Vanguard Health Care ETF

Latest Vanguard Health Care ETF News and Updates

Emerging Markets Drive Abbott’s Nutritional Business Growth

In 1Q17, Abbott Laboratories’ (ABT) Nutritional segment reported revenue of nearly $1.6 billion, a year-over-year (or YoY) fall of ~1%.

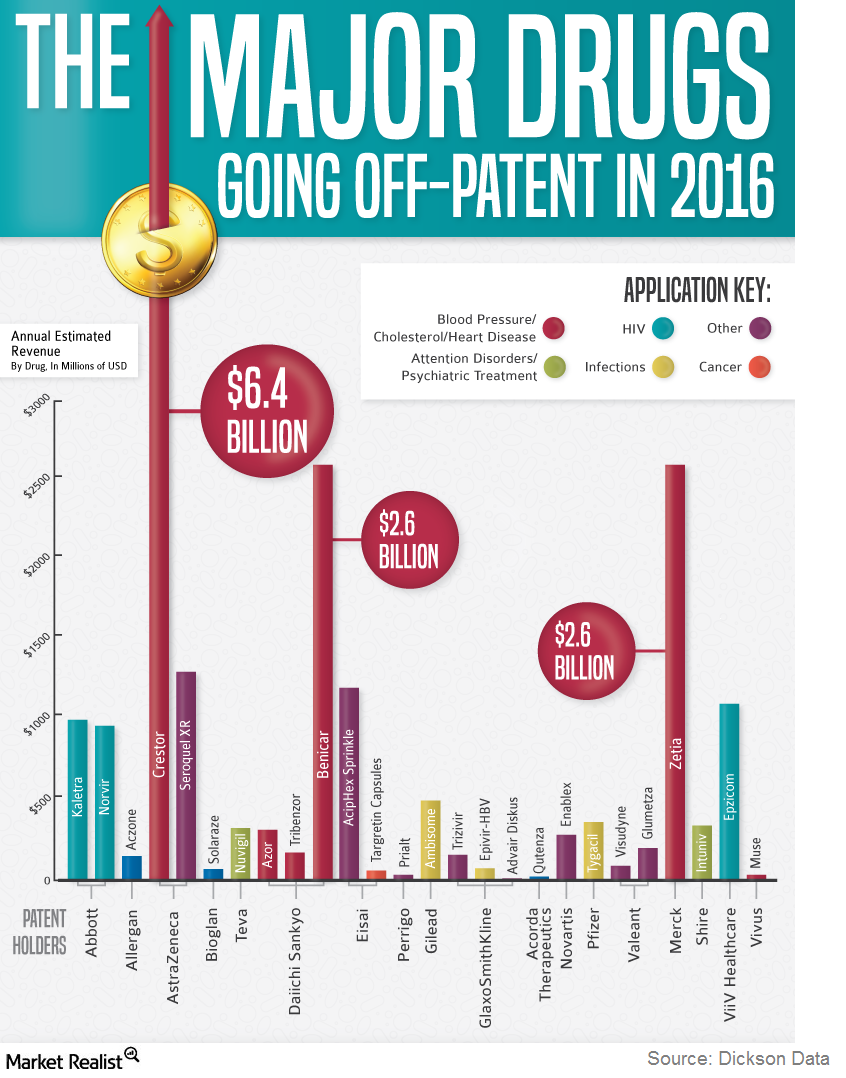

Drug Patent Expirations: $190 Billion Is Up for Grabs

According to estimates by Evaluate Pharma, a whopping $120 billion in sales was lost to patent expirations between 2009 and 2014.

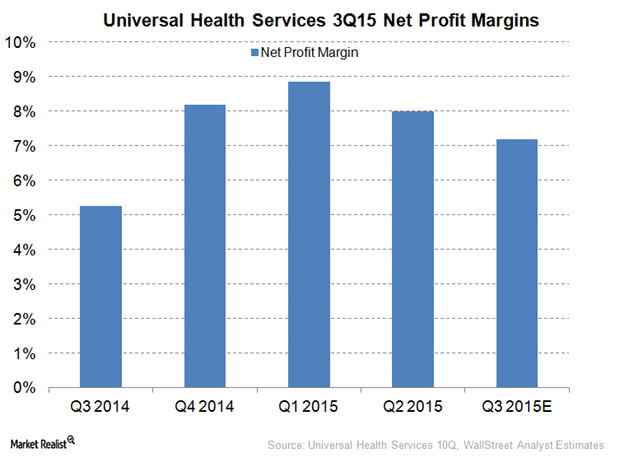

Universal Health Services’ Net Profit Margin Expected to Rise

Wall Street analysts expect that Universal Health Services (UHS) will report higher net profit margins in 3Q15 compared to margins in 3Q14.

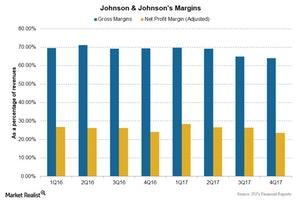

Changes in Johnson & Johnson’s Profit Margins in 4Q17

Johnson & Johnson’s gross profit margin decreased to 64.1% in 4Q17, a ~5% decrease compared to 69.1% in 4Q16.

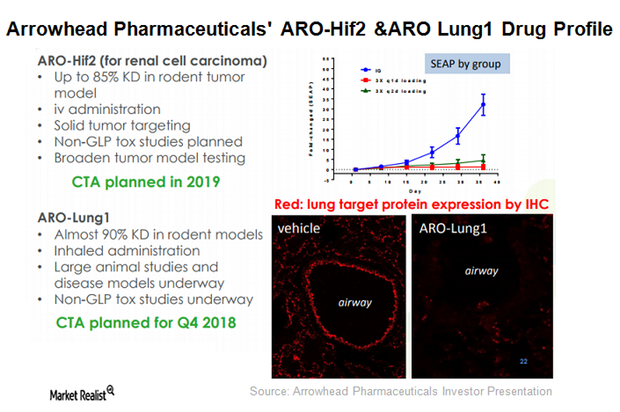

What Led to Arrowhead Pharmaceuticals’ Revenue Surge in 2017?

Arrowhead Pharmaceuticals’ therapeutic candidate ARO-LUNG1 is being developed for an undisclosed disease of the lung. This is the first candidate to utilize the company’s TRiM platform.

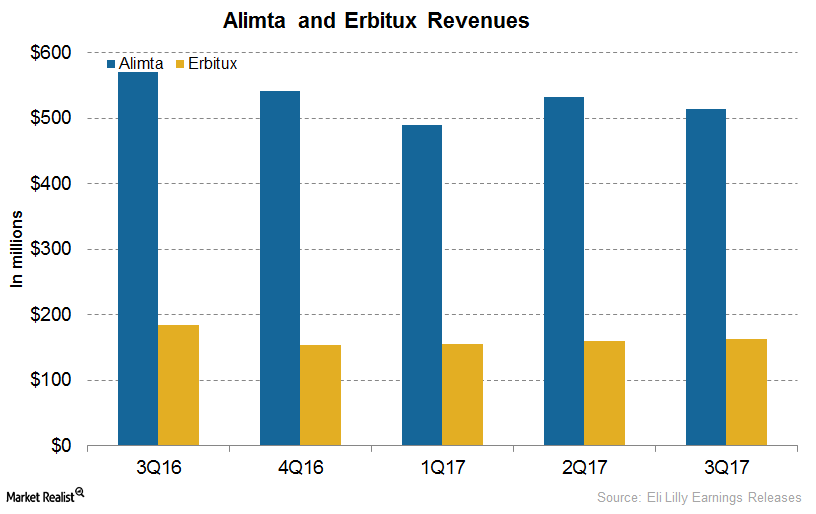

An Update on Eli Lilly’s Oncology Drugs: Alimta, Erbitux, and Gemzar

In 3Q17, Eli Lilly’s (LLY) Alimta generated revenues of $514.5 million, a ~10% increase on a year-over-year (or YoY) basis and a 3% decline on a quarter-over-quarter basis.

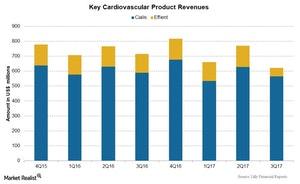

Eli Lilly’s Cialis and Other Cardiovascular Products in 3Q17

Eli Lilly’s cardiovascular franchise includes the drugs Cialis and Effient, but for 3Q17, both drugs reported lower sales.

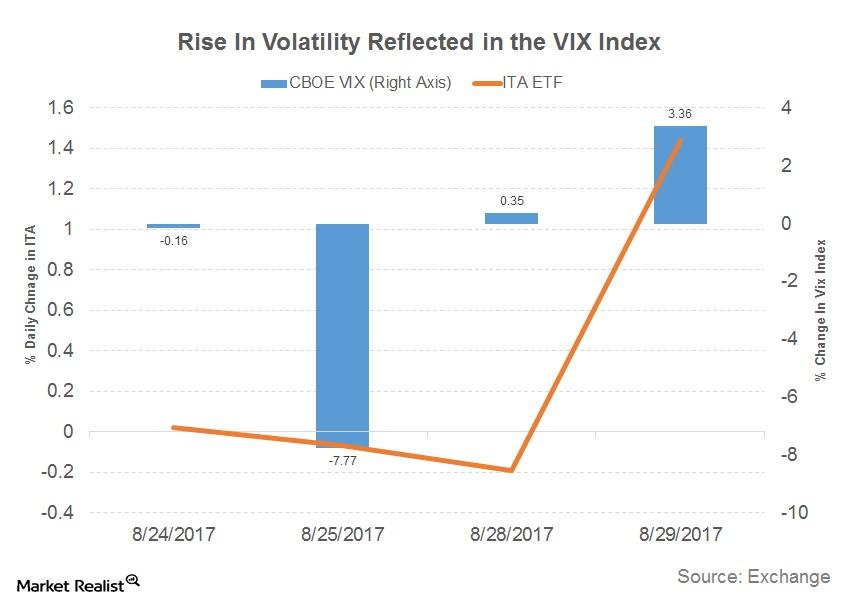

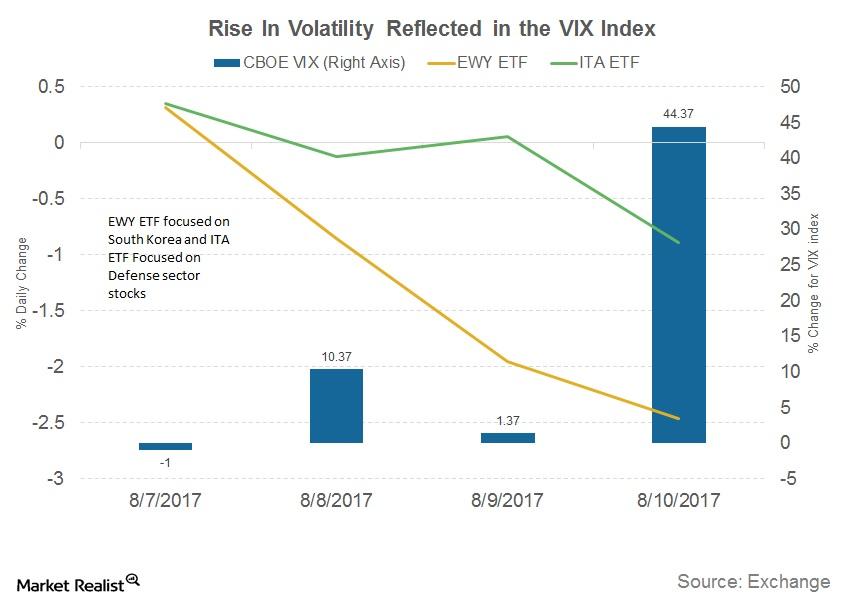

What Stocks Should Be on Your Radar amid Geopolitical Tensions

Renewed tensions arising out of North Korea’s missile launch on Tuesday had a major impact on volatility. Asian markets have declined more than 1% as risk aversion dominated markets.

Which Stocks Will Benefit the Most from US-Korea Tensions?

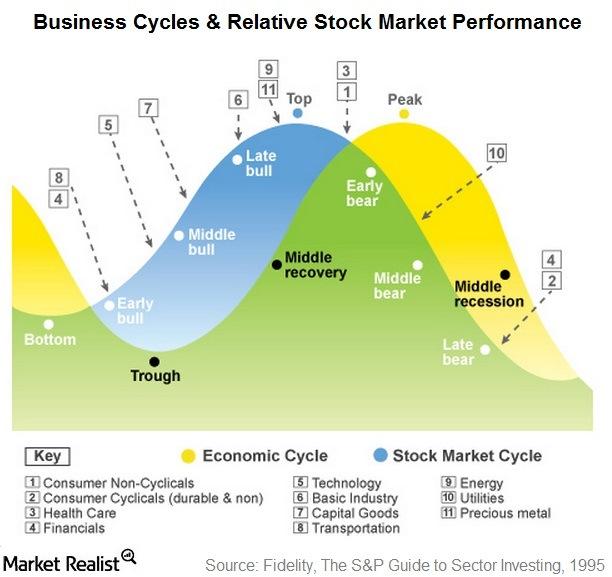

Some companies benefit in times of uncertainty, and some sectors provide cover for investors.

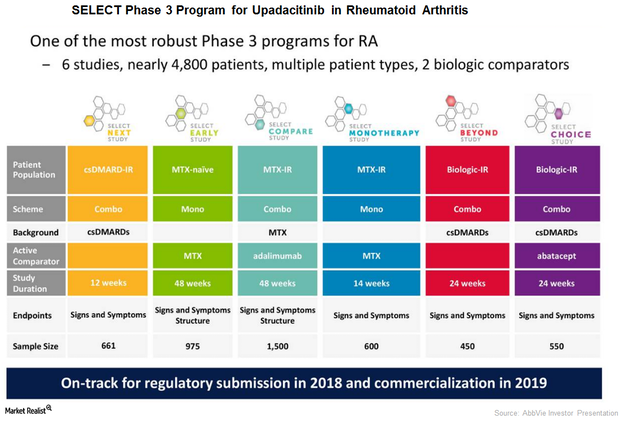

Upadacitinib: Opportunity for AbbVie’s Long-Term Growth?

ABBVie anticipates upadacitinib to be commercialized by 2019. If approved, AbbVie’s upadacitinib will directly compete with Pfizer’s (PFE) Xeljanz.

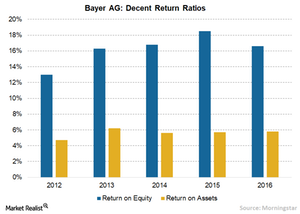

How Bayer Is Creating Value through Innovation

In 2016, Bayer owned ~51,000 valid patent applications and patents relating to ~5,000 protected inventions worldwide.

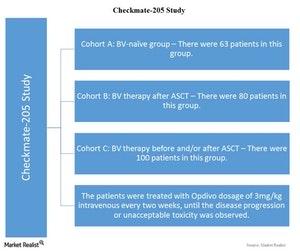

Data from the Checkmate-205 Study Evaluating Opdivo

Follow-up data were released from the Checkmate-205 study. It evaluated long-term effects of PD-1 inhibitors in patients with classical Hodgkin Lymphoma.

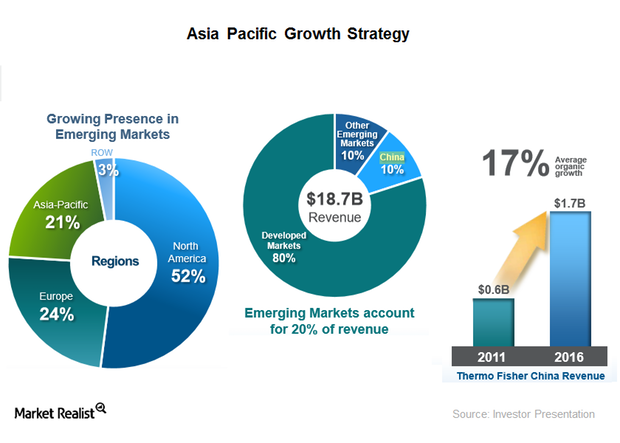

How Long Can Thermo Fisher Scientific’s Asia-Pacific Growth Momentum Last?

Thermo Fisher Scientific (TMO) has a presence around the globe, but around 80% of its revenues are generated from developed markets.

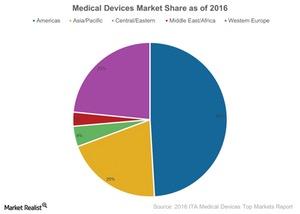

Is Medical Technology Driving the US Healthcare Industry?

The US medical device industry is a global leader. Its market was valued at ~$140 billion for 2016. It represents ~45% of the global market.

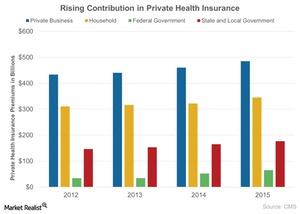

Rising Costs Are a Major Issue in the Healthcare Sector

The US economy is dealing with rising healthcare costs. The national healthcare expenditure grew 5.8% to $3.2 trillion in 2015 or $9,990 per person.

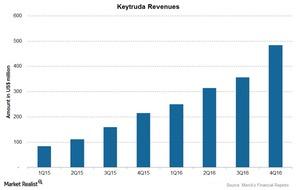

Merck’s Keytruda Saw Impressive Growth in 2016

Keytruda, a prescription medicine classified under Merck’s (MRK) immunooncology franchise, is used to treat non-small cell lung cancer as well as melanoma.

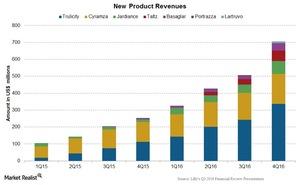

Eli Lilly and Co.’s New Products Portfolio

In 4Q16, Eli Lilly (LLY) reported Basaglar sales of $40 million from Japan and several European markets.

Business Cycle Perspective: Has the Healthcare Sector Hit Bottom?

This year, the healthcare sector seems to be receding, and the utilities sector seems to be in good gear. This is a sign that the early bear phase is over.

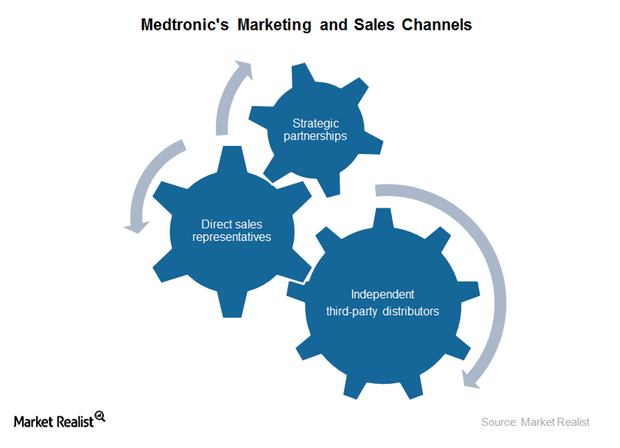

Assessing Medtronic’s Marketing and Sales Strategy in 2015

To extend cost-effective, high-quality medical devices and therapies, Medtronic aims to organize its marketing and sales teams around physician preferences.

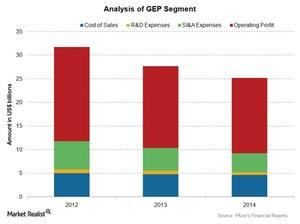

Pfizer’s Global Established Pharmaceutical Segment

The Global Established Pharmaceutical segment deals with products that have or are expected to lose market exclusivity through 2015 in most major markets.

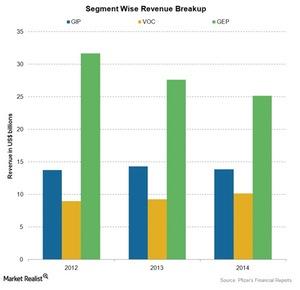

Analyzing Pfizer’s Business Segments

Pfizer (PFE) is one of the oldest and largest pharmaceutical companies in the US. The company deals in two major business segments.

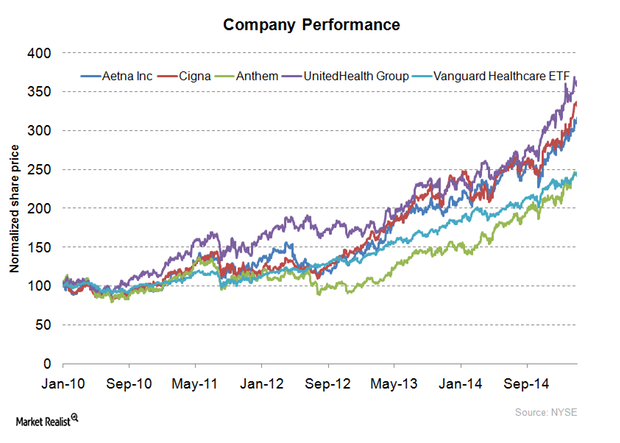

A Key Overview of Aetna, One of the Largest Insurance Providers

With a market capitalization of $35.1 billion, Aetna (AET) is one of the largest insurance providers in the US.