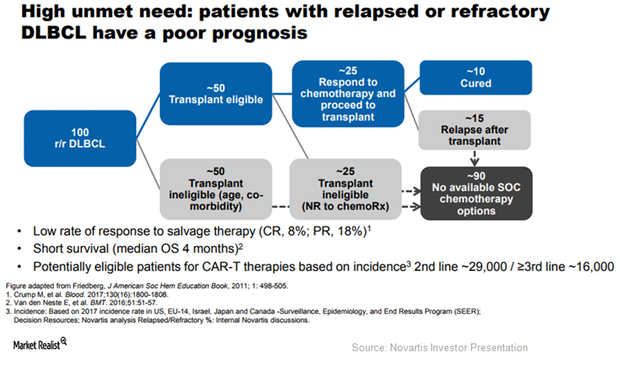

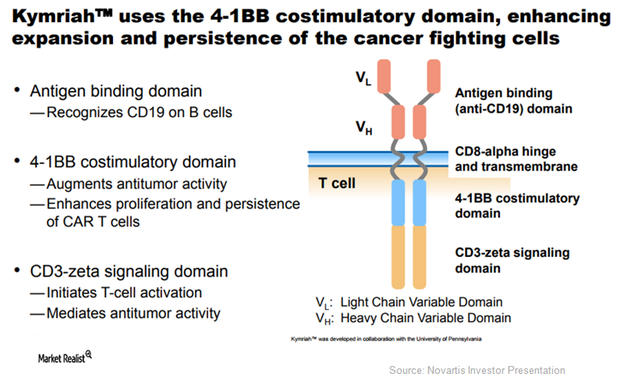

Kymriah May Emerge as a Robust Treatment Option in DLBCL Indication

Kymriah is the first FDA-approved chimeric antigen receptor T cell (or CAR-T) therapy.

Novartis’ Kymriah: The First Gene Therapy to Be Approved in the US

The National Cancer Institute estimates that the incidence of ALL in patients aged 20 or younger is ~3,100 in the US.

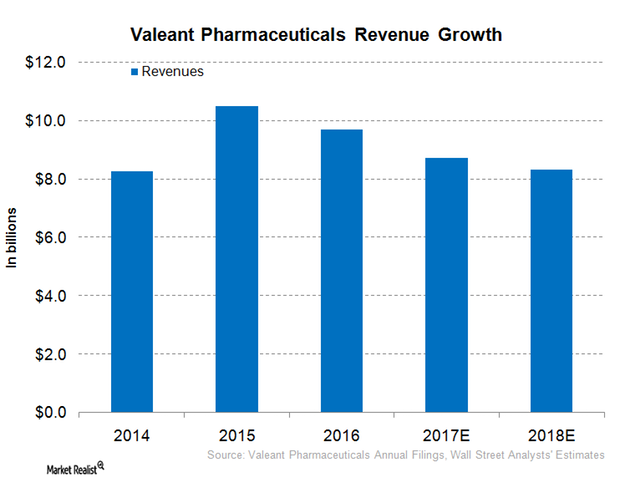

A Deeper Look at Valeant Pharmaceuticals’ Recent Financial Performance

In 3Q16, Valeant Pharmaceuticals (VRX) generated revenues of $2.4 billion, compared with $2.2 billion in 3Q17.

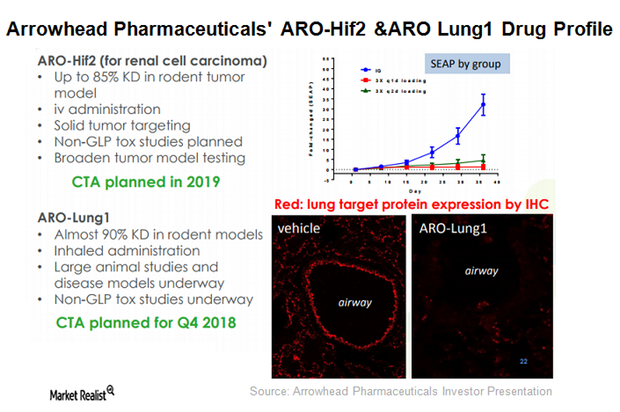

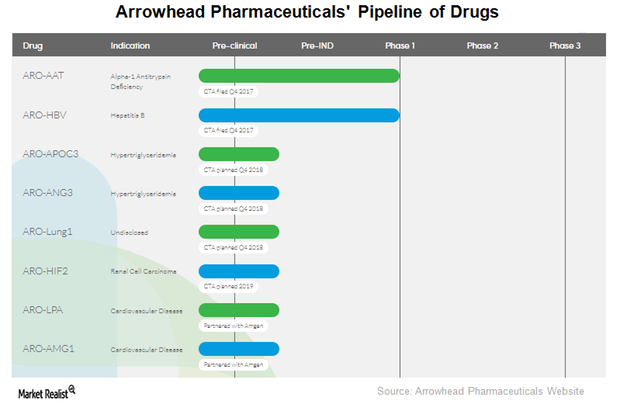

What Led to Arrowhead Pharmaceuticals’ Revenue Surge in 2017?

Arrowhead Pharmaceuticals’ therapeutic candidate ARO-LUNG1 is being developed for an undisclosed disease of the lung. This is the first candidate to utilize the company’s TRiM platform.

Arrowhead’s Candidates for Hepatitis B, Cardiovascular Diseases

ARO-HBV is Arrowhead Pharmaceuticals’ (ARWR) investigational drug candidate for treating chronic hepatitis B infection.

Taking a Closer Look at Arrowhead Pharmaceuticals’ TRIM Platform

Arrowhead Pharmaceuticals’ (ARWR) prior efforts were aimed at clinical programs that utilized the dynamic polyconjugate (or DPC), also called the EX1 delivery vehicle.

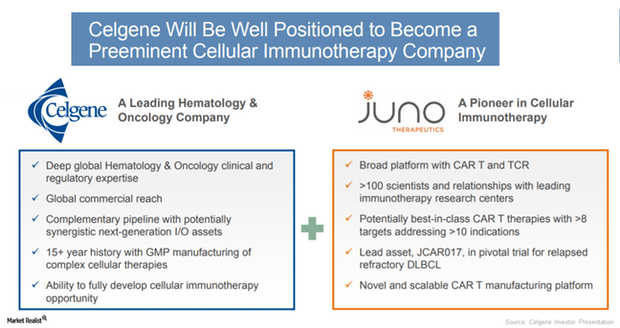

Celgene to Acquire Juno Therapeutics

On January 22, 2018, Celgene and Juno Therapeutics announced a merger agreement in which the former will acquire the latter’s business.

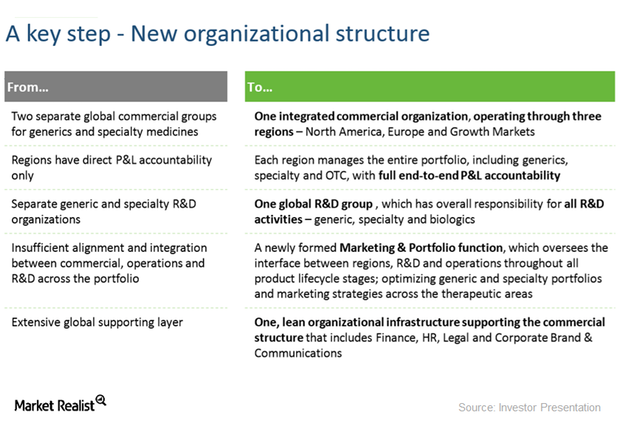

How Teva Pharmaceutical Is Realigning Organizational Structure

On December 14, 2017, Teva Pharmaceutical Industries (TEVA) announced its restructuring plan to cut costs by ~$3 billion over the next two years.

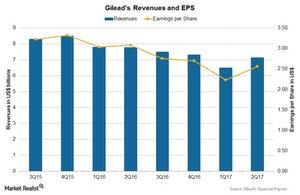

These Factors Are Contributing to Gilead Sciences’ Weak Outlook

Gilead Sciences’ (GILD) revenue fell 7% and 13% in 2016 and 9M17, respectively. The fall was due to lower product sales. Both antiviral products and other products recorded declines in both the periods.

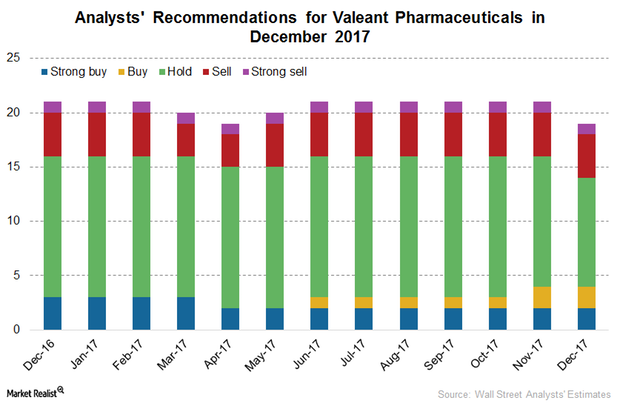

Valeant on the Street: Analyst Recommendations in December 2017

Of the 19 analysts tracking Valeant Pharmaceuticals in December 2017, two recommended a “strong buy,” while another two of recommended a “buy.”

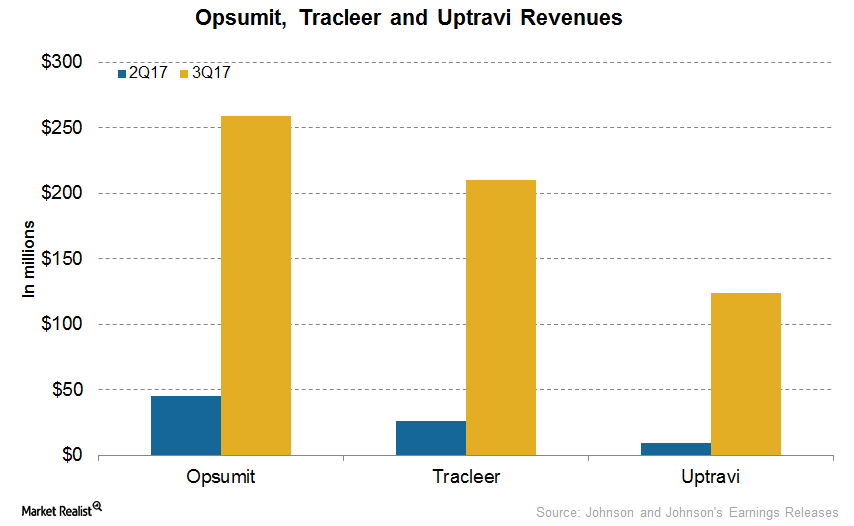

How JNJ’s Pulmonary Hypertension Portfolio Performed in 3Q17

In 3Q17, in the US and outside the US (international markets), JNJ’s pulmonary hypertension portfolio generated revenues of $357 million and $283 million, respectively.

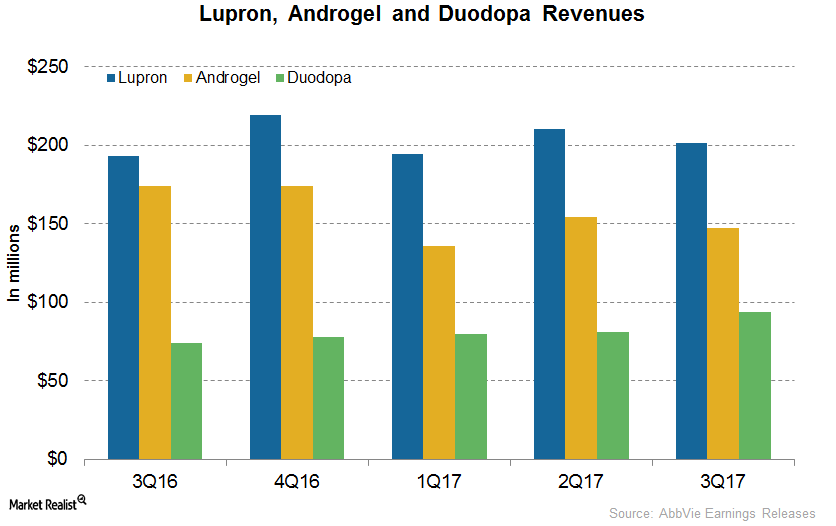

How AbbVie’s Drugs Performed in 3Q17

In 3Q17, AbbVie’s (ABBV) Lupron generated revenues of around $201 million, which reflected ~4% growth on a year-over-year (or YoY) basis.

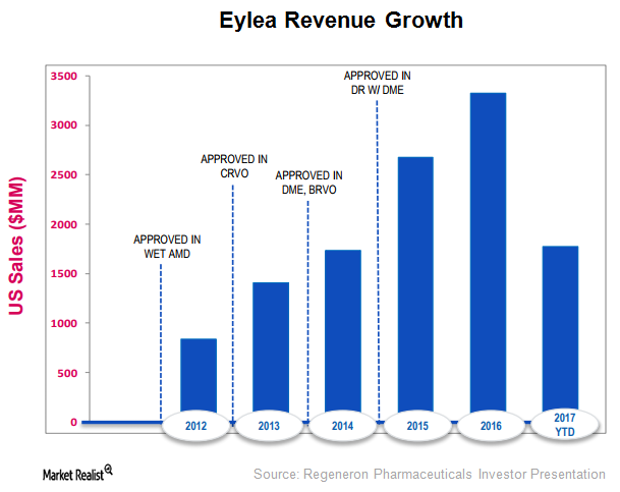

Eylea Leads the Retinal Diseases Sector

In 1H17, Eylea’s total sales rose 10% on a year-over-year basis.

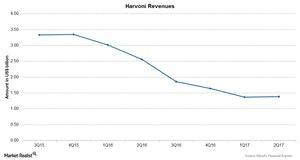

How Did Gilead’s Blockbuster Drug Harvoni Perform in 2Q17?

Harvoni is the top-selling drug in Gilead Sciences’ (GILD) portfolio. The drug is used for the treatment of genotype-1 hepatitis C virus (or HCV) infection.

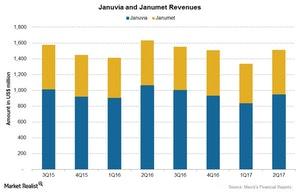

How Merck’s Diabetes Portfolio Performed in 2Q17

Merck’s (MRK) diabetes portfolio includes drugs used for controlling the blood sugar levels for patients with diabetes.

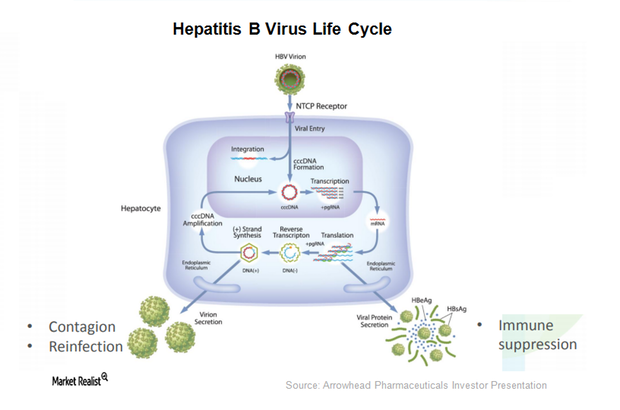

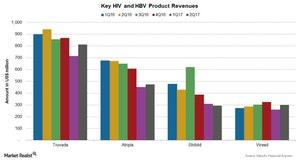

How Gilead’s HIV and HBV Portfolios Performed in 2Q17

Gilead Sciences’ (GILD) portfolio includes various drugs for key therapeutic areas including HIV/AIDS, liver diseases, oncology, cardiovascular, inflammation, respiratory, and others.

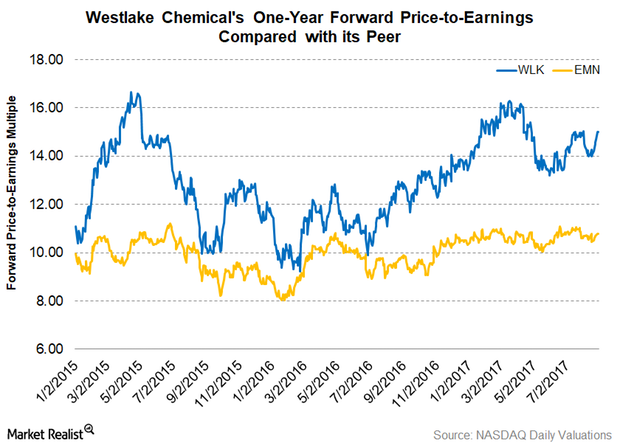

What Do Westlake Chemical’s Valuations Suggest?

Westlake Chemical is trading at a premium to its peer Eastman Chemical. After good earnings in 1H17, analysts expect Westlake Chemical to post EPS of $4.66.

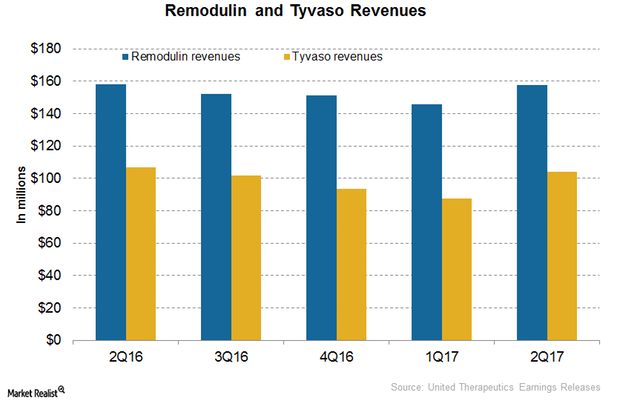

How United Therapeutics’ Remodulin and Tyvaso Are Performing

In 2Q17, United Therapeutics’ (UTHR) Remodulin generated revenues of around $158 million, which reflected ~8% growth on a quarter-over-quarter basis.

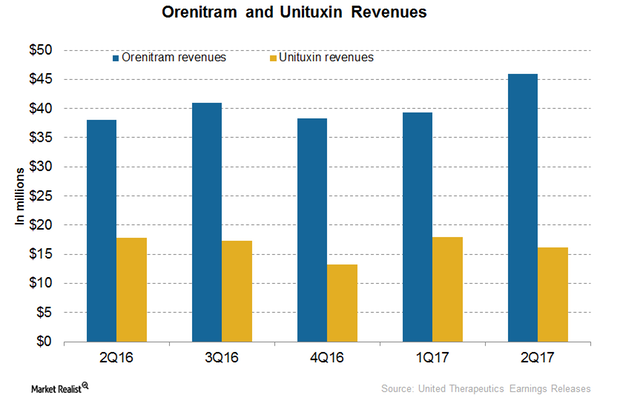

How Did United Therapeutics’ Orenitram and Unituxin Perform in 2Q17?

In 2Q17, United Therapeutics’ (UTHR) Unituxin generated revenues of around $16 million, a 10% decline on a year-over-year (or YoY) basis and an 11% decline on a quarter-over-quarter basis.

What’s Ionis Pharmaceuticals’ Valuation?

Ionis Pharmaceuticals (IONS) has been one of the leading pharmaceutical companies in the RNA-targeted therapeutic space for over 26 years.

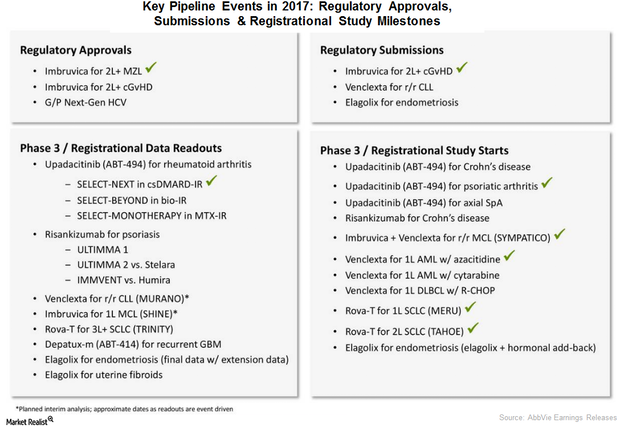

An Update on AbbVie’s Clinical Pipeline in 2017

In December 2016, the European Commission granted Venclyxto conditional marketing approval for the treatment of CLL in the presence of 17p deletion or TP53 mutation.

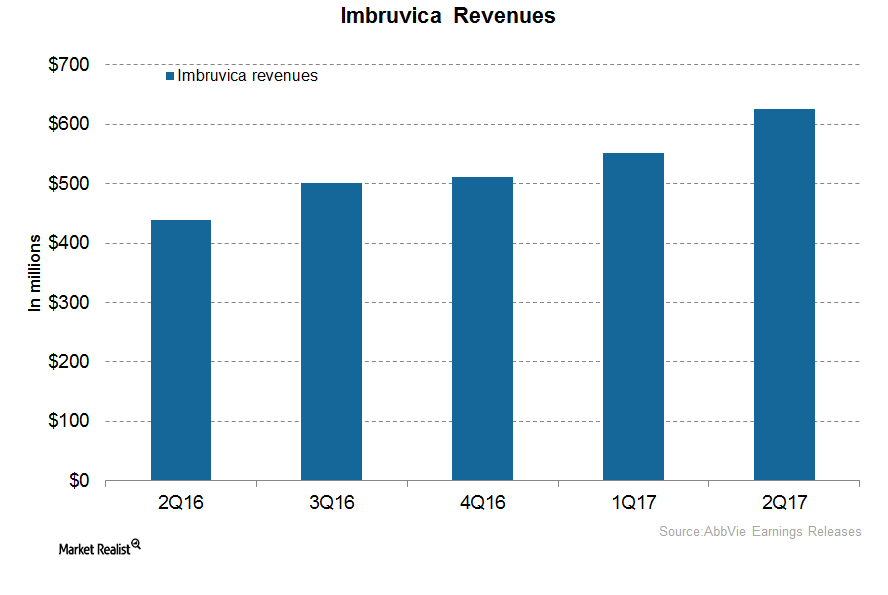

Imbruvica Could Significantly Drive AbbVie’s Revenue Growth

In 2Q17, AbbVie’s (ABBV) Imbruvica generated revenues of around $626.0 million, which reflected a ~43.0% rise YoY and a ~14.0% rise QoQ.

Pfizer on the Street: Analyst Recommendations after 2Q17

As of July 31, 2017, of the 22 analysts tracking Pfizer, ten recommend a “buy” for the stock, while 11 recommend a “hold,” and one recommends a “sell.”

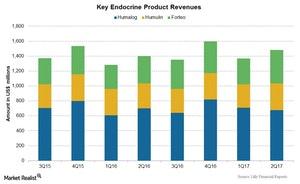

Eli Lilly in 2Q17: Humulin and Endocrine Products

Eli Lilly’’s (LLY) Human Pharmaceuticals segment reported a rise of ~11.0% to ~$5.0 billion for 2Q17 compared to ~$4.6 billion for 2Q16.

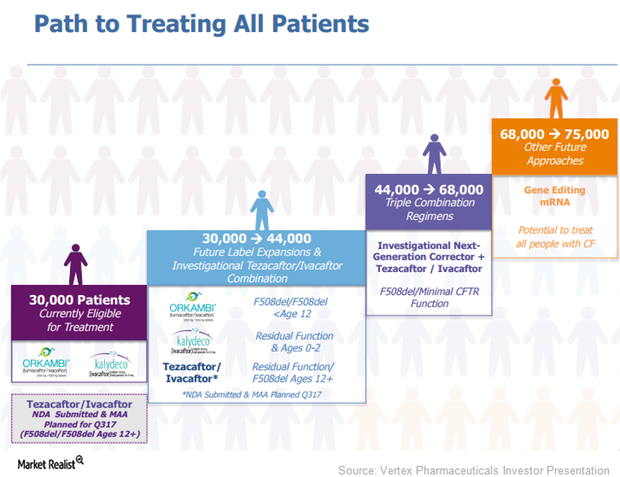

Vertex Pharmaceuticals Cystic Fibrosis Market Could Expand

Vertex Pharmaceuticals’ (VRTX) drugs, Orkambi (lumacaftor/ivacaftor) and Kalydeco (ivacaftor), are capable of treating around 30,000 cystic fibrosis (or CF) patients.

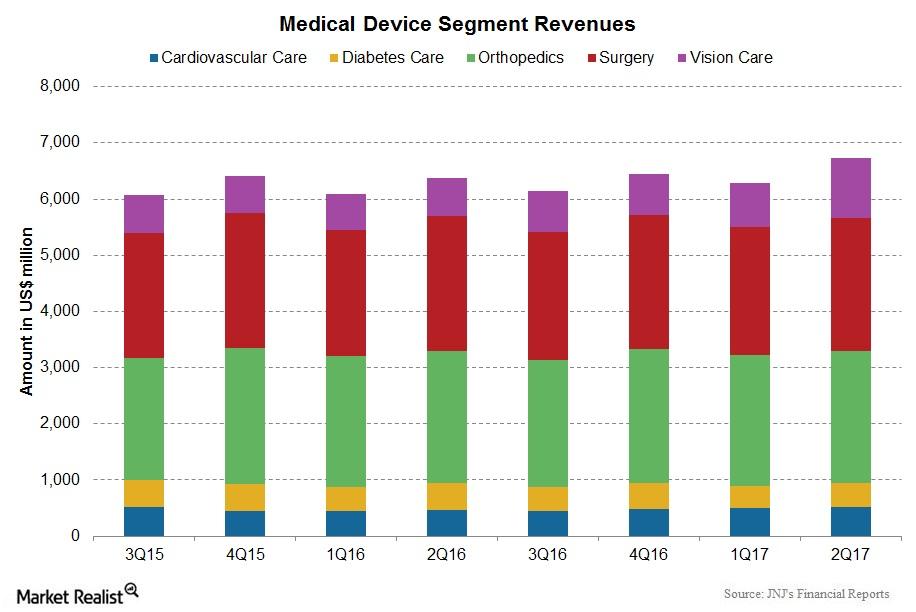

Johnson & Johnson: Medical Devices in 2Q17

Medical devices segment Johnson & Johnson’s (JNJ) medical devices segment grew ~4.9% to ~$6.7 billion for 2Q17, compared with $6.4 billion in 2Q16. This rise included an operational increase of 5.9%, and was offset by a 1% impact of foreign exchange. Cardiovascular care franchise Cardiovascular care franchise sales rose 11.3% to $523 million for 2Q17. This […]

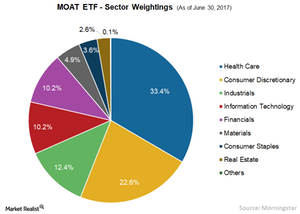

How to Take Exposure to Moat Stocks

The VanEck Vectors Morningstar Wide Moat ETF (MOAT) tracks the price and yield performance of the Morningstar Wide Moat Focus Index.

How Intangible Assets Create Value

Intangible assets are nonphysical and nonmonetary in nature, which makes it hard to measure and manage them. They can be worth more to a company than tangible assets.

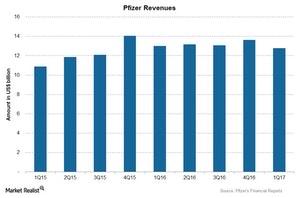

A Look at Pfizer’s Revenue for 1Q17

Pfizer (PFE) reported a 2.0% fall in 1Q17 revenues to ~$12.8 billion, with a 1.0% operational fall in revenues and a 1.0% negative impact of foreign exchange.

What Do Analysts Expect from Merck’s 1Q17 Earnings?

Merck and Co. (MRK) will release its 1Q17 earnings on May 2, 2017. Analysts’ estimates show EPS of $0.83 on revenues of $9.25 billion for 1Q17.

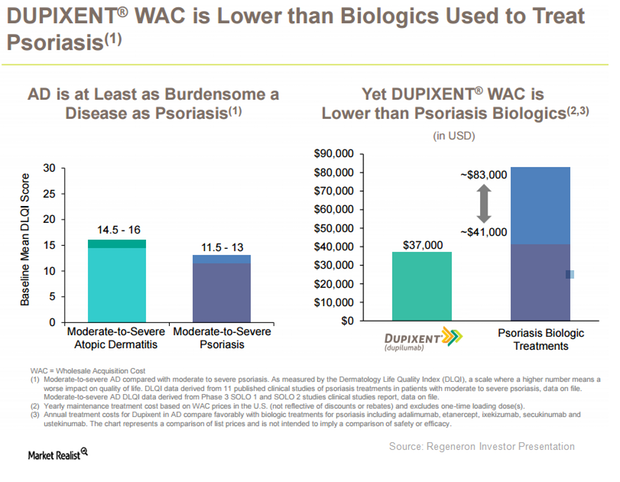

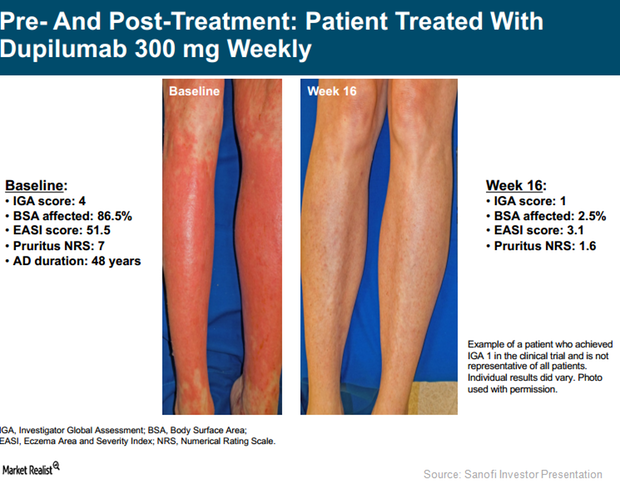

Dupixent Expected to Be a Solid Addition to Regeneron’s Portfolio

On March 28, 2017, the FDA approved Regeneron (REGN) and Sanofi’s (SNY) Dupixent for the treatment of patients with moderate-to-severe eczema or atopic dermatitis (or AD).

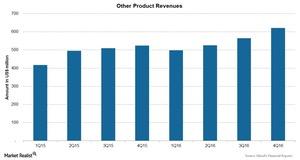

How Gilead’s Other Products Fared in 2016

The oncology portfolio includes the drug Zydelig, which is used in combination with rituximab for the treatment of chronic lymphocytic leukemia (or CLL).

Dupixent: Leading Therapy for Atopic Dermatitis in the Future?

Existing treatment options for AD aren’t tolerated well by the entire patient population. Dupixent might become a preferred regimen in the future.

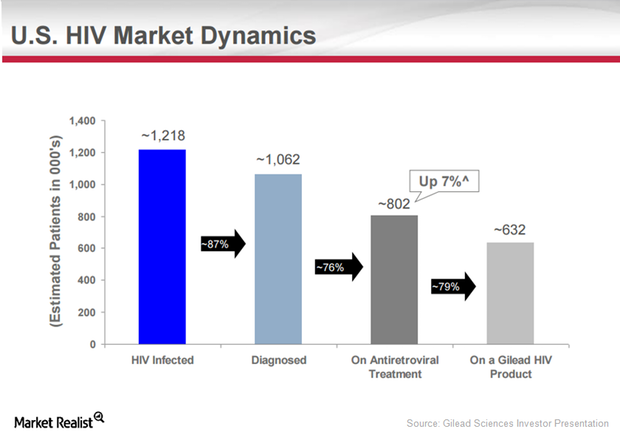

How GILD Plans to Battle through Impending HIV Patent Cliff

Gilead Sciences (GILD) is the leading biotechnology player in the global HIV market.

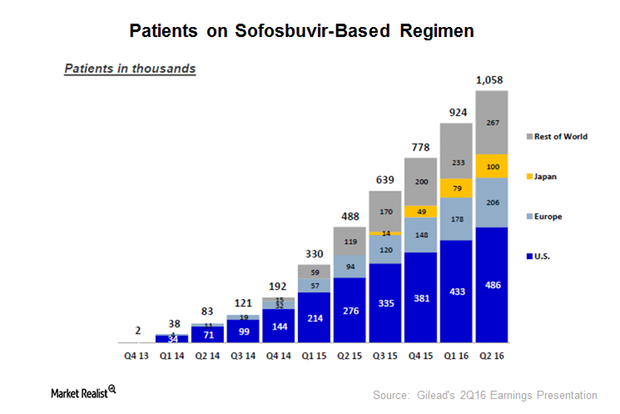

How Gilead Dominates the HCV Space

In January 2012, Gilead Sciences (GILD) acquired Pharmasset and got access to sofosbuvir. In December 2013, the FDA approved sofosbuvir under the brand name Sovaldi.

GlaxoSmithKline’s Combo Treatment for HIV Faces Stiff Competition

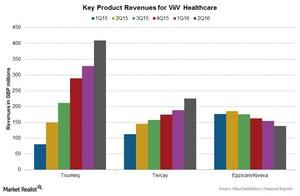

GlaxoSmithKline’s (GSK) HIV medicines business is managed by ViiV Healthcare, a global specialist company in HIV medicines.

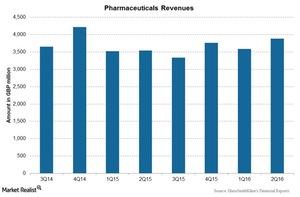

How Did GlaxoSmithKline’s Pharmaceuticals Segment Do in 2Q16?

GlaxoSmithKline’s (GSK) Pharmaceuticals segment declined substantially in 2015 due to the divestment of its oncology business to Novartis (NVS) in March 2015.