What Do Westlake Chemical’s Valuations Suggest?

Westlake Chemical is trading at a premium to its peer Eastman Chemical. After good earnings in 1H17, analysts expect Westlake Chemical to post EPS of $4.66.

Sept. 1 2017, Updated 7:36 a.m. ET

Westlake Chemical’s forward PE multiple

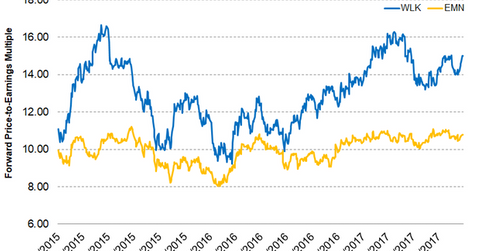

In the previous part, we discussed analysts’ views and recommendations. In this part, we’ll look at Westlake Chemical’s (WLK) valuations compared to its peer Eastman Chemical (EMN). As of August 28, 2017, Westlake Chemical’s one-year forward PE (price-to-earnings) multiple stood at 15.0x, while its peer Eastman Chemical (EMN) has a one-year forward PE multiple of 10.80x.

The forward PE multiple considers future earnings to calculate valuations. It could be useful for investors to compare two or more companies that are operating in the same industry. The PE multiple determines which company is overvalued and undervalued. The forward PE multiple suggests how much investors are paying for a stock per dollar of expected earnings over the next 12 months.

Westlake Chemical trades at a premium

Currently, Westlake Chemical is trading at a premium to its peer Eastman Chemical. After good earnings in 1H17, analysts expect Westlake Chemical to post EPS (earnings per share) of $4.66—an increase of 39.90% on a YoY (year-over-year) basis. For fiscal 2018, analysts expect Westlake Chemical’s EPS to be $5.16, which is a 10.80% increase compared to fiscal 2017. The expected earnings growth is primarily driven by Westlake Chemical’s Axiall acquisition.

On the other hand, Eastman Chemical’s EPS for fiscal 2017 is $7.51, which implies growth of 11.10% on a YoY basis. For fiscal 2018, analysts expect Eastman Chemical to post EPS of $8.15, which is 8.5% higher than fiscal 2017. Westlake Chemical’s earnings growth is stronger than Eastman Chemical’s earnings growth. As a result, it commands a premium over Eastman Chemical.

Investors can hold Westlake Chemical indirectly by investing in the First Trust Multi Cap Value AlphaDEX Fund (FAB), which has invested 0.40% of its portfolio in Westlake Chemical. The fund’s other holdings include LyondellBasell (LYB) and Gilead Sciences (GILD) with weights of 0.5% each, respectively, as of August 28, 2017.

In the next part, we’ll discuss Westlake Chemical’s stock performance in 2017.