Gilead Sciences Inc

Latest Gilead Sciences Inc News and Updates

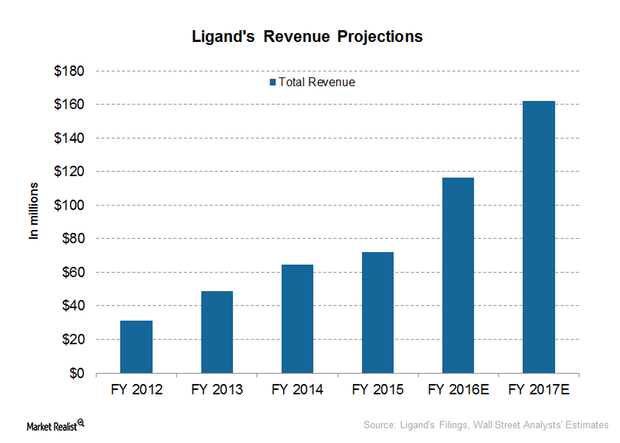

What Is Ligand Pharmaceuticals’s Expected Revenue Growth in 2016?

Ligand Pharmaceuticals (LGND) is a high-growth company with a comparatively low-risk business model. It earns most of its revenue from royalty and license fees.

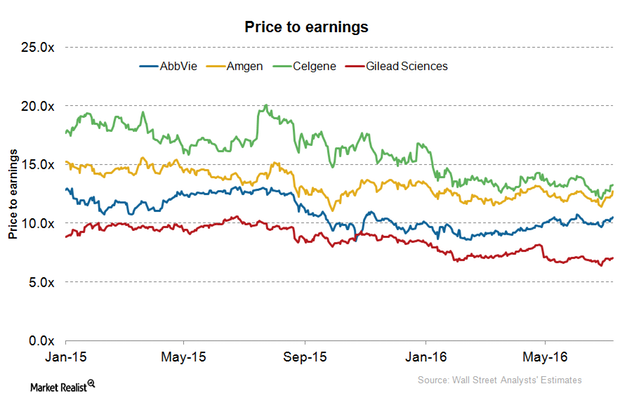

Why Is AbbVie’s Valuation Multiple Rising in July?

AbbVie believes that the Market has misunderstood the growth potential of Rova-T, which is expected to earn $1.5 billion–$2 billion in peak sales even under extremely conservative assumptions.

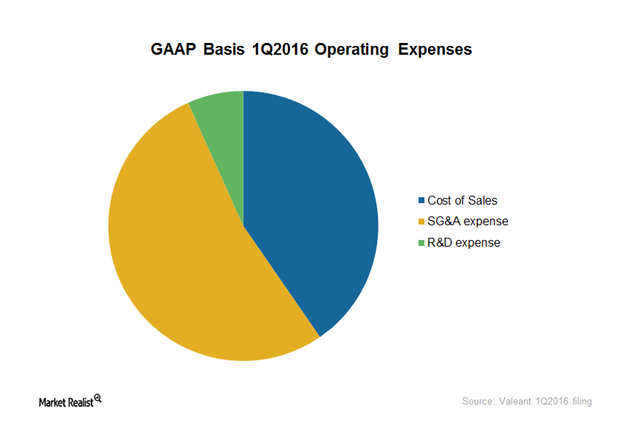

What’s behind Valeant’s Operating Expenses?

Valeant’s major operating expenses include cost of sales, SG&A (selling, general, and administrative) expenses, and R&D (research and development) costs.

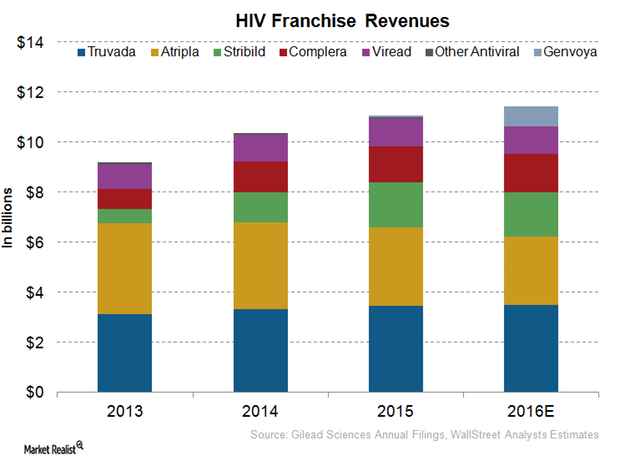

Inside Gilead Sciences’ Involvement in TAF Therapies

On March 01, 2016, the FDA approved Gilead Sciences’ TAF-based HIV drug, Odefsey, for the treatment of certain HIV-1 afflicted patients.

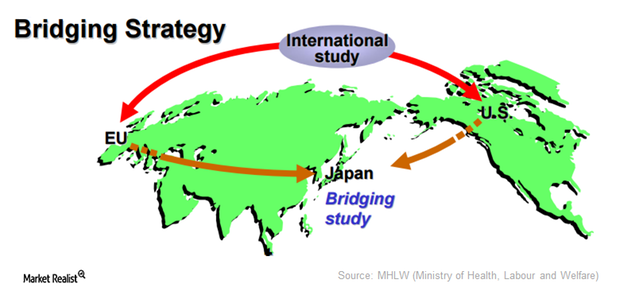

What Is a Bridging Study?

A bridging study on a drug is an additional study performed in a new region to provide clinical data on safety, efficacy, dosage, and dose regimen.

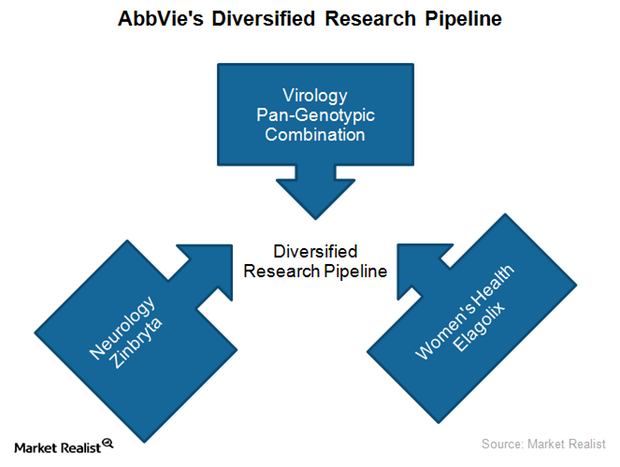

AbbVie’s Therapies in Virology, Neurology, and Women’s Health

In addition to its Oncology and Immunology segments, AbbVie is focused on launching innovative therapies in its Virology, Neurology, and Women’s Health segments.

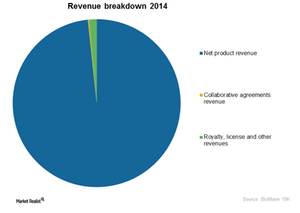

BioMarin’s Business Model and Its 3 Sources of Revenue

Let’s discuss BioMarin’s business model. It derives revenue from three sources, including product revenue. The latter accounts for ~98% of total revenue.

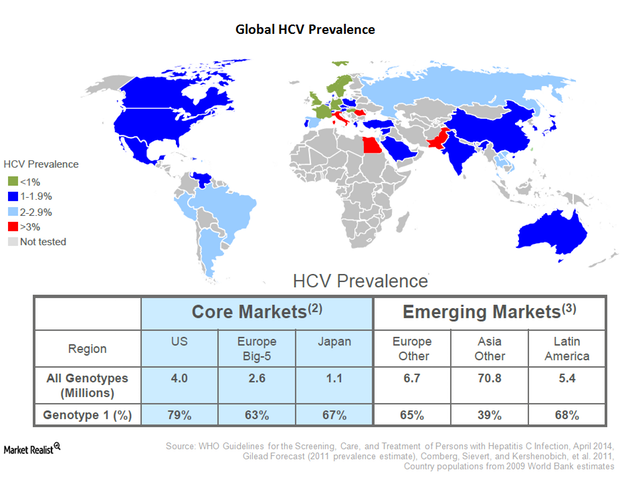

Merck Will Soon See a Decision on Its New Hepatitis C Therapy

The FDA has scheduled the Prescription Drug User Fee Act (or PDUFA) date for Merck’s new hepatitis C combination therapy for January 28, 2016.

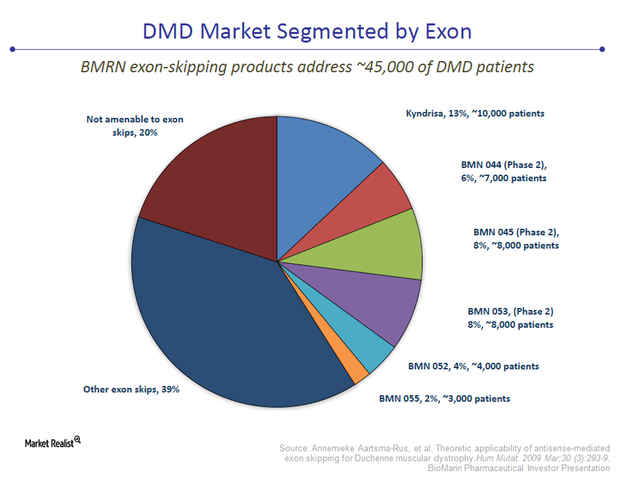

How Would Kyndrisa Treat Duchenne Muscular Dystrophy?

The FDA advisory committee has given an unfavorable opinion to Kyndrisa. But most analysts estimate the probability of FDA approval for the drug to be about 50%.

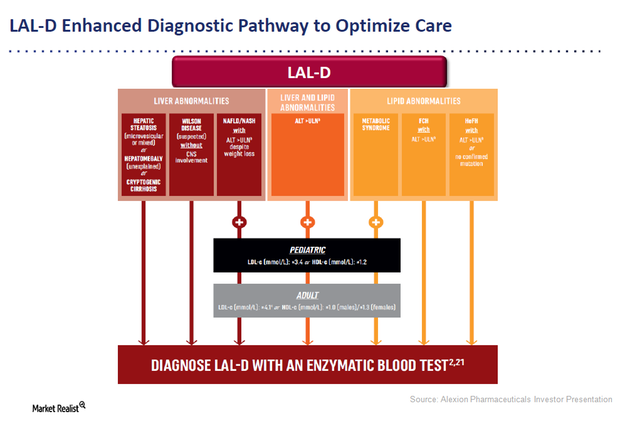

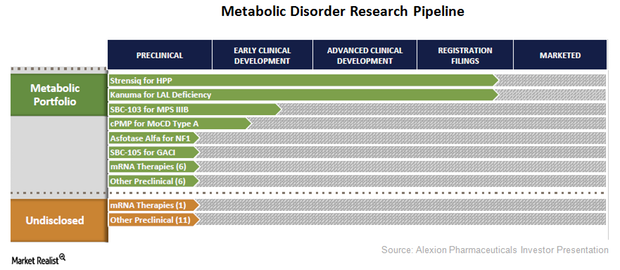

Kanuma: An Innovative Enzyme Replacement Therapy for LAL-D

Alexion Pharmaceuticals’ Kanuma is an innovative enzyme replacement therapy for patients suffering with lysosomal acid lipase deficiency (or LAL-D).

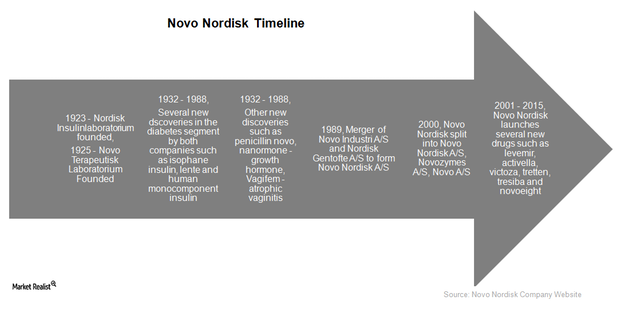

Novo Nordisk: An Investor’s Guide to a Leading Biotech Company

Novo Nordisk (NVO) is a leader in diabetes care with 90 years of experience coupled with a strong workforce of 39,700 in 75 countries around the world.

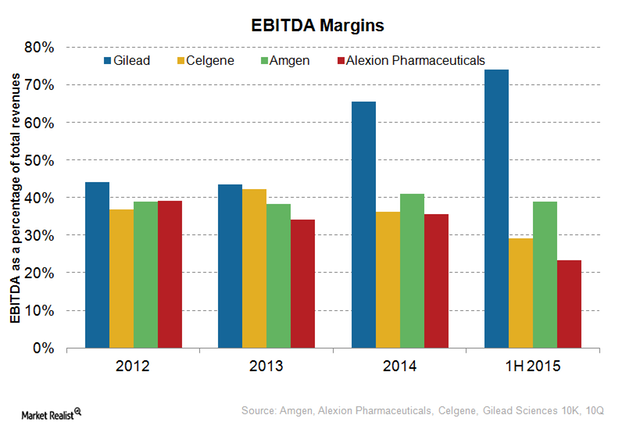

Alexion Pharmaceuticals’ Cost Structure and EBITDA Margins

Mature biotechnology companies generally earn EBITDA margins of about 30% to 40%.

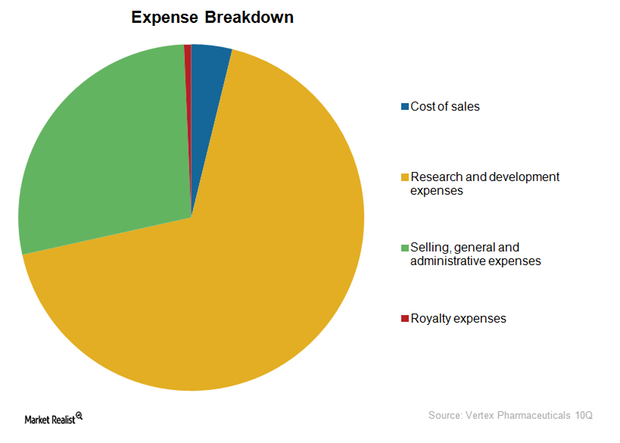

Vertex Pharmaceuticals’ Cost Structure and EBITDA Margins

While mature biotechnology companies with drugs in multiple disease segments earn an average of 30%–40% EBITDA, margins of companies targeting only rare diseases can vary due to unique business models.

Alexion Pharmaceuticals Diversifies Its Research Pipeline

Alexion Pharmaceuticals (ALXN) has strengthened its drug pipeline by diversifying its research programs across the metabolic disorder segment.

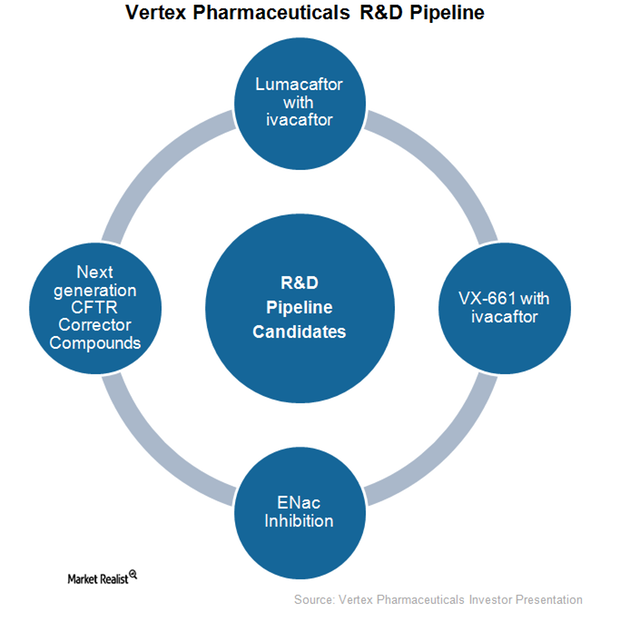

Vertex Has Strong Research and Development Pipeline

As part of its research and development, Vertex Pharmaceuticals (VRTX) has been actively exploring new cystic fibrosis (or CF) drugs as well as other indications for its existing drug Kalydeco.

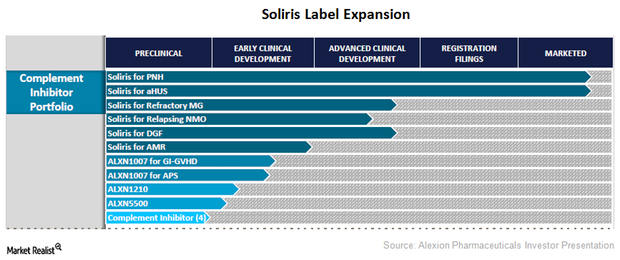

Alexion Pharmaceuticals Expands Soliris Labels

Alexion Pharmaceuticals is actively involved in expanding the approved labels for its flagship product Soliris.

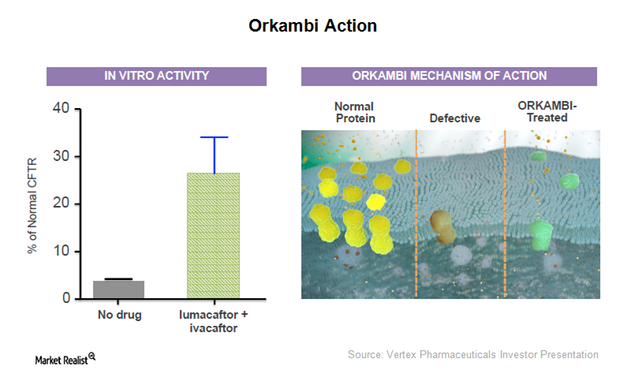

Vertex Pharmaceuticals’ New Drug Orkambi Receives FDA Approval

On July 2, 2015, the FDA (U.S. Food and Drug Administration) approved Orkambi, a combination drug of lumacaftor and ivacaftor, for treating cystic fibrosis (or CF) patients.

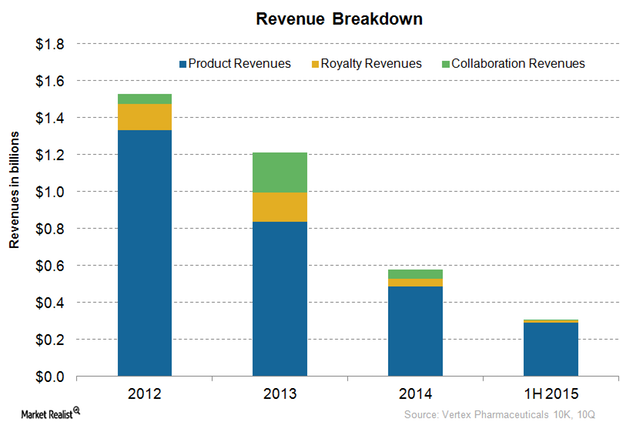

Vertex Pharmaceuticals’ 3-Pronged Business Model

Vertex Pharmaceuticals’ (VRTX) business model includes revenues in three areas: products, royalties, and collaboration. There’s significant variability in royalty and collaboration revenues.

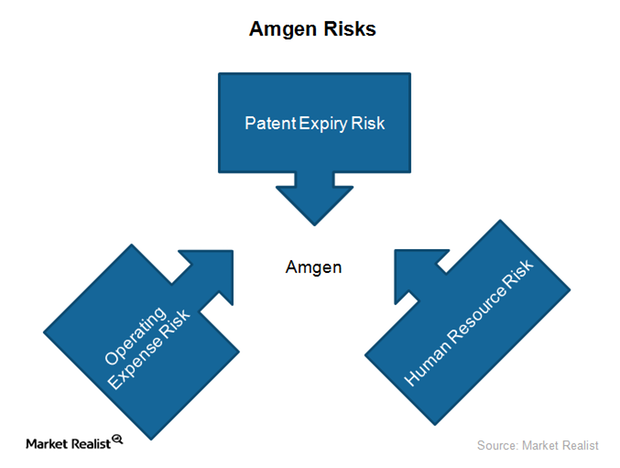

Amgen’s Key Risks

Amgen’s key risks include market erosion due to generic competition for Neulasta and Neupogen. Its restructuring also involves a reduction of about 3,500–4,000 employees.

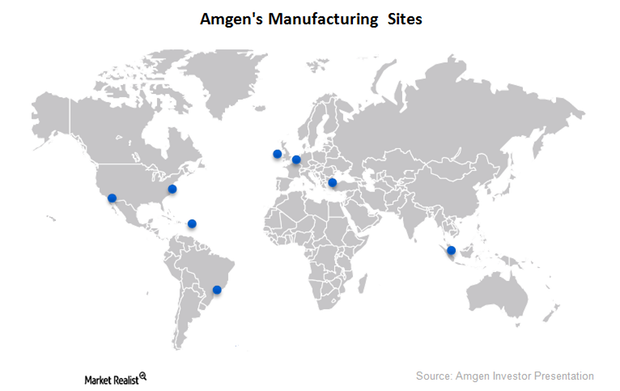

Amgen Develops World-Class Manufacturing Capability

Enhancing its manufacturing capability, Amgen has launched a next-generation bio-manufacturing facility in Singapore and plans to set up more in the coming years.

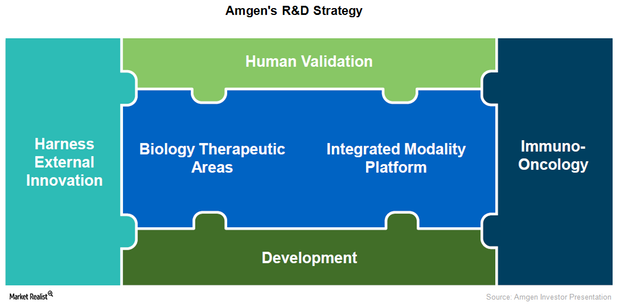

Amgen’s Research and Development Strategy

Amgen (AMGN) has adopted a well-structured research and development strategy focused on inflammation, metabolism, bone, and cardiovascular diseases.

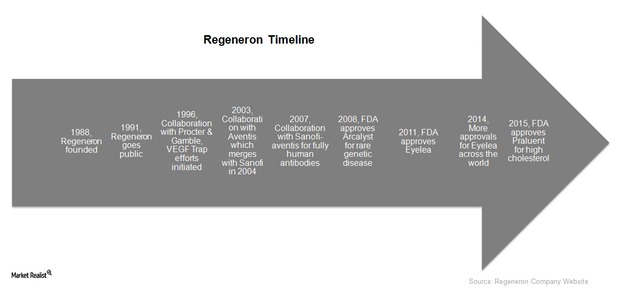

Regeneron: An Investor’s Overview to a Leading Biotech Company

With a market capitalization of $50.7 billion, Regeneron is one of the country’s major biotechnology companies. Its products and pipeline candidates focus on cancer, eye diseases, and cardiovascular diseases.

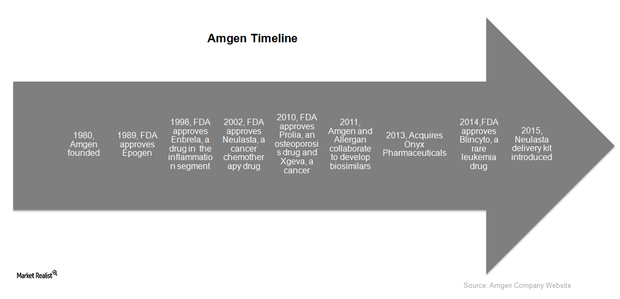

Amgen: An Investor’s Overview to a Leading Biotech Company

An overview of global biotechnology company Amgen shows a market capitalization of $127.2 billion. Headquartered in Thousand Oaks, California, Amgen has a presence in 75 countries.

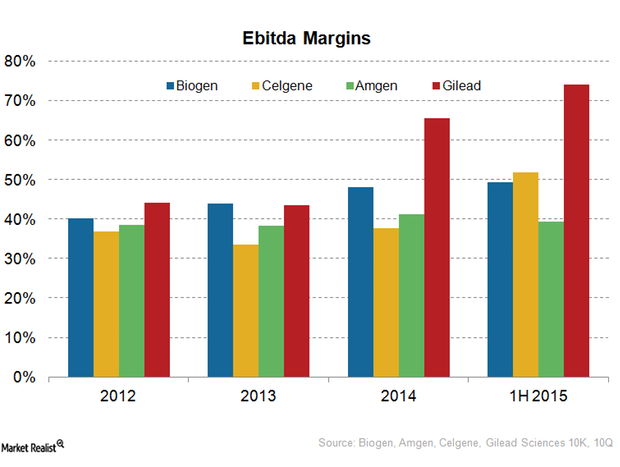

Celgene’s EBITDA Margins Surpass Competitors

Celgene’s EBITDA margins were lower than those of its competitors. Its R&D investment appears to be higher than its peers, and its SG&A expenses have risen.

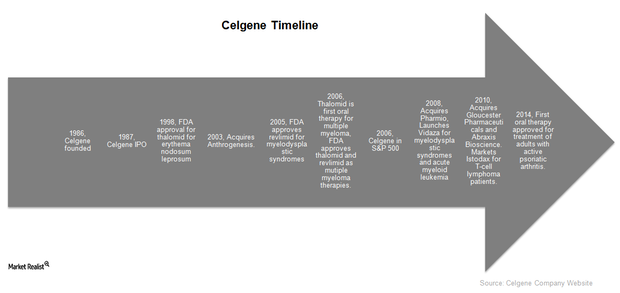

Introducing Celgene, a Leading Biotech Company

Celgene has consistently delivered breakthrough innovations in biotechnology and has as actively pursued acquisitions of companies for access to compounds.

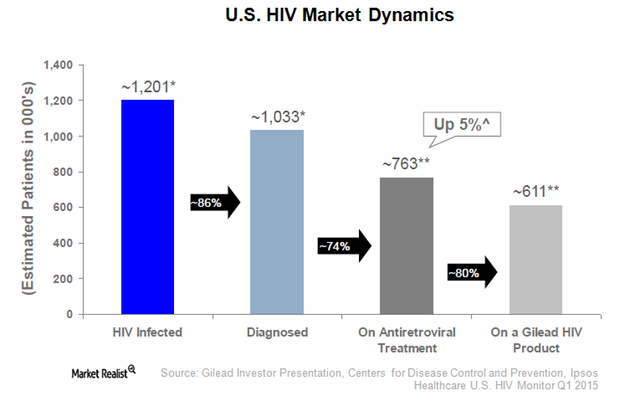

Gilead: Global Leader in the HIV Market

Gilead Sciences (GILD), a biotechnology leader in the human immunodeficiency virus, or HIV, market, offers drugs to eight out of every ten HIV naïve patients in the US.

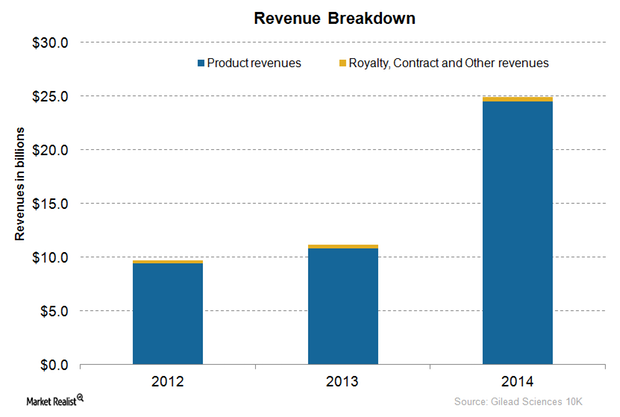

An Overview of Gilead Sciences’ Business Model

Gilead Sciences’ business model consists of product sales in the HIV and HCV markets, as well as royalty, contract, and other revenues.

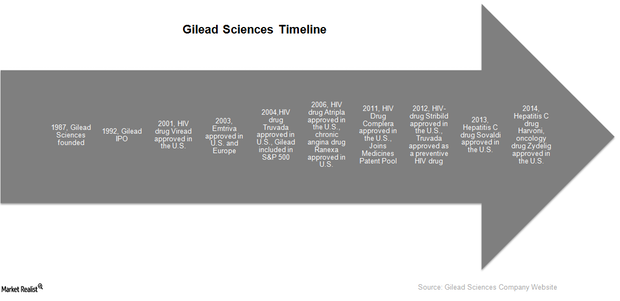

Gilead Sciences: Investor’s Overview of a Leading Biotech Company

The strong leadership of Gilead’s talented scientists has enabled the company to consistently deliver innovative therapies in the market.

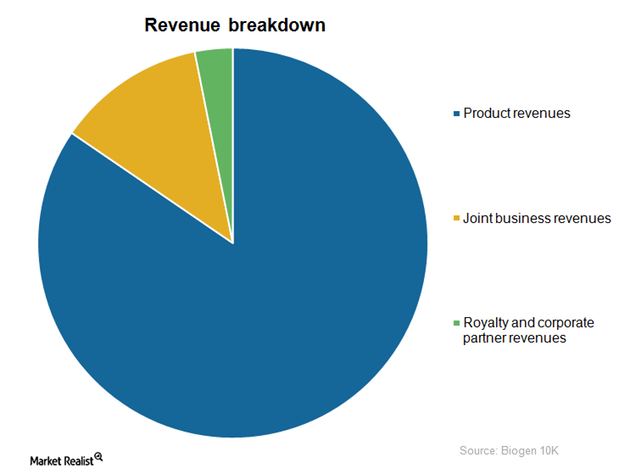

An Overview of Biogen’s Business Model

A leader in the development of multiple sclerosis treatments, Biogen earned 82.5% of its total revenues from its MS drugs in 2014.

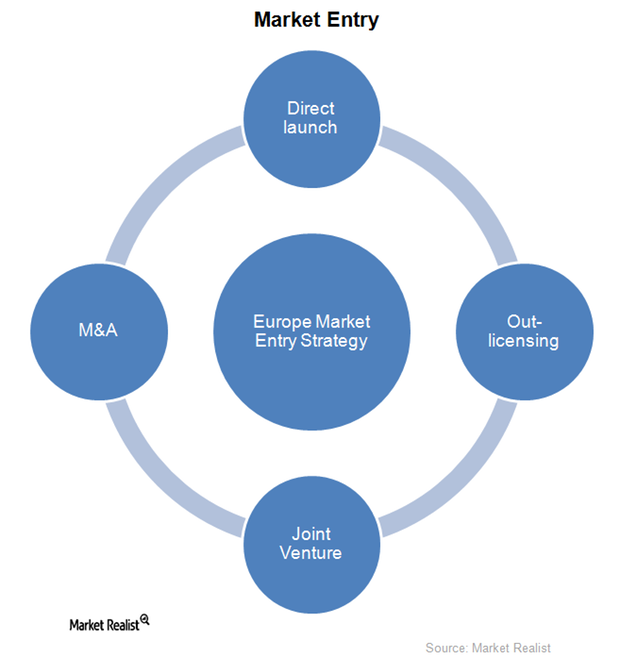

Market Entry Strategies for Biotechnology in Europe

When a US biotechnology company uses market entry strategies to launch its drug directly in the European market, it has to bear all the expenses related to the drug approval process in Europe.

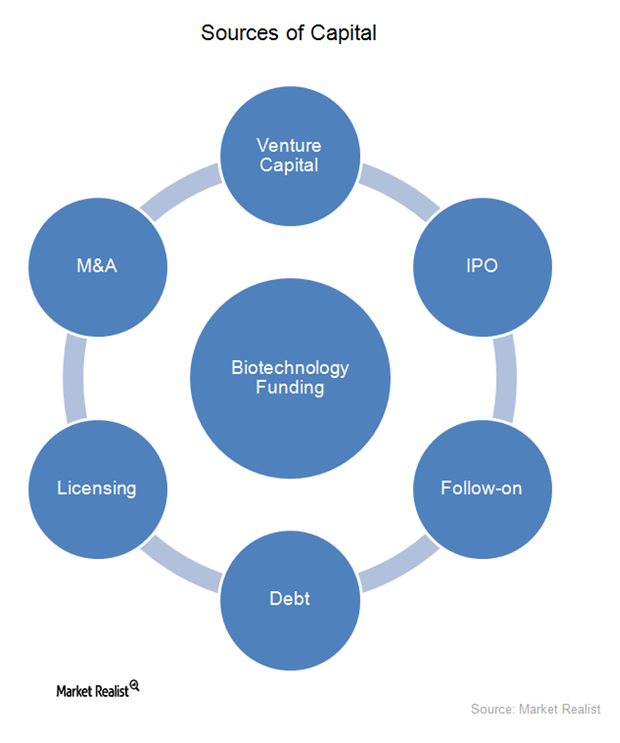

Sources of External Capital for the Biotechnology Industry

In the early stages of their life cycles, most biotechnology companies are financed by venture capital, which typically comes from wealthy investors who invest in startup companies.

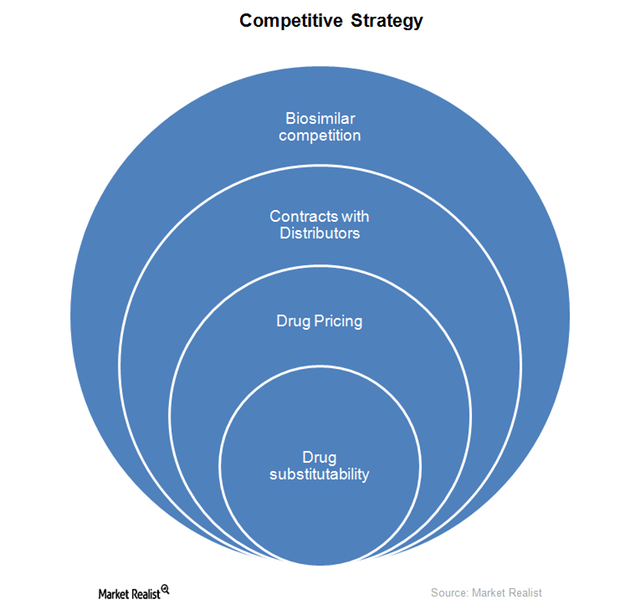

How Does Competition Impact the Biotechnology Industry?

The biotechnology sector is witnessing intense competition with big pharmaceutical companies entering into collaborations and mergers and acquisitions with biotechnology companies.

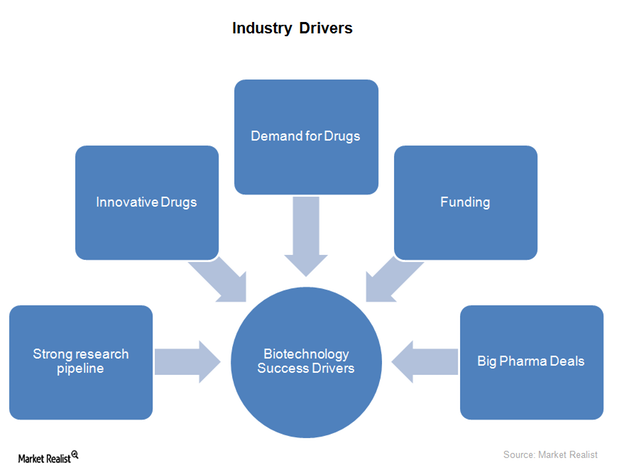

Commercial Growth Drivers of the Biotechnology Industry

After 2012, the biotechnology industry (IBB) had a period of solid growth, mainly driven by novel scientific inventions and aggressive commercial distribution.

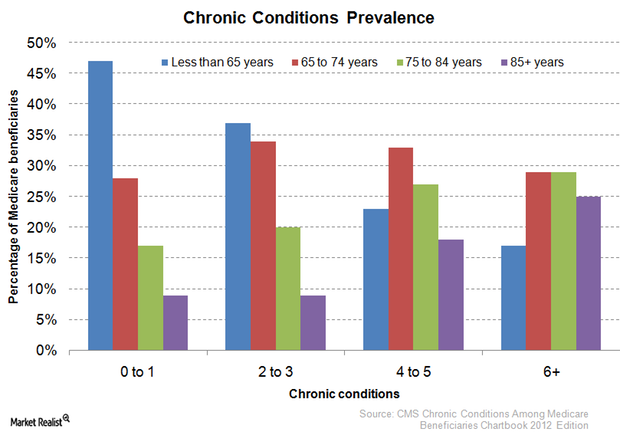

Social Factors That Impact the Biotechnology Industry

The aging Baby Boomer population in the United States is one of the social factors driving the US healthcare industry. By 2030, Americans over 55 will be 31% of the population.

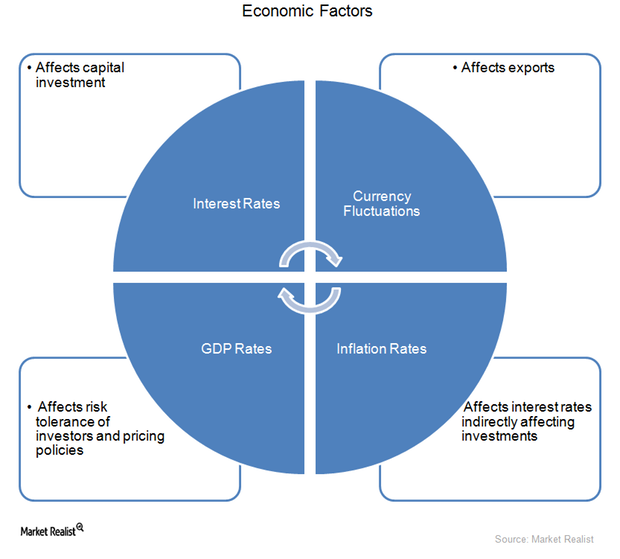

Economic Factors That Affect the Biotechnology Industry

Compared to pure-play pharmaceutical companies, the biotechnology industry is more sensitive to economic factors such as changes in GDP, interest rates, and exchange rates.

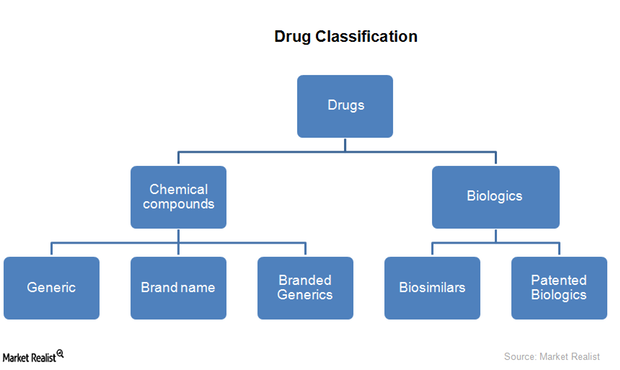

How Are Drugs Classified?

The two main classifications for drugs are chemical compound drugs and biologics. Medicinal drugs are broadly classified as prescription drugs and over-the-counter drugs.

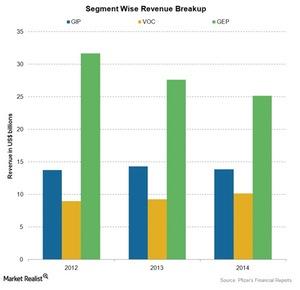

Analyzing Pfizer’s Business Segments

Pfizer (PFE) is one of the oldest and largest pharmaceutical companies in the US. The company deals in two major business segments.

Where Does Johnson & Johnson Stand in the Industry?

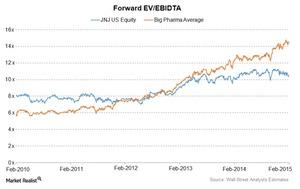

Estimates suggest that Johnson & Johnson’s forward PE ratio increased from 15.5x in 2014 to 16.1x in 2015. The PE ratio is hovering around 19x for the industry.

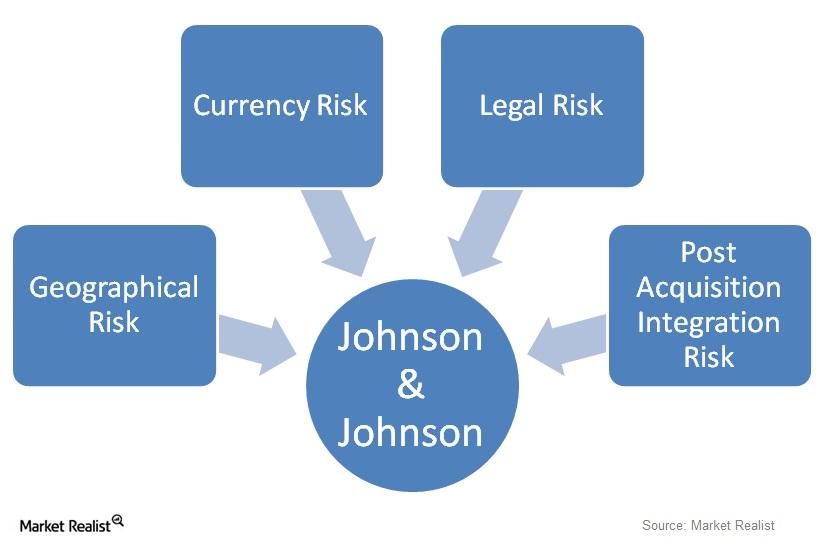

What Risks Does Johnson & Johnson Face?

Johnson & Johnson (JNJ) faces a unique combination of risks. The risks are in addition to specific risks in the pharmaceutical industry.

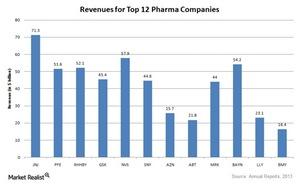

What it takes to be called ‘big pharma’

Pharmaceutical companies either deal with patented drugs, generic drugs, or both. Most big pharma companies deal with both.